IPSWICH

CITY

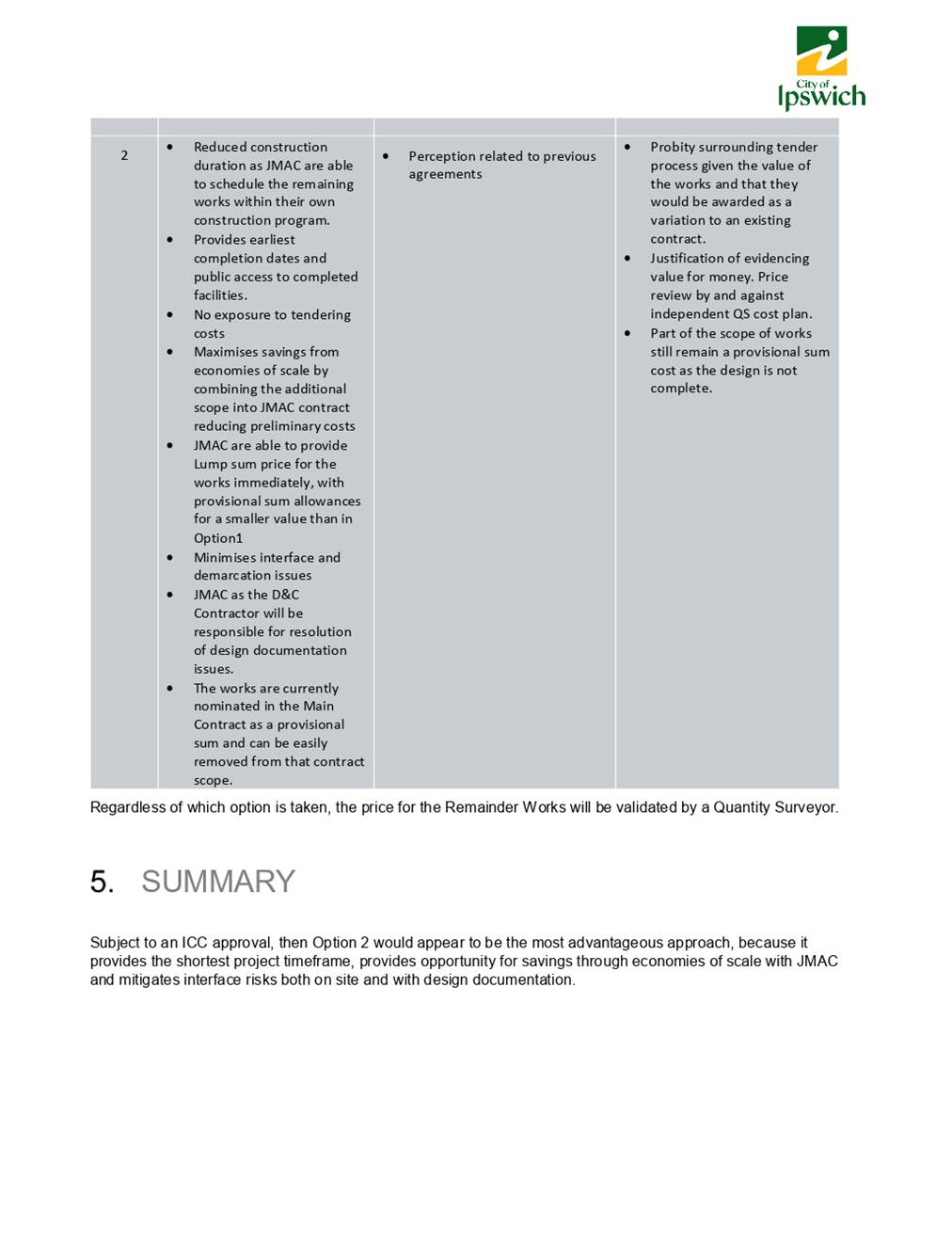

COUNCIL

AGENDA

of the

Council Special Meeting

Held in the Council Chambers

2nd floor – Council Administration

Building

45 Roderick Street

IPSWICH QLD 4305

On Thursday,

27 June 2019

At 9.00

am

The purpose of

the meeting is to consider:

1. Riverview

Community Centre

2. Disposal

of Part of 95A Brisbane Road, Booval described as part of Lot 169 on RP24111 to

Swifts Leagues Club Ltd

3. Transfer

of Property and Other Assets of Ipswich City Properties Pty Ltd and associated

matters

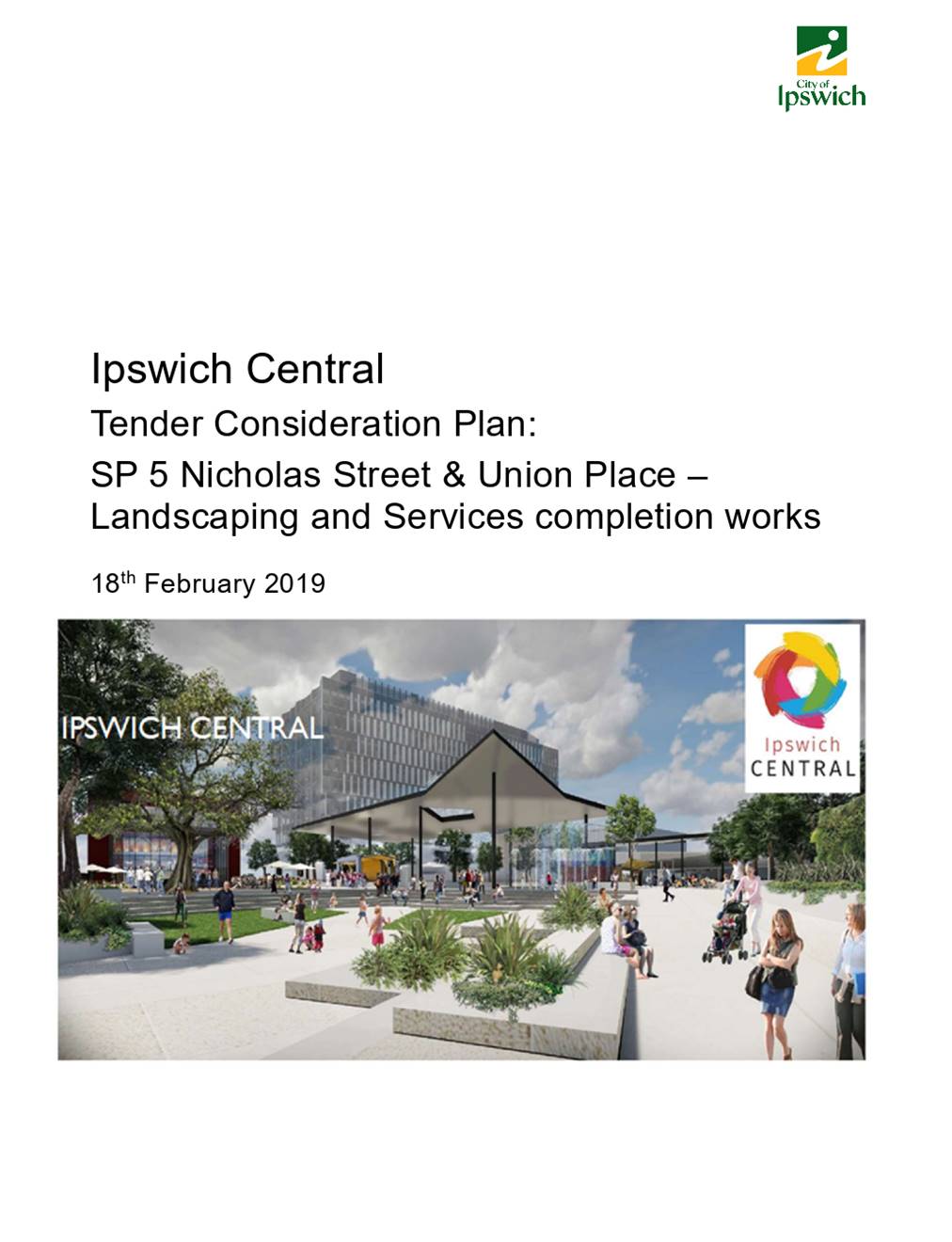

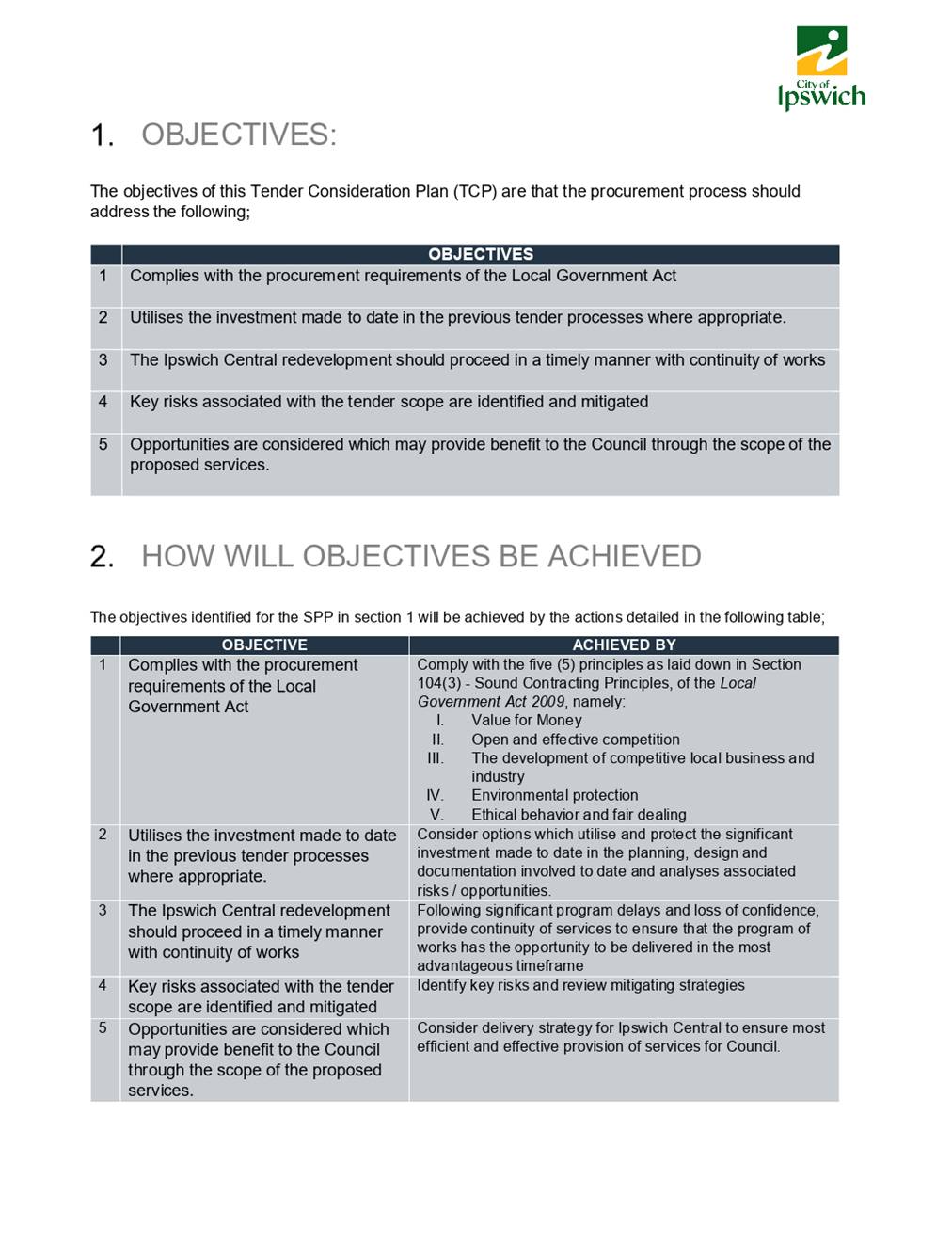

4. Nicholas

Street and Union Place Landscaping and Services Completion Works - Nicholas

Street Ipswich Resubmission

5. Tender

Consideration Plan - Ipswich City Properties Pty Ltd Supplier Agreement

Novations to Ipswich City Council

6. Tender

Consideration Plan - Appointment of Retail Leasing Agent - Ipswich Central CBD

Transformation Project

|

Council

Special

Meeting Agenda

|

27 June

2019

|

BUSINESS

A. OPENING OF MEETING:

B. WELCOME

TO COUNTRY OR ACKNOWLEDGEMENT OF COUNTRY:

C. OPENING

PRAYER:

D. APOLOGIES

AND LEAVE OF ABSENCE:

E. Officers' reports:

· Riverview

Community Centre................................ 5

· Disposal

of Part of 95A Brisbane Road, Booval described as part of Lot 169 on RP24111 to

Swifts Leagues Club Ltd.................................................. 29

· Transfer

of Property and Other Assets of Ipswich City Properties Pty Ltd and associated

matters... 39

· Nicholas

Street and Union Place Landscaping and Services Completion Works - Nicholas

Street Ipswich Resubmission.......................................... 61

· Tender

Consideration Plan - Ipswich City Properties Pty Ltd Supplier Agreement

Novations to Ipswich City Council......................................... 73

· Tender

Consideration Plan - Appointment of Retail Leasing Agent - Ipswich Central CBD

Transformation Project........................................ 95

--ooOOoo--

|

Council

Special

Meeting Agenda

|

27 June

2019

|

Doc ID No: A5581439

ITEM: E.1

SUBJECT: Riverview Community Centre

AUTHOR: Community Engagement Manager

DATE: 10 June 2019

Executive Summary

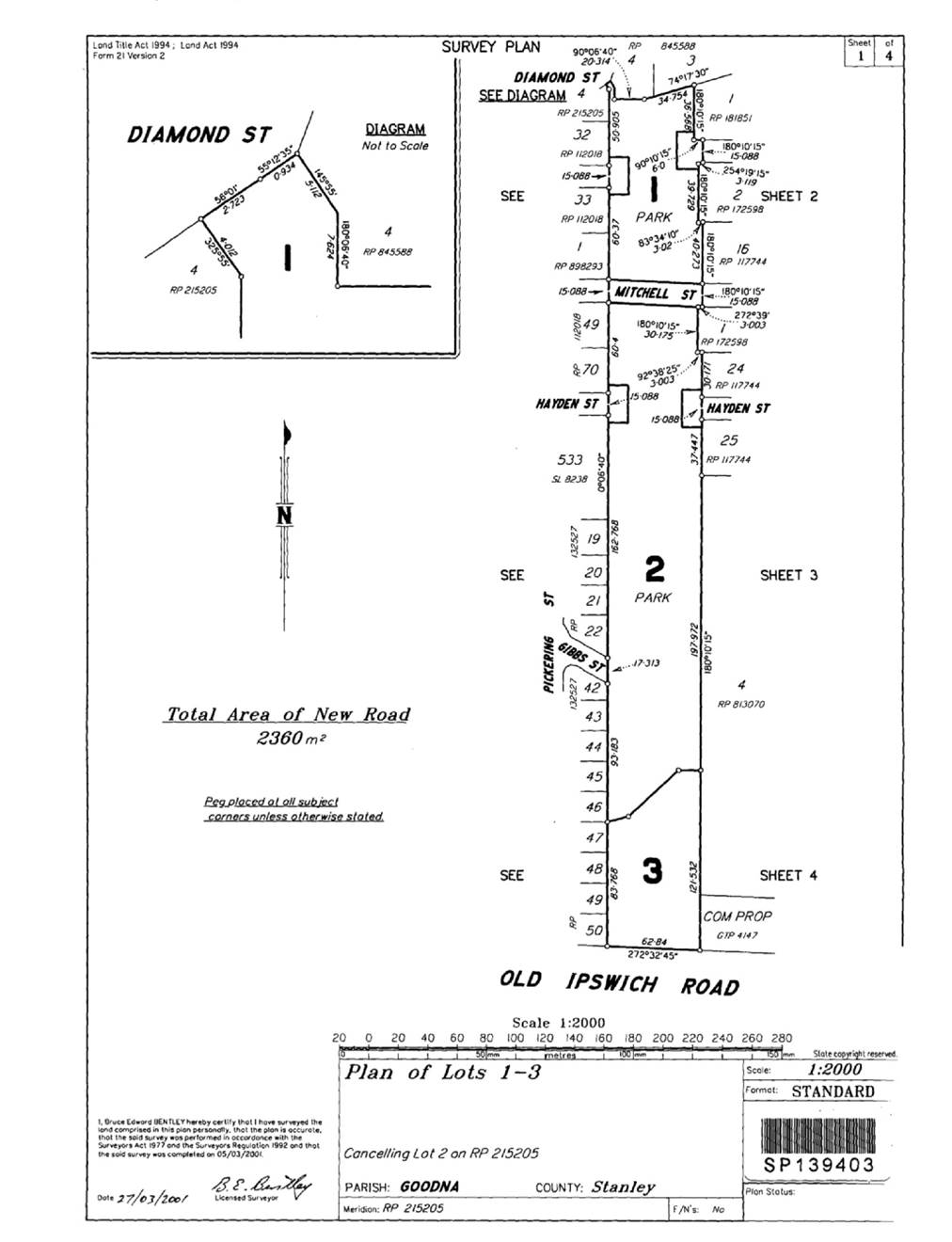

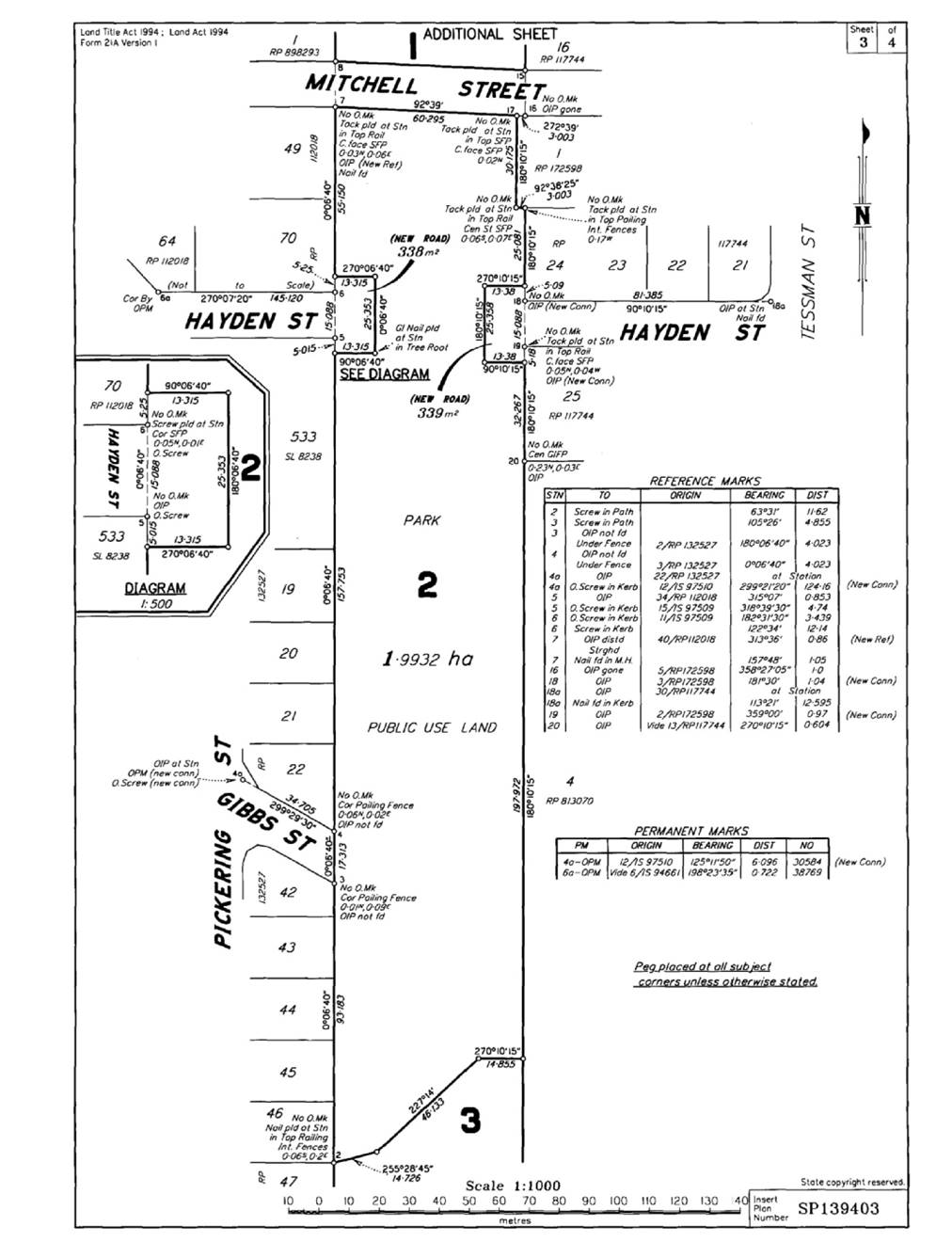

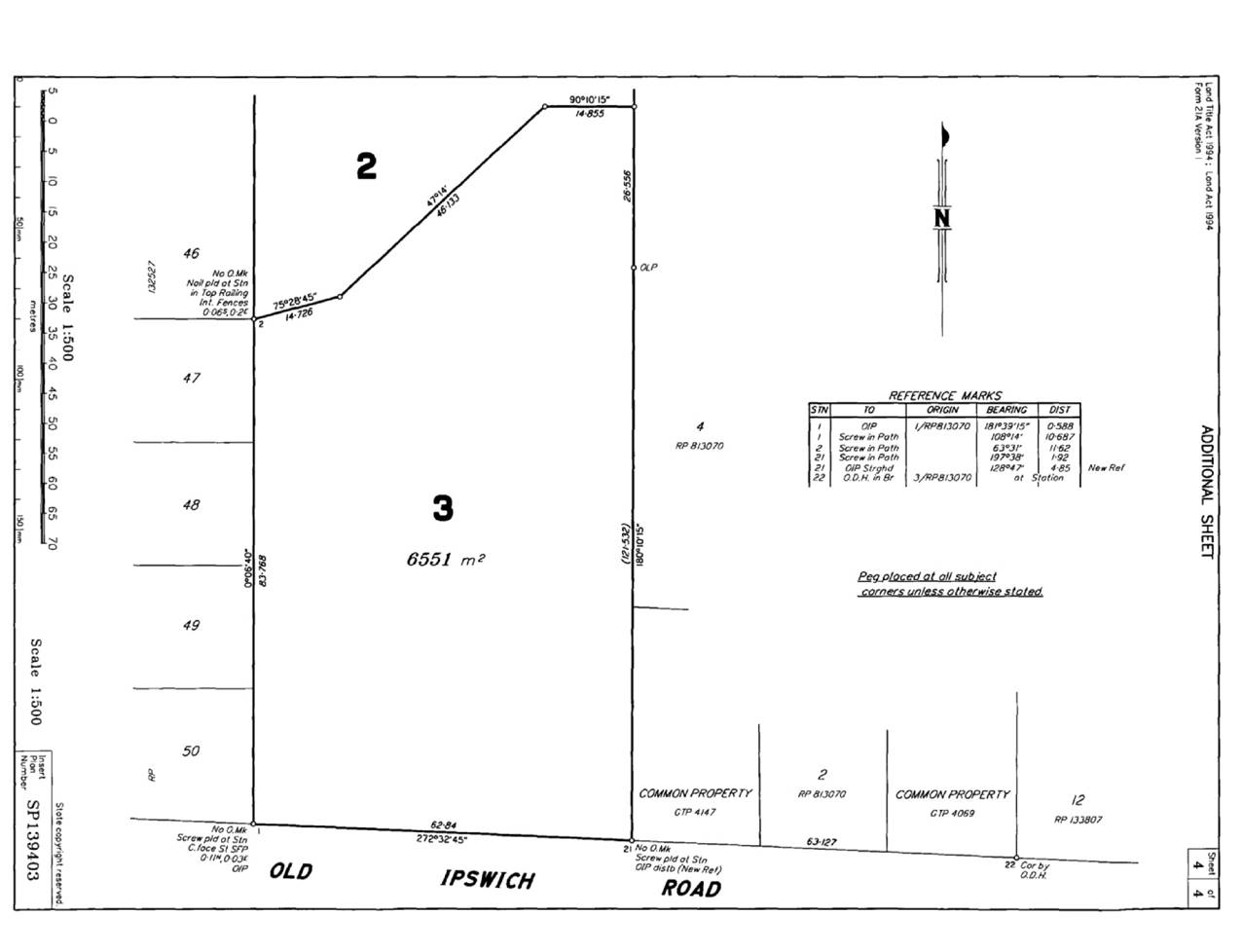

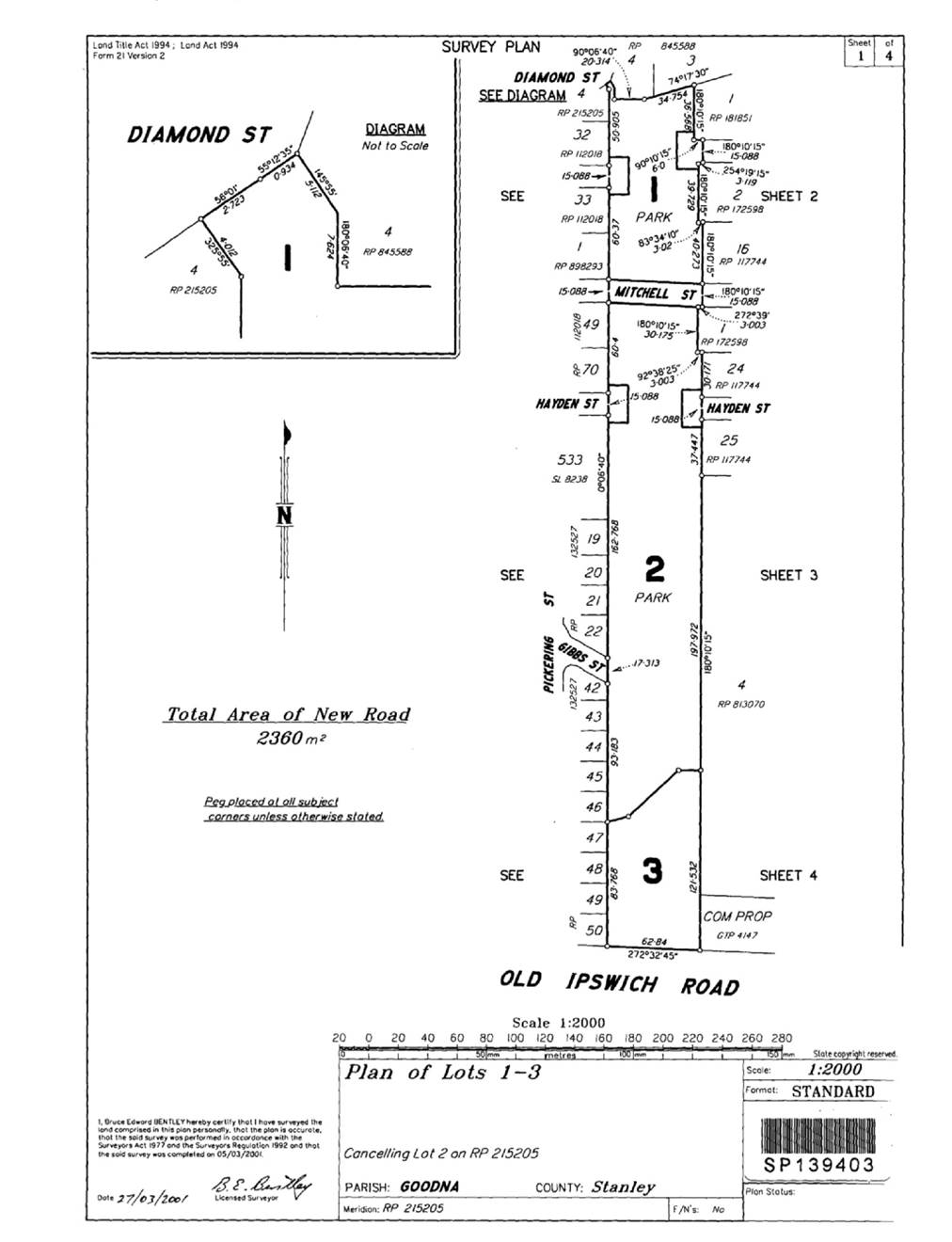

This is a report concerning the tenure

of Riverview Community Centre located at 138 Old Ipswich Road, Riverview on Lot

3 on SP139403.

RECOMMENDATION

That the Interim Administrator of Ipswich City

Council resolve:

A. That

the previous decision of Council, as per Item No. 5 of the Governance Committee

No.2019(05), 14 May 2019 and adopted at the Council Ordinary meeting of 21 May

2019, be repealed.

B. That

Council (Interim Administrator of Ipswich City Council) assume management of

the Riverview Community Centre as an interim operating model, with another public

Expression of Interest process to be run again on or before 1 July 2020.

RELATED PARTIES

The current Lessee of the

Riverview Community Centre is the Riverview Neighbourhood House Association

Inc. and its Lease Agreement is due to expire on 30 June 2019. The

current Lessee has been in occupation of the premises for a period of 11 years.

In accordance with the terms of the Lease, the Lessee is required to vacate the

Premises on or before 30 June 2019.

Advance Ipswich Theme Linkage

Listening, leading and financial

management.

Purpose of Report/Background

The Riverview Community Centre

located at 138 Old Ipswich Road, Riverview, described as Lot 3 on SP139403

occupies 6,551 square meters (Attachment 1). The property is improved with an

onsite community use building. The purpose of the land is for ‘Community,

Recreational and Neighbourhood Centre’.

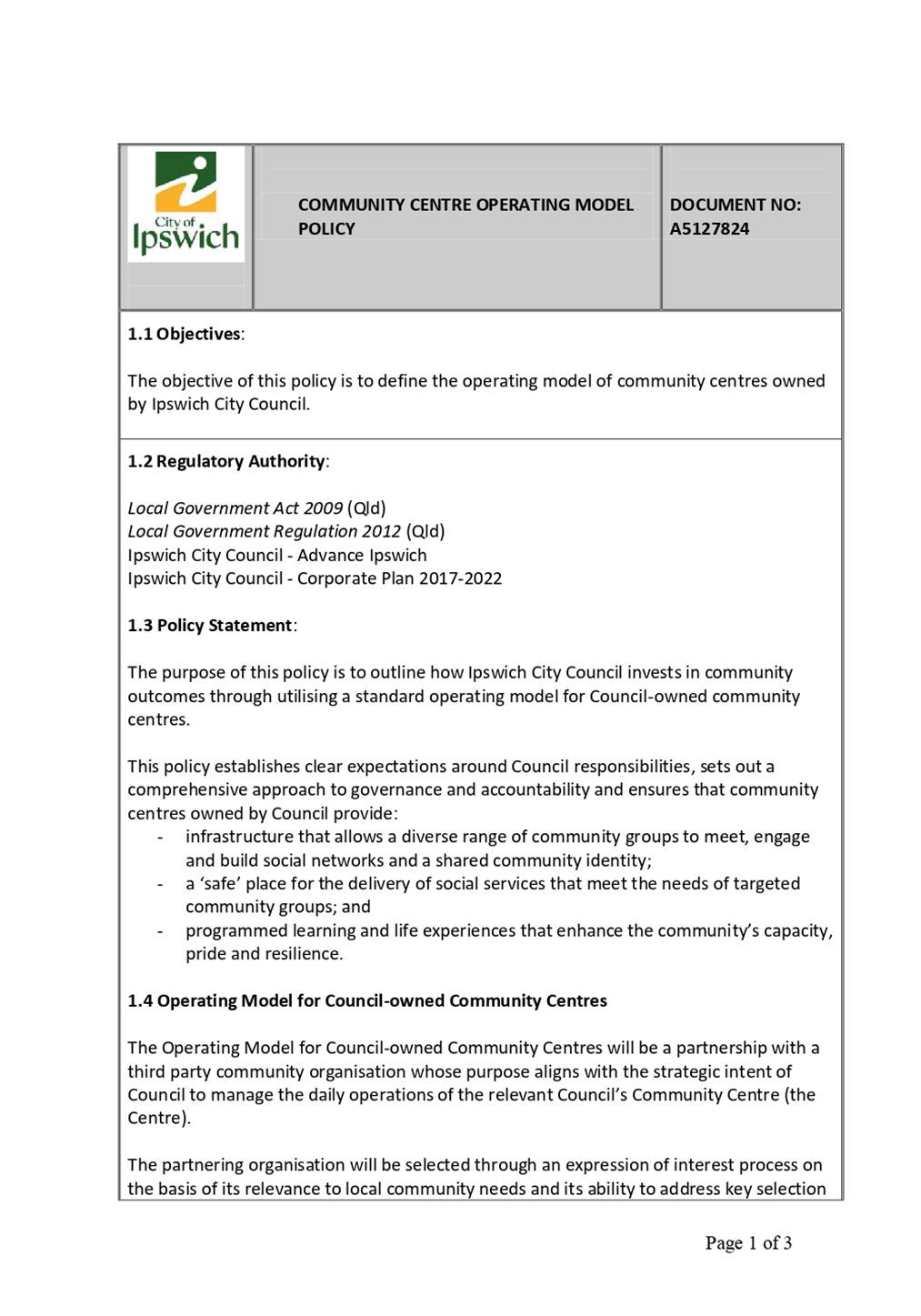

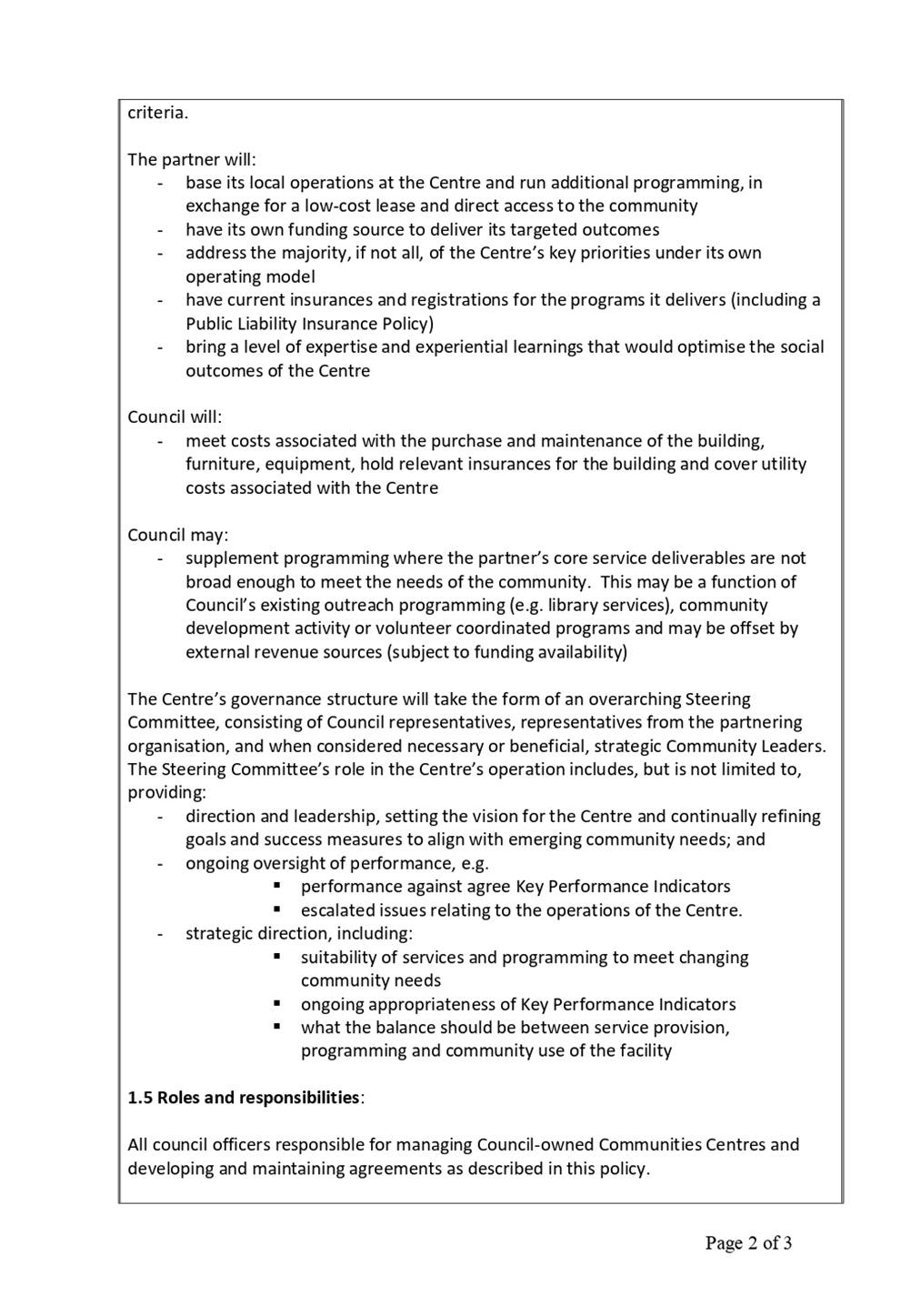

In accordance with Council’s

Community Centre Operating Model Policy (Attachment 2), on 2 March 2019,

Ipswich City Council (‘Council’) opened a Request for Expression of

Interest (REOI) for the tenure and management of the Riverview Community Centre

(‘the Centre’). The intention of the REOI was to establish a

partnership with a community organisation whose services aligned with the strategic

intent of Council to facilitate the provision of quality social and community

outcomes.

Applications to the REOI closed on

2 April 2019 and attracted a total of three (3) expressions of interest. Each

response was evaluated by a Panel of Council representatives and a successful

respondent was identified. (Attachment 3).

At the Ordinary Council meeting of

21 May 2019, Council resolved:

A. That

Council (Interim Administrator of Ipswich City Council) resolve pursuant to

section 236(2) of the Local Government Regulation 2012 (the Regulation)

that the exceptions under sections 236(1)(b)(ii) of the Regulation apply

to the disposal of the leasehold interest located at 138 Old Ipswich Road,

Riverview on Lot 3 on SP139403 (“the land”), by way of a leasehold

arrangement between Council and Ipswich YUPI Program Inc. for a consideration

sum of $1.00 pa ex GST, if demanded.

B. That

Council (Interim Administrator of Ipswich City Council) enter into a lease with

Ipswich YUPI Program Inc. (“the tenant”) for a period of three (3)

years with an option period of an additional three (3) years.

C. That

the Chief Executive Officer be authorised to negotiate and finalise the terms

of the Lease to be executed by Council and to do any other acts necessary to

implement Council’s decision in accordance with section 13(3) of the Local

Government Act 2009.

As a result of the above Council

resolution, the Community Engagement Branch began conversations with the

successful respondent and provided them with a draft lease agreement and

management agreement to review and consider.

At the same time, the current managing

organisation and associated community members/organisation wrote several pieces

of correspondence to the Interim Administrator articulating their concern about

the Council resolution.

Upon further consultation with the

community and stakeholders, the Interim Administrator regards Council assuming

management of the facility and operations of the centre as the preferred

interim model, with another public

Expression of Interest process to be run again on or before 1 July 2020.

RISK MANAGEMENT IMPLICATIONS

Legal

The REOI documentation clearly

outlines that Council has absolute discretion with regard to the REOI process

and, further, that Council does not need to provide any reasons under the REOI

for any decision it may make. Accordingly, Council does not have any legal

obligation to the successful respondent until such time as a lease agreement

and management agreement is executed. This has not occurred.

The REOI process undertaken to

select a respondent organisation for the tenure and management of the Centre

was undertaken in line with the sound contracting principles articulated in

section 104(3) of the Local Government Act 2009, specifically, the

process was conducted transparently, open to a number of parties and was accountable.

The repeal of the previous decision of Council could be perceived as being

inconsistent with that process.

Policy

The recommendations of this report could be perceived to be inconsistent

with Council’s Community Centre Operating Model Policy (Attachment 2),

which articulates:

“The operating model for Council-owned Community

Centres will be a partnership with a third party community organisation whose

purpose aligns with the strategic intent of Council to manage the daily

operations of the relevant Council Community Centre (the Centre).

The partnering organisation will be selected through an

expression of interest process on the basis of its relevance to local community

needs and its ability to address key selection criteria.”

However, as Council assuming management of the Riverview

Community Centre is an interim operating model, with another public Expression

of Interest process to be run again on or before 1 July 2020, this perceived inconsistency

is marginal.

Reputational

The REOI process undertaken to

select a respondent organisation for the tenure and management of the Centre

was in line with the sound contracting principles articulated in section 104(3)

of the Local Government Act 2009, specifically, the process was

conducted transparently, open to a number of parties and was accountable. There

may be some reputational risk for Council in repealing a resolution to enter

into lease with the successful respondent, specifically with the third party

community organisations who operate in this sector and may be considering

future partnerships with Council.

FINANCIAL/RESOURCING

IMPLICATIONS

In order for Council to assume management of the facility

and operations of the Centre, the following resourcing is being recommended. Four

(4) resources are proposed in order to comprehensively manage the Centre:

- Riverview

Community Centre Director;

- Riverview

Community Centre Community Development Officers (x2); and

- Riverview

Community Centre Administrative Officer.

Riverview Community Centre Director

This position will be held by Council’s Community Development

Coordinator. This position will provide strategic leadership for the Centre and

will be responsible for the development and implementation of a policy and

procedure document suite to govern the operations of the Centre.

Riverview Community Centre Community Development Officers

(x2)

These positions will be held by two Council Community

Development Officers. These positions will work collaboratively and be

responsible for the operations and activation of the Centre. These positions

will work to ensure that service provision to the local community is maintained

and is responsive to community needs and best practice community development

methodologies.

Riverview Community Centre Administrative Officer

This position is not able to be filled within the current

resourcing of the Community Development Team and will need to be sourced

outside of the Community Development Team. This position would be responsible

for the administrative aspects of the Centre. That is, managing the reception

desk, taking enquiries, etc.

Legal/Policy Basis

The repeal of Council’s decision, as per Item No. 5 of

the Governance Committee No.2019(05), 14 May 2019 and adopted at the Council

Ordinary meeting of 21 May 2019, is consistent with Council’s Governance

Policy as it formalises Council’s decision-making process thereby

ensuring the decision being made is done in a rational, informed, ethical and

transparent fashion.

COMMUNITY and OTHER CONSULTATION

Council approached organisations

through a REOI process to establish a partnership that will facilitate the

provision of quality social and community outcomes through the tenure and

management of the Centre.

To encourage applicants from the local

industry and market, Council advertised the REOI in both the Queensland Times

and Courier Mail newspapers and online at LGTenderbox.

At the Ordinary Council meeting of

21 May 2019 Council resolved to enter into a leasehold arrangement with the

successful respondent to the REOI process.

As a result of the above Council

resolution, the Community Engagement Branch began conversations with the

successful respondent and provided them with a draft lease agreement and

management agreement to review and consider.

At the same time, the current

managing organisation and associated community members/organisation wrote

several pieces of correspondence to the Interim Administrator articulating

their concern about the Council resolution.

Upon further consultation with the

community and stakeholders, the Interim Administrator regards Council assuming

management of the facility and operations of the centre as the preferred

interim model, with another public

Expression of Interest process to be run again on or before 1 July 2020.

Conclusion

This is a report concerning the

tenure of Riverview Community Centre located at 138 Old Ipswich Road, Riverview

on Lot 3 on SP139403. The current Lessee is the Riverview Neighbourhood House

Association Inc. and its Lease Agreement is due to expire on 30 June

2019.

In accordance with Council’s

Community Centre Operating Model Policy (Attachment 2), on 2 March 2019, Council

opened a REOI for the tenure and management of the Centre. Each response

received was evaluated by a Panel of Council representatives and a successful

respondent was identified. (Attachment 3).

At the Ordinary Council meeting of

21 May 2019, Council resolved to enter into a lease agreement with the

successful respondent. Upon further consultation with the community and

stakeholders, the Interim Administrator regards Council assuming management of

the facility and operations of the centre as the preferred interim model, with another public Expression of Interest

process to be run again on or before 1 July 2020.

There are legal, policy, reputational

and resourcing matters to be considered by Council when determining the

recommendations of this report.

Attachments and Confidential Background Papers

|

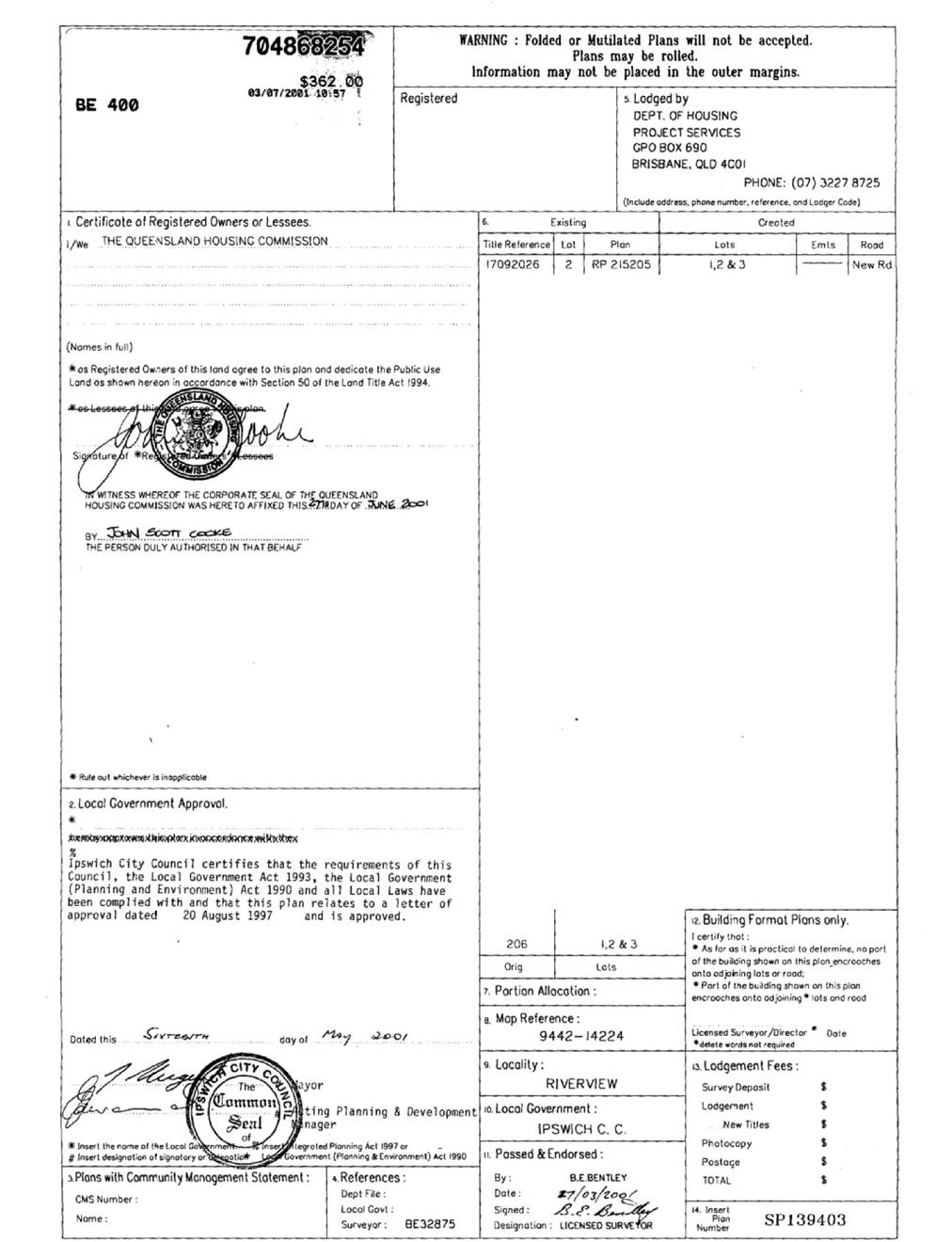

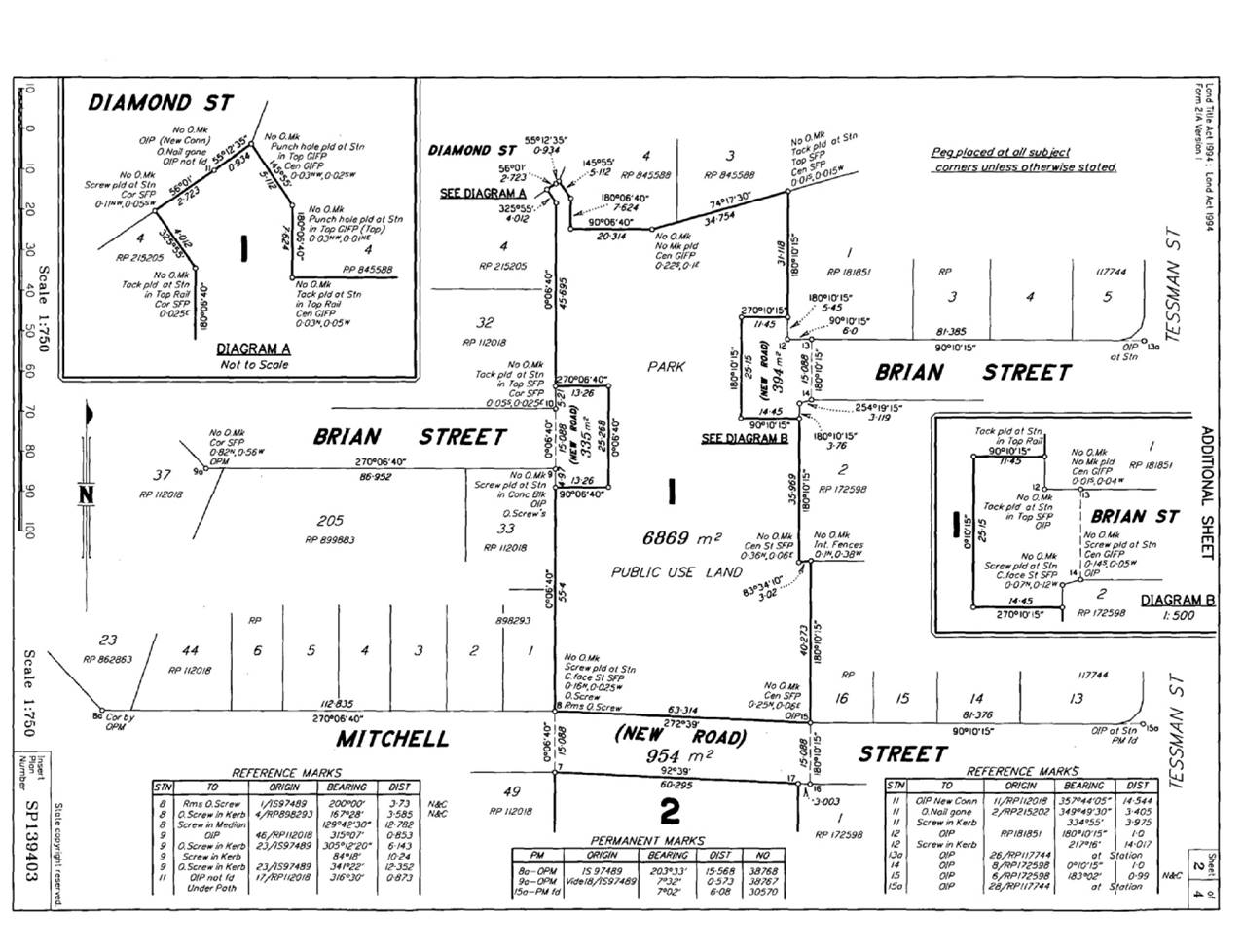

1.

|

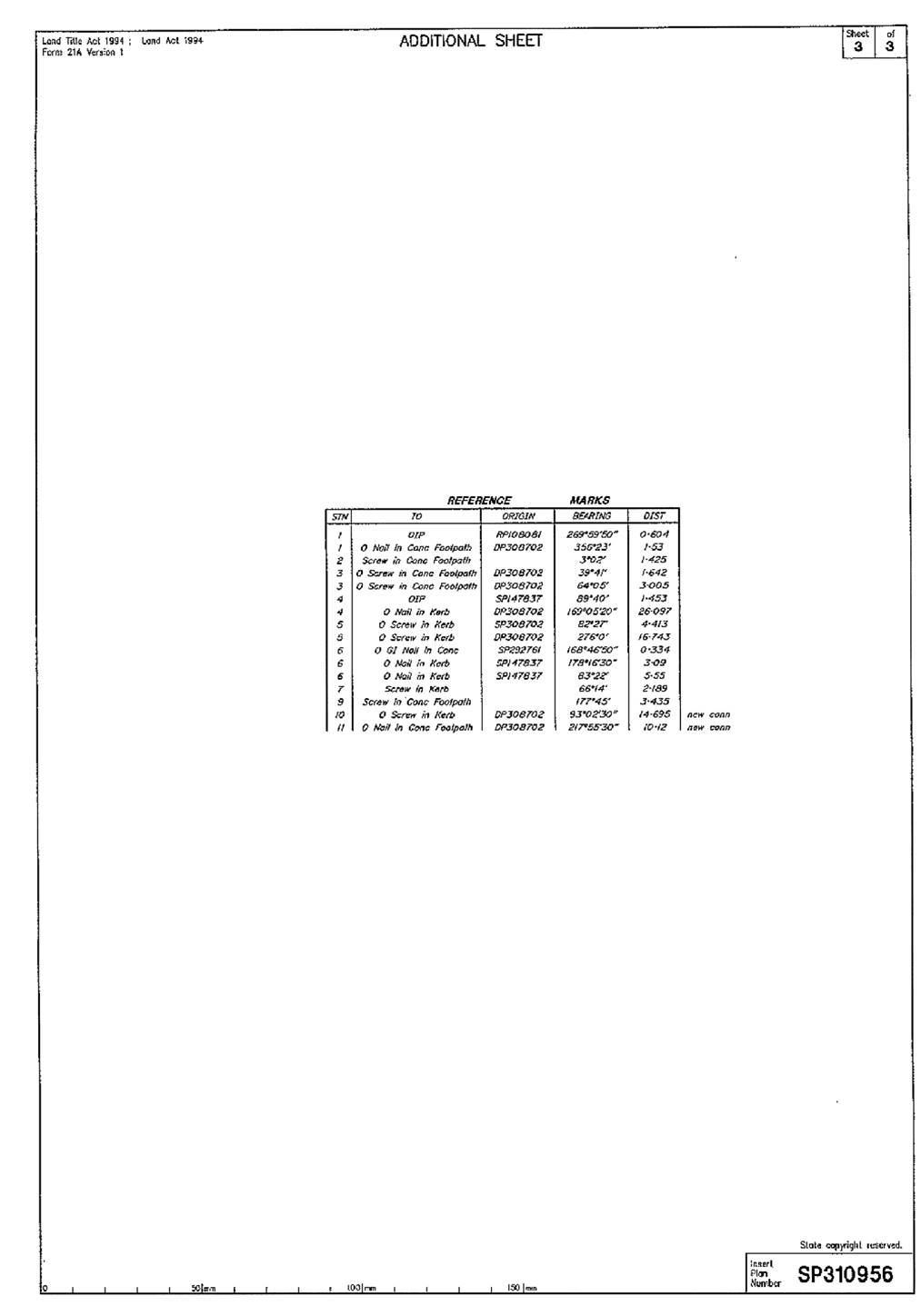

Survey Plan of Lot 3 on SP139403 ⇩

|

|

2.

|

Community Centre Operating Model Policy ⇩

|

|

3.

|

REOI Executed Evaluation Report ⇩

|

Abbey Richards

Community

Engagement Manager

I concur with the recommendations contained in this

report.

Ben Pole

General Manager -

Community, Cultural and Economic Development

“Together,

we proudly enhance the quality of life for our community”

|

Council

Meeting

Agenda

|

27 June

2019

|

Item E.1 / Attachment 1.

|

Council

Meeting

Agenda

|

27 June

2019

|

Item E.1 / Attachment 2.

|

Council

Meeting

Agenda

|

27 June

2019

|

Item E.1 / Attachment 3.

|

Council

Special

Meeting Agenda

|

27 June

2019

|

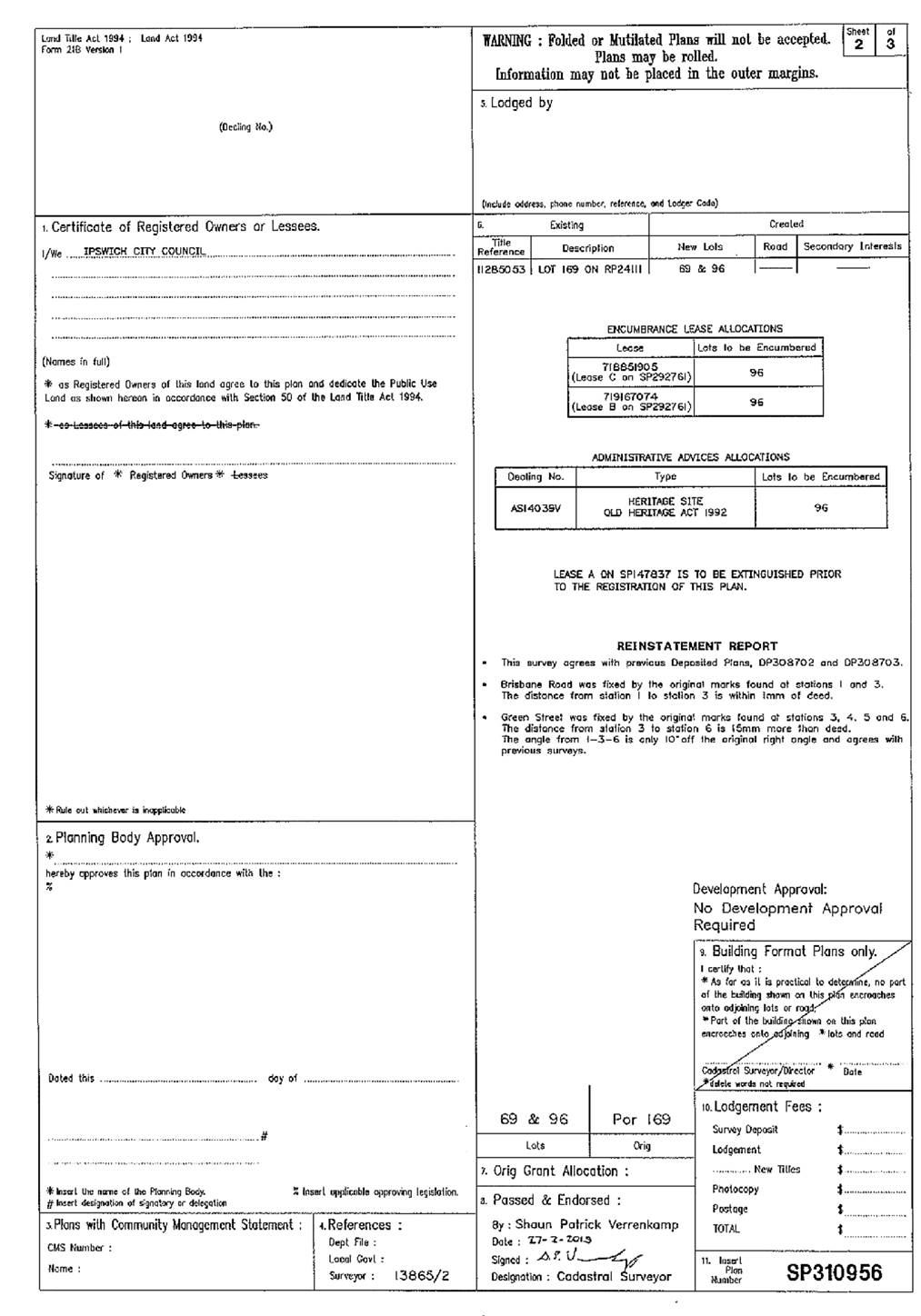

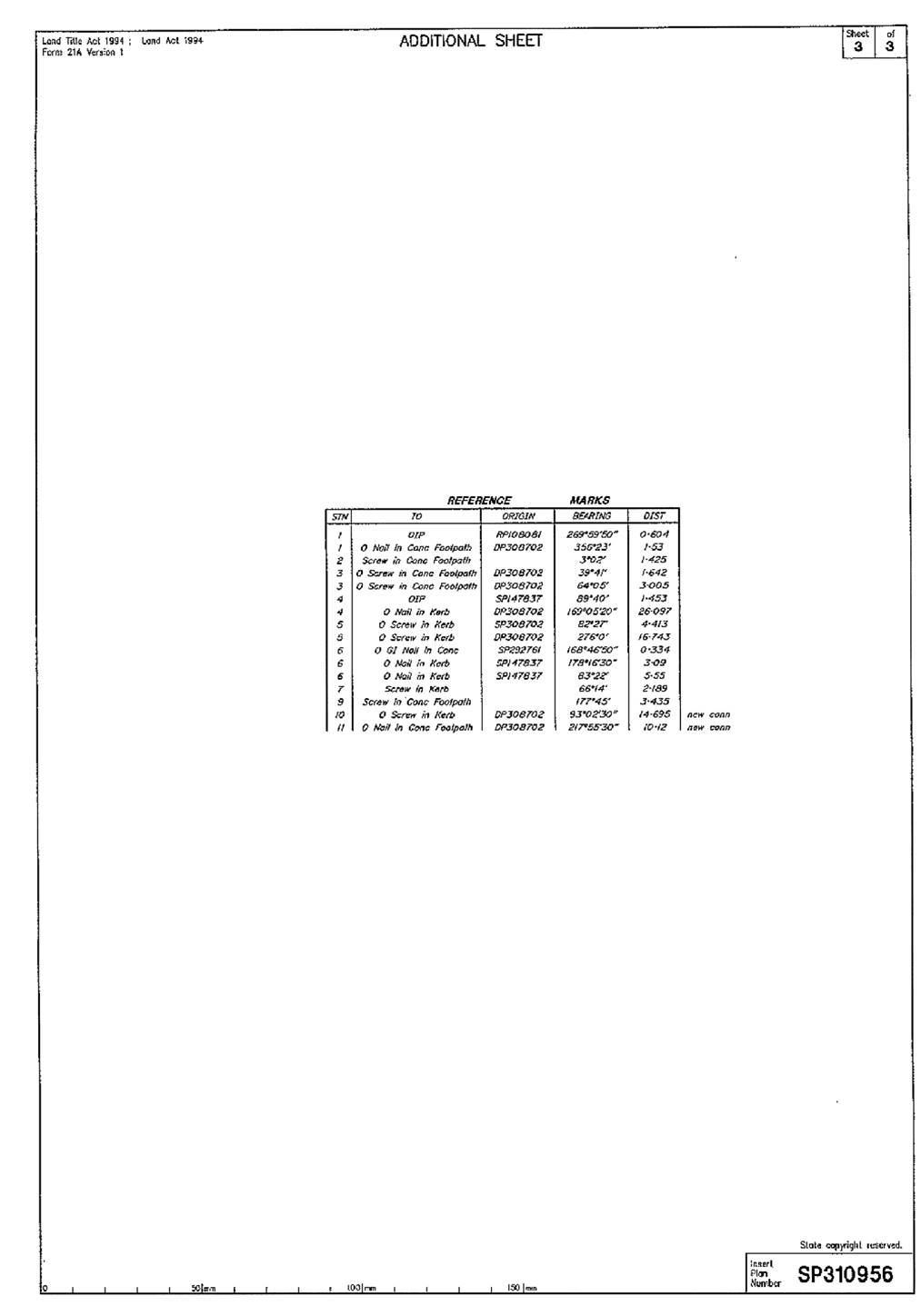

Doc ID No: A5618278

ITEM: E.2

SUBJECT: Disposal of Part of 95A Brisbane Road, Booval

described as part of Lot 169 on RP24111 to Swifts Leagues Club Ltd

AUTHOR: Business Accounting and Asset Manager

DATE: 25 June 2019

Executive Summary

This is a report concerning the proposed

disposal by Ipswich City Council (Council) of part of 95A Brisbane Road, Booval

described as part of Lot 169 on RP24111 to the Swifts Leagues Club Ltd

ACN 010 165 045 [ABN 58 010 165 045] (Swifts).

RECOMMENDATION

That the Interim Administrator of Ipswich City Council

resolve:

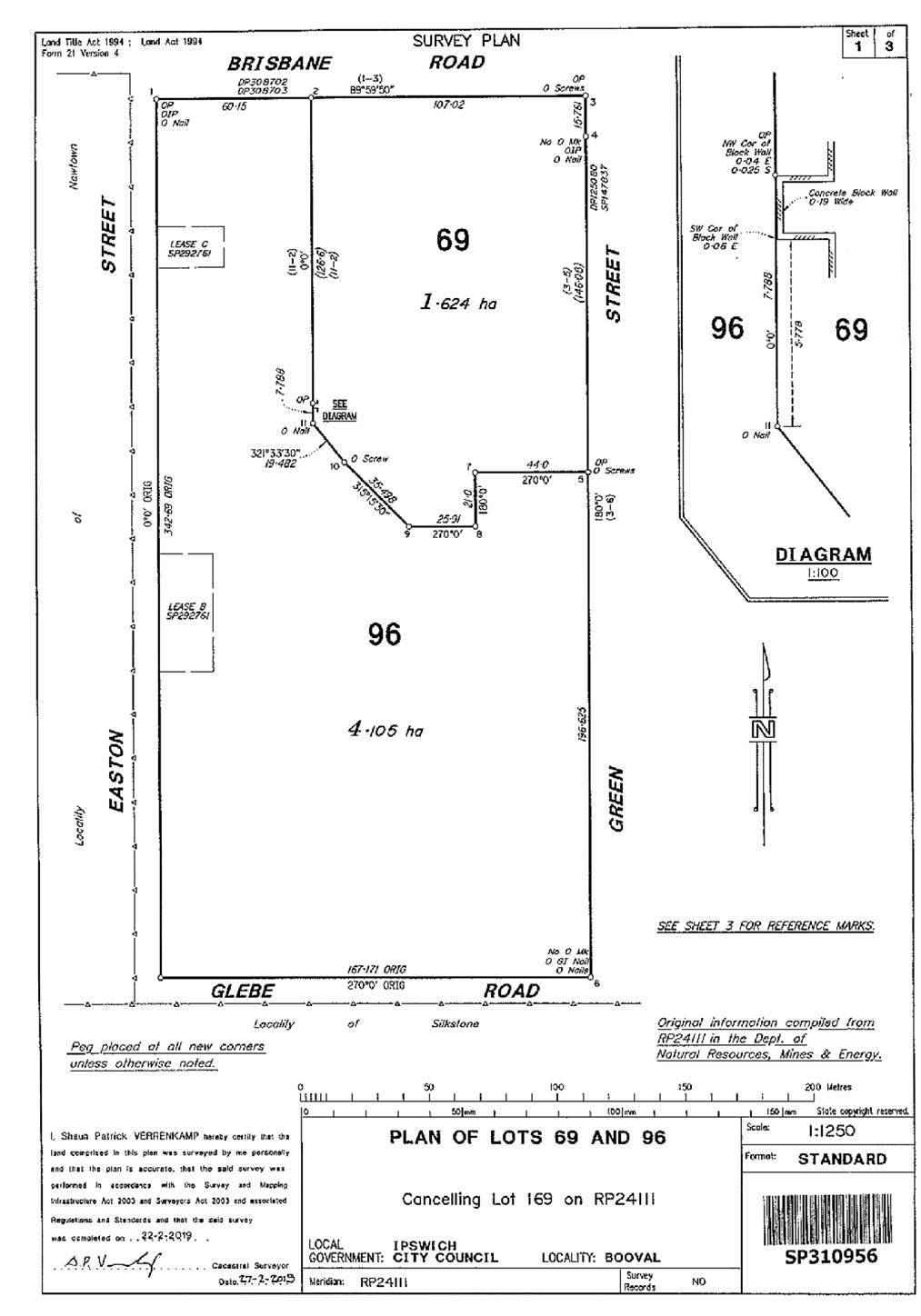

A. That

part of Council-owned land at 95A Brisbane Road,

Booval (part of Lot 169 on RP24111), being approximately 1.624 hectares, as

identified in Attachment 1 as “Proposed Land Disposal” (the Land) to the report by the Business

Accounting and Asset Manager dated 20 June 2019, is surplus

to Council’s future requirements.

B. That

the disposal of the Land and the improvements of the Land is a disposal of a valuable non-current asset.

C. That pursuant to section 236(3) of the Local

Government Regulations 2012 (Qld) (Regulations),

that the exemption available under section 236(1)(b)(ii) of the Regulations

applies to the disposal of the Land and the improvements on the Land to Swifts

as a ‘Community Organisation’ (as defined Schedule 8 of the

Regulations).

D. That

the Land and improvements on the Land can be disposed of other than by tender

or auction as required by section 227 of the Regulations.

E. That

Council request Swifts Leagues Club to prepare a proposed master plan for the

site that reflects their proposal and undertake appropriate community

consultation to satisfy Council that their proposal has sufficient community

support.

That subject to

Council being satisfied with the outcome of the community consultation process

and accordingly determining that the sale to Swifts Leagues Club is in the best

interest of the community, that Council sell the Land and the improvements on

the Land to Swifts Leagues Club Ltd at a purchase price equal to the market

value of the Land (including the market value of the improvements on the Land),

as determined by a registered valuer, in compliance with section 236(3) of the

Regulations.

F. That

the Chief Executive Officer be authorised to negotiate and finalise the terms

of the sale contract to be executed by Council and to do any other acts

necessary to implement Council’s decision in accordance with section

13(3) of the Local Government Act 2009.

RELATED PARTIES

Swifts Leagues Club Ltd (Swifts) may fund the purchase of

the property through their own financial resources however there is a

possibility they may be funded by a third party to purchase the Land from Ipswich

City Council (Council). The President of the club has advised that they are

currently in discussions with potential suitors who may be willing to fund the

purchase.

Advance Ipswich Theme Linkage

Managing growth and delivering key

infrastructure

Purpose of Report/Background

Cameron Park is Council freehold

land located at 95A Brisbane Road, Booval and described as Lot 169 on RP24111

(5.729 ha). Swifts have a twenty (20) year lease with two (2) x ten (10) year

options for Lease A in Lot 169 on RP24111 (1.119ha), which commenced on 6 September

2001 for the occupation of the land and facility as a sports and recreation

club.

A report was originally presented

to Council in relation to Cameron Park – Future Use of Parkland and

Facilities on the 29 January 2019. The recommendation was for the

disposal of the land directly related to the sports and recreation club to

Swifts Leagues Club Ltd at market value. A further report was submitted

to Council in May that repealed the previous decision of Council on the 29

January 2019, as there were a number of unresolved issues regarding the

future use of the property and Cameron Park.

The proposal will result in Council surrendering 1.624

hectares (subject to the final survey plan) of current recreational land. The

remaining land area of Cameron Park will be 4.105 hectares (subject to the

final survey plan).

Communication and discussions with

Swifts have continued in relation to the operations of the property, where a

number of these issues have now been addressed.

The three key issues are:

a) What

are the options?

In essence, there are four

options available:

1) Council

can sell the property to Swifts, as has been requested by Swifts

2) Council

can publicly offer the property for sale, with Swifts being the incumbent

tenant as per their current lease

3) Council

can retain the property, undertake any necessary upgrades to the property, and

Swifts continue as is

4) Council

and Swifts may reach agreement for the lease to be terminated, Swifts

cease operations and Council either publicly offer the property for lease to other

entities or demolish the buildings and return the area to parkland

Option 2 is

considered to be unrealistic. The property requires significant capital

investment (further discussed below) which would not be recouped by any

realistic rental stream. It is therefore highly unlikely to be a

commercial proposition for any third party. The most likely purchaser

would be Swifts, and option 1 provides a more effective approach for Council to

undertake that transaction.

Options 3 and 4

are both possible, and are further discussed below in the context of exploring

option 1; selling the property to Swifts as they have requested.

b) Whether

Council can lawfully sell the property to Swifts

This issue was

addressed in the 29 January 2019 report to Council. The information

presented in that report clearly showed that Swifts are a Community

Organisation and Council is legally able to sell the property directly to

Swifts, under section 236(3) of the Local

Government Regulations 2012 (Qld) (Regulations),

that the exemption available under section 236(1)(b)(ii) of the Regulations

applies to the disposal of the Land and the improvements on the Land to Swifts

as a ‘Community Organisation’ (as defined Schedule 8 of the

Regulations).

To further ensure that Council is able to sell the land to

Swifts, it has been recommended to Council that the sale be made conditional on

the following:

I. Subject to a Council

resolution being made by Council’s Interim Administrator giving effect to

the sale (once the Interim Administrator is satisfied the sale meets the

requirement of the Regulations and subject to a satisfactory outcome of the

community consultation process) ; and

II. Swifts are to undertake

community consultation and satisfy Council that the transaction is for the

benefit of the community and has community support as demonstrated through the

community consultation process.

c)

Whether Council should sell the property to Swifts.

This is a more complex question, with all

the relevant key information either not being available or appropriately

presented in the previous two reports to Council to enable this to be

adequately and transparently addressed by Council.

There are two aspects to this question:

· What is the best

financial outcome for Council? and;

· (More importantly)

What is the best community outcome?

The best

financial outcome for Council is to sell the property.

Council has recently undertaken a

condition assessment of the buildings, which highlighted over $1 million worth

of refurbishment work to be undertaken over the next 10 years and an additional

$800,000 of upgrades that are required to be undertaken on the kitchen and

air-conditioning to keep the current operational requirements of the

building. This expenditure however, is to maintain the current

configuration of the building which does not meet the club’s desired

configuration for a growing club (this is discussed further below).

Council receives annual rent of

over $16,000 from Swifts, plus rates of approximately $16,000. This

revenue stream will not be sufficient to recoup over time the capital costs

that Council would need to incur as identified in the condition assessment

report.

An independent professional

valuation of the property indicates a market value in the order of $1.4m.

In summary, sale of the property represents a financially better result for

Council (and hence ratepayers) in the order of $2.4m over retaining the

property.

Whilst the financial analysis is

important, the more critical question is what is the best community outcome.

Swifts have obtained independent

advice from professional club management consultants that verifies that the

current configuration of the Cameron Park facilities are inappropriate for the

ongoing successful operation of a sports and recreation club with the

objectives of delivering community services and facilities. A substantial

reconfiguration of the premises is needed for the club to be able to continue

to operate successfully.

This requires investment that the

club agrees is beyond the scope and responsibility of Council. However, without

security of property title, the club is unable to secure funding support needed

to make the necessary investment to deliver a contemporary sports and

recreation club. Even Council undertaking the $1.8 million refurbishment

cited in the condition assessment report will not meet the club’s future

operating needs. This is why option 3 above is not a feasible choice for

Council.

Closure of the club would result

in termination of the facilities and services delivered for Ipswich residents

at the Cameron Park facility as well as termination of the financial support of

junior rugby league through proceeds from the venue operations. This is

not a favourable community outcome.

A key issue raised with Council

in regard to community outcomes is whether Swifts would be seeking to

substantially increase the number if gaming machines at the site as part of the

reconfiguration. Council does not regulate gaming machines; that is the

role of the State Government through the Office of Liquor and Gaming Regulation

and the Gaming Machine Act 1991 and the Gaming Machine Regulation

2002.

That state regulatory regime

includes the need for a ‘community impact statement’ to be prepared

for any increase of 20 gaming machines or more. The Office of Liquor and

Gaming Regulation has issued Guidelines in regard to these matters; in essence a

substantial community consultation exercise would be required to be undertaken

by Swifts before any significant increase in gaming machines would be possible.

This is a matter for the state government regulators to determine at the time,

although Council would be asked for its views as part of any decision by the

Office of Liquor and Gaming Regulation.

Swifts representatives advised

the Interim Administrator at a meeting on Thursday 20 June 2019 that there is

no intention by the club to significantly increase the number of gaming

machines as part of the reconfiguration at this stage, and they understood the

need for extensive community engagement prior to this position changing.

Another issue raised with Council

is, once sold to Swifts, how the community can be assured the site remains as a

sport and recreation facility in the future. This is entirely within the

decision-making powers of the Council. Any proposed change in use would

require a development application under the Ipswich planning scheme and would

be subject to the provisions of the planning law and framework. The site

is currently zoned recreation and Council would have full authority to refuse

any development application for any material change in use such as retail or

commercial buildings.

In addition there is a

recommendation to Council that any sale contract should contain a restriction

on the buyer from selling the property to any “person” that is not

a Community Organisation”, and that any transferee is to enter into a

deed of covenant obliging them to obtain a similar covenant from any further

transferee.

Financial/RESOURCE IMPLICATIONS

If Council adopts the recommendation in this report, the operational

and legal costs associated with the sale of property will form part of the

project budget, and the net financial benefit to Council is estimated to be in

the order of $2.4 million.

RISK MANAGEMENT IMPLICATIONS

There are significant financial

and operational risks associated with continuing with the maintenance and

refurbishment of the current facility as it presently stands. If the

property is sold to Swifts, these risks would be transferred to that

organization.

The risk of the property, if sold,

being subsequently changed from community services club to other uses (such as

residential, retail or commercial developments) is within the control of

Council through the development application process and the current zoning of

the land as recreation.

The risk of the property, if sold,

being converted to a more significant gaming machine venue is within the

control of the state government through the Office of Liquor and Gaming

Regulation, including the need for a community impact statement that Council

would be invited to contribute to.

Legal/Policy Basis

This report and its recommendations are consistent with the

following legislative provisions:

Land Act 1994

Planning Act 2016

Local Government Act 2009

Local Government Regulation 2012

COMMUNITY and OTHER CONSULTATION

The report that previously repealed the sale to Swifts

recommended that community consultation be undertaken for any future decisions

to ensure transparency and accountability. Given this is public land and Swifts

have requested to purchase the site, it is imperative that the management and

development of the land aligns with the strategic focus for the area and

supports the community’s needs into the future. Swifts will be required

to supply information outlining the future plans and how the club will continue

to develop sport and recreation services for the benefit of the community.

Council may undertake community consultation to ensure that

the proposed sale and future plans for the club by Swifts are supported by the

community, or at Council’s request Swifts will be required to undertake,

manage and finalise the community consultation process.

Conclusion

Council’s ongoing ownership and leasing of the

facility to Swifts carries significant financial and operational risk from a

future capital investment perspective. The current arrangements are

unfavourable to Council and the Ipswich community from a financial

perspective.

The current facilities do not meet the requirements of a

contemporary sports and recreation club and reconfiguration to meet these

demands is beyond the scope and role of the Council to deliver.

The proposal to dispose of the land and its associated

improvements offers Council the opportunity to remove the financial burden of

the maintenance of the facility, and more importantly will allow a local

community sporting group to deliver a more contemporary facility and continue

to provide positive community benefits.

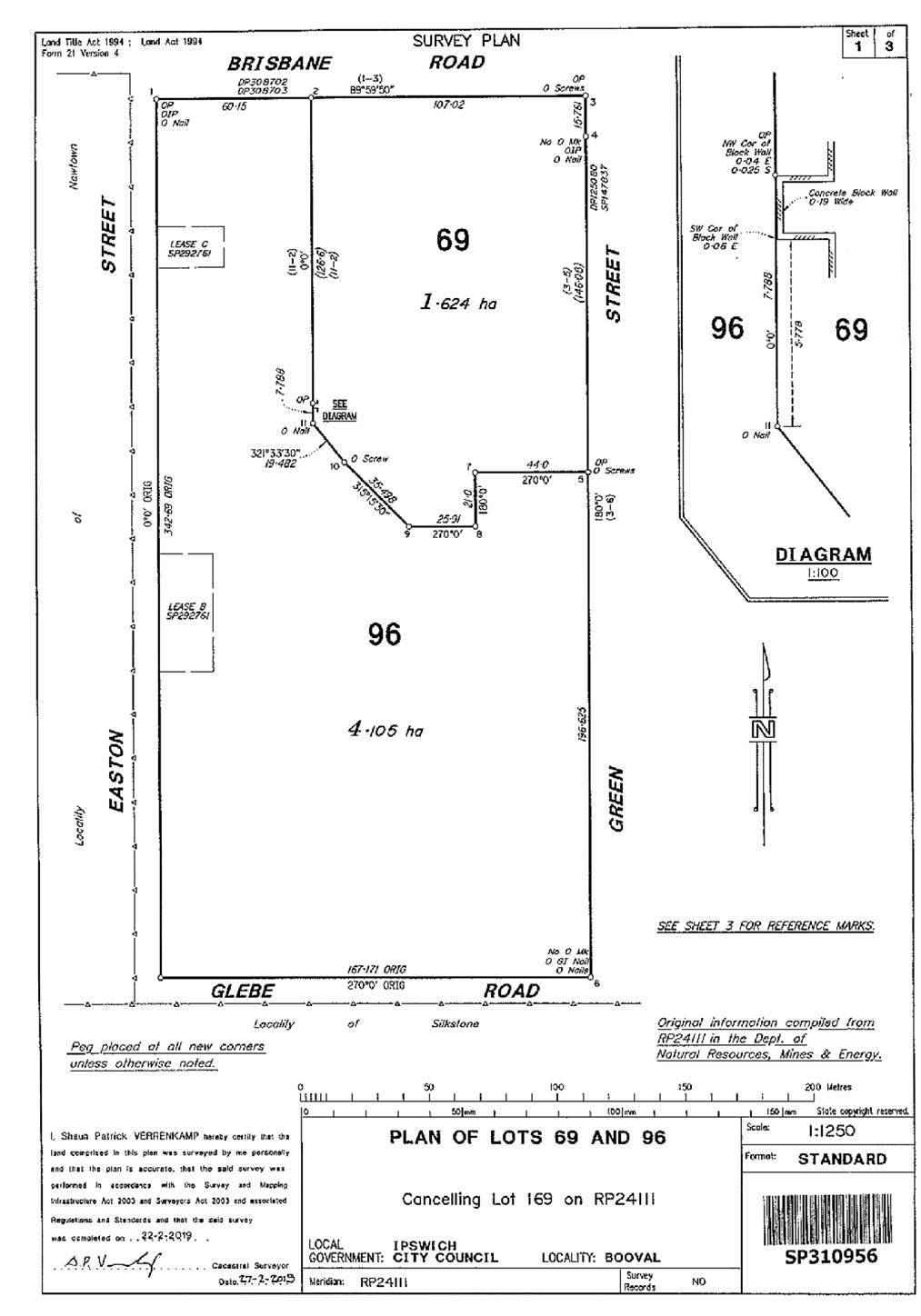

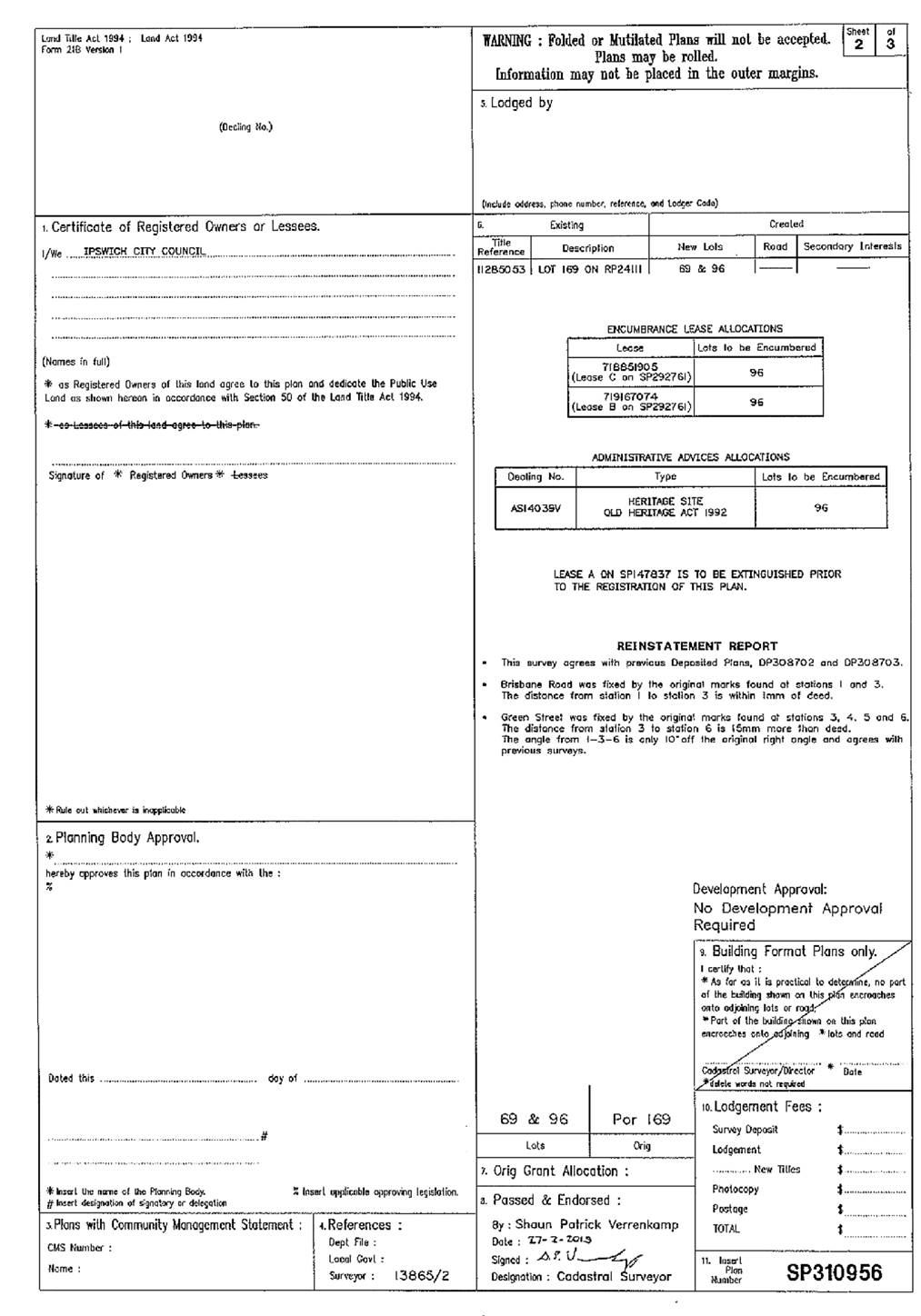

Attachments and Confidential Background Papers

|

1.

|

Survey Plan ⇩

|

Shane Gillett

Business

Accounting and Asset Manager

I concur with the recommendations contained in this

report.

Charlie Dill

General Manager -

Infrastructure and Environment

“Together,

we proudly enhance the quality of life for our community”

|

Council

Meeting

Agenda

|

27 June

2019

|

Item E.2 / Attachment 1.

|

Council

Special

Meeting Agenda

|

27 June

2019

|

Doc ID No: A5600984

ITEM: E.3

SUBJECT: Transfer of Property and Other Assets of

Ipswich City Properties Pty Ltd and associated matters

AUTHOR: Finance Manager

DATE: 16 June 2019

Executive Summary

This is a report concerning the

transfer of property and other assets of Ipswich City Properties Pty Ltd (ICP)

and other associated matters to Ipswich City Council (Council), in

preparation for the wind up of ICP. Other associated matters include:

· the operation of

ICP’s retails assets, redevelopment activities and asset valuations;

· preparation of

property transfer documents, indemnities and stamp duty exemptions;

· the novation of

supplier agreements and related quote or tender consideration plans;

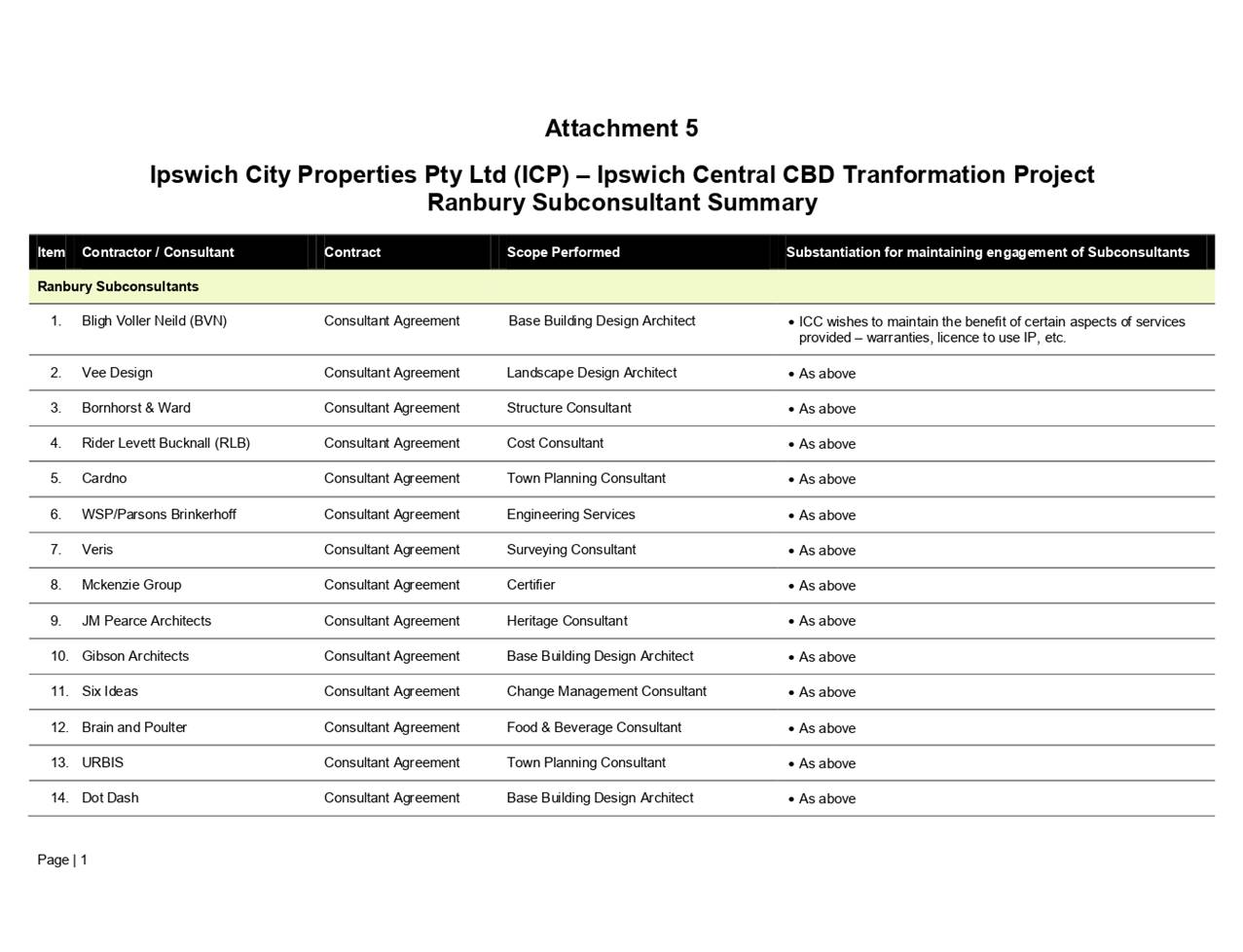

· Ranbury leasing

agreement;

· Ministerial

Direction for the disposal of leasehold interests;

· approval under the

Statutory Bodies Financial Arrangements Act 1982 (SBFA) for a

performance guarantee; and

· Deed of Release

concerning the transfer of other assets, settlement for property and other

assets, compensations, reimbursements, liabilities and debt forgiveness.

At the ordinary Council meeting of

16 October 2018, the Interim Administrator resolved to endorse the

winding up and ultimate deregistration of ICP and the integration of the ICP

assets and operations into Council.

Following the settlement for

the transfer of the property and other assets of ICP via a reduction in

the loan between Council and ICP, this report recommends the write-down

(forgiveness) of the residual balance of that loan. This is anticipated

to be $24.9 million and is materially within the $78.7 million of

losses outlined by McGrathNicol in their March 2019 report. All

reimbursements, payments, transfer, write-downs etc… cited in the

recommendations below reflect costs that were identified as part of the

McGrathNicol report. None of these arrangements in terminating ICP

represent any new expenditure not previously recognised by McGrathNicol.

Recommendation/s

That the Interim Administrator

of Ipswich City Council resolve:

A. That

the Chief Executive Officer be authorised to negotiate and finalise the terms

of the Deed of Release to be executed by Council and to do any other acts

necessary to implement Council’s decision in accordance with section

13(3) of the Local Government Act 2009.

B. That

the total valuation of the property assets of Ipswich City Properties Pty Ltd

being $27,795,000 be accepted by Council for the purposes of the property

transfers.

C. That

the Chief Executive Officer be authorised to negotiate and finalise the terms

of all agreements, deeds, indemnities or documents (“all

Documents”), for the transfer to Ipswich City Council of the property

(both real property and personal property) belonging to Ipswich City Properties

Pty Ltd with a total cumulative value of $27,814,565.78 (including

chattels of $19,565.78), and for Council to execute all Documents and to do any

other acts necessary to implement Council’s decision in accordance with

section 13(3) of the Local Government Act 2009.

D. That

Council note that the decision of the Office of State Revenue in regards an exemption

from Stamp Duty under corporate reconstruction remains outstanding and that the

approval of the exemption does not impact Council’s intention to approve

and enact the transfer of property and other assets of Ipswich City

Properties Pty Ltd before 30 June 2019.

E. That

Council reimburse Ipswich City Properties Pty Ltd, as outlined in the Deed of

Release, for costs incurred in relation to planning, design, engineering

and construction of the retail assets of Ipswich City Properties Pty Ltd

to the value of $2,300,127.95.

F. That

Council reimburse Ipswich City Properties Pty Ltd, as outlined in the Deed of

Release, for costs incurred in relation to planning, design, engineering

and construction works that were intended to be acquired by Council under a

development agreement to the value of $16,875,657.28.

G. That

Council note the request for an approval under the Statutory Bodies

Financial Arrangements Act 1982 for the provision of a performance guarantee

in relation to the Crown lease for the Bremer Street Ramps has been lodged with

the Department of Local Government, Racing and Multicultural Affairs.

H. That

Council pay $4,699,035.11 to Ipswich City Properties Pty Ltd in

accordance with the Deed of Release as the GST component of the property and

other assets transfer.

I. That

the anticipated loan repayment of $750,000.00 by Ipswich City Properties Pty

Ltd, be noted.

J. That

subsequent to all the reductions in accordance with recommendations C, E, F and

I and in accordance with the Deed of Release excluding clause 6, the balance of

the loan between Ipswich City Council and Ipswich City Properties Pty Ltd at

close of business on 27 June 2019, estimated to be $24,925,371.15, in

accordance with clause 6 of the Deed of Release, be written‑down to zero.

K. That

subject to the loan between Ipswich City Council and Ipswich City Properties

Pty Ltd being written‑down to zero, the loan agreement between Ipswich

City Council and Ipswich City Properties Pty Ltd be terminated.

L. That

the Chief Executive Officer be authorised to negotiate and finalise the terms

of any other agreement, deed, indemnity or document associated with or in

conjunction to the transfer of the other assets of Ipswich City Properties Pty

Ltd, in accordance with the Deed of Release, to be executed by Council and to

do any other acts necessary to implement Council’s decision in accordance

with section 13(3) of the Local Government Act 2009.

RELATED PARTIES

Ipswich City Properties Pty Ltd

Ranbury Management Group Pty Ltd

Ranbury Property Services Pty Ltd

Advance Ipswich Theme Linkage

Strengthening our local economy

and building prosperity

Purpose of Report/Background

Subsequent to Council’s

endorsement of the winding up of ICP, McGrathNicol were engaged to support and

coordinate with Council officers the actions required to transfer the property,

other assets and operations of the ICP to Council, allowing the subsequent wind

up of ICP.

In addition to Council’s

Legal Service Branch, King and Wood Mallesons (KWM) were engaged to

advise Council and Clayton Utz were engaged to advise ICP.

In this report Council and ICP may

collectively be referred to as the Group.

Deed of Release

A Deed of Release (Attachment 1)

has been prepared to finalise financial and related matters between ICP and

Council, including residual asset transfers, any residual liabilities of ICP,

settlement transactions and Council's forgiveness of certain debt owed by ICP

to Council (detailed further in this report).

Payments for the transfer of

property and other assets (excluding GST) is proposed under the Deed of Release

to be via a reduction to the loan account between Council and ICP.

Valuations

Jones Lang LaSalle Advisory

Service Pty Ltd (JLL) were engaged to provide valuations for the

property assets of ICP. The current land and buildings of the Ipswich

City Square Shopping Centre, the Commercial Hotel site (Murphys Pub) as well as

2 Bell Street have been valued for the purpose of transfer between related

parties. The collective valuation of these ICP assets totals

$27.8 million and remains unchanged from the valuation undertaken to

support the 2017‑2018 financial statements. A separate independent

valuation by Council was not undertaken in this instance and Council will need

to rely upon the ICP valuation for the purposes of the transfer.

Property Transfers

The relevant transfer documents

and sale contracts have been prepared for the transfer of ICP properties

including leasehold land, Crown leasehold land, freehold land and option

deeds. There are also indemnities in favour of the State of Queensland

and Queensland Rail, required in relation to the transfer of property assets as

well as for retail tenancies. These transfer documents have been reviewed

by both Council officers and McGrathNicol. A schedule of documents

requiring signature has also been prepared to ensure that all required actions

for the transfer of the ICP properties are competed.

Stamp Duty

An application has been lodged

with the Office of State Revenue (OSR) for an exemption from Stamp Duty

under the corporate reconstruction provisions. Advice from KWM indicates

that the transfer of property from ICP to Council, in the manner proposed by

the Deed of Release, will likely meet the exemption requirements, however this

is yet to be assessed by the OSR. The absence of a decision from the OSR

on the exemption, prior to the transfer of the properties, is not considered an

impediment to the transfer.

If there was any stamp duty

obligation, this would rest with Council. This risk was obviously not

quantified in the March 2019 McGrathNicol report.

Work In Progress

ICP has recognised

$2.3 million of work in progress costs in relation to planning, design,

engineering and construction of its retail assets. This includes a net

$1.1 million for the demolition and stabilisation of the Commercial Hotel

(former Murphy’s Pub) site after consideration of the total cost to

complete the project and initial assessment of possible market value at

completion.

The costs on these retail

properties of ICP were undertaken with the visibility of Council, contribute to

the broader CBD redevelopment and relate to those properties that are to be

transferred. Therefore it is considered appropriate for Council to

reimburse ICP for these costs (refer clause 3(a) of the Deed of Release).

This is premised on Council’s decision to wind up ICP at this time which

will not permit ICP to complete these works nor subsequently generate an

appropriate return from this expenditure.

Construction Work In Progress -

Development Inventory

ICP has incurred

$16.9 million of costs in relation to planning, design, engineering,

demolition and construction works which were ultimately intended to become or

contribute to assets of Council. This includes expenditure on the

proposed administration building, library, civic square and other associated

assets.

This expenditure was incurred by

ICP on the basis of the Development Agreement between ICP and Council for the

civic space, library and carpark, staged approvals under this agreement and an

intended variation for the Administration Building, after Council resolved to

own the building vs lease it and that these costs would be met (reimbursed) by

Council (refer recommendation C of the report by the Executive Support Officer

dated 23 January 2018 concerning CDB Redevelopment to the City

Management, Finance and Community Engagement Committee of

23 January 2018).

On this basis, and in conjunction

with the decision by Council to transfer ICP properties to Council, it is

appropriate for Council to reimburse ICP for these costs (refer clause 3(b) of

the Deed of Release).

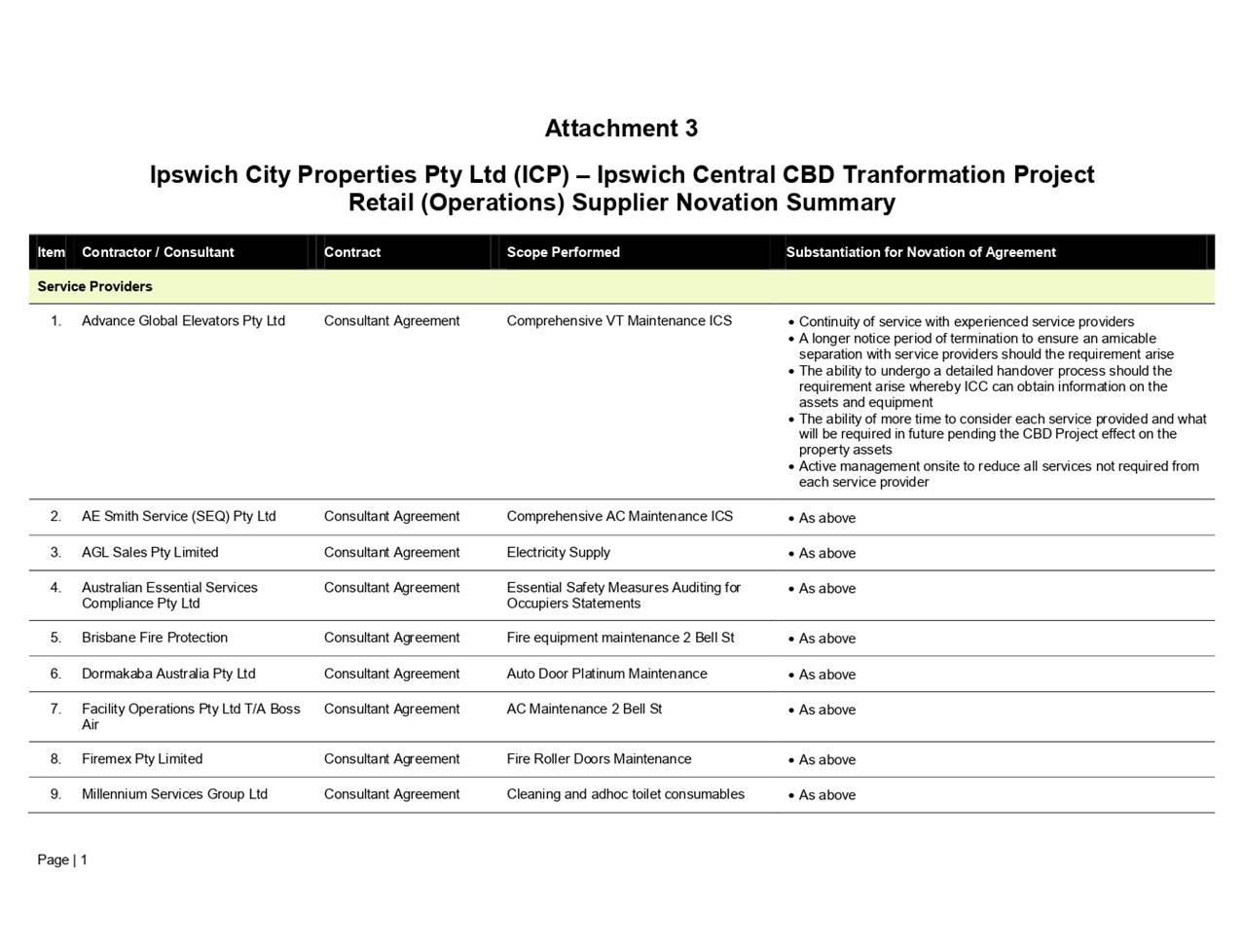

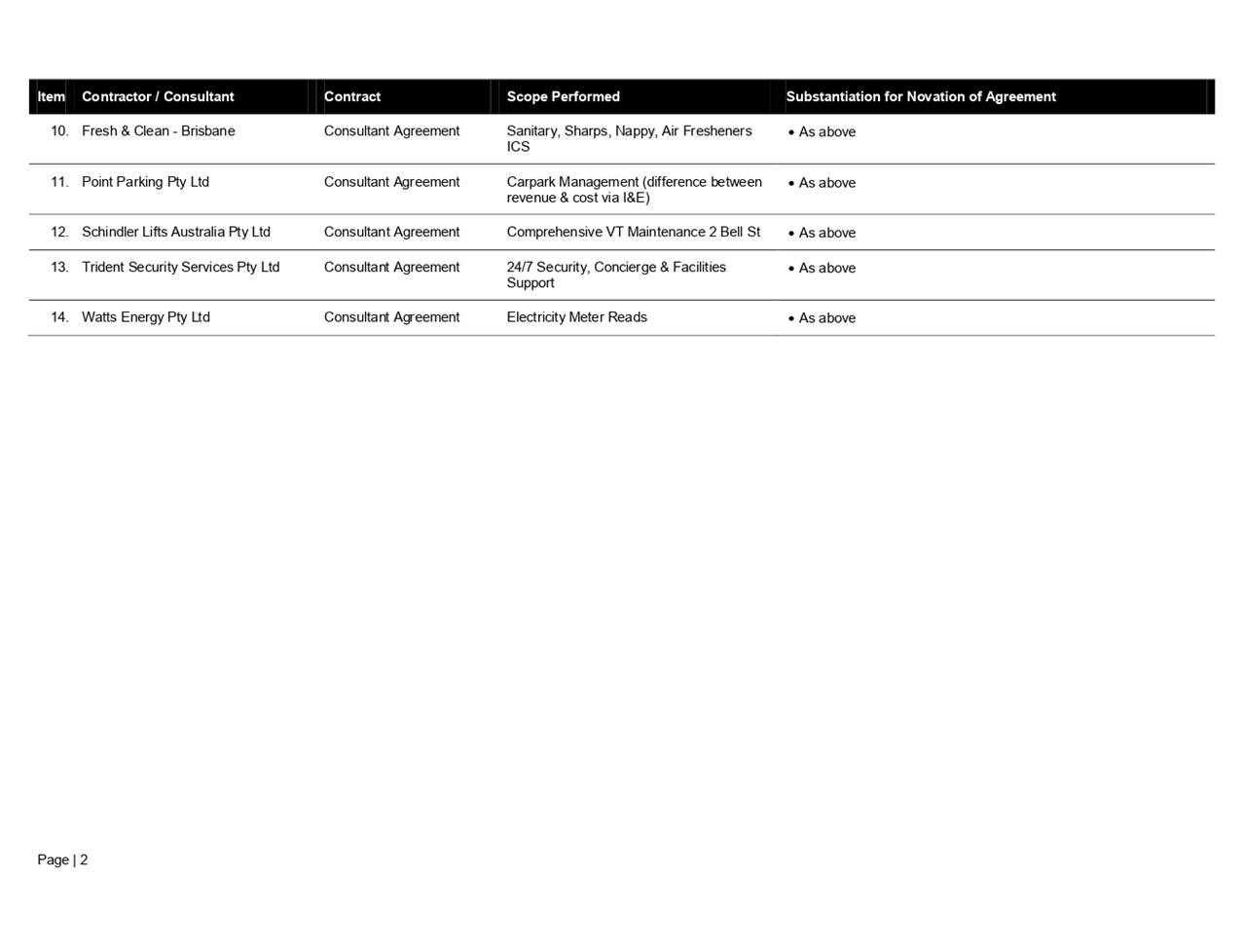

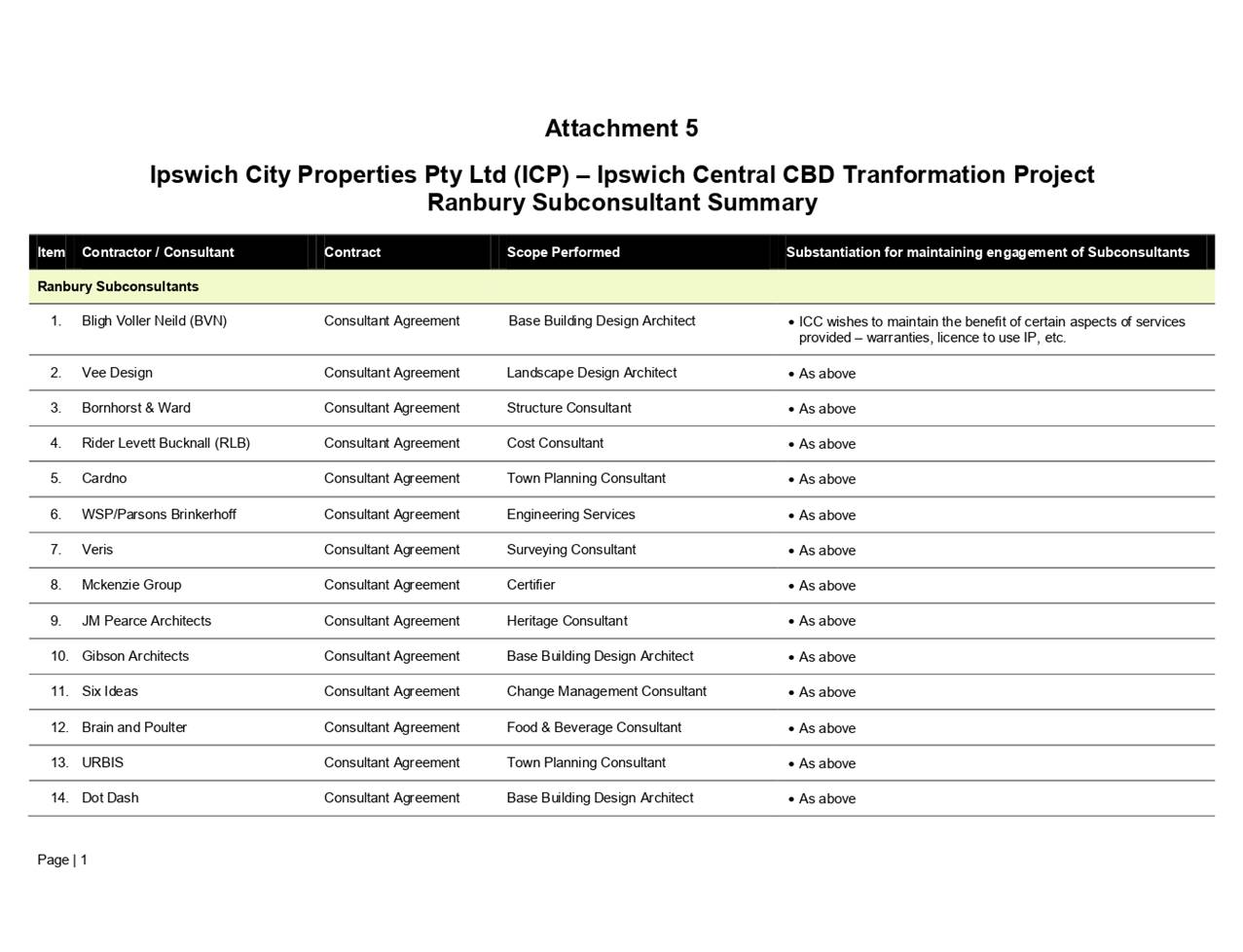

Tender Consideration Plan -

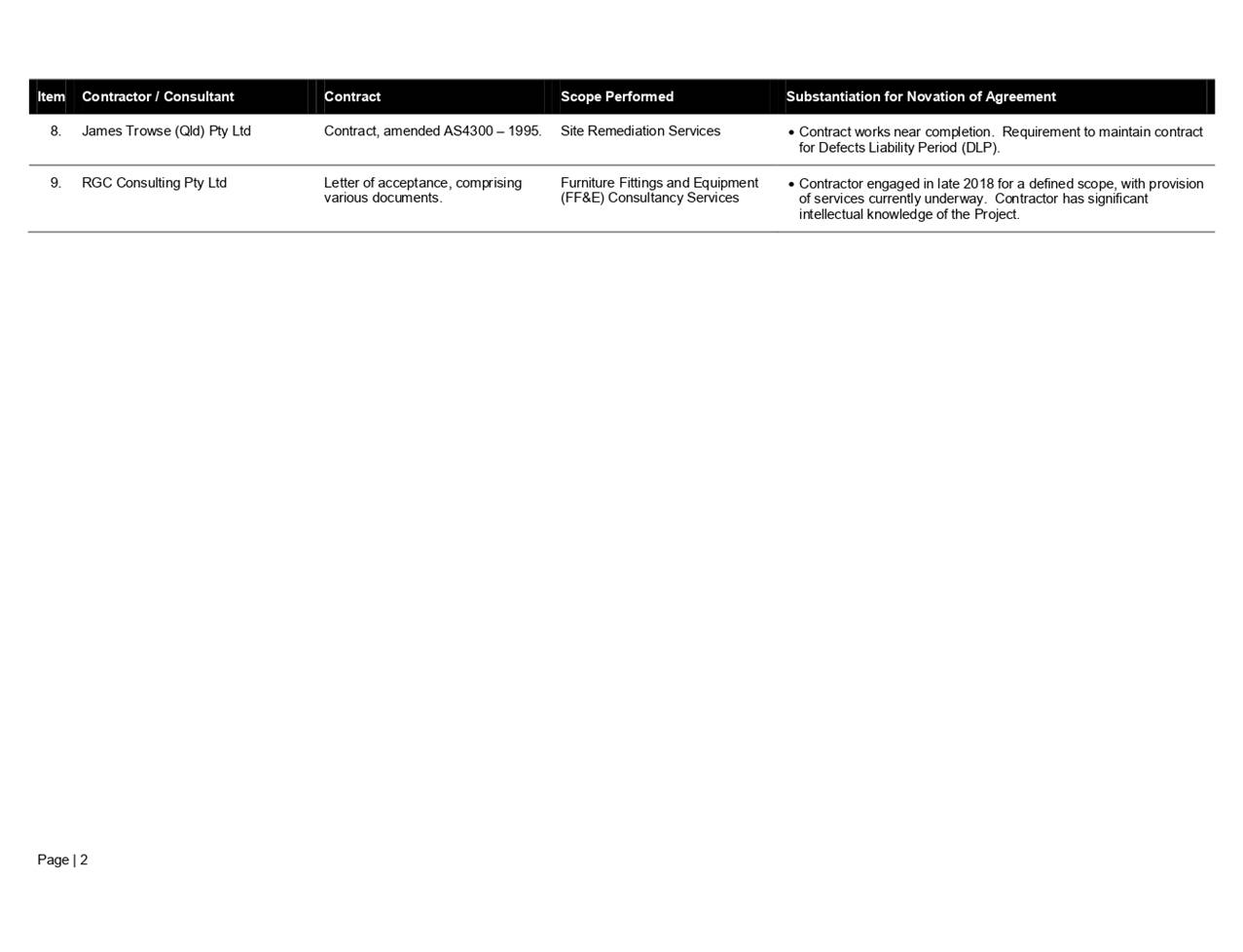

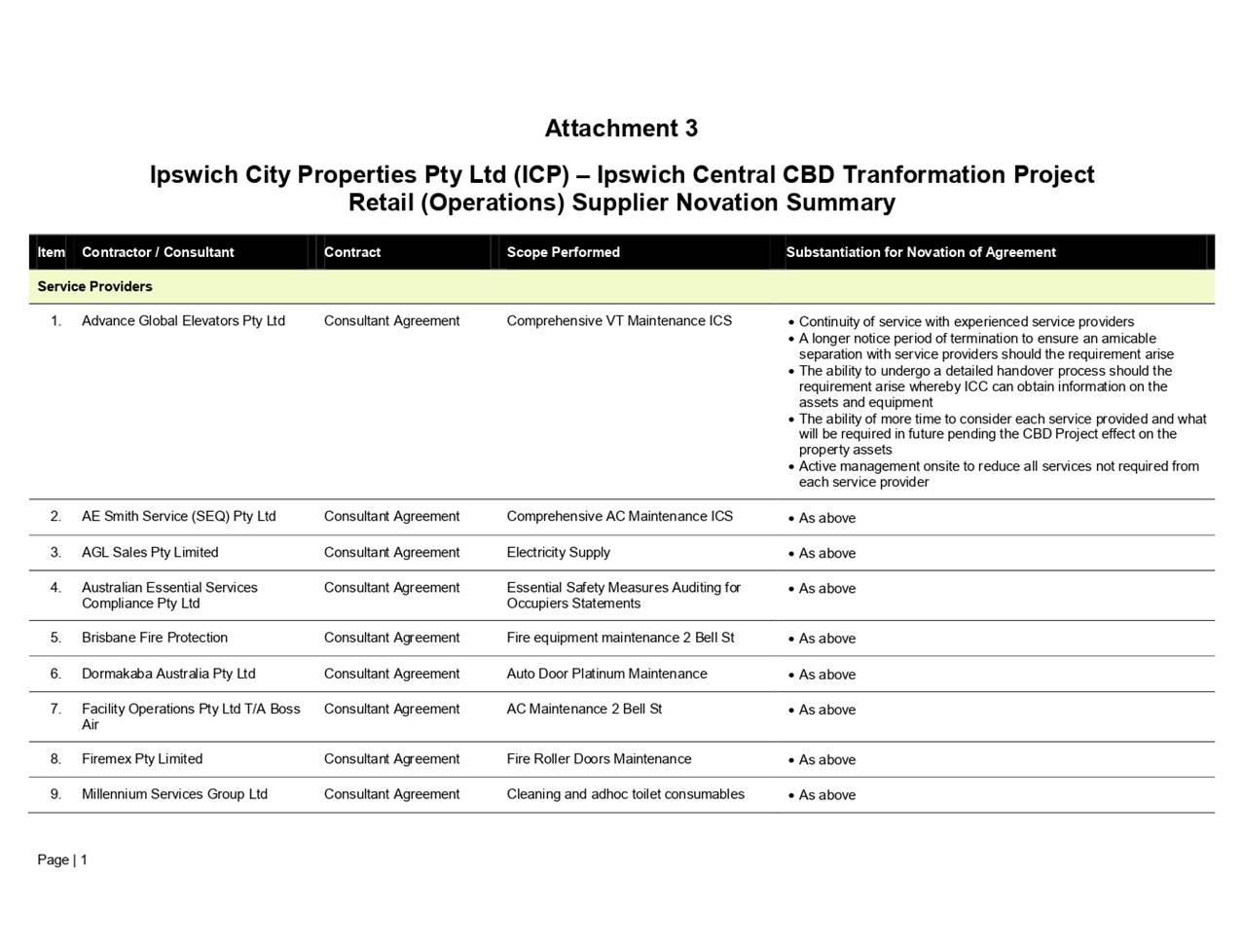

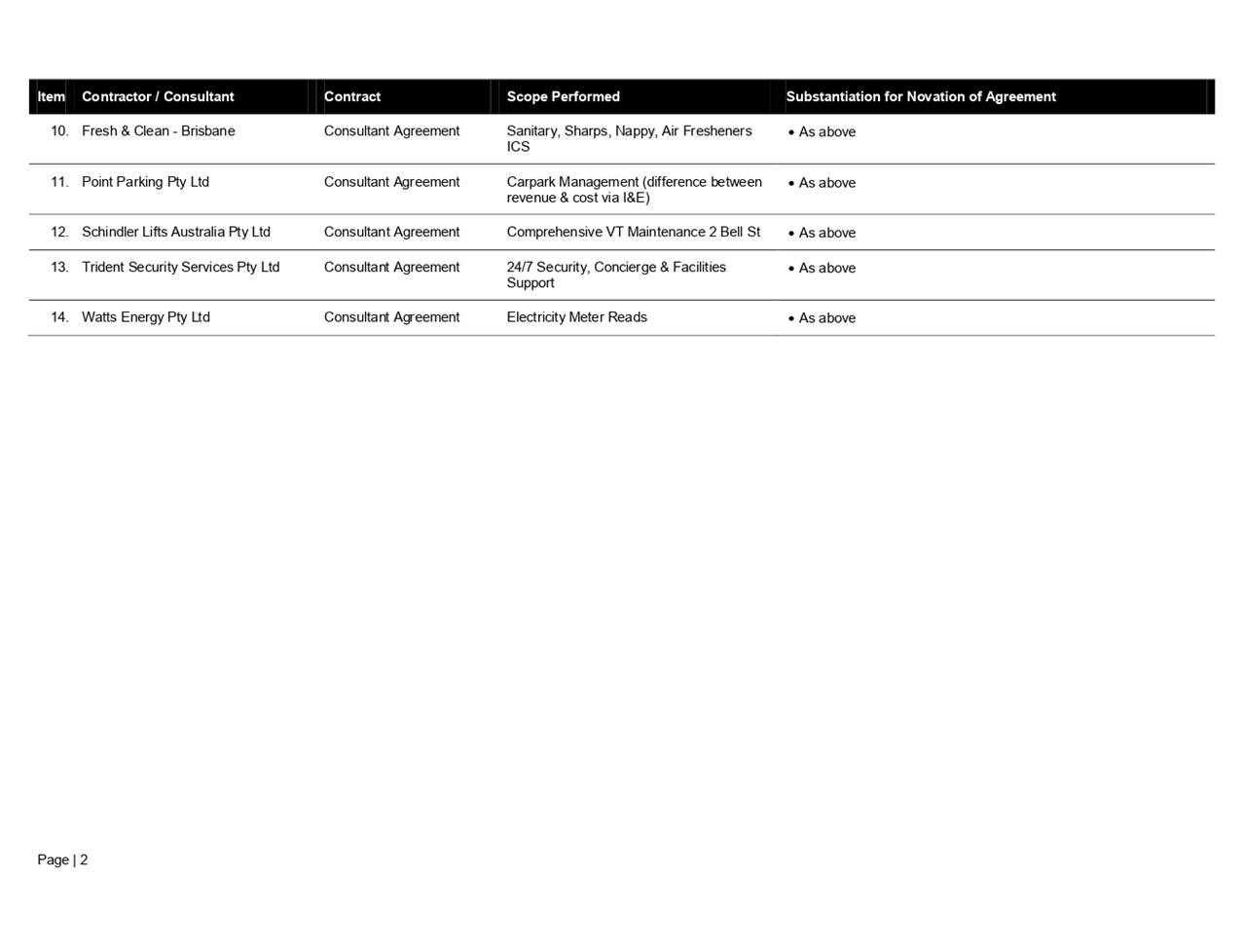

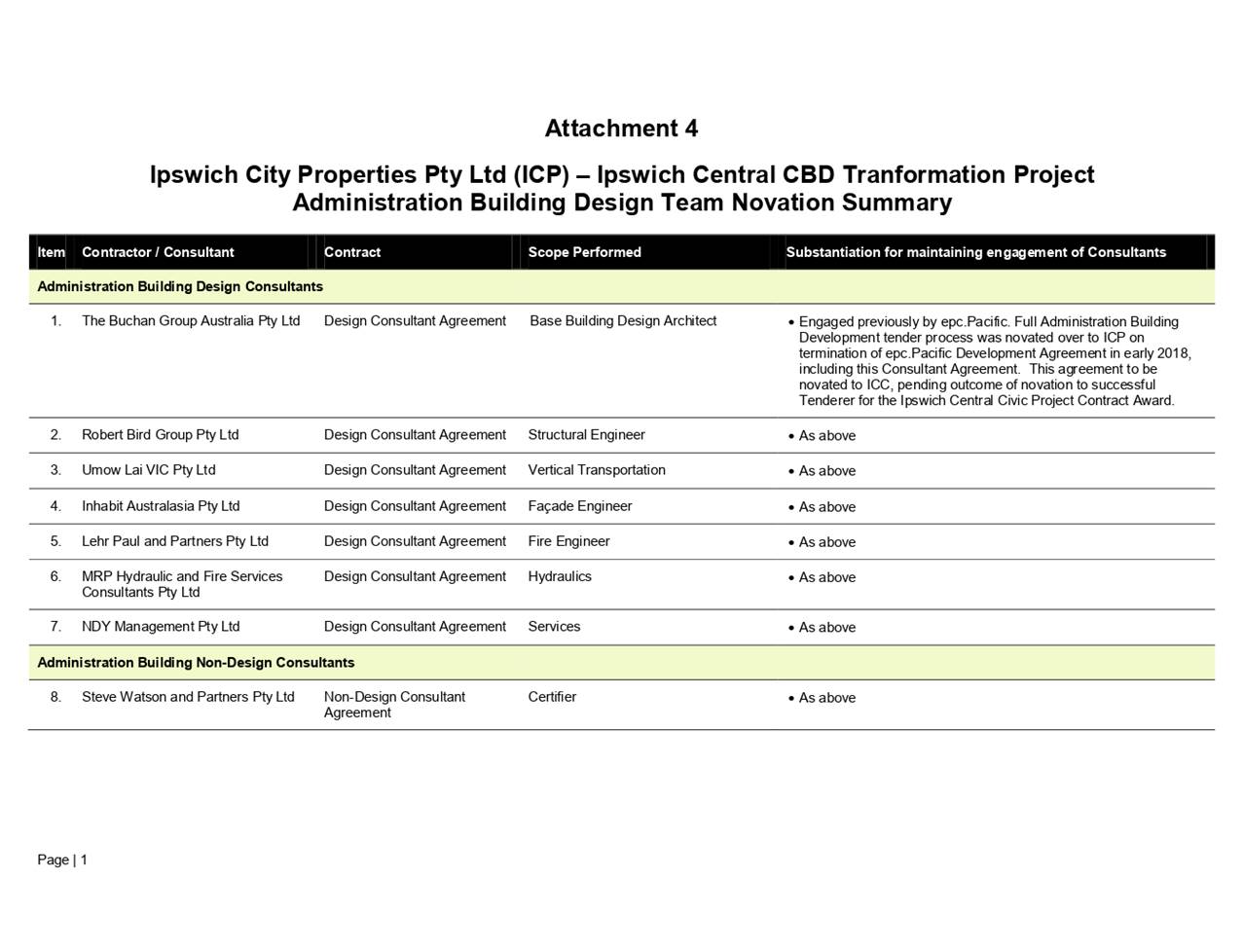

Novation of Supplier Agreements

To provide a smooth transition and

to maintain and preserve the supplier relationships, for the transfer of ICP

properties, the existing agreements between ICP and its suppliers, for both the

operations and maintenance of the ICP retail properties as well as ICPs

redevelopment activities, are required to be novated to Council.

A quote or tender consideration

plan in accordance with section 230 of the Local Government Regulation

2012 has been prepared as a separate report for Council’s

consideration and adoption, to enable the redevelopment project and retail

operations to continue on a timely basis and to ensure all intellectual

property, knowledge, rights, warranties etc… are transferred to Council

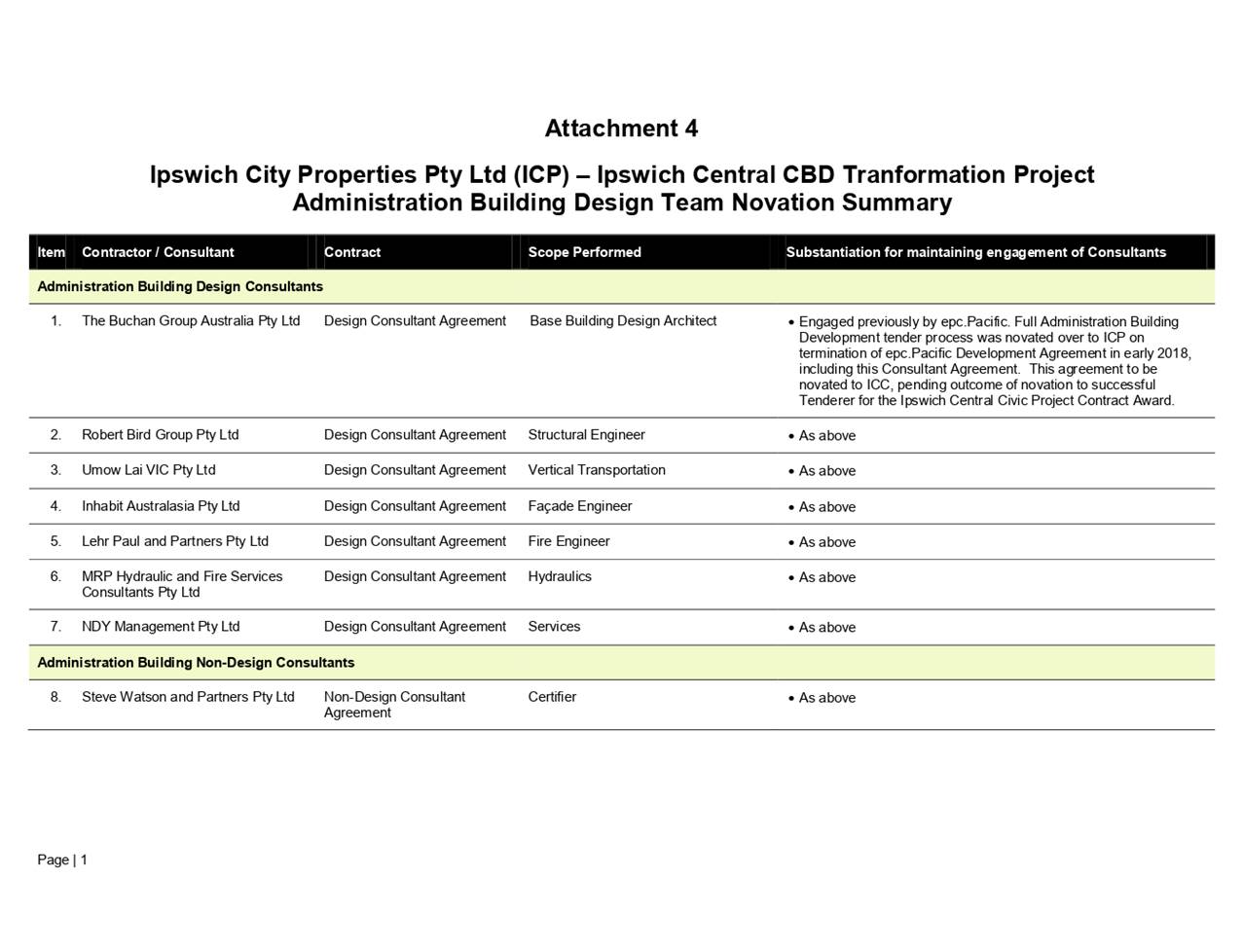

Ranbury – Appointment as

Leasing Agent

ICP has engaged Ranbury Property

Services Pty Ltd to advise and act as a leasing agent for the retail and commercial

areas of the ICP assets. To leverage the benefits and effort already

undertaken, subject to a separate quote or tender consideration plan, Council

may consider appointing Ranbury Property Services Pty Ltd to continue in this

role.

The separate report and plan, for

consideration by Council, outlines the independent market assessment and

proposal process undertaken as part of the appointment.

Ministerial Exemption for the

Disposal of Leasehold Interests

Owing to the unique nature of

negotiations for retail and commercial tenancy, and to enable Council to

achieve the objectives of its leasing strategy, Council may choose to seek a

Ministerial Exemption under Section 236(1)(f) of the Local Government

Regulation 2012 in relation to the disposal of a valuable non‑current

asset by means of a lease. An exemption would allow Council to then lease

the retail and commercial tenancies of Ipswich City Square and 2 Bell Street

without the need to put each tenancy space out to separate tender or auction.

The leasing plan and strategy will outline how Council and its leasing agent

will ensure maximum value for Council and the decision and approval process to

ensure transparency and accountability in the leasing process.

A submission seeking such an

exemption is being prepared by Council’s Coordination and Performance

Department.

SBFA Approval for a Performance

Guarantee

An approval under the SBFA has

been requested from the Department of Local Government, Racing and

Multicultural Affairs (the Department). This is required for the

provision of a performance guarantee (Bank Guarantee) in relation to the Crown

lease for the Bremer Street Ramps that are attached to the Ipswich City Square

Shopping Centre. Council will request the guarantee be provided by the

Queensland Treasury Corporation (QTC).

The Department has indicated that

this approval is unlikely to be received prior to the proposed settlement of

the ICP assets. Whilst advice has been received that the transfer

(settlement) of the property can occur, the registration of title on this lease

asset will be delayed until the guarantee can be provided. This may also

impact on the registration of the title on the property to which the Bremer

Street ramps are attached. As mentioned, the delay in the registration of

the title does not impact on the settlement (ownership) of assets.

GST

Notwithstanding that the

settlement for the transfer of ICP properties and other assets under the Deed

of Release is via a reduction of the loan account between ICP and Council, both

Council and ICP will separately remain responsible for their GST obligations in

relation the transfer transactions.

The Deed of Release does not

permit the GST value attributed to the transfer transactions to reduce the loan

account between ICP and Council. The GST value is to be paid by Council

to ICP as a cash amount. The estimate of the GST component of the

transfer transactions is $4,699,035.11.

Loan Repayment

Prior to the application of clause

6 of the Deed of Release, ICP intends to repay $750,000.00, or other amount as

appropriate, of surplus cash to Council. The surplus cash is due to GST

credits claimable by ICP. Given the requirement for Council to settle, in

full, the transfer of the property and other assets with ICP, it was not

considered appropriate to offset the GST cash payment against the estimated GST

credits of ICP.

Debt Forgiveness

Following the settlement of ICP

properties, the reimbursement of Work In Progress and the Construction Work In

Progress – Development Inventory, via a reduction to the loan account

between ICP and Council, as well as receiving the loan repayment, the estimated

balance of the loan from Council to ICP will be $24,925,371.15.

Previous Council decisions to

build and own the new administration building and library and to develop a

significant portion of land as civic space, have impacted on ICP’s

ability to earn future revenues, in the form of land sales and development

profits. In turn this impacts on ICP’s ability to make further

repayment against the loan account.

In light of the decision to wind

up ICP at this time and to transfer the properties to Council at their current

market value, ICP will not have the assets or capacity to earn revenues to

repay the remaining balance. It is appropriate for Council to write down the

remaining balance of its loan receivable from ICP and terminate the loan

agreement.

The remaining balance of the

loan to be written off by Council is materially within the $78.7 million

losses outlined by McGrathNicol in their recent report.

The total cost of ICP activities, the subject of the

McGrathNicol report from March 2019, was assessed as approximately

$78.7 million. The forgiveness of the residual balance of the loan

between ICP and Council does not materially increase that assessment. The

forgiveness of the loan is a non-cash intra‑Group transaction (as are the

property and other asset transfers) and has no impact on the consolidated

results of Council and its Controlled Entities.

|

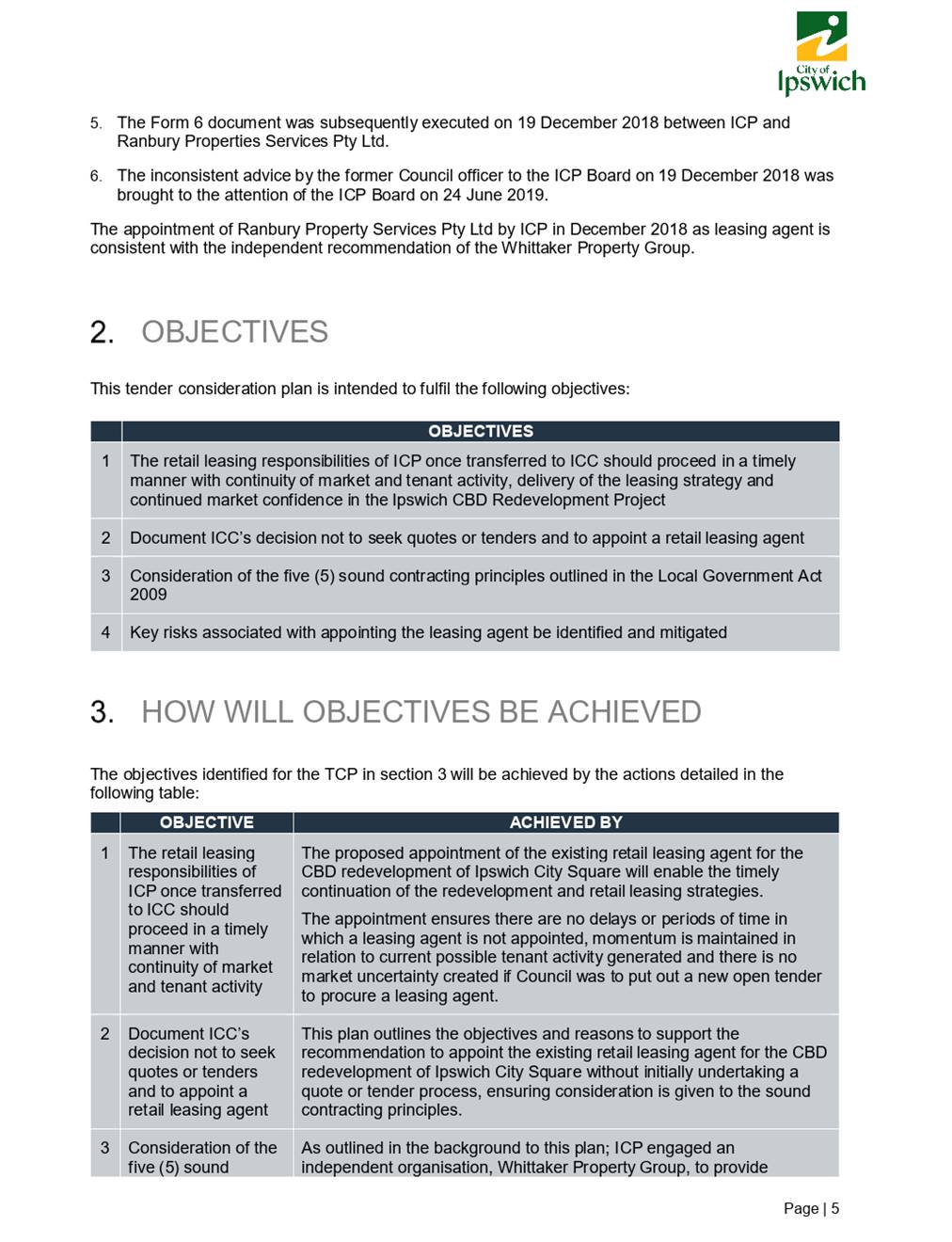

Loan balance as at 18 June 2019

|

|

$72,665,722.16

|

|

less settlement for property assets

|

Recommendation C

|

$27,814,565.78

|

|

less settlement for work-in-progress assets

|

Recommendation E

|

$2,300,127.95

|

|

less settlement for development inventory

assets

|

Recommendation F

|

$16,875,657.28

|

|

less loan repayment (from surplus cash)

|

Recommendation I

|

$750,000.00

|

|

Value of loan to be written down (forgiven)

|

|

$24,925,371.15

|

Members Voluntary Liquidation

Following the transfer to Council

of the ICP properties, other assets and operations, Council, via the shareholders

representative, may then give further consideration to placing ICP into Members

Voluntary Liquidation.

Financial/RESOURCE IMPLICATIONS

As a wholly owned subsidiary of

Council, the transfer of the ICP properties, other assets and operations to Council

will have a minimal impact on the combined revenues and expenses of ICP and

Council (the Group). While there be impacts on Council’s

operating surplus and balance sheet, however the cash flows impact for the

Group are minimal and the ultimate wind up of ICP will save Council costs in

the long term.

The delivery of the Ipswich

Central CBD Transformation Project including the construction of the new

administration building and library is included in Council’s 2019‑2020

Budget and Long Term Financial Forecast at a total cost of approximately

$201.5 million.

As outlined in this report,

settlement for the transfer of the properties ($27.8 million) and reimbursement

of Construction Work in Progress and Work in Progress (approximately

$19.2 million) will be by way of a reduction against the loan between ICP

and Council. The residual value of $24.9 million of loan account

between ICP and Council will be forgiven.

RISK MANAGEMENT IMPLICATIONS

Should the exemption from Stamp

Duty under corporate reconstruction not be approved by the OSR, Council will be

liable to pay Stamp Duty on the value of the transfer transactions. The

value of the Stamp Duty, if payable, is estimated to be

$1.6 million. This may increase if the OSR consider the WIP and WIP

to be dutiable.

Council is proposing to acquire

the assets and operations of ICP and in doing so creates a potential for

exposure to unknown liabilities resulting from the assets and operations of

ICP. Under the Deed of Release Council agrees to pay the operational liabilities

arising after 18 June 2019 (typically in the form of invoiced

costs). For other non‑operational liabilities, the Deed of Release

does not require Council to pay such liabilities but it may elect to do so.

The loan between Council and ICP

is limited to a maximum value of $75 million (the loan cap) under

the most recent amended SBFA approval of the Under Treasurer, dated

2 June 2015. This amended approval lapses on

30 June 2019 at which time the loan cap reverts to its value under

the original SBFA approval of $50 million.

Should the transfer of properties

and reimbursement of construction costs incurred by ICP (approximately

$47 million in total) not occur before 30 June 2019 nor be

reduced against the loan account, Council would be in breach of the original

SBFA approval.

Legal/Policy Basis

This report and its recommendations are consistent with the

following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

COMMUNITY and OTHER CONSULTATION

No specific community consultation

has been undertaken in relation to the transfer of ICP’s properties,

other assets and operations back into Council.

Conclusion

The operations and activities of

ICP has been the subject of great public interest in recent years. The

transfer of the ICP properties, other assets and operations back into Council

and the subsequent wind up of ICP enacts Council’s resolution of October

2018. It is also considered a necessary step in the delivery of the

Ipswich Central CBD Transformation Project and the revitalisation of the

Ipswich CBD.

Attachments and Confidential Background Papers

|

1

|

Deed of Release ⇩

|

Jeffrey Keech

Finance Manager

I concur with the recommendations contained in this

report.

Sean Madigan

General Manager -

Coordination and Performance

I concur with the recommendations contained in this

report.

Andrew Knight

General Manager -

Corporate Services

“Together,

we proudly enhance the quality of life for our community”

|

·

Council

·

Meeting

Agenda

|

·

27 June

·

2019

|

Item E.3 / Attachment 1

Deed

of release

Ipswich

City Properties Pty Ltd ACN 135 760 637

ICP

Ipswich

City Council

ICC

Contents

1. Definitions and

interpretation. 1

1.1 Definitions. 1

1.2 Interpretation. 2

2. Asset transfer 3

3. Reimbursement to be

effected. 3

4. Payment 4

5. Operational

Liabilities and Non-Operational Liabilities. 4

6. Debt Forgiveness. 4

7. Notices. 5

7.1 How notice to be

given. 5

7.2 When notice taken to

be received. 5

7.3 Notices sent by more

than one method of communication. 5

8. General 6

8.1 Stamp duties. 6

8.2 Costs. 6

8.3 Governing law. 6

8.4 Jurisdiction. 6

8.5 Counterparts. 6

8.6 Further acts and

documents. 6

8.7 Severance. 6

8.8 Waiver 6

9. GST. 7

9.1 Definitions. 7

9.2 GST payable. 7

9.3 Reimbursement of

costs, expenses and other amounts. 7

9.4 Variation. 7

9.5 No merger 8

Schedule 1 – Real Property. 10

Date

Parties Ipswich

City Properties Pty Ltd ACN 135 760 637 of 45 Roderick Street, Ipswich, Queensland

4305 (ICP)

Ipswich

City Council of

45 Roderick Street, Ipswich, Queensland 4305 (ICC)

Background

A. ICP

is transferring all its Assets to ICC under various Documents.

B. ICC

is paying value to ICP for the various Assets to be transferred as per

consideration set out in the Documents.

C. ICC

is to reimburse ICP for certain costs that ICP has incurred.

D. This

deed is being entered into, to finalise financial and related matters between

ICP and ICC, including ICC's forgiveness of certain debt owed by ICP to ICC as

set out in this deed.

Operative provisions

1. Definitions and

interpretation

1.1 Definitions

In this deed:

Assets means all the assets

of ICP, extending to and including:

(a) all real property

listed in Schedule 1;

(b) all personal

property;

(c) ICP IP; and

(d) goodwill in any

business conducted by ICP, including the exclusive right to represent itself as

carrying on the business as the successor to ICP,

but

not including cash at bank required by ICP to pay its debts as and when they

fall due.

Bremer

Street Leasehold Tenure means the Bremer Street Ramp - State Leasehold as

referred to in 1.2 of Schedule 1.

Business

Day means

Monday to Friday other than when there is a public holiday in Ipswich.

Debt means the debt of

approximately $24,925,371.15 as at 27 June 2019 (subject to the terms of this

deed).

Discretionary

Payment

has the meaning in clause 5(c).

Documents means the documents

signed at or about the time of this deed to transfer the Assets from ICP to

ICC.

Forgiven

Debt

means the debt forgiven as defined in clause 6(a).

GST

Legislation

means A New Tax System (Goods and Services Tax) Act 1999.

ICP

IP

means all Intellectual Property Rights owned by the ICP and the right to take

action against any third party for the infringement of any rights relating to

those Intellectual Property Rights whether occurring before or after the date

of this deed.

Intellectual

Property Rights

means:

(a) patents, designs,

trade marks and service marks (whether registered or unregistered) and any

applications for, or rights to apply for, registration of any patent, design,

trade mark or service mark;

(b) copyright (including

copyright in software, websites, databases and advertising and other

promotional materials);

(c) all rights to have

information (including trade secrets, know-how, operating procedures and

technical information) kept confidential; and

(d) all other rights or

protections having similar effect anywhere in the world.

Non-Operational Liabilities means any

liabilities of ICP:

(a) which are or have

been incurred as a consequence of:

(i) any

default or wrongdoing of ICP under any contract or arrangement, including any

liability under any indemnity; and

(ii) any

negligence or wrongful act or omission of ICP or persons for whom ICP is

responsible; or

(b) in respect of which

ICP has insurance and in respect of which the insurance cover responds to meet

that liability.

Operational

Liabilities

means liabilities of ICP which are or have been incurred by ICP in the ordinary

course of its business under contracts or arrangements it has entered into in

relation to its Assets, including any proposed development or letting of those

Assets and extends to any taxation (including GST) liabilities, on the basis

any refund or payment due to ICP and paid to ICP as a result of a tax paid by

ICC on behalf of ICP, shall be paid by ICP to ICC, but does not include Non‑Operational

Liabilities.

Payment means the consideration payable to

ICP by ICC under the Documents in the sum of $27,814,565.78.

1.2 Interpretation

In this deed:

(a) headings

are for convenience only and do not affect interpretation;

and unless the context indicates a contrary

intention:

(b) an

obligation or liability assumed by, or a right conferred on, 2 or more

parties binds or benefits all of them jointly and each of them severally;

(c) the

expression "person"

includes an individual, the estate of an individual, a corporation, an

authority, an association or a joint venture (whether incorporated or

unincorporated), a partnership and a trust;

(d) a

reference to any party includes that party's executors, administrators,

successors and permitted assigns, including any person taking by way of

novation and, in the case of a trustee, includes any substituted or additional

trustee;

(e) a

reference to any document (including this deed) is to that document as varied,

novated, ratified or replaced from time to time;

(f) a

reference to any statute or to any statutory provision includes any statutory

modification or re-enactment of it or any statutory provision substituted for

it, and all ordinances, by-laws, regulations, rules and statutory instruments

(however described) issued under it;

(g) words

importing the singular include the plural (and vice versa);

(h) references

to parties, clauses, schedules, exhibits or annexures are references to

parties, clauses, schedules, exhibits and annexures to or of this deed, and a

reference to this deed includes any schedule, exhibit or annexure to this deed;

(i) where

any term is used in this deed which is defined in the GST Legislation, it will

have the same meaning which it bears in the GST Legislation;

(j) where

a word or phrase is given a defined meaning, any other part of speech or

grammatical form of that word or phrase has a corresponding meaning; and

(k) the

word "includes"

in any form is not a word of limitation.

(a) To

the extent ICP has not transferred any Assets held by it under any of the

Documents, by force of this deed, ICP transfers and assigns to ICC all Assets

not otherwise transferred under the Documents.

It

is anticipated that Assets not otherwise transferred under the Documents will

either be nil or will be limited in scope and value.

(b) In

respect of the Bremer Street Leasehold Tenure the transfer of lease for $1 may not

have been effected as at the date of this deed and to the extent not effected,

shall be effected as soon as practicable thereafter (once the necessary

Ministerial approval to transfer can be secured) and each party must do all

things to see that that occurs.

3. Reimbursement to be

effected

(a) ICC

agrees that on 27 June, 2019, it will reimburse ICP an amount of $2,300,127.95

for the cost of consultancy services and early works services effected in

connection with the Assets transferred under the Documents.

(b) ICC

agrees that on 27 June, 2019, it will reimburse ICP an amount of $16,875,675.28

for the cost of consultancy services and works services effected in connection

with the Assets transferred under the Documents and more particularly in

connection with a development agreement entered into between ICP and ICC.

(c) ICP

accepts the reimbursements of $2,300,127.95 and $16,875,675.28 respectively in

full and final satisfaction of all amounts owing by ICC to ICP on account of

any works and services provided by ICP to ICC on any account (including under

any agreement or arrangement between ICP and ICC).

(d) ICP

acknowledges that it owes a debt to ICC and that the reimbursements referred to

in clause 3(a) and 3(b) (other than the cash amount required by ICP to meet its

GST liabilities for supplies made by ICP in connection with the reimbursement

amounts) will not be made in cash, but rather ICC will make the reimbursements

(other than a cash amount required by ICP to meet its GST liabilities for

supplies made by ICP in connection with the reimbursement amounts) as and by

way of reduction of the debt and the debt shall be reduced accordingly.

(a) ICC

will make the Payment to ICP, as and when the Documents require, (expected to

be on 27 June, 2019).

(b) ICP

acknowledges that it owes a debt to ICC and that the Payment (other than a cash

amount required by ICP to meet its GST liabilities in connection with supplies

made by ICP on the transfer of Assets to ICC under the Documents), made need

not be made in cash, but rather ICC will make the Payment (other than a cash

amount required by ICP to meet its GST liabilities in connection with supplies

made by ICP on the transfer of Assets to ICC under the Documents), as and by

way of reduction of the debt owed to ICC by ICP and the debt shall be reduced

accordingly.

5. Operational

Liabilities and Non-Operational Liabilities

(a) ICP

and ICC agree that ICC will pay on behalf of ICP and ICC do undertake to pay on

behalf of ICP, all the Operational Liabilities of ICP arising on or after

18 June 2019, to the extent that ICP does not have cash to meet those

Operational Liabilities.

(b) In

respect of Operational Liabilities that comprise any taxation (including GST)

liability paid by ICC on behalf of ICP, any refund or similar payment due to

ICP as a result of tax paid by ICC on behalf of ICP shall be paid by ICP to

ICC, upon receipt and shall be ICC's property.

(c) In

respect of Non-Operational Liabilities, ICC are not required by this deed to

pay such liability on behalf of ICP, but may elect to do so ( in this deed, Discretionary

Payment).

(a) The

debt owing to ICC by ICP after the transfer of the Assets under the Documents,

the reimbursements referred to in clause 3 and the Payment referred to in

clause 4, will be for the purposes of this deed be the Forgiven Debt.

As at 27 June, 2019 the Forgiven Debt is anticipated to be (more or

less) the amount of the Debt.

(b) ICC

forgives and releases ICP from its obligation to pay the Forgiven Debt.

(c) In

consideration of the forgiveness and release in clause 6(b), apart from the

obligations of ICC under this deed, ICP releases ICC from all liability and

claims, damages, costs and expenses (actual or contingent) on any account,

owing, payable or due by ICC to ICP.

(d) If

after the forgiveness and release under clause 6(b), any further amounts are

paid by ICC in respect of any amount for Operational Liabilities or a

Discretionary Payment, then ICC agrees to forgive and release ICP to pay that

amount to ICC.

7.1 How

notice to be given

Each

communication (including each notice, consent, approval, request and demand)

under or in connection with this deed:

(a) must

be given to a party:

(i) using

one of the following methods (and no other method) namely, hand delivery,

courier service or post; and

(ii) using

the address or other details for the party set out below (or as otherwise

notified by that party to each other party from time to time under this

clause 6(d)):

ICP

Tenant: Ipswich City

Properties ACN 135 760 637

Address: 45

Roderick Street, Ipswich, Queensland 4305

Email: steve.bannister-tyrrel@ipswich-commercial.com.au

ICC

Name: Ipswich City Council

Address: 45

Roderick Street, Ipswich, Queensland 4305

Email: Jeffrey.Keech@ipswich.qld.gov.au

(b) must

be in legible writing and in English;

(c) must

be signed by the sending party or by a person duly authorised by the sending

party;

and

(d) may

be sent by email, at the address set out in clause 7.1(a)(ii).

7.2 When

notice taken to be received

Each

communication (including each notice, request and demand) under or in

connection with this deed is taken to be given by the sender and received by

the recipient:

(a) (in

the case of delivery by hand or courier service) on delivery;

(b) (in

the case of prepaid express post sent to an address in the same country) on the

second Business Day after the date of posting;

(c) (in

the case of email) at the time it is sent,

provided

that:

(d) if

the communication would otherwise be taken to be received on a day that is not

a Business Day or after 5.00 pm, it is taken to be received at 9.00 am on the

next Business Day.

7.3 Notices

sent by more than one method of communication

If

a communication delivered or sent under this clause 7 is delivered or sent

by more than one method, the communication is taken to be given by the sender

and received by the recipient whenever it is taken to be first received in

accordance with clause 7.2.

8.1 Stamp

duties

ICC:

(a) must

pay on time all stamp duties on this deed and the transfer of Assets and any

related fines and penalties in connection with this deed and the transfer of

Assets, the performance of them and each transaction effected by or made under

them;

(b) is

authorised to apply for and retain the proceeds of any refund due in respect of

stamp duty paid under this clause 8.1.

8.2 Costs

ICC will bear the legal costs and expenses

for negotiating, preparing and executing this deed.

8.3 Governing

law

This

deed is governed by and will be construed according to the laws of Queensland.

8.4 Jurisdiction

(a) Each

party irrevocably submits to the non-exclusive jurisdiction of the courts of

Queensland, and the courts competent to determine appeals from those courts,

with respect to any proceedings which may be brought at any time relating in

any way to this deed.

(b) Each

party irrevocably waives any objection it may now or in the future have to the

venue of any proceedings, and any claim it may now or in the future have that

any proceedings have been brought in an inconvenient forum, where that venue

falls within clause 8.4(a).

8.5 Counterparts

This

deed may be executed in any number of counterparts and by the parties on

separate counterparts. Each counterpart constitutes an original of this

deed, all of which together constitute one agreement.

8.6 Further

acts and

documents

ICP

and ICC must promptly do all further acts and execute and deliver all further

documents required by law to give effect to this deed.

8.7 Severance

If

at any time any provision of this deed is or becomes illegal, invalid or

unenforceable in any respect under the law of any jurisdiction, that will not

affect or impair:

(a) the

legality, validity or enforceability in that jurisdiction of any other

provision of this deed; or

(b) the

legality, validity or enforceability under the law of any other jurisdiction of

that or any other provision of this deed.

8.8 Waiver

(a) Failure

to exercise or enforce, or a delay in exercising or enforcing, or the partial

exercise or enforcement of, a right, power or remedy provided by law or under

this deed by a party does not preclude, or operate as a waiver of, the exercise

or enforcement, or further exercise or enforcement, of that or any other right,

power or remedy provided by law or under this deed.

(b) A

waiver or consent given by a party under this deed is only effective and

binding on that party if it is given or confirmed in writing by that party.

(c) No

waiver of a breach of a term of this deed operates as a waiver of another

breach of that term or of a breach of any other term of this deed.

9.1 Definitions

The

terms "GST" and "GST Act" have the meanings

ascribed to those terms by the A New Tax System (Goods and Services Tax) Act

1999 (Cth) (as amended from time to time) or any replacement or

other relevant legislation and regulations enacted to validate, recapture or

recoup tax collected as GST.

Unless

expressly stated otherwise,

any amounts stated in this deed exclude GST.

9.2 GST payable

If

GST is payable under the GST Act in relation to any supply made by a party (Supplier)

under this deed, the parties agree that:

(a) an

additional amount will be payable by the party providing consideration for that

supply (Recipient) equal to the amount of GST payable on that supply; and

(b) the

additional amount is payable at the same time as payment is otherwise due under

this

deed.

9.3 Reimbursement

of costs, expenses and other amounts

If

a party is required under this deed to reimburse or pay to the other party an

amount calculated by reference to a cost, expense, or an amount paid or

incurred by that party, the amount of the reimbursement or payment will be

reduced by the amount of any input tax credits to which that party is entitled

in respect of any acquisition relating to that cost, expense or other amount.

9.4 Variation

(a) If

the Supplier determines on reasonable grounds, is advised by the Commissioner

of Taxation or otherwise becomes aware that the GST payable on a supply made

under or in connection with this deed is different to the additional amount

paid by the Recipient to the Supplier in accordance with clause 9.2 (if any) in

respect of that supply such that:

(i) the

Supplier is required to pay an amount (or further amount) of GST in respect of

that supply; or

(ii) the

Supplier receives or becomes entitled to receive a refund or credit of the

whole or any part of the GST paid by the Supplier in relation to that supply,

the

Supplier:

(iii) must

provide a corresponding refund or credit to the Recipient; or

(iv) will

be entitled to receive the amount of that variation (including any penalties,

interest or other charges levied on, or applied to the Supplier) from the

Recipient,

as the case may be.

(b) For

the purposes of calculating further variations under this clause 9.4, any

additional amount referred to in clause 9.2 is taken to be amended by the

amount of any earlier variation made under this clause.

(c) Where

an adjustment event occurs in relation to a supply made by the Supplier under

or in connection with this deed, the Supplier will issue an adjustment note to

the Recipient in respect of that supply within 14 days after becoming aware of

the relevant adjustment.

9.5 No

merger

This

clause shall not merge on any transfer of Assets.

Executed as a deed.

|

A.

Executed

by

Ipswich

City Properties Pty Ltd ACN 135 760 637 in accordance with

section 127 of the Corporations Act 2001 (Cth):

|

B.

|

C.

|

D.

|

|

E.

|

F.

|

G.

|

H.

|

|

I.

Full

name of sole director and company secretary who states that he or she is the

sole director and sole company secretary of Ipswich City Properties Pty Ltd ACN 135 760 637

|

J.

|

K.

|

L.

Signature

of sole director and sole company secretary

|

|

M.

Signed,

sealed and delivered for and on behalf of Ipswich City Council by its duly

authorised signatory/delegate in the presence of:

|

N.

|

O.

|

P.

|

|

Q.

|

R.

|

S.

|

T.

Signature

of signatory/delegate

|

|

U.

|

V.

|

W.

|

X.

|

|

Y.

|

Z.

|

AA.

|

BB.

Full

name of signatory/delegate

|

|

CC.

|

DD.

|

EE.

|

FF.

|

|

GG.

Signature

of witness

|

HH.

|

II.

|

JJ.

|

|

KK.

|

LL.

|

MM.

|

|

|

NN. Full name of witness

|

OO.

|

PP.

|

QQ.

|

Schedule

1 – Real Property

1.1 2

Bell Street, Ipswich - Leasehold

|

Lot/Plan

|

Title Reference

|

|

Lease No.601375840 and Lease No.601375841

over Lot

1 on RP157021

|

18007008

|

1.2 Bremer

Street Ramp - State Leasehold

|

Lot/Plan

|

Title Reference

|

|

Special Lease SL 27/51591, Sublease