IPSWICH

CITY

COUNCIL

AGENDA

of the

Governance Committee

Held in the Council Chambers

2nd floor – Council Administration

Building

45 Roderick Street

IPSWICH QLD 4305

On Tuesday,

17 March 2020

At 12.30pm

or within any period of time up to a maximum of 10 minutes after the conclusion

of the Environment Committee

|

MEMBERS OF THE Governance

Committee

|

|

Interim Administrator

Steve Greenwood (Chairperson)

|

|

|

Governance Committee

Meeting

Agenda

|

17 March

2020

|

Governance Committee AGENDA

12.30pm or within any period of time up to a maximum

of 10 minutes after the conclusion of the Environment Committee on Tuesday, 17 March 2020

Council Chambers

|

Item No.

|

Item Title

|

Page No.

|

|

1

|

Review of Policies - Corporate Services Department

|

7

|

|

2

|

Monthly Financial Performance Report - January 2020

|

25

|

|

3

|

Overdue General Rates and Utility Charges - October to

December 2019

|

34

|

** Item includes confidential papers

Governance

Committee NO. 2

17 March 2020

AGENDA

1. Review of Policies - Corporate Services

Department

This is a report concerning the

continuing review of policies within the functional responsibility of Corporate

Services Department.

Recommendation

That the Interim Administrator of

Ipswich City Council resolve:

A. That

the policy titled ‘Review of Statutory Decisions including Penalty

Infringement Notices’ as detailed in Table 1, be adopted.

B. That

the five (5) policies detailed below and outlined in Table 2, be repealed:

Ex-Gratia Payments

Policy

Withdrawal of

Infringement Notice Policy

Enterprise Risk

Management Policy

Mail-out Postage

Distribution Authorisation Policy

Damage to Private

or Commercial Property caused by trees on Council owned or controlled land

Policy

C. That

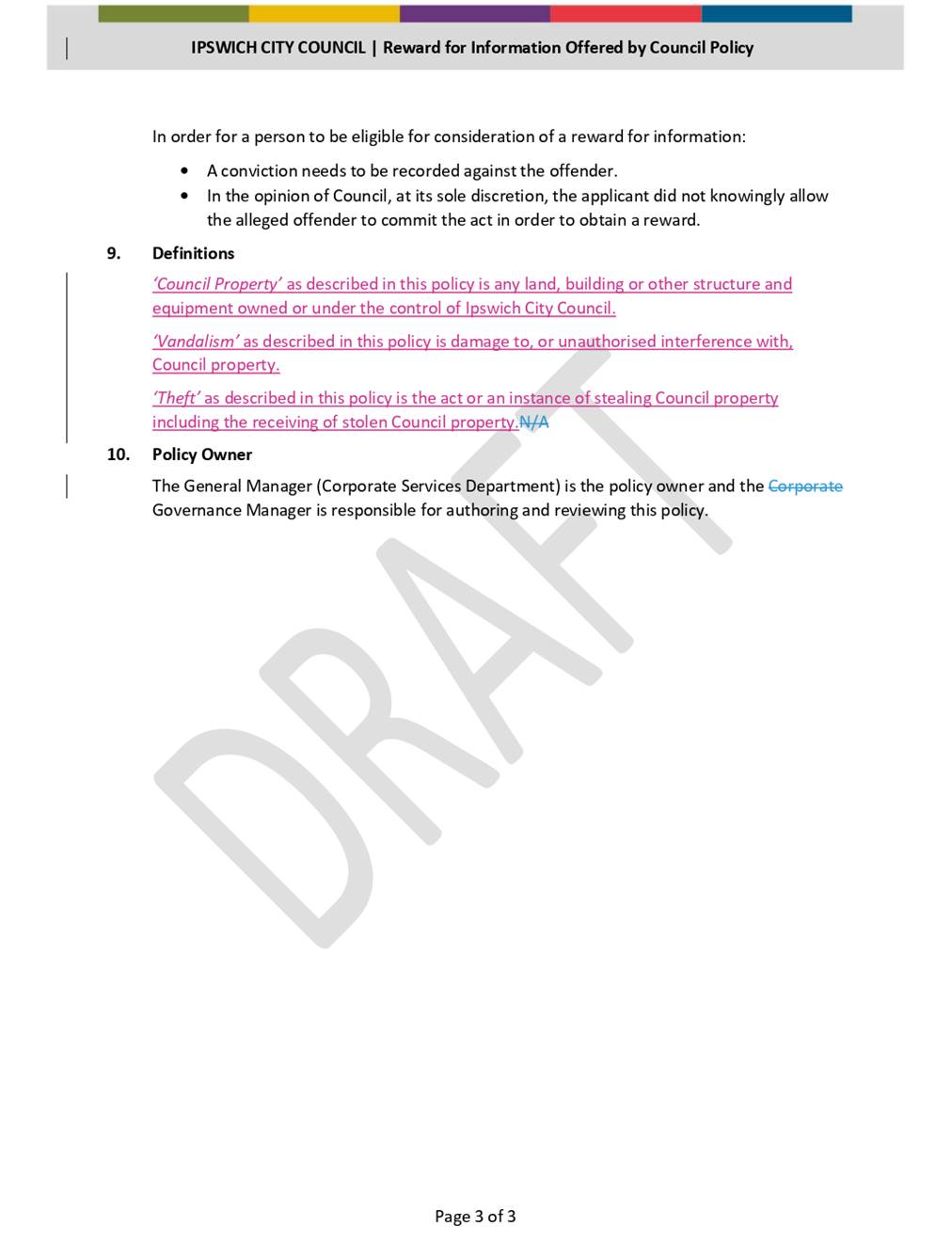

the policy titled ‘Reward for Information Offered by Council’, be

amended as detailed in Table 3.

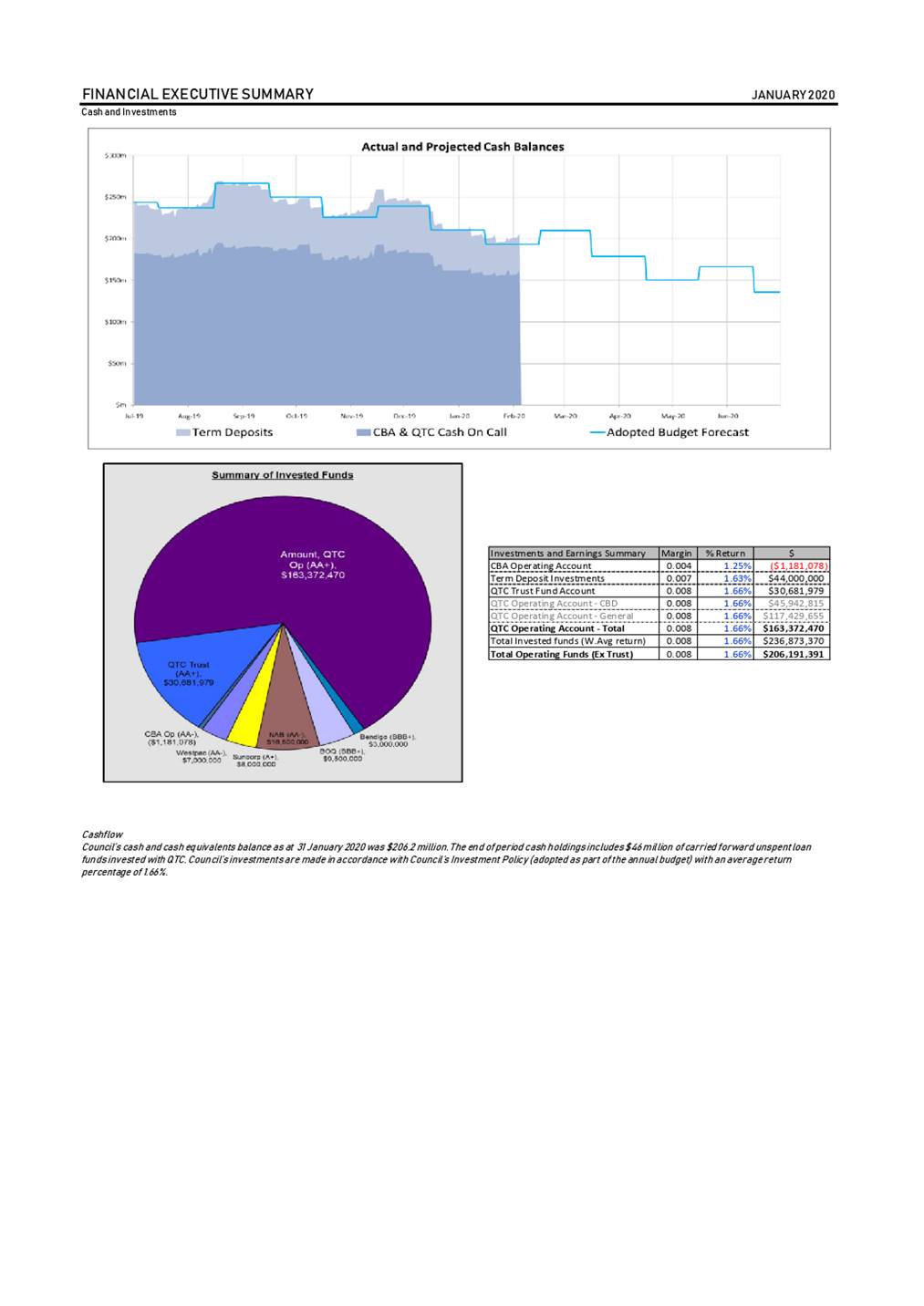

2. Monthly Financial Performance Report - January

2020

This is a report concerning

Council’s financial performance for the period ending 31 January 2020,

submitted in accordance with section 204 of the Local Government Regulation

2012.

A budget amendment was approved

by Council in February relating to a number of the variances noted below. The

budget amendment will be reflected in February results.

Recommendation

That the

Interim Administrator of Ipswich City Council resolve:

That the report be received and

the contents noted.

3. Overdue General Rates and Utility Charges -

October to December 2019

This is a report by the Treasury

Accounting Manager dated 6 March 2020 concerning rate arrears and rate

collection statistics for the period October-December 2019.

Recommendation

That the

Interim Administrator of Ipswich City Council resolve:

That the report be received and

the contents noted.

** Item includes confidential papers

and any other items as considered

necessary.

|

Governance

Committee

Meeting

Agenda

|

17 March

2020

|

Doc ID No: A6057965

ITEM: 1

SUBJECT: Review of Policies - Corporate Services

Department

AUTHOR: Business Improvement Advisor (Policy)

DATE: 11 February 2020

Executive Summary

This is a report concerning the

continuing review of policies within the functional responsibility of Corporate

Services Department.

Recommendation/s

That the Interim Administrator

of Ipswich City Council resolve:

A. That

the policy titled ‘Review of Statutory Decisions including Penalty

Infringement Notices’ as detailed in Table 1, be adopted.

B. That

the five (5) policies detailed below and outlined in Table 2, be repealed:

Ex-Gratia

Payments Policy

Withdrawal of

Infringement Notice Policy

Enterprise Risk

Management Policy

Mail-out

Postage Distribution Authorisation Policy

Damage to

Private or Commercial Property caused by trees on Council owned or controlled

land Policy

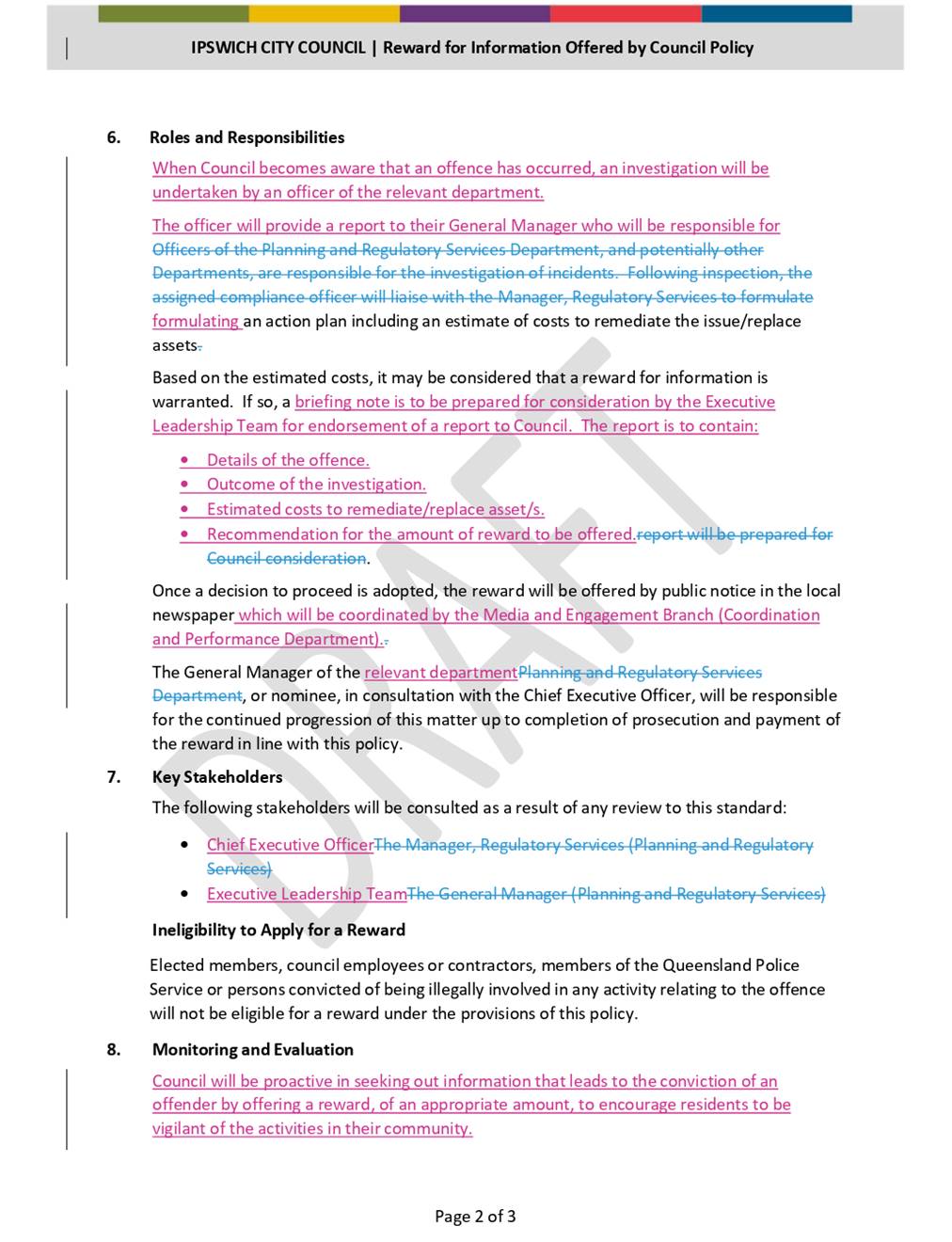

C. That

the policy titled ‘Reward for Information Offered by Council’, be

amended as detailed in Table 3.

RELATED PARTIES

There are no related parties associated

with this report.

Advance Ipswich Theme

Listening, leading and financial

management

Purpose of Report/Background

Corporate Services Department is

continuing to review policies that fall within its functional

responsibility. The following policies have been identified as requiring

action:

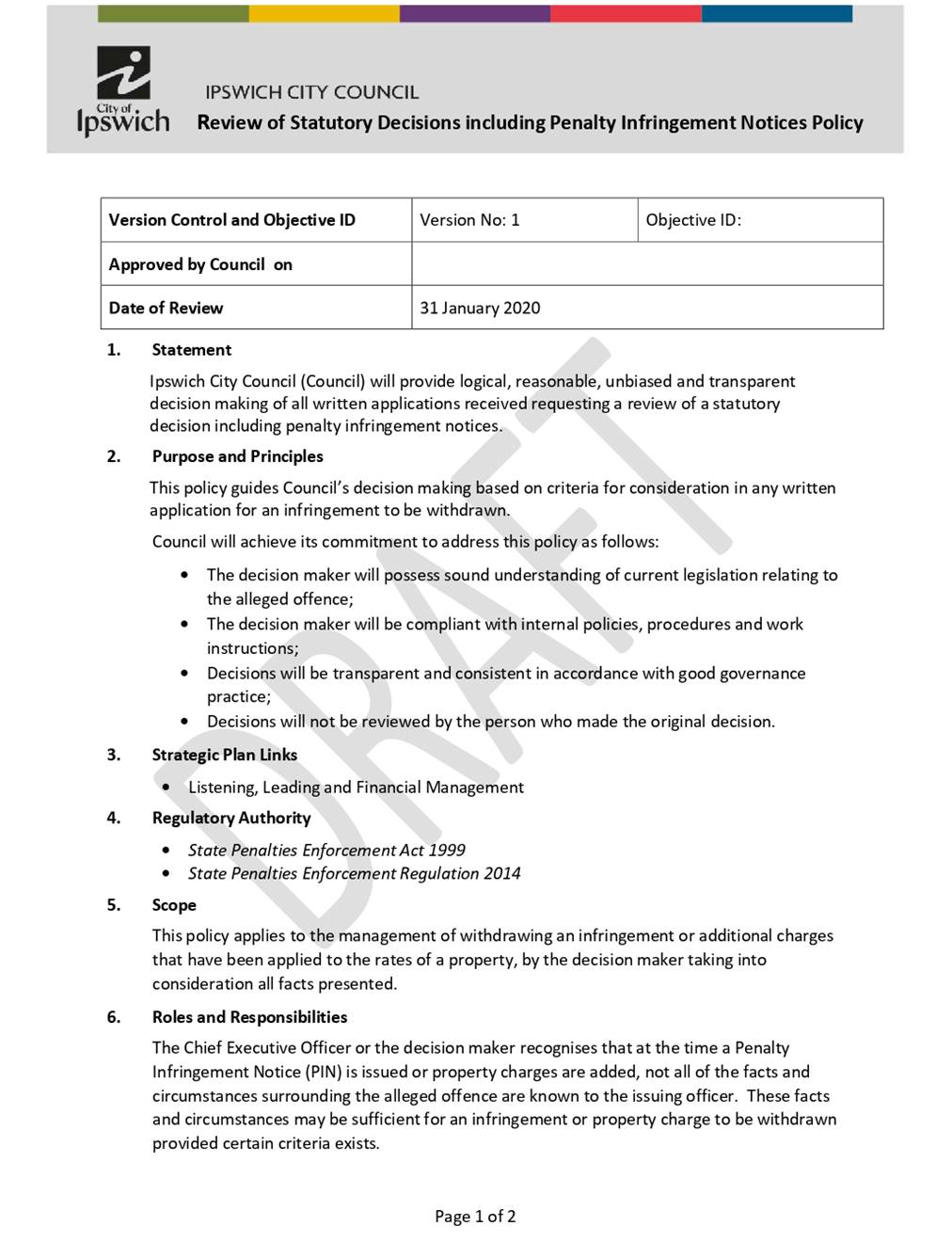

Table 1 – Policy for

Adoption by Council

|

Policy

|

Reason for Adoption

|

Attachment No.

|

|

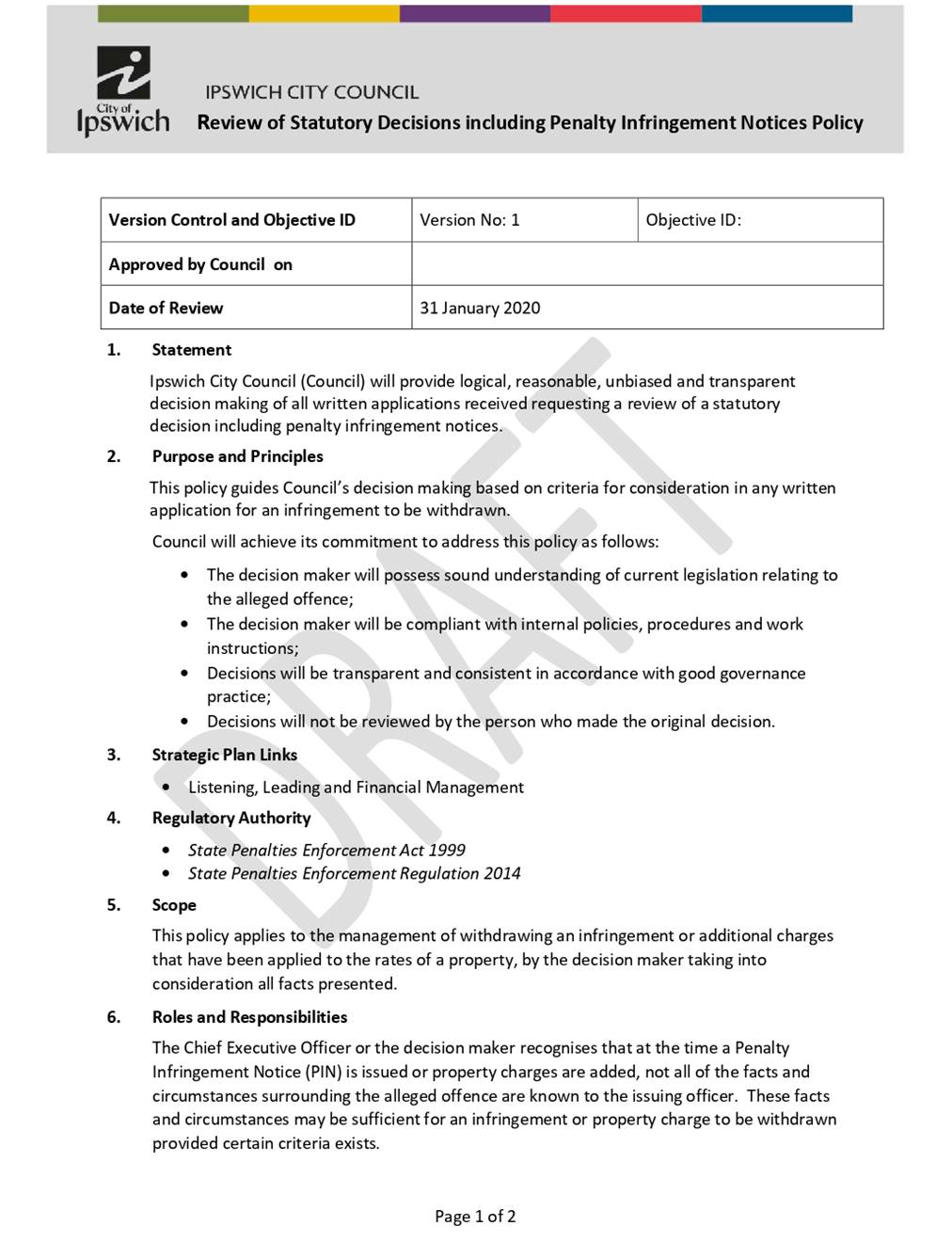

Review of Statutory Decisions including Penalty

Infringement Notices Policy

|

The Complaints Management Unit has created a new policy

for managing both the review of penalty infringement notices and charges

placed against the land by Council. The policy was endorsed by the

Executive Leadership Team at its 20 February 2020 meeting.

|

1

|

Table 2 – Policies for

Repeal by Council

|

Policy

|

Reason for Repeal

|

Attachment No.

|

|

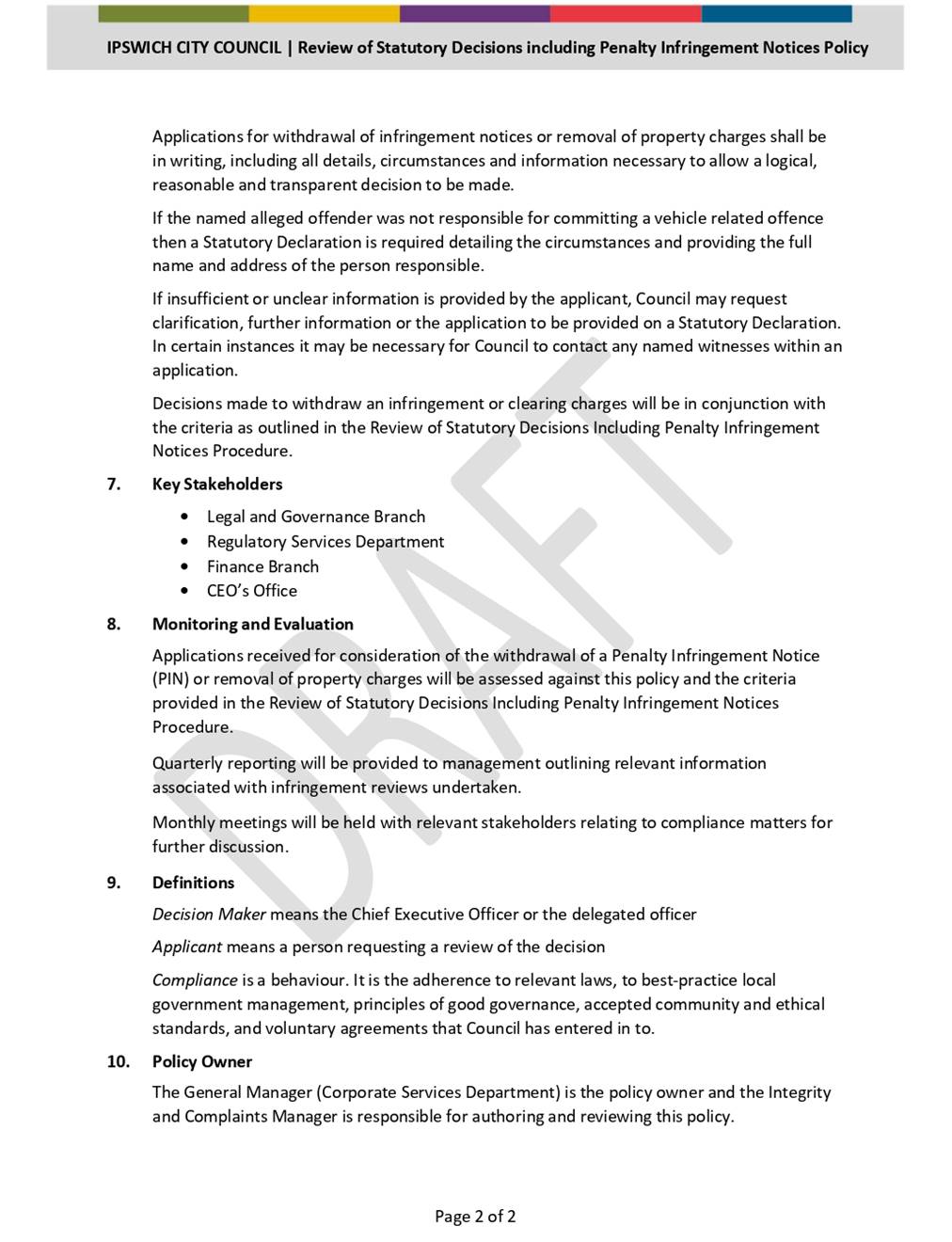

Ex-Gratia Payments Policy

|

This policy has been reviewed and transitioned to an

Administrative Directive as decisions on ex-gratia payments are within the

legislative delegation of the CEO. The Administrative Directive was

formally approved by the CEO on 28 February 2020.

|

2

|

|

Withdrawal of Infringement Notice Policy

|

This policy will be superseded by the proposed Review of

Statutory Decisions including Penalty Infringement Notices Policy.

Accordingly, this policy is submitted for repeal subject to the adoption of

the new policy detailed in Table 1.

|

3

|

|

Enterprise Risk Management Policy

|

The CEO approved a new Administrative Directive titled

Enterprise Risk Management Administrative Directive that replaces this

policy. Accordingly, this policy is submitted for repeal.

|

4

|

|

Mail-out Postage Distribution Authorisation Policy

|

Council’s Financial Management Policy is the head of

power document that guides all departmental expenditure arrangements

including mail-out postage distribution. Any revisions to

Council’s budget are undertaken under the guidance of the head of power

document. Accordingly, this policy is submitted for repeal as it is

superfluous.

|

5

|

|

Damage to Private or Commercial Property Caused by Trees

on Council Owned or Controlled Land Policy

|

A review of this policy indicates that claims of this

nature can more appropriately be addressed by the Insurance Claims against

Ipswich City Council Administrative Directive and the Ex-Gratia Payments

Administrative Directive. Accordingly, this policy is submitted for

repeal.

|

6

|

Table 3– Policy for

Amendment by Council

|

Policy

|

Reason for Amendment

|

Attachment No.

|

|

Reward for Information Offered by Council Policy

|

When creating the supporting procedure to this policy, it

was identified that a number of gaps existed in the document.

Accordingly, the policy document has been amended (see track changes) and is

submitted for adoption.

|

7

|

Legal/Policy Basis

This report and its recommendations are consistent with the

following legislative provisions:

Local Government Act 2009

RISK MANAGEMENT IMPLICATIONS

The review of these policies has

been undertaken in accordance with Council’s adopted Policy and Procedure

Management Framework. Any delay in approving the recommendations of this report

may potentially have adopted policies inconsistent with the Council Framework.

Financial/RESOURCE IMPLICATIONS

The review of all policies

associated with the functions of the Corporate Services Department are being

managed as part of the department’s operational budget for 2019-2020.

COMMUNITY and OTHER CONSULTATION

Consultation has been undertaken

with relevant internal stakeholders in relation to the policies presented for

repeal, amendment and adoption.

Conclusion

In accordance with Council’s

adopted Policy and Procedure Management Framework, the Corporate Services

Department is continuing to review policies under its functional responsibility

to ensure that they meet Council’s standards of transparency and good

governance.

Attachments and Confidential Background Papers

|

1.

|

Review of Statutory Decisions including Penalty

Infringement Notices Policy ⇩

|

|

2.

|

Ex-Gratia Payments Policy ⇩

|

|

3.

|

Withdrawal of Infringement Notice Policy ⇩

|

|

4.

|

Enterprise Risk Management Policy ⇩

|

|

5.

|

Mailout Postage Distribution Authorisation Policy ⇩

|

|

6.

|

Damage to Private or Commercial Property caused by Trees

on Council Owned or Controlled Land Policy ⇩

|

|

7.

|

Reward for Information Offered by Council Policy - track

changes ⇩

|

Carol Dellit

Business Improvement

Advisor (Policy)

I concur with the recommendations contained in this

report.

Angela Harms

Governance Manager

I concur with the recommendations contained in this

report.

Sonia Cooper

General Manager

Corporate Services

“Together,

we proudly enhance the quality of life for our community”

|

Governance

Committee

Meeting

Agenda

|

17 March

2020

|

Item 1 / Attachment 1.

|

Governance Committee

Meeting

Agenda

|

17 March

2020

|

Item 1 / Attachment 2.

|

Governance Committee

Meeting

Agenda

|

17 March

2020

|

Item 1 / Attachment 3.

|

Governance Committee

Meeting

Agenda

|

17 March

2020

|

Item 1 / Attachment 4.

|

Governance Committee

Meeting

Agenda

|

17 March

2020

|

Item 1 / Attachment 5.

|

Governance

Committee

Meeting

Agenda

|

17 March

2020

|

Item 1 / Attachment 6.

|

Governance Committee

Meeting

Agenda

|

17 March

2020

|

Item 1 / Attachment 7.

|

Governance Committee

Meeting

Agenda

|

17 March

2020

|

Doc ID No: A6086559

ITEM: 2

SUBJECT: Monthly Financial Performance Report - January

2020

AUTHOR: Manager, Finance

DATE: 27 February 2020

Executive Summary

This is a report concerning

Council’s financial performance for the period ending 31 January 2020,

submitted in accordance with section 204 of the Local Government Regulation

2012.

A budget amendment was approved by

Council in February relating to a number of the variances noted below. The

budget amendment will be reflected in February results.

Recommendation/s

That the Interim Administrator

of Ipswich City Council resolve:

That the report be received

and the contents noted.

RELATED PARTIES

There are no related party matters

associated with this report.

Advance Ipswich Theme

Strengthening our local economy

and building prosperity

Purpose of Report/Background

The attached report shows the

financial results for Ipswich City Council as at 31 January 2020. As noted

above, this is a report as at 31 January 2020 and accordingly the budget

amendment adopted by Council on 24 February 2020 is not reflected in the

report. The budget amendment took into consideration and amended for, a

number of the variances highlighted in this report which have been discussed in

previous reports to Council.

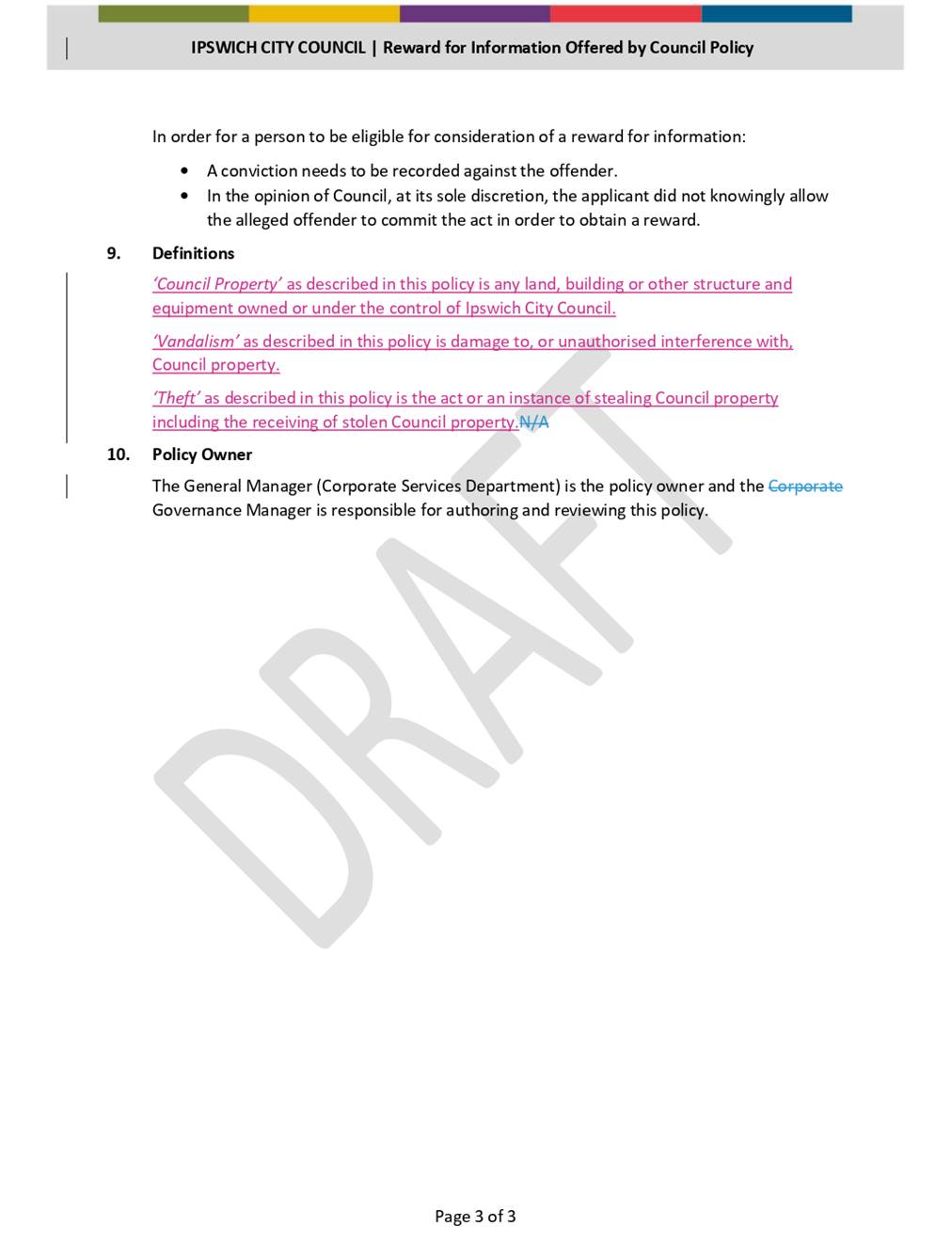

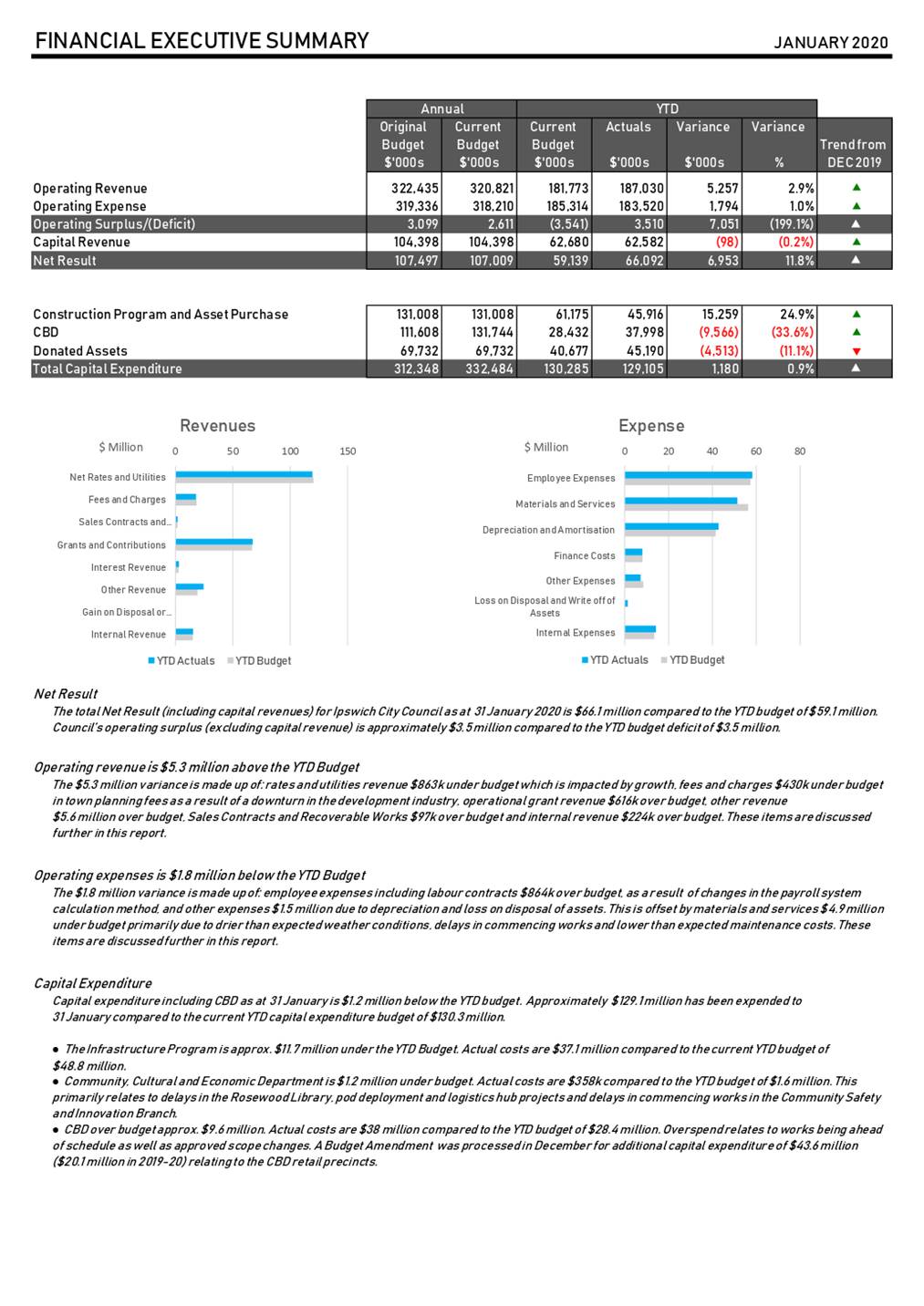

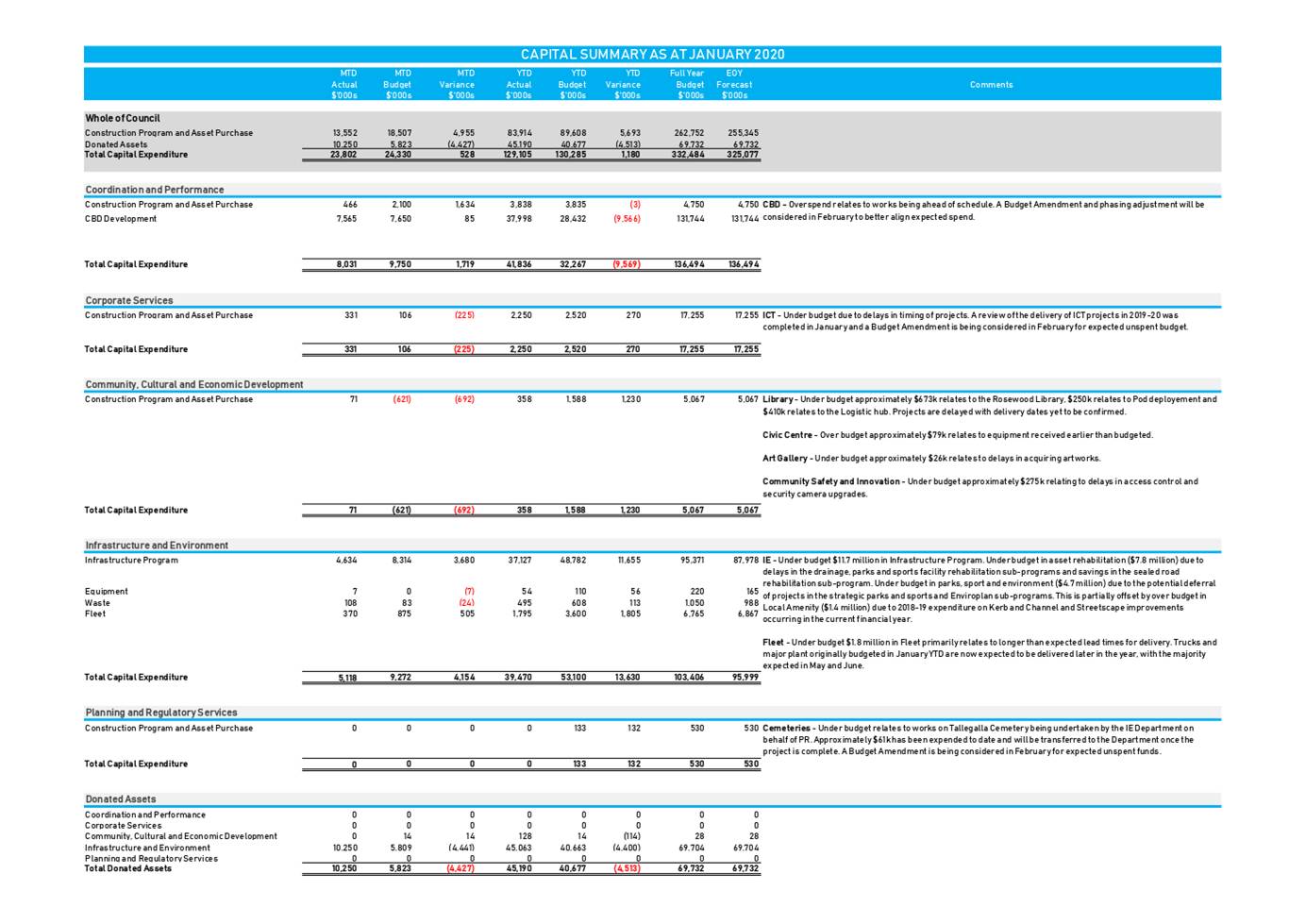

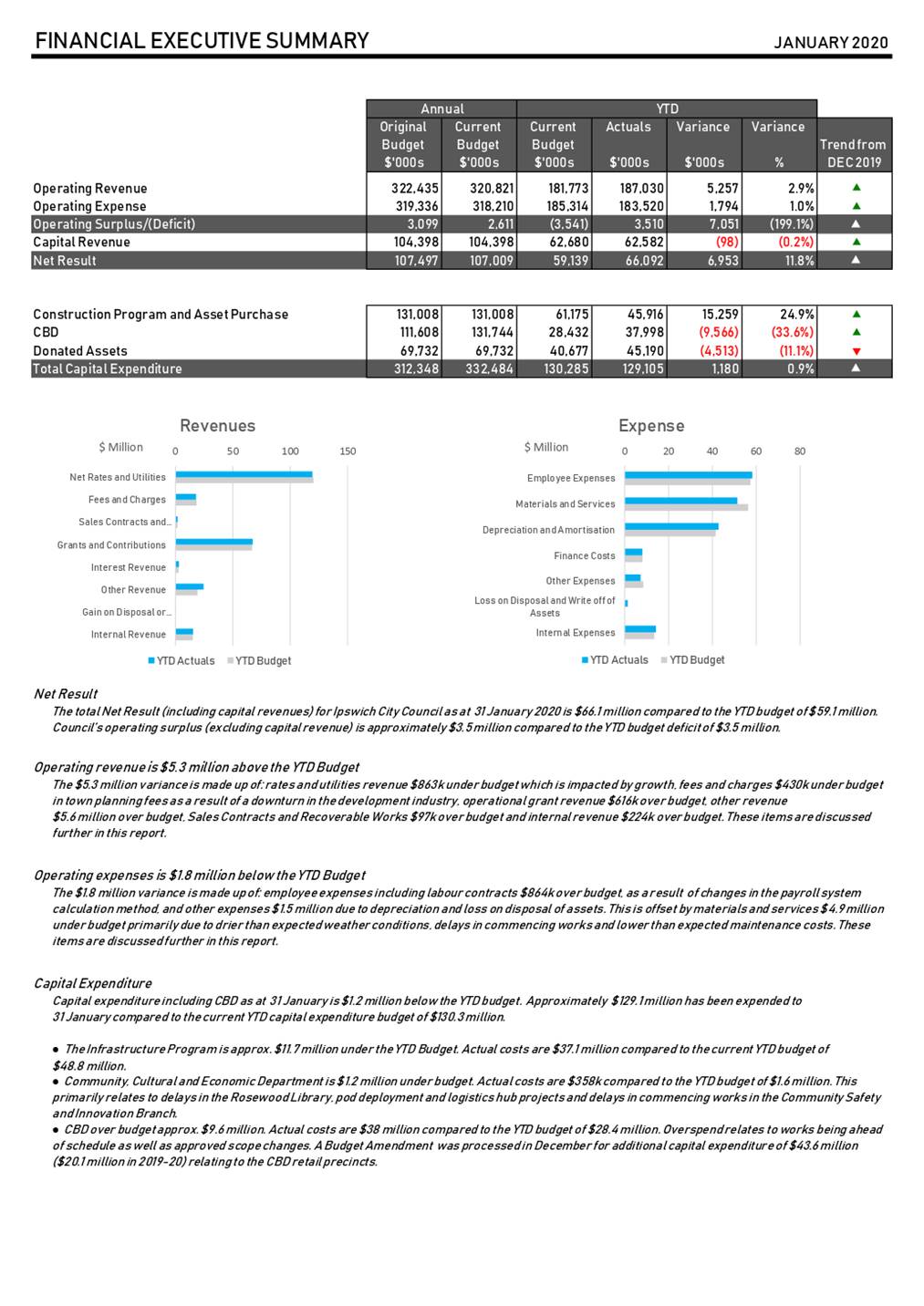

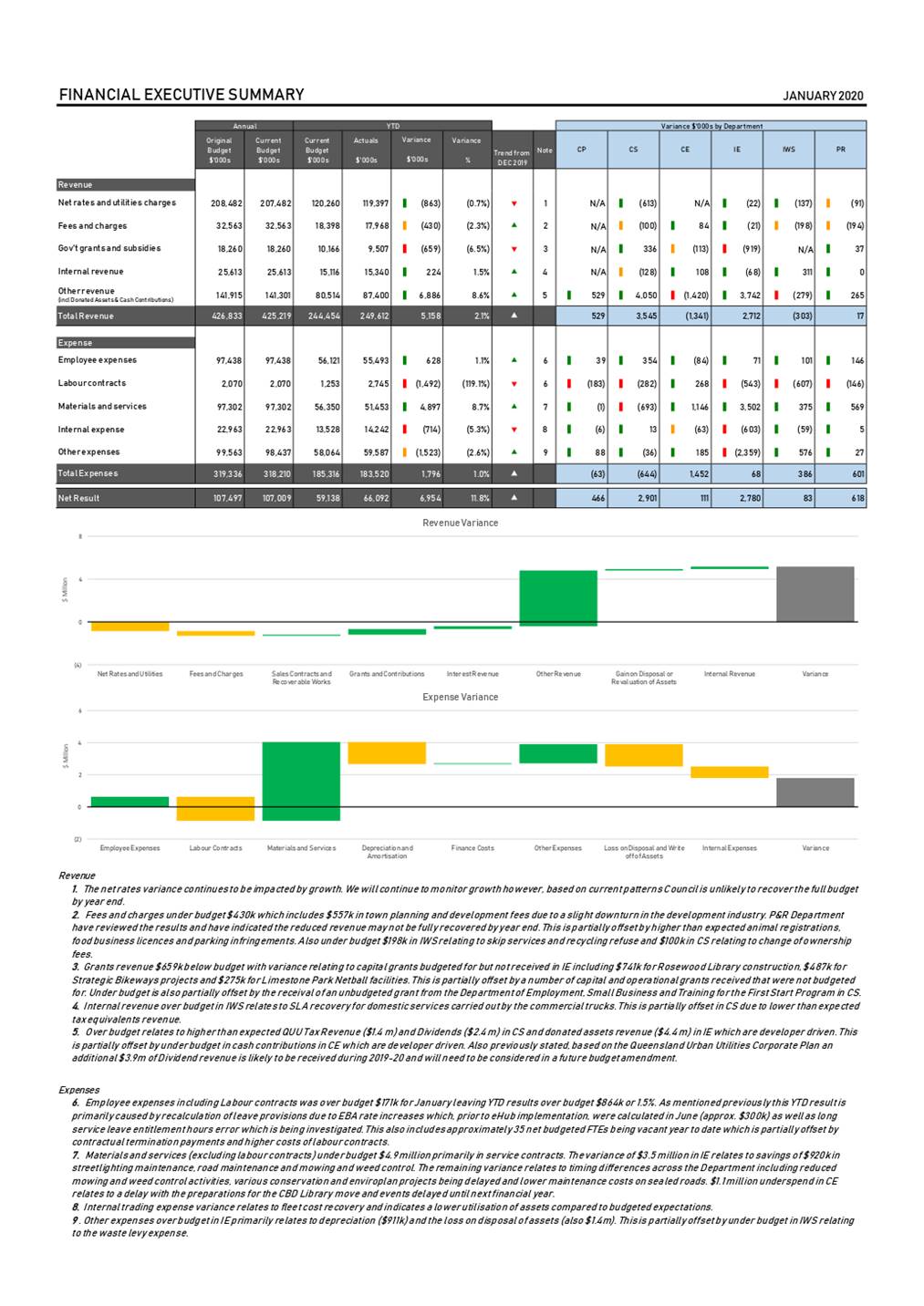

The total Net Result (including

capital revenues) is $66.1 million compared to the YTD budget of $59.1 million.

Council’s YTD operating surplus (excluding capital revenue) is approximately

$3.5 million compared to the YTD budget deficit of $3.5 million (the full year

budget surplus is $2.6 million). Additional operating revenue of $5.3 million

YTD for items including QUU tax and dividends and operational grants has driven

the current positive position.

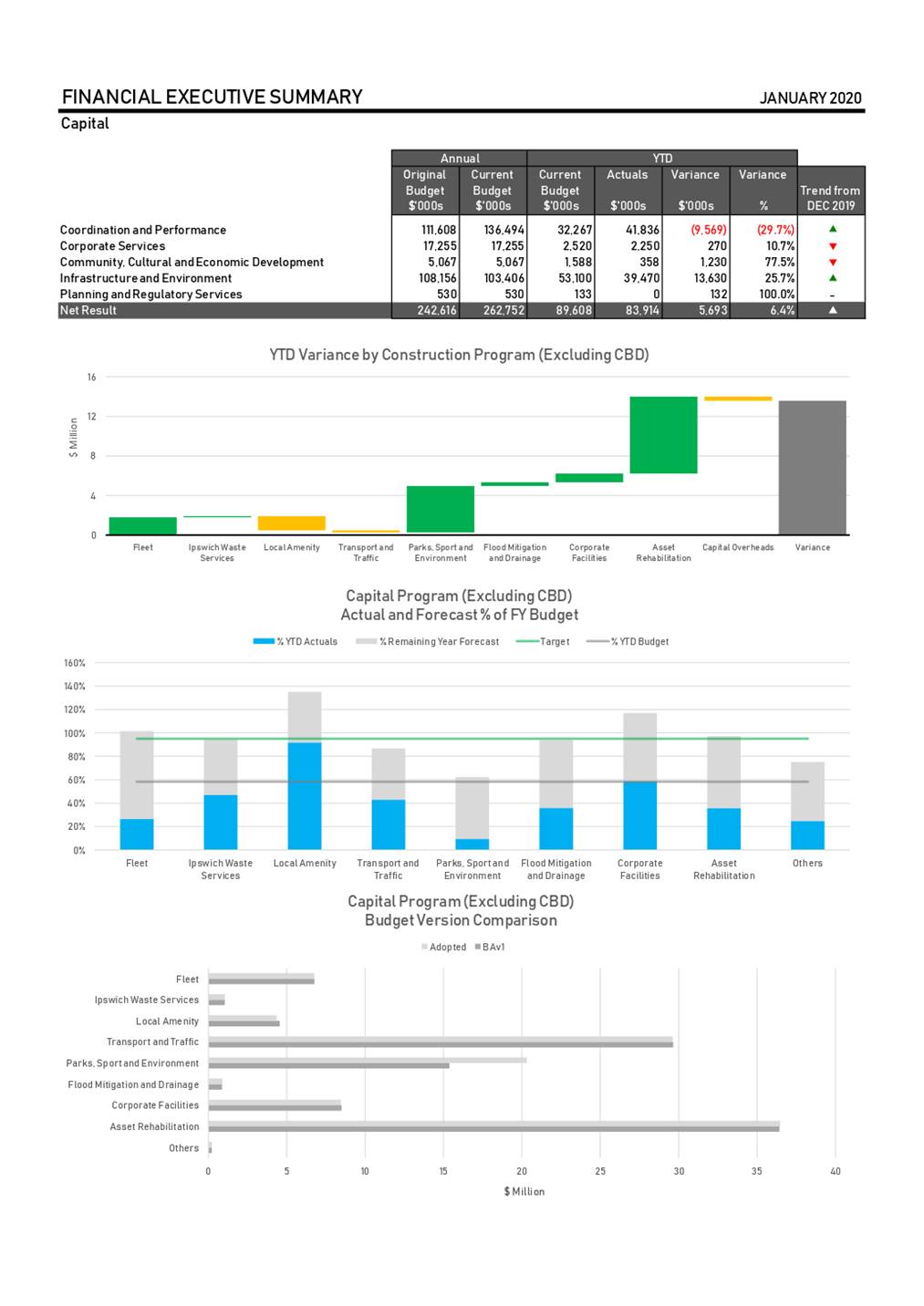

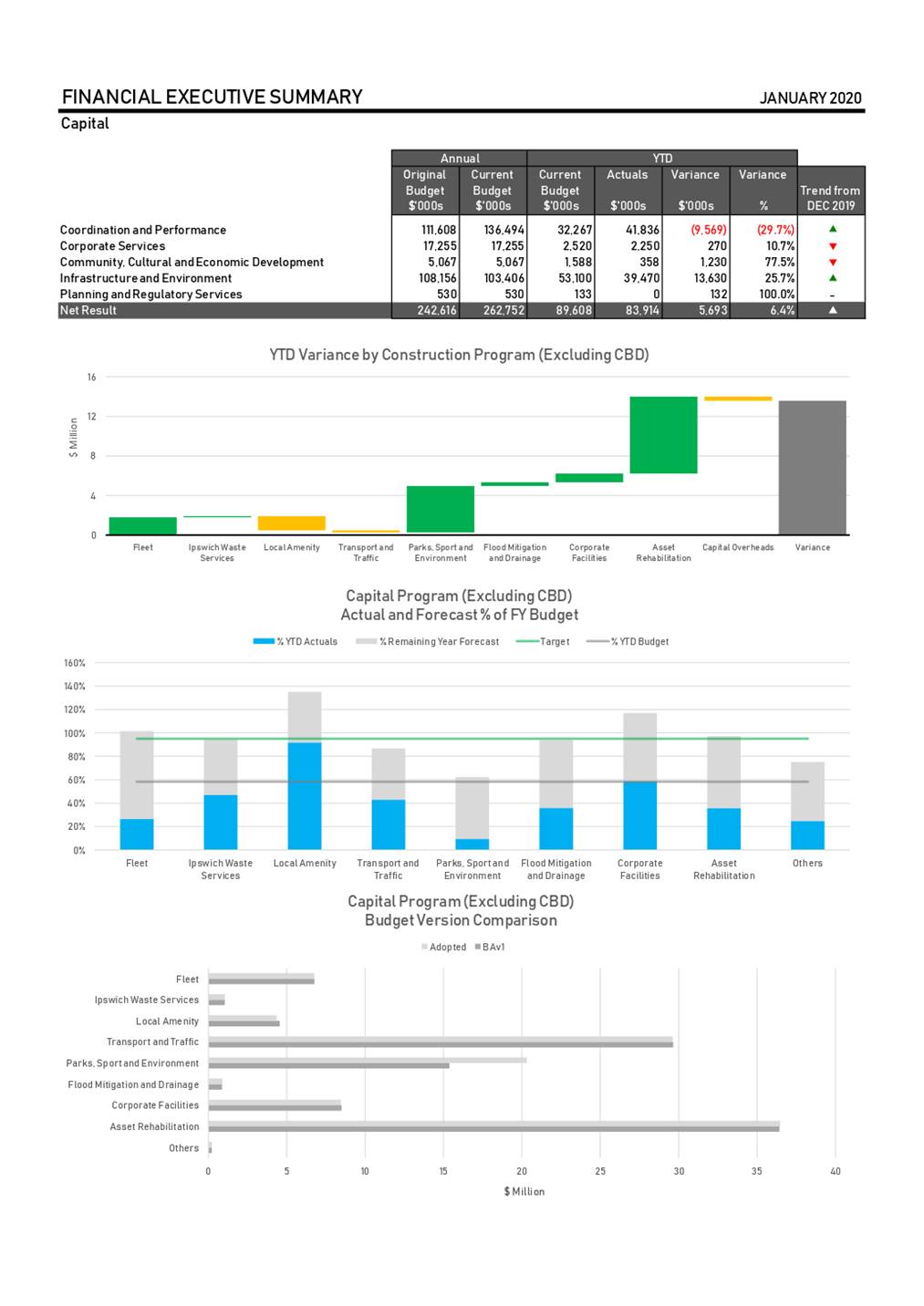

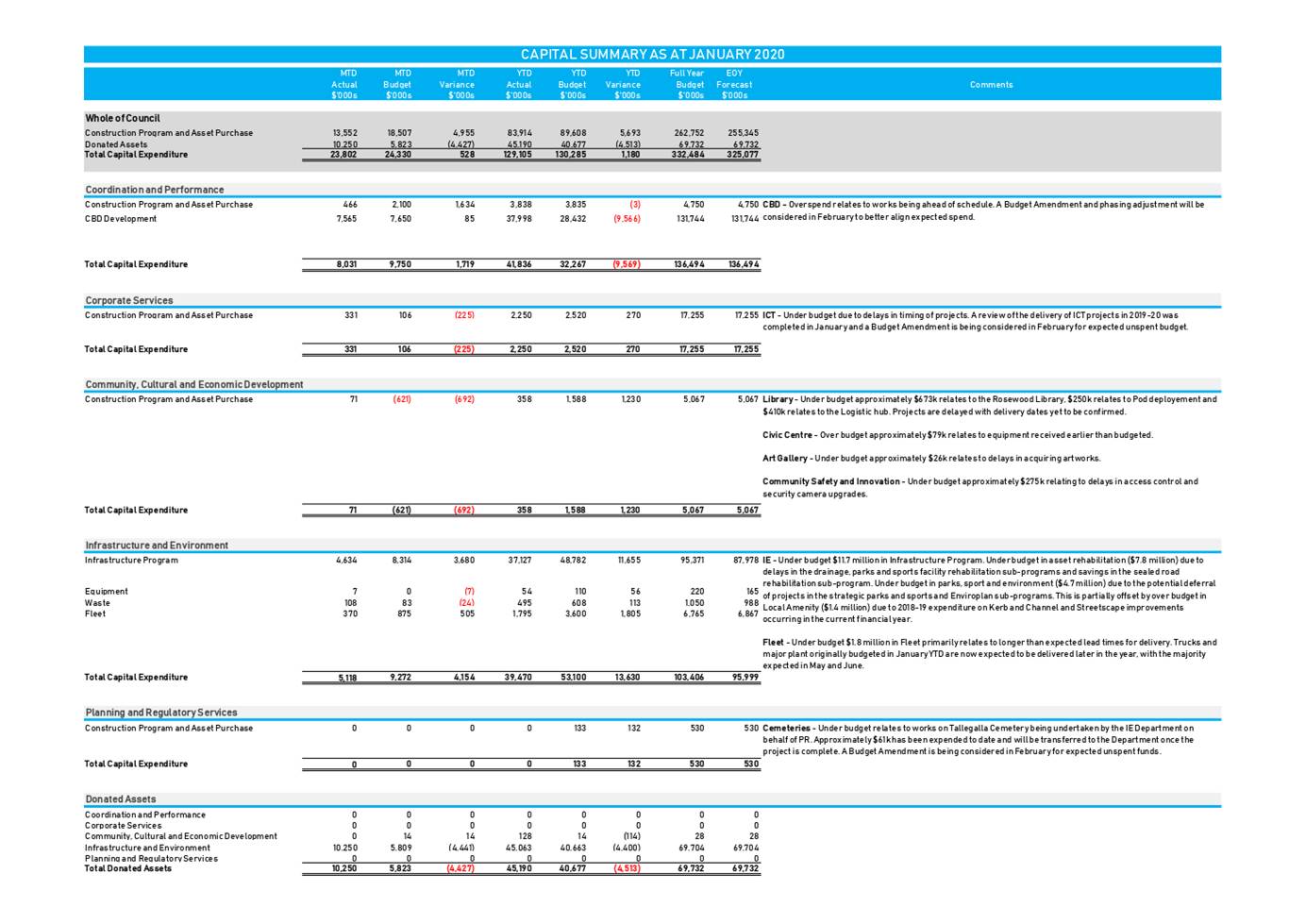

Capital expenditure including the

CBD Redevelopment as at 31 January is $1.2 million below the YTD budget.

Approximately $129.1 million has been expended or donated to 31 January

compared to the current YTD capital budget of $130.3 million.

Commentary and analysis of the

results is included in the attached report. Items to note include:

• Council’s

rates and utility charges continue to be impacted by lower than forecast growth

(especially from Quarter 4 in the 18-19 financial year). YTD January results

show that growth has not recovered and it is unlikely that Council will recover

full budget by year end. Accordingly a budget amendment was approved by

Council in February to reduce the rates budget.

· Town

Planning Fees are under budget YTD $557k following a slight improvement in the

January results ($282k), it is expected that town planning fees will be below

budget by the end of the financial year and this was also adjusted for in the

budget amendment.

• Employee

expenses continue to be over budget due to additional labour contracts to fill

staff vacancies and support, the impact of EBA rate increases on leave

provisions and contractual payments.

• Materials

and services expenses continue to be below budget as a result of underspends in

service contracts due earlier weather conditions, works not commencing as

expected and lower than expected maintenance costs. An analysis of the timing

of expenditure in prior years has identified significant additional expense

recognition in June each year. Therefore as part of the budget amendment

finance will re phase some of the YTD variance into later months in the

financial year to better align with expected recognition.

• Whilst

the capital expenditure on the CBD Redevelopment has exceeded the YTD budget by

$9.6 million, the timing of the cash flow for the project over the 19-20 and

20-21 financial years has been reviewed to better align with the project

schedule. Required changes have been approved in the February budget amendment.

• Capital

expenditure on other capital projects, including the ICT and Infrastructure

programs, are $15.3 million below YTD budget. The capital program delivery

schedule and forecast expenditure by the end of the financial year has been

reviewed and a reduction in capital expenditure across Council has been

approved in the February budget amendment.

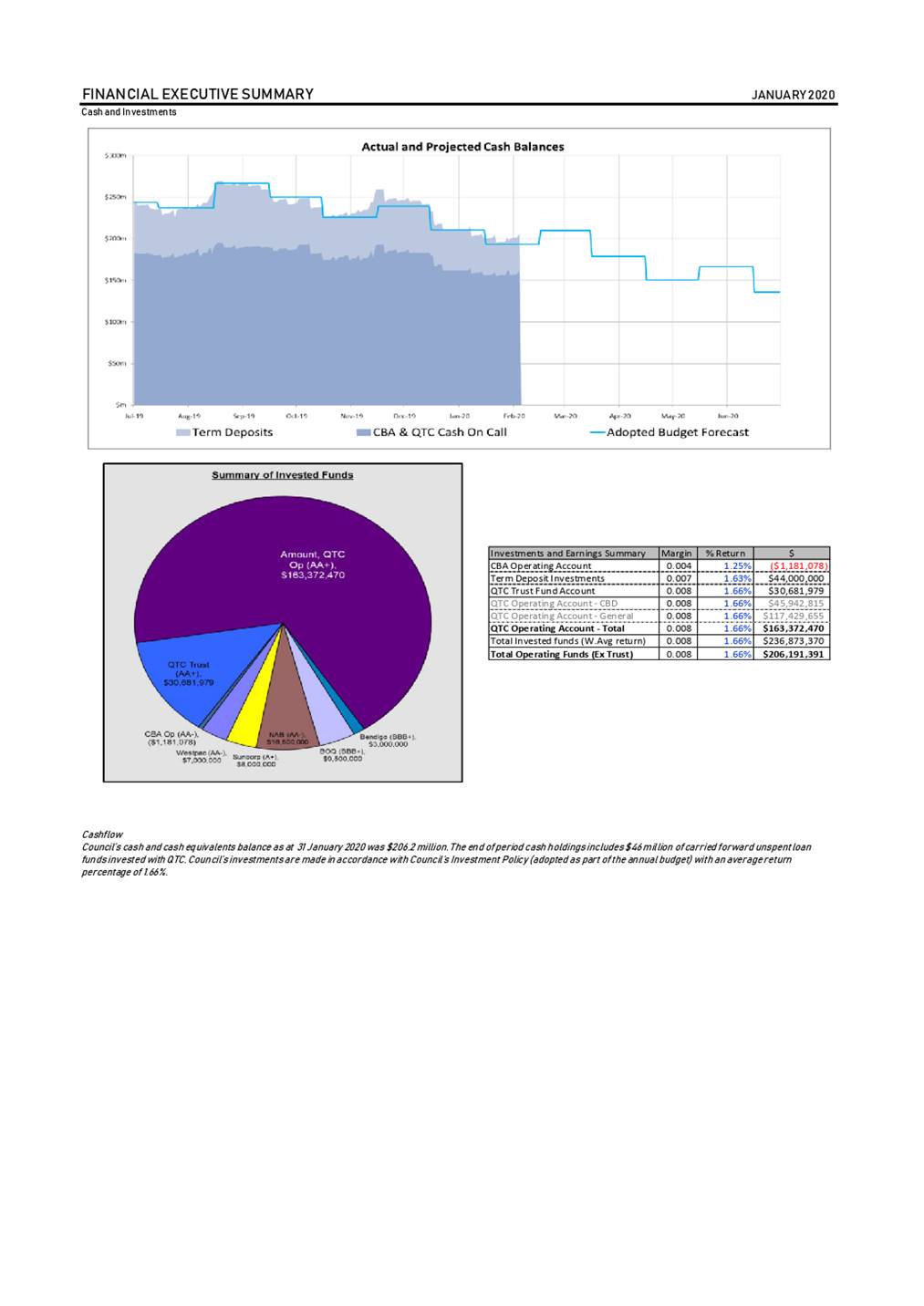

• Considering

the results above, cash currently held is slightly above forecasted cash

balances.

Legal/Policy Basis

This report and its recommendations are consistent with the

following legislative provisions:

Local Government Regulation 2012

RISK MANAGEMENT IMPLICATIONS

The implications of the financial

results YTD will be monitored by management and any changes or risks to

Council’s forecast position will be considered as part of Council’s

budget amendments.

As highlighted above there is a

risk to Council’s forecast rates and utility charges revenue and town

planning fees as a result of lower than forecast growth (especially from

Quarter 4 in the 2018-2019 financial year). Year to date this has not been

recovered and accordingly a budget amendment was included to reduce the

applicable budget.

Employee expenses and deferred

capital projects were also included in the February budget amendment.

Financial/RESOURCE IMPLICATIONS

There are no specific implications

as a result of this report.

COMMUNITY and OTHER CONSULTATION

The contents of this report did

not require any community consultation. Analysis and explanations of the

variances is undertaken in conjunction with the various Departments.

Conclusion

The monthly performance report for

January 2020 is included at Attachment 1.

Attachments and Confidential Background Papers

|

1.

|

Monthly Performance Report - January 2020 ⇩

|

Jeffrey Keech

Manager, Finance

I concur with the recommendations contained in this

report.

Sonia Cooper

General Manager

Corporate Services

“Together,

we proudly enhance the quality of life for our community”

|

Governance

Committee

Meeting

Agenda

|

17 March

2020

|

Item 2 / Attachment 1.

|

Governance

Committee

Meeting

Agenda

|

17 March

2020

|

Doc ID No: A6108563

ITEM: 3

SUBJECT: Overdue General Rates and Utility Charges -

October to December 2019

AUTHOR: Treasury Accounting Manager

DATE: 11 March 2020

Executive Summary

This is a report by the Treasury

Accounting Manager dated 6 March 2020 concerning rate arrears and rate

collection statistics for the period October-December 2019.

Recommendation/s

That the Interim Administrator of

Ipswich City Council resolve:

That the report be received and

the contents noted.

RELATED PARTIES

There are no related party issues

concerning this report.

Purpose of Report/Background

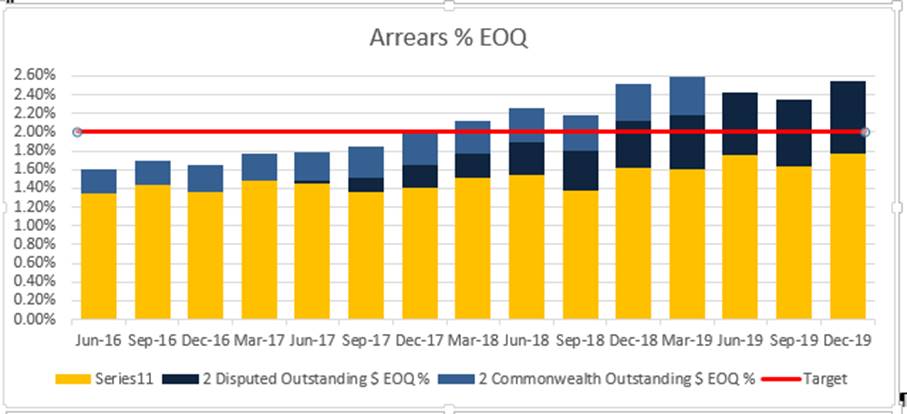

This report highlights the overdue

rates and charges pertaining to the October – December 2019 rating

period.

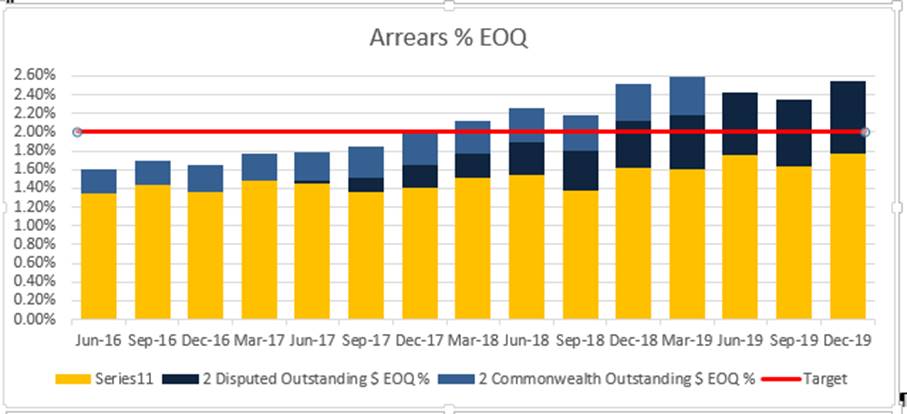

Following the completion of the October-December

2019 rating period, the approximate balance of overdue rates and charges was $6,002,508

or 2.55% of the total rates. This represents an increase in outstanding

balances of $526,183 or 0.2% from the previous quarter.

A high level breakdown of the

overdue rates and charges between residential, non-residential properties and

highlighting the large arrears on two disputed properties is below:

Table 1

|

|

# of Properties

|

Balance

Outstanding $

|

% of Total

|

|

Residential

|

6,869

|

$3,854,337

|

64%

|

|

Non-Residential

|

174

|

$330,714

|

6%

|

|

2 Disputed Non-Residential Properties

|

2

|

$1,817,457

|

30%

|

Overdue

Rates and Charges:

Table 2

|

|

Yearly Levies

|

Arrears $

End of quarter

|

Arrears%

|

Total Assessments

|

Assessments

in Arrears

End of quarter

|

%

in Arrears

|

|

June 2015

|

$175,942,886

|

$2,764,243

|

1.57

|

72,515

|

4,949

|

6.82

|

|

June 2016

|

$189,635,715

|

$3,034,312

|

1.60

|

75,207

|

5,090

|

6.77

|

|

June 2017

|

$205,419,598

|

$3,680,474

|

1.79

|

78,689

|

6,067

|

7.71

|

|

June 2018

|

$218,794,862

|

$4,929,782

|

2.25

|

82,232

|

6,089

|

7.40

|

|

June 2019

|

$231,646,878

|

$5,614,100

|

2.42

|

84,911

|

7,355

|

8.66

|

|

Sept 2019

|

$233,519,322

|

$5,476,325

|

2.35

|

85,845

|

6,441

|

7.59

|

|

Dec 2019

|

$235,396,875

|

$6,002,508

|

2.55

|

86,284

|

7,045

|

8.16

|

The current rates arrears

exceeding target are impacted by the following:

1. Two

(2) properties have substantial arrears and are in dispute with Council.

The rates arrears associated with these two properties represents 0.77% of the

total yearly levies and account for 30.27% of the total rate arrears.

2. The

percentage of accounts in arrears has deteriorated since mid-2017 due in the

most part to these two substantial properties transitioning. If the two

properties were removed from the rate arrears calculation, Council’s performance

for the quarter would be 1.78% (leading practice for local government

recoveries). The two properties are represented as black in Chart 1

below.

Chart 1

Arrears - Number of

Assessments:

· At the end

of the October-December 2019 quarter, 7,045 assessments remained in arrears.

· Of those, 5,978

or 85% assessments held balances outstanding of less than $1000, including 3,196

or 45% with outstanding balances of less than $100.

Reminder Letters:

Table 3

|

Quarter

|

Reminder letters

|

$

|

Second letter

|

$

|

|

April - June 2015

|

8,634

|

$5,117,628

|

3,888

|

$2,320,978

|

|

April - June 2016

|

9,776

|

$5,767,789

|

4,247

|

$2,375,731

|

|

April-June 2017

|

11,102

|

$6,214,851

|

4,950

|

$3,023,858

|

|

April-June 2018

|

10,264

|

$6,566,455

|

5,561

|

$4,505,858

|

|

April-June 2019

|

11,387

|

$7,346,791

|

5,921

|

$4,208,937

|

|

July-September 2019

|

12,072

|

$7,944,841

|

5,205

|

$3,955,289

|

|

October-December 2019

|

12,096

|

$8,487,729

|

5,246

|

$3,933,342

|

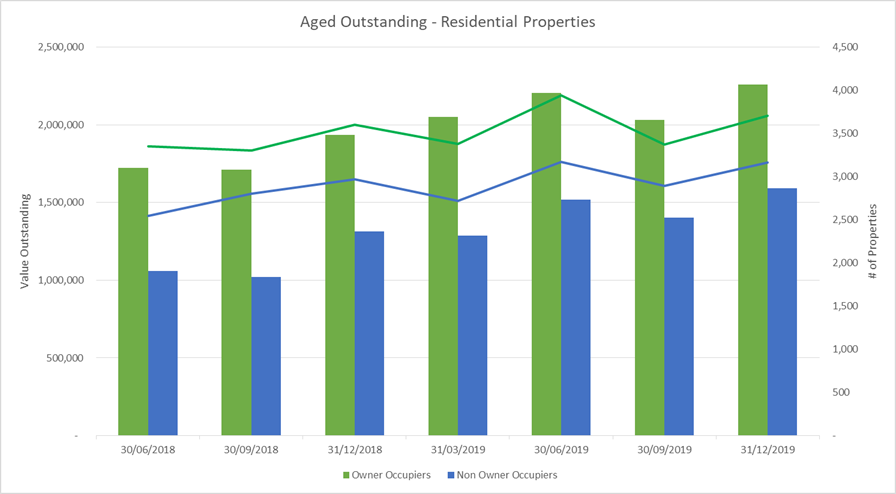

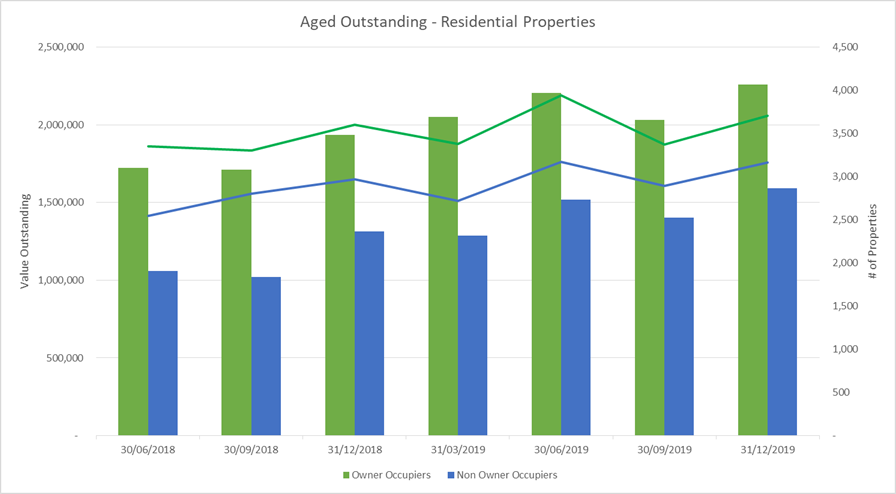

Chart 2 shows the trends

for the last six quarters in relation to owner occupied and non‑owner occupied

residential properties. The mix between owner and non-owner properties in

arrears is broadly similar to the mix in total properties. The data used

in this chart excludes those properties with very large arrears and are the

subject of disputes (referenced earlier in this report). This allows for

a visual representation of the underlying trends for the typical owner and non‑owner

occupied residential properties.

Whilst the number of properties in

arrears continues to be cyclical there is still upward trend which is also

reflecting the total value of the arrears. This requires further analysis

to understand what may be driving this trend.

Chart 2

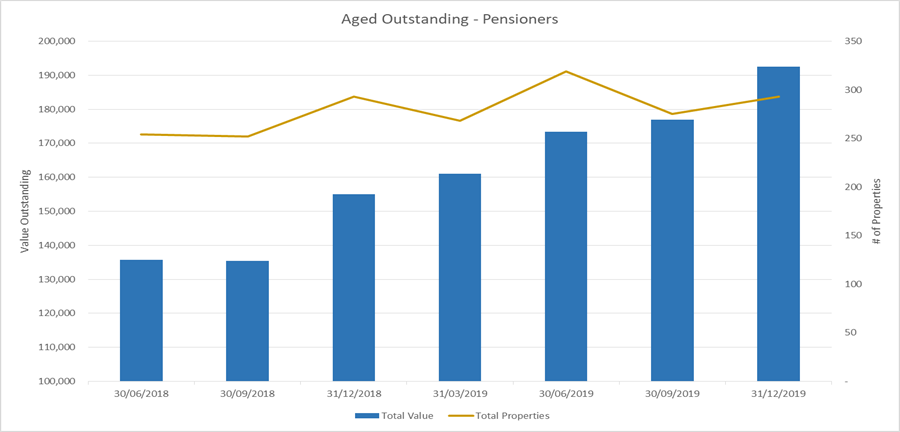

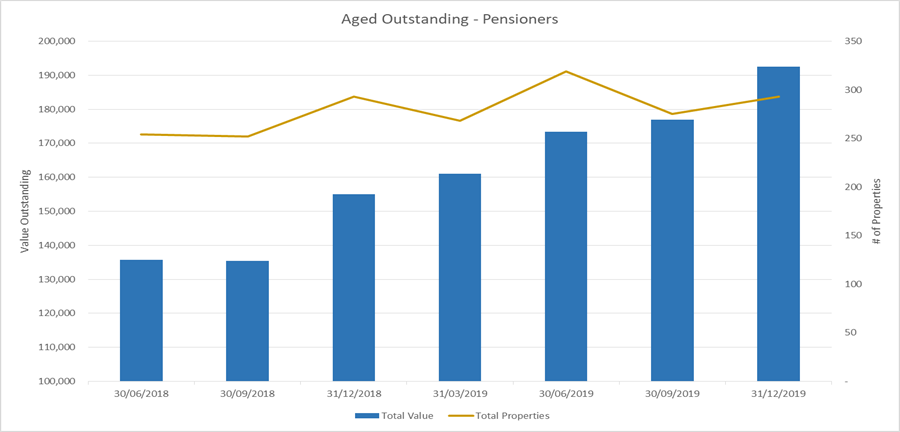

The following Chart 3 shows

the trend for the last six quarters in relation to pensioner owned properties,

including both owner occupied and non-owner occupied residential properties, as

well as a limited number of primary producer properties. The trend

relating to pensioner owned properties are generally similar to that of the

non-pensioner owned properties other than the last quarter where there

continued to be a small increase. The 275 properties in the most recent

quarter reflects 3.2% of total pensioner owned properties. This compares

to 7.6% of total properties.

Chart 3

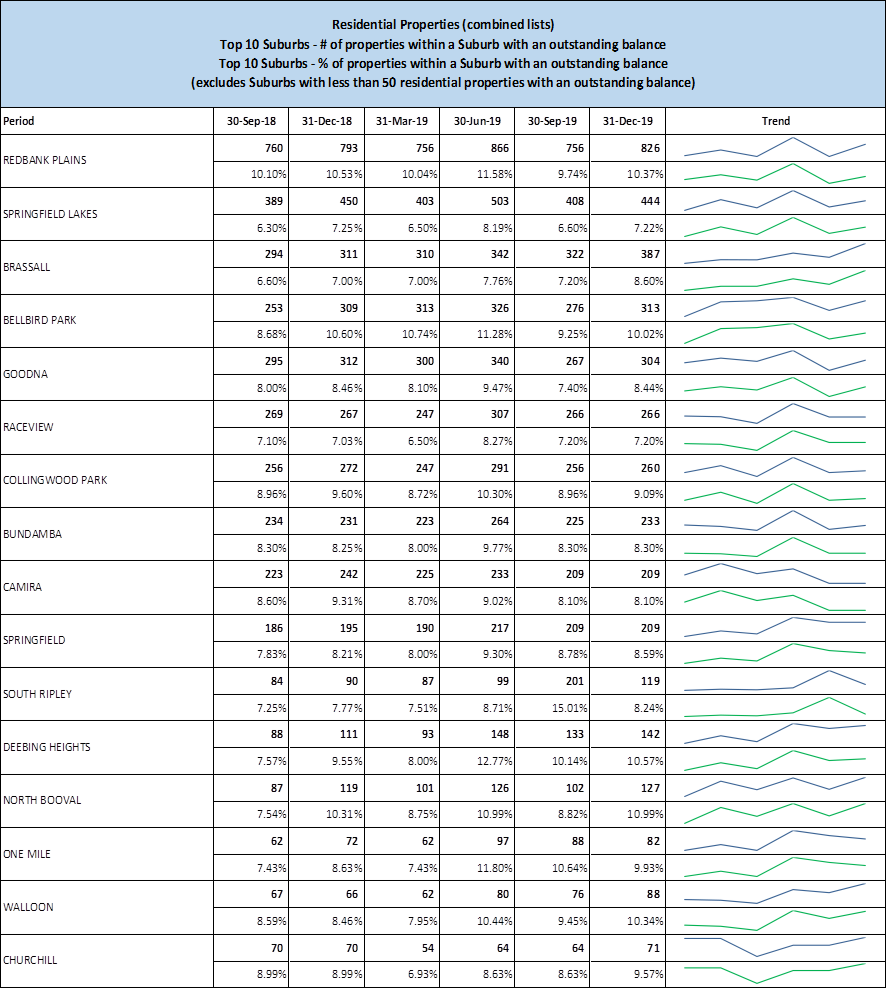

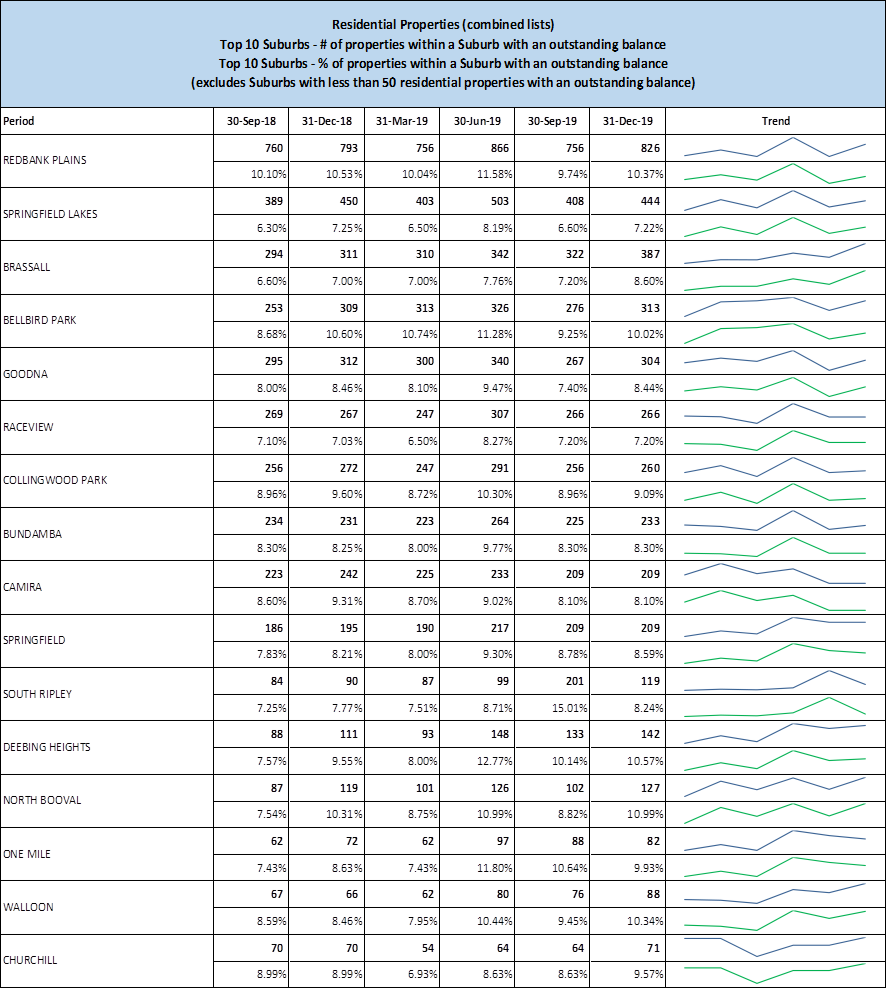

Table 4 is a combined list

of:

1. the

top 10 suburbs by number of properties within a Suburb with an outstanding

balance; plus

2. the

top 10 Suburbs by % of properties within a Suburb with an outstanding balance

(noting that four suburbs appear on both lists).

Most of the suburbs listed,

display a similar trend with the exception of South Ripley which has been

influenced by a single property owner who holds a number of properties with

arrears. The top 10 suburbs by number of properties within a suburb with

an outstanding balance has remained same for the past five quarters.

Table 4

Legal Actions undertaken to

recover Rates:

The following actions were commenced, or finalised on

behalf of Council during the October‑December quarter 2019:

|

Action

|

Number

|

Value

|

|

New Claims Filed

|

39

|

$143,707

|

|

Filed Claims Paid in full prior to Judgement

|

7

|

$20,336

|

|

Defences Lodged

|

1

|

$5,724

|

|

Defences Resolved

|

|

|

|

Defences under Legal Dept. Control

|

4

|

$445,249

|

|

Judgments Granted

|

27

|

$70,583

|

|

Sale of Land Resolutions

|

10

|

$81,165

|

|

Rates paid prior to Auction during the quarter

|

2

|

$17,314

|

|

Properties Auctioned

|

0

|

0

|

|

Properties Sold at Auction

|

0

|

0

|

|

Properties purchased by Council at Auction

|

0

|

0

|

Planned Actions:

· Continue

to apply collection strategies to non-owner occupied properties i.e. companies,

trusts, vacant land, investment properties.

· Continue

to apply collection strategies to habitual defaulters.

· Continued

close maintenance of payment plans and escalation of breaches.

· Continued

drive to liaise with banks and finance providers for payments in full.

· Continue

to analyse emerging trends that are impacting the collection of overdue rates.

Legal/Policy Basis

This report and its

recommendations are consistent with the following legislative provisions:

Local Government Regulation 2012

Conclusion

The target arrears percentage rate

of 2.00% was exceeded by 0.55%, due to the impact of two properties with

substantial rates arrears. There is a continuing upward trend in the

number of residential properties with an outstanding balance as well as the

value of those outstanding balances.

Paul Mollenhauer

Treasury

Accounting Manager

I concur with the recommendations contained in this

report.

Jeffrey Keech

Manager, Finance

I concur with the recommendations contained in this report.

Sonia Cooper

General Manager

Corporate Services

“Together,

we proudly enhance the quality of life for our community”