IPSWICH

CITY

COUNCIL

AGENDA

of the

Audit and Risk Management Committee

Held in the Council Chambers

2nd floor – Council Administration Building

45 Roderick Street

IPSWICH QLD 4305

On Wednesday, 19 June 2019

At 1.00 pm - 3.00 pm

IPSWICH

CITY

COUNCIL

AGENDA

of the

Audit and Risk Management Committee

Held in the Council Chambers

2nd floor – Council Administration Building

45 Roderick Street

IPSWICH QLD 4305

On Wednesday, 19 June 2019

At 1.00 pm - 3.00 pm

|

MEMBERS OF THE Audit and Risk Management Committee |

|

|

Interim Administrator Greg Chemello (Chairperson) |

|

|

Audit and Risk Management Committee Meeting Agenda |

19 June 2019 |

Audit and Risk Management Committee AGENDA

1.00 pm - 3.00 pm on Wednesday, 19 June 2019

Council Chambers

Presentation – At the commencement of the meeting there will be a 15 minute presentation by Tony Welsh (Interim ICT Management and Support).

As part of TP#17 ICT Strategy a ‘current state assessment’ has been conducted. This has identified some weaknesses and exposures in current ICT systems, arrangements and practices in Ipswich City Council. This presentation will focus on refreshing those items reported in the Audit Update 17/18 by the ICT Manager to reflect the current status and outlook.

Verbal Report – Andrew Knight (General Manager – Corporate Services) will be providing an update on procurement. Mary Goodwin (Procurement Specialist assisting TP#3) and Cathy Murray (Lead of TP#3) will also be attending.

|

Item No. |

Item Title |

Page No. |

|

1 |

Report - Audit and Risk Management Committee No. 2019(01) of 13 February 2019 |

9 |

|

2 |

2018-2019 Asset Revaluation |

19 |

|

3 |

Impact of New Accounting Standards |

67 |

|

4 |

Accounting for Reintegration of Ipswich City Properties Pty Ltd |

81 |

|

5 |

Waste Task Force Update |

140 |

|

6 |

Progress of the 2018-2019 Annual Internal Audit Plan |

143 |

|

7 |

**Update on QAO Recommendations (Planning and Regulatory Services Department) |

149 |

|

8 |

**Internal Audit Branch Activities Report for the period 4 February 2019 to 10 June 2019 |

160 |

|

9 |

**Annual Internal Audit Plan for 2019-2020 that includes the Strategic Internal Audit Plan for 2020-2022 |

169 |

|

10 |

**Summary of Recent Internal Audit Reports Issued |

173 |

|

11 |

**Overdue Recommendations as at 10 June 2019. |

176 |

|

12 |

**Risk and Planning Section's Performance in the Management of Corporate Risk and Insurance |

180 |

|

13 |

**Integrity and Governance Section's Performance in relation to Legislative Compliance |

186 |

|

14 |

**QAO Briefing Paper and draft Interim Management Report |

196 |

|

15 |

Next Meeting |

- |

|

16 |

General Business |

- |

|

17 |

Private Session of Member (if required) |

- |

** Item includes confidential papers

Audit and Risk Management Committee NO. 2

19 June 2019

AGENDA

1. Report - Audit and Risk Management Committee No. 2019(01) of 13 February 2019

This is a report concerning the previous report of the Audit and Risk Management Committee No. 2019(01) of 13 February 2019 for confirmation together with an extract of the Governance Committee and the Council Ordinary Meeting where the report was adopted.

Recommendation

That the report be received and the contents noted.

2. 2018-2019 Asset Revaluation

This is a report concerning the 2018-2019 Asset Revaluation and its effect on Ipswich City Council’s annual financial statements.

Council’s current revaluation procedure FCS-5 provides that Council will revalue all its non-current assets on a five year rolling basis provided that these assets do not experience significant and volatile change in fair value.

The current revaluation schedule is as follows:

|

Year |

Formal Valuation |

Desktop Valuation |

Final Report Due Date |

|

2015 |

(a) Land |

(b),(c),(d),(e) |

25-May-15 |

|

2016 |

(b) Roads, bridges and footpaths |

(a),(c),(d),(e) |

30-Apr-16 |

|

2017 |

(c) Building and Other structures |

(a),(b),(d),(e) |

30-Apr-17 |

|

2018 |

(d) Flooding and drainage |

(a),(b),(c),(e) |

30-Apr-18 |

|

2019 |

(e) Artworks |

(a),(b),(c),(d) |

30-Apr-19 |

Shaded area only included for completeness.

Recommendation

That the Interim Administrator of Ipswich City Council resolve:

A. That the report by the Principal Financial Accountant dated 30 April 2019, including attachments 1, 2, 3 and 4 be received and noted.

B. That the artworks asset class being a formal valuation and the roads, bridges and footpaths asset class indexation be revalued as outlined in the report by the Principal Financial Accountant dated 30 April 2019 and in accordance with Attachments 1 and 3.

C. That all other asset classes of land, buildings and other structures, and flooding and drainage not be revalued as the cumulative valuation percentage increases/decreases are below 5%, as outlined in the report by the Principal Financial Accountant dated 30 April 2019.

3. Impact of New Accounting Standards

This is a report concerning a request from the Queensland Audit Office (QAO) requiring Ipswich City Council (ICC) and its controlled entities to provide a position paper regarding the impact of recently issued or amended accounting standards. Council is required to provide the position paper by the 31 May 2019.

Recommendation

That the report of the Principal Financial Accountant regarding the impact of the recently released or amended Accounting Standards on Ipswich City Council dated 23 May 2019 be received and the contents noted.

4. Accounting for Reintegration of Ipswich City Properties Pty Ltd

This is a report concerning a requirement of the Queensland Audit Office (QAO) for Ipswich City Council (ICC) to provide a position paper regarding the impact of the reintegration of Ipswich City Properties Pty Ltd (ICP). Council is required to provide the position paper by the 31 May 2019.

Recommendation

That the report by the Principal Financial Accountant regarding the impact of the reintegration of Ipswich City Properties Pty Ltd with Ipswich City Council dated 30 May 2019 be received and the contents noted.

5. Waste Task Force Update

This is a report concerning the Department of Environment and Science (‘DES’) representatives meeting with Council on 8 April 2019 to provide an update on operations, findings, and outputs of the Odour Abatement Taskforce (‘OAT’).

Recommendation

That the report be received and the contents noted.

6. Progress of the 2018-2019 Annual Internal Audit Plan

This is a report concerning the status of the 2018-2019 Annual Internal Audit Plan as presented in the attachment to this report.

Recommendation

That the report be received and the contents noted

7. **Update on QAO Recommendations (Planning and Regulatory Services Department)

This is a report concerning the Planning and Regulatory Services Department’s progress in complying with the Queensland Audit Office (QAO) recommendations outlined in ‘QAO 2018 Closing Report’ (adopted by Council on 4 December 2018). Specifically, Appendix A - Internal Control Issues (items 1 to 3) relating to developer infrastructure contributions and fee variations.

Recommendation

That the report be received and the contents noted.

8. **Internal Audit Branch Activities Report for the period 4 February 2019 to 10 June 2019

This is a report concerning the activities of Internal Audit undertaken since 4 February 2019 and the current status of these activities.

Recommendation

That the report be received, the contents noted and the recommendations in Attachments 2 and 3, be considered finalised and archived.

9. **Annual Internal Audit Plan for 2019-2020 that includes the Strategic Internal Audit Plan for 2020-2022

This is a report concerning the proposed Annual Audit Plan for 2019-2020 that includes the Strategic Internal Audit Plan for 2020-2022.

Recommendation

That the Interim Administrator of Ipswich City Council resolve:

A. That the draft Internal Audit Annual Plan for 2019-2020 that includes the draft Strategic Internal Audit Plan for 2020-2022 (Attachment 1) as prepared by the Chief Audit Executive be reviewed and considered by the Audit and Risk Management Committee.

B. That, following receipt of the views of the Audit Committee, the Plans subject to amendments as considered necessary, be formally approved by the Chief Executive Officer as required under the Internal Audit Charter.

10. **Summary of Recent Internal Audit Reports Issued

This is a report concerning recently completed internal audits and the subsequent reports released since the previous report dated 4 February 2018.

Recommendation

That the report be received and the contents noted.

11. **Overdue Recommendations as at 10 June 2019.

This is a report concerning the status of each Department's progress in actioning the internal and external audit recommendations due or overdue for implementation.

Recommendation

That the report be received and considered.

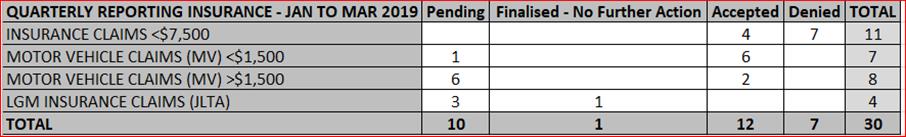

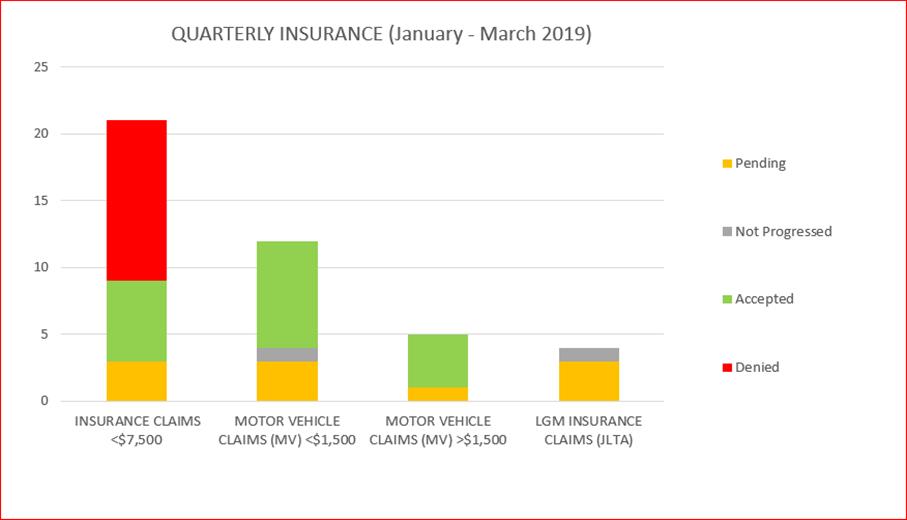

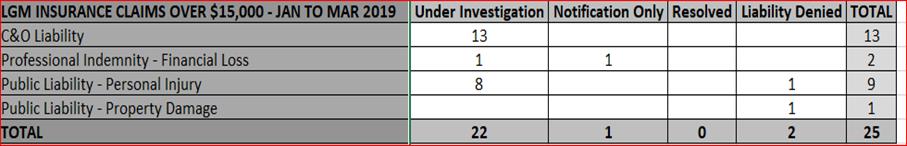

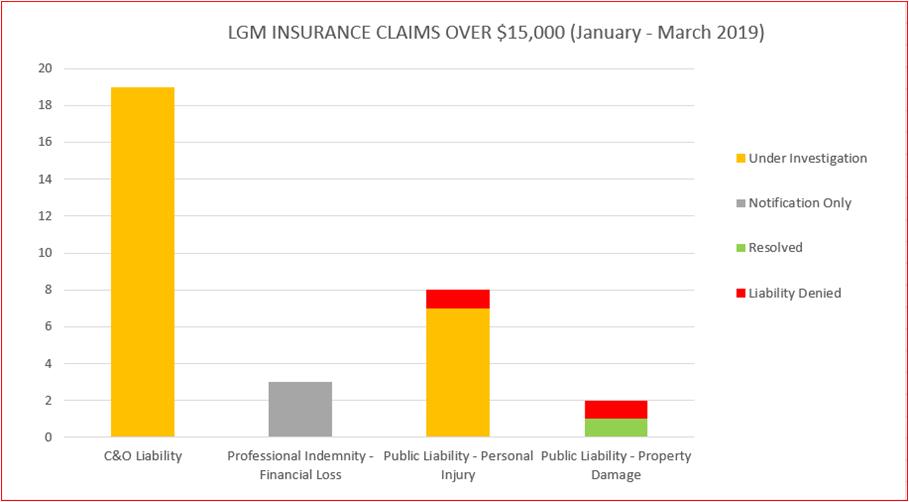

12. **Risk and Planning Section's Performance in the Management of Corporate Risk and Insurance

This is a report concerning the performance of the Risk and Planning Section (the Section) in relation to the management of corporate risk and insurance for the period 1 January 2019 to 31 March 2019 (the Quarter).

Recommendation

That the report be received and the contents noted.

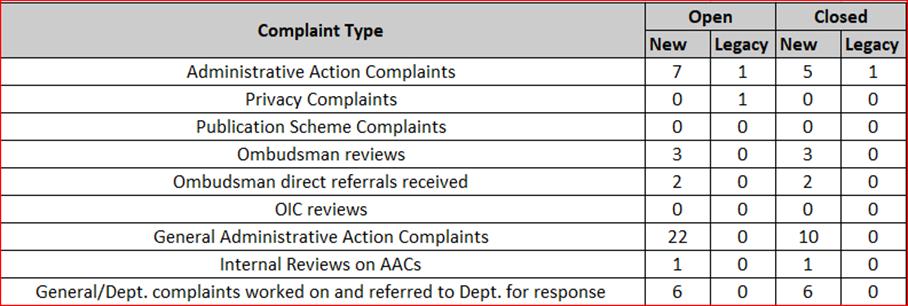

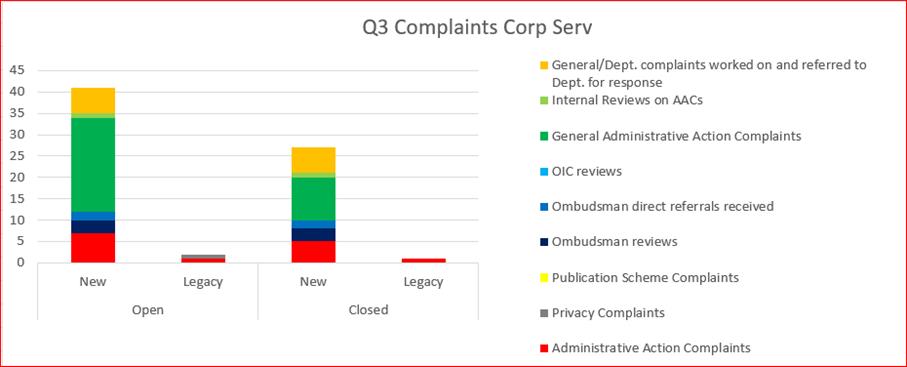

13. **Integrity and Governance Section's Performance in relation to Legislative Compliance

This is a report concerning the performance of the Integrity and Governance Section (the Section) in relation to managing Council’s legislative compliance in the management of complaints, insurance, risk, Right to Information and Information Privacy functions for the period 1 January 2019 to 31 March 2019 (the Quarter).

Recommendation

That the report be received and the contents noted.

14. **QAO Briefing Paper and draft Interim Management Report

This is a report concerning a briefing paper and draft interim management report submitted by Queensland Audit Office.

Recommendation

That the reports be received and the contents noted.

15. NEXT MEETING

The next meeting is scheduled for Wednesday, 28 August 2019.

16. GENERAL BUSINESS

17. PRIVATE SESSION OF MEMBER (IF REQUIRED)

** Item includes confidential papers

and any other items as considered necessary.

|

Audit and Risk Management Committee Meeting Agenda |

19 June 2019 |

ITEM: 1

SUBJECT: Report - Audit and Risk Management Committee No. 2019(01) of 13 February 2019

AUTHOR: Administration Support Manager

DATE: 14 June 2019

This is a report concerning the previous report of the Audit and Risk Management Committee No. 2019(01) of 13 February 2019 for confirmation together with an extract of the Governance Committee and the Council Ordinary Meeting where the report was adopted.

That the report be received and the contents noted.

Not applicable

Listening, leading and financial management

The purpose of the report is to present the previous report of the Audit and Risk Management Committee for confirmation.

Not applicable

Not applicable

This report and its recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

Not applicable

The previous report of the Audit and Risk Management Committee is presented to the committee for confirmation.

|

1. |

Report - Audit and Risk Management Committee No. 2019(01) ⇩ |

|

1.01 |

Extract Governance Committee No. 2018(02) of 19 February

2019 ⇩ |

|

1.02 |

Extract Council Ordinary Meeting of 26 February 2019 ⇩ |

Vicki Lukritz

Administration Support Manager

I concur with the recommendations contained in this report.

Andrew Knight

General Manager - Corporate Services

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

19 June 2019 |

Item 1 / Attachment 1.01

GOVERNANCE COMMITTEE NO. 2019(02)

19 February 2019

REPORT

E X T R A C T

MEMBER’S ATTENDANCE: Greg Chemello (Chairperson)

INTERIM MANAGEMENT Stan Gallo, Steve Greenwood, Simone Webbe, Jan Taylor

COMMITTEE ATTENDANCE: and Robert Jones

Pursuant to section 13 of Council’s Local Law No 2 (Council Meetings) 2013, the Interim Administrator invited the Interim Management Committee being Stan Gallo, Steve Greenwood, Simone Webbe, Jan Taylor and Robert Jones to address the Governance Committee on any matters before it.

The Interim Administrator advised that he is bound to declare Conflict of Interests and potential Conflict of Interests and that the members of the Interim Management Committee are not legally bound, however in accordance with the Interim Management Committee Charter they will also declare Conflict of Interests and potential Conflict of Interests.

7. REPORT – AUDIT AND RISK MANAGEMENT COMMITTEE NO. 2019(01) OF 13 FEBRUARY 2019

With reference to the report of the Audit and Risk Management Committee No. 2019(01) of 13 February 2019.

RECOMMENDATION

That

the report of the Audit and Risk Management Committee No. 2019(01) of

13 February 2019 be received, the contents noted and the recommendations

contained therein be adopted.

PROCEDURAL MOTIONS AND FORMAL MATTERS

The meeting opened at 10.56 am.

The meeting closed at 11.54 am.

|

Audit and Risk Management Committee Meeting Agenda |

19 June 2019 |

Item 1 / Attachment 1.02

26 February 2019

E X T R A C T

Held in the Council Chambers, Administration Building

The meeting commenced at 9.03 am

Pursuant to section 13 of Council’s Local Law No 2 (Council Meetings) 2013, the Interim Administrator invited the Interim Management Committee members present being Simone Webbe, Jan Taylor, Stan Gallo, Steve Greenwood and Robert Jones to address the Council on any matters before it.

The Interim Administrator advised that he is bound to declare Conflict of Interests and potential Conflict of Interests and that the members of the Interim Management Committee are not legally bound, however in accordance with the Interim Management Charter they will also declare Conflict of Interests and potential Conflict of Interests.

|

ATTENDANCE AT COMMENCEMENT |

MEMBER'S ATTENDANCE: Greg Chemello (Interim Administrator) INTERIM MANAGEMENT COMMITTEE: Simone Webbe, Jan Taylor, Stan Gallo, Steve Greenwood and Robert Jones |

|

|

RECEPTION AND CONSIDERATION OF COMMITTEE REPORTS

|

The Interim Administrator of the Ipswich City Council resolves:

That the Governance Committee Report No. 2019(02) of 19 February 2019 be received and adopted.

|

|

|

|

The motion was put and carried.

|

|

|

OFFICER’S REPORT

|

PLANNING FOR FUTURE AUDIT AND RISK MANAGEMENT COMMITTEE MEETINGS FOR 2019

|

|

|

|

That the report by the Chief Audit Executive dated 4 February 2019 concerning the proposed structured and planned agenda for the Audit and Risk Management Committee for the period 1 January 2019 to 31 December 2019, be received and adopted.

In considering the report, the following matters were raised by the Interim Administrator and Interim Management Committee members:

|

|

|

|

RECOMMENDATION:

That the Interim Administrator of Ipswich City Council resolves:

A. That the 2019 Audit and Risk Management Committee meetings as scheduled normally a week prior to the Governance Committee meetings in the months of February, June, August, September (date determined by COO Finance and Corporate Services) and November, be accepted.

B. That

the proposed draft agenda discussion topics detailed in Attachment 1 of the

report by the Chief Audit Executive dated

The motion was put and carried.

|

|

|

DISCUSSION |

The Interim Administrator thanked Rob Jones for his assistance.

The report outlines the Audit and Risk Management Committee as having an independent Chair, an independent majority of members and a minority of future councillors. The Interim Administrator made comment that this was an appropriate way for governance for the council in the future.

|

|

|

|

The motion was put and carried.

|

|

|

MEETING CLOSED |

The meeting closed at 9.15 am.

|

|

|

Audit and Risk Management Committee Meeting Agenda |

19 June 2019 |

ITEM: 2

SUBJECT: 2018-2019 Asset Revaluation

AUTHOR: Principal Financial Accountant

DATE: 30 April 2019

Executive Summary

This is a report concerning the 2018-2019 Asset Revaluation and its effect on Ipswich City Council’s annual financial statements.

Council’s current revaluation procedure FCS-5 provides that Council will revalue all its non-current assets on a five year rolling basis provided that these assets do not experience significant and volatile change in fair value.

The current revaluation schedule is as follows:

|

Year |

Formal Valuation |

Desktop Valuation |

Final Report Due Date |

|

2015 |

(a) Land |

(b),(c),(d),(e) |

25-May-15 |

|

2016 |

(b) Roads, bridges and footpaths |

(a),(c),(d),(e) |

30-Apr-16 |

|

2017 |

(c) Building and Other structures |

(a),(b),(d),(e) |

30-Apr-17 |

|

2018 |

(d) Flooding and drainage |

(a),(b),(c),(e) |

30-Apr-18 |

|

2019 |

(e) Artworks |

(a),(b),(c),(d) |

30-Apr-19 |

Shaded area only included for completeness.

Recommendation/s

That the Interim Administrator of Ipswich City Council resolve:

A. That the report by the Principal Financial Accountant dated 30 April 2019, including attachments 1, 2, 3 and 4 be received and noted.

B. That the artworks asset class being a formal valuation and the roads, bridges and footpaths asset class indexation be revalued as outlined in the report by the Principal Financial Accountant dated 30 April 2019 and in accordance with Attachments 1 and 3.

C. That all other asset classes of land, buildings and other structures, and flooding and drainage not be revalued as the cumulative valuation percentage increases/decreases are below 5%, as outlined in the report by the Principal Financial Accountant dated 30 April 2019.

RELATED PARTIES

There are no related parties

Advance Ipswich Theme Linkage

Listening, leading and financial management

Purpose of Report/Background

The 2018-2019 revaluation process consists of a full revaluation for artworks assets and an indexed valuation for roads, bridges and footpaths (RBF), land, buildings and other structures assets, and flooding and drainage assets.

Valuation for artworks was carried out by Ross Searle and Associates. The indexation for land, building and other structures and infrastructure assets was provided by Cardno.

Revaluation Materiality

Asset Revaluation Procedure: ‘Council will need to consider the impact of revaluation only if the cumulative change in the index is greater than 5% (either positive or negative) since the last formal valuation of an asset class.’

AASB1031 Materiality (paragraph 15):

(a) an amount which is equal to or greater than 10 per cent of the appropriate base amount may be presumed to be material unless there is evidence or convincing argument to the contrary; and

(b) an amount which is equal to or less than 5 per cent of the appropriate base amount may be presumed not to be material unless there is evidence, or convincing argument, to the contrary.

VALUATION

Artworks

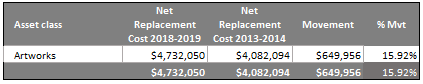

Summary of Artworks valuation.

Valuation for Artwork assets is based on a formal valuation and the valuer made a full inspection of artwork assets. A total of 639 items were revalued. The last formal valuation for this asset class was 2013-2014.

For marketable cultural/heritage assets, valuation was determined using observable market prices for similar assets. While for some cultural/heritage assets that have an active market and observable market prices valuation was determined using comparable inputs of a similar class of asset, but for other assets that have a thin market which have unobservable market prices rely on a combination of observable and unobservable inputs. A copy of artworks assets indexation report is attached in Attachment 1.

INDEXATION

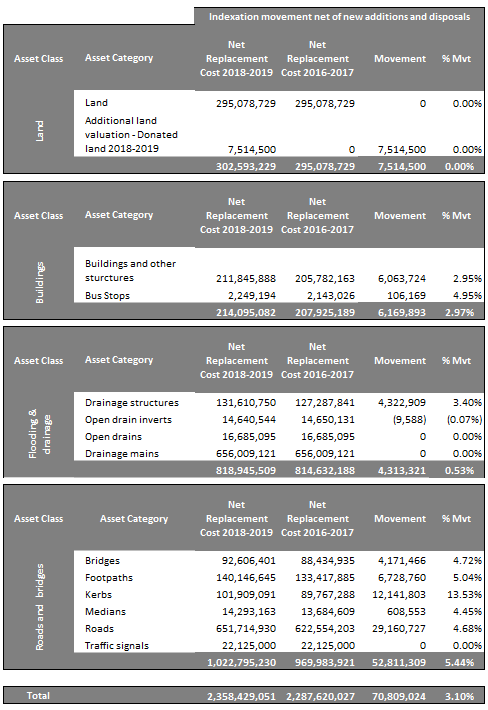

Summary of land, building and other structures, and infrastructure assets indexation results.

The above table reports the net replacement cost for 2018-2019 as per Cardno’s indexation files which determines the movement in asset value. Please note that Table 4.3 in Attachment 3: 2018-2019 Infrastructure Assets Valuation Report – Cardno reports the gross replacement cost for 2018-2019.

Land

A desktop valuation (indexation) for land was conducted for the year end, 30 June 2019. Valuation for existing land assets remained unchanged in 2019.

Cardno also formally valued 41 land assets not previously recorded in the fixed asset register. These are donated parcels of land identified through a land reconciliation exercise performed in January 2019. It was agreed that the land be recorded in the fixed asset register at the fair value provided by Cardno in this year’s valuation. A copy of land indexation report is attached in Attachment 2.

INFRASTRUCTURE ASSETS (Buildings and Other Structures, Flooding and Drainage, Roads Bridges and Footpaths)

This year’s indexation is similar to past infrastructure valuations, which is based on Council’s Asset Management Data (physical asset register) to enable the valuer to use quantitative information to calculate asset values. The fixed asset register therefore only records financial information.

Cardno attributes the increase in index movement of 2.97% for buildings and other structures assets and 0.53% for flooding and drainage assets to an increase in unit rates for construction materials.

Also, Cardno attributes the increase in index movement of 5.44% for roads, bridges and footpaths to a change in unit rates for construction materials. In particular, there is an increase in unit rates for construction materials relating to concrete and road formation (sealed and unsealed). However, for bridges the increase of 4.72% is due to a change in materials for 10 bridges. Council assessed the 5.44% increase for roads, bridges and footpaths as material and will apply the valuation increment to the roads, bridges and footpaths asset class in fixed asset register. A copy of infrastructure assets indexation report is attached in Attachment 3.

Further to the review carried out by Business Accounting, Council’s Asset Management officers have undertaken a review of the revaluation process as well as the report provided by Cardno. A copy of the report from ICC’s Asset Management Team is attached in Attachment 4.

There were no major issues identified across all asset classes in this year’s valuation exercise.

Financial/RESOURCE IMPLICATIONS

No relevance to this report.

RISK MANAGEMENT IMPLICATIONS

The risk in not approving the recommendation would result in Council not be complying with Australian Accounting Standards.

AASB 116 Property, Plant and Equipment require assets to be revalued to ensure that the carrying amount of the assets do not differ materially from their fair value at the end of each reporting period.

AASB13 Fair Value defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Legal/Policy Basis

This report and its recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

Australian Accounting Standards

COMMUNITY and OTHER CONSULTATION

No relevance to this report.

Conclusion

In accordance with Council’s asset valuation policy FCS-5 and Australian Accounting Standards, Council is required to recognise assets at fair value. Both the artworks valuation of 15.92% and the indexation for roads, bridges and footpaths of 5.44% are required to be applied to the respective asset classes in fixed asset register so fair value is recognised.

Attachments and Confidential Background Papers

|

1. |

ICC - Artworks Valuation Report 2018-19 ⇩ |

|

2. |

ICC - Land Indices 2018-19 ⇩ |

|

3. |

ICC - Infrastructure Assets Valuation Report 2018-19 ⇩ |

|

4. |

WPR Infrastructure Asset Valuation Report 2018-19 ⇩ |

Barbara Watson

Principal Financial Accountant

I concur with the recommendations contained in this report.

Jeffrey Keech

Finance Manager

I concur with the recommendations contained in this report.

Andrew Knight

Chief Operating Officer (Finance and Corporate Services)

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

19 June 2019 |

ITEM: 3

SUBJECT: Impact of New Accounting Standards

AUTHOR: Principal Financial Accountant

DATE: 23 May 2019

This is a report concerning a request from the Queensland Audit Office (QAO) requiring Ipswich City Council (ICC) and its controlled entities to provide a position paper regarding the impact of recently issued or amended accounting standards. Council is required to provide the position paper by the 31 May 2019.

That the report of the Principal Financial Accountant regarding the impact of the recently released or amended Accounting Standards on Ipswich City Council dated 23 May 2019 be received and the contents noted.

There are no related parties

Listening, leading and financial management

Australian Accounting Standards Board (AASB) has recently issued or amended Australian Accounting Standards some standards are expected to have a material impact, while other standards are expected to have no material impact for Council and its controlled entities (Ipswich City Properties Pty Ltd, Ipswich City Developments Pty Ltd, Ipswich City Enterprises Pty Ltd, Ipswich City Enterprises Investments Pty Ltd, Ipswich Arts Foundation and Ipswich Arts Foundation Trust).

Accounting standards expected to have a material impact.

· AASB 9 Financial Instruments

· AASB 15 Revenue from Contracts with Customers

· AASB 1058 Income of Not-for-Profit Entities

· AASB 16 Leases.

Accounting standards not expected to have any impact.

· AASB 1059 Service Concession Arrangements: Grantors

Application to Council and its controlled entities

AASB 9 Financial Instruments

Effective for annual reporting periods beginning on or after 1 July 2018. AASB 9 has been adopted in the 2018-2019 financial year.

Financial Assets now classified in Two Financial Categories (Amortised Cost and Fair Value)

Council’s financial assets and financial liabilities are both measured at amortised cost. Initially recognition is measured at cost (financial assets) or fair value (financial liabilities), then subsequently measured at amortised cost and impairment recognised in the profit and loss. (Refer to paragraph 4.1.1 to 4.1.2 and 4.2.1 of AASB 9.) Council and its controlled entities hold financial assets in order to collect contractual cash flows, for example fixed term deposits, investments and trade receivables. While for financial liabilities this consists of loans of solely payments of principal and interest.

Option to account for equity instruments in other comprehensive income

Council and its controlled entities will continue to measure equity instruments at amortised cost and account for equity instruments in the profit and loss. Dividends from equity investments relating to subsidies and associates will continue to be presented in profit and loss.

Impairment

Council and its controlled entities now assess the collectability of trade receivables and loan receivables on an expected basis rather than an incurred basis using the simplified approach by applying a percentage based on past recognition of impairment (with the exclusion of extraordinary anomalies).

Trade Receivables: Percentages for impairment are based on historical data (debts written off and trends in debt collection). Impairment percentages are 2.92% for 0 to 90 days, 12.11% - 91 to 120 days and 33.62% - 120+ Days. Refer to Attachment 1 for workings.

First time adoption of AASB 9 requires the opening balance of impairment for receivables to be recalculated using the new methodology with an adjustment to the opening balance as at 1 July 2018. Impairment for receivables recalculated balance is $70k, less $47k already recognised resulting in an adjustment of $23k, journal entry as follows:

Equity Account Debit $23k

Impairment for Receivables Credit $23k

Loan receivable to Ipswich City Properties Pty Ltd (ICP): ICP plan that the full balance of the loan or at least a significant portion of the loan should be repaid or reduced to asset transfers prior to 30 June 2019.

Rates Receivable: Impairment will not be applied due to the provisions of the Local Government Act 2009 which empowers Council to sell an owner’s property to recover outstanding rate debts.

AASB 15 Revenue from Contracts with Customers

AASB 1058 Income of Not-for-Profit Entities

Effective for annual reporting periods beginning on or after 1 July 2019.

Under AASB 15 and AASB 1058 the timing of income recognition will depend on whether a grant is enforceable and gives rise to a sufficiently specific performance obligation, liability or contribution by owners. Hence, revenue is recognised initially as a liability and once the obligation is satisfied the liability is derecognised and revenue recognised. (Refer to paragraph 15 and 16 of AASB 15 and paragraph 16 of AASB 1058.) Also, AASB 1058 requires the fair value measurement of assets and transactions for which consideration is significantly below fair value (including peppercorn leases). (Refer to paragraph 7 of AASB 1058.) Refer to Attachment 2 for an analysis of the impact on Council’s revenue streams.

Grants and Contributions

Grants of financial assets with sufficiently specific performance obligations will be initially recognised as a liability and subsequently as revenue when the obligation is satisfied. This will only affect grants that span over the end of a financial year. From a review of Council’s grant funding agreements currently there are no sufficiently specific performance obligations relating to grants of financial assets. Financial Assistance Grants will continue to be recognised as revenue upon receipt, as advised by the Department of Local Government, Racing and Multicultural Affairs (DLGRMA).

Grant agreements for construction or acquisition of non-financial assets to be controlled by the entity which are enforceable and sufficiently specific are initially recognised as a liability as there is an obligation to construct an asset. As the performance obligations are satisfied the liability is derecognised and revenue recognised. Most of Council’s grant revenue relating to non-financial assets is recognised when Council submits a milestone claim when a percentage of works have been completed. From a review of Council’s grant funding agreements, grant arrangements which are enforceable, sufficiently specific performance agreements and up-front grant payments relate to roads to recovery (R2R), Rosewood Library Construction and the Ipswich CBD Renewal (Civic Space Construction). Current advice from Council’s grant team is that Council’s annual submission for R2R funding is usually for only one (1) major capital project so sufficiently specific performance obligations will be measureable. The Finance team will further investigate R2R grant funding and if there are the required specific obligations.

Council will recognise developer contributions immediately as revenue as there is no sufficiently specific present obligations. While for donated assets when these become “on maintenance” an asset is recognised at fair value and revenue recognised immediately. (eg, land, infrastructure assets and artworks).

Rates Paid in Advance

As the period to which rates paid in advance has not occurred, the obligation has not been fulfilled and prepaid rates are refundable at the request of the ratepayer. During the refundable period the rates received in advance give rise to a financial liability, then subsequently as revenue when the rating period occurs. Currently when rates are paid in advance the Council recognises these receipts initially as cash (Debit) and unearned rates paid in advance liability (Credit), then at the end of each quarter the balance of rates paid in advance liability would be accrued to revenue. On the 30 June 2019 Council will continue to recognise rates paid in advance as revenue by posting an adjustment journal (not an accrual journal) as follows:

Unearned rates paid in advance Debit $4m (Estimate)

Rates Revenue Credit $4m (Estimate)

As advised by QAO during the 2019 Tropical Workshop, on the 1 July 2019 first time adoption of AASB 1058 will require an adjustment to the opening balance of unearned rates paid in advance, adjustment journal entry as follows:

Equity Account Debit $4m (Estimate)

Unearned rates paid in advance Credit $4m (Estimate)

After this Council will cease the practice of accruing the balance of rates paid in advance liability to revenue at the end of each quarter.

Fees and Charges

Town planning, animal, cemetery, infringement fees and licence fees revenue is recognised upon receipt as there is no enforceable contract with the customer, no sufficiently specific performance obligations attached and these transactions are large volumes of low dollar value so these fees are assessed immaterial.

Peppercorn Leases

AASB 1058 requires the fair value measurement of lease transactions for which consideration is significantly below fair value and recognising the difference between fair value and the nominal value as revenue. In accordance with the AASB, Council will defer the requirement to fair value peppercorn leases, hence peppercorn lease will continue to be recognised at nominal value. Refer to section AASB 16 Leases for more information.

Volunteer Services

AASB 1058 requires an inflow of resources in the form of volunteer services as an asset or expense if the services can be measured reliably and would have been purchased if they were not donated. Paragraph 19 of AASB 1058 states the entity may “elect to recognise volunteer services or a class of volunteer services”. Council will not elect to recognise volunteer services. Council currently has over 200 individuals who volunteer their services in the Ipswich Art Gallery, Libraries, Ipswich Visitor’s Information Centre, Ipswich Cemetery and Queens Park Nature Centre, etc. Council departments have confirmed that they would not have purchased these services if they were not donated.

AASB 16 Leases

Effective for annual reporting periods beginning on or after 1 July 2019.

The intention of the standard is to put ‘off-balance sheet’ operating leases ‘on-balance sheet’. As a result, a right-of-use asset and a lease liability is recognised for the discounted cash flow of lease payments for the lease term. (Refer to paragraph 22 to 28 of AASB 16.) The right-of-use asset will be measured at its carrying amount discounted using the incremental borrowing rate and adjusted by any prepaid amounts. (Refer to paragraph C8 of AASB 16). Lease payments are apportioned between the reduction in the lease liability and interest expense. An incremental increase in the annual charge or consumer price index (CPI) is required to be applied to both the lease asset and lease liability. Also, right-of-use assets are recognised in a separate asset class in the fixed asset register and amortised over the period of the lease, refer to paragraph 29 to 46 of AASB 16 and AASB 116 Property, Plant and Equipment.

Council will claim exemption for the lease of 300 laptops as these leases are of low value (AUD $7,500). (Refer to paragraph 5 of AASB 16.) Also, there are no embedded leases where there is an explicit or implicit asset in the contract and the customer controls use of the asset. Council owns their fleet of vehicles and waste trucks.

As at the 30 June 2018, Council had 16 property leases, with 10 of those leases relating to the former Councillor divisional offices. The Chief Executive Officer announced on the 16 May 2019 that the divisional offices would close at the end of May 2019, hence these have been excluded. Also, Council had prepaid the lease of the hockey grounds located at 65 Briggs Road Raceview for $1.1m so no lease liability or right-of-use asset is required to be recognised. While the lease for the monitoring room for Safe City expired during 2018-2019. Council entered into a new property lease for the Springfield library site which commenced on the 1 July 2018. Council paid a deposit of $58k being for payment in advance for the month of July 2019 and the lessor granted Council a base rent free period of 12 months. As at the 30 June 2019 lease asset and liabilities on the balance sheet will increase/decrease by $2.2m and $2.3 m respectively, refer to Attachment 3.

The requirements of AASB 16 will be applied using the modified retrospective approach with the accumulative effect being recognised as an adjustment to the opening balance of the equity account and no restatement in the comparative reporting period.

Peppercorn Leases

Lease payments of nominal value and that do not reflect the market value of lease payments for the property being leased are required to be brought to fair value. As a result, revenue is recognised for the difference between the right-of-use asset (measured at fair value) and the lease liability (measured at present value). The fair value requirements of AASB 1058 apply to peppercorn leases as well. The Australian Accounting Standards Board (AASB) decided on the 13 November 2018 to defer the requirement to value peppercorn leases (and other significantly below market value). The AASB will released an exposure draft which considers temporary relief for all not-for-profit entities in relation to peppercorns as the Australian Charities and Not-for-Profits Commission (ACNC) are yet to issue thresholds and guidance by the fair value panel in relation to valuation of right of use assets. Council currently has three (3) “peppercorn leases” with the Department of Natural Resources and Mines (DNRM), in which Council pays less than market value lease payments. Council will not recognise right-of-use assets or lease liabilities for peppercorn leases until the ACNC thresholds take effect. It is expected that this will have a material impact for Council when implemented in the future.

Leases Model

An Excel worksheet has been prepared in accounting for Council’s leases, however there is complexity in accounting for multiple leases with different terms, CPI adjustment, interest, split lease payments and more. During the 2019 Tropical Workshop the Queensland Audit Office recommended organisations to acquire software to calculate and manage lease accounting.

AASB 1059 Service Concession Arrangements: Grantors

Public sector entities (grantor) enter into an arrangement with the private sector (operator) for the delivery of public services. The grantor will recognise a service concession asset when they control an asset which is constructed or acquired by the operator. The operator in return is compensated either directly be the grantor or by collecting payments from the public. A grantor controls an asset if they control or regulates what services the operator must provide with the asset, to whom it must provide them and at what price, and the grantor controls any significant residual interest in the asset at the end of the term of the arrangement. These arrangements are often referred to as public to private partnerships (PPPs), for example arrangements with toll roads.

Council does not have any service concession arrangements.

No relevance to this report.

The risk in not approving the recommendation would result in Council not complying with Australian Accounting Standards. As a result, Council’s financial statements would receive a qualified audit opinion.

This report and its recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

Australian Accounting Standards

No relevance to this report.

AASB 9 Financial Instruments has been adopted in the 2018-2019 financial year. Impairment of receivables are now assessed using an expected basis which is based on a percentage of historical customer default rates, the new impairment percentages will not have a material financial impact. The recalculated opening balance for impairment for receivables is $71k resulting in an adjustment to the opening balance for impairment receivables of $23k.

AASB15 Revenue from Contracts with Customers requires grants with enforceable arrangements and sufficiently specific performance obligations to be initially recognised as a liability and once the obligation is satisfied the liability is derecognised and revenue recognised. Currently Council’s grant funding agreement relating to financial assets do not have sufficiently specific performance obligations relating to grants of financial assets. Developer contribution revenue is now recognised immediately as there is no sufficiently specific performance obligations.

AASB1058 Income of Not-for Profit Entities will require grants relating to non-financial assets with enforceable arrangements and sufficiently specific performance obligations to recognise up-front grant payments as a liability and then revenue once the obligation has been complete. Most grant revenue for non-financial assets is recognised once a percentage of work has been completed and then a milestone claim is submitted. Currently two of Council’s grant funding agreements relating to non-financial assets do have sufficiently specific performance obligations these relate to roads to recovery (R2R) and Rosewood Library Construction, hence a liability will be recognised initially for up-front payments and then revenue when obligations are met. While rates paid in advance will be recognised as a liability initially and then revenue when the rating period occurs. An adjustment to the opening balance (1 July 2019) for unearned rates revenue of approximately $4m will be required. Recognition of revenue relating to peppercorn leases has been delayed until fair value thresholds are established.

AASB 16 Leases would result in a financial impact with recognition of a right-of-use asset of $2.3m and lease liability of $2.2m. Recognition of revenue relating to peppercorn leases has been delayed until fair value thresholds are established, when this does occur it is expected this will have a material impact for Council. As recommended by the QAO to ensure accuracy and management of leases Council would benefit from acquiring software to manage lease accounting.

|

1. |

Impairment of Receivables. ⇩ |

|

2. |

Revenue Analysis as at 31 March 2019. ⇩ |

|

3. |

Lease Assets and Liabilities Register ⇩ |

Barbara Watson

Principal Financial Accountant

I concur with the recommendations contained in this report.

Jeffrey Keech

Finance Manager

I concur with the recommendations contained in this report.

Andrew Knight

General Manager - Corporate Services

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

19 June 2019 |

ITEM: 4

SUBJECT: Accounting for Reintegration of Ipswich City Properties Pty Ltd

AUTHOR: Principal Financial Accountant

DATE: 30 May 2019

Executive Summary

This is a report concerning a requirement of the Queensland Audit Office (QAO) for Ipswich City Council (ICC) to provide a position paper regarding the impact of the reintegration of Ipswich City Properties Pty Ltd (ICP). Council is required to provide the position paper by the 31 May 2019.

Recommendation/s

That the report by the Principal Financial Accountant regarding the impact of the reintegration of Ipswich City Properties Pty Ltd with Ipswich City Council dated 30 May 2019 be received and the contents noted.

RELATED PARTIES

Ipswich City Properties Pty Ltd

Advance Ipswich Theme Linkage

Listening, leading and financial management

Purpose of Report/Background

Ipswich City Council controls and owns 100% of Ipswich City Properties Pty Ltd (ICP). On the 16 October 2018, the Council resolved to endorse the winding up and ultimately deregistration of Ipswich City Properties Pty Ltd and the integration of ICP assets and operations into Council. Currently Council is in the progress of winding up ICP and reintegrating assets back to Council. It is planned that current ICP assets, licences, leases, intellectual property and operations should be substantially transferred and incorporated into Council by 30 June 2019. While final deregistration is scheduled to occur from July to December 2019.

McGrath Nicol have been engaged to assist Council in project managing the activities prior to wind up. King and Wood Mallesons (lawyers) are advising Council, while Clayton Utz has been engaged to advise on and carry out all legal requirements associated with the wind up on behalf of ICP. The distribution of ICP’s assets is governed by the requirements of the Local Government Regulation 2012 and being prepared in accordance with Australian Accounting Standards.

Based on the transition plan and current discussions with advisors, it is intended that a report be prepared for Council’s meeting on 25 June providing an update on the winding up and seeking approval to enter into a Deed between ICP and ICC encompassing the transfer of properties, reimbursement of works undertaken, any level of indemnity Council might provide re operational costs and loan from ICC to ICP.

Application to Ipswich City Properties Pty Ltd

ICP plans to settle the loan to Council prior to 30 June 2019. The majority of the loan will be settled by non-cash asset transfer. Refer to paragraph 3.3 of AASB 9 Financial Instruments, “Derecognition of financial liabilities”.

The non-cash assets include the following ICP assets of non-current asset held for distribution to owners, investment property, work in progress and construction work in progress-development agreement.

ICP’s Financials

Loan (Settle) Debit TBA

Assets (Transfer) Credit TBA

Journal prepared in accordance with paragraph 3.3 of AASB 9 Financial Instruments.

Application to Council

When Council’s vesting interest in ICP’s assets transfers back to Council this will be treated as a distribution to owners. This is in accordance with paragraph 49 of AASB 1004 Contributions. The distribution of assets will be accounted for as a redemption of its ownership interest (investment) in ICP, refer to paragraph 43 of Interpretation 1038 Contributions by Owners Made to Wholly-Owned Public Sector Entities.

Distribution of ICP’s assets are planned to occur prior to 30 June 2019 and will include transfer of freehold land, leasehold land, buildings, work-in-progress (WIP) and inventory. The distribution of ICP’s assets to Council will offset the loan receivable. Council will subsequently need to consider the remaining balance of the loan receivable. In essence, the transition will be a loan receivable (asset) to asset swap. This is in accordance with paragraph 53 of AASB 1004.

Assets to Transfer

Before the transition of land and building assets ICP has undertaken a valuation so as assets are recognised at fair value at date of transition. This is in accordance with paragraph B98 of AASB1004, AASB 13 Fair Value and AASB 116 Property, Plant and Equipment. ICP has engaged external valuer, John Lang LaSelle Advisory Services Pty Ltd, to perform a desktop valuation as at the 24 April 2019. A market value approach was used for the desktop valuation which was based on discounted cash flows. The land is categorised as a level 2 valuation with the most significant inputs into this market valuation approach being price per square metre. Refer to Attachment 1.

While work in progress (WIP) and inventory will be transferred at cost.

Non-current assets held for distribution to owners

ICP has classified Civic Space (land) and the Administration Building (land) as non-current assets held for distribution to owners in their balance sheet. When these assets transfer, Council’s intention is to principally recover the carrying value of the land and building initially through use rather than the sale of the assets. Therefore, Council will recognise Civic Space (land) and the Administration Building (land) in property, plant and equipment rather than non-current assets held for sale. Refer to paragraphs 6 to 9 and Appendix B of AASB 5 Non-current Assets Held for Sale and Discontinued Operations.

In Council’s property, plant and equipment, land is valued using the fair value market approach and buildings are valued using the current replacement cost method. As per Council’s five year rolling valuation schedule, land will be formally revalued in 2019-2020. While for the Administration Building the change in use impacts on how the building is valued. Hence, the building development will need to be carried at current replacement cost in property, plant and equipment rather than at fair value so a formal valuation will be undertaken when the building development is complete to recognise its current replacement cost.

Investment Property

Council’s present intention for 2 Bell Street, Ipswich City Square and 5 Union Place is to earn income from the property rather than use in the production or supply of goods or services or for administrative purposes, thus satisfying the definition in paragraph 6 of AASB 140 Investment Property. However, some of these properties are not occupied and need to be refurbished prior to earning income. In accordance with paragraph 8 of AASB 140 examples of investment property include (d) a building that is vacant but is held to be leased out under one or more operating leases, and (e) property that is being constructed or developed for future use as investment property. In applying AASB 140’s examples to 2 Bell Street, Ipswich City Square and 5 Union Place, Council will recognise these assets as investment properties.

At the time of transition the investment properties will transfer to Council at fair value based on the fair value market approach assessed by the external valuer as at the 30 June 2019. Council will initially recognise the investment property at fair value as at transition date, refer to paragraph 20 of AASB140 and AASB 116. However, as required by AASB 140 Council will engage an external valuer in 2019-2020 to revalue the investment property and for each financial year after that. The movement in fair value will be recognised as an increment or decrement and will be accounted for in the Statement of Comprehensive Income in profit or loss.

List of ICP assets to distribute to Council

Asset Description 24 April 2019 Valuation

Civic Space 23 Ipswich City Mall $ 9,950,000

Administration Building 1 Union Place Mall $ 2,800,000

Non-current asset held for distribution to owners $12,750,000

2 Bell Street 2 Bell Street (Metro B) $ 5,300,000

Ipswich City Square 163 Brisbane Street $ 5,250,000

Ipswich City Square 24 Ipswich City Mall

– Bell St Link (Metro A) $ 3,200,000

Ipswich City Square 25 Ipswich City Mall (Eat) $ 475,000

Ipswich City Square 27 Ipswich City Mall (Eat) $ 360,000

Ipswich City Square Lot 25 on Crown Plan

– Bremer St Ramp Nil

5 Union Place Commonwealth Hotel $ 460,000

Investment Property $15,045,000

Work in Progress and Inventory

On the 30 June 2018 ICP provided notification of CBD redevelopment expenditure claims to Council for the value of $15,065,267.92 this accrued amount is still current as at the 24 May 2019, breakdown as follows:

Description Capital Expense Total

Administration Building

– Ellenborough St Land Purchase $ 6,726,906.86 $315,871.03 $7,042,777.89

Safe City Fitout Costs 409,689.61 5,687.50 415,377.11

56 Library Project Development Fee 962,037.74 0.00 962,037.74

57 Car Park Development Fee 692,563.25 61,918.24 754,481.49

58 Nicholas Street / Union Place 2,522,939.42 68,734.89 2,591,674.30

60 Civic Area Development Fee 3,282,887.19 16,032.19 3,298,919.38

Total still accrued 30 May 2019 $ 14,597,024.07 $468,243.85 $15,065,267.92

Accrual journal entry posted as at the 30 June 2018.

Work in Progress Debit $14,597,024.07

Expense Debit 468,243.85

Accrued Creditors Credit 15,065,267.92

Work in progress (WIP) and inventory will not be revalued prior to transition, but will be carried at cost when transferred to Council. When work in progress and inventory transfers to Council the above accrual will reverse and the recognition of the transferred WIP and inventory (as held by ICP) will offset the reversing accrual. Inventory will be reclassified and recognised as WIP. Council will recognise both WIP and inventory as WIP and subsequently capitalise to the respective property, plant and equipment or investment properties.

While ICP will process a credit note for the tax invoices raised as at the 30 June 2018. The effect of the credit note will be:

Sales Revenue Debit

GST Debit

Trade Receivables Credit

Liability to be Extinguished

As at the 31 March 2019, Council’s loan to ICP had a net value of $47,465,722.16 being $69,565,722.16 less impairment of $22,100,000. On the 30 June 2018, Council recognised an impairment of $22,100,000 for the loan to ICP due to Council’s decision to wind up ICP (in the short-term) which adversely impacts ICP’s ability to continue to earn development profits from its assets to repay the loan balance. As mentioned above, a report will be prepared to Council before 30 June 2019 outlining the transactions and implications of the integration of ICP’s assets and liabilities to Council. As part of this report Council will need to consider any remaining balance of the loan receivable and may consider to forgive a portion of the remaining balance, refer to paragraphs 3.2 and 5.5 of AASB 9 Financial Instruments. Council will need to resolve if any portion of the loan receivable is to be forgiven. The below journal entries would be recognised if Council passes such a resolution.

Council’s Financials

Reverse 30 June 2018 impairment

Loan to Ipswich City Properties Pty Ltd Receivable Debit $22,100,000

Impairment of inter-entity loan expense Credit $22,100,000

Write-down of inter-entity loan expense Debit TBA

Loan to Ipswich City Properties Pty Ltd Receivable Credit TBA

Journal prepared in accordance with paragraph 3.2 of AASB 9 Financial Instruments.

Other Matters

Stamp duty is incurred on any business merger and the cost borne by the receiving entity. Council has applied to State Government for exemption to stamp duty caused by the corporate reconstruction. If exemption is granted Council will not be required to pay stamp duty.

Related party transactions will still be reported in the related party disclosure note in the financial statements. This is in accordance with paragraph 18 of AASB Related Party Disclosure, “If an entity has had related party transactions during the periods covered by the financial statements, it shall disclose the nature of the related party relationship as well as information about those transactions and outstanding balances, including commitments, necessary for users to understand the potential effect of the relationship on the financial statements”.

Consolidated Financial Statements will be prepared for the 2018-2019 financial year as ICP will still exist as at the 30 June 2019 as there will be some balance sheet items remaining and there will have been a volume of transactions posted to the profit and loss throughout the financial year.

In the 2019-2020 financial year, consolidated financial statements will no longer be required as there will be a limited number of immaterial transactions recognised and ICP will be de-registered by December 2019. By not preparing consolidated financials for 30 June 2020 this will impact how Council accounts for its investment in Queensland Urban Utilities (QUU) participation distribution. When consolidated financials are prepared Council recognises its investment in associate QUU by applying the equity method in its consolidated financials, however Council will revert back to accounting for its participation share in QUU by applying the cost method of accounting in Council’s financials. This is in accordance with AASB 10 Consolidated Financial Statements and AASB 128 Investments in Associates and Joint Ventures. As a result of applying the cost method, an adjustment will be required to re-instate Council’s recognition in undistributed profits in QUU in investments for the period from June 2011 to June 2019. For example, total undistributed profits for June 2011 to June 2018 was $99,418,000. The adjustment will be applied against investments and equity, refer to Attachment 2 for a breakdown.

Proposed journal entry for the 2019-2020 financial year as follows:

Participation Rights in QUU – Investment Debit

Equity Credit

To recognise Council’s undistributed profits in associate QUU as an investment for the 2019-2020 financial year the following journal will be processed:

Participation Rights in QUU – Investment Debit

QUU Participation Rights Revenue Credit

Financial/RESOURCE IMPLICATIONS

No relevance to this report.

RISK MANAGEMENT IMPLICATIONS

The risk in not approving the recommendation would result in Council not accounting for the reintegration of Ipswich City Properties Pty Ltd in accordance with Australian Accounting Standards. As a result, both Ipswich City Properties Pty Ltd and Council’s financial statements would receive a qualified audit opinion.

Legal/Policy Basis

This report and its recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

Australian Accounting Standards

COMMUNITY and OTHER CONSULTATION

No relevance to this report.

Conclusion

The reintegration of Ipswich City Properties Pty Ltd with Council will be a loan receivable (asset) to asset swap. The assets should substantially transfer and be incorporated into Council by the 30 June and final deregistration of ICP is scheduled to occur from July to December 2019.

Attachments and Confidential Background Papers

|

1. |

John Lang LaSelle Advisory Pty Ltd - Valuation Report

24.04.2019 ⇩ |

|

2. |

Council's interest in undistributed profits in QUU - June

2011 to June 2018 ⇩ |

Barbara Watson

Principal Financial Accountant

I concur with the recommendations contained in this report.

Jeffrey Keech

Finance Manager

I concur with the recommendations contained in this report.

Andrew Knight

General Manager - Corporate Services

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

19 June 2019 |

ITEM: 5

SUBJECT: Waste Task Force Update

AUTHOR: Executive Business Support Officer

DATE: 10 June 2019

This is a report concerning the Department of Environment and Science (‘DES’) representatives meeting with Council on 8 April 2019 to provide an update on operations, findings, and outputs of the Odour Abatement Taskforce (‘OAT’).

That the report be received and the contents noted.

External

- Department of Environment and Science

Internal

- Corporate Governance

- Planning & Regulatory Services

Caring for the environment

The Odour Abatement Taskforce was a DES task force that primarily sought to audit and undertake compliance action for sites reported as having odour nuisance.

In parallel, Council was running an internal waste compliance team that focused on compliance and auditing for waste uses in the Willowbank, Tivoli and Swanbank Industrial Areas. These 2 task forces ran largely in independence.

On 8 April 2019, members of the waste compliance team, Council leadership and the Interim Administrator met with the DES to discuss the progress of the Odour Abatement Taskforce.

The update from DES staff is as follows:

OAT focus reduced from over 30 sites in the initial stages of taskforce monitoring to seven sites at the six month milestone:

- Candy Soils

- Cleanaway New Chum Landfill

- Veolia Wattle Glen Landfill

- Sapar Landscape Supplies

- Remondis Landfill

- Wood Mulching Industries

- NuGrow

Further OAT activities reduced priority sites to three:

- Cleanaway New Chum Landfill

- NuGrow

- Wood Mulching Industries

OAT has undertaken 23 pre-enforcement actions, issued 7 s451 Notices, 7 warnings, 2 environmental evaluations and 7 PINs since commencement.

In addition, DES staff and ICC staff resolved to work together more proactively and to share information. To this end and since the collaborative meeting DES has provided ICC with Public Register Documents for NuGrow and WMI through drop box access.

Not applicable.

This report and its recommendations are consistent with the following legislative provisions:

Not Applicable

DES and ICC staff have resolved to explore available pathways to information exchange relevant to the broader compliance and enforcement actions of each organisation in relation to the Swanbank Industrial Area.

In conclusion key staff in development and compliance areas are most appropriate to engage DES in the project moving forward. Further work is required to build relationships and identify core contacts in both organisations.

Louise Randall

Executive Business Support Officer

I concur with the recommendations contained in this report.

Brett Davey

Acting General Manager - Planning and Regulatory Services

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

19 June 2019 |

ITEM: 6

SUBJECT: Progress of the 2018-2019 Annual Internal Audit Plan

AUTHOR: Chief Audit Executive

DATE: 11 June 2019

This is a report concerning the status of the 2018-2019 Annual Internal Audit Plan as presented in the attachment to this report.

That the report be received and the contents noted.

Not applicable.

The intention is for the Internal Audit activity to support all five themes:

Strengthening our local economy and building prosperity

Managing growth and delivering key infrastructure

Caring for the community

Caring for the environment

Listening, leading and financial management

Individual internal audits and corrupt conduct investigations will to a varying degree support these themes, but the main objective for Internal Audit is to support the organisation in achieving its objectives.

The attachment is an indication of the progress and indicating the number of actual audit days compared to the budgeted audit days in the approved audit plan, relative to various Internal Audit Branch activities undertaken during the year.

Resources are provided to internal audit through the annual audit plan and budgeting processes. No additional resources were required because of this report. However situations will dictate if internal audits and investigations have to be outsourced and also management will have to consider their implications to implement the recommendations as per the individual reports.

Each of the individual reports provides for a control environment opinion as well as individual risk ratings per individual findings and recommendations. The importance is for management to implement the individual recommendations well to either address or diminish the exposure for Council, or explain why it is acceptable to not implement the suggested improvements. As per the corrupt conduct investigation, the findings and risks vary in each situation and are discussed in the confidential reports. Having said that the key risks are still if the information is not well presented, well understood or does not generate an appropriate response.

This report and its recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

Internal Audit mostly consults internally to the organisation and its management in conducting the internal audits and finalising the reports. For investigations the appropriate consultations take place as the situation allows and requires.

The Internal Audit Branch continued to have another demanding year due to the increased requirements regarding corrupt conduct investigations.

There were five carry over internal audits from the previous year completed in this financial year.

Six internal audits were postponed. These were mainly done due to timing issues in that many of these are affected by transformation projects and were mostly rescheduled into the next financial year. Portable and Attractive Assets were moved out till 2021-2022 due to Asset Management as a whole being brought forward to hopefully be done as the new framework is put in place.

One internal audit was cancelled due to changes of focus and circumstances. The Change Management New Building will now be done externally by experts when it is deemed appropriate.

With the carry overs from the previous year added it is expected that the Internal Audit Branch will still complete about 13/14 Internal Audit Reports/Projects/Consulting Tasks/Investigation projects for the year.

|

1. |

Progress of Internal Audit Plan 2018-2019 ⇩ |

Freddy Beck

Chief Audit Executive

I concur with the recommendations contained in this report.

David Farmer

Chief Executive Officer

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

19 June 2019 |

Doc ID No: A5560923

ITEM: 7

SUBJECT: Update on QAO Recommendations (Planning and Regulatory Services Department)

AUTHOR: Business Support Manager

DATE: 10 June 2019

This is a report concerning the Planning and Regulatory Services Department’s progress in complying with the Queensland Audit Office (QAO) recommendations outlined in ‘QAO 2018 Closing Report’ (adopted by Council on 4 December 2018). Specifically, Appendix A - Internal Control Issues (items 1 to 3) relating to developer infrastructure contributions and fee variations.

That the report be received and the contents noted.

There are no related party matters associated with this report.

Managing growth and delivering key infrastructure

In 2018, QAO conducted an audit of Ipswich City Council’s (Council’s) financial records and processes, including outstanding infrastructure contributions (as of 31 August 2018). QAO delivered their findings and recommendations in the ‘QAO 2018 Closing Report’ (Attachment 3) on 28 November 2018. Of the issues identified in this report, items 1 to 3 relate to functions owned by the (former) Planning and Development Department:

1. No policies or procedures in relation to developer infrastructure contributions;

2. Reconciliation of Infrastructure Charges Notice (ICN) Register to Pathway for outstanding developer infrastructure contributions; and

3. Lack of transparency in calculation of fee variations.

After consultation with QAO, on 15 October 2018 the (former) Planning and Development Department commenced the review of the $304m of infrastructure contributions that had been levied but not yet collected. The Department reviewed and categorised the 725 development applications to identify applications with contributions legitimately owing (see table below). Of the $304m in outstanding contributions, $231.7m were for developments that had not commenced or were under construction. As infrastructure contributions are payable once the work is finalised, these contributions were not owing.

|

|

No. of applications |

Contributions |

|

Development not commenced (contributions not payable) |

306 |

$107,253,930 |

|

Under construction/staged development (contributions not payable) |

140 |

$124,419,557 |

|

Requires further investigation (development completed) |

88 |

$46,597,394 |

|

Lapsed and superseded (contributions no longer payable) |

130 |

$22,787,639 |

|

Contributions paid during review period

|

35 |

$1,750,003 |

|

Redundant contributions (e.g. water/sewer) |

21 |

$1,161,242 |

|

Administrative errors (i.e. duplicates, incorrect entry) |

5 |

$34,686 |

|

TOTAL |

725 |

$304,004,451 |

Since completing the review, $79m has been removed from the outstanding infrastructure contributions balance owing to:

· the removal of water and sewerage contributions no longer collected by Council;

· correction of administrative errors;

· removal of lapsed and superseded applications; and

· contributions paid during this time.

The current balance of the outstanding infrastructure contributions report for the same period (as at 15 October 2018) is now $224.6m which consists of:

|

|

No. of applications |

Contributions |

Percentage of Contributions |

|

Development not commenced (contributions not payable) |

296 |

$93,999,499 |

41.9% |

|

Under construction/staged development (contributions not payable) |

122 |

$93,322,535 |

41.6% |

|

Audit underway (contributions outstanding) |

76 |

$37,243,826 |

16.5% |

|

*Development completed (contributions not collected) |

1 |

$11,026 |

0% |

|

TOTAL |

495 |

$224,576,886 |

100% |

*Note: this application relates to a development at Braeside road, Bundamba where legal assistance has been sought, and contributions continue to remain outstanding.

The recommendations of QAO have been managed through several new procedures and workflows have been developed to facilitate transparent and effective processes around infrastructure contributions and fee variations, including:

· Infrastructure Charges Procedure: provides a framework for assessing, levying, monitoring, collecting, reporting and reconciling infrastructure contributions, offsets and refunds. This procedure also relates to the reconciliation of contributions and credits as part of an infrastructure agreement. This procedure is being finalised and it is expected to be adopted and in effect by 1 July 2019.

· Variation of Development Applications Fees Procedure (Attachment 2): supports the Ipswich City Council Register of Fees and Charges in the determination of fee variations, providing a consistent approach to receiving, assessing and approving requests that align with financial delegations. It is expected that this procedure will be noted in a report to the June round of the Governance Committee and will take effect by 1 July 2019.

· Development Approval Compliance Program (Attachment 1): this workflow facilitates the monitoring and collection of infrastructure contributions through a proactive compliance program and forms the basis for the Development Approval Compliance procedure currently being drafted. It is expected that this procedure will be approved and in effect by 1 July 2019.

In addition, auditing of the ICN Register is underway and due to be complete by 30 June 2019. Register entries relating to applications determined after 1 July 2017 are being reviewed for consistency with Pathway and compliance with the requirements of the Planning Act 2016.

In addition to the above, a subsequent body of work is required to finalise and appropriately implement the recommendations made by the QAO, including:

· Further reconciliation of the ICN Register for applications determined between 1 July 2011 and 30 June 2016 under the Sustainable Planning Act 2009.

· Reconciliation of offsets and credit transactions between ICN Register, the Infrastructure Agreements (IA) Registers and Pathway.

· Quarterly reconciliations between the ICN Register and Pathway to ensure completeness and accuracy of outstanding infrastructure contributions.

In addition to the above, there is a proposed reform to the Planning Act 2016 and Planning Regulation 2017 which may result in significant changes to the process for levying, collecting and recording of infrastructure charges. The complexity of the existing system as well as the complexity of managing the levying of charges under the existing framework and information systems, with the use of Microsoft Excel to fill gaps in the system, suggests that a complete systems review may be warranted to better manage this aspect of Council’s business. This will be further investigated by the Development Planning Branch.

All costs associated with completing the QAO recommendations have been absorbed within the Planning and Regulatory Services Department operational budget. Therefore, there are no financial implications associated with this report.

There are no risk management implications associated with this report.

This report and its recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Planning Act 2016

The Planning and Regulatory Services Department continue to work through the QAO recommendations and it is anticipated that all QAO recommendations will be complete by 31 December 2019.

|

1. |

Development Approval Compliance Program Workflow ⇩ |

|

2. |

Variation of Development Application Fees Procedure ⇩ |

|

2.1 |

Attachment within Attachment 2 ⇩ |

|

|

|

|

|

CONFIDENTIAL |

|

3. |

Nicole Yiannou

Business Support Manager

I concur with the recommendations contained in this report.

Brett Davey

Acting General Manager - Planning and Regulatory Services

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

19 June 2019 |

ITEM: 8

SUBJECT: Internal Audit Branch Activities Report for the period 4 February 2019 to 10 June 2019

AUTHOR: Chief Audit Executive

DATE: 10 June 2019

This is a report concerning the activities of Internal Audit undertaken since 4 February 2019 and the current status of these activities.

That the report be received, the contents noted and the recommendations in Attachments 2 and 3, be considered finalised and archived.

Not applicable.

The intention is for the Internal Audit activity to support all five themes:

Strengthening our local economy and building prosperity

Managing growth and delivering key infrastructure

Caring for the community

Caring for the environment

Listening, leading and financial management

The purpose of this report is to keep the Audit and Risk Management Committee informed and to report on performance of the Internal Audit Branch:

• Summary of the activities of the Internal Audit Branch

• Report the status of the audit recommendations from completed audits

• Report the status of the audits currently under way

The supply of the information to the Mayor, the Chief Executive Officer and Audit and Risk Management Committee, is a requirement of the Internal Audit Charter.

Audits, Reviews, Projects and Activities (Attachment 1)

This is a report on audits, reviews, projects and activities that were conducted during the period or in progress as at 10 June 2019.

Audit Recommendations (Attachment 2 and 3)

Extracted from the Audit Recommendations System, these reports list all Internal 2 and External 3 Audit recommendations (with management comments and responses) that managers advise have been implemented since the report made to the last Audit Committee meeting.

This report is presented to the Audit and Risk Management Committee prior to the recommendations being finalised and/or archived.

Internal Audit Report Register (Attachment 4)

This is a historic register recording the reference number of formal reports produced, audits commenced, report status and date completed for the last ± two years.