IPSWICH

CITY

COUNCIL

AGENDA

of the

Council Special Meeting

Held in the Council Chambers

2nd floor – Council Administration

Building

45 Roderick Street

IPSWICH QLD 4305

On Tuesday,

30 June 2020

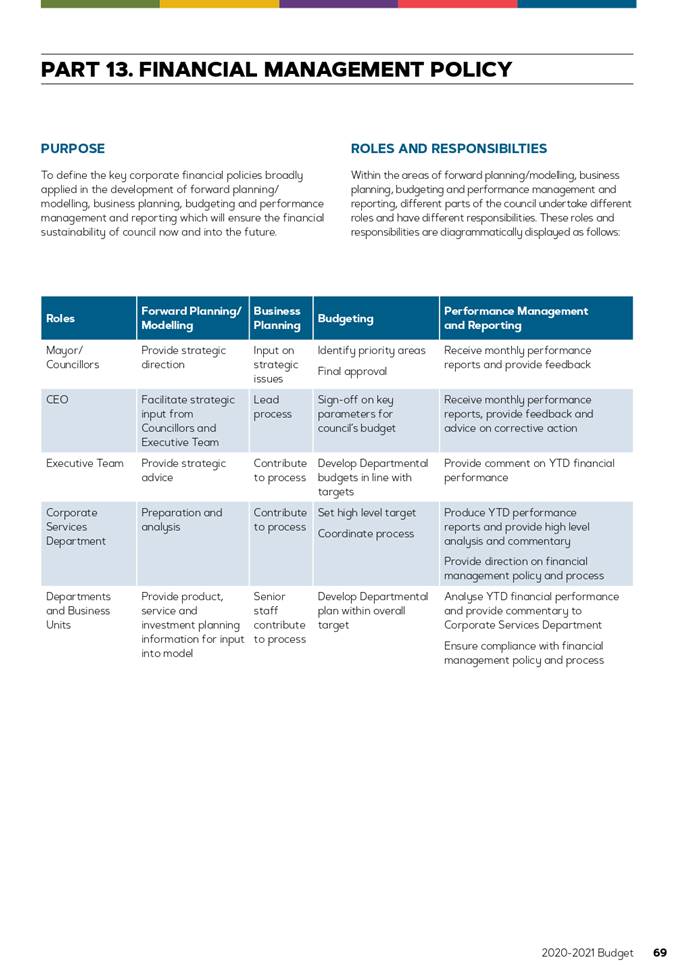

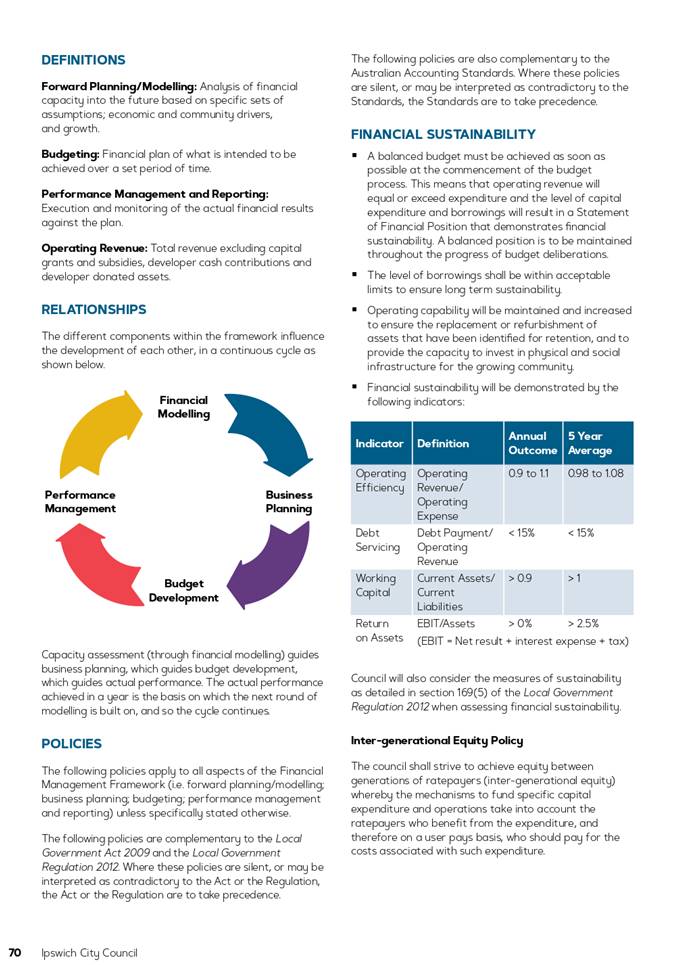

At 9.30

am

The purpose of

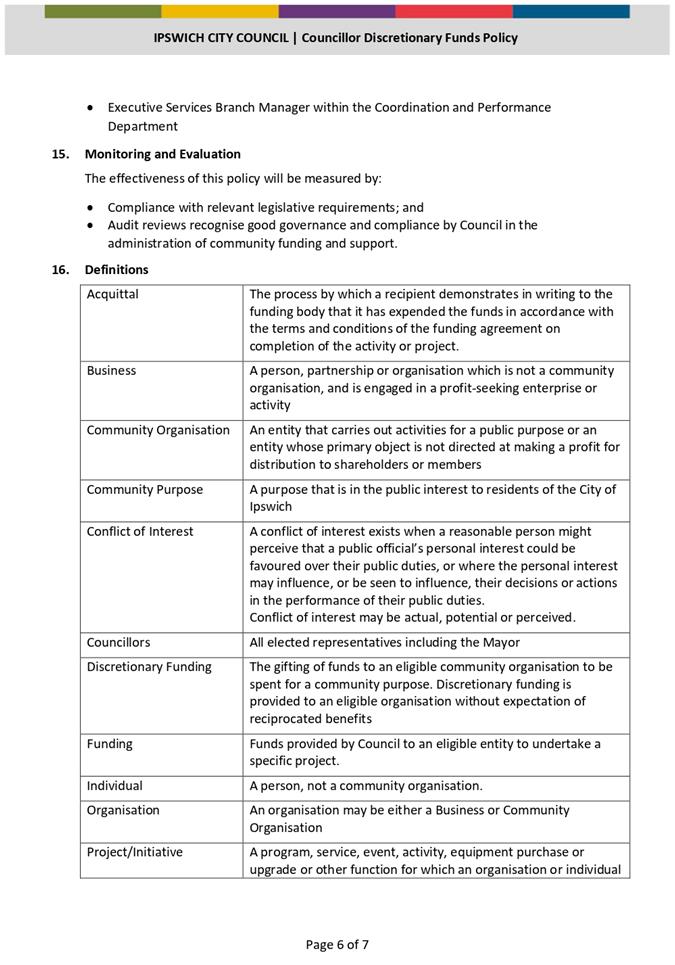

the meeting is to consider:

1. Adoption

of the 2020-2021 Budget and associated matters

2. Ipswich

City Council Operational Plan 2020-2021

3. Proposed

2020-2021 Fees and Charges

4. Rates

relief in response to COVID-19

5. Overall

Plan for the Rural Fire Resources Levy Special Charge

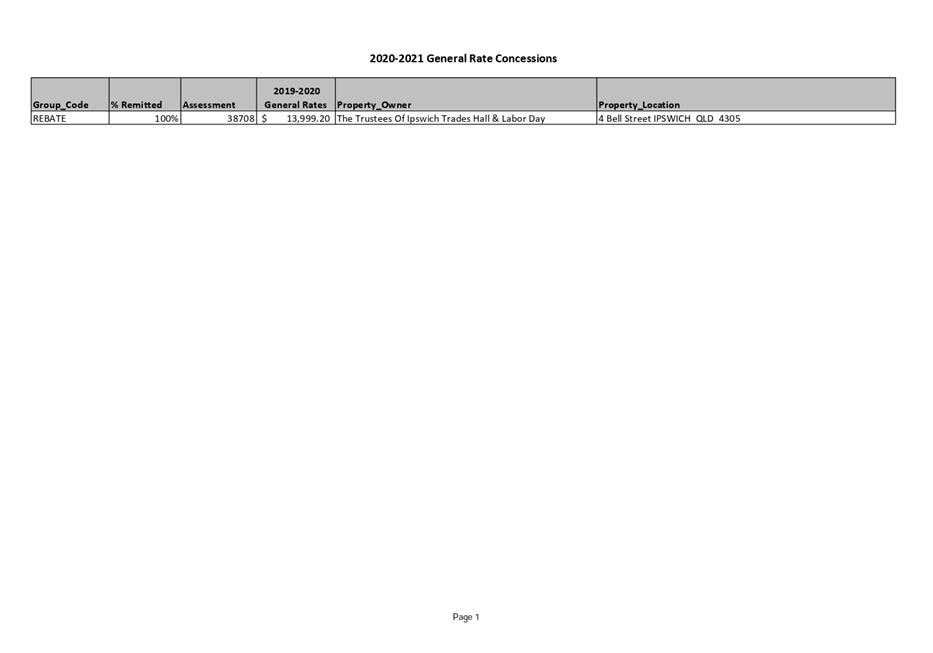

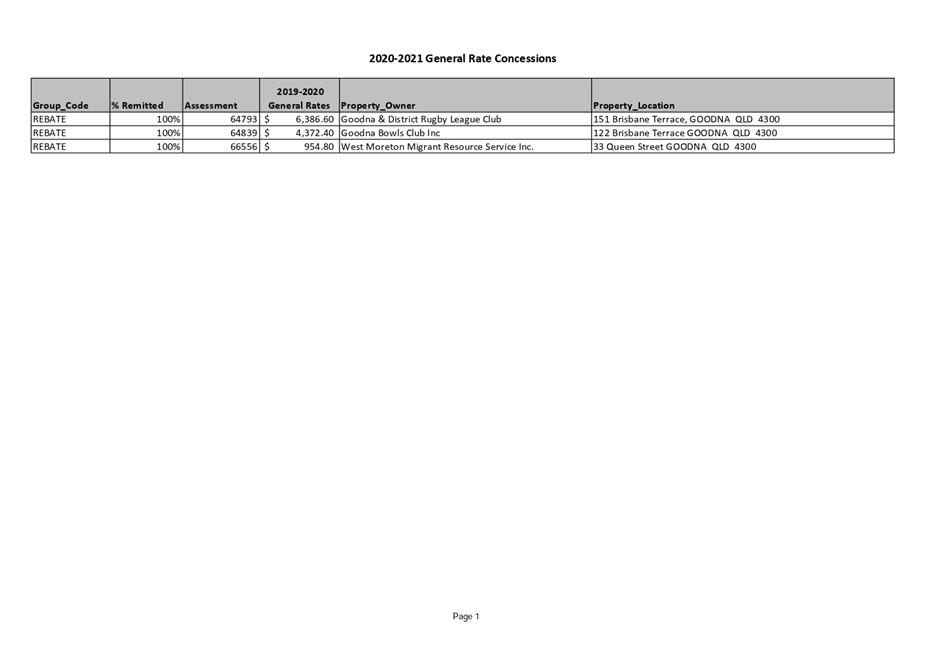

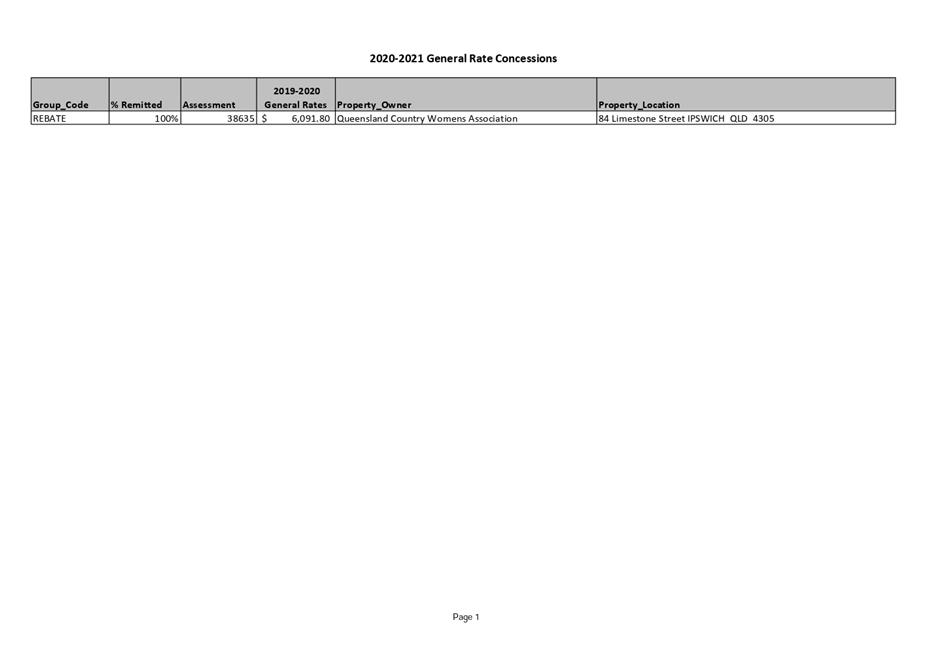

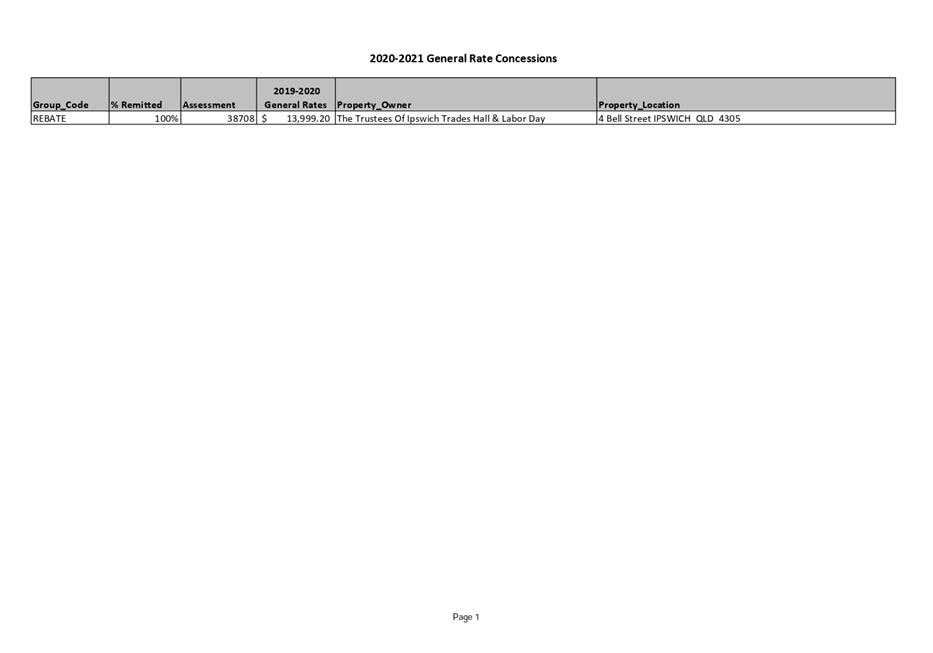

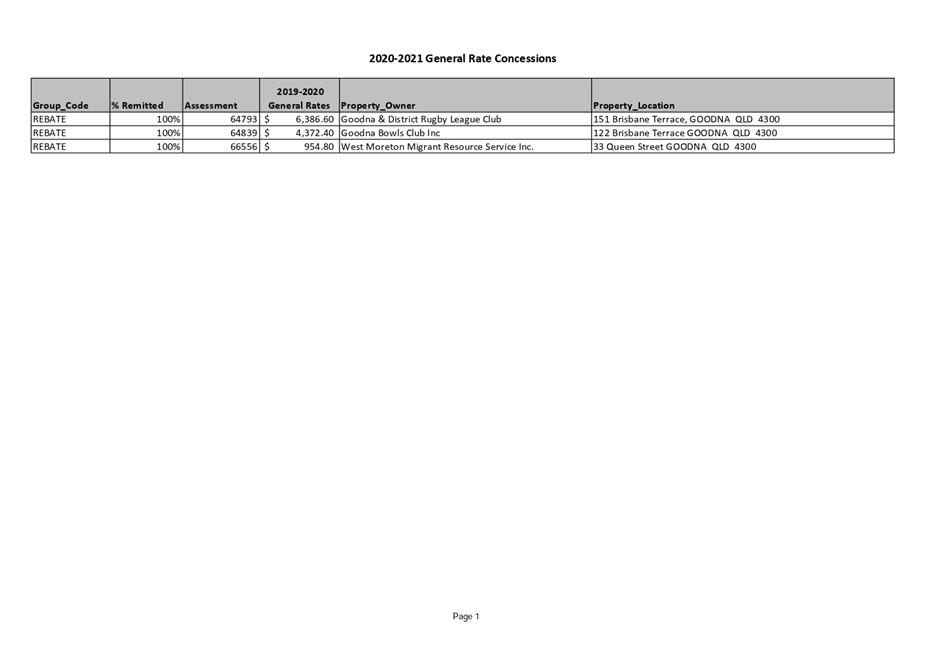

6. Concession

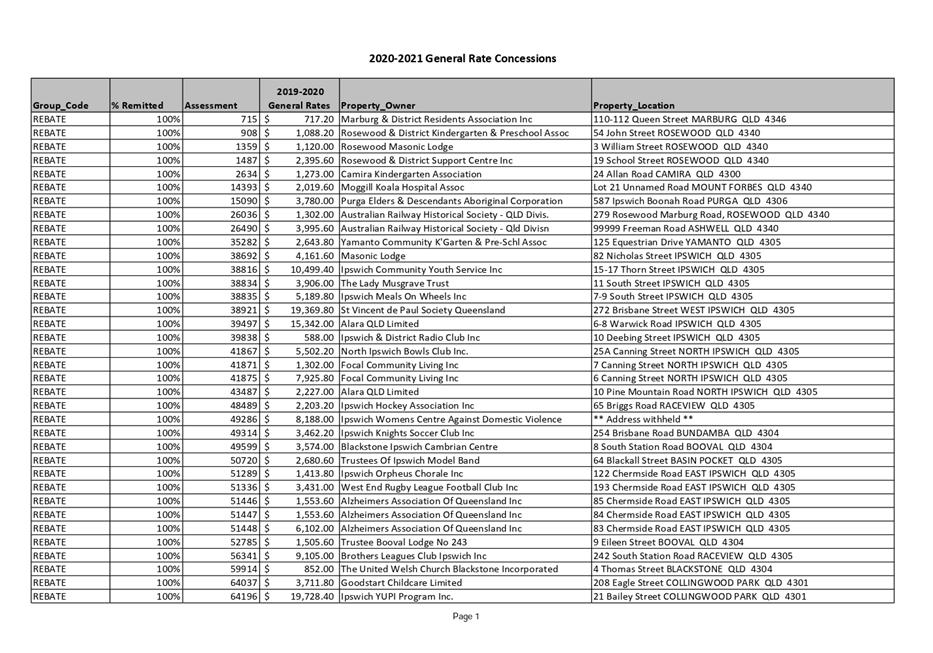

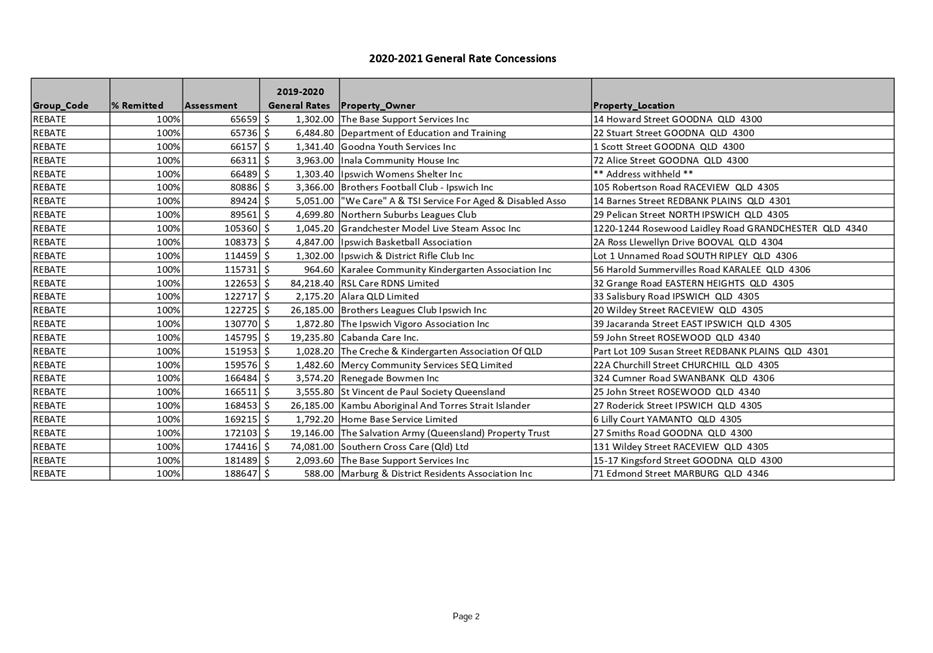

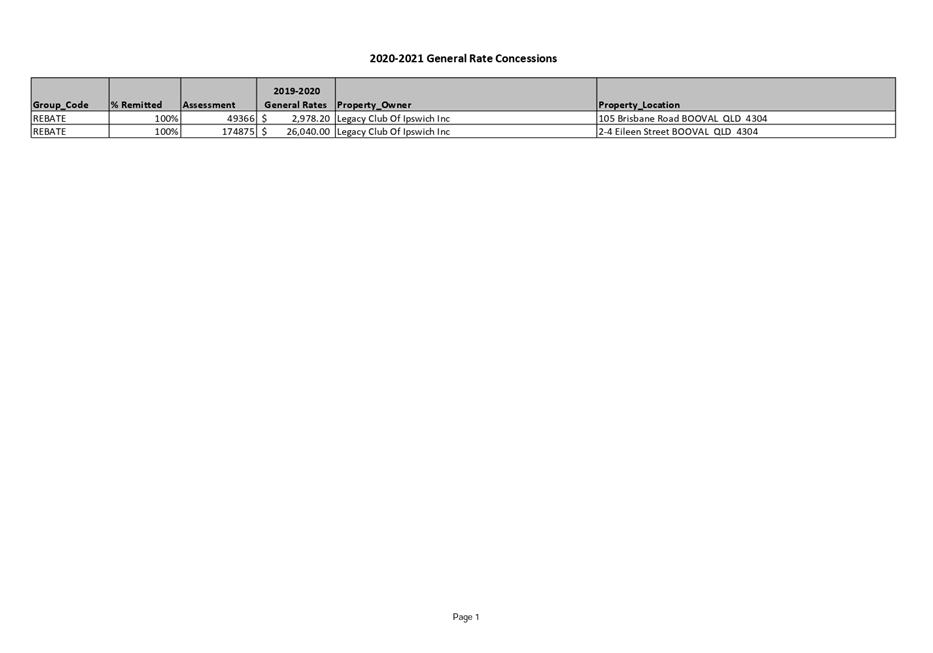

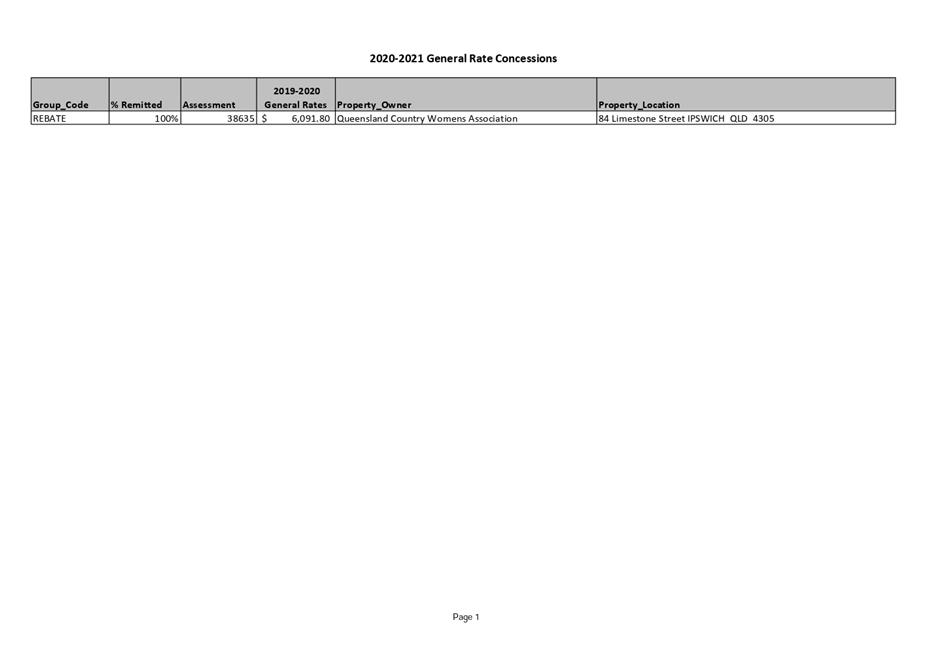

for General Rates - various properties

7. Concession

for General Rates - 4 Cribb Street, SADLIERS CROSSING QLD 4305

8. Rate

Concession - Charitable, Non Profit/Sporting Organisation

9. Councillor

Discretionary Funds

10. Community

Funding and Support Programs

|

Council

Special

Meeting Agenda

|

30 June

2020

|

BUSINESS

A. OPENING OF MEETING:

B. WELCOME

TO COUNTRY OR ACKNOWLEDGEMENT OF COUNTRY:

C. OPENING

PRAYER:

D. APOLOGIES

AND LEAVE OF ABSENCE:

E. DECLARATIONS

OF INTEREST:

F. Officers' reports:

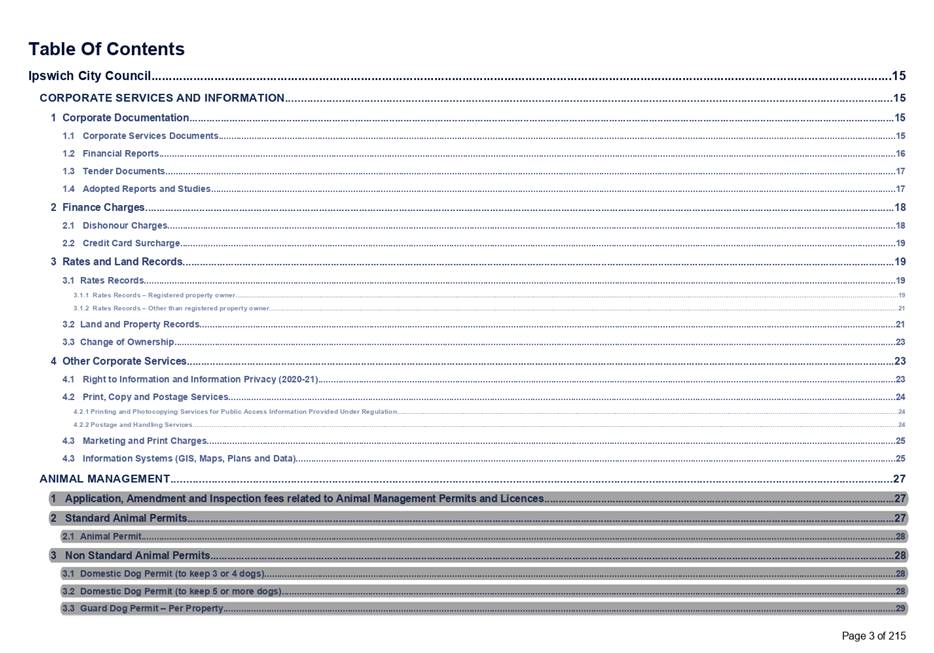

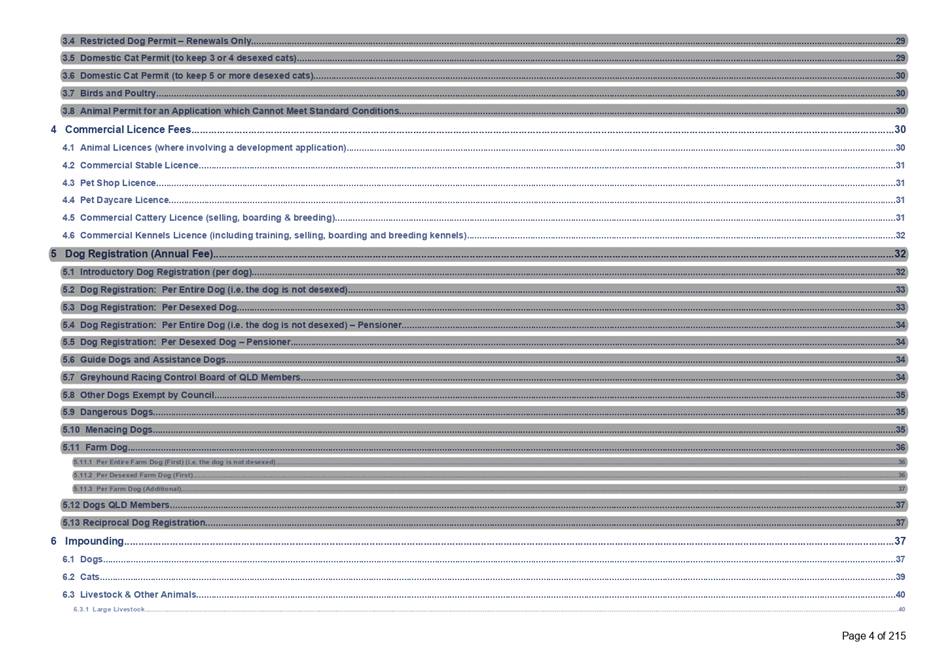

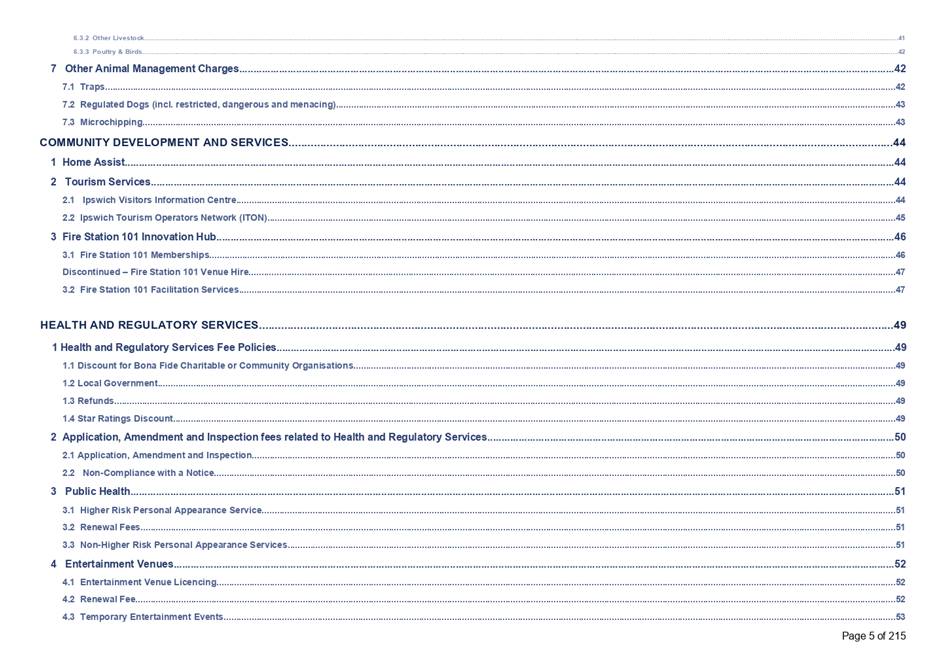

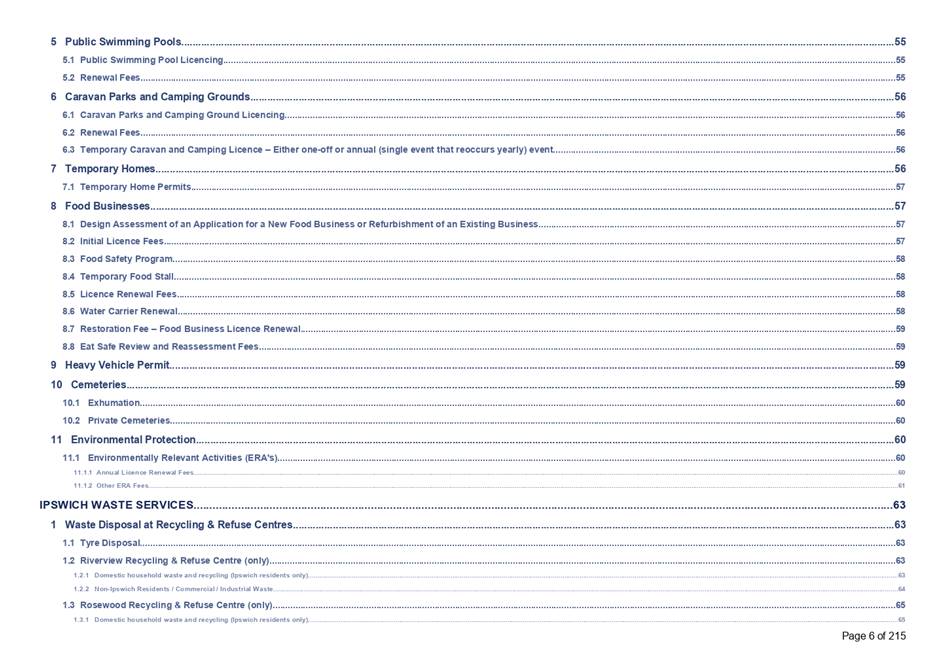

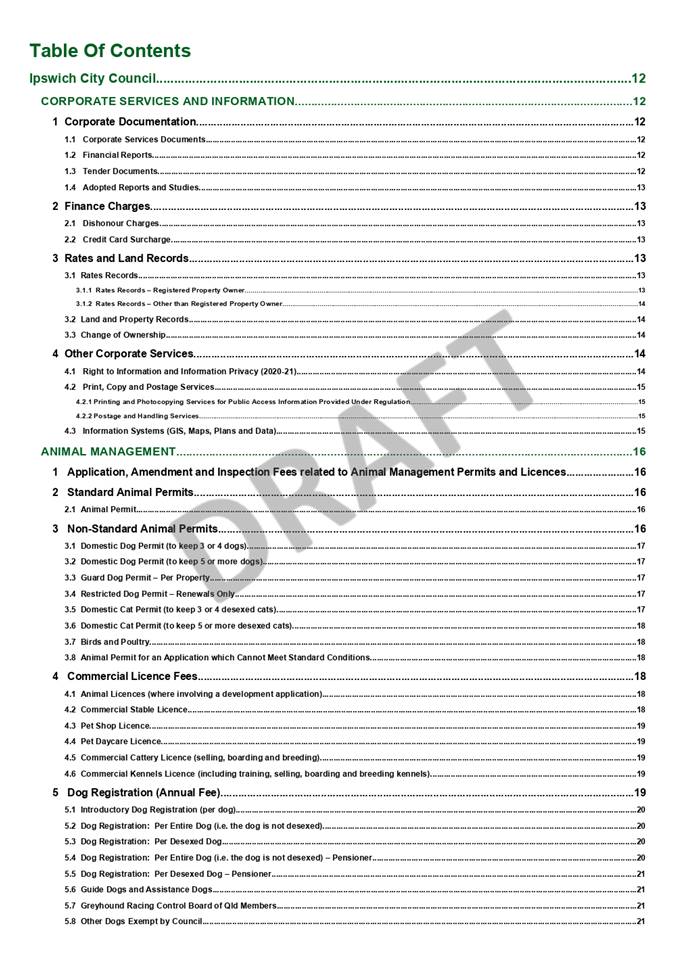

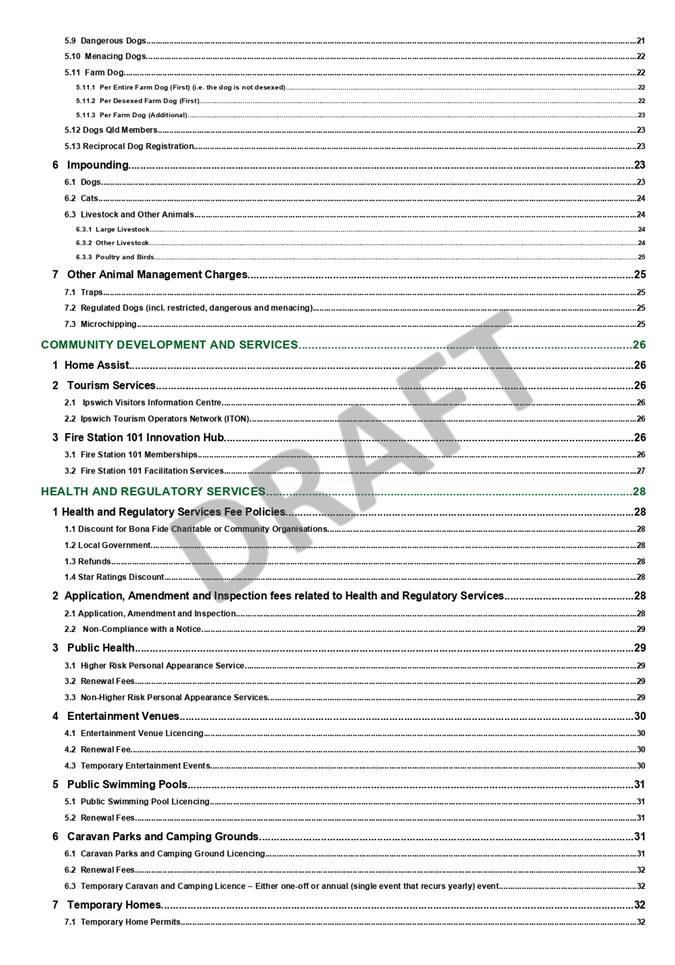

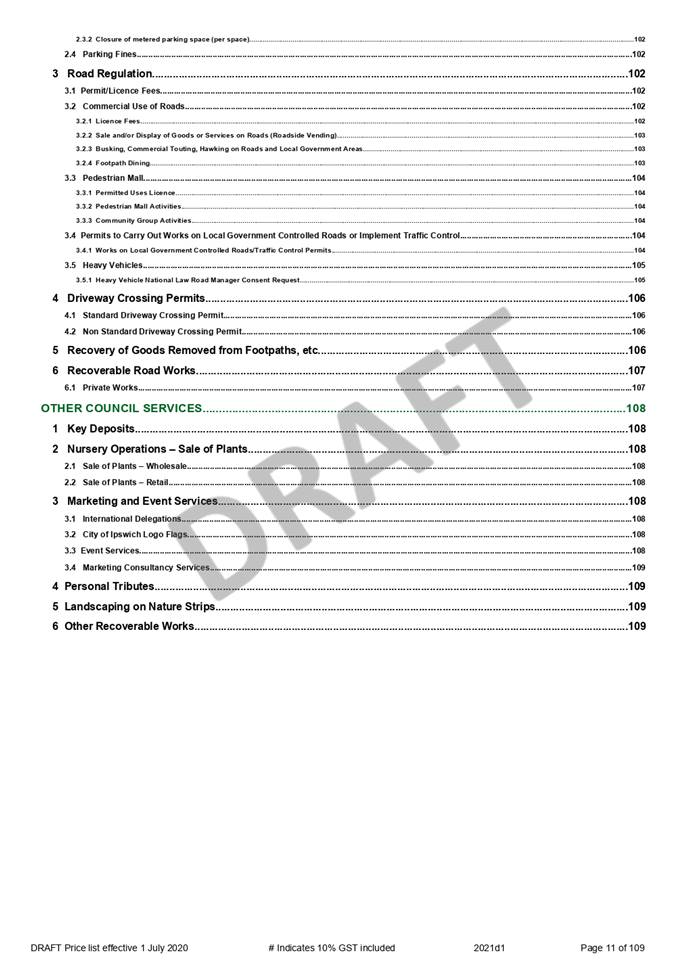

5.1 Adoption

of the 2020-2021 Budget and associated matters......................... 5

5.2 Ipswich

City Council Operational Plan 2020-2021..................................... 113

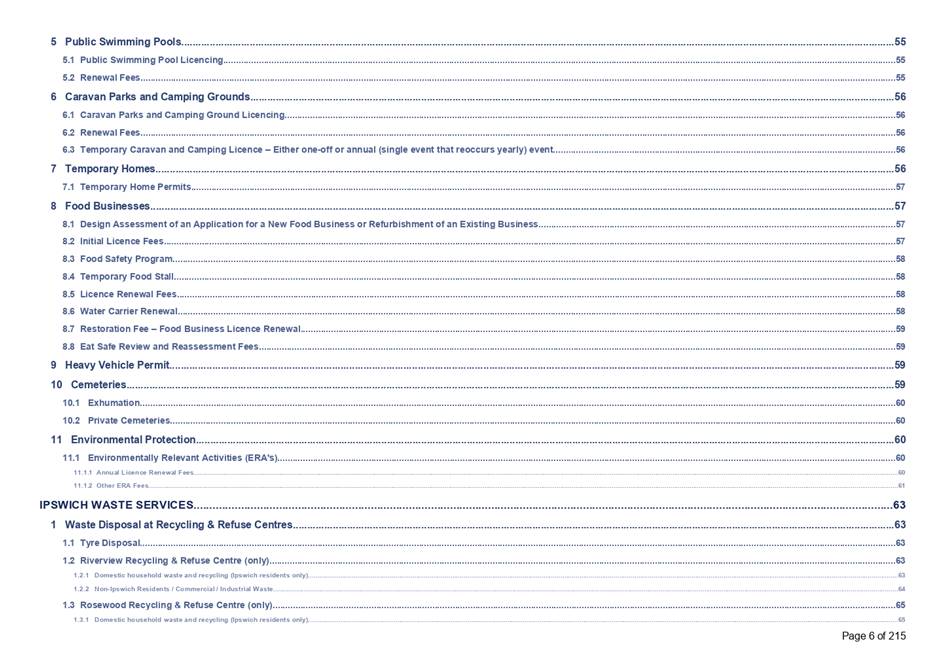

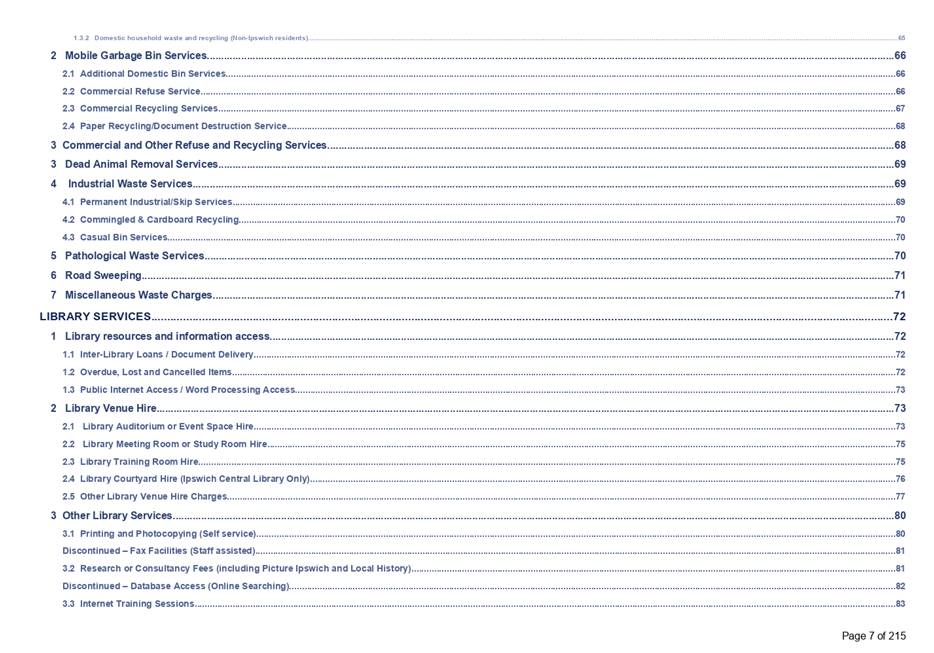

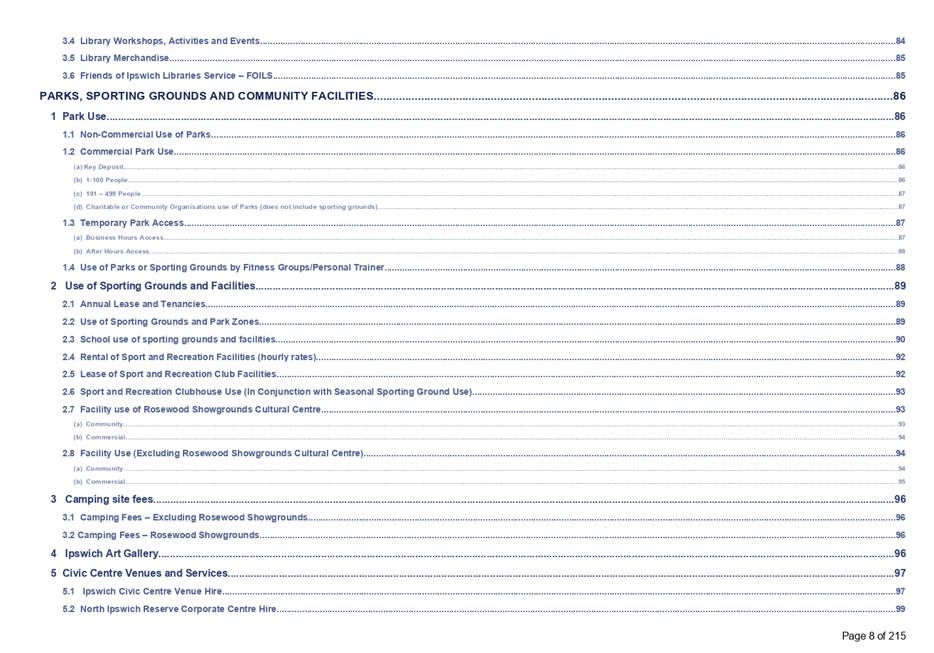

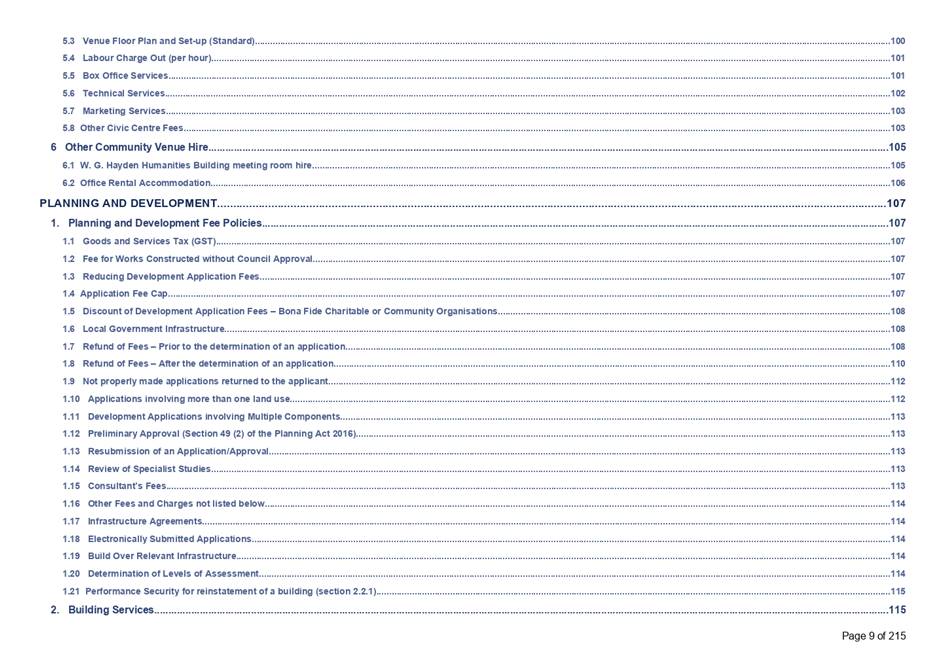

5.3 Proposed

2020-2021 Fees and Charges..................................................... 151

5.4 Rates

relief in response to COVID-19........................................................ 493

5.5 Overall

Plan for the Rural Fire Resources Levy Special Charge................ 501

5.6 Concession

for General Rates - various properties................................... 507

5.7 Concession

for General Rates - 4 Cribb Street, SADLIERS CROSSING QLD 4305.................................................................................................................... 515

5.8 Rate

Concession - Charitable, Non Profit/Sporting Organisation.............. 523

5.9 Councillor

Discretionary Funds.................................................................. 537

5.10 Community

Funding and Support Programs.............................................. 549

--ooOOoo--

|

Council

Special

Meeting Agenda

|

30 June

2020

|

Doc ID No: A6274062

ITEM: 5.1

SUBJECT: Adoption of the 2020-2021 Budget and

associated matters

AUTHOR: Manager, Finance

DATE: 25 June 2020

Executive Summary

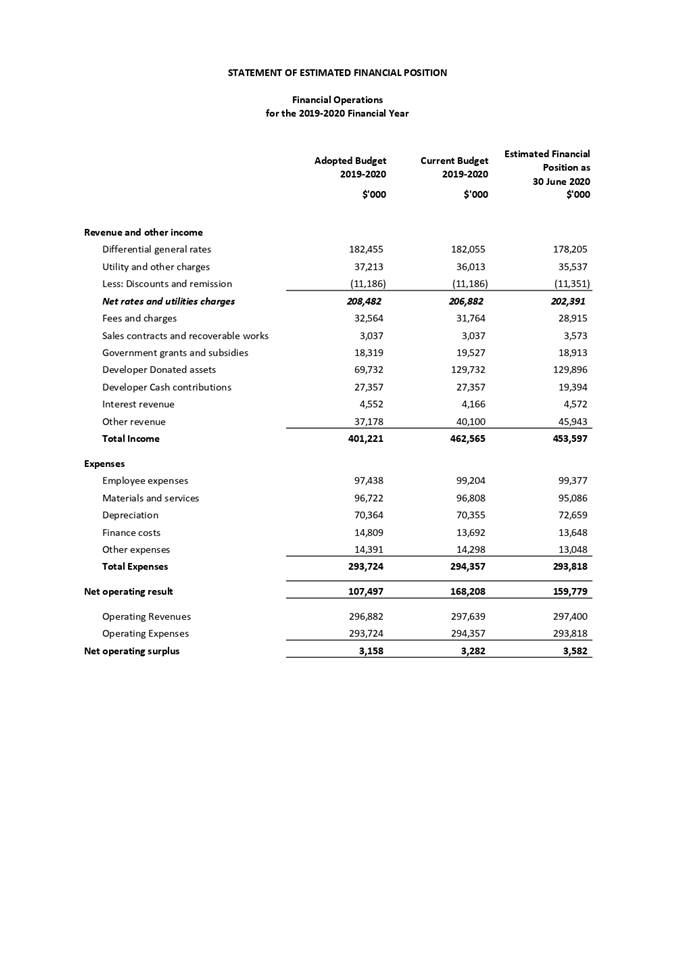

This is a report concerning the

adoption of the 2020‑2021 Budget and associated matters.

Recommendation/s

A. That

Ipswich City Council receive and note the contents of the report by the

Manager, Finance dated 25 June 2020 concerning the 2020‑2021

Budget and associated matters.

B. That

Ipswich City Council receive and note the Statement of Estimated Financial

Position for the previous financial year 2019‑2020, outlined in

Attachment 1 to the report by the Manager, Finance dated

25 June 2020.

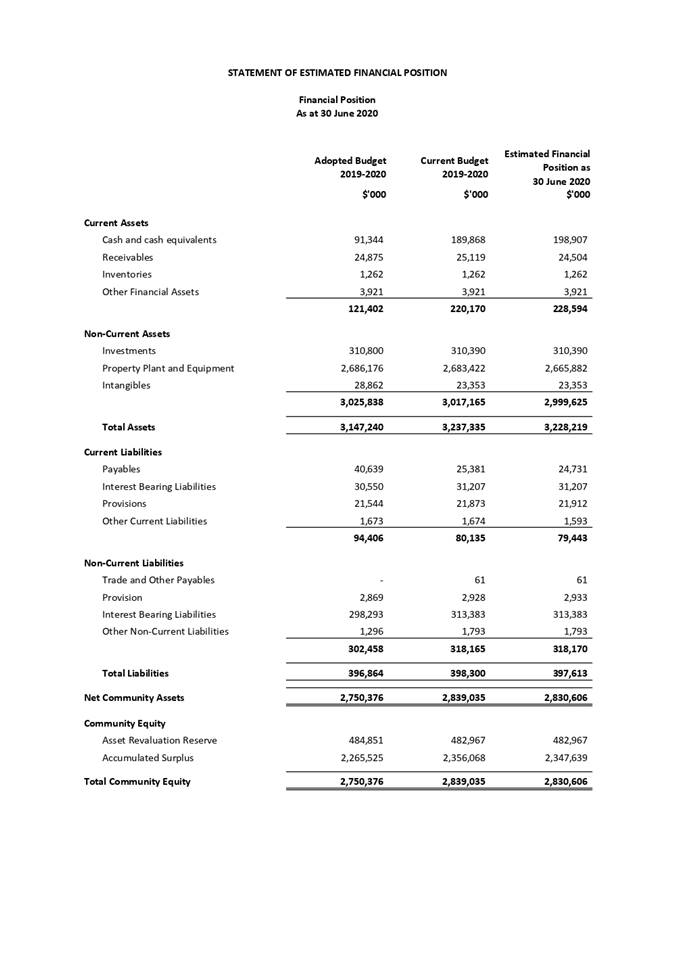

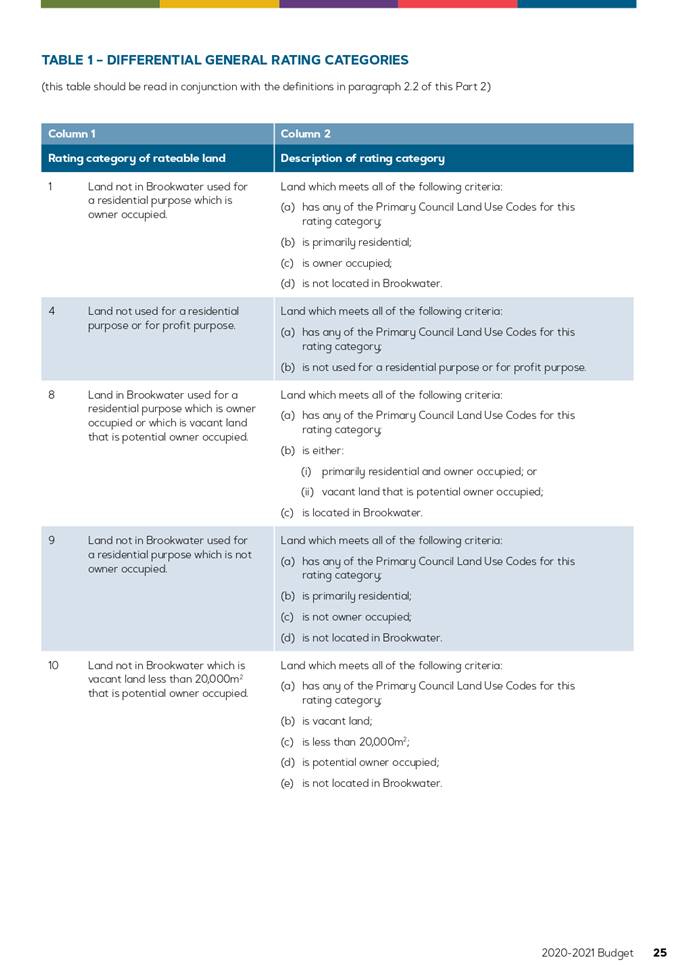

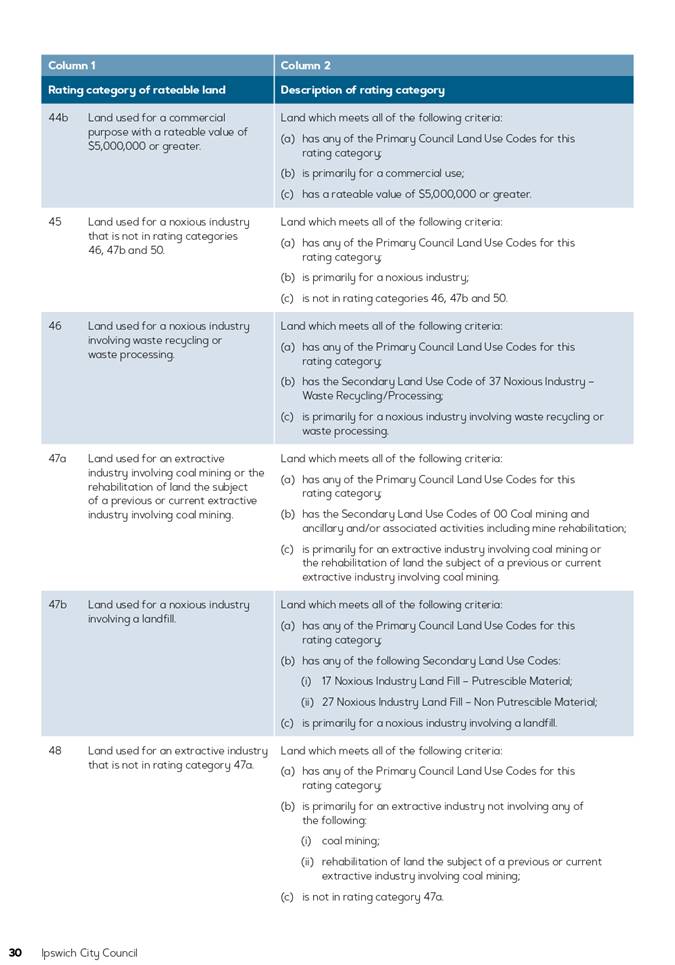

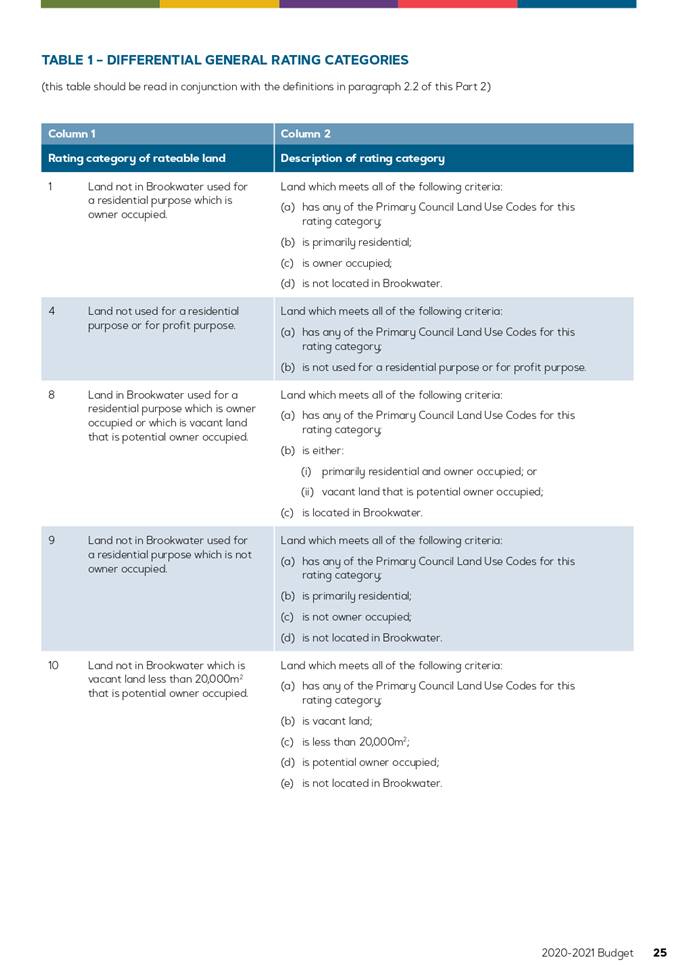

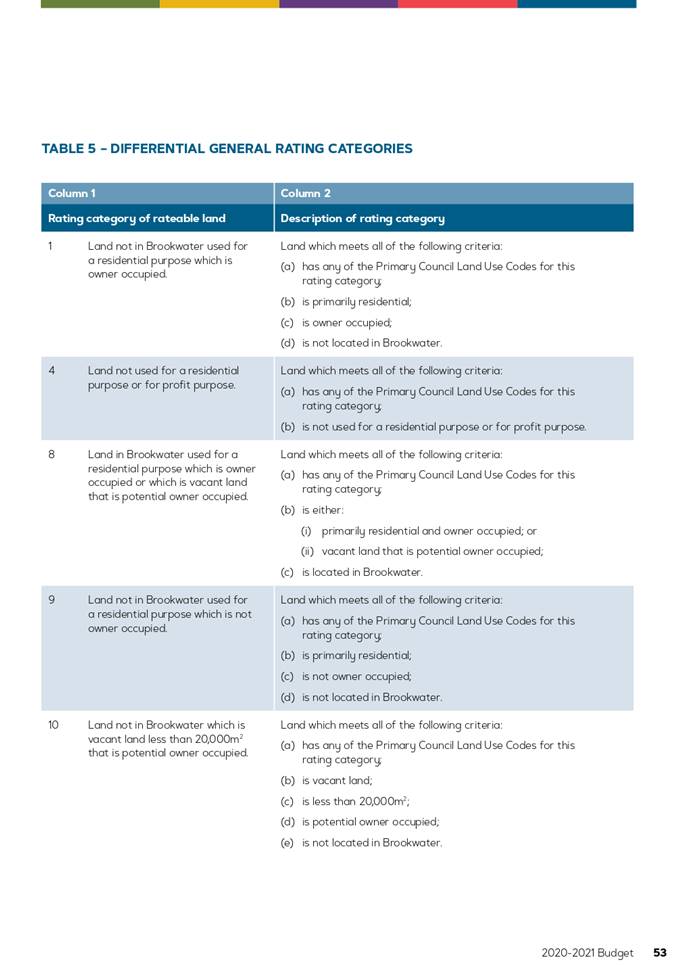

C. That

in accordance with section 81 of the Local Government Regulation 2012,

Ipswich City Council decide the different rating categories of rateable land in

the local government area as follows:

(a) the

rating categories of rateable land in the local government area are in column 1

of the table below which is stated in Part 2 of the 2020‑2021 Budget

in Attachment 2 to the report by the Manager, Finance dated

25 June 2020;

(b) the

description of each of the rating categories of rateable land in the local

government area are in column 2 of the table below which is stated in

Part 2 of the 2020‑2021 Budget in Attachment 2 to the report by

the Manager, Finance dated 25 June 2020;

(c) the

rating category to which each parcel of rateable land in the local government

area belongs, is the rating category which is included in the Council’s

rating files at the date of issue of a relevant quarterly rating assessment

notice.

|

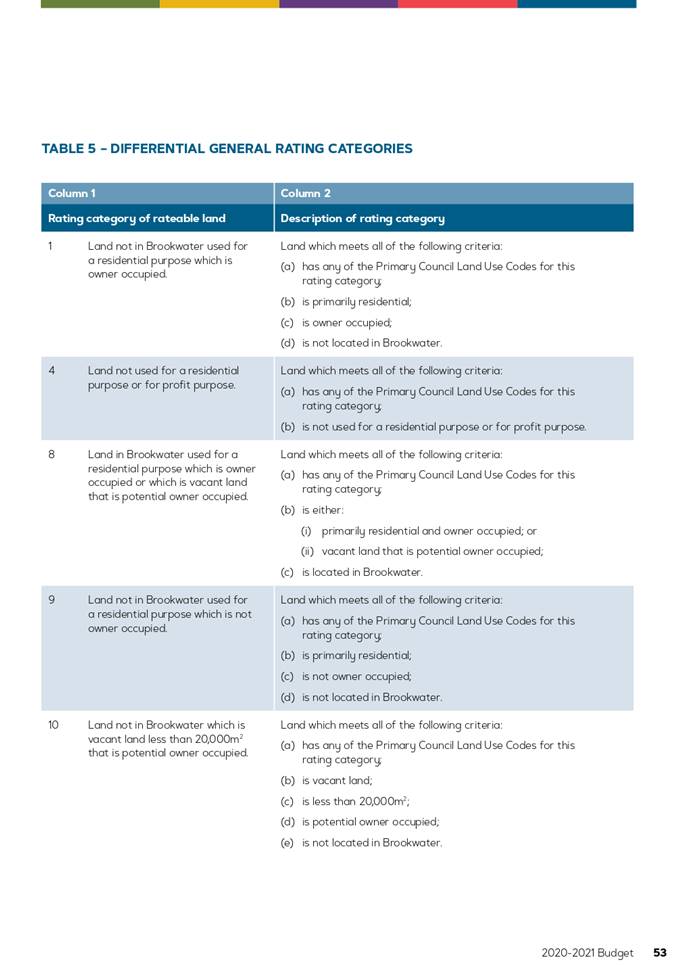

Column 1

Rating category of rateable land

|

Column 2

Description of rating category

|

|

1

|

Land not in Brookwater used

for a residential purpose which is owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) is

owner occupied;

(d) is not

located in Brookwater.

|

|

4

|

Land not used for a

residential purpose or for profit purpose.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is not

used for a residential purpose or for profit purpose.

|

|

8

|

Land in Brookwater used for

a residential purpose which is owner occupied or which is vacant land that is

potential owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

either:

(i) primarily residential

and owner occupied; or

(ii) vacant land that

is potential owner occupied;

(c) is

located in Brookwater.

|

|

9

|

Land not in Brookwater used

for a residential purpose which is not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) is not

owner occupied;

(d) is not

located in Brookwater.

|

|

10

|

Land not in Brookwater

which is vacant land less than 20,000m2 that is potential owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

vacant land;

(c) is

less than 20,000m2;

(d) is

potential owner occupied;

(e) is not

located in Brookwater.

|

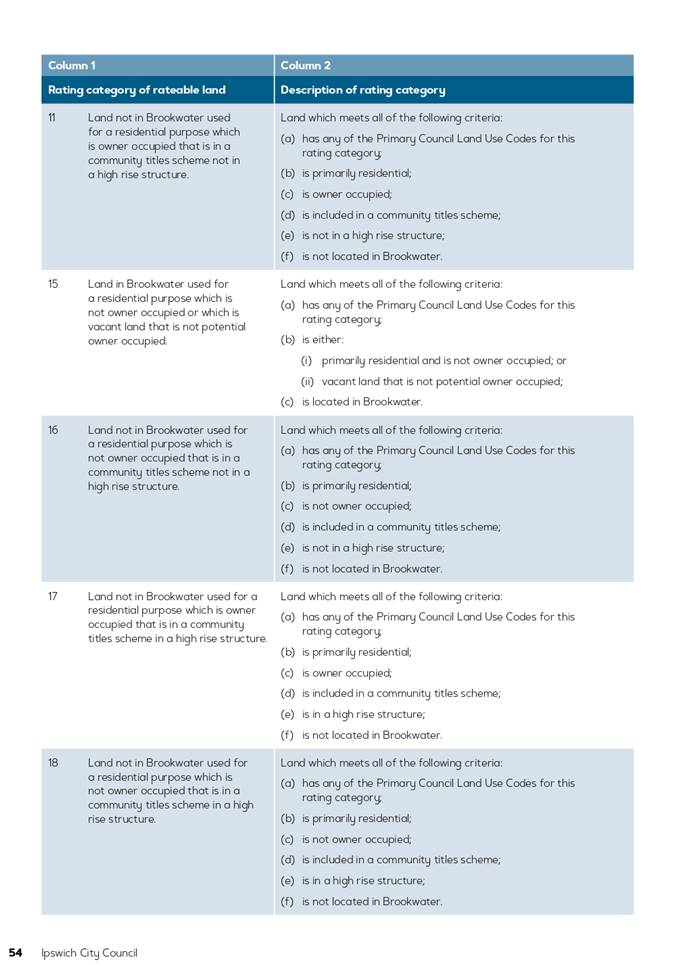

|

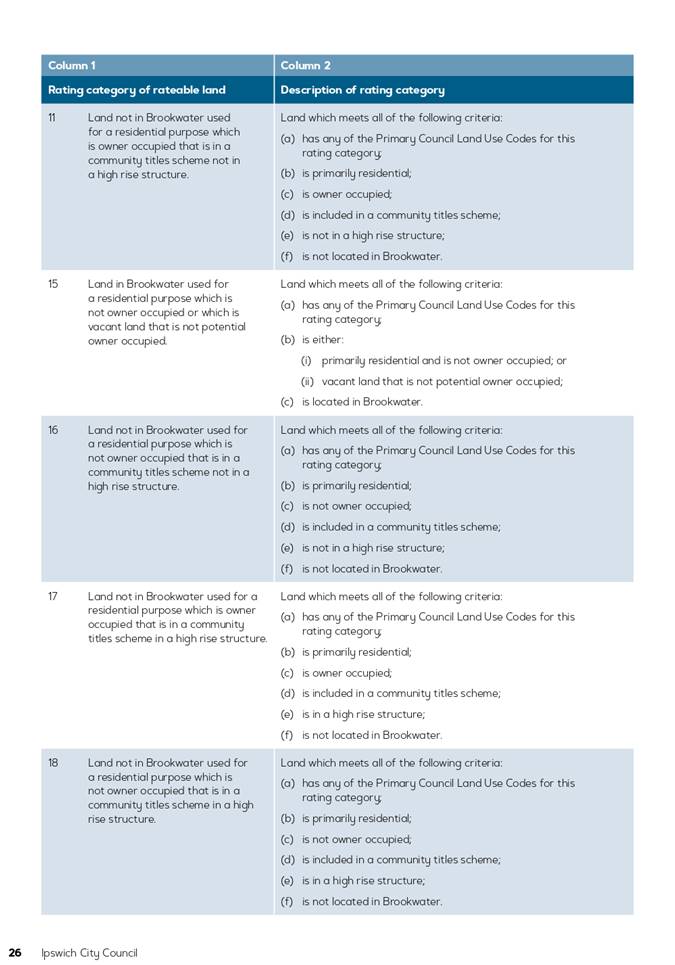

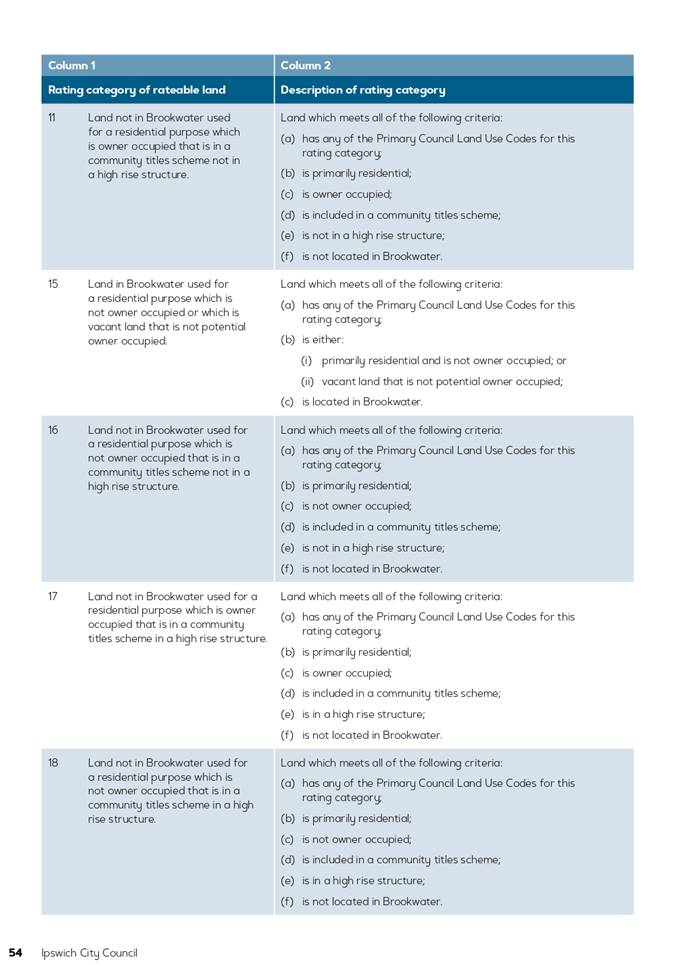

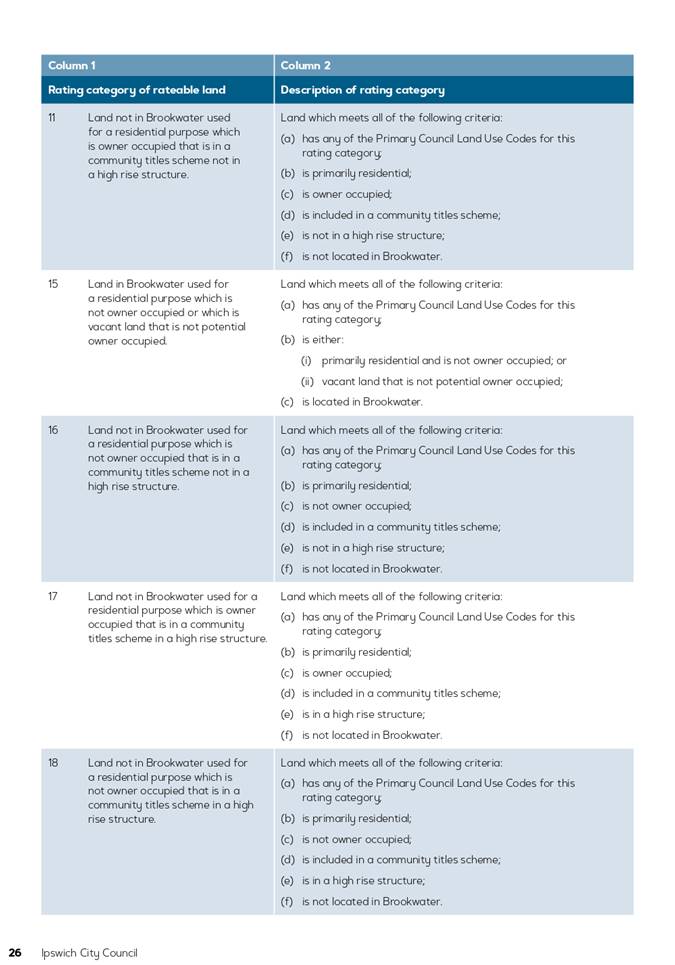

11

|

Land not in Brookwater used

for a residential purpose which is owner occupied that is in a community

titles scheme not in a high rise structure.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) is

owner occupied;

(d) is

included in a community titles scheme;

(e) is not

in a high rise structure;

(f) is

not located in Brookwater.

|

|

15

|

Land in Brookwater used for

a residential purpose which is not owner occupied or which is vacant land

that is not potential owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

either:

(i) primarily

residential and is not owner occupied; or

(ii) vacant land that

is not potential owner occupied;

(c) is

located in Brookwater.

|

|

16

|

Land not in Brookwater used

for a residential purpose which is not owner occupied that is in a community

titles scheme not in a high rise structure.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) is not

owner occupied;

(d) is

included in a community titles scheme;

(e) is not

in a high rise structure;

(f) is

not located in Brookwater.

|

|

17

|

Land not in Brookwater used

for a residential purpose which is owner occupied that is in a community

titles scheme in a high rise structure.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) is

owner occupied;

(d) is

included in a community titles scheme;

(e) is in

a high rise structure;

(f) is

not located in Brookwater.

|

|

18

|

Land not in Brookwater used

for a residential purpose which is not owner occupied that is in a community

titles scheme in a high rise structure.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) is not

owner occupied;

(d) is

included in a community titles scheme;

(e) is in

a high rise structure;

(f) is

not located in Brookwater.

|

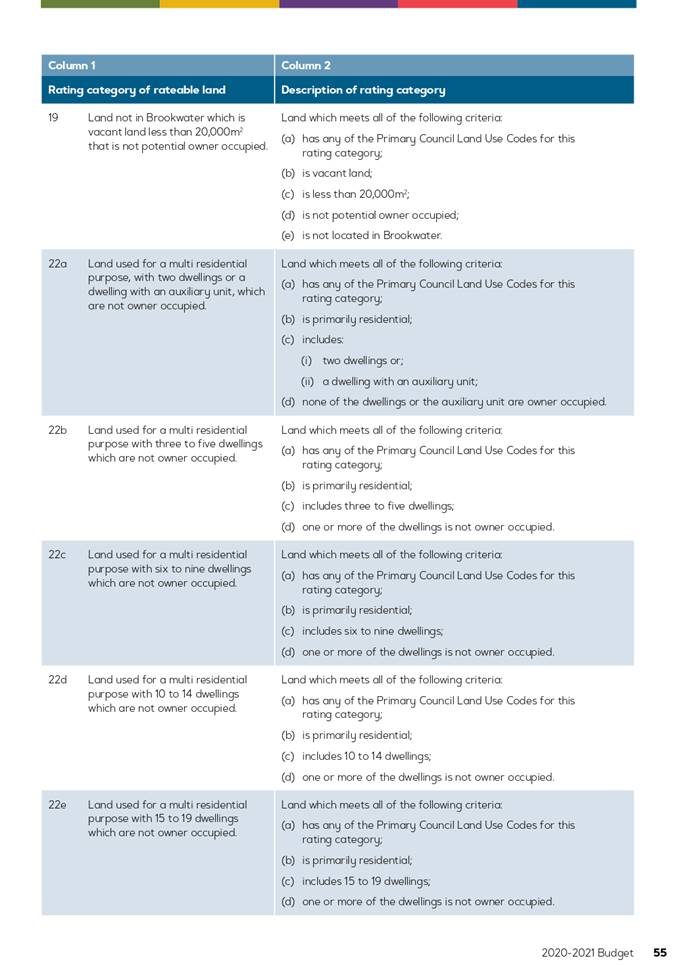

|

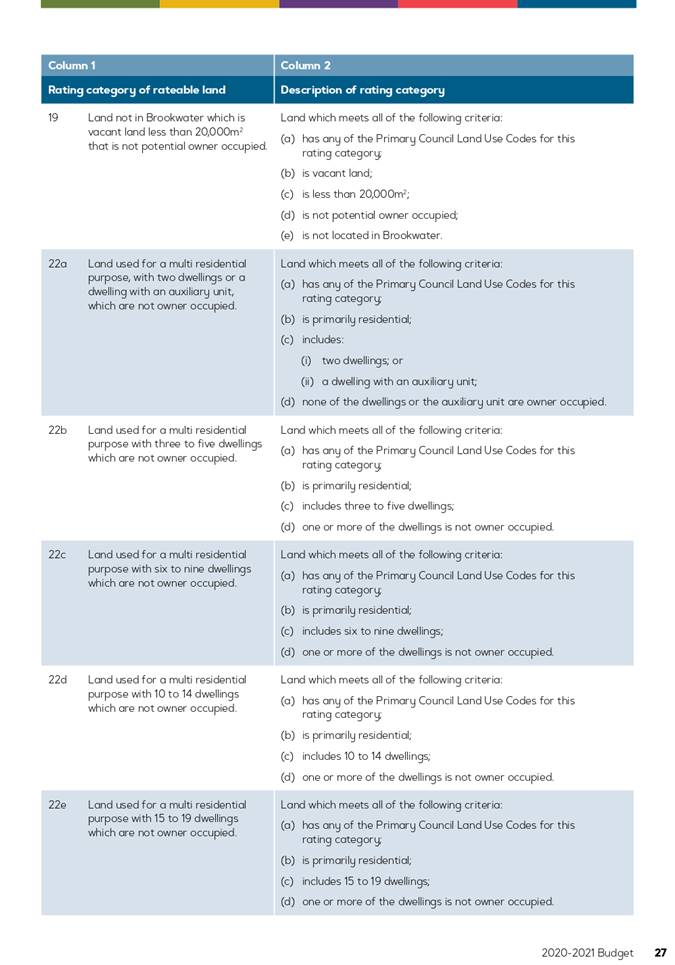

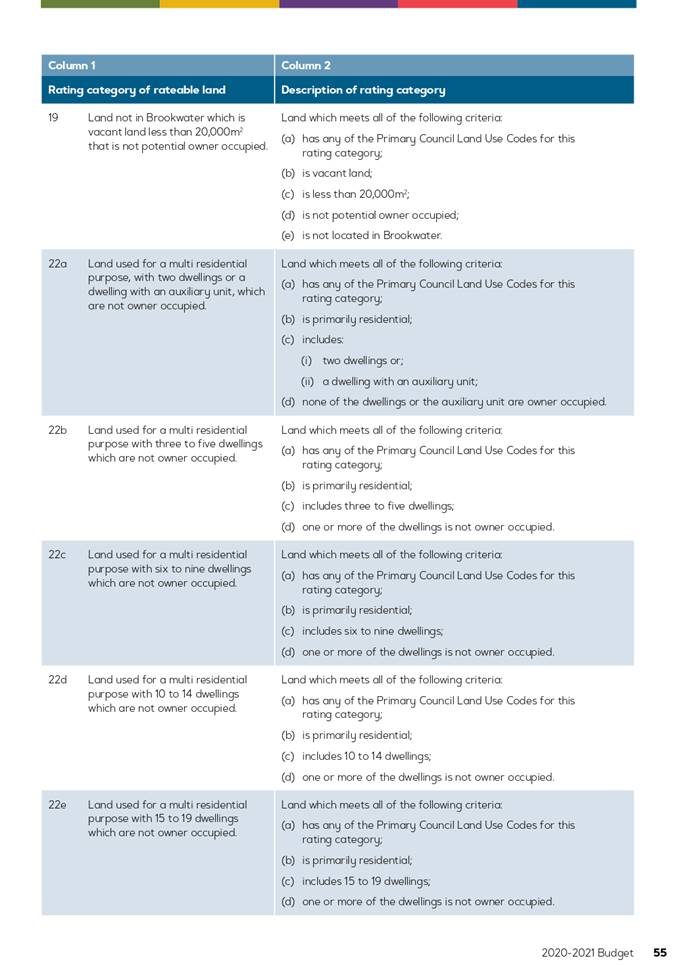

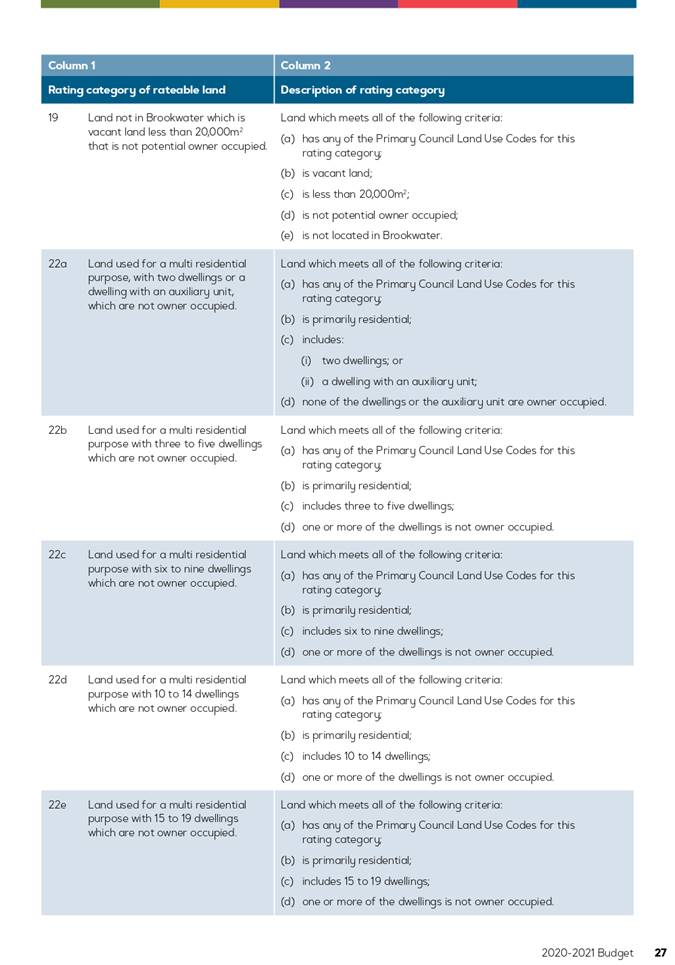

19

|

Land not in Brookwater

which is vacant land less than 20,000m2 that is not potential

owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

vacant land;

(c) is

less than 20,000m2;

(d) is not

potential owner occupied;

(e) is not

located in Brookwater.

|

|

22a

|

Land used for a multi

residential purpose, with two dwellings or a dwelling with an auxiliary unit,

which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes:

(i)---- two dwellings; or

(ii)---- a dwelling with an auxiliary unit;

(d) none

of the dwellings or the auxiliary unit are owner occupied.

|

|

22b

|

Land used for a multi

residential purpose with three to five dwellings which are not owner

occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes

three to five dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

|

22c

|

Land used for a multi

residential purpose with six to nine dwellings which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes

six to nine dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

|

22d

|

Land used for a multi

residential purpose with 10 to 14 dwellings which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes

10 to 14 dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

|

22e

|

Land used for a multi

residential purpose with 15 to 19 dwellings which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes

15 to 19 dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

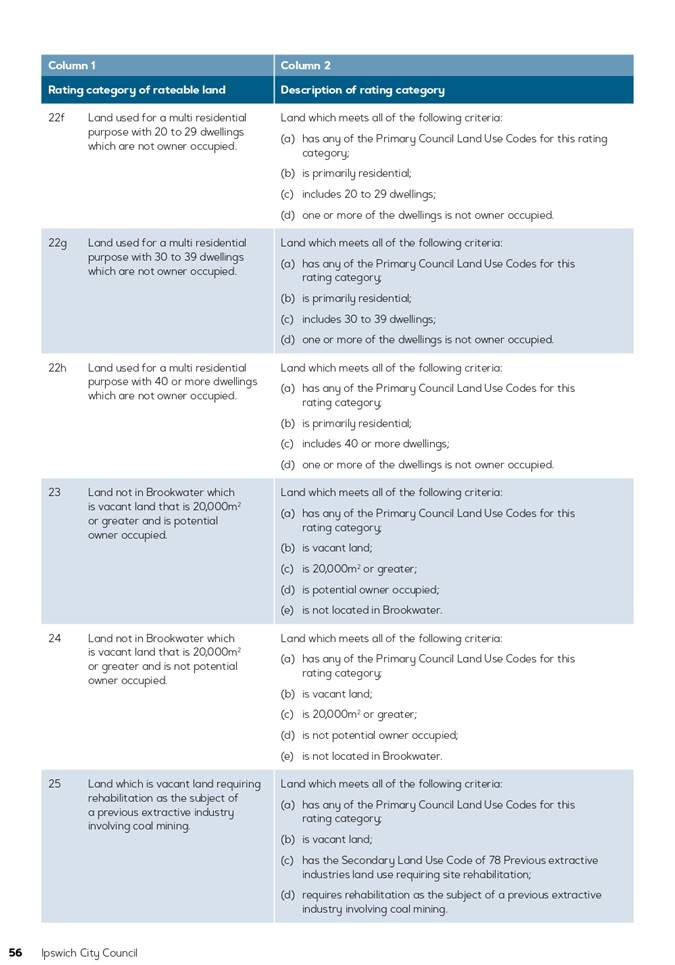

|

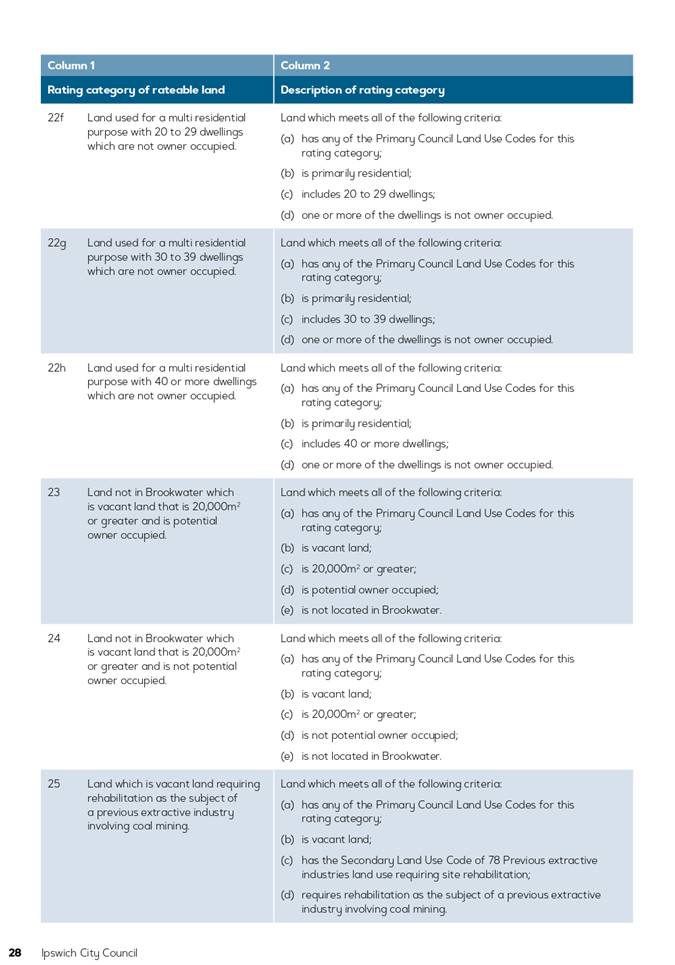

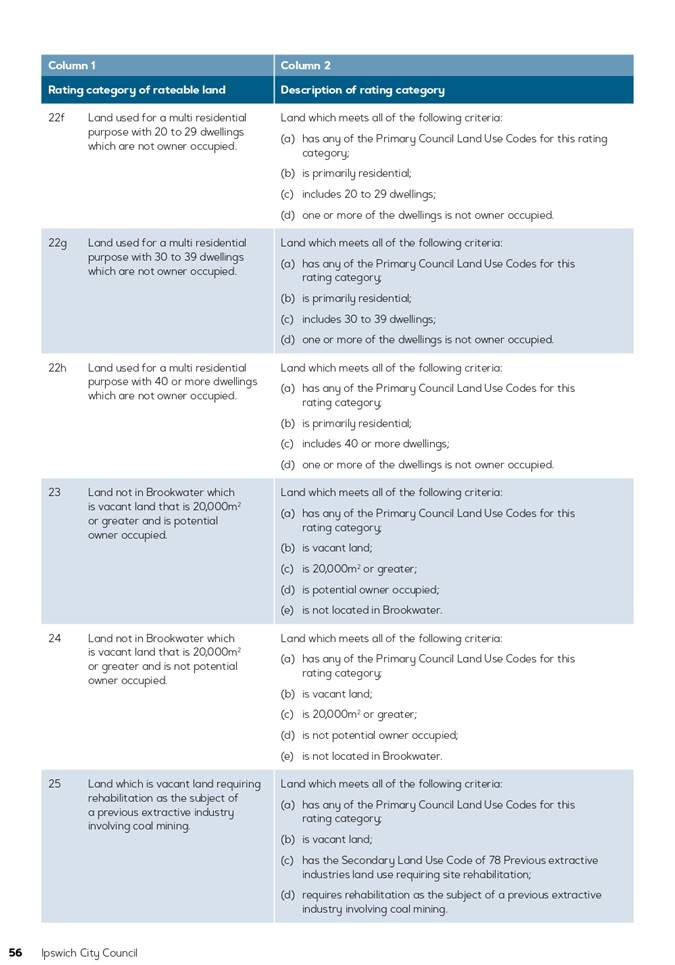

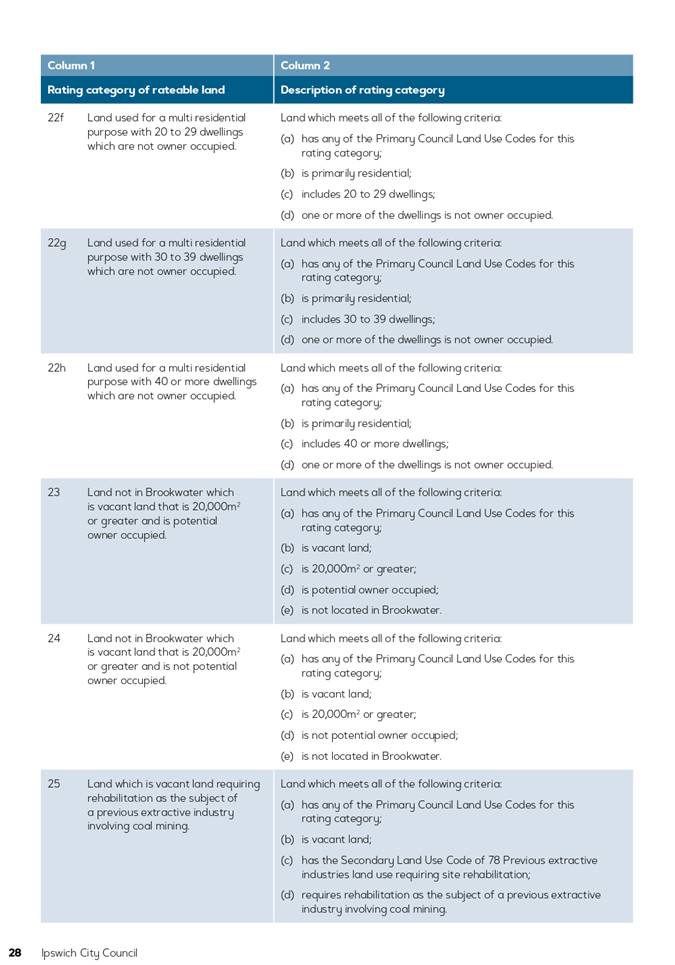

22f

|

Land used for a multi

residential purpose with 20 to 29 dwellings which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes

20 to 29 dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

|

22g

|

Land used for a multi

residential purpose with 30 to 39 dwellings which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes

30 to 39 dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

|

22h

|

Land used for a multi

residential purpose with 40 or more dwellings which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes

40 or more dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

|

23

|

Land not in Brookwater

which is vacant land that is 20,000m2 or greater and is potential

owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

vacant land;

(c) is

20,000m2 or greater;

(d) is

potential owner occupied;

(e) is not

located in Brookwater.

|

|

24

|

Land not in Brookwater

which is vacant land that is 20,000m2 or greater and is not

potential owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

vacant land;

(c) is 20,000m2

or greater;

(d) is not

potential owner occupied;

(e) is not

located in Brookwater.

|

|

25

|

Land which is vacant land

requiring rehabilitation as the subject of a previous extractive industry

involving coal mining.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

vacant land;

(c) has

the Secondary Land Use Code of 78 Previous extractive industries land use

requiring site rehabilitation;

(d) requires

rehabilitation as the subject of a previous extractive industry involving

coal mining.

|

|

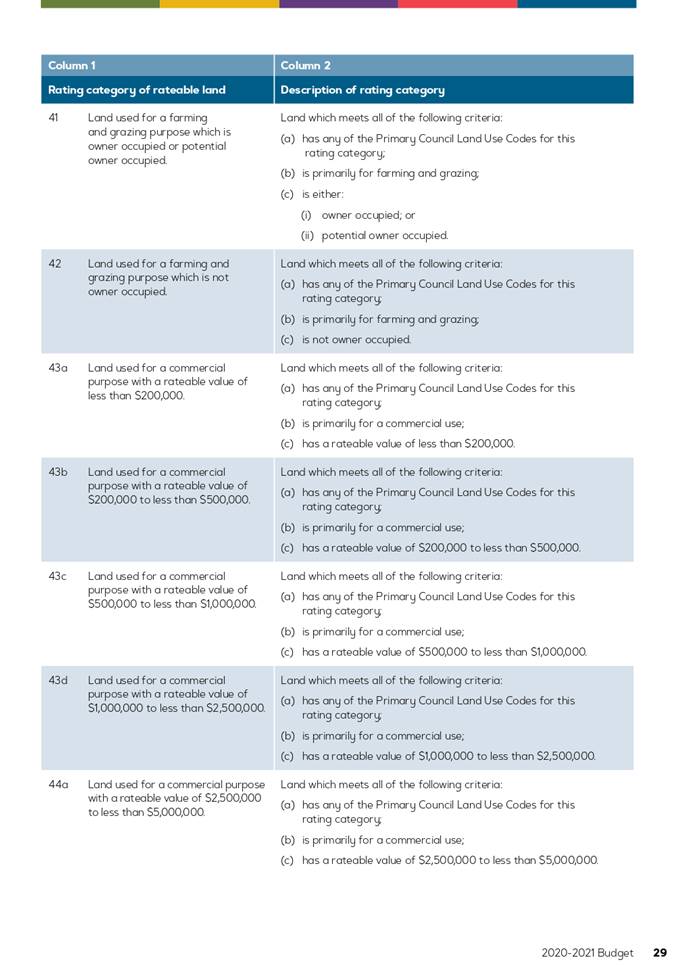

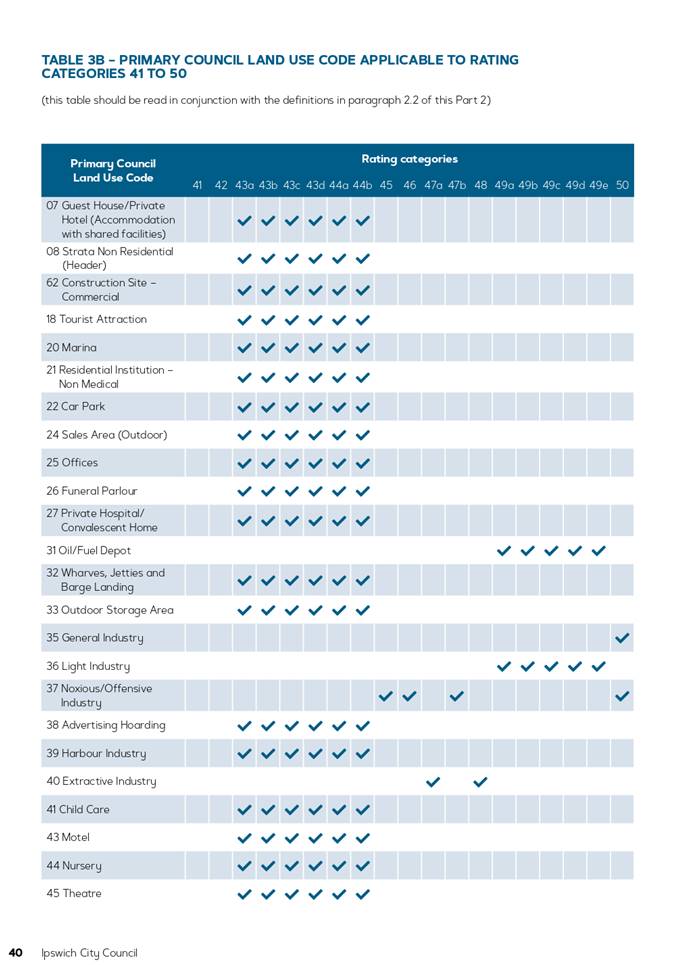

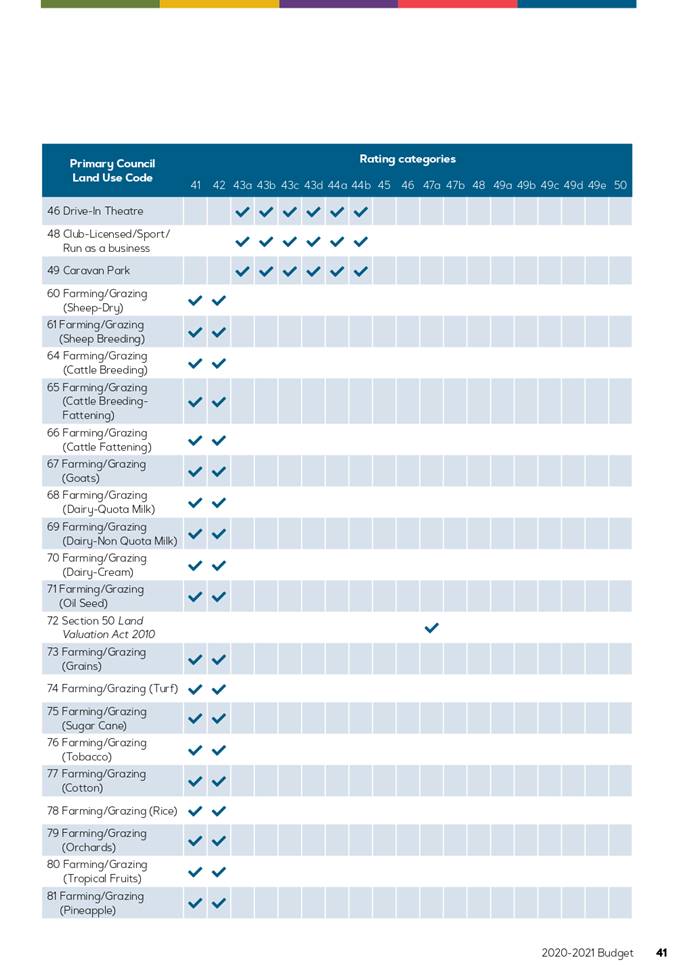

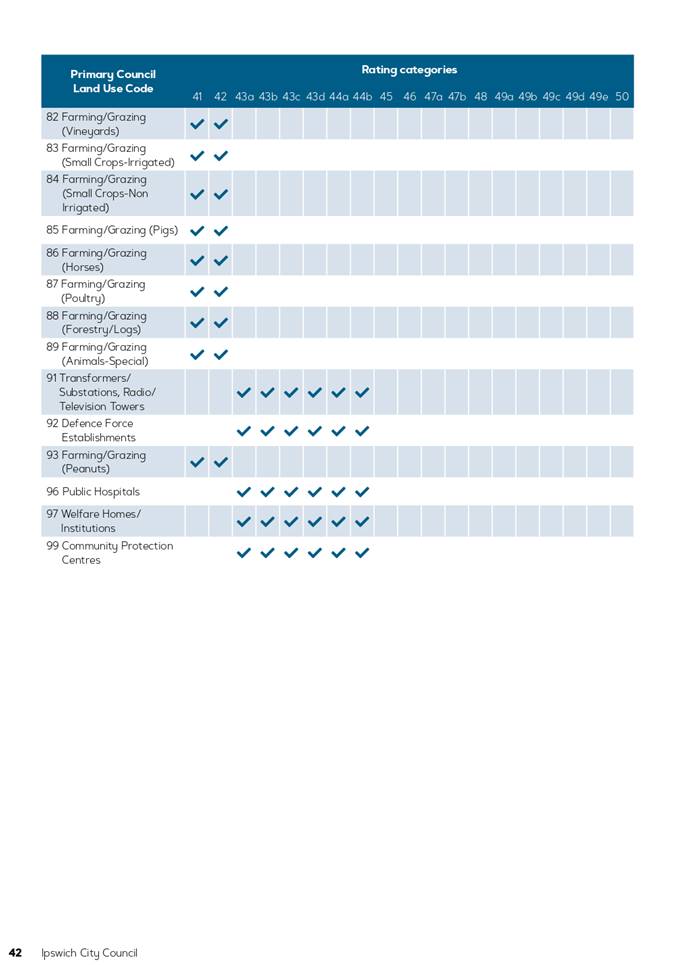

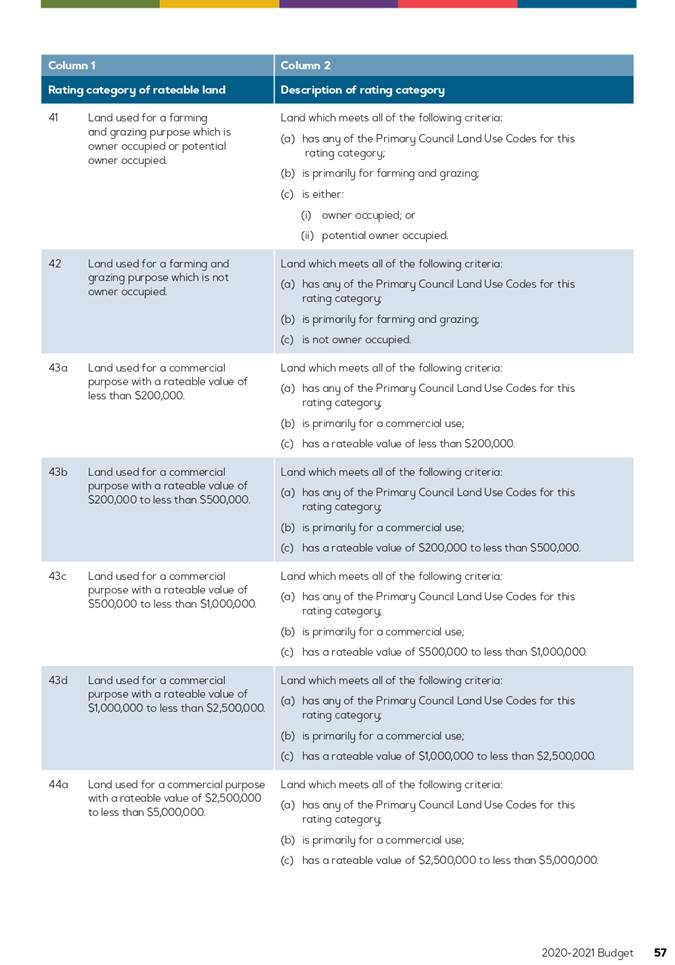

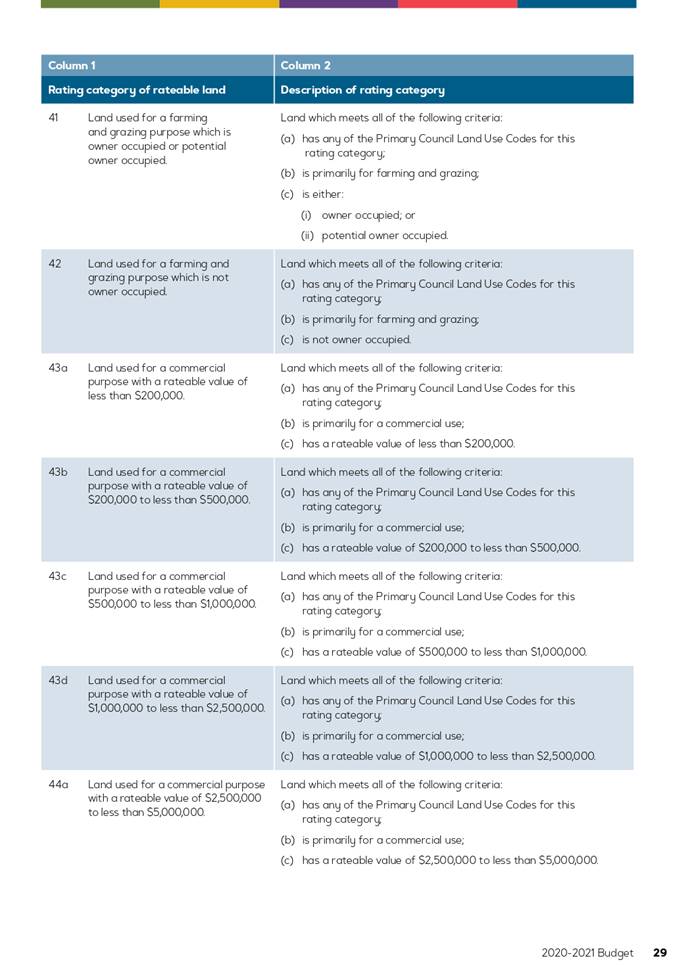

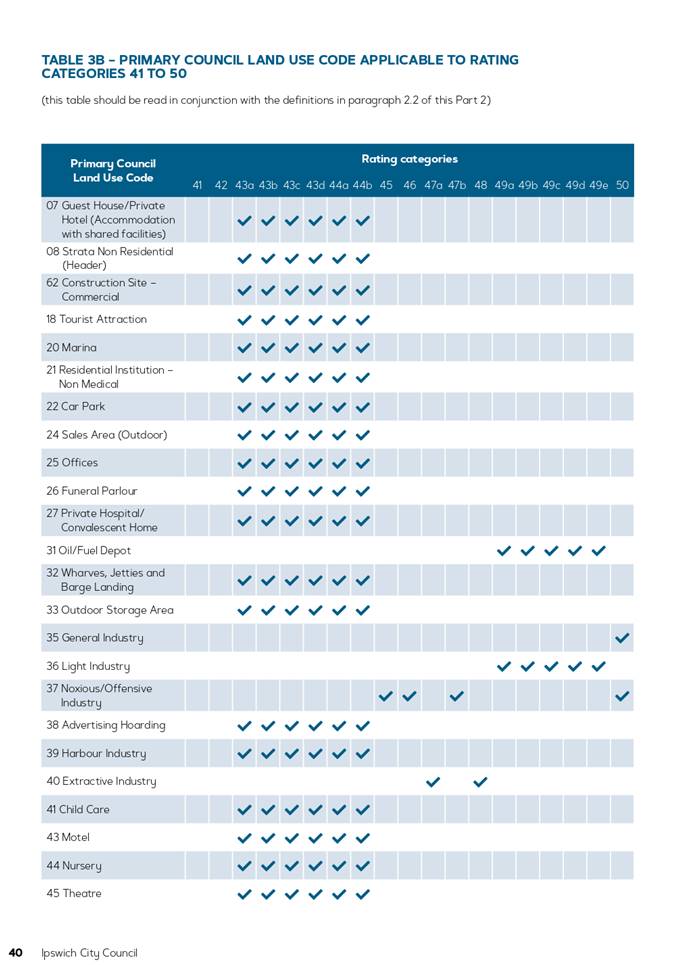

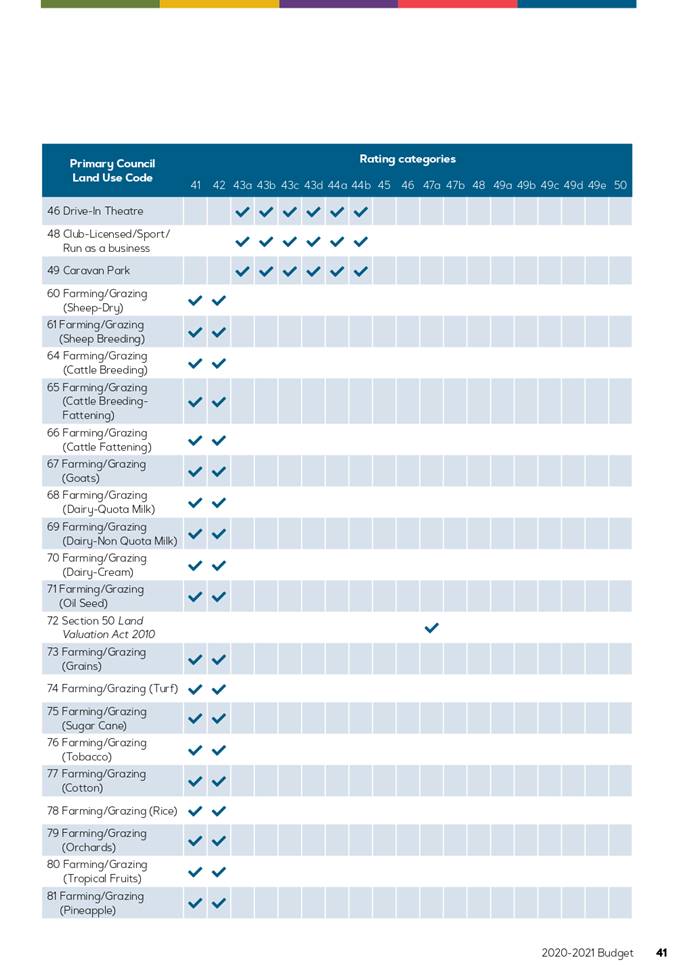

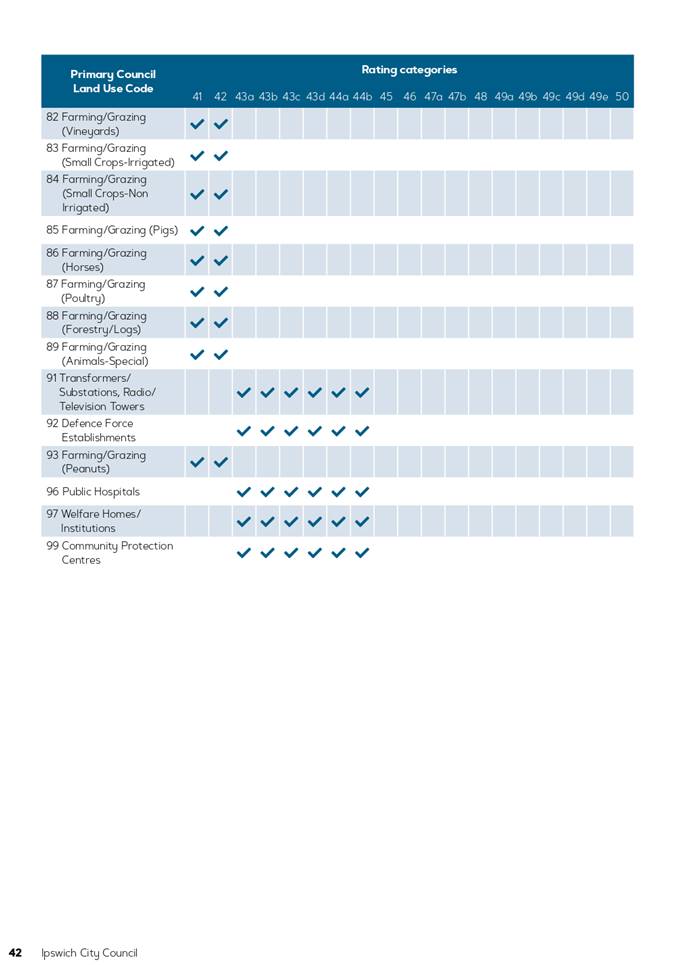

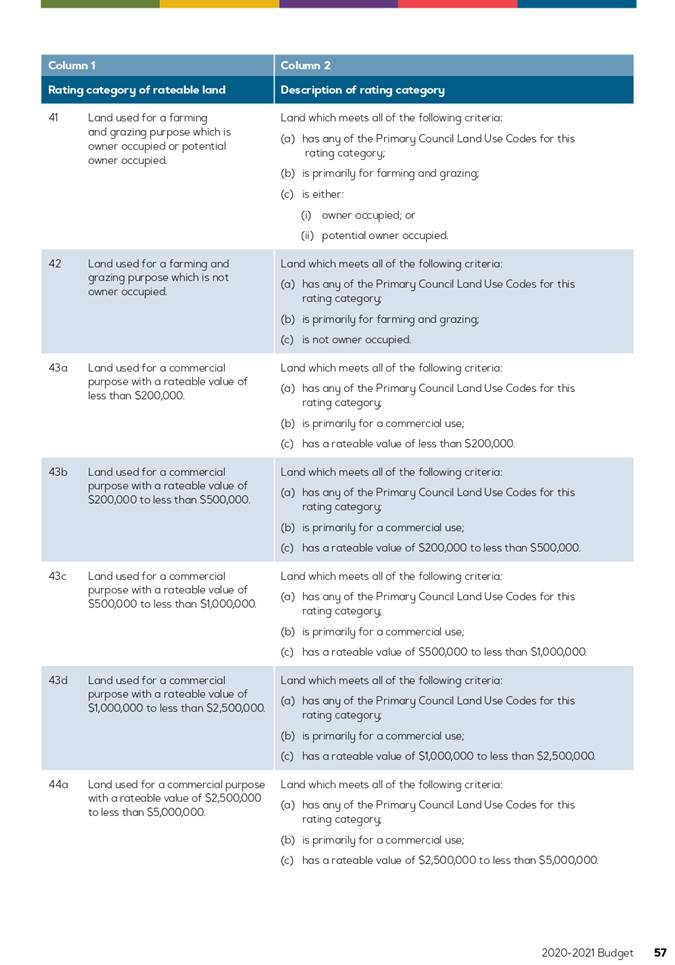

41

|

Land used for a farming and

grazing purpose which is owner occupied or potential owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for farming and grazing;

(c) is

either:

(i) owner

occupied; or

(ii) potential owner

occupied.

|

|

42

|

Land used for a farming and

grazing purpose which is not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for farming and grazing;

(c) is not

owner occupied.

|

|

43a

|

Land used for a commercial

purpose with a rateable value of less than $200,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a commercial use;

(c) has a

rateable value of less than $200,000.

|

|

]43b

|

Land used for a commercial

purpose with a rateable value of $200,000 to less than $500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a commercial use;

(c) has a

rateable value of $200,000 to less than $500,000.

|

|

43c

|

Land used for a commercial

purpose with a rateable value of $500,000 to less than $1,000,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a commercial use;

(c) has a

rateable value of $500,000 to less than $1,000,000.

|

|

43d

|

Land used for a commercial

purpose with a rateable value of $1,000,000 to less than $2,500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a commercial use;

(c) has a

rateable value of $1,000,000 to less than $2,500,000.

|

|

44a

|

Land used for a commercial

purpose with a rateable value of $2,500,000 to less than $5,000,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a commercial use;

(c) has a

rateable value of $2,500,000 to less than $5,000,000.

|

|

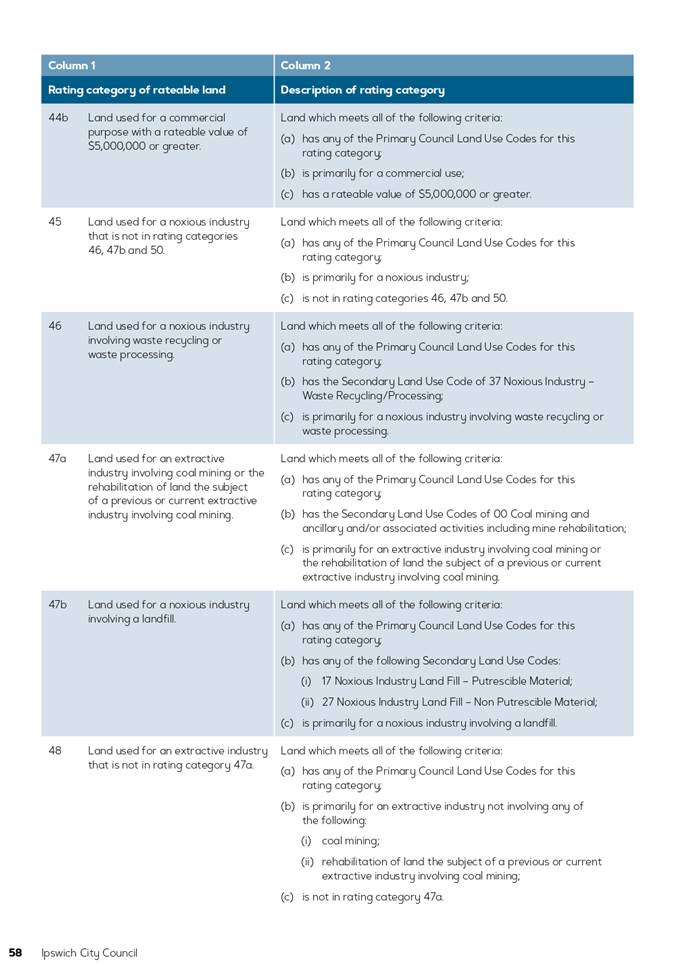

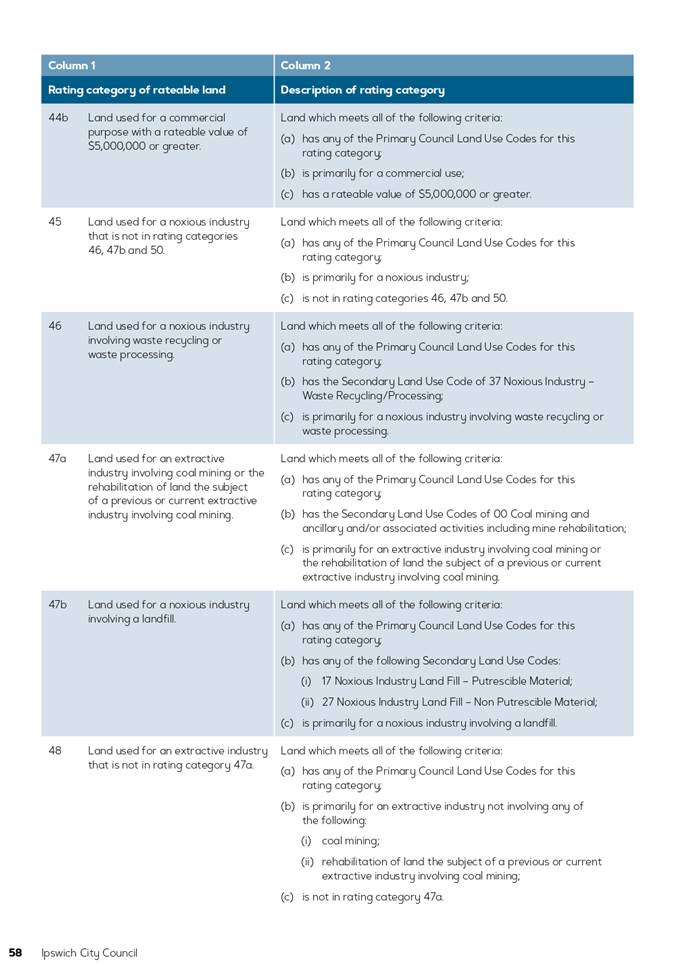

44b

|

Land used for a commercial

purpose with a rateable value of $5,000,000 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a commercial use;

(c) has a

rateable value of $5,000,000 or greater.

|

|

45

|

Land used for a noxious

industry that is not in rating categories 46, 47b and 50.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a noxious industry;

(c) is not

in rating categories 46, 47b and 50.

|

|

46

|

Land used for a noxious

industry involving waste recycling or waste processing.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) has

the Secondary Land Use Code of 37 Noxious Industry - Waste

Recycling/Processing;

(c) is

primarily for a noxious industry involving waste recycling or waste

processing.

|

|

47a

|

Land used for an extractive

industry involving coal mining or the rehabilitation of land the subject of a

previous or current extractive industry involving coal mining.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) has

the Secondary Land Use Codes of 00 Coal mining and ancillary and/or

associated activities including mine rehabilitation;

(c) is

primarily for an extractive industry involving coal mining or the

rehabilitation of land the subject of a previous or current extractive

industry involving coal mining.

|

|

47b

|

Land used for a noxious

industry involving a landfill.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) has

any of the following Secondary Land Use Codes:

(i) 17 Noxious

Industry Land Fill - Putrescible Material;

(ii) 27 Noxious

Industry Land Fill - Non Putrescible Material;

(c) is

primarily for a noxious industry involving a landfill.

|

|

48

|

Land used for an extractive

industry that is not in rating category 47a.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for an extractive industry not involving any of the following:

(i) coal mining;

(ii) rehabilitation of

land the subject of a previous or current extractive industry involving coal

mining;

(c) is not

in rating category 47a.

|

|

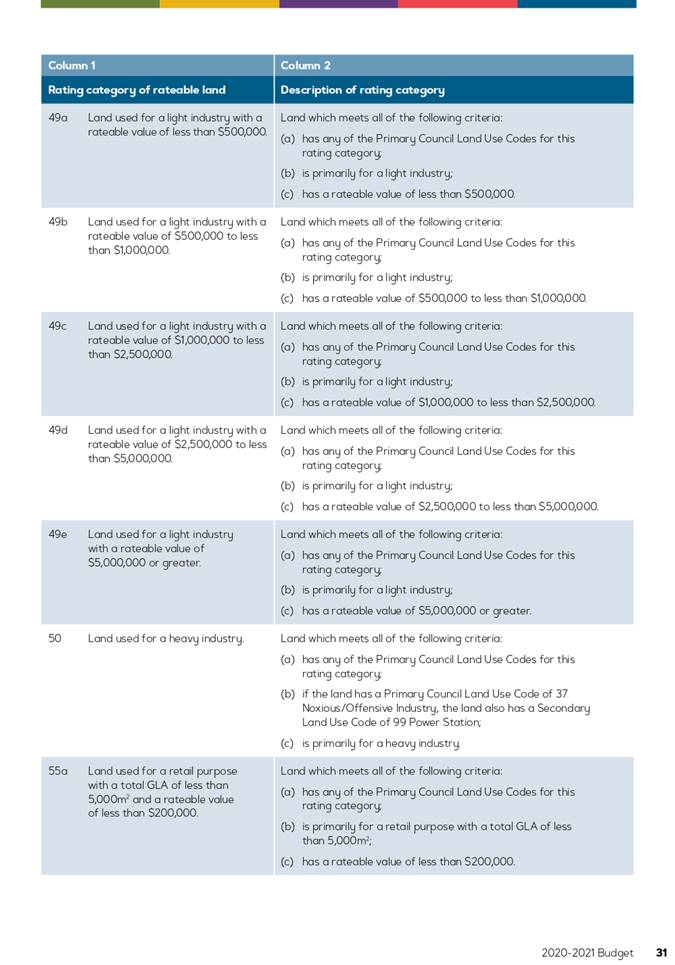

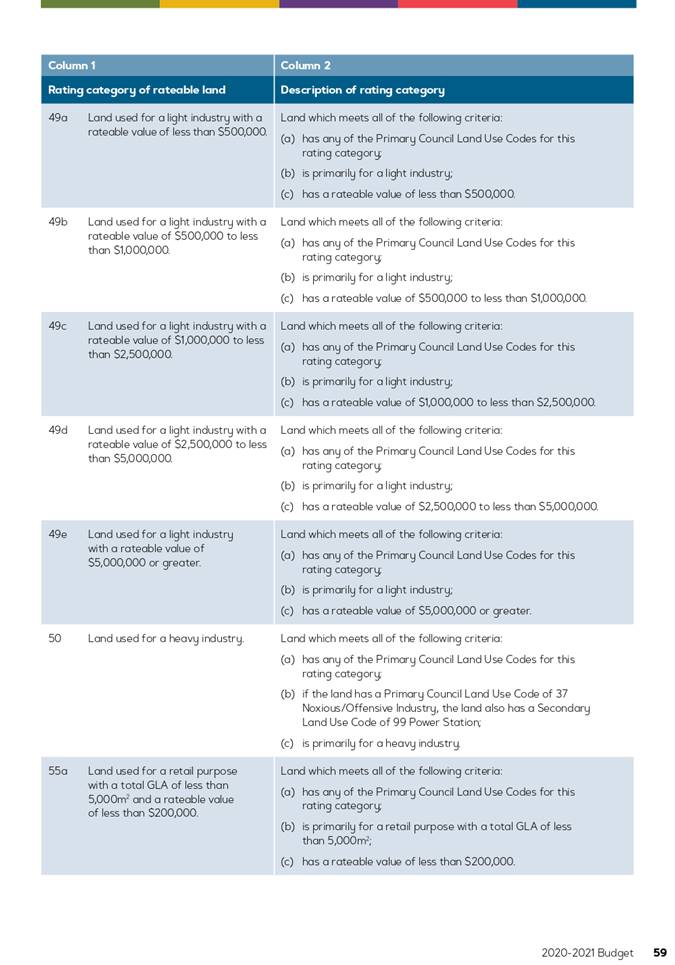

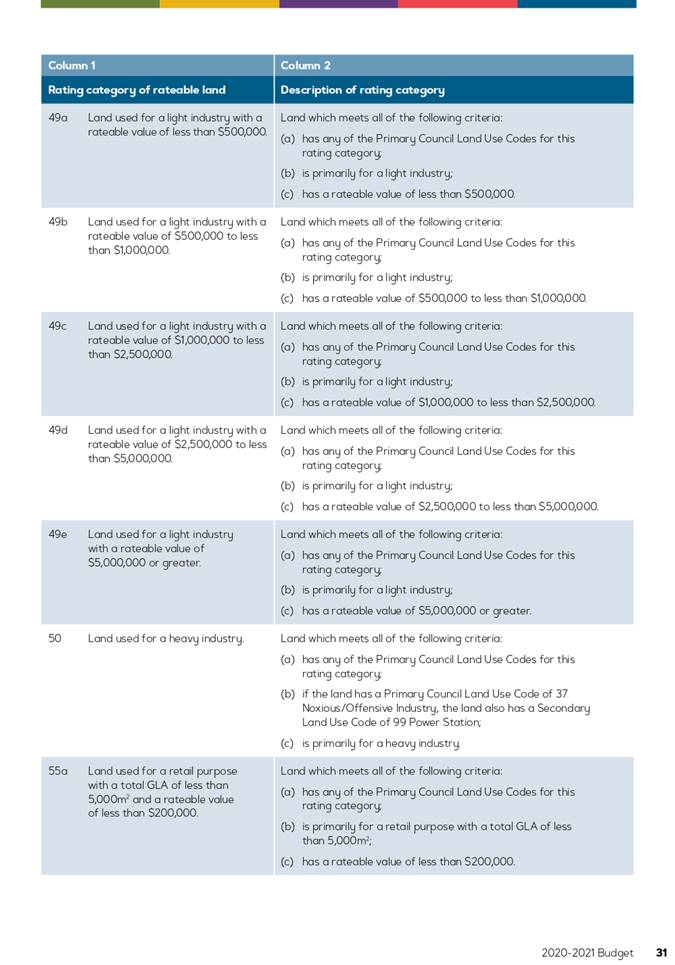

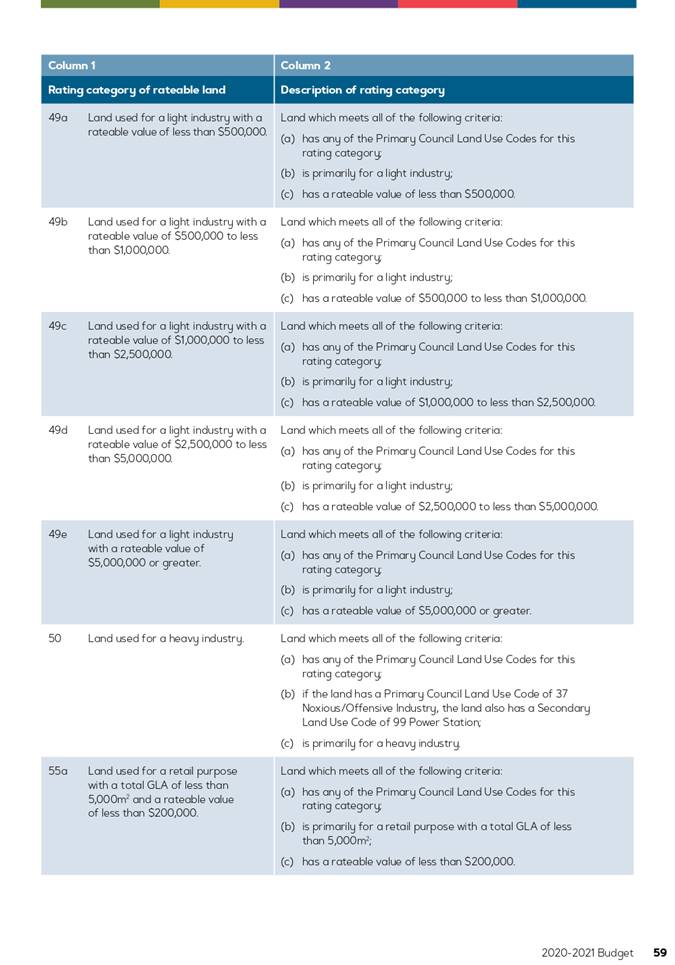

49a

|

Land used for a light

industry with a rateable value of less than $500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a light industry;

(c) has a

rateable value of less than $500,000.

|

|

49b

|

Land used for a light

industry with a rateable value of $500,000 to less than $1,000,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a light industry;

(c) has a

rateable value of $500,000 to less than $1,000,000.

|

|

49c

|

Land used for a light

industry with a rateable value of $1,000,000 to less than $2,500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a light industry;

(c) has a

rateable value of $1,000,000 to less than $2,500,000.

|

|

49d

|

Land used for a light

industry with a rateable value of $2,500,000 to less than $5,000,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a light industry;

(c) has a

rateable value of $2,500,000 to less than $5,000,000.

|

|

49e

|

Land used for a light

industry with a rateable value of $5,000,000 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a light industry;

(c) has a

rateable value of $5,000,000 or greater.

|

|

50

|

Land used for a heavy

industry.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) if the

land has a Primary Council Land Use Code of 37 Noxious/Offensive Industry,

the land also has a Secondary Land Use Code of 99 Power Station;

(c) is

primarily for a heavy industry.

|

|

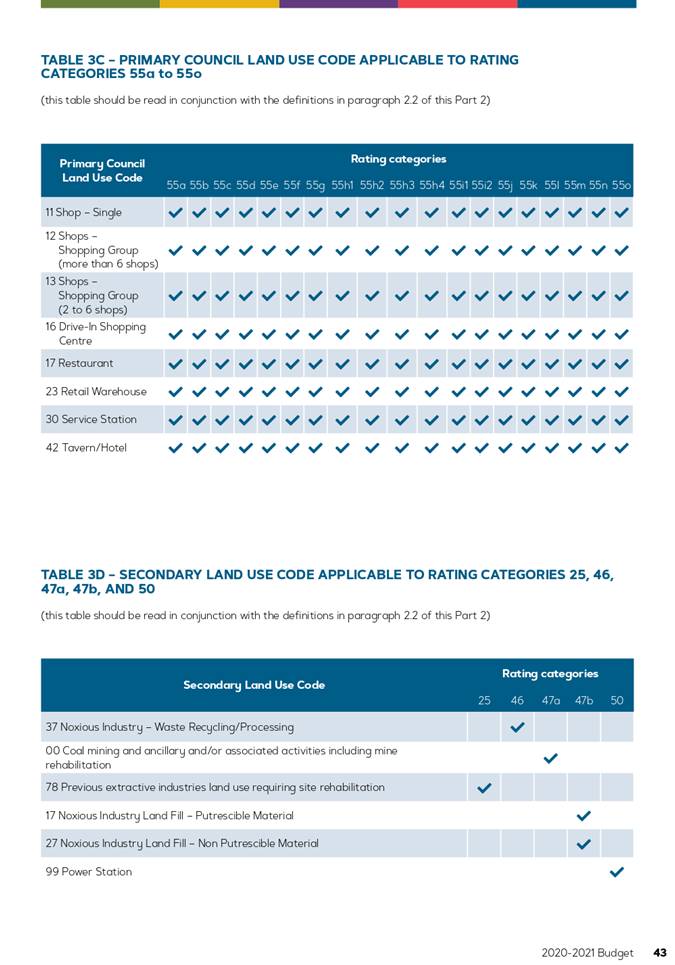

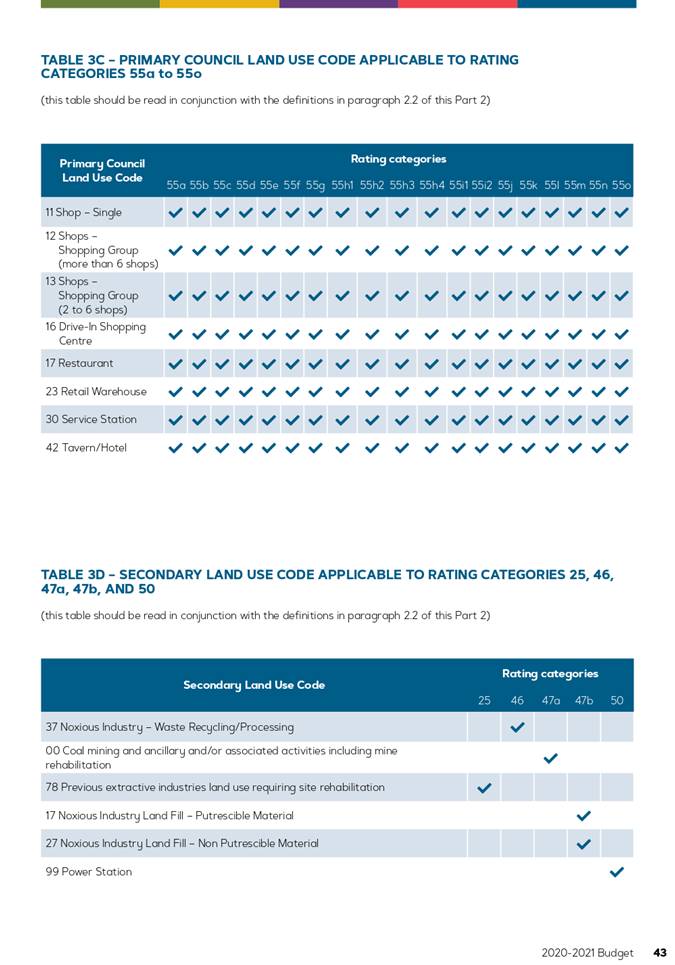

55a

|

Land used for a retail

purpose with a total GLA of less than 5,000m2 and a rateable value

of less than $200,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of less than 5,000m2;

(c) has a

rateable value of less than $200,000.

|

|

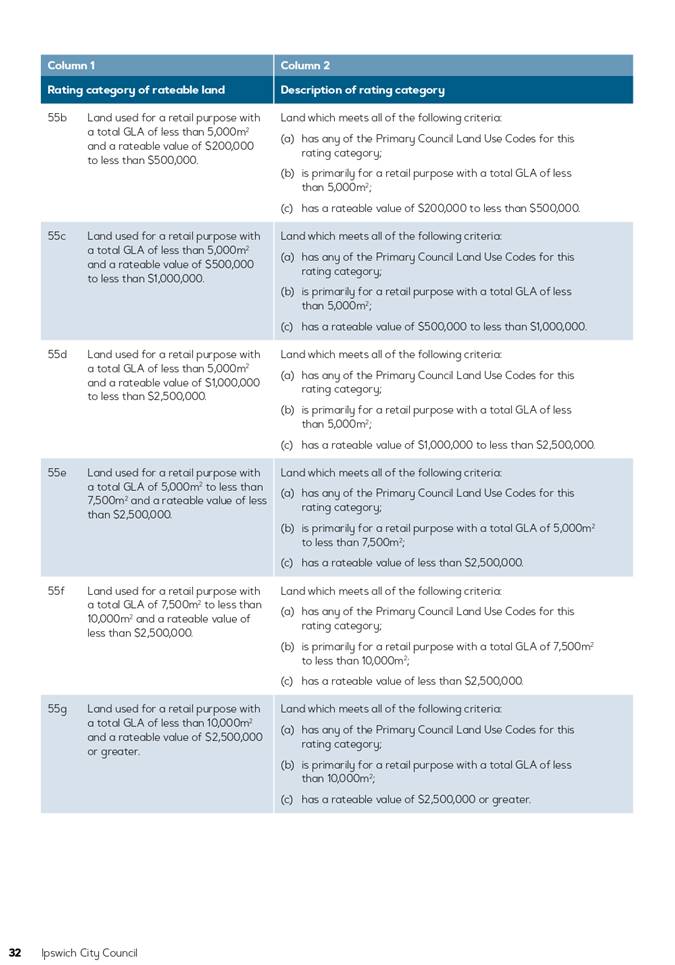

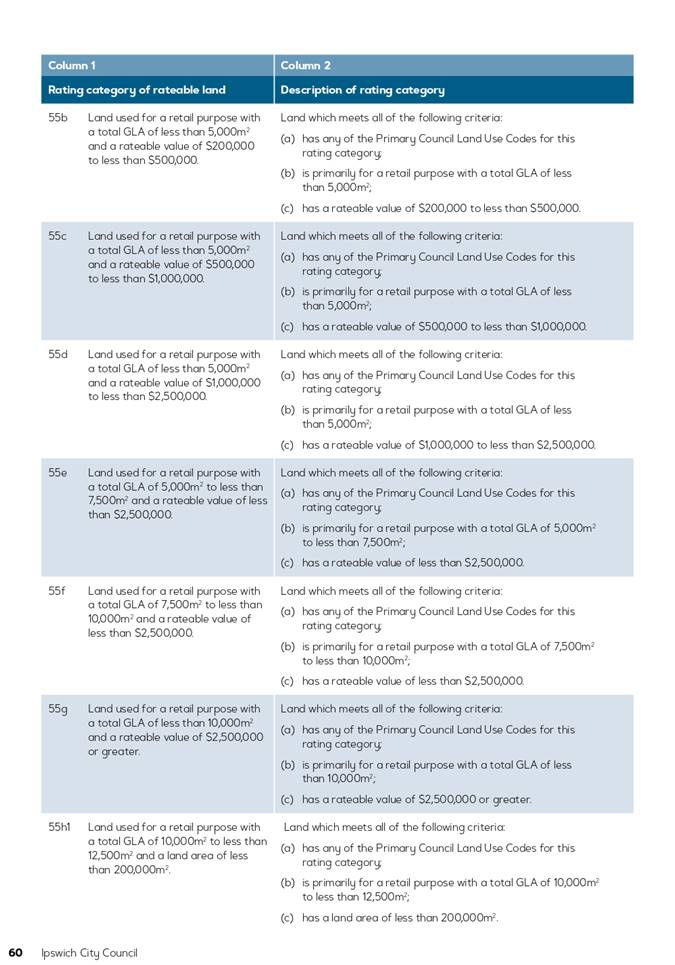

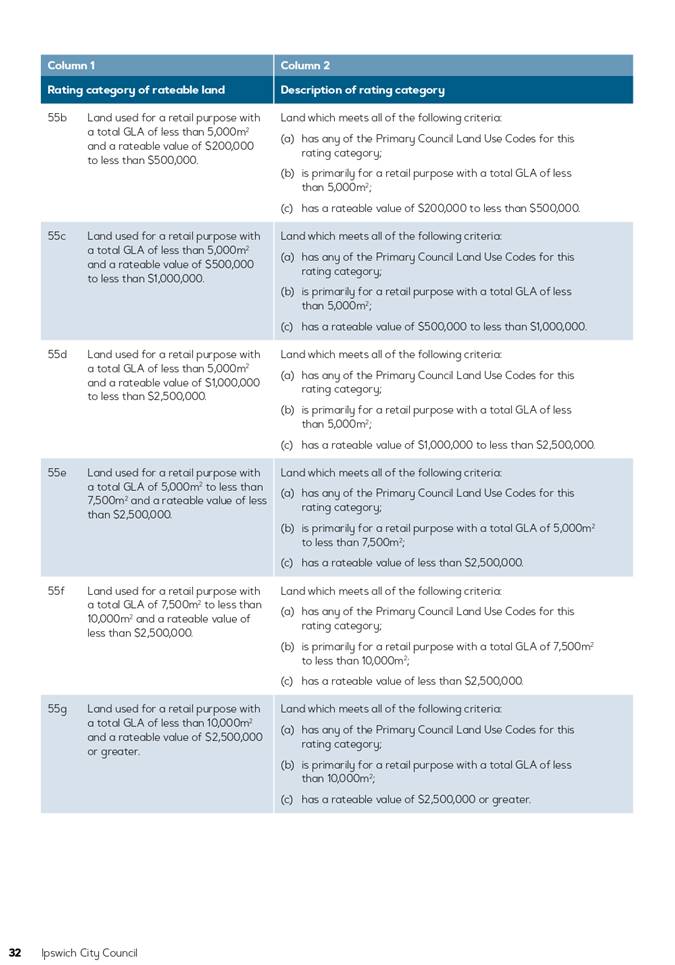

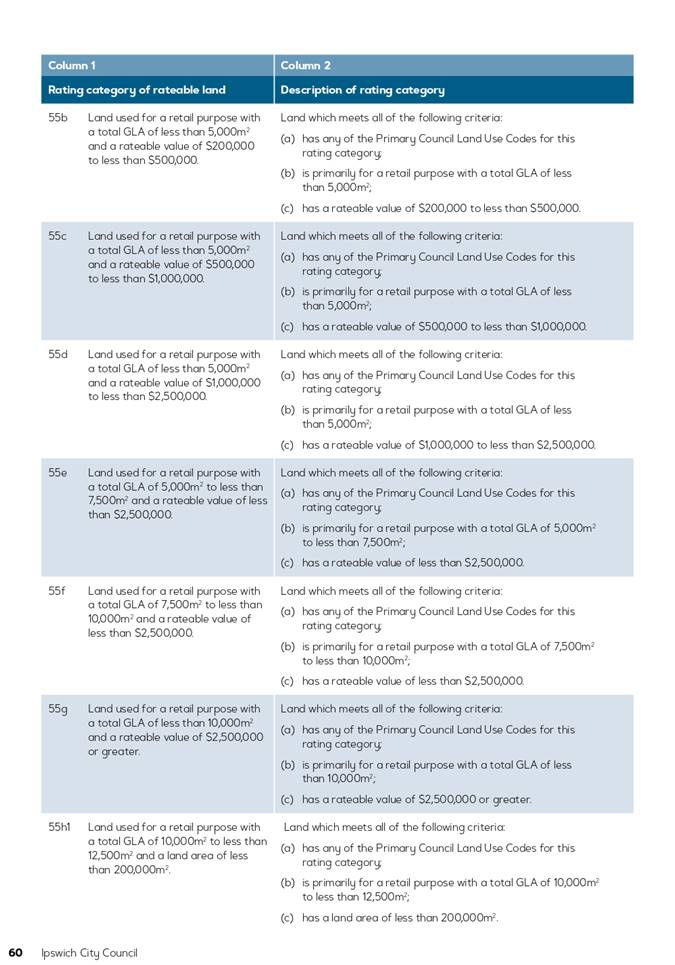

55b

|

Land used for a retail

purpose with a total GLA of less than 5,000m2 and a rateable value

of $200,000 to less than $500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of less than 5,000m2;

(c) has a

rateable value of $200,000 to less than $500,000.

|

|

55c

|

Land used for a retail

purpose with a total GLA less of than 5,000m2 and a rateable value

of $500,000 to less than $1,000,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of less than 5,000m2;

(c) has a

rateable value of $500,000 to less than $1,000,000.

|

|

55d

|

Land used for a retail

purpose with a total GLA of less than 5,000m2 and a rateable value

of $1,000,000 to less than $2,500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of less than 5,000m2;

(c) has a

rateable value of $1,000,000 to less than $2,500,000.

|

|

55e

|

Land used for a retail purpose

with a total GLA of 5,000m2 to less than 7,500m2 and a

rateable value of less than $2,500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 5,000m2 to less

than 7,500m2;

(c) has a

rateable value of less than $2,500,000.

|

|

55f

|

Land used for a retail

purpose with a total GLA of 7,500m2 to less than 10,000m2 and

a rateable value of less than $2,500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 7,500m2 to less

than 10,000m2;

(c) has a

rateable value of less than $2,500,000.

|

|

55g

|

Land used for a retail

purpose with a total GLA of less than 10,000m2 and a rateable

value of $2,500,000 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of less than 10,000m2;

(c) has a

rateable value of $2,500,000 or greater.

|

|

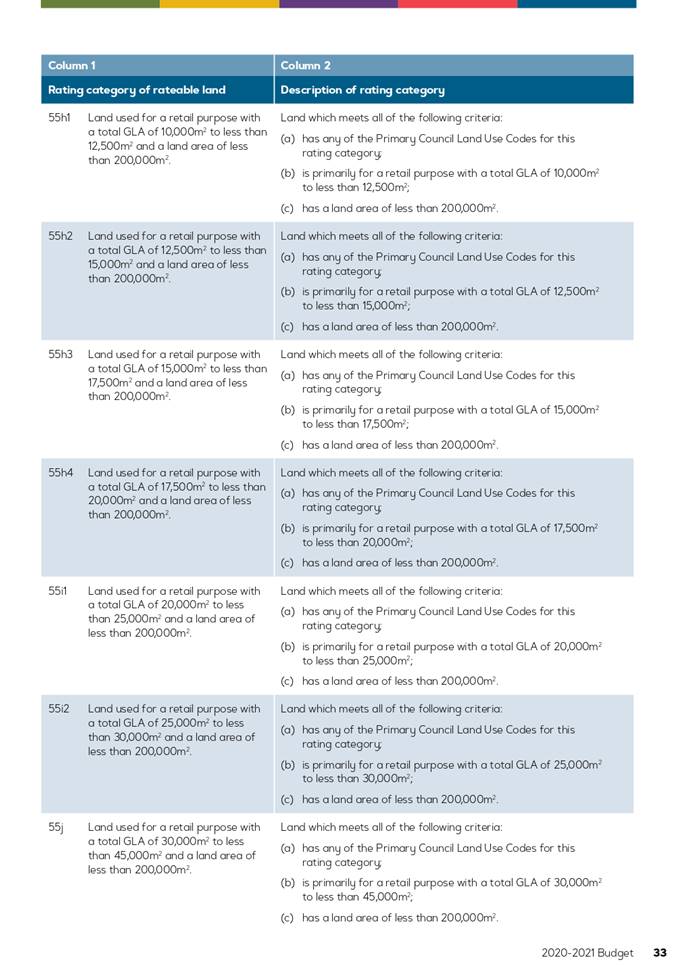

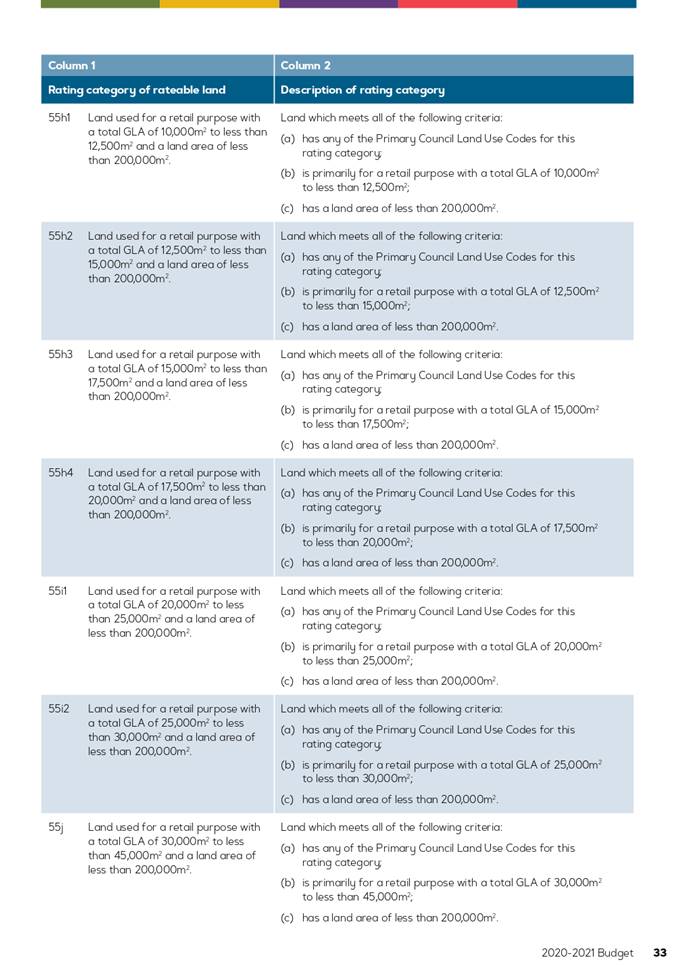

55h1

|

Land used for a retail

purpose with a total GLA of 10,000m2 to less than 12,500m2

and a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 10,000m2 to

less than 12,500m2;

(c) has a

land area of less than 200,000m2.

|

|

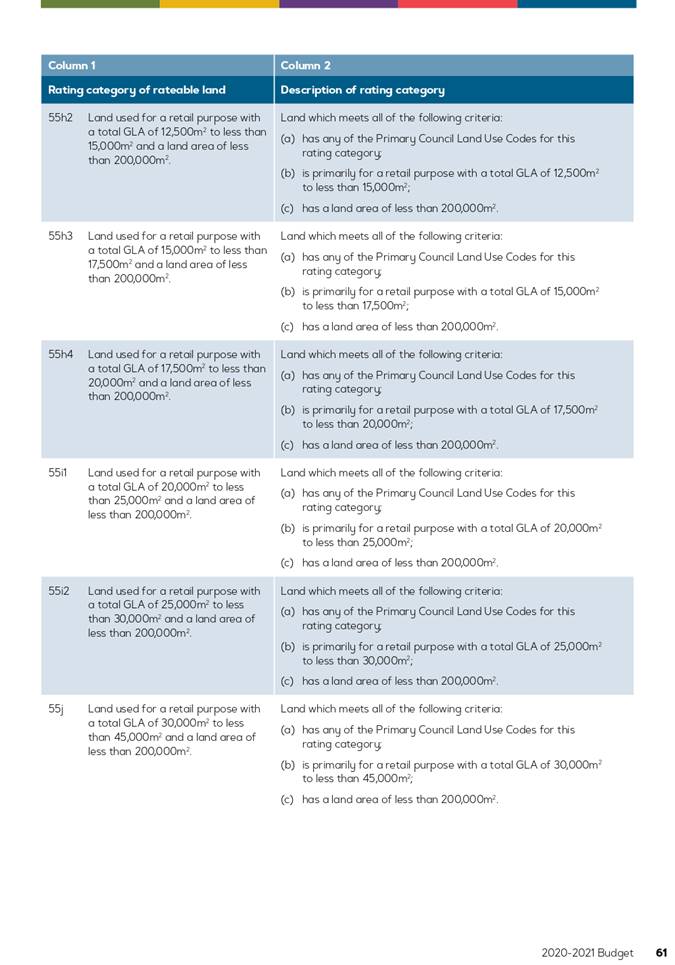

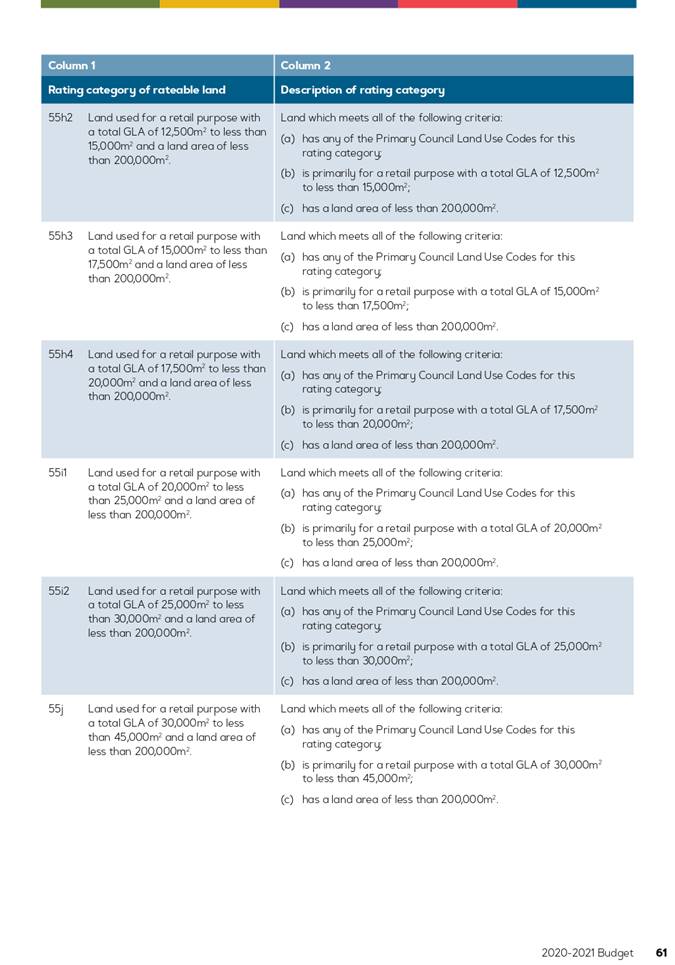

55h2

|

Land used for a retail

purpose with a total GLA of 12,500m2 to less than 15,000m2

and a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 12,500m2 to

less than 15,000m2;

(c) has a

land area of less than 200,000m2.

|

|

55h3

|

Land used for a retail

purpose with a total GLA of 15,000m2 to less than 17,500m2

and a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 15,000m2 to

less than 17,500m2;

(c) has a

land area of less than 200,000m2.

|

|

55h4

|

Land used for a retail

purpose with a total GLA of 17,500m2 to less than 20,000m2

and a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is primarily

for a retail purpose with a total GLA of 17,500m2 to less than

20,000m2;

(c) has a

land area of less than 200,000m2.

|

|

55i1

|

Land used for a retail

purpose with a total GLA of 20,000m2 to less than 25,000m2

and a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 20,000m2 to

less than 25,000m2;

(c) has a

land area of less than 200,000m2.

|

|

55i2

|

Land used for a retail

purpose with a total GLA of 25,000m2 to less than 30,000m2

and a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 25,000m2 to

less than 30,000m2;

(c) has a

land area of less than 200,000m2.

|

|

55j

|

Land used for a retail

purpose with a total GLA of 30,000m2 to less than 45,000m2

and a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 30,000m2 to

less than 45,000m2;

(c) has a

land area of less than 200,000m2.

|

|

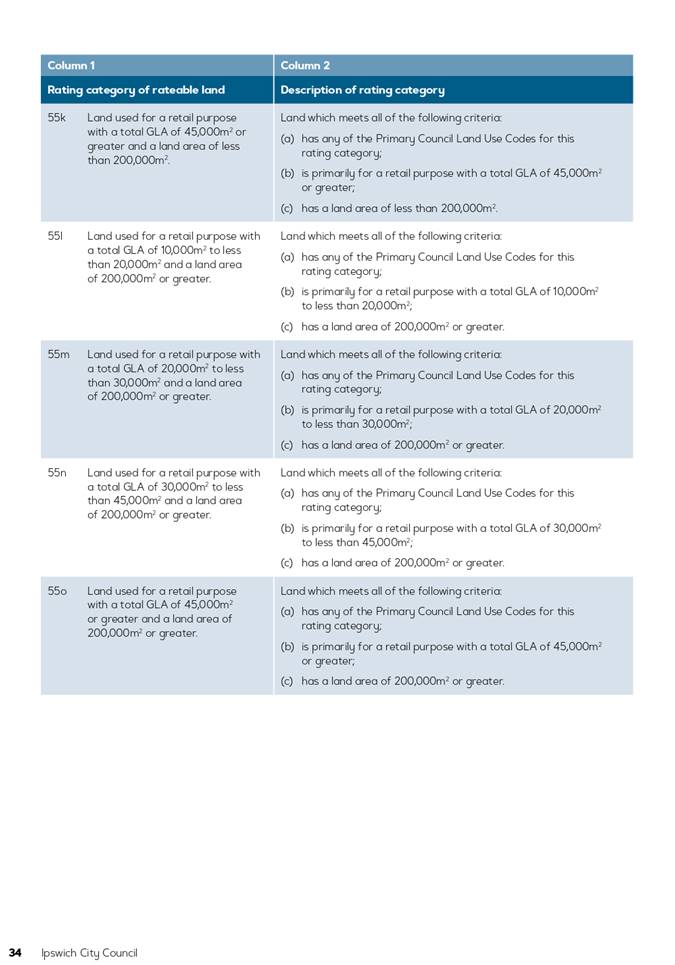

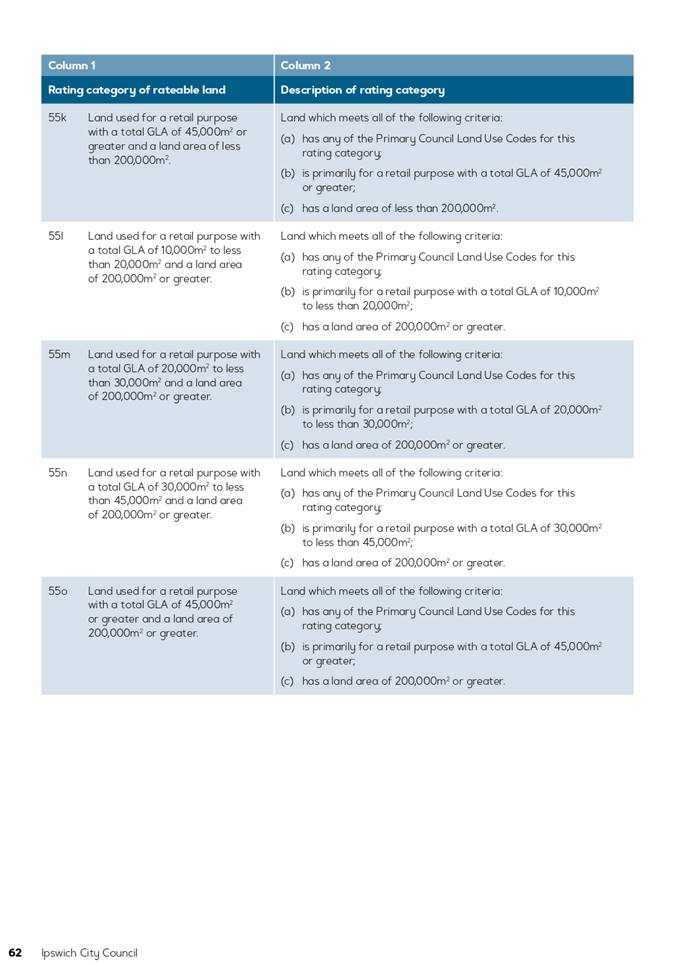

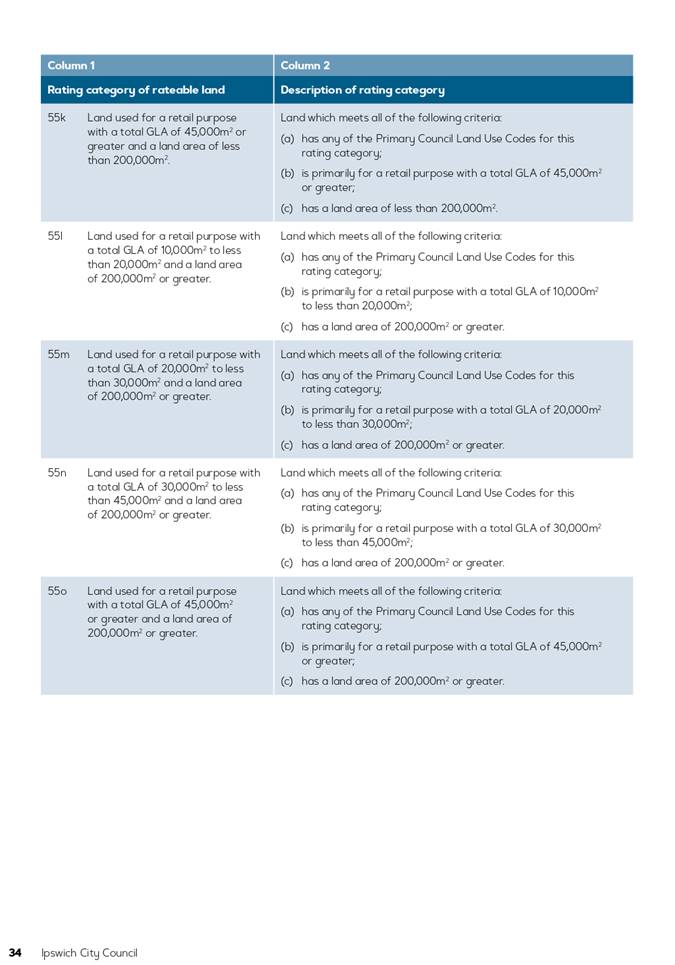

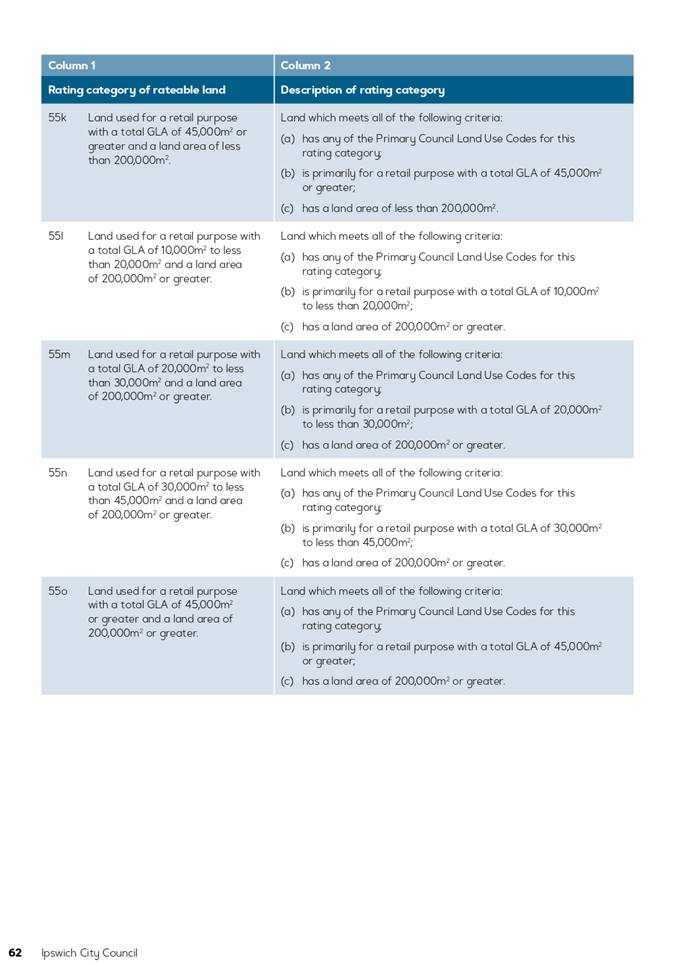

55k

|

Land used for a retail

purpose with a total GLA of 45,000m2 or greater and a land area of

less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 45,000m2 or

greater;

(c) has a

land area of less than 200,000m2.

|

|

55l

|

Land used for a retail

purpose with a total GLA of 10,000m2 to less than 20,000m2

and a land area of 200,000m2 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 10,000m2 to

less than 20,000m2;

(c) has a

land area of 200,000m2 or greater.

|

|

55m

|

Land used for a retail

purpose with a total GLA of 20,000m2 to less than 30,000m2

and a land area of 200,000m2 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 20,000m2 to

less than 30,000m2;

(c) has a

land area of 200,000m2 or greater.

|

|

55n

|

Land used for a retail

purpose with a total GLA of 30,000m2 to less than 45,000m2

and a land area of 200,000m2 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 30,000m2 to

less than 45,000m2;

(c) has a

land area of 200,000m2 or greater.

|

|

55o

|

Land used for a retail

purpose with a total GLA of 45,000m2 or greater and a land area of

200,000m2 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 45,000m2 or

greater;

(c) has a

land area of 200,000m2 or greater.

|

D. That

in accordance with section 257 of the Local Government Act 2009,

Ipswich City Council delegate to the Chief Executive Officer the power to

identify the rating category to which each parcel of rateable land belongs

under section 81(4) and (5), section 82 and any other applicable

provision of Chapter 4 of the Local Government Regulation 2012.

E. That

in accordance with section 94 of the Local Government Act 2009 and

section 80 of the Local Government Regulation 2012, Ipswich City

Council decide to levy differential general rates on rateable land in the local

government area, on the basis stated in Part 2 of the 2020‑2021

Budget in Attachment 2 to the report by the Manager, Finance dated

25 June 2020.

F. That

in accordance with section 74 and section 76 of the Local

Government Regulation 2012, Ipswich City Council decide that the rateable

value of land for the financial year will be the three (3)-year averaged value

of the land, on the basis stated in Part 2 of the 2020‑2021 Budget

in Attachment 2 to the report by the Manager, Finance dated

25 June 2020.

G. That

in accordance with section 80 of the Local Government Regulation 2012,

Ipswich City Council decide that the differential general rates for each rating

category of rateable land in the local government area is that in column 2

of the table below which is stated in Part 2 of the 2020‑2021 Budget

in Attachment 2 to the report by the Manager, Finance dated

25 June 2020.

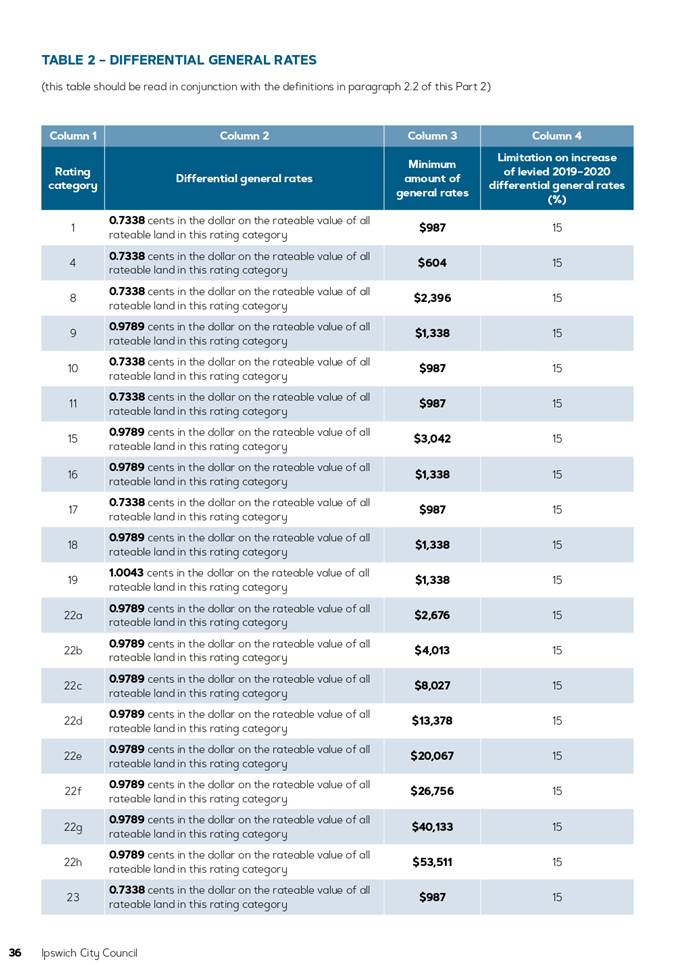

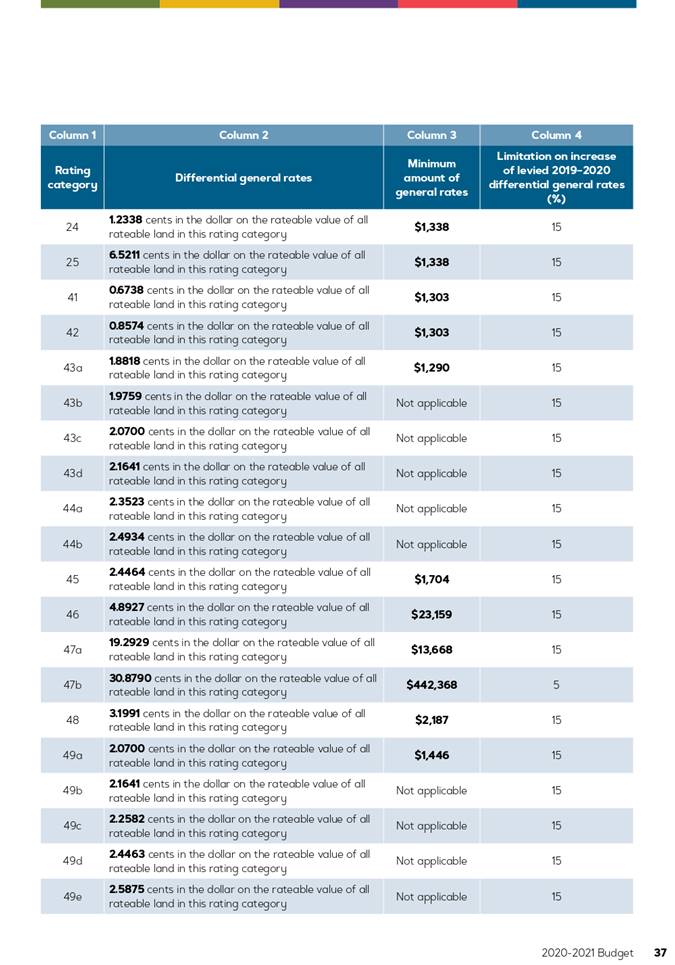

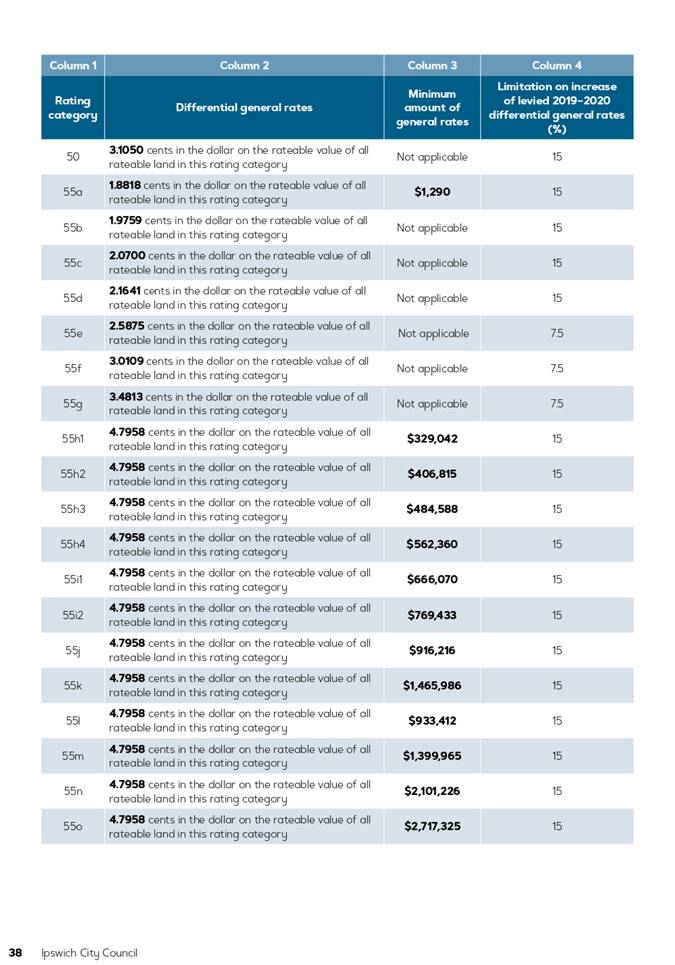

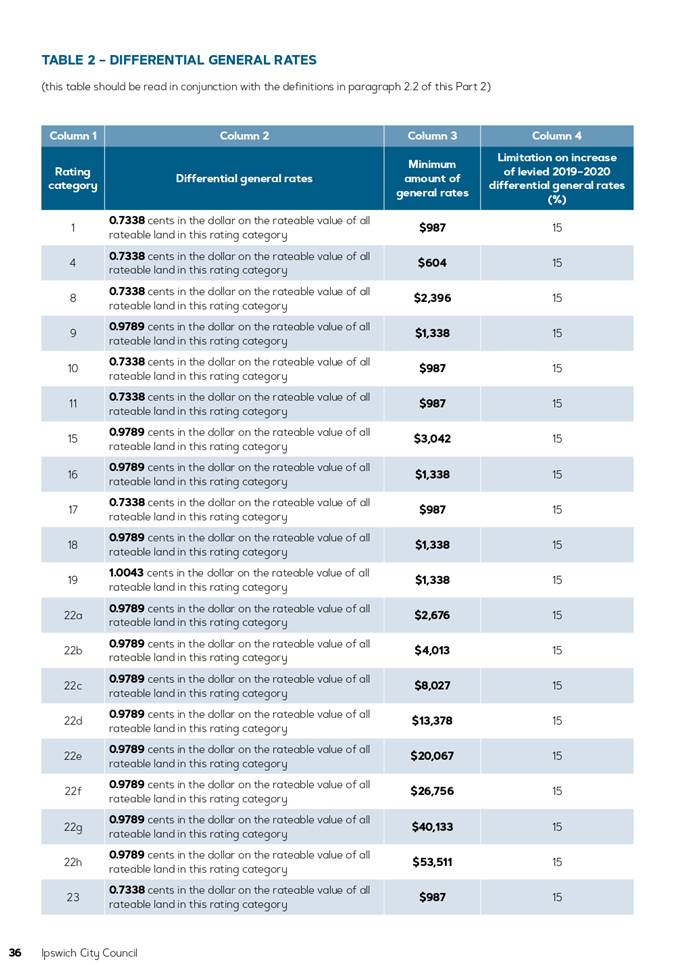

|

Column

1

Rating category

|

Column

2

Differential

general rates

|

Column

3

Minimum

amount of general rates

|

Column

4

Limitation on increase of levied

2019-2020 differential general rates (%)

|

|

1

|

0.7338 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$987

|

15

|

|

4

|

0.7338 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$604

|

15

|

|

8

|

0.7338 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$2,396

|

15

|

|

9

|

0.9789 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$1,338

|

15

|

|

10

|

0.7338 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$987

|

15

|

|

11

|

0.7338 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$987

|

15

|

|

15

|

0.9789 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$3,042

|

15

|

|

16

|

0.9789 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,338

|

15

|

|

17

|

0.7338 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$987

|

15

|

|

18

|

0.9789 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$1,338

|

15

|

|

19

|

1.0043 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,338

|

15

|

|

22a

|

0.9789 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$2,676

|

15

|

|

22b

|

0.9789 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$4,013

|

15

|

|

22c

|

0.9789 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$8,027

|

15

|

|

22d

|

0.9789 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$13,378

|

15

|

|

22e

|

0.9789 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$20,067

|

15

|

|

22f

|

0.9789 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$26,756

|

15

|

|

22g

|

0.9789 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$40,133

|

15

|

|

22h

|

0.9789 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$53,511

|

15

|

|

23

|

0.7338 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$987

|

15

|

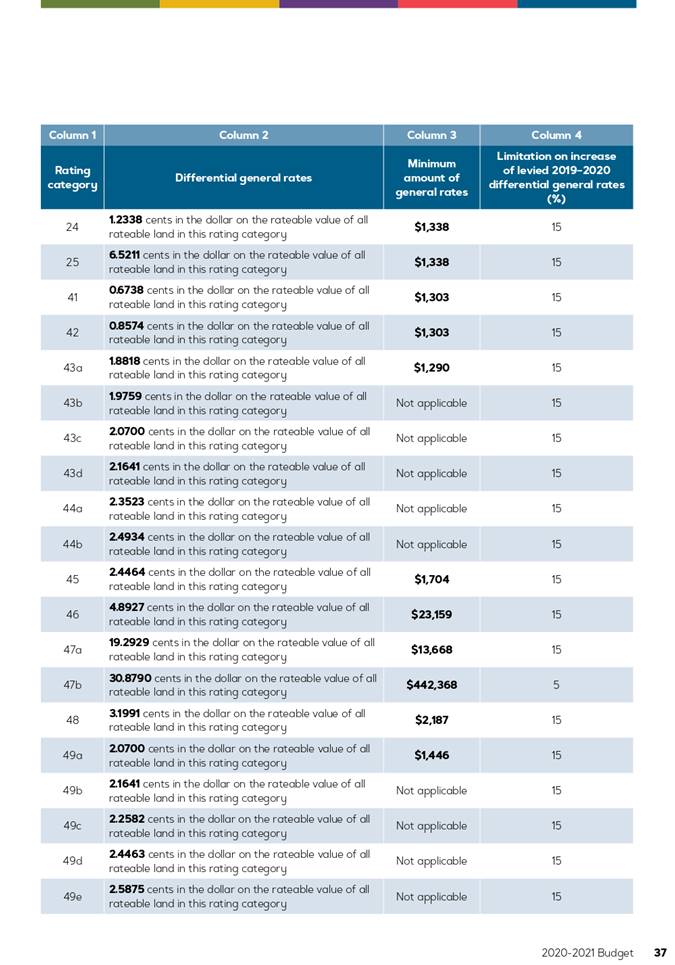

|

24

|

1.2338 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,338

|

15

|

|

25

|

6.5211 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,338

|

15

|

|

41

|

0.6738 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,303

|

15

|

|

42

|

0.8574 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,303

|

15

|

|

43a

|

1.8818cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,290

|

15

|

|

43b

|

1.9759 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

15

|

|

43c

|

2.0700 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

15

|

|

43d

|

2.1641 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

15

|

|

44a

|

2.3523 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

15

|

|

44b

|

2.4934 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

15

|

|

45

|

2.4464 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,704

|

15

|

|

46

|

4.8927 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$23,159

|

15

|

|

47a

|

19.2929 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$13,668

|

15

|

|

47b

|

30.8790 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$442,368

|

5

|

|

48

|

3.1991 cents in the dollar on the rateable

value of all rateable land in this rating category

|

$2,187

|

15

|

|

49a

|

2.0700 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,446

|

15

|

|

49b

|

2.1641 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

15

|

|

49c

|

2.2582 cents in the dollar on the rateable

value of all rateable land in this rating category

|

Not applicable

|

15

|

|

49d

|

2.4463 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

15

|

|

49e

|

2.5875 cents in the dollar on the rateable

value of all rateable land in this rating category

|

Not applicable

|

15

|

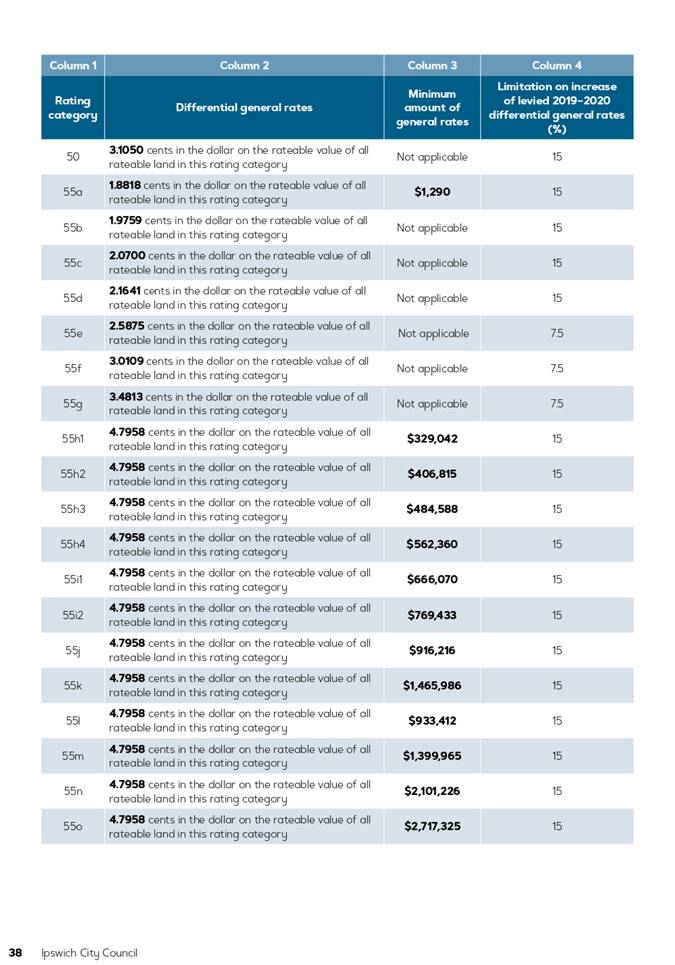

|

50

|

3.1050 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

15

|

|

55a

|

1.8818 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$1,290

|

15

|

|

55b

|

1.9759 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

15

|

|

55c

|

2.0700 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

15

|

|

55d

|

2.1641 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

15

|

|

55e

|

2.5875 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

7.5

|

|

55f

|

3.0109 cents in the dollar on the rateable value of all rateable

land in this rating category

|

Not applicable

|

7.5

|

|

55g

|

3.4813 cents in the dollar on the rateable value of all rateable

land in this rating category

|

Not applicable

|

7.5

|

|

55h1

|

4.7958 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$329,042

|

15

|

|

55h2

|

4.7958 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$406,815

|

15

|

|

55h3

|

4.7958 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$484,588

|

15

|

|

55h4

|

4.7958 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$562,360

|

15

|

|

55i1

|

4.7958 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$666,070

|

15

|

|

55i2

|

4.7958 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$769,433

|

15

|

|

55j

|

4.7958 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$916,216

|

15

|

|

55k

|

4.7958 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$1,465,986

|

15

|

|

55l

|

4.7958 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$933,412

|

15

|

|

55m

|

4.7958 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$1,399,965

|

15

|

|

55n

|

4.7958 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$2,101,226

|

15

|

|

55o

|

4.7958 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$2,717,325

|

15

|

H. That

in accordance with section 77 of the Local Government Regulation 2012,

Ipswich City Council decide that the minimum amount of general rates for

certain rating categories of rateable land in the local government area is to

be fixed to that amount in column 3 of the table in Resolution G, on

the basis stated in Part 2 of the 2020‑2021 Budget in

Attachment 2 to the report by Manager, Finance dated

25 June 2020.

I. That

in accordance with section 116 of the Local Government Regulation 2012,

Ipswich City Council decide to limit the increase in the differential general

rates for certain rating categories of rateable land in the local government

area to not more than the differential general rates for the last financial

year increased by the percentage stated in column 4 of the table in

Resolution G, on the basis stated in Part 2 of the 2020‑2021

Budget in Attachment 2 to the report by the Manager, Finance dated

25 June 2020.

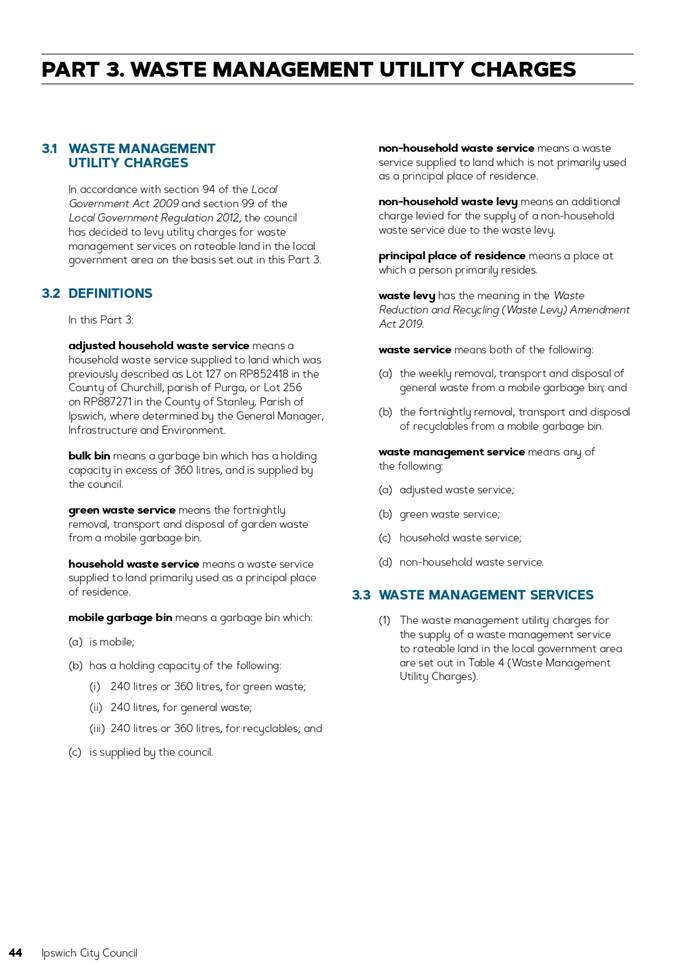

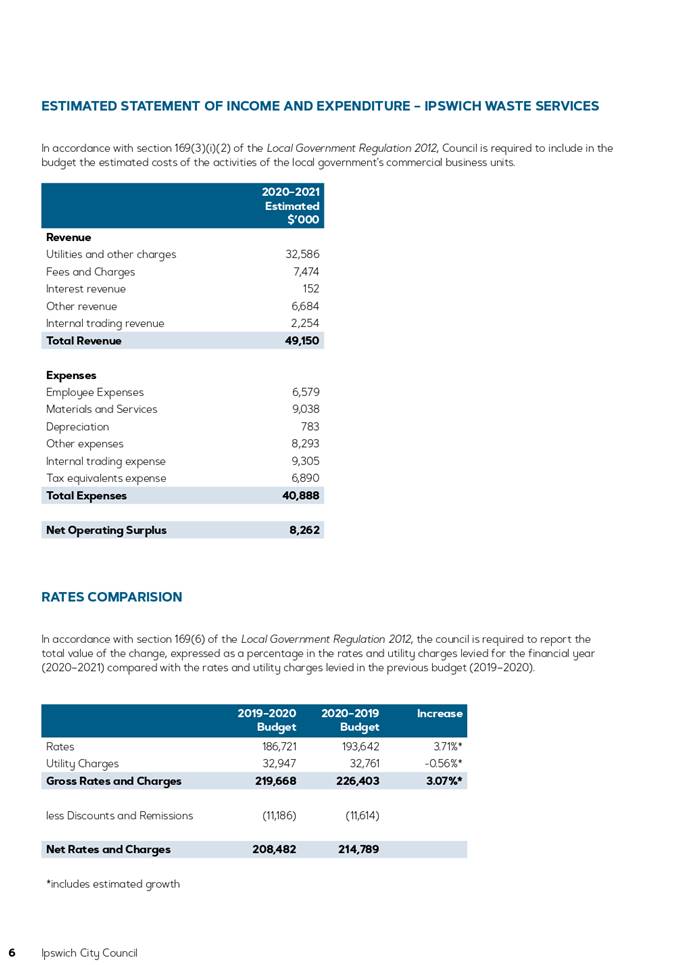

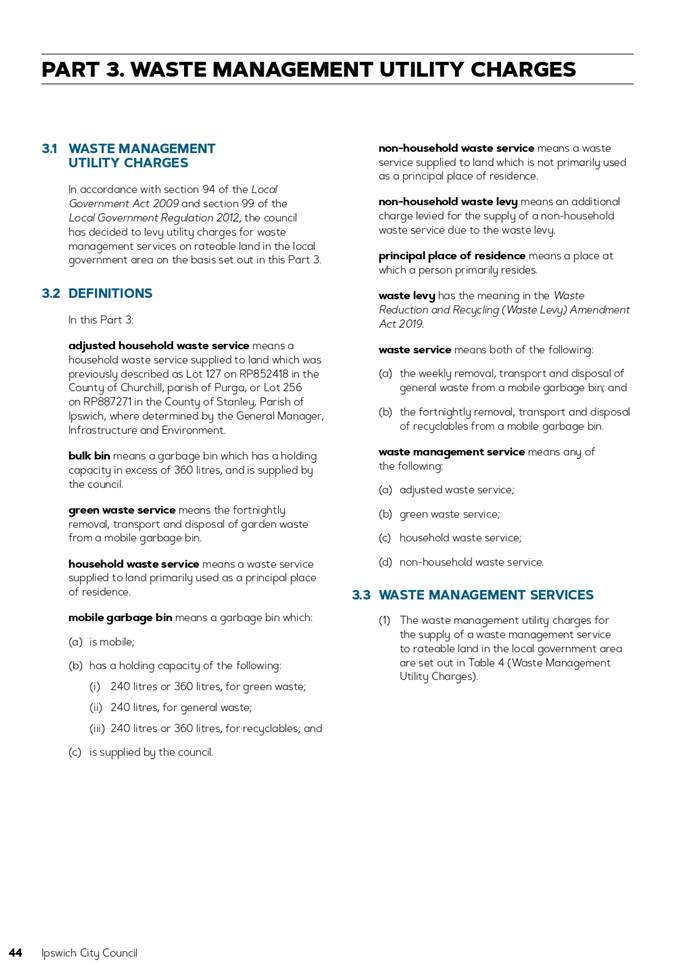

J. That

in accordance with section 94 of the Local Government Act 2009 and

section 99 of the Local Government Regulation 2012, Ipswich City

Council decide to levy utility charges for waste management services on

rateable land in the local government area that are in column 2 of the

table below, on the basis stated in Part 3 of the 2020‑2021 Budget

in Attachment 2 to the report by the Manager, Finance dated

25 June 2020.

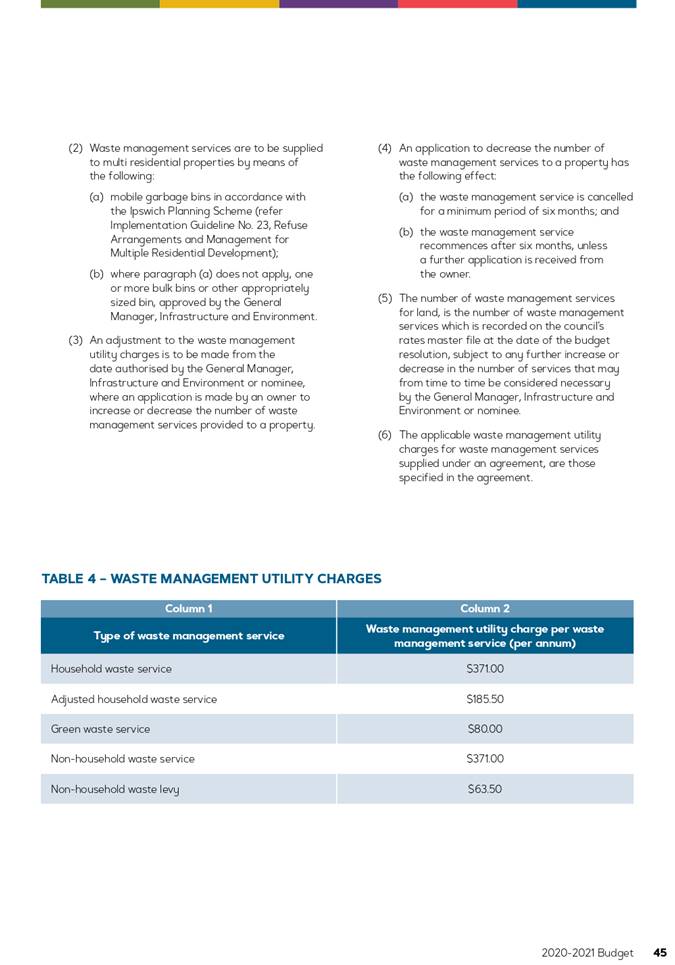

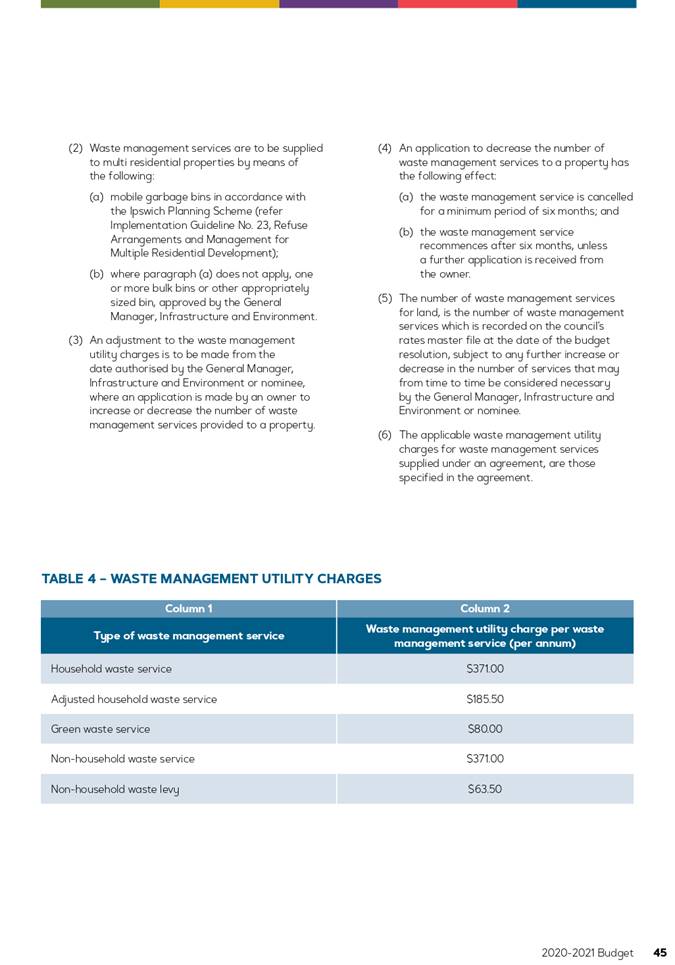

|

Column 1

Type of waste management

service

|

Column 2

Waste management utility

charge per waste management service (per annum)

|

|

Household waste service

|

$371.00

|

|

Adjusted household waste

service

|

$185.50

|

|

Green waste service

|

$80.00

|

|

Non-household waste service

|

$371.00

|

|

Non-household waste levy

|

$63.50

|

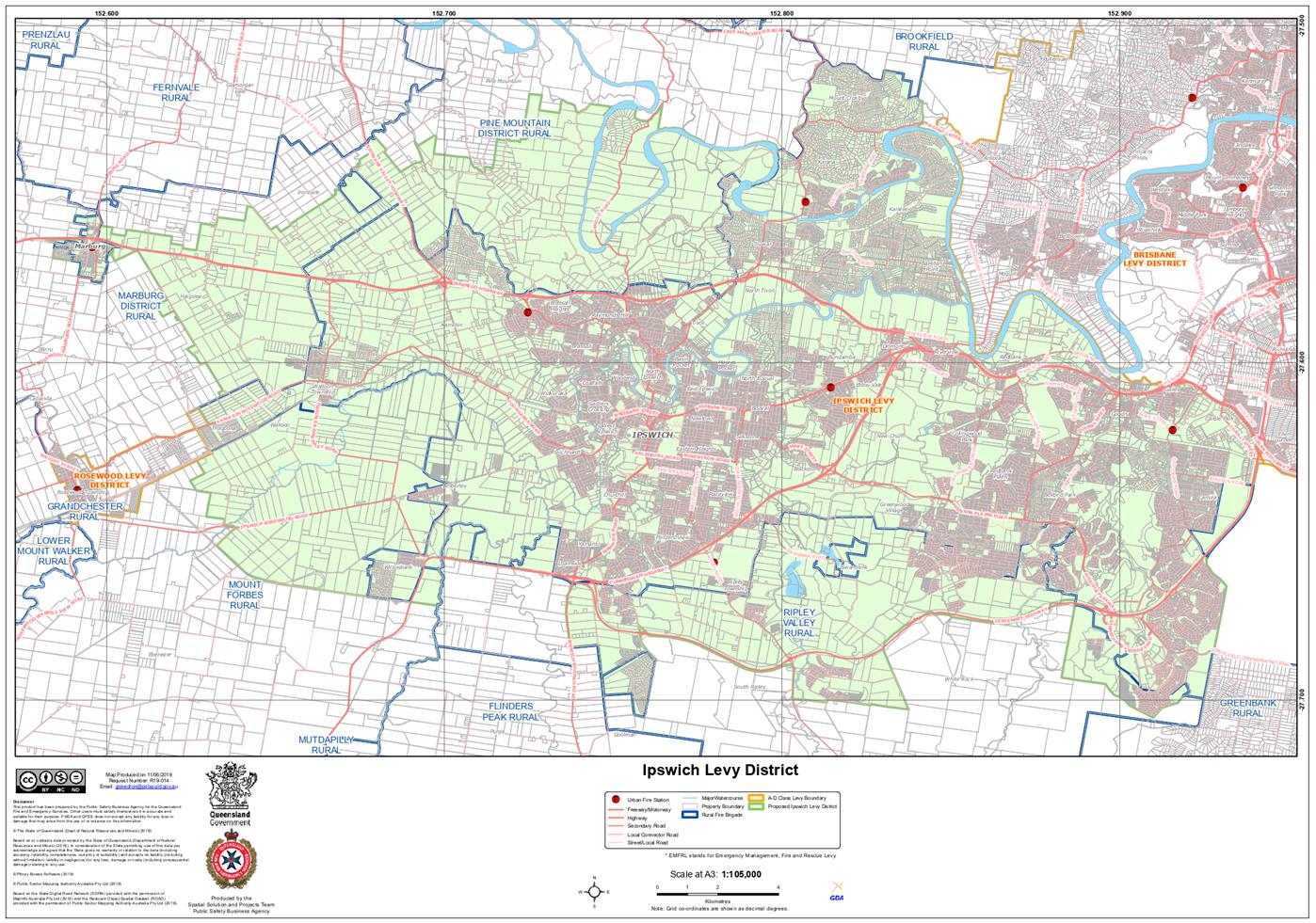

K. That

in accordance with section 94 of the Local Government Act 2009,

section 94 of the Local Government Regulation 2012 and

section 128A of the Fire and Emergency Services Act 1990, Ipswich

City Council decide to levy a special charge of $39 per annum for the Rural

Fire Brigades Services for the services, facilities or activities identified in

the Rural Fire Resources Levy Special Charge Overall Plan, on rateable land in

the local government area that specially benefits from the Rural Fire Brigades

Services, on the basis stated in Part 4 of the 2020‑2021 Budget in

Attachment 2 to the report by the Manager, Finance dated

25 June 2020.

L. That

in accordance with section 94 of the Local Government Act 2009, section 103

of the Local Government Regulation 2012 and section 128A of the Fire

and Emergency Services Act 1990, Ipswich City Council decide to levy a

separate charge of $3 per annum for the Rural Fire Brigades Services on

rateable land in the local government area, on the basis stated in Part 5

of the 2020‑2021 Budget in Attachment 2 to the report by the

Manager, Finance dated 25 June 2020.

M. That

in accordance with section 94 of the Local Government Act 2009 and

section 103 of the Local Government Regulation 2012, Ipswich City

Council decide to levy a separate charge of $46 per annum for the Ipswich

Enviroplan on rateable land in the local government area, on the basis stated

in Part 6 of the 2020‑2021 Budget in Attachment 2 to the report

by the Manager, Finance dated 25 June 2020.

N. That

in accordance with section 107 of the Local Government Regulation 2012

and section 114 of the Fire and Emergency Services Act 1990,

Ipswich City Council decide that rates and charges (including the Emergency

Management Levy) will be levied quarterly on the basis stated in Part 7 of

the 2020‑2021 Budget in Attachment 2 to the report by the Manager,

Finance dated 25 June 2020.

O. That

Ipswich City Council decide on the basis stated in Part 7 of the 2020‑2021

Budget in Attachment 2 to the report by the Manager, Finance dated

25 June 2020, the following:

(a) the

period within which rates and charges (including the Emergency Management Levy

under section 115 of the Fire and Emergency Services Act 1990) must

be paid in accordance with section 118 of the Local Government

Regulation 2012;

(b) to

allow ratepayers to pay rates and charges (including the Emergency Management

Levy) by instalments in accordance with section 129 of the Local

Government Regulation 2012;

(c) to

allow a discount for payment of rates and charges before the end of a period

that ends on or before the due date for payment in accordance with

section 130 of the Local Government Regulation 2012.

P. That

in accordance with section 133 of the Local Government Regulation 2012,

Ipswich City Council decide that interest is payable on overdue rates and

charges, at an annual rate of 8.53%, on the basis stated in Part 8 of the

2020‑2021 Budget in Attachment 2 to the report by the Manager,

Finance dated 25 June 2020.

Q. That

in accordance with Chapter 4, Part 10 of the Local Government

Regulation 2012, Ipswich City Council decide to grant a concession for

rates and charges to an eligible pensioner who owns and occupies rateable land,

on the basis stated in Part 9 of the 2020‑2021 Budget in

Attachment 2 to the report by the Manager, Finance dated

25 June 2020.

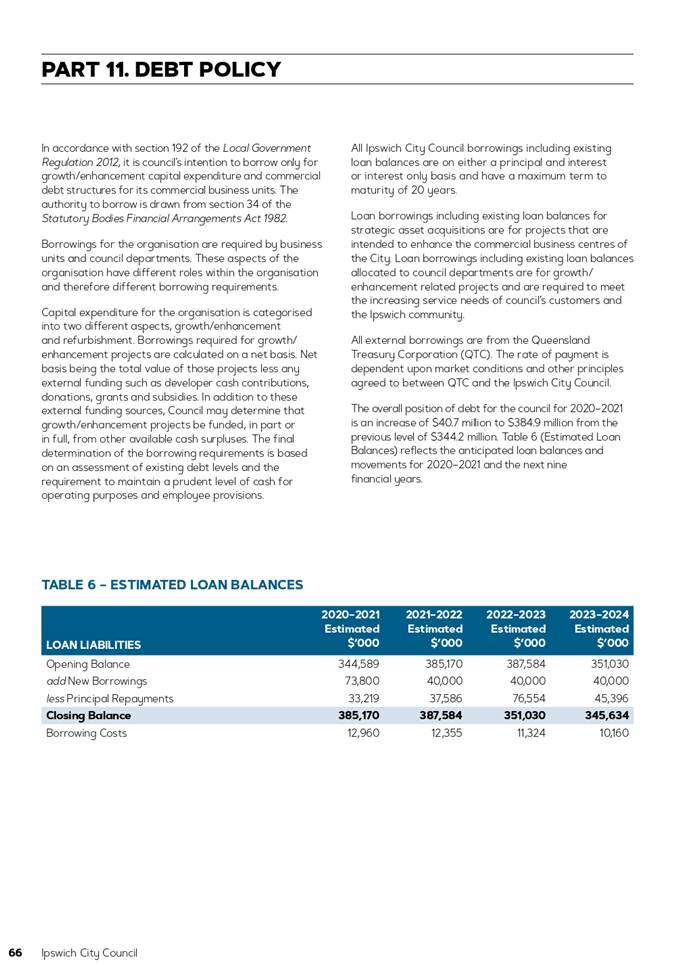

R. That

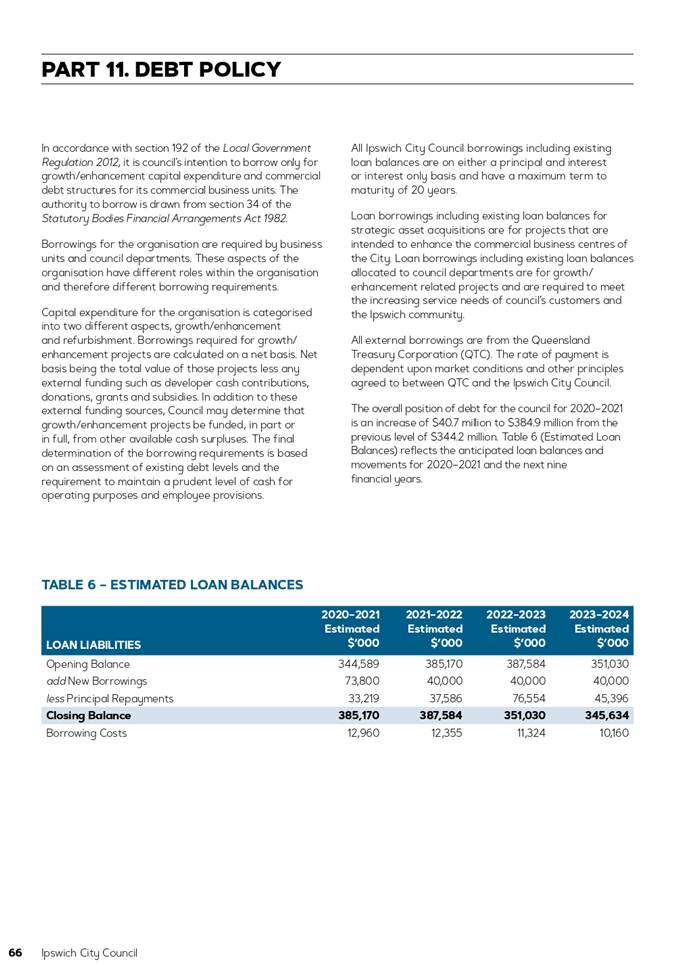

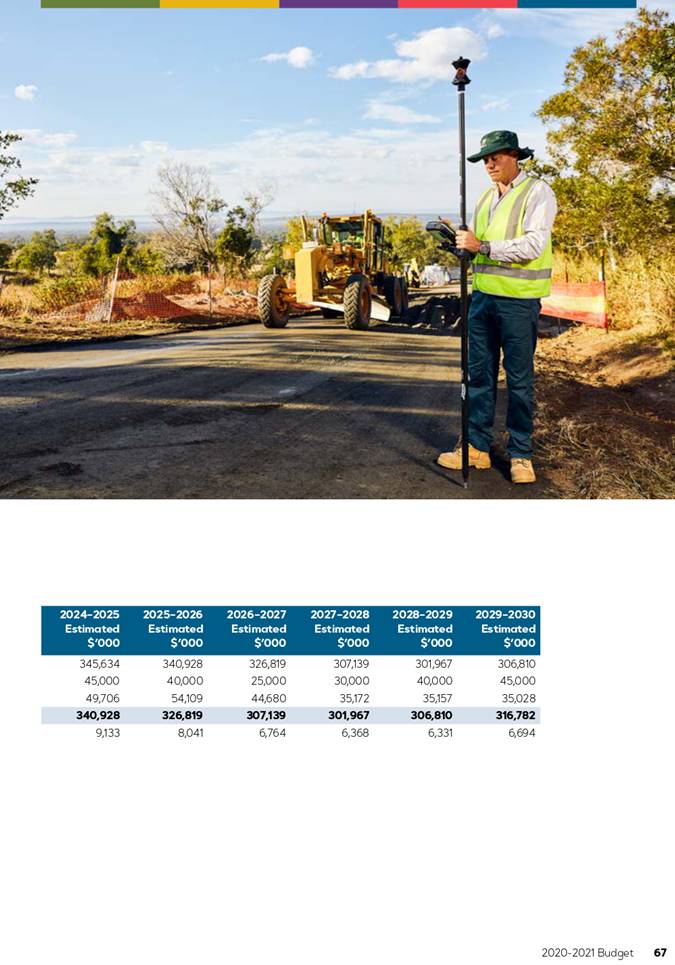

in accordance with section 192 of the Local Government Regulation 2012,

Ipswich City Council adopt the Debt Policy for 2020-2021 which is stated in

Part 11 of the 2020‑2021 Budget in Attachment 2 to the report

by the Manager, Finance dated 25 June 2020.

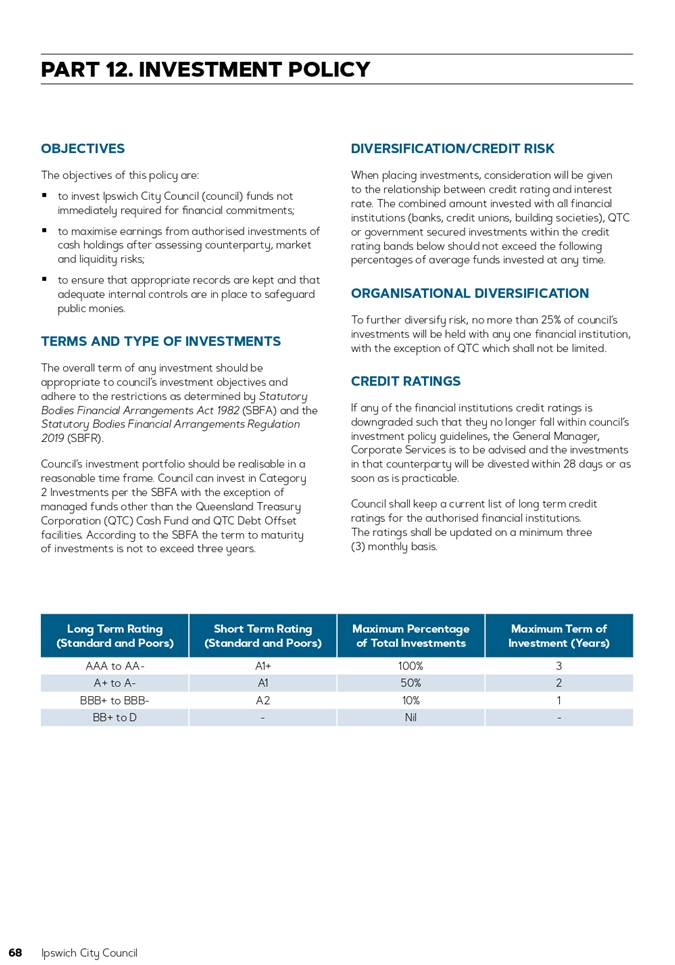

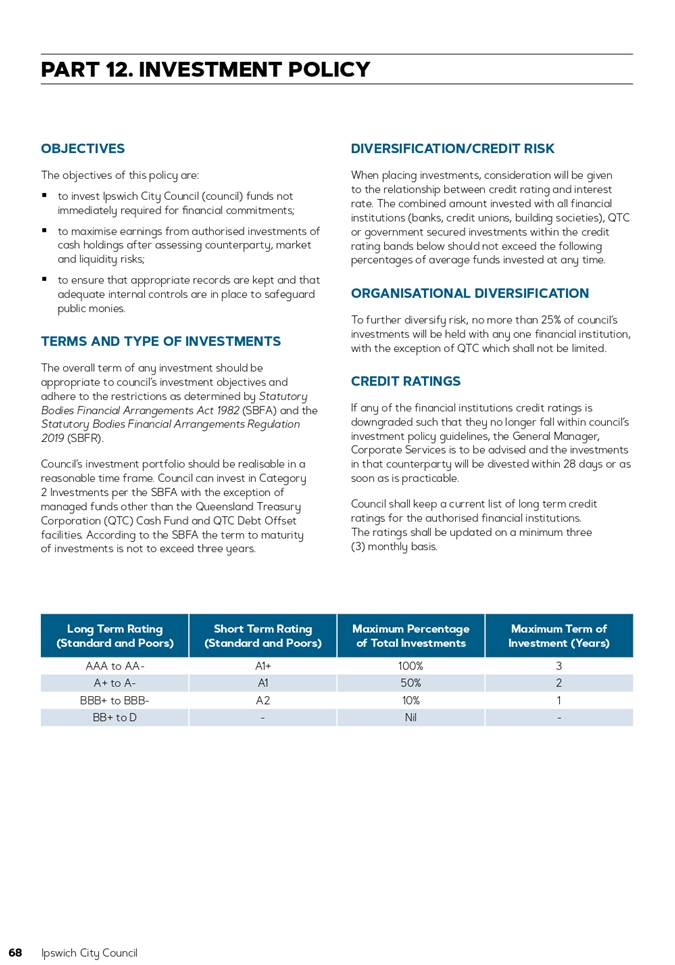

S. That

in accordance with section 191 of the Local Government Regulation 2012,

Ipswich City Council adopt the Investment Policy for 2020‑2021 which is

stated in Part 12 of the 2020‑2021 Budget in Attachment 2 to

the report by the Manager, Finance dated 25 June 2020.

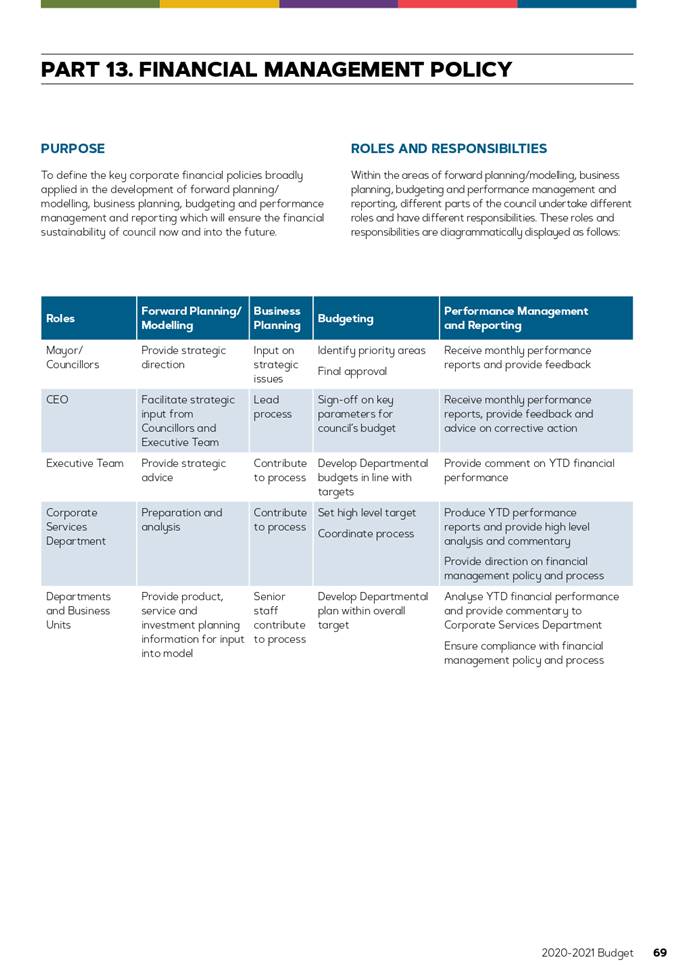

T. That

Ipswich City Council adopt the Financial Management Policy for 2020‑2021

which is stated in Part 13 of the 2020‑2021 Budget in

Attachment 2 to the report by the Manager, Finance dated

25 June 2020.

U. That

in accordance with section 104 of the Local Government Act 2009 and

section 170 of the Local Government Regulation 2012, Ipswich City

Council consider and adopt the 2020‑2021 Budget, which is Attachment 2

to the report by the Manager, Finance dated 25 June 2020, that

includes the following:

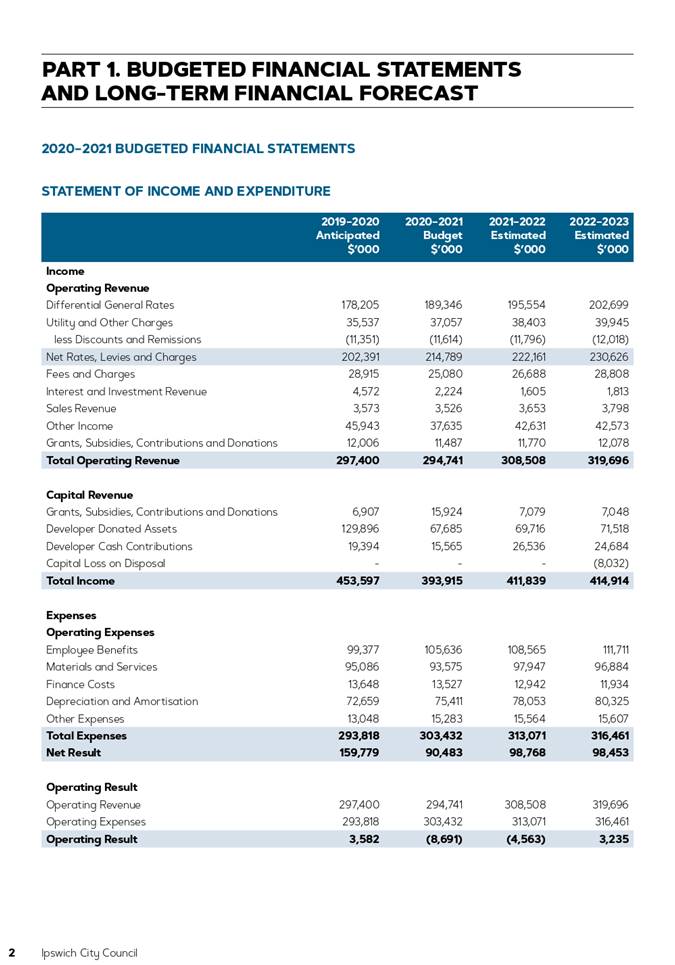

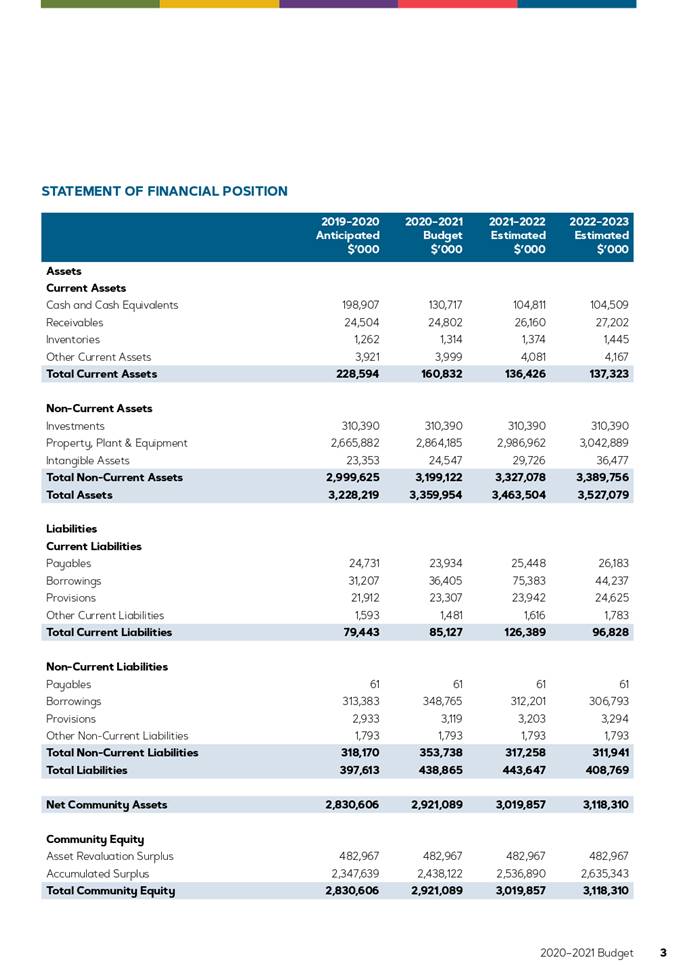

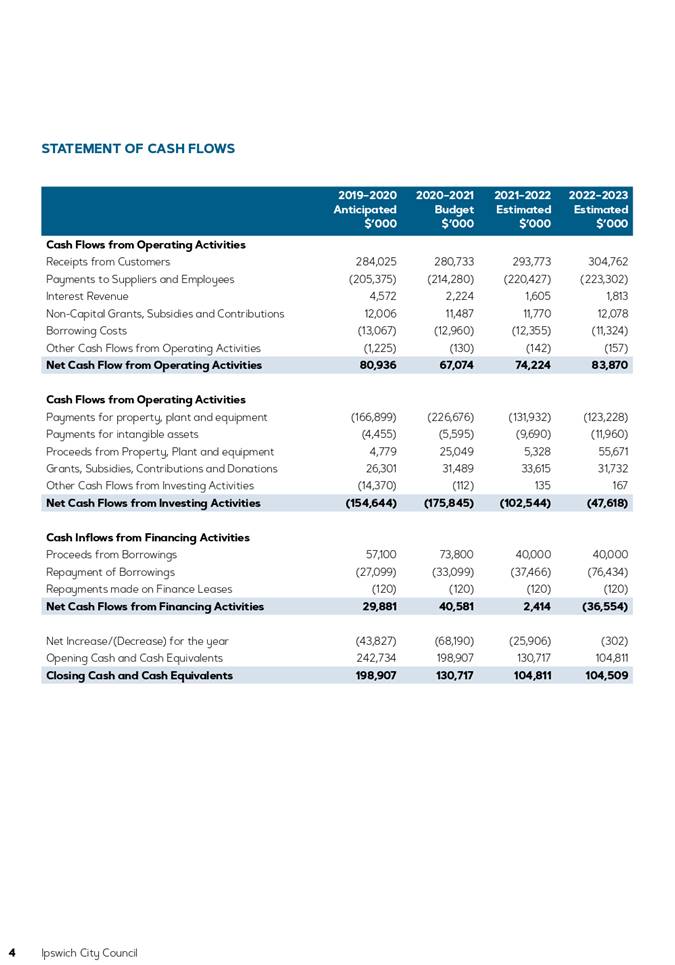

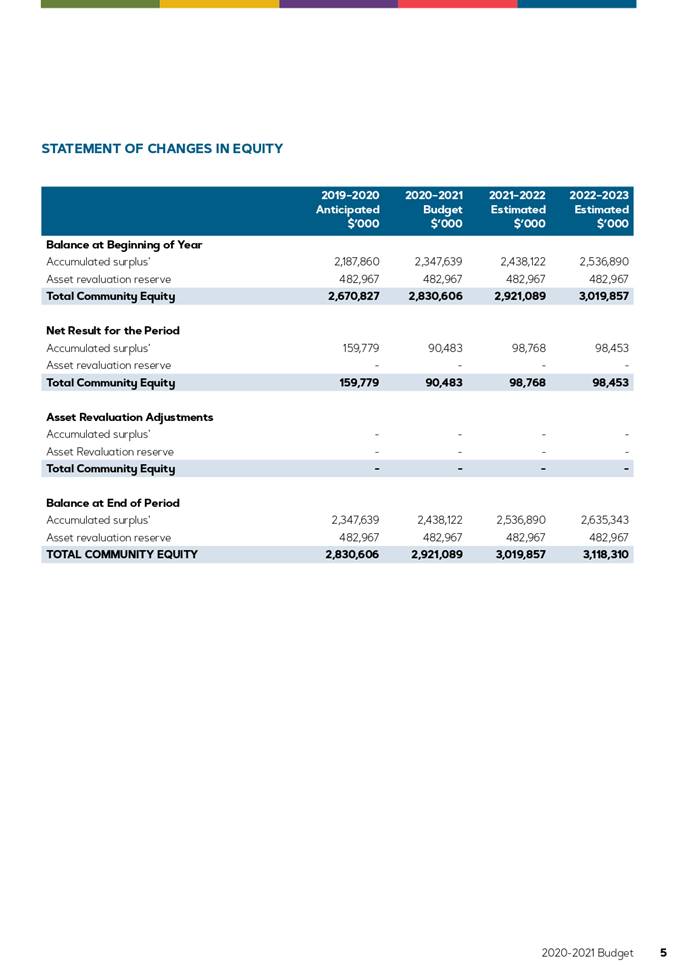

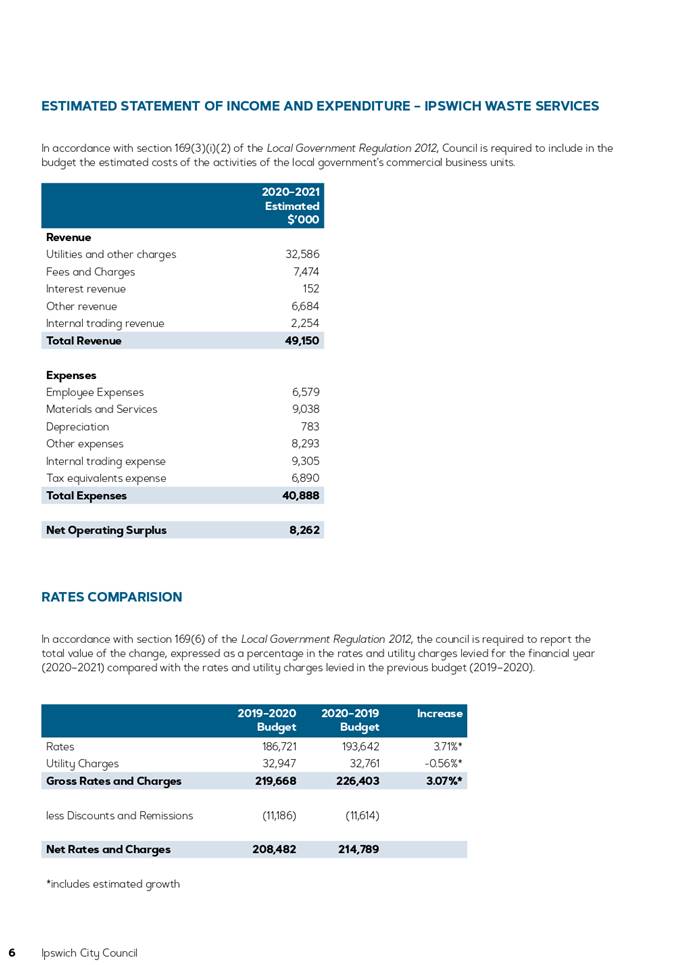

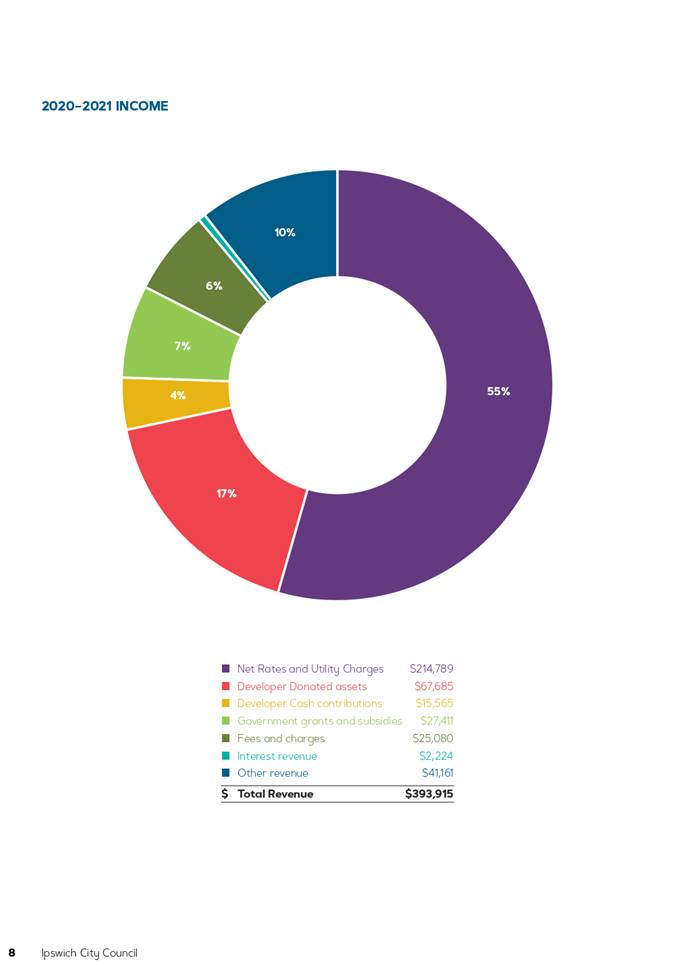

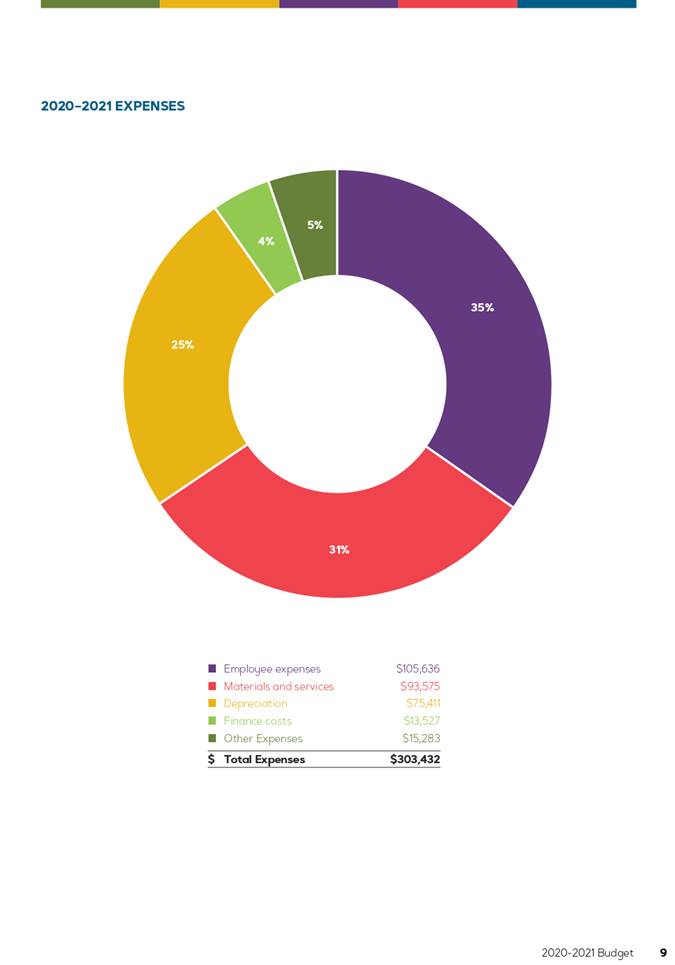

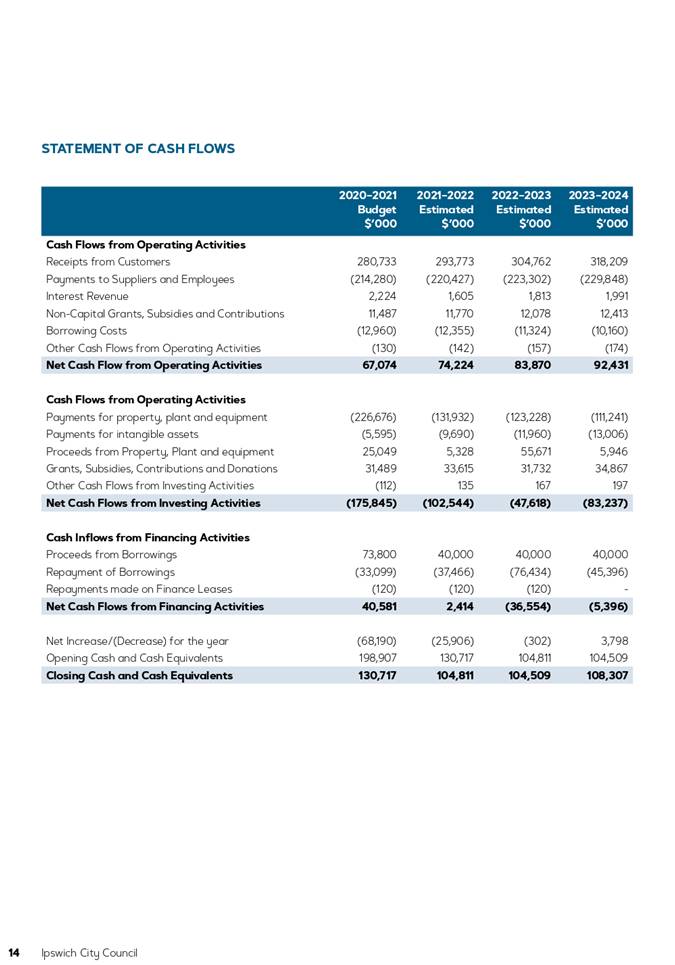

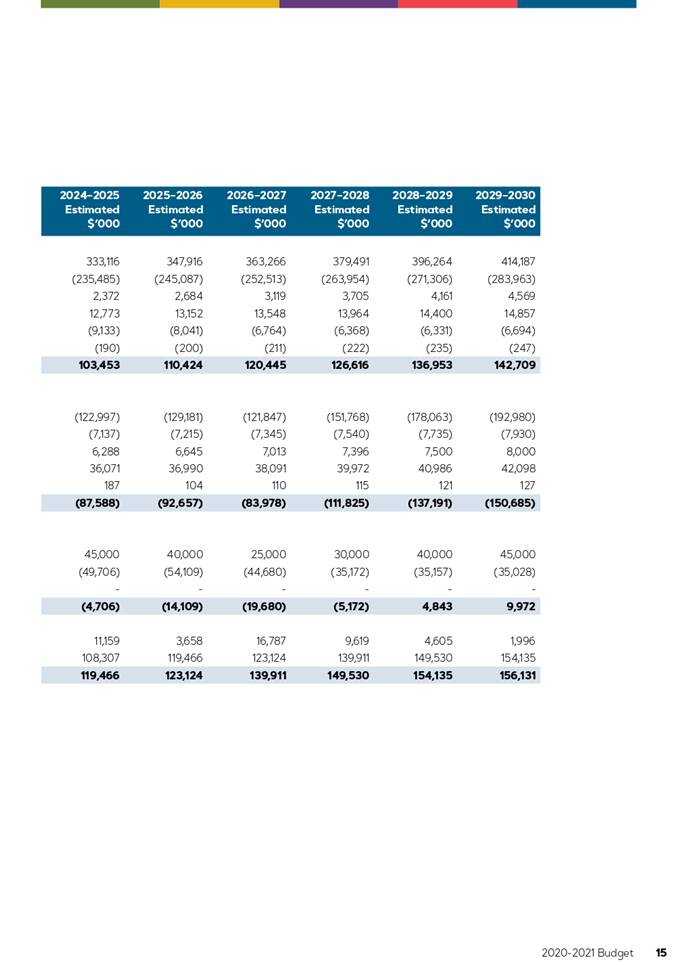

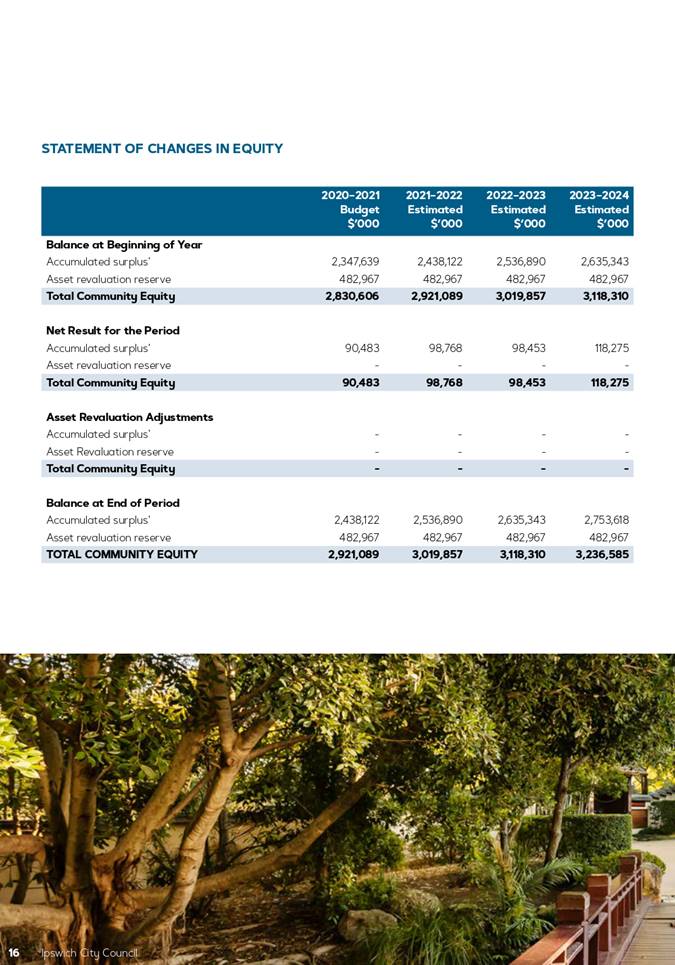

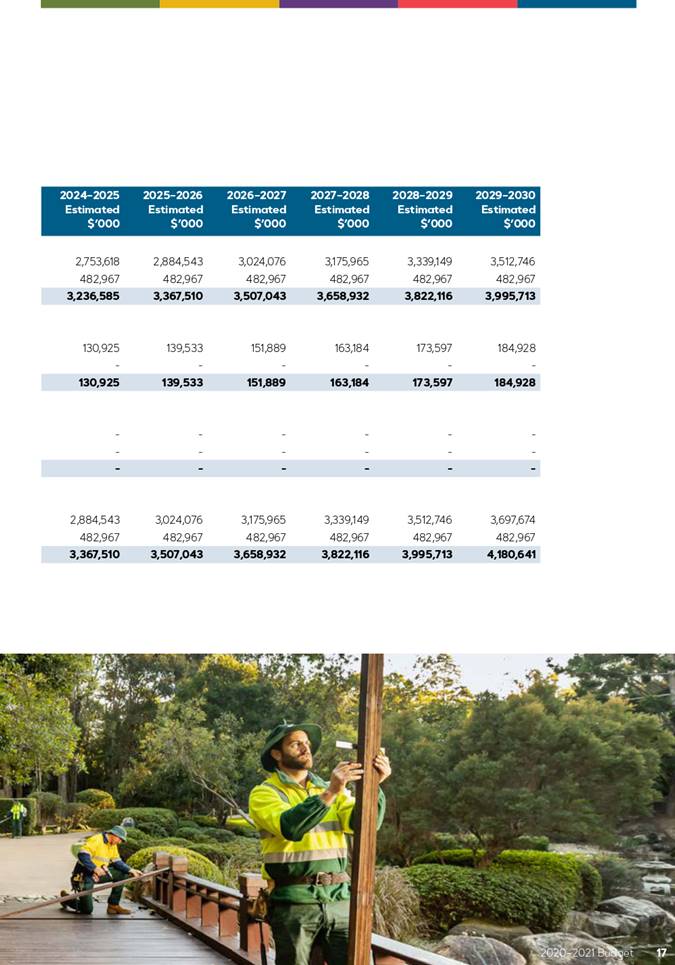

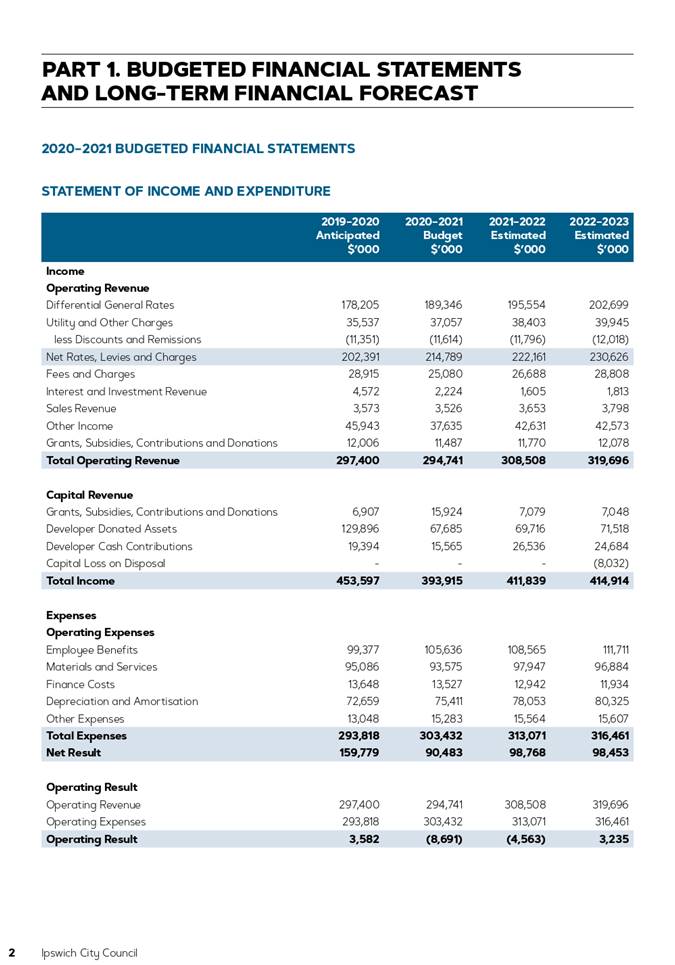

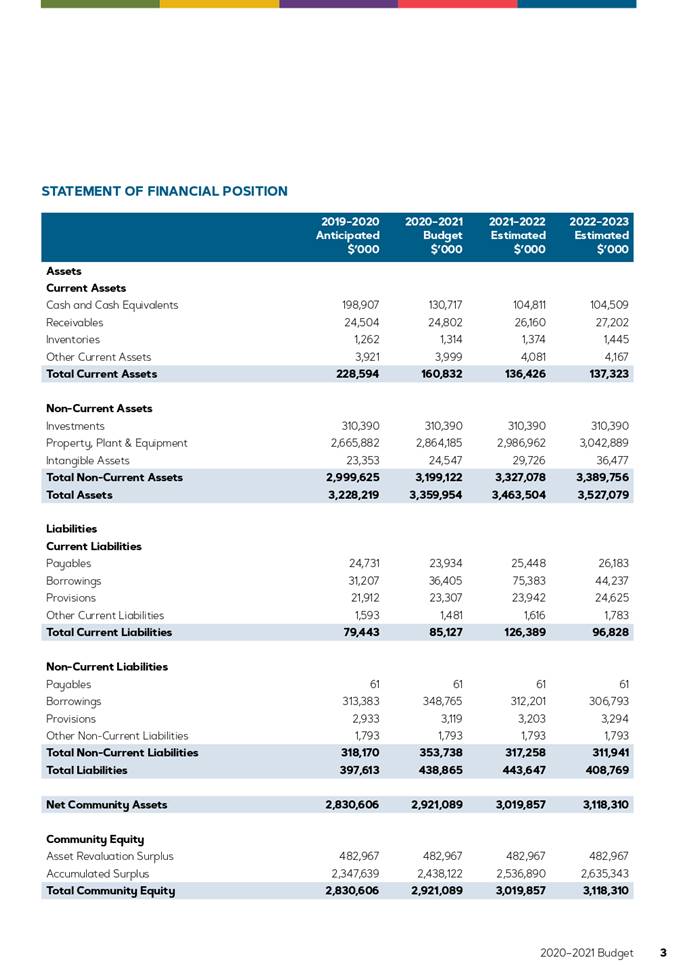

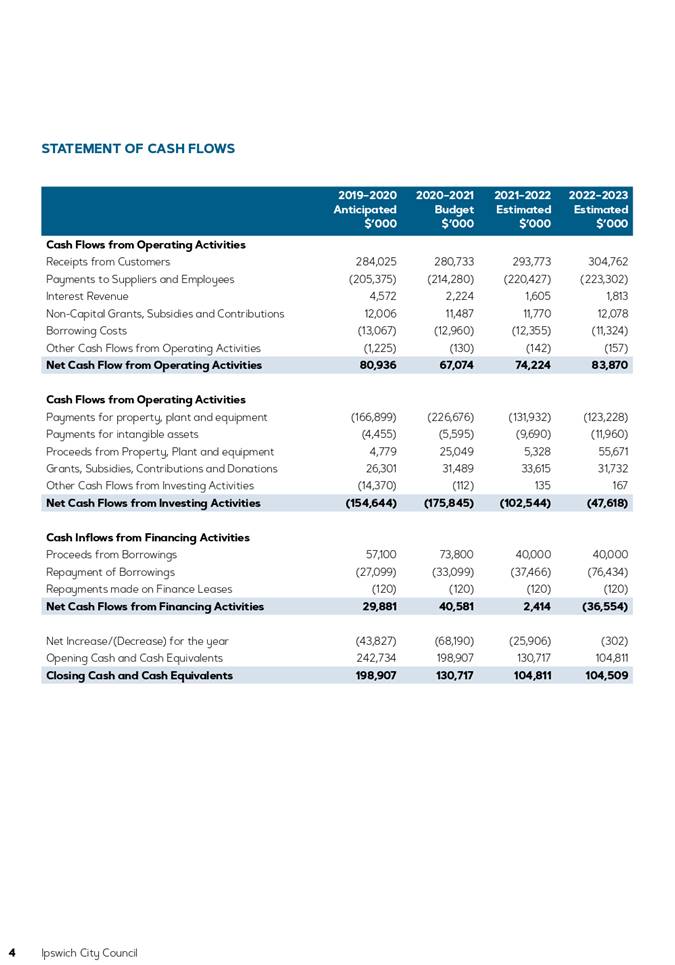

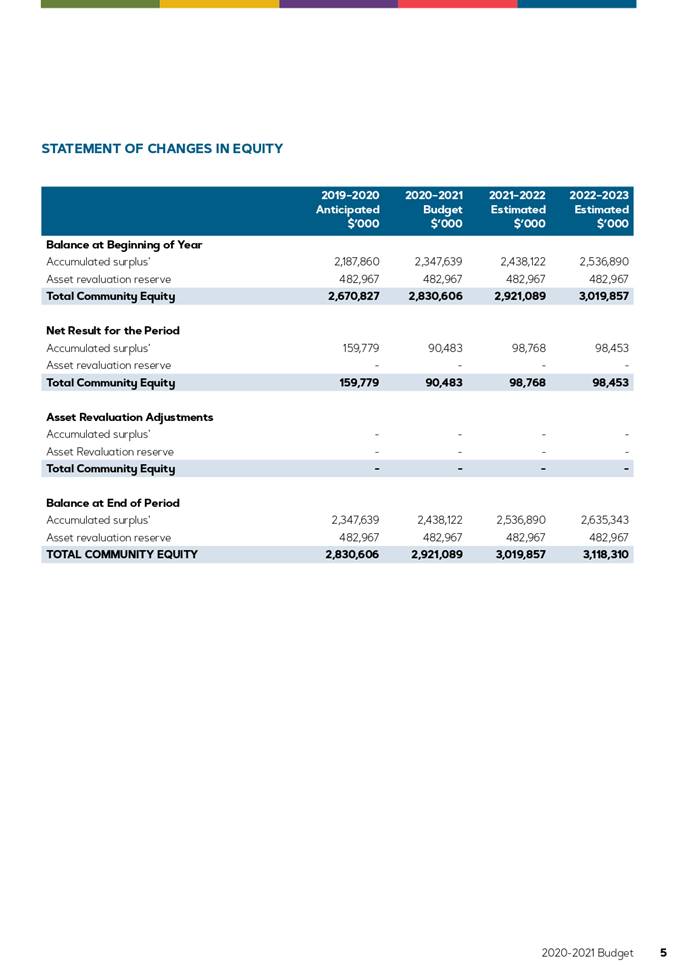

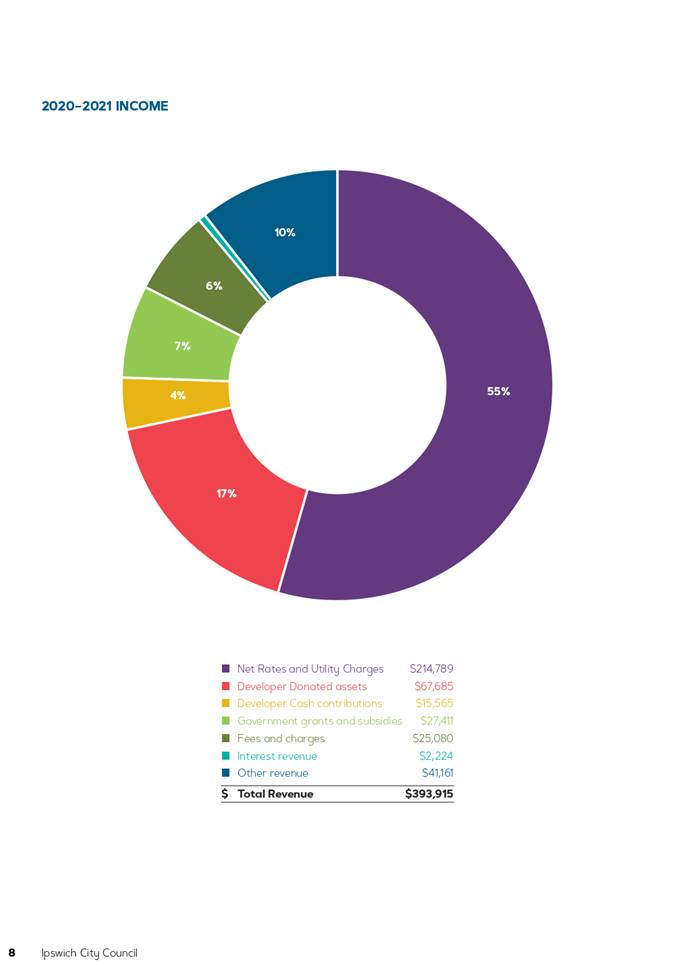

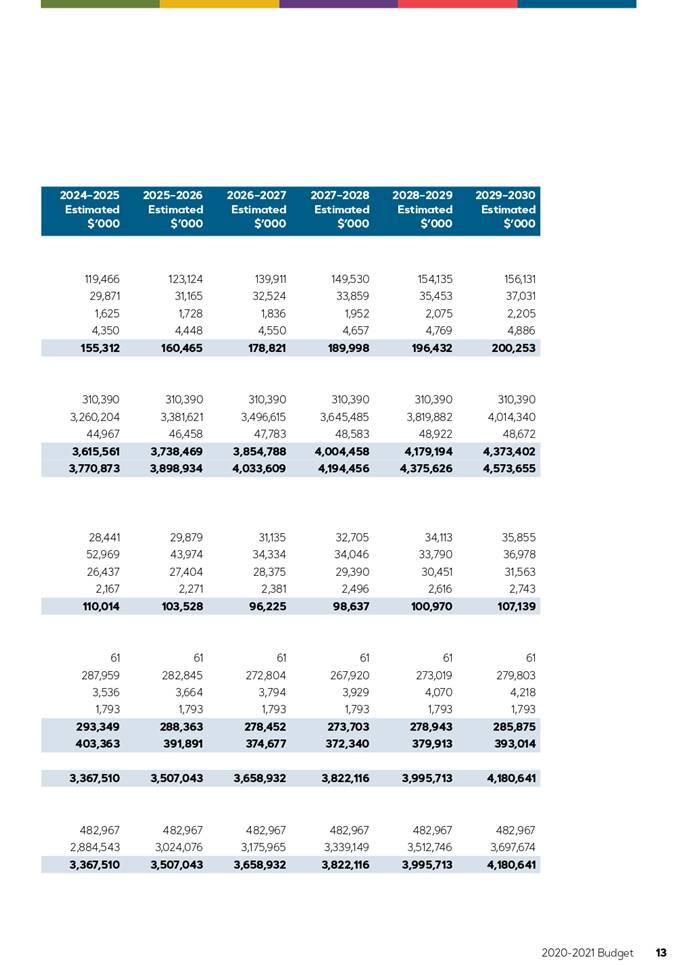

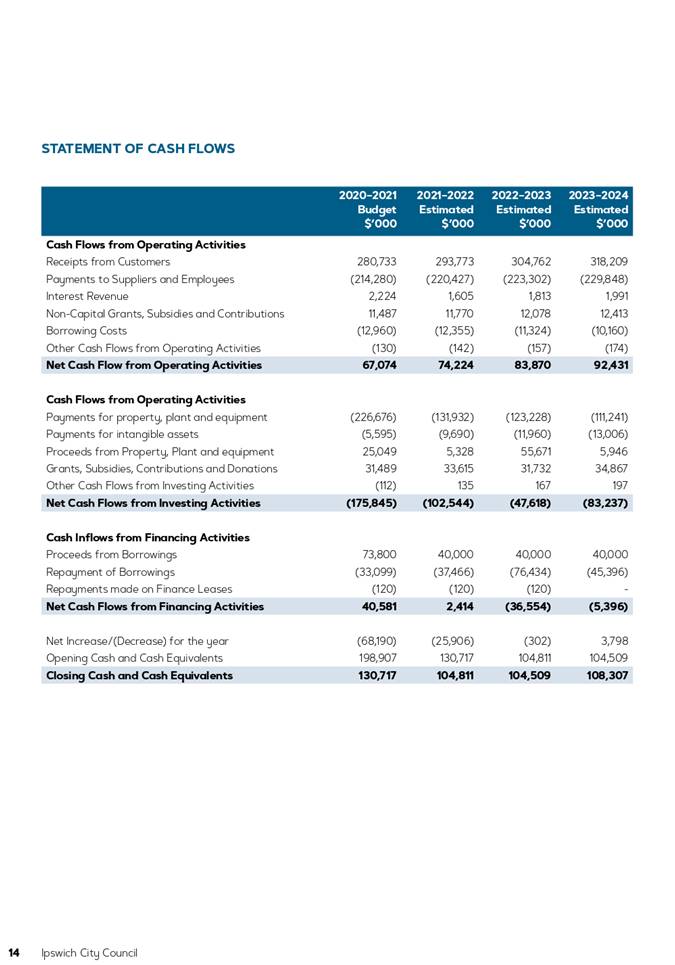

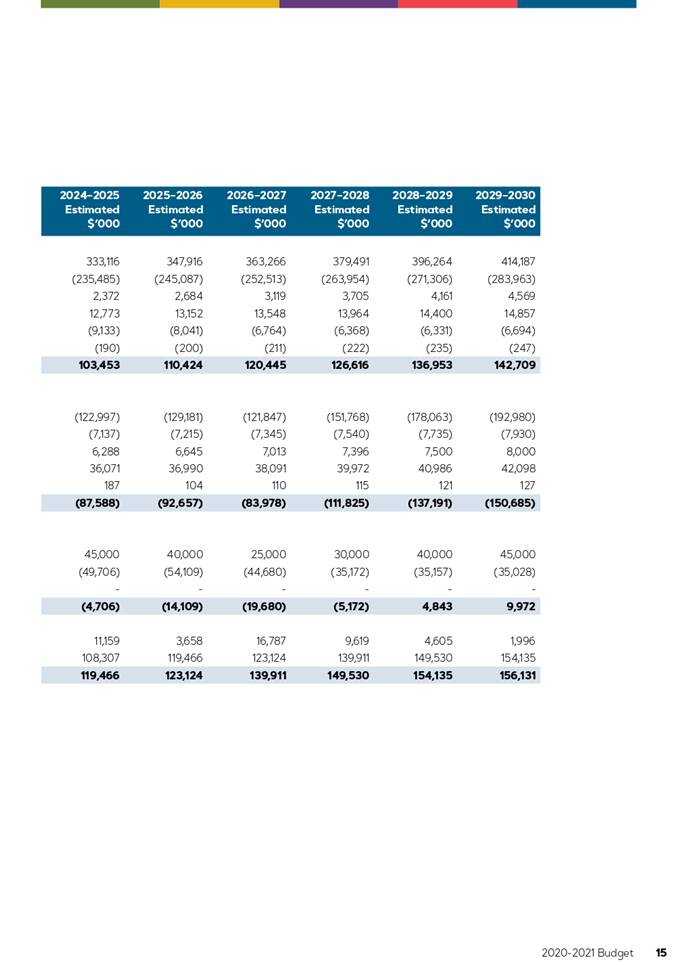

(a) the

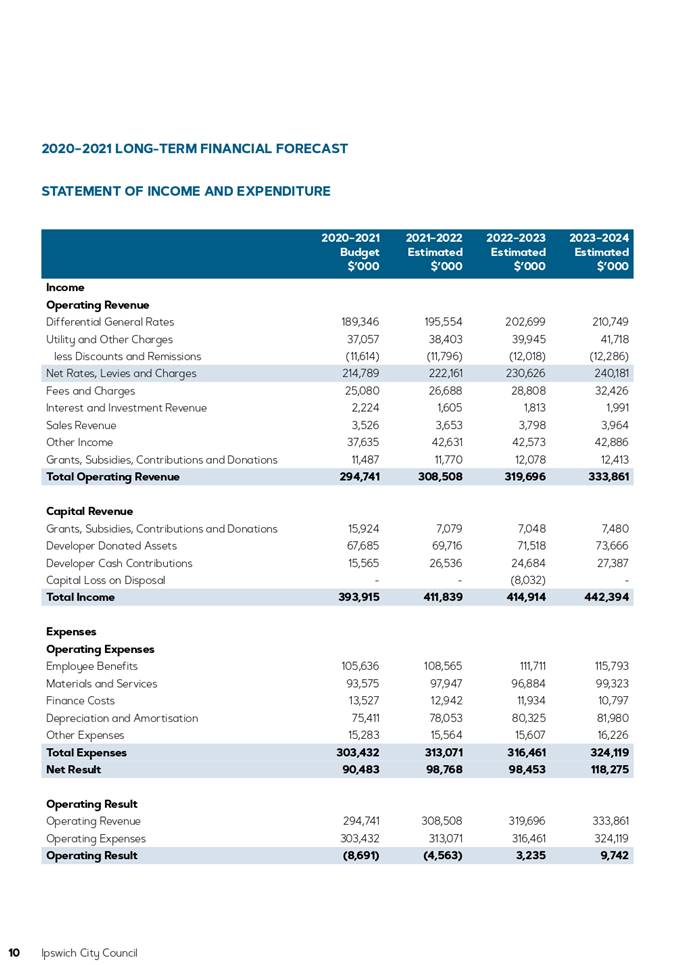

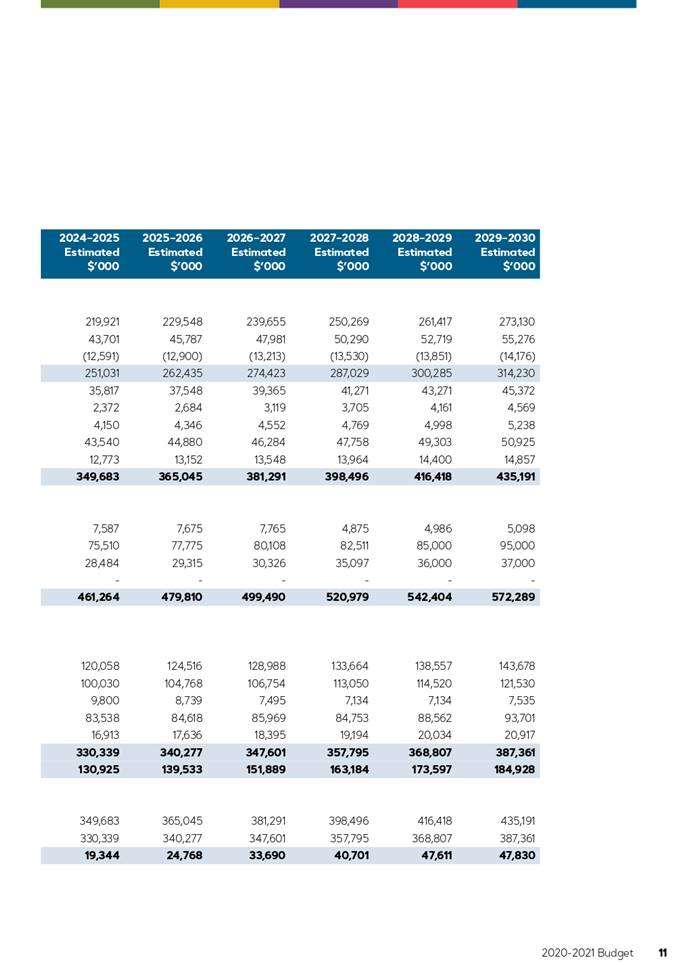

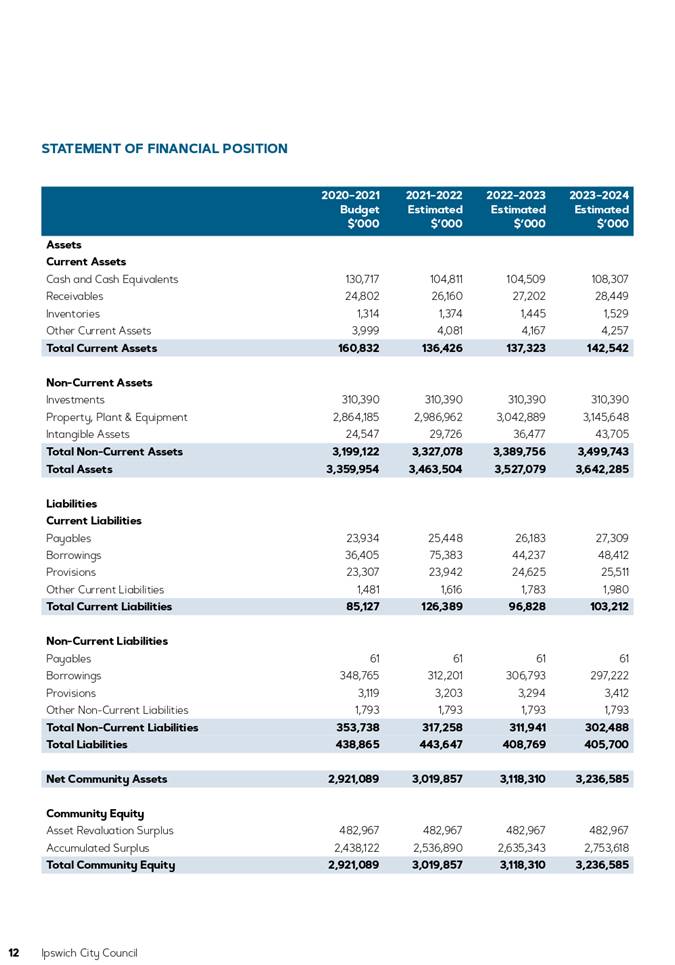

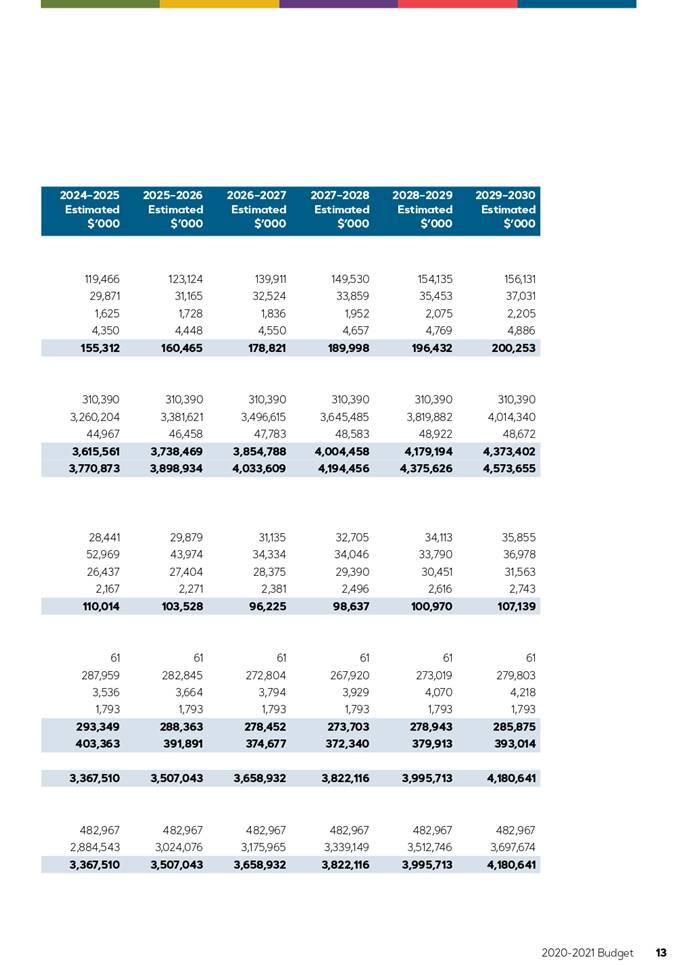

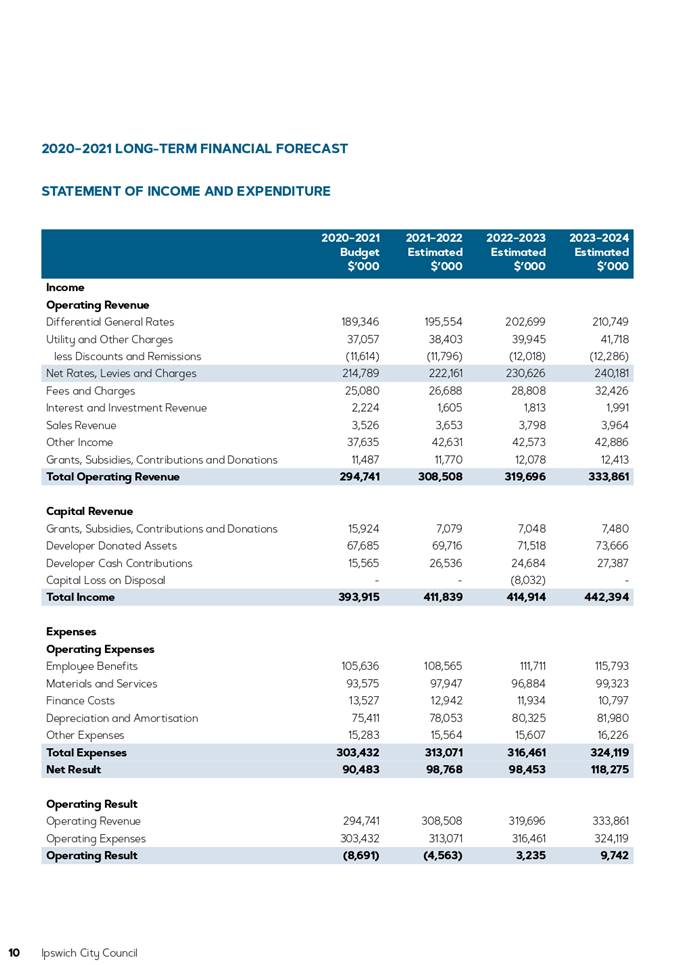

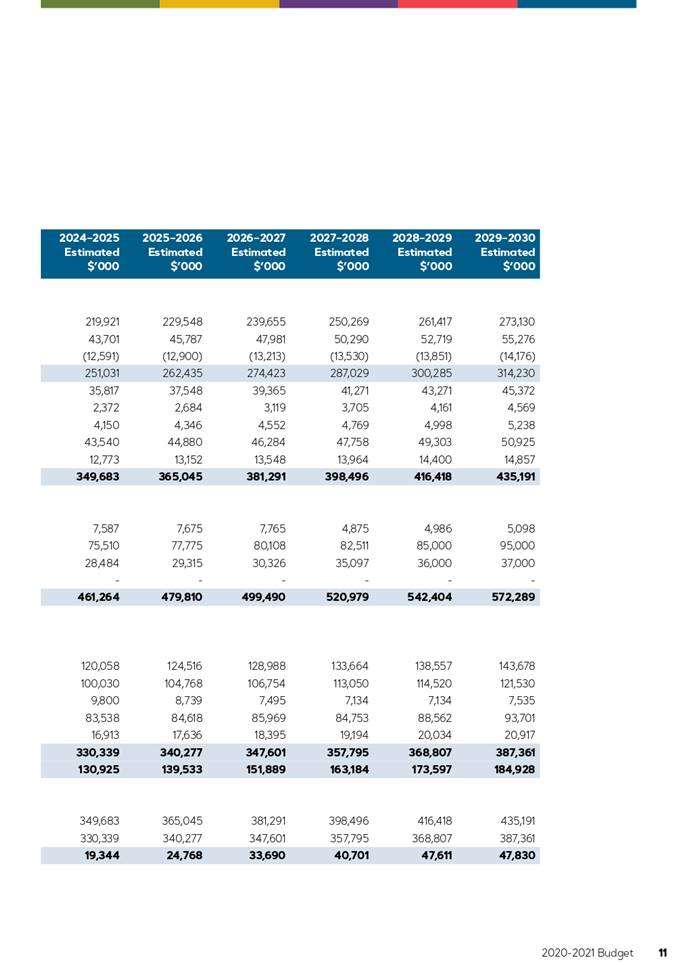

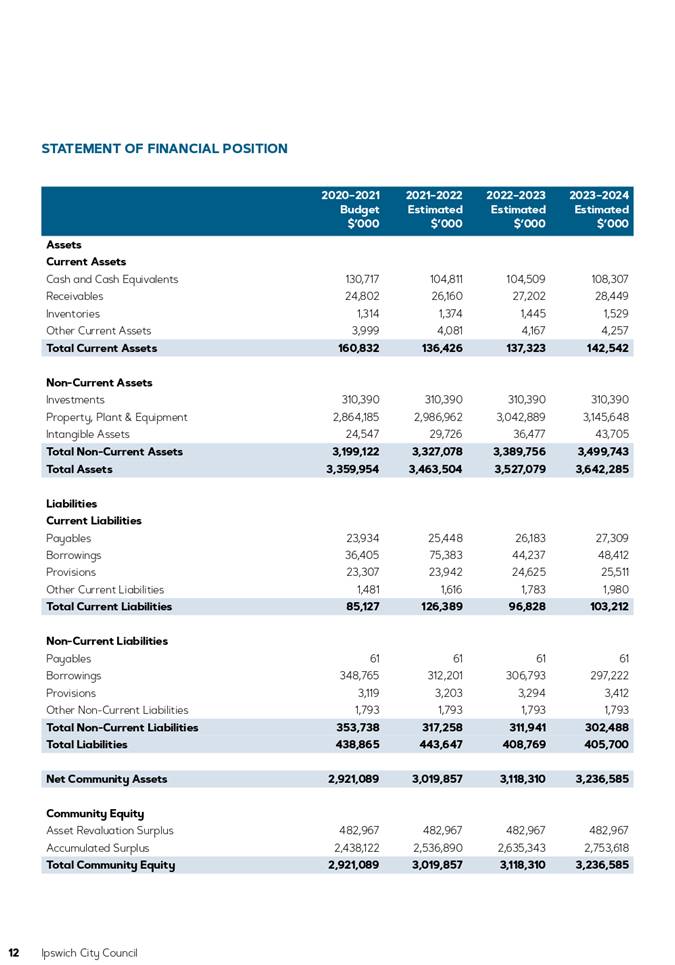

Budget and Long-Term Financial Forecast which is stated in Part 1,

including the Forecast Financial Statements: Statement of Income and

Expenditure, Statement of Financial Position, Statement of Cash Flows and

Statement of Changes in Equity;

(b) the

Revenue Statement which is stated in Part 10;

(c) the

Revenue Policy which is stated in Part 15;

(d) the

relevant measures of financial sustainability which is stated in Part 1;

(e) the

total value of the change, expressed as a percentage, in the rates and utility

charges levied for the financial year compared with the rates and utility

charges levied in the previous budget which is stated in Part 1.

V. That

it be recorded that in each case where a preceding Resolution refers to the

whole or a part of a document which is in Attachment 1 or

Attachment 2 to the report by the Manager, Finance dated

25 June 2020, the whole or part of the document is incorporated by

reference into and forms part of the terms and content of the Resolution.

RELATED PARTIES

There are no related parties in

relation to this report.

Advance Ipswich Theme

Listening, leading and financial

management

Purpose of Report/Background

Financial Information for the

Budget Meeting

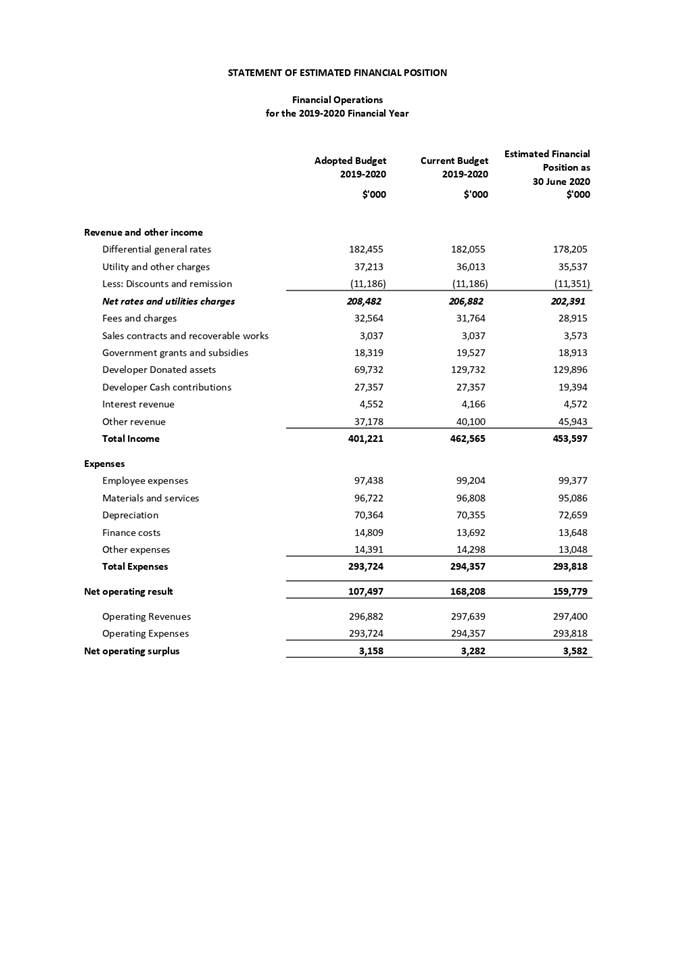

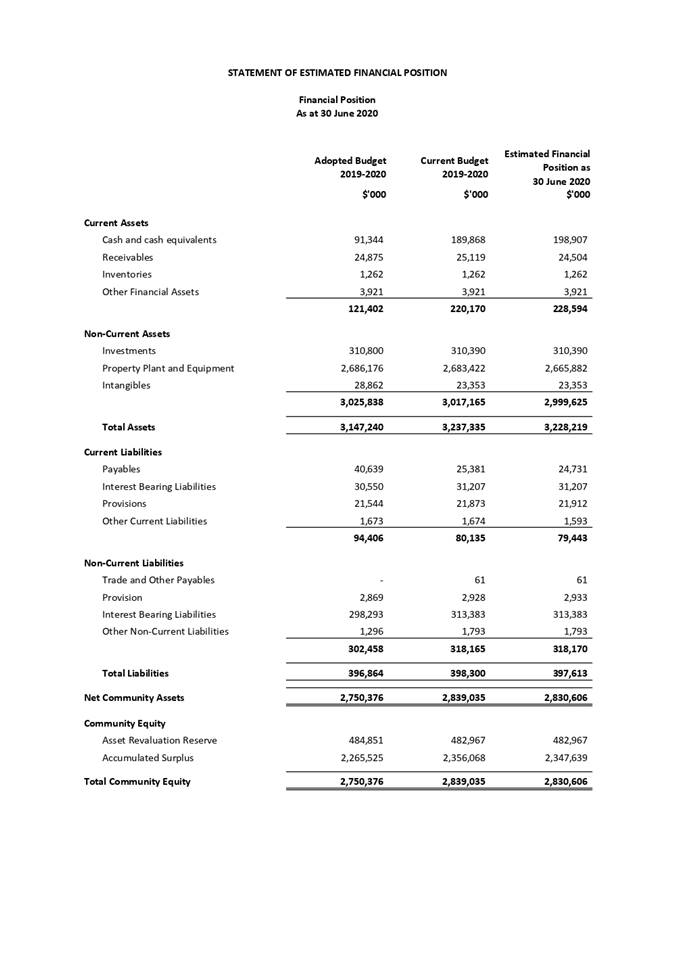

Section 205 of the Local

Government Regulation 2012 requires the Chief Executive Officer to present

the local government’s annual budget meeting with a statement of

estimated financial position for the previous financial year.

The statement of estimated

financial position is a document stating the financial operations, and

financial position, of the local government for the previous financial year (Attachment 1).

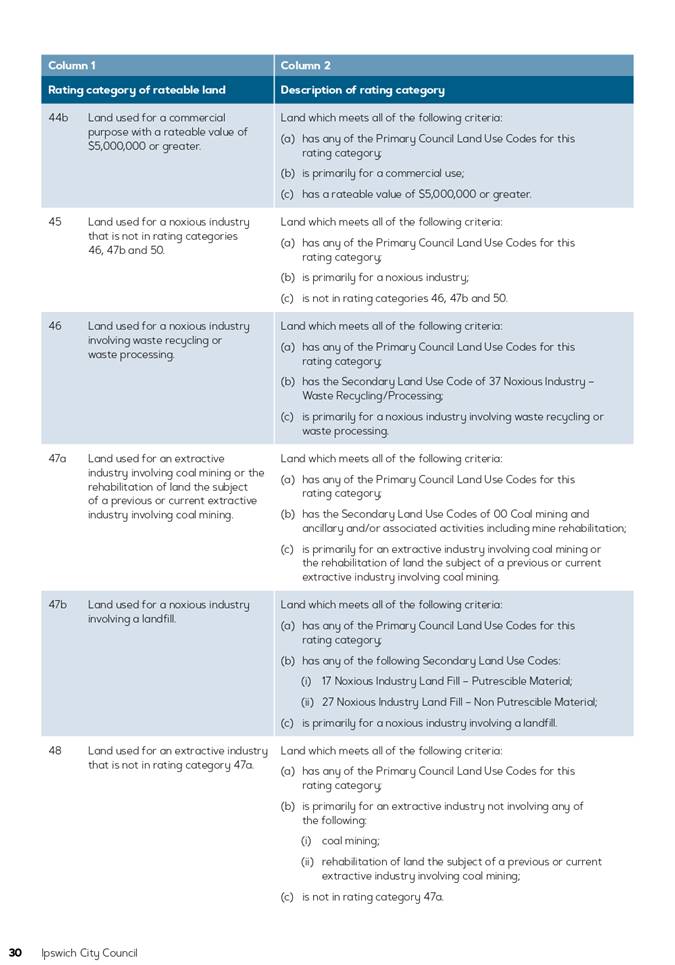

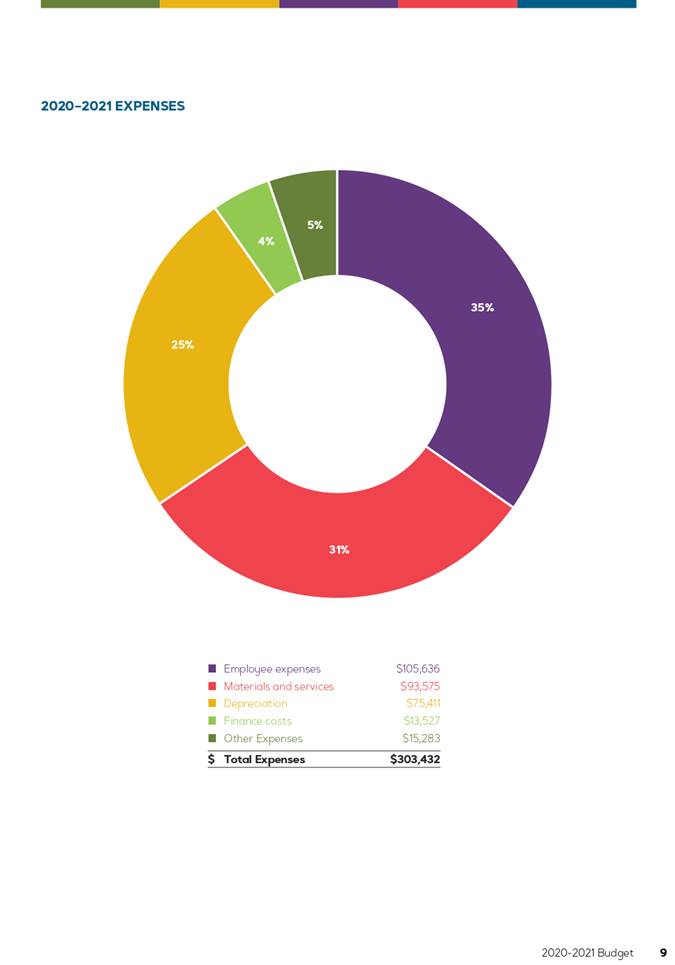

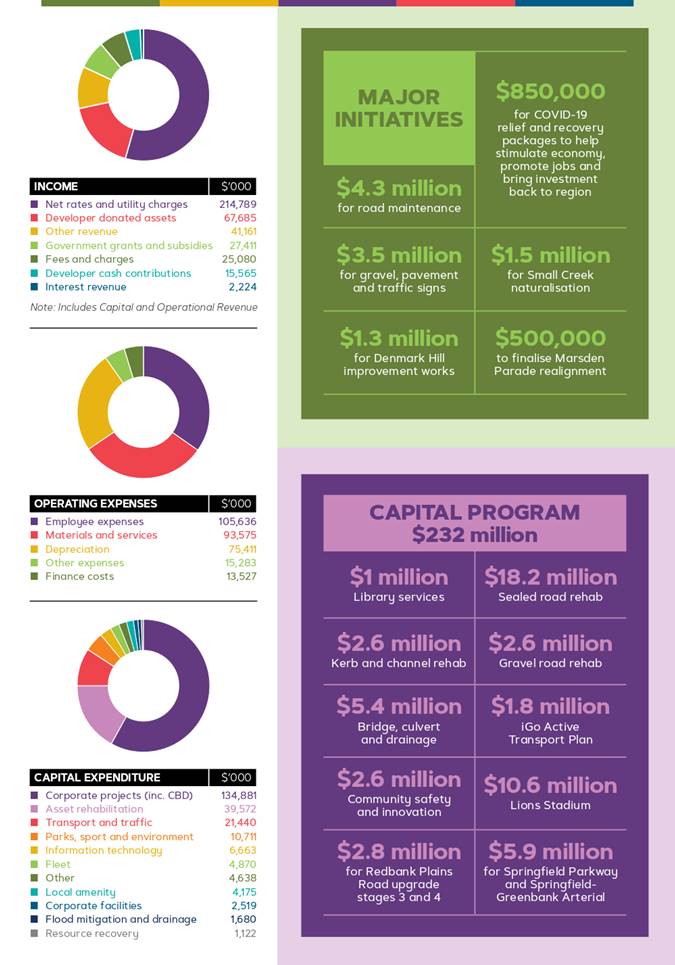

2020-2021 Budget

The 2020-2021 Budget (Attachment 2)

contains the Budget, Long-Term Financial Forecast, General Rates, Utility

Charges, Special Charges, Separate Charges and other associated documents and

polices for the 2020-2021 financial year including the following:

• The

2020-2021 Budget;

• Long-Term

Financial Forecast

• Differential

General Rates;

• Waste

Management Utility Charges;

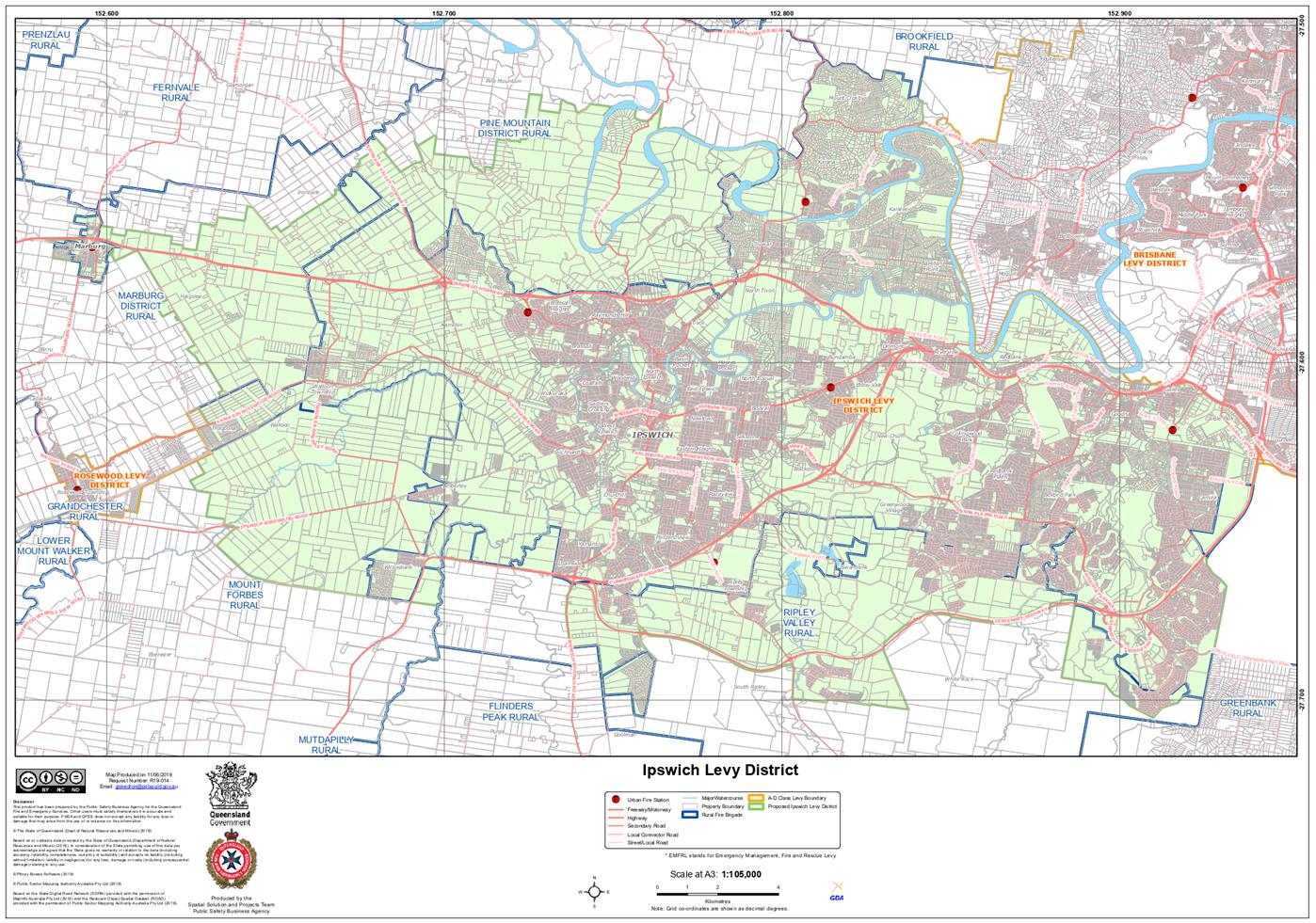

• Rural

Fire Resources Levy Special Charge;

• Rural

Fire Resources Levy Separate Charge;

• Enviroplan

Separate Charge;

• Time

and Manner of Payment of Rates and Charges;

• Interest

on Overdue Rates and Charges;

• Concession

for Rates or Charges to Pensioners;

• Revenue

Statement;

• Debt

Policy;

• Investment

Policy;

• Financial

Management Policy;

• Procurement

Policy;

• Revenue

Policy.

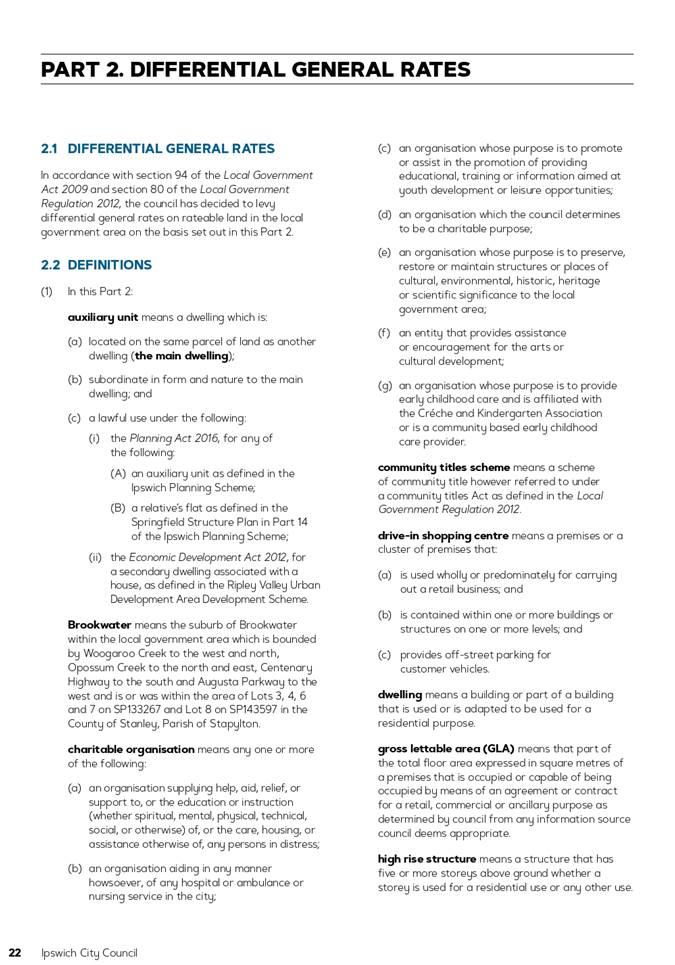

Legal/Policy Basis

This report and its

recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

Land Valuation Act 2010

Retail Shop Leases Regulation 2016

Waste Reduction and Recycling (Waste Levy) Amendment Act

2019

Fire and Emergency Services Act 1990

Revenue Policy

Revenue Statement

Financial Management Policy

Debt Policy

Investment Policy

Procurement Policy

Pensioner remission of Rates Policy

RISK MANAGEMENT IMPLICATIONS

There no specific risk management

issues to consider in adopting the 2020‑2021 Budget and Long Term

Financial Forecast.

Financial/RESOURCE IMPLICATIONS

The 2020-2021 Budget, rating

resolutions and related policies provide the financial resources for the

organisation for the coming financial year. The Long Term Financial

Forecast are the outcomes of the financial strategies intended to provide a

sustainable future for the City of Ipswich.

COMMUNITY and OTHER CONSULTATION

The 2020‑2021 Budget

including the Long Term Financial Forecast is presented for consideration.

Conclusion

The 2020‑2021 Budget

including the Long Term Financial Forecast is presented for consideration.

Attachments and Confidential Background Papers

|

1.

|

Statement of Estimated Financial Position ⇩

|

|

2.

|

2020-2021 Budget ⇩

|

Jeffrey Keech

Manager, Finance

I concur with the recommendations contained in this

report.

Sonia Cooper

General Manager

Corporate Services

I concur with the recommendations contained in this

report.

David Farmer

Chief Executive

Officer

“Together,

we proudly enhance the quality of life for our community”

|

Council

Meeting

Agenda

|

30 June

2020

|

Item 5.1 / Attachment 1.

|

Council

Meeting

Agenda

|

30 June

2020

|

Item 5.1 / Attachment 2.

|

Council

Special

Meeting Agenda

|

30 June

2020

|

Doc ID No: A6260048

ITEM: 5.2

SUBJECT: Ipswich City Council Operational Plan

2020-2021

AUTHOR: Corporate Planning Officer

DATE: 25 June 2020

Executive Summary

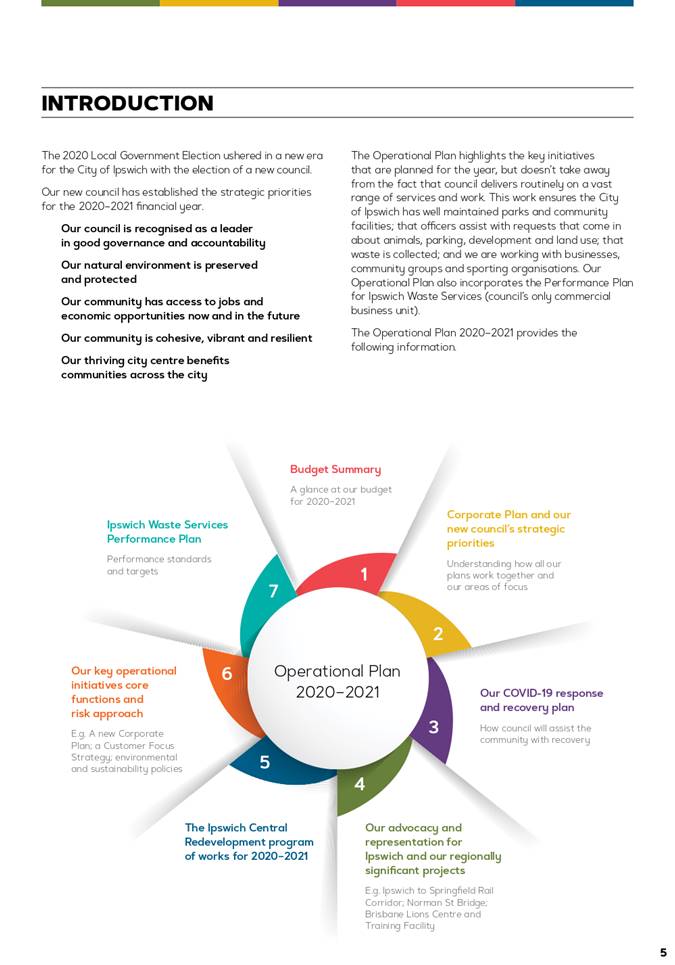

This is a report concerning the

adoption of the proposed Ipswich City Council Operational Plan for 2020-2021.

Recommendation

That Council adopt the

Operational Plan 2020-2021 as detailed in Attachment 1.

RELATED PARTIES

There are no related party matters

associated with this report.

Advance Ipswich Theme

Listening, leading and financial

management

Purpose of Report/Background

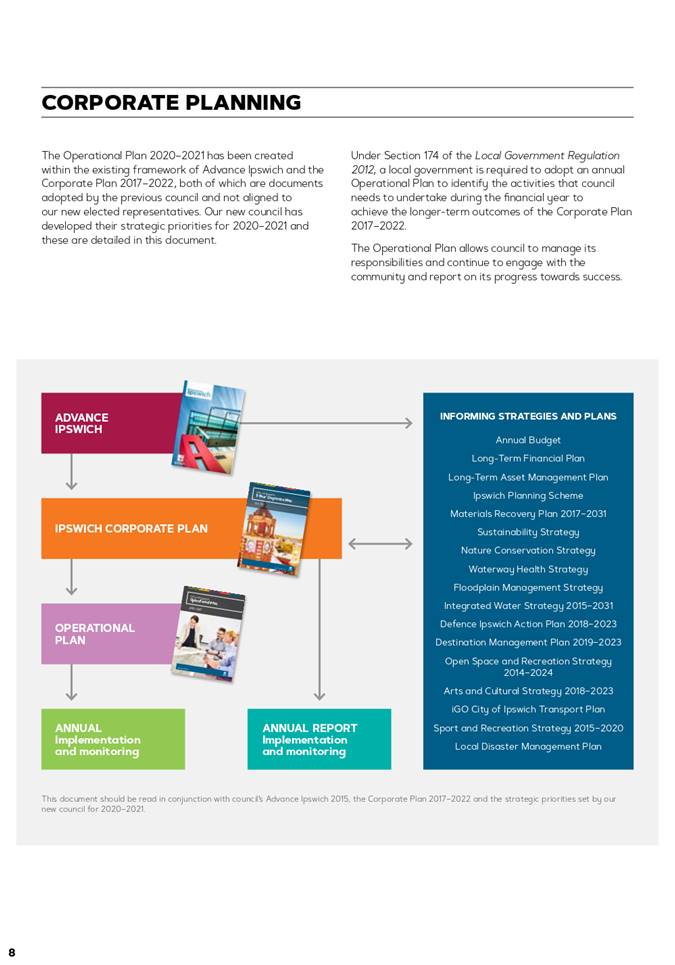

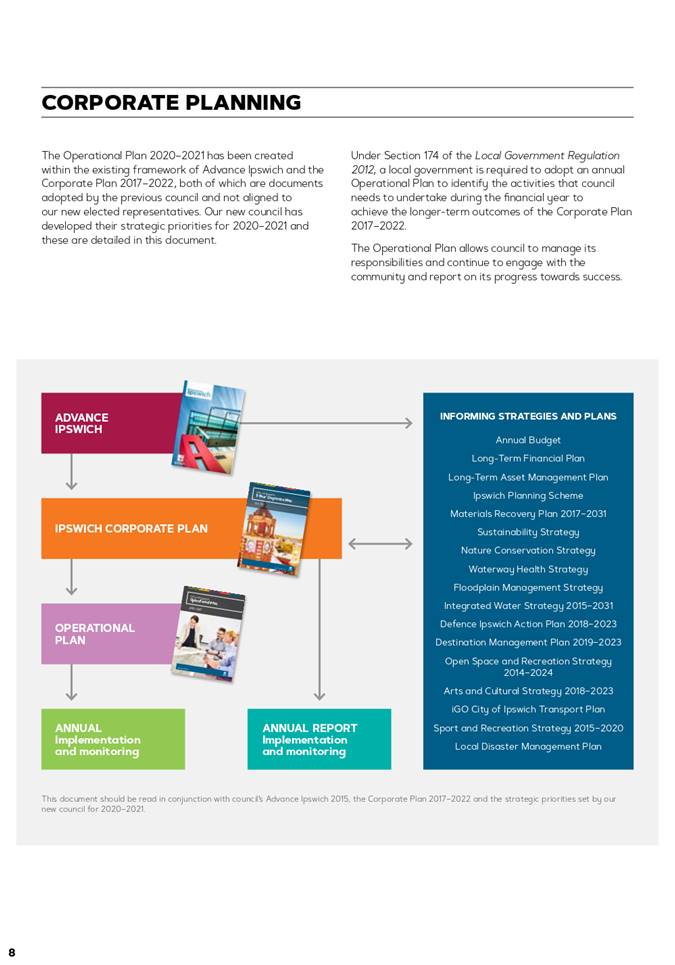

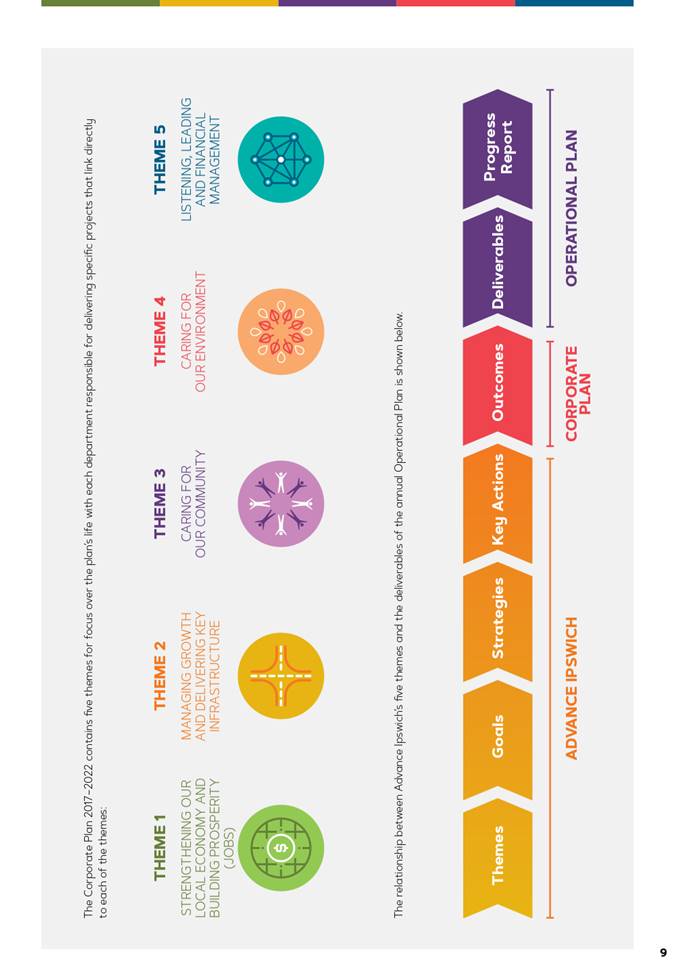

In accordance with section 174 and

175 of the Local Government Regulation 2012 (the Regulation) a local government

must, for each financial year, prepare and adopt an Operational Plan and that

it be developed to progress the implementation of the 2017-2022 Corporate Plan for

the year, is consistent with the annual budget and manages the operational

risks associated with its implementation.

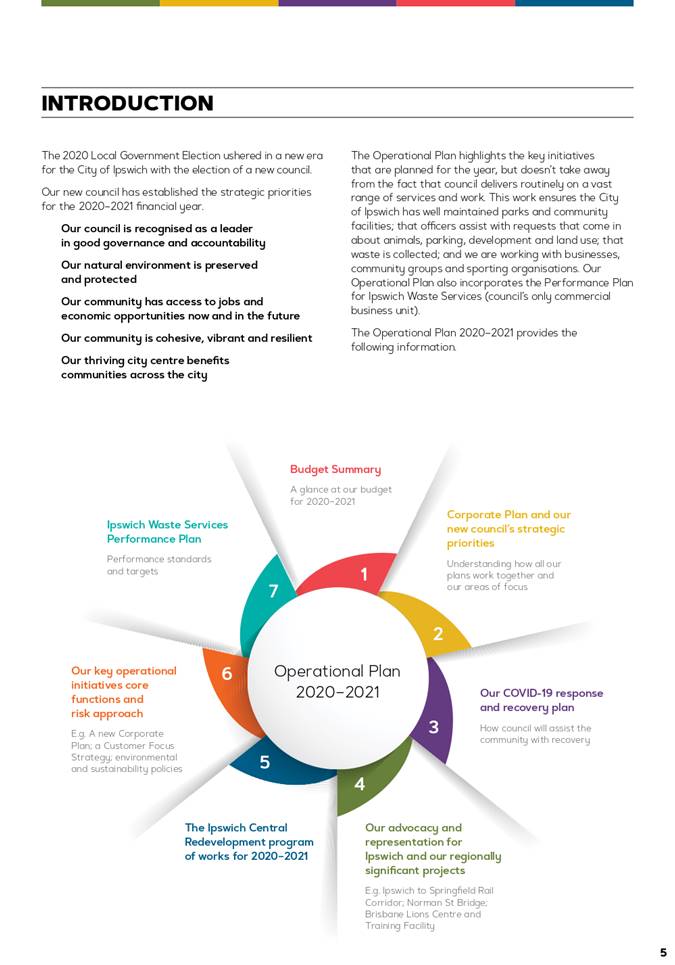

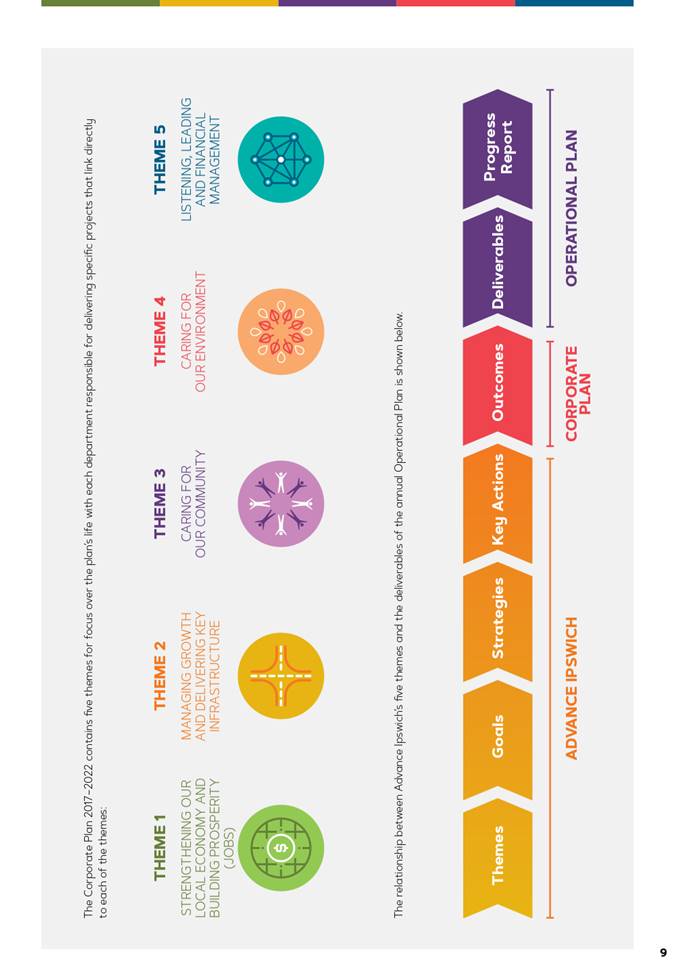

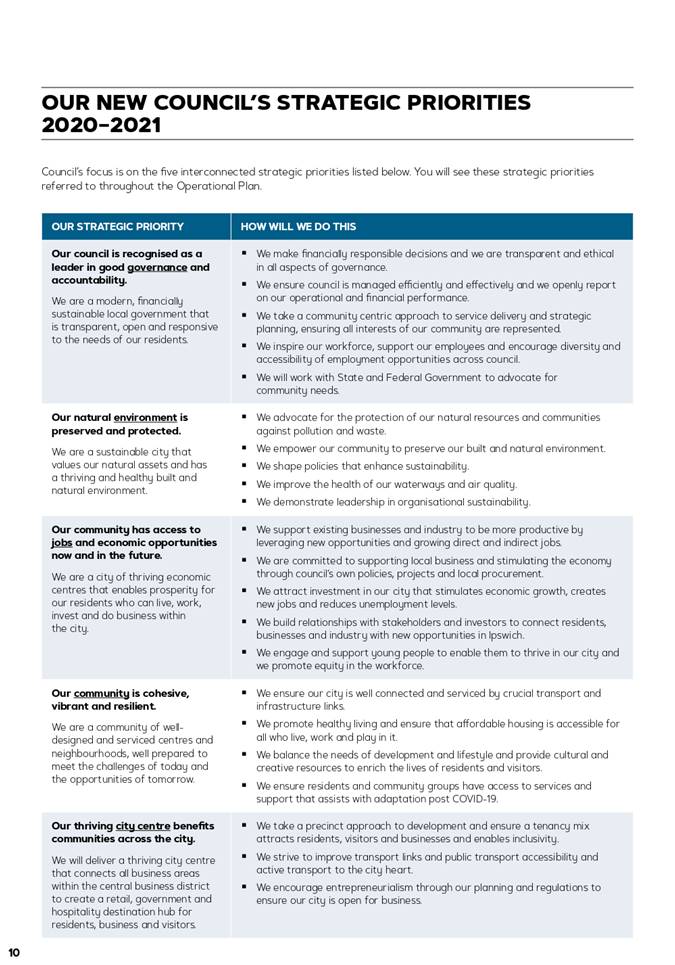

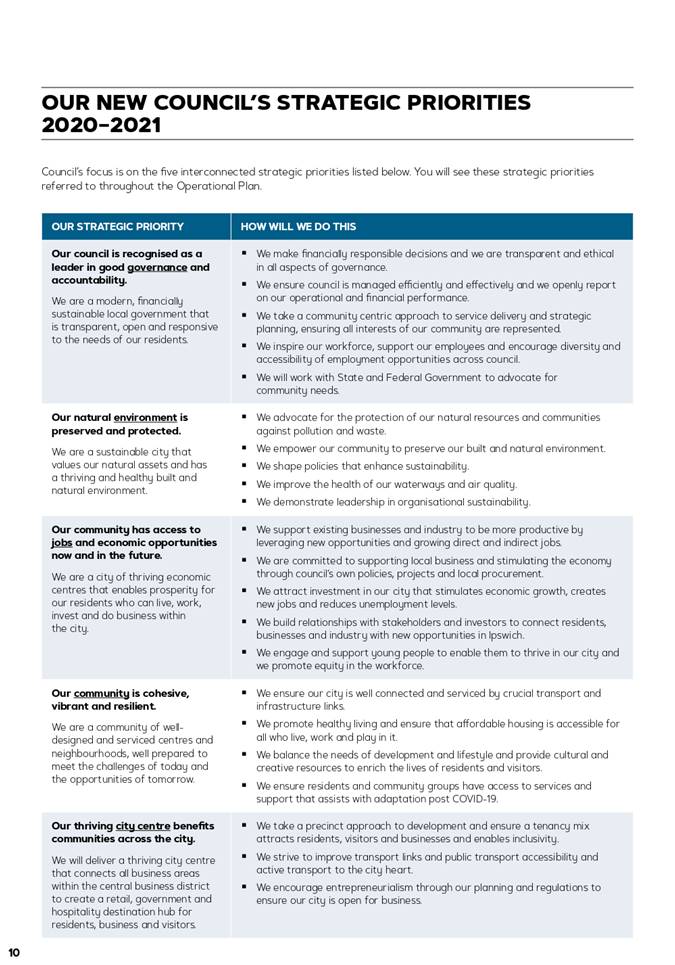

The Operational Plan 2020-2021 sets

Council’s strategic priorities for the next year. They are:

· Our council is

recognised as a leader in good governance and accountability

· Our natural

environment is preserved and protected

· Our community has

access to jobs and economic opportunities now and in the future

· Our community is

cohesive, vibrant and resilient

· Our thriving city

centre benefits communities across the City

It recognises Council’s

move from response to recovery for COVID-19, our advocacy for regionally

significant projects such as the Ipswich to Springfield Public Transport

Corridor and our second Bremer River crossing the Norman Street Bridge, as well

as the Ipswich Central Redevelopment which includes the opening of our new

library in the CBD this year.

The Operational Plan 2020-2021

highlights the key initiatives that are planned for the year, but doesn’t

take away from the fact that council delivers routinely on a vast range of

services and work. This work ensures the City of Ipswich has well maintained

parks and community facilities; that officers assist with requests that come in

about animals, parking, development and land use; that waste is collected; and

we are working with businesses, community groups and sporting organisations.

Our Operational Plan also incorporates the Performance Plan for Ipswich Waste

Services (council’s only commercial business unit).

The monitoring of the progress

of the Operational Plan 2020-2021 is undertaken throughout the year with the

presentation of the Quarterly Performance Report to Council.

Legal/Policy Basis

This report and its recommendations are consistent with the

following legislative provisions:

Local Government Regulation 2012

RISK MANAGEMENT IMPLICATIONS

The Local Government Regulation

2012 requires an operational report to be prepared and adopted each year. The

highest risks are political/reputational and legal/governance should council

fail to meet this legislative requirement.

Reporting against the Operational

plan deliverables is undertaken each quarter. Any deliverable being identified

as ‘At Risk’ will be identified and mitigation actions be noted.

Financial/RESOURCE IMPLICATIONS

The Operational Plan has been

developed in concert with the development of the Annual Budget. All activity

recorded in the Operational Plan has been appropriately funded where

required.

COMMUNITY and OTHER CONSULTATION

The Operational Plan 2020-2021 was

developed in parallel to the annual budget development and involved all General

Managers representing the submissions of all departments. The Operational Plan

presents the activities to be undertaken to meet the deliverables in the 2017-2022

Corporate Plan. The 2017-2020 Corporate plan was developed in partnership with

the wider community.

Conclusion

The 2020-2021 Operational Plan has

been developed in consultation with departments and represents the activities

council proposes to undertake in the 2020-2021 financial year in accordance

with the requirements of the Local Government Regulation 2012.

Attachments and Confidential Background Papers

|

1.

|

Operational Plan 2020-2021 ⇩

|

Stephanie Hoffmann

Corporate Planning

Officer

I concur with the recommendations contained in this

report.

Barbara Dart

Manager

Performance

I concur with the recommendations contained in this

report.

Sean Madigan

General Manager -

Coordination and Performance

“Together,

we proudly enhance the quality of life for our community”

|

Council

Meeting

Agenda

|

30 June

2020

|

Item 5.2 / Attachment 1.

|

Council

Special

Meeting Agenda

|

30 June

2020

|

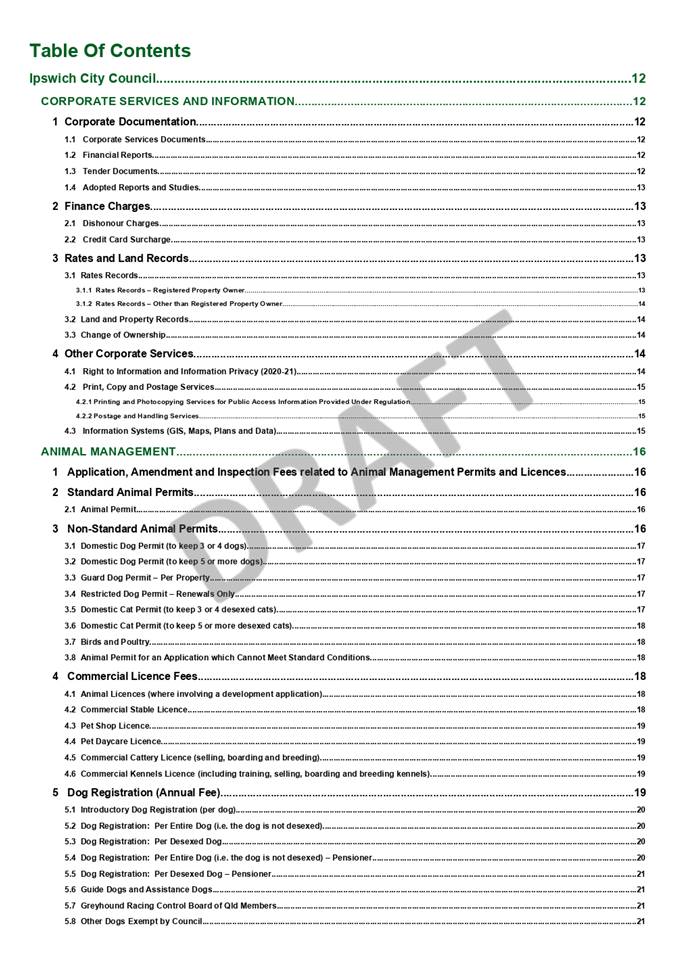

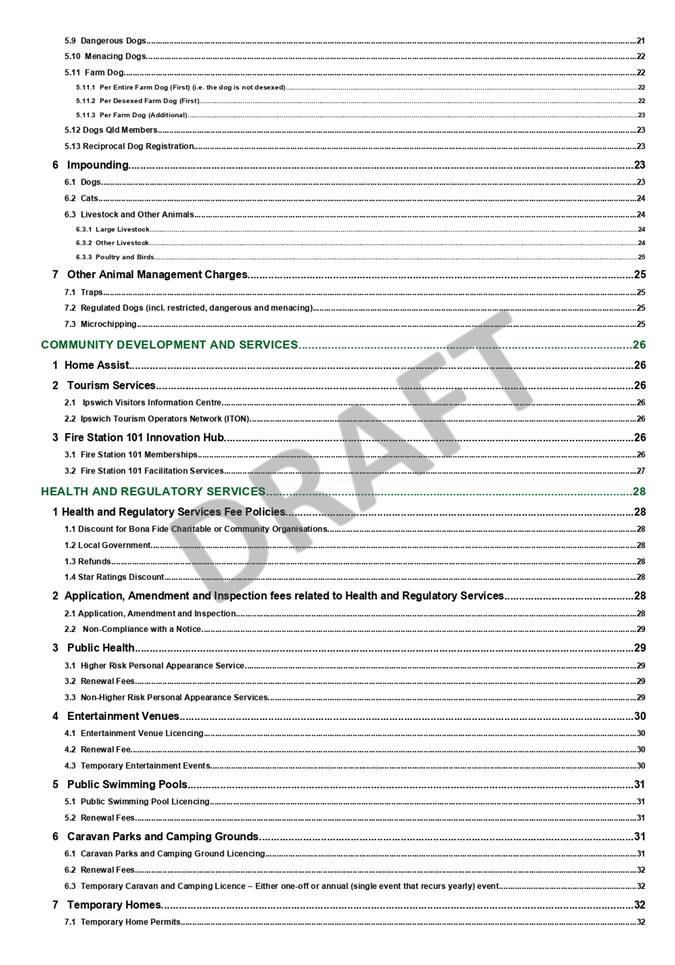

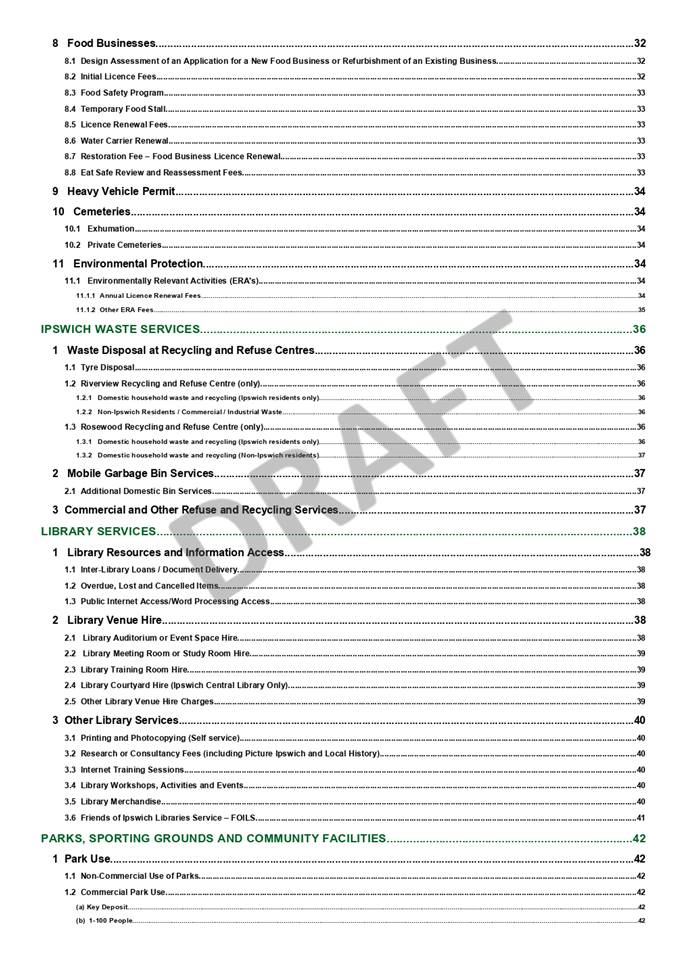

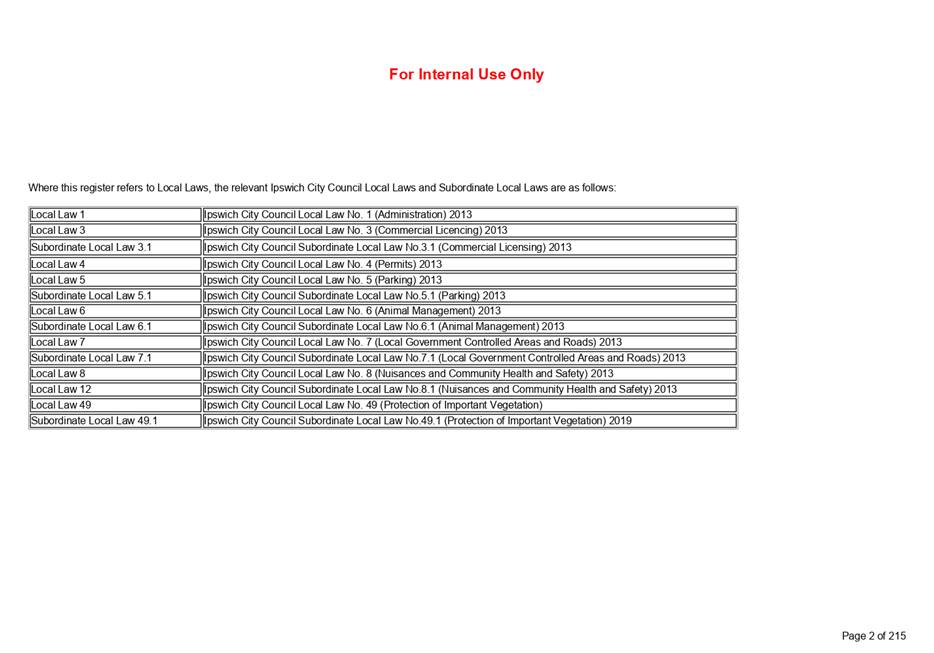

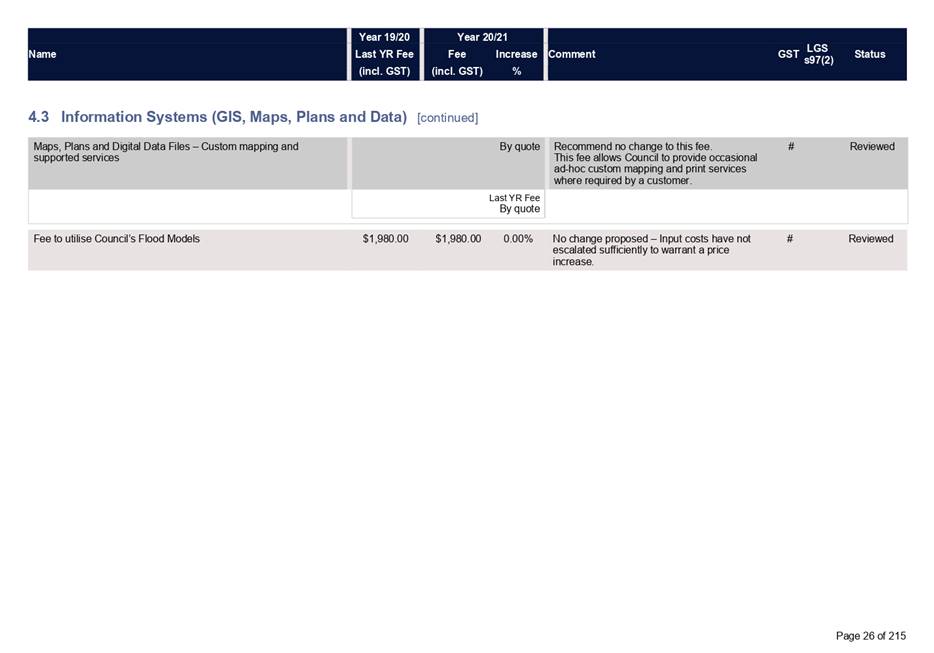

Doc ID No: A6282131

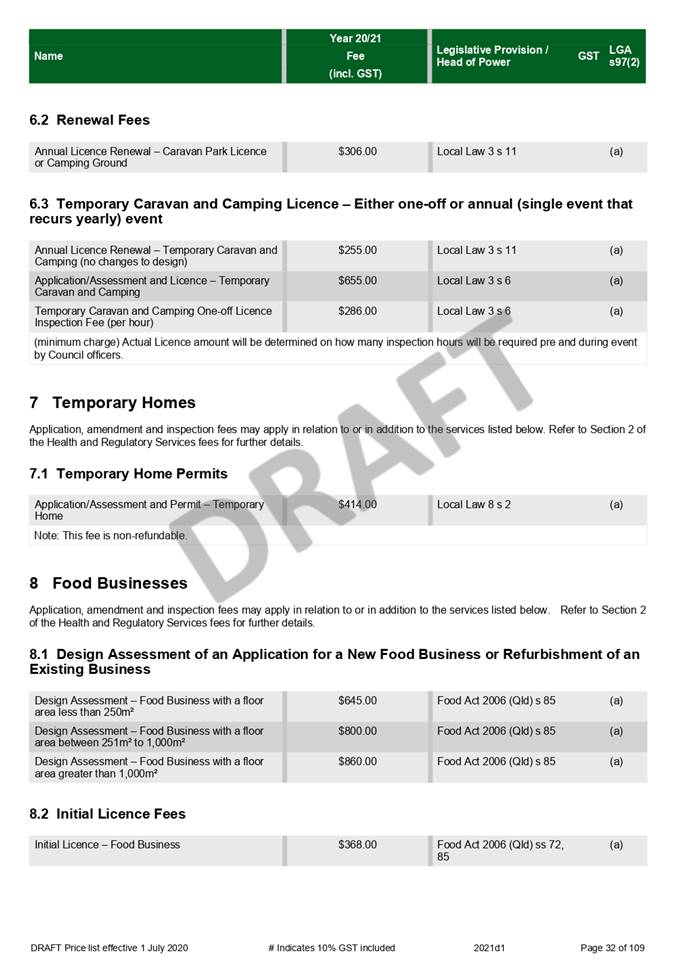

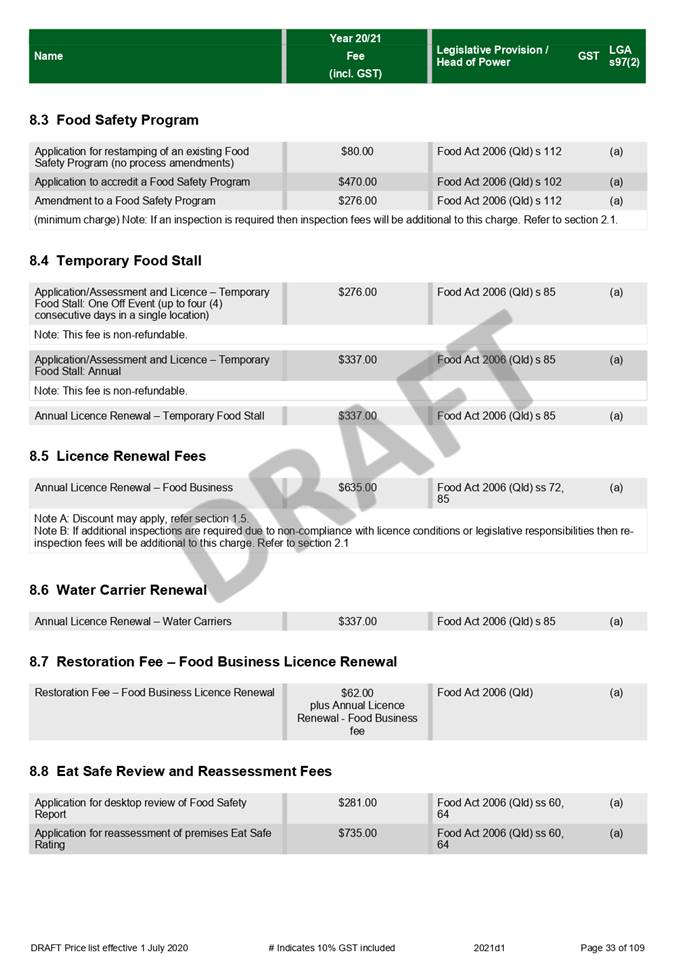

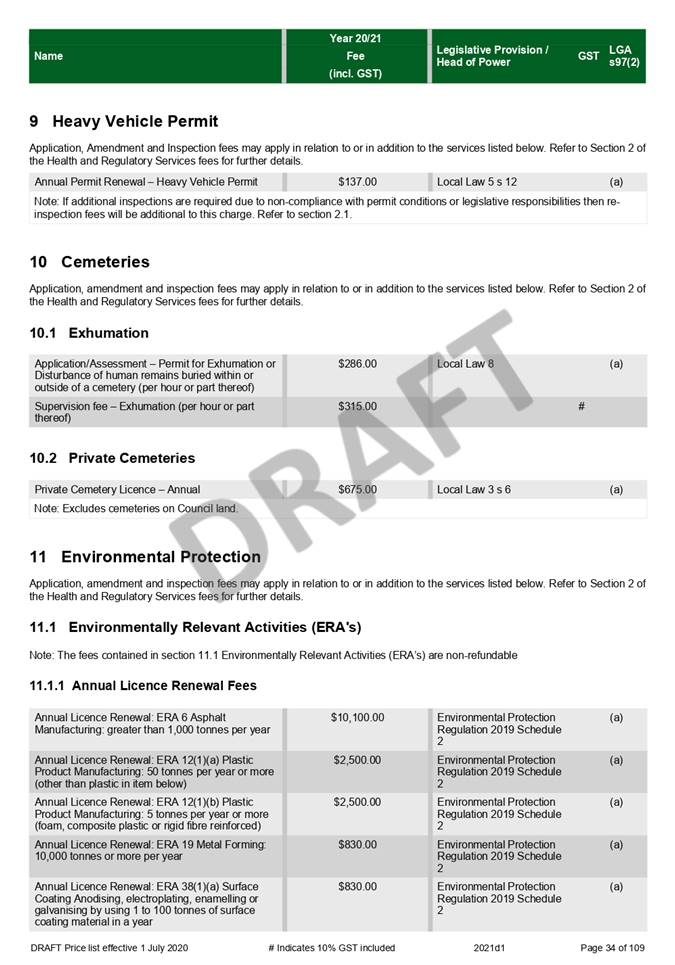

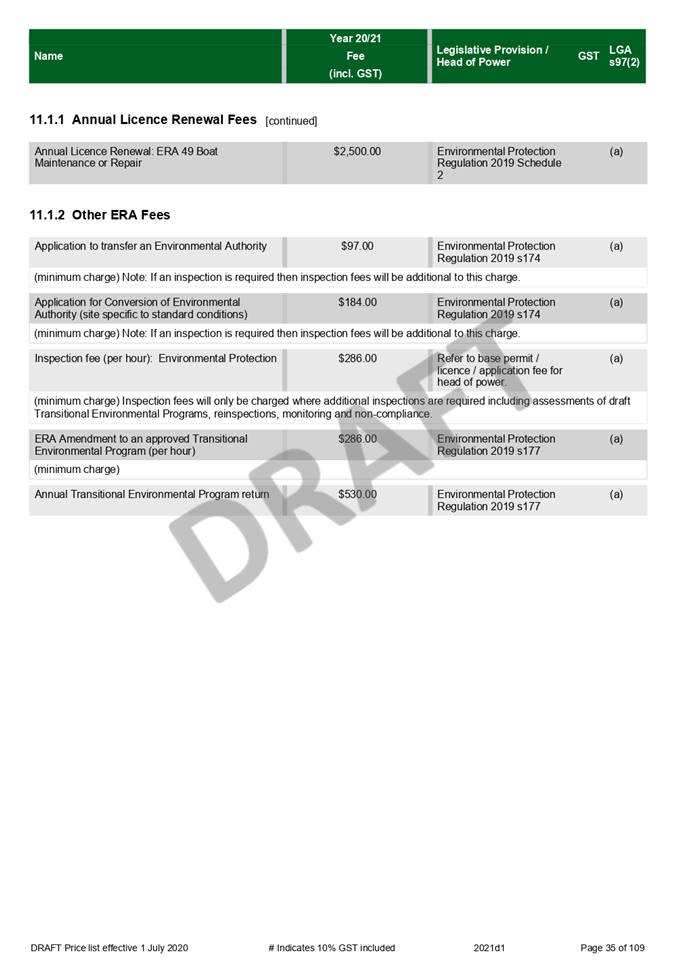

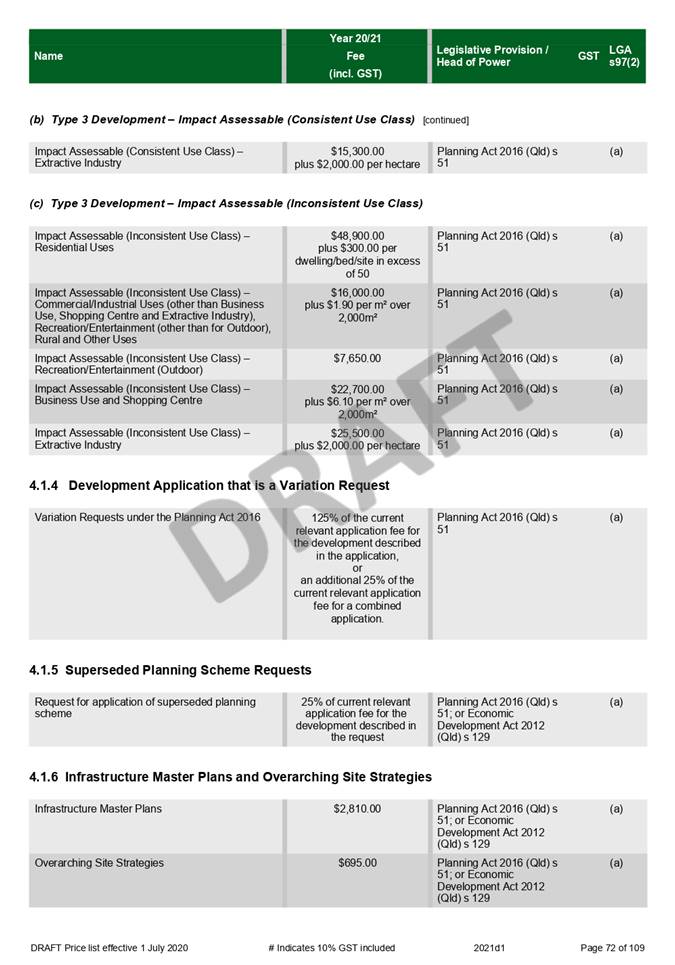

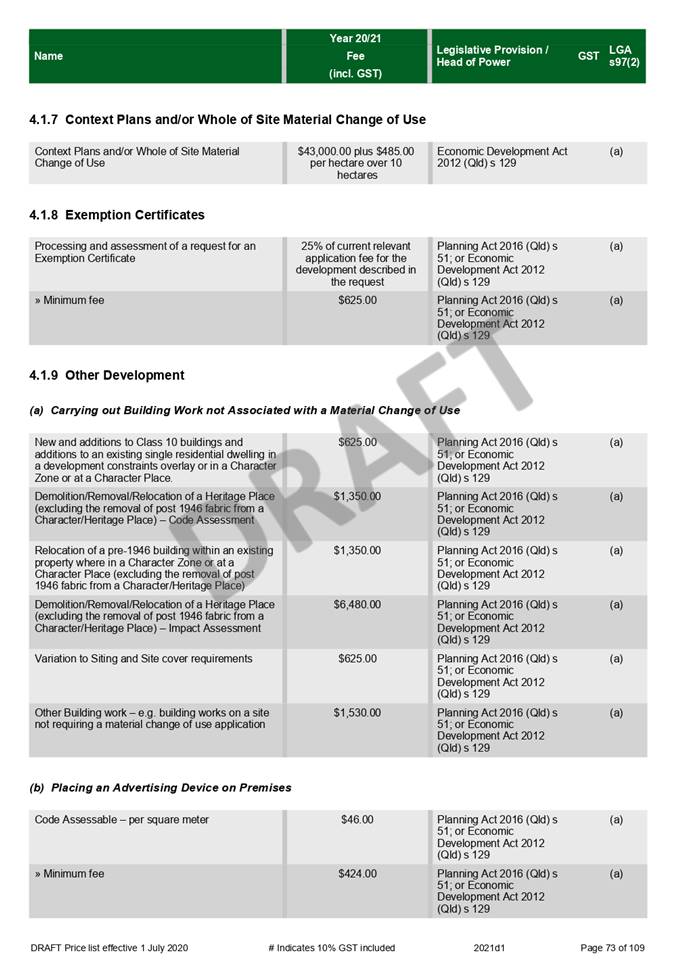

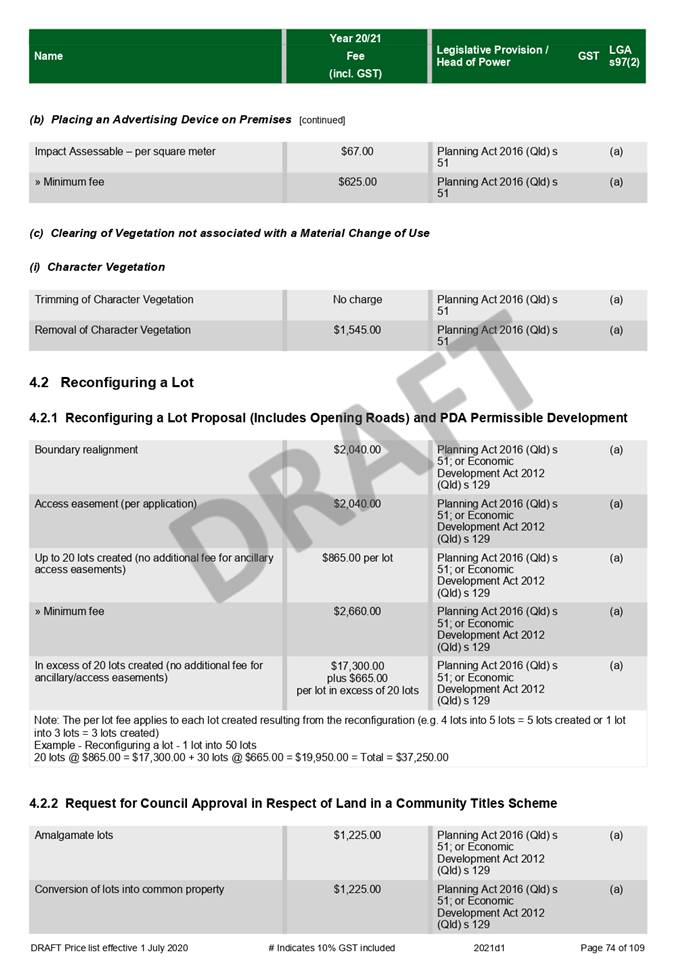

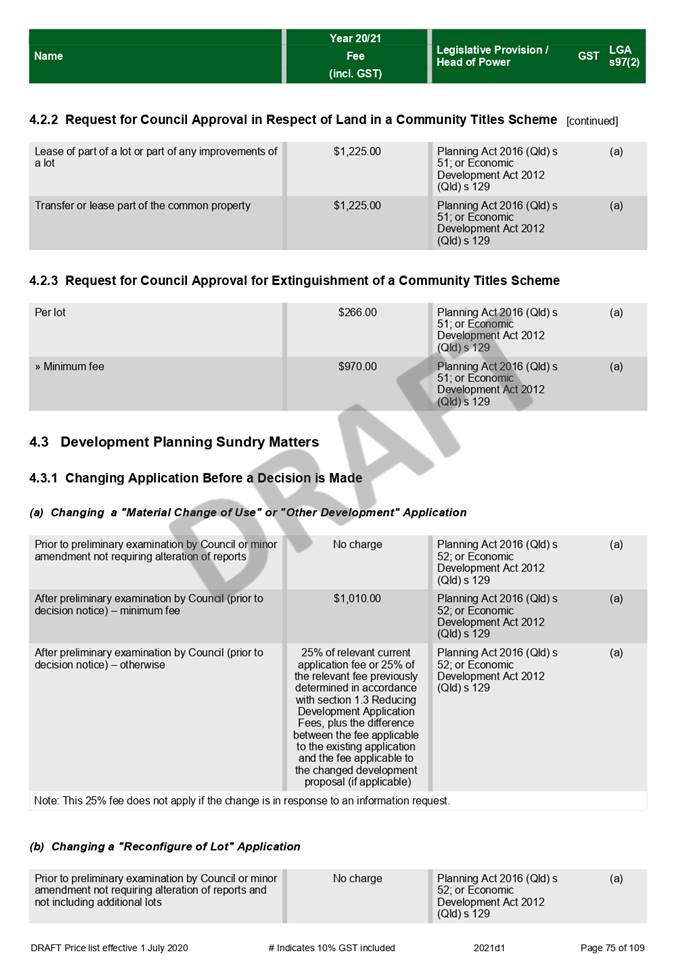

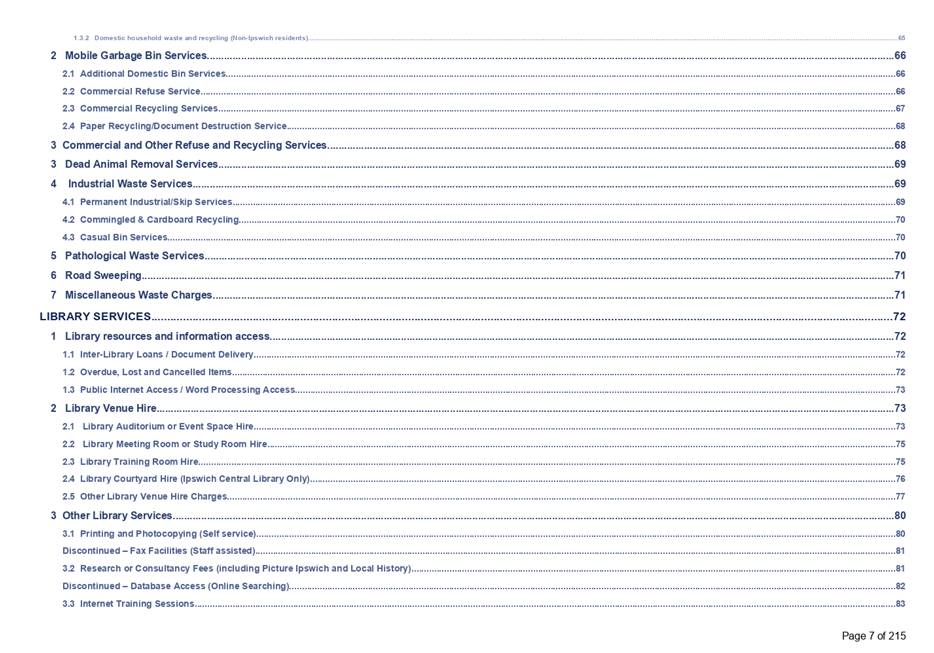

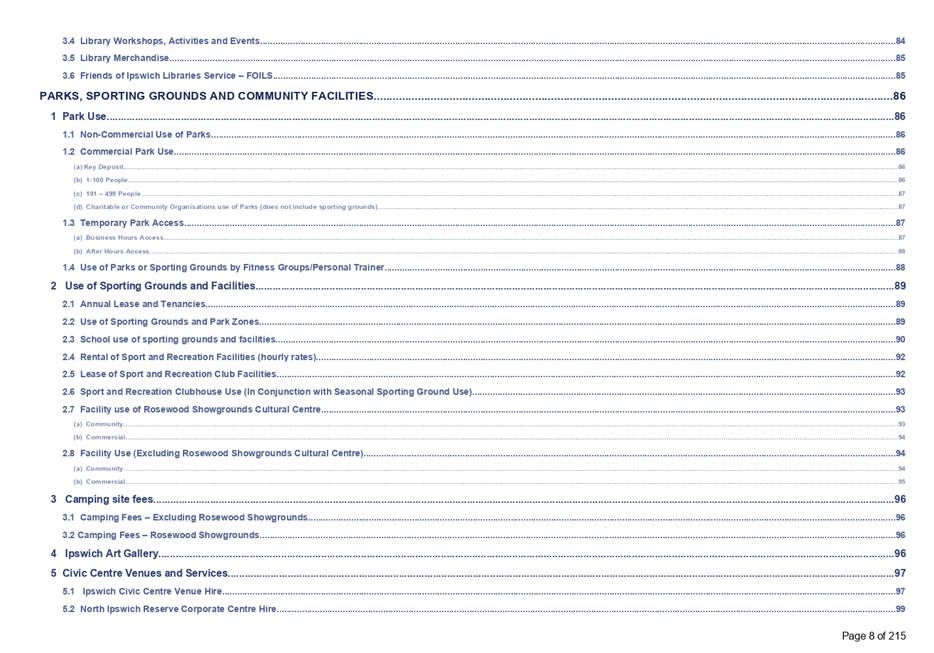

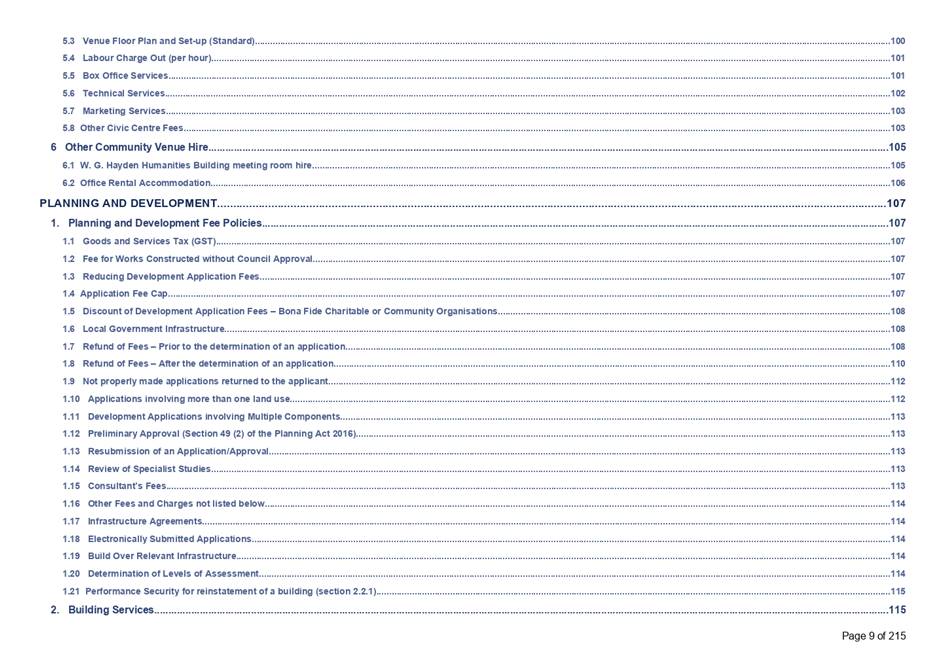

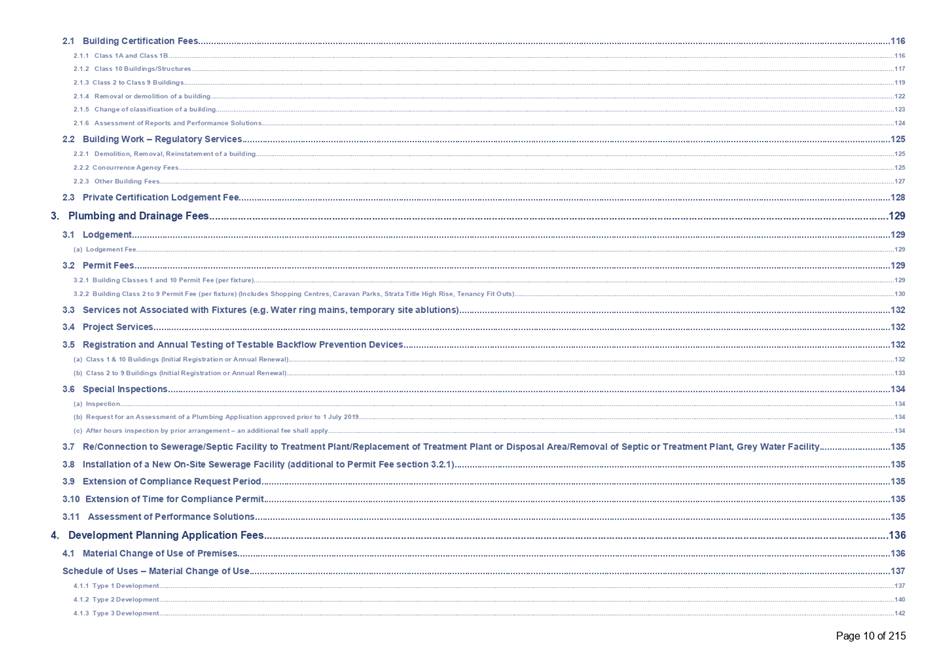

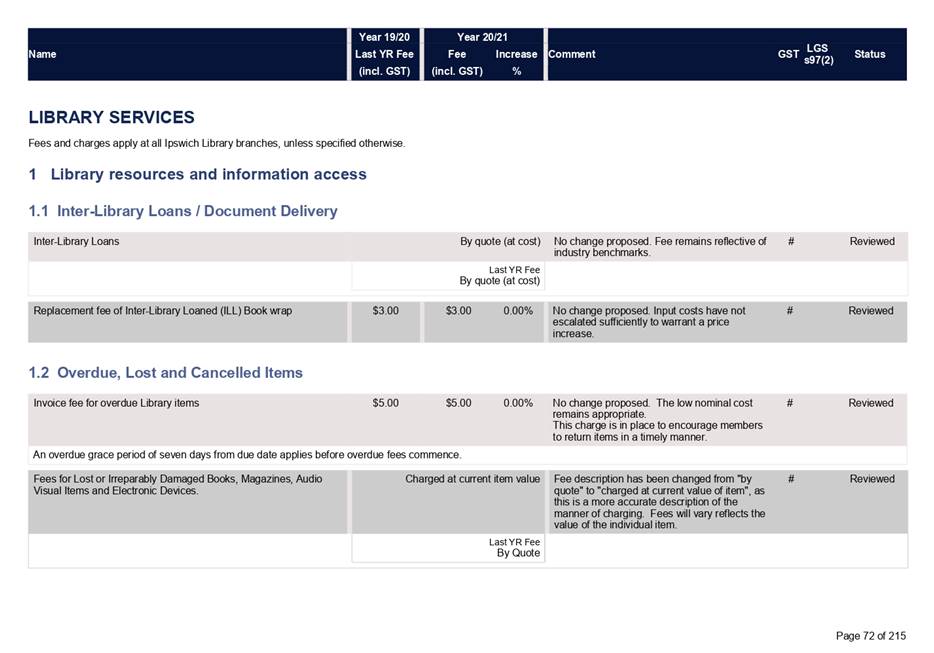

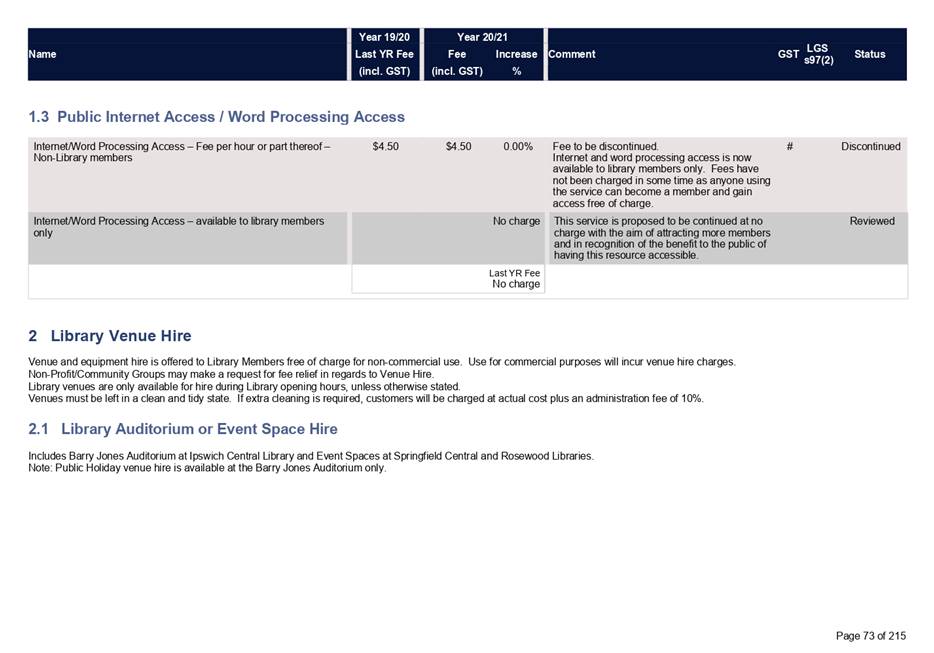

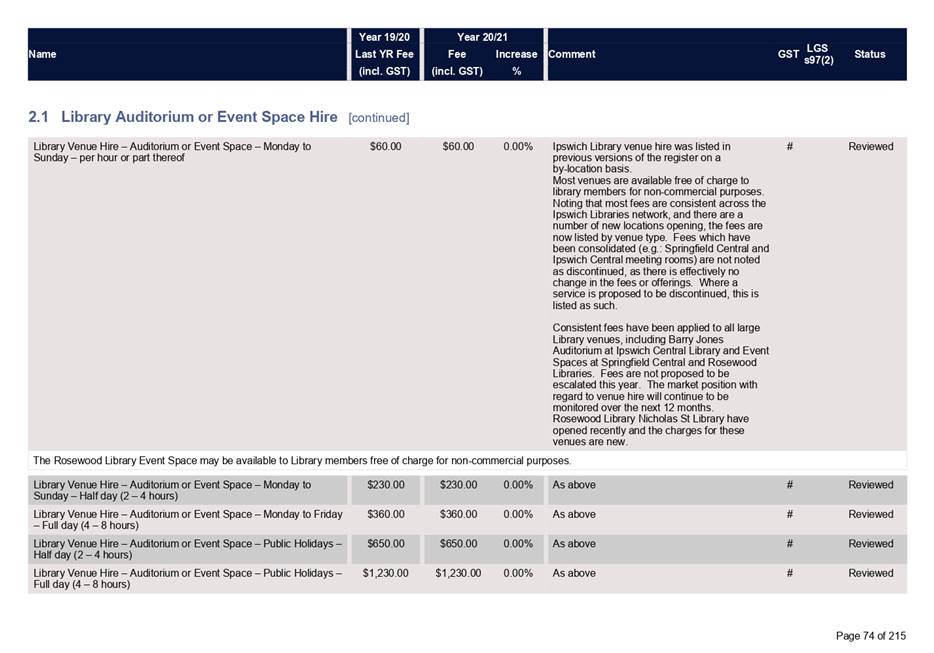

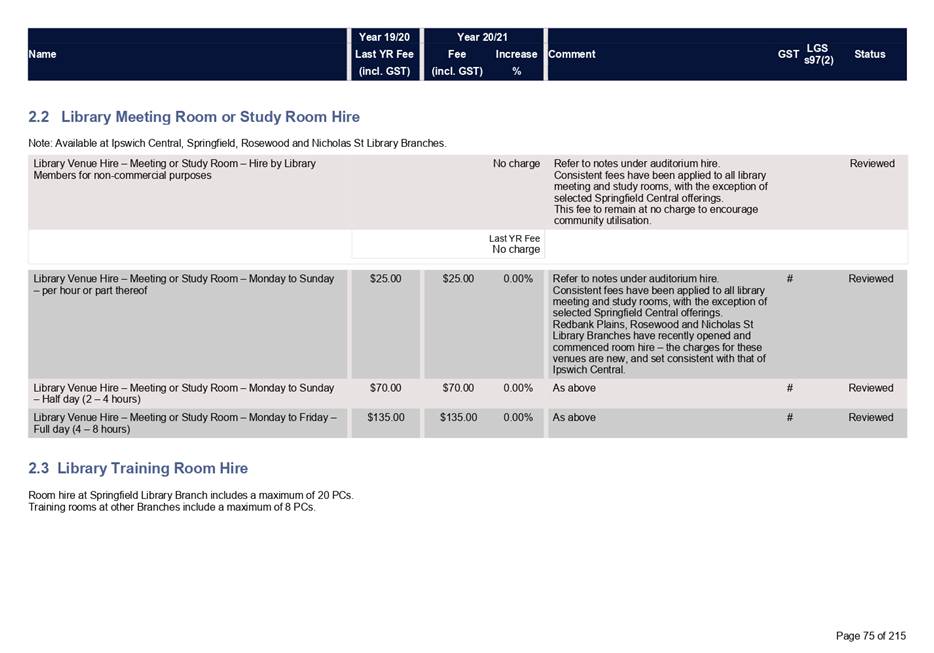

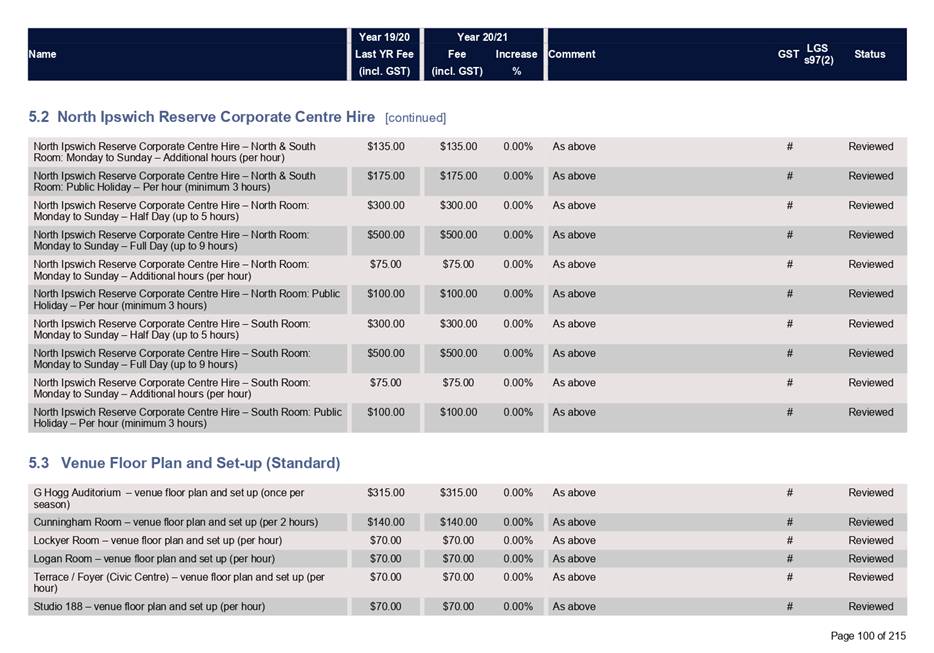

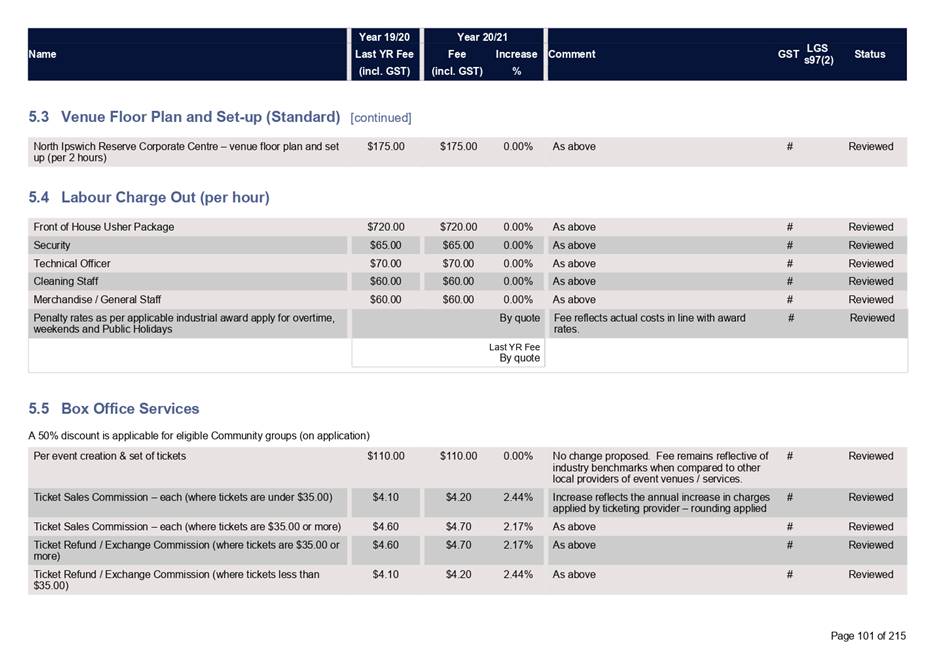

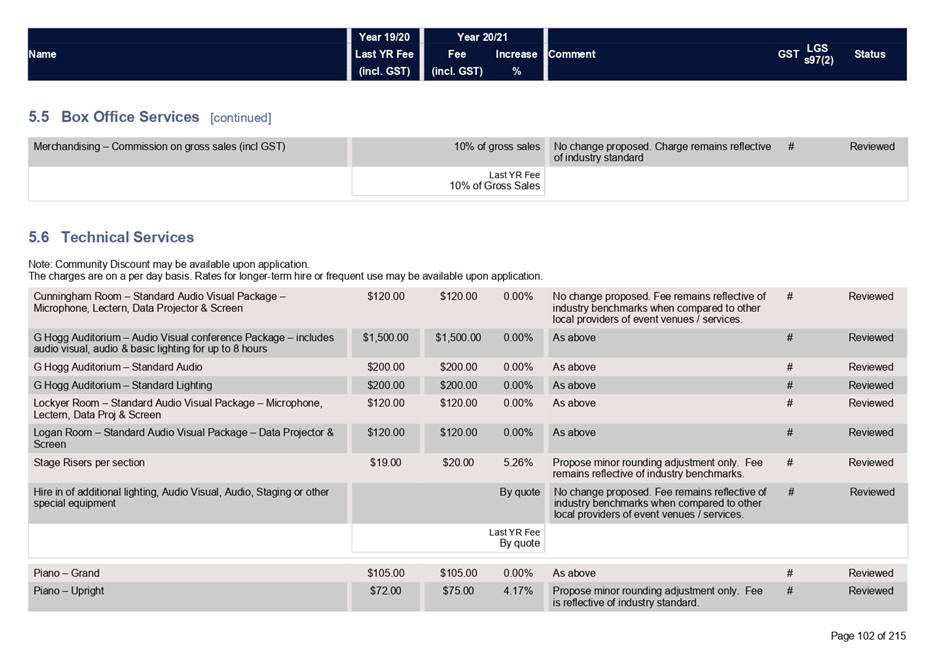

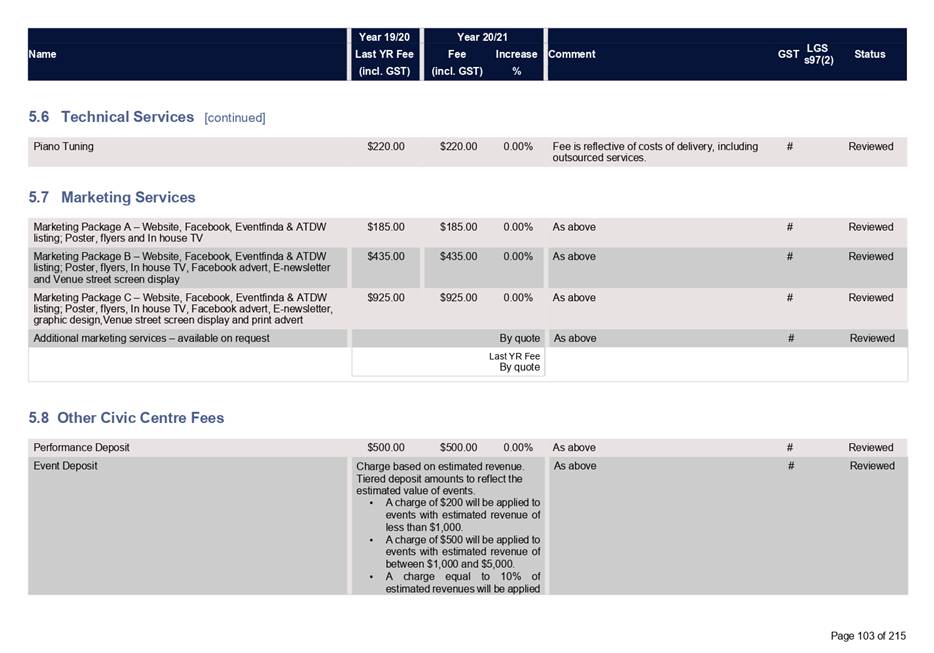

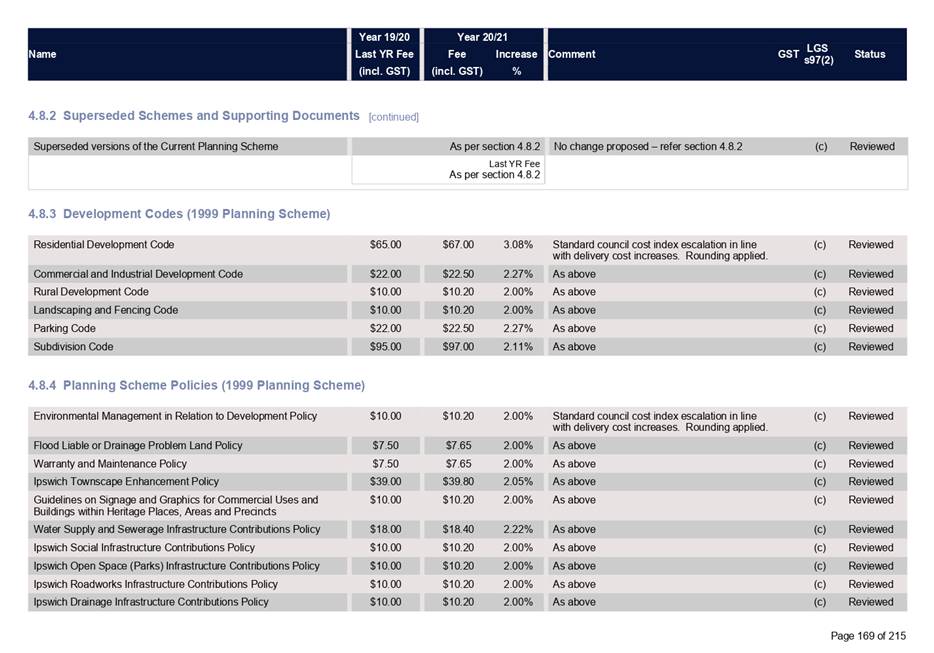

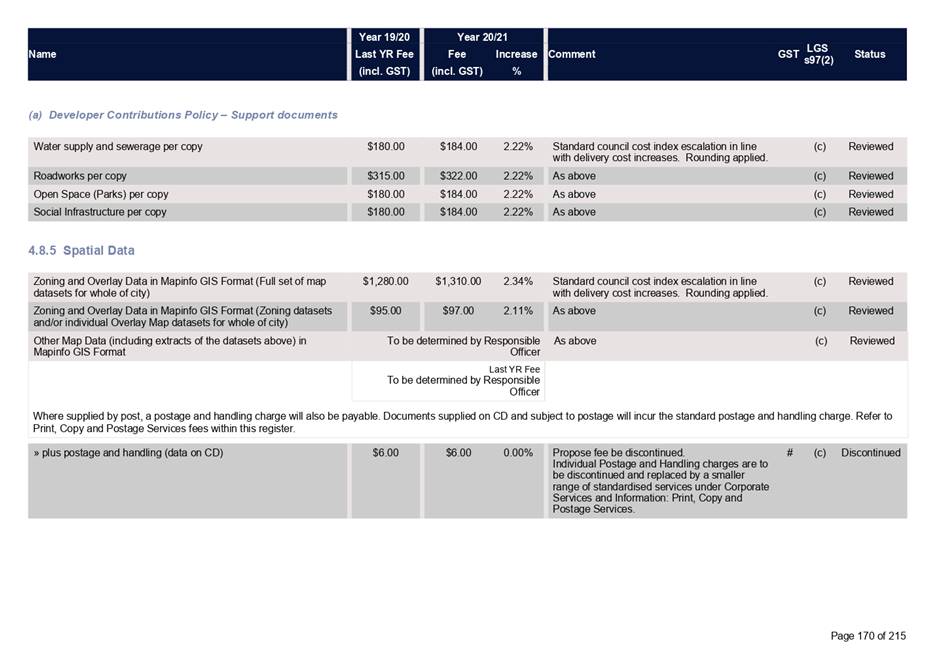

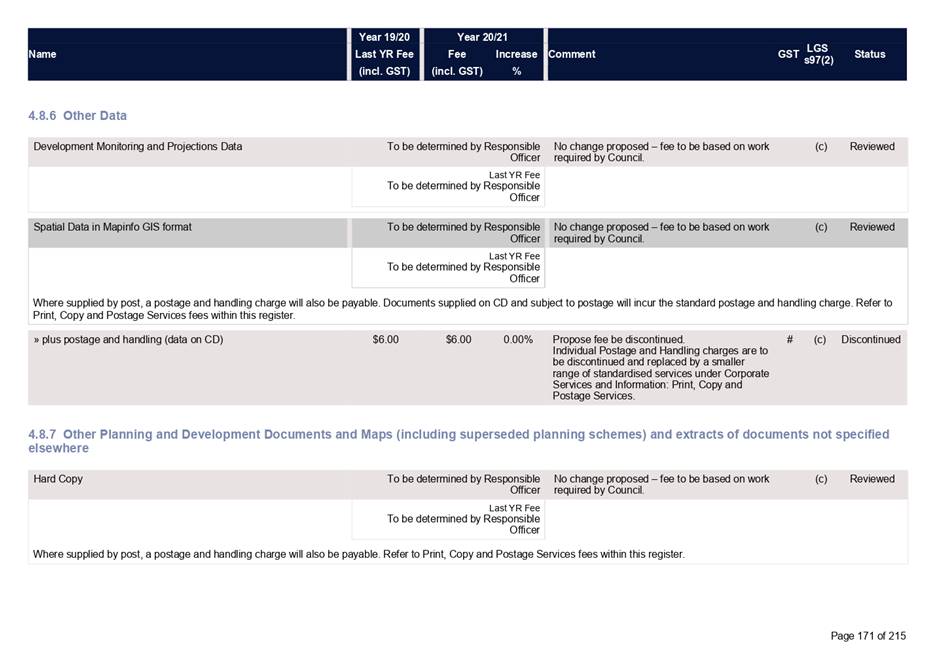

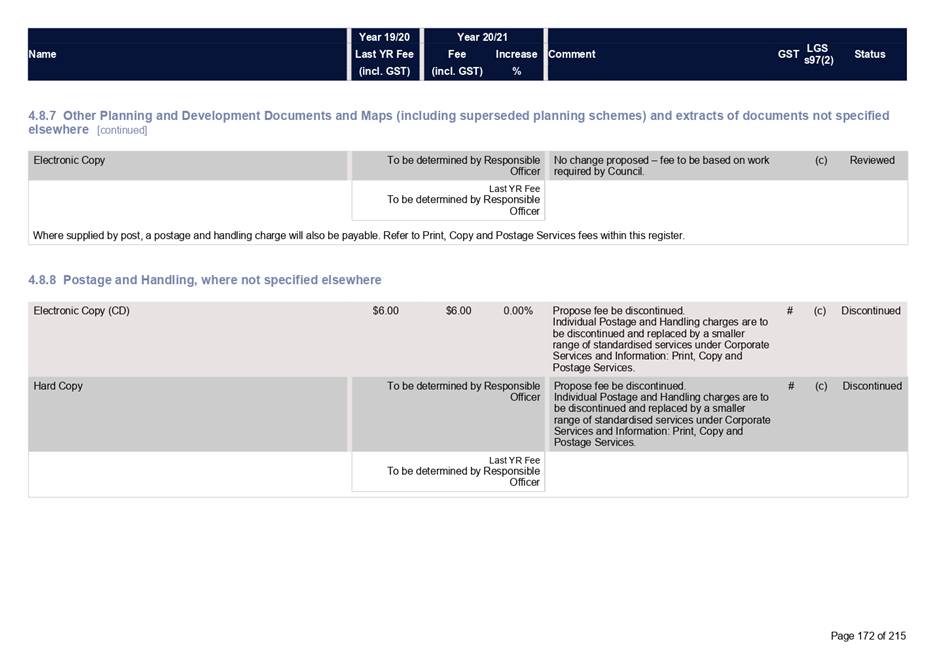

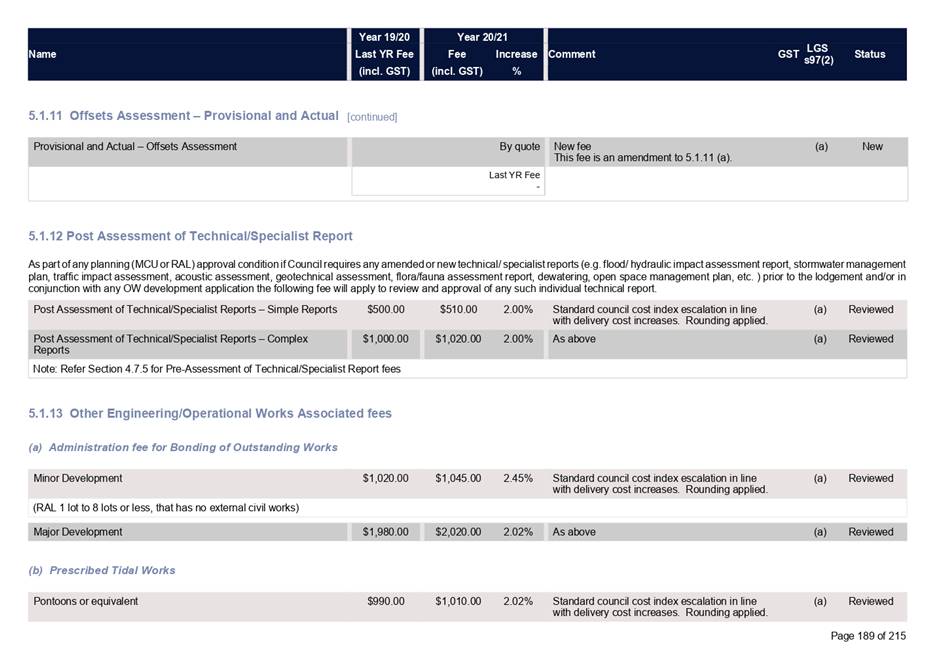

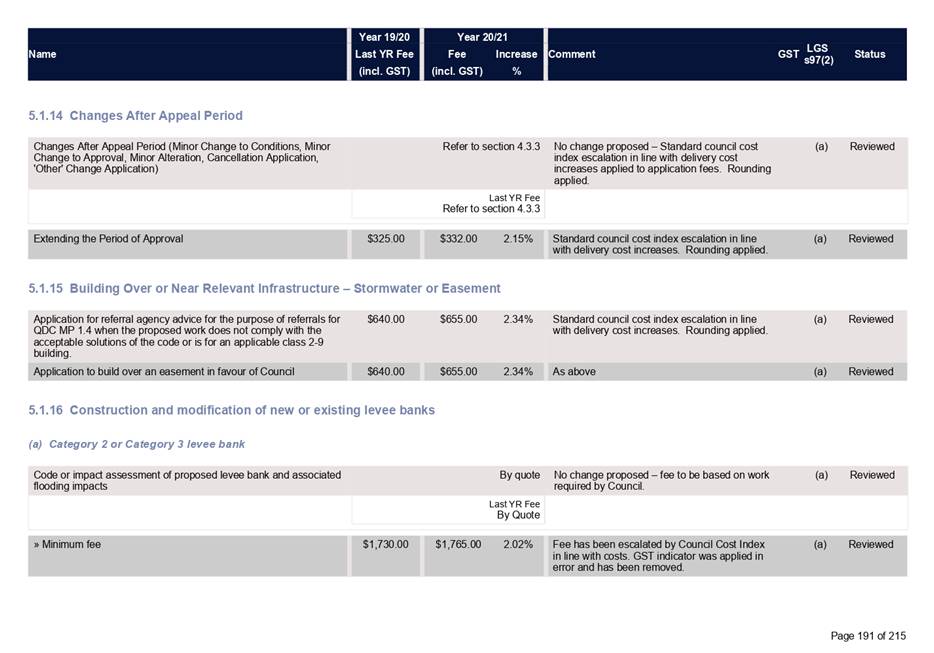

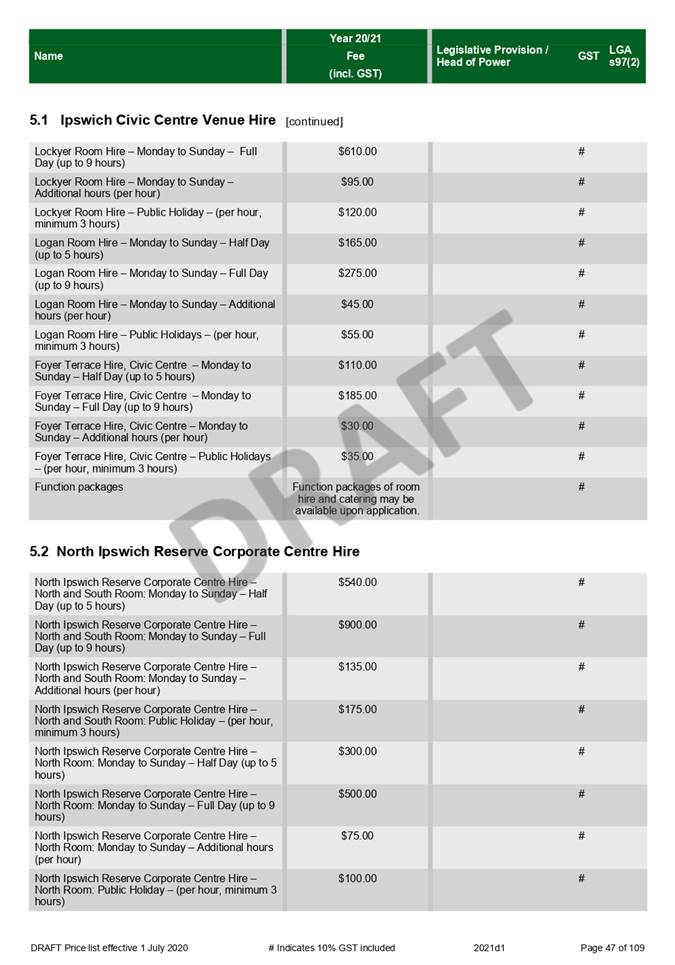

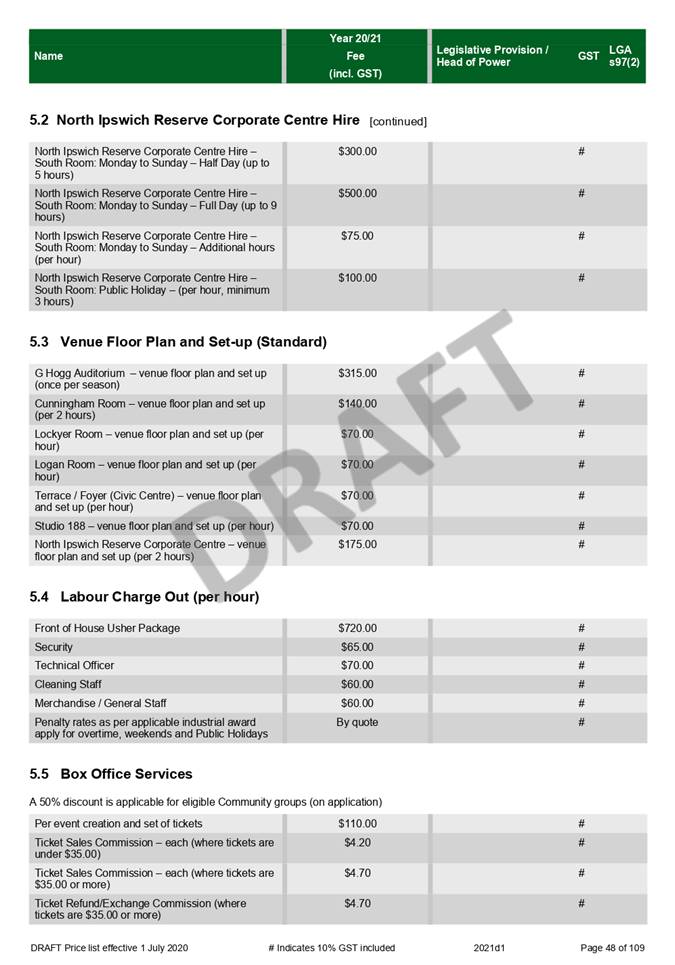

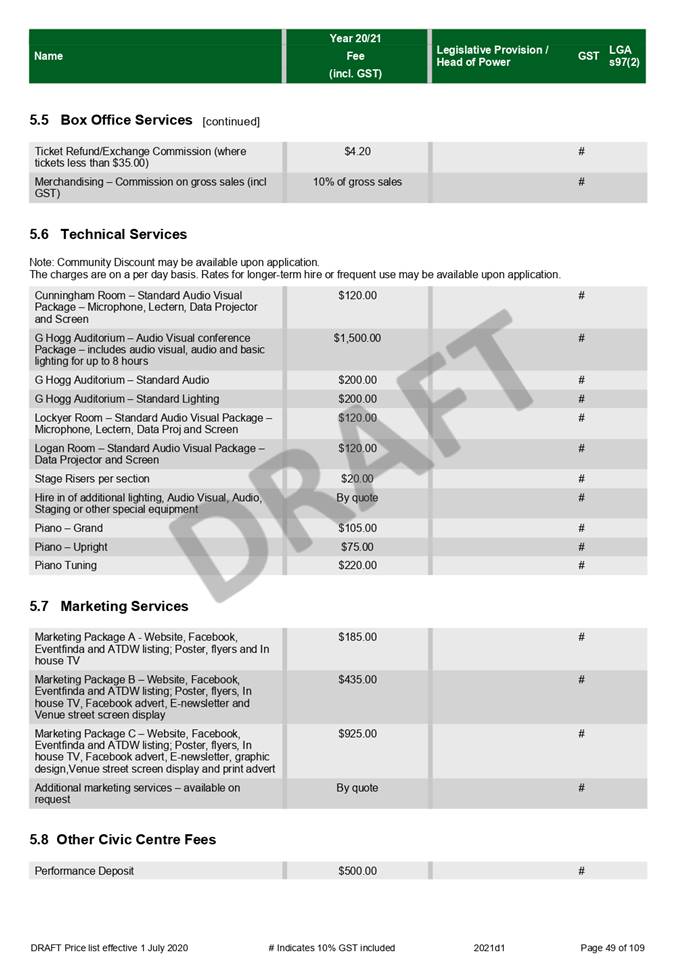

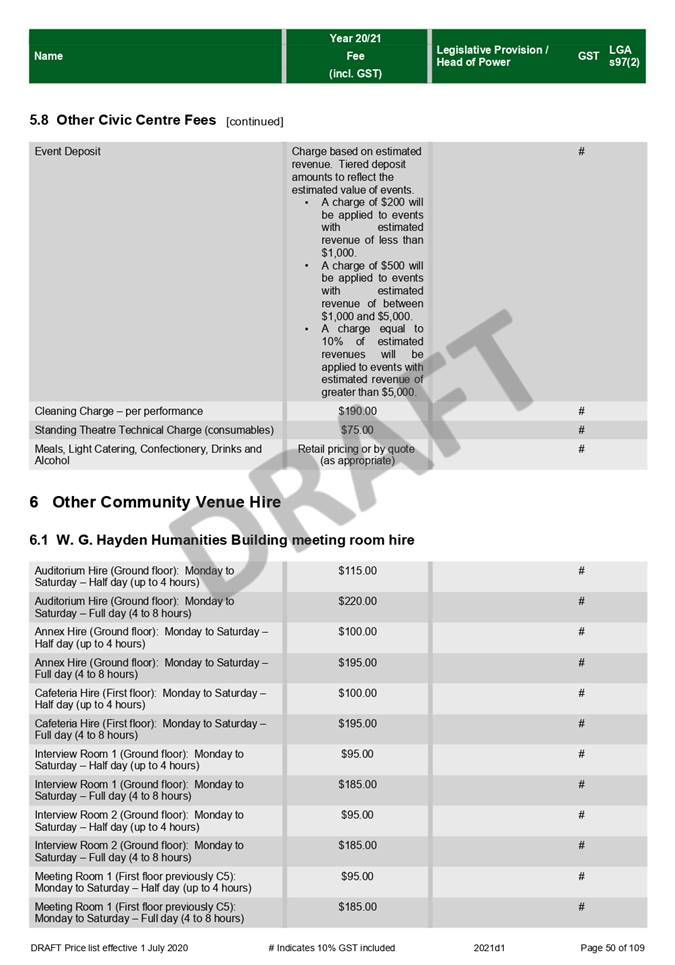

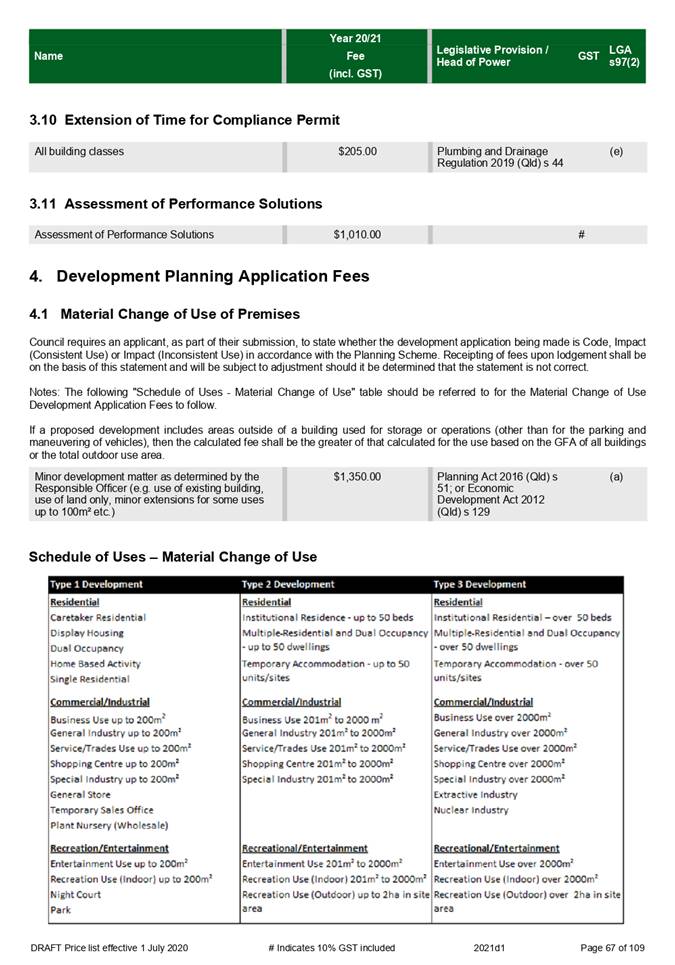

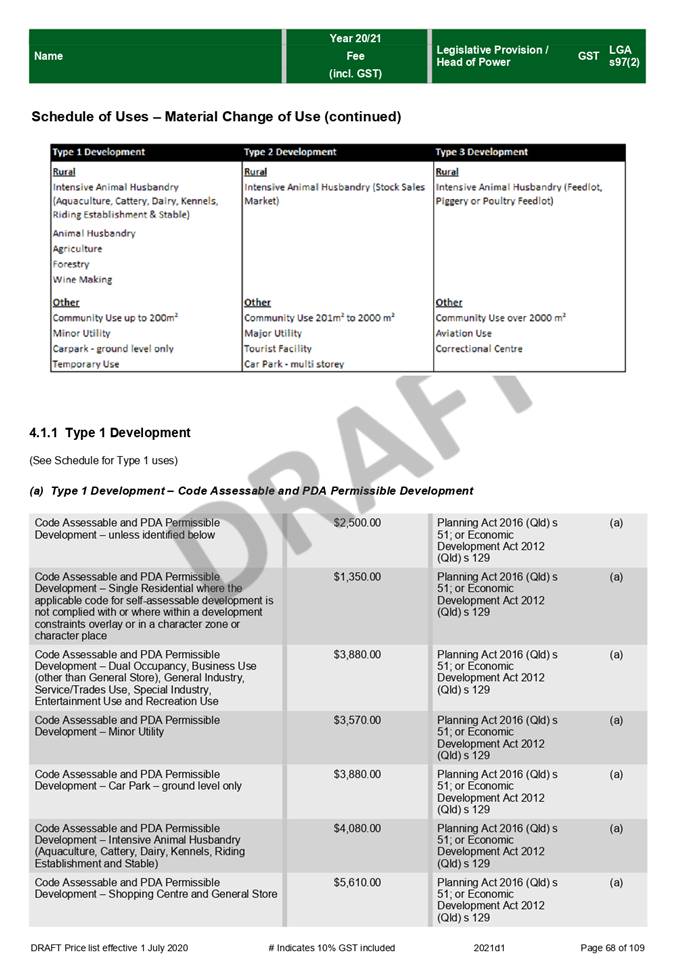

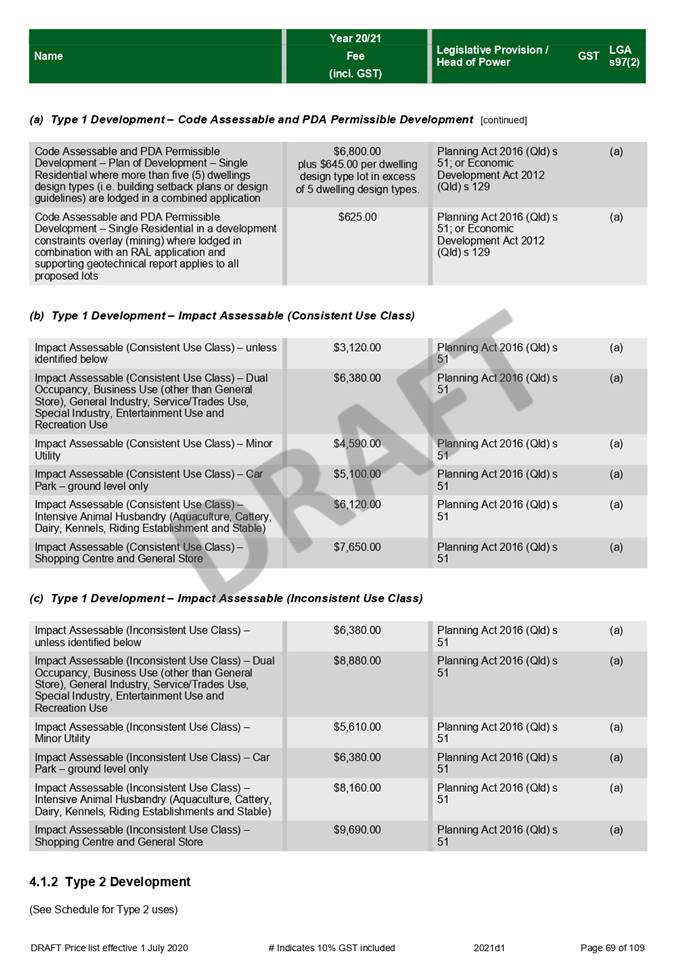

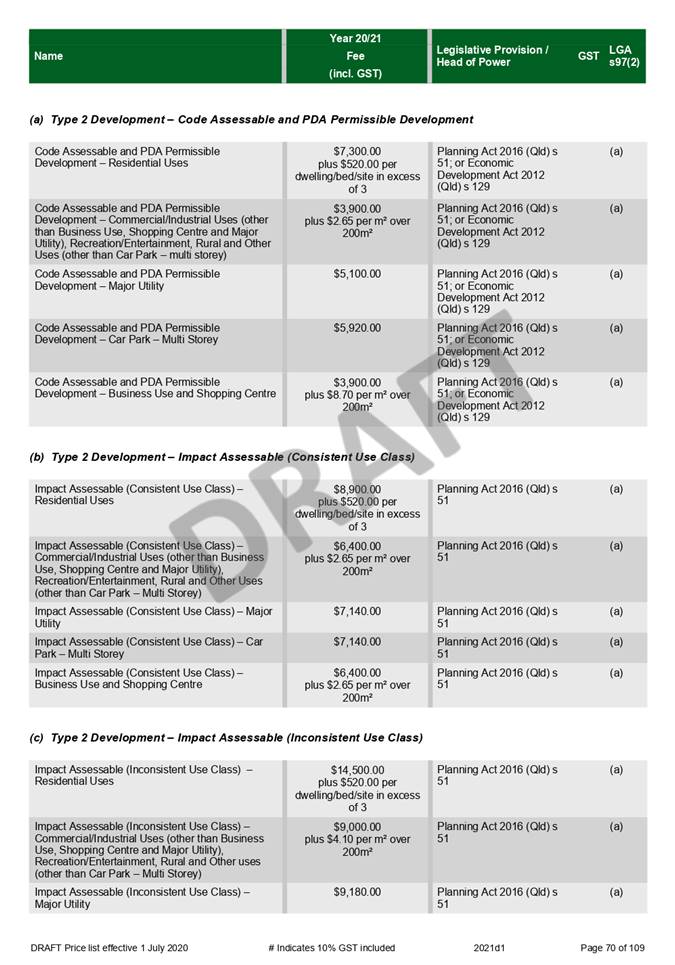

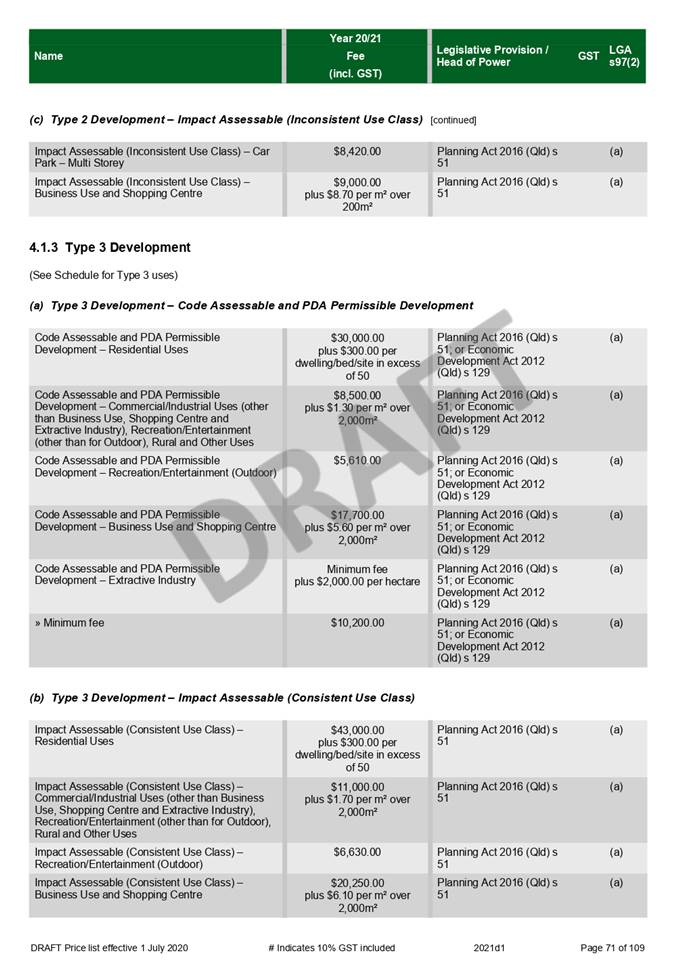

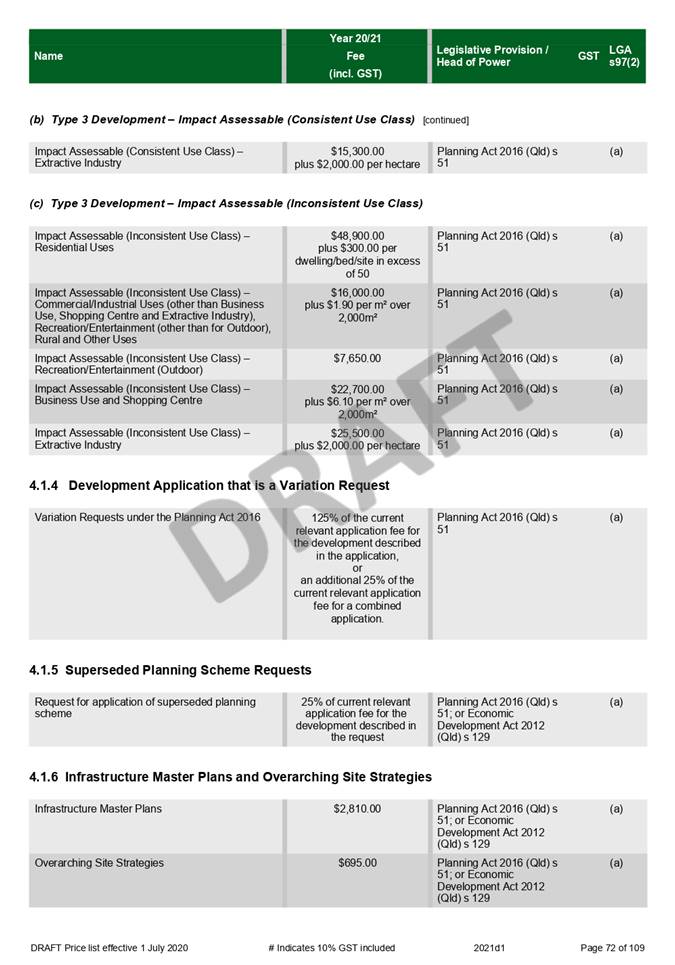

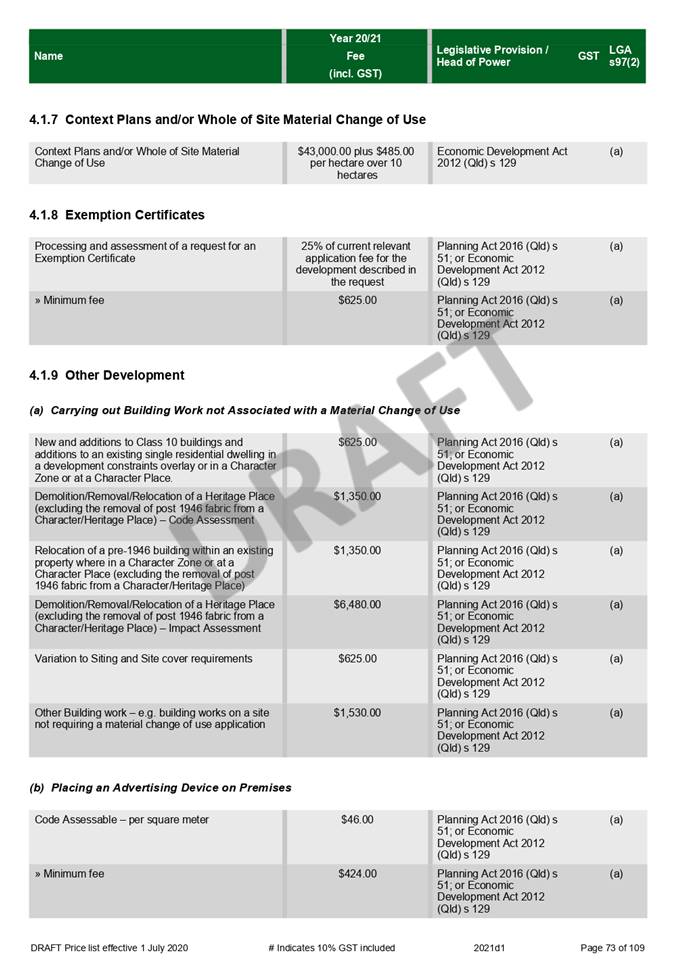

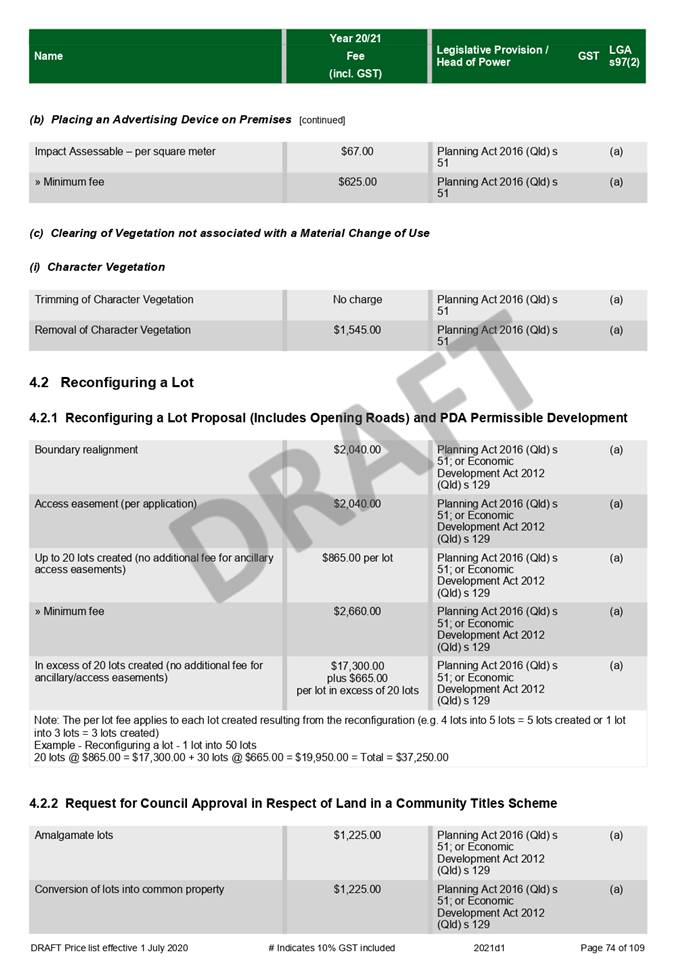

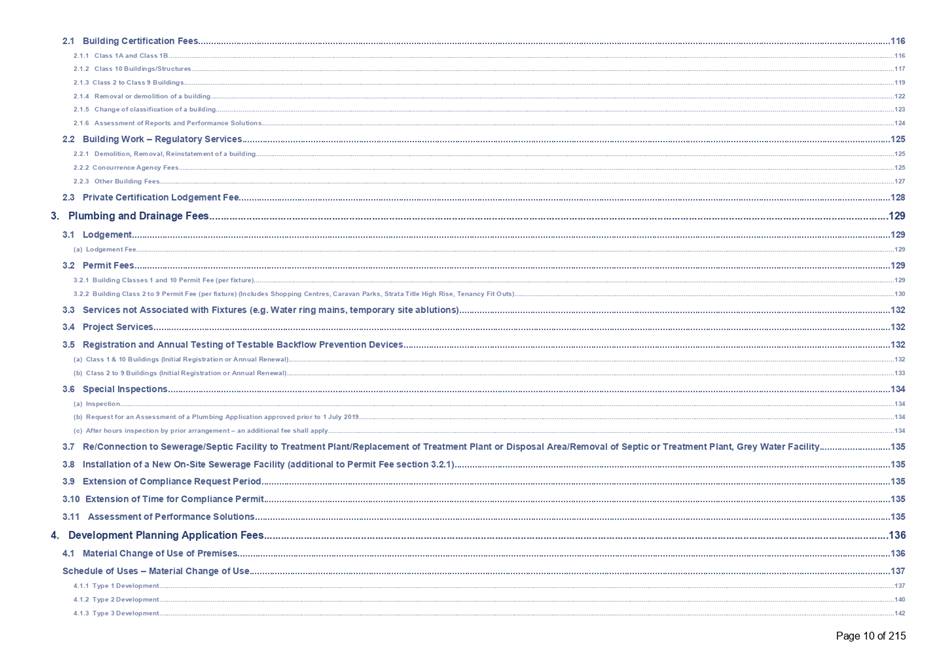

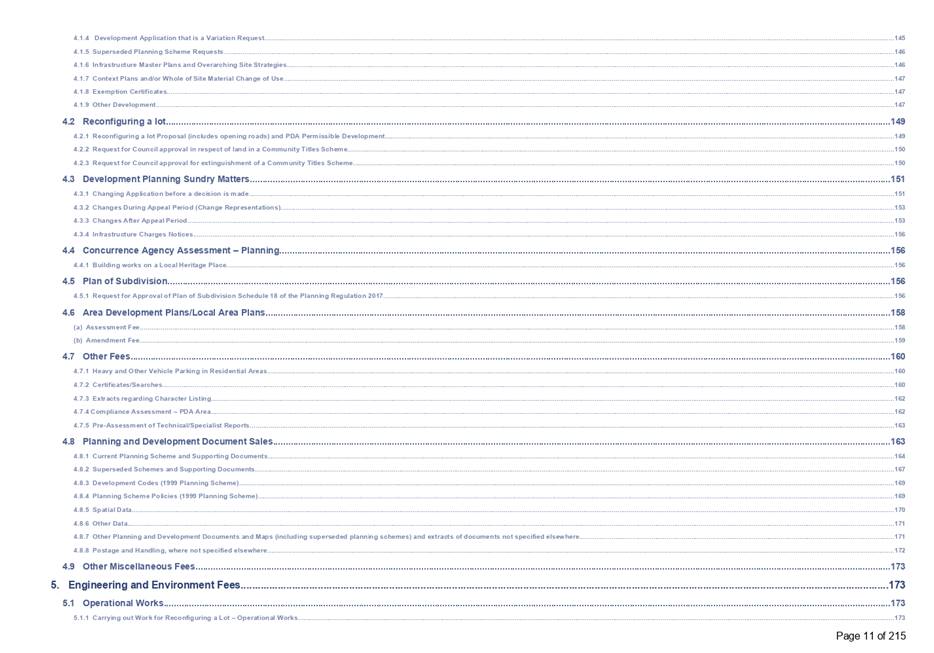

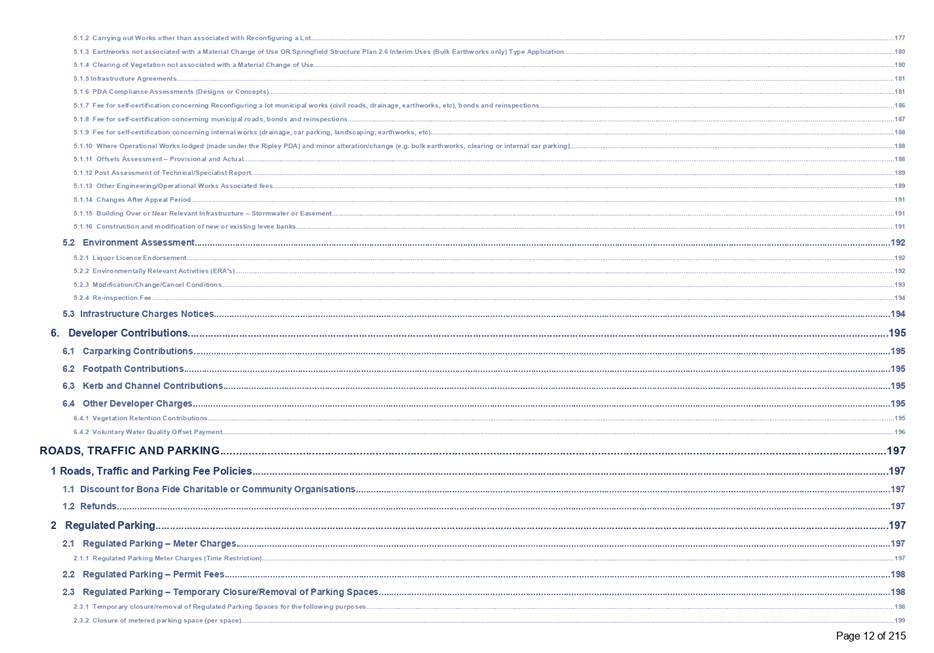

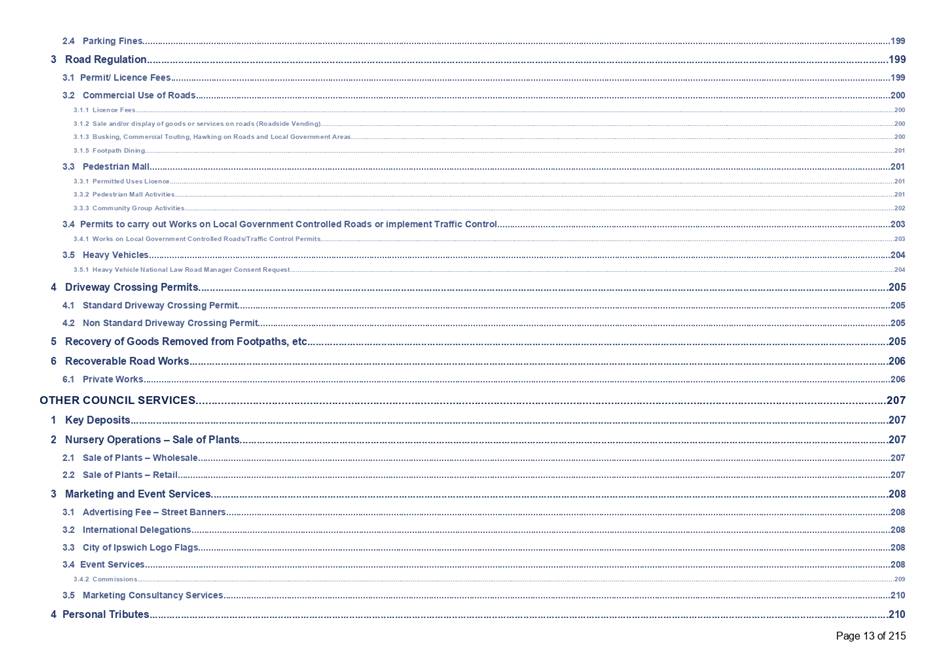

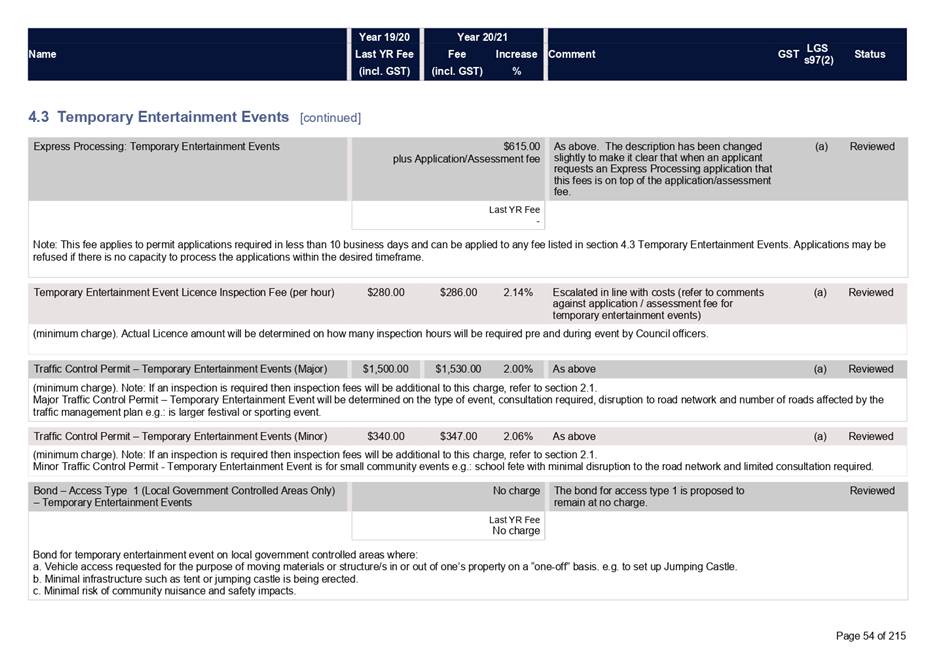

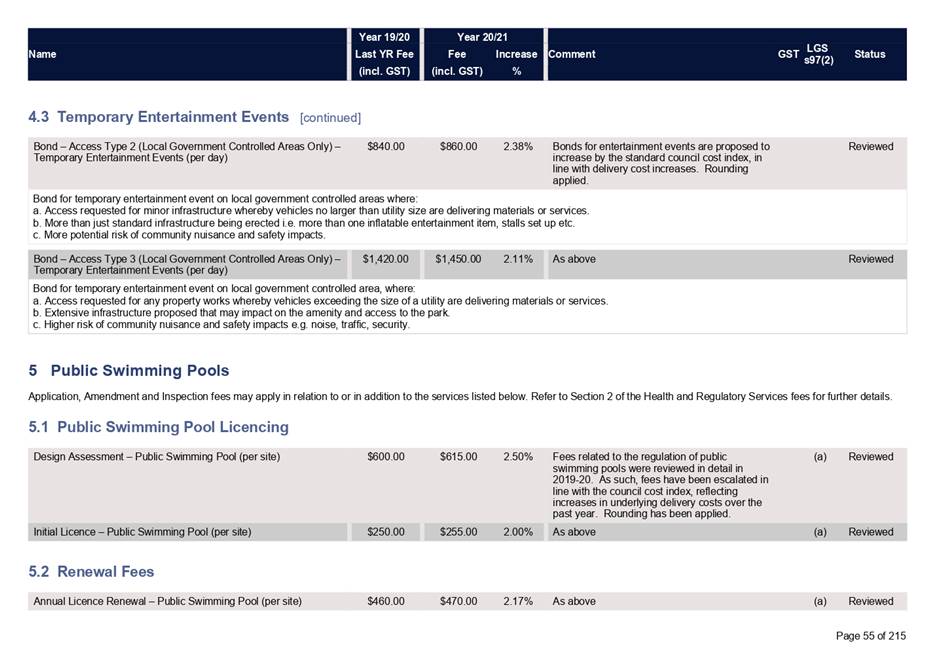

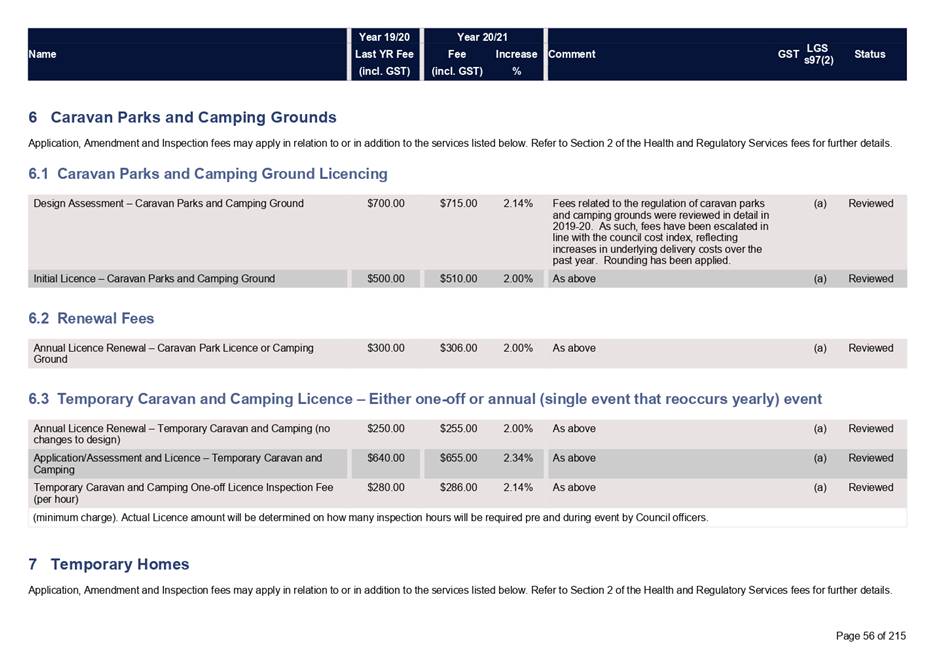

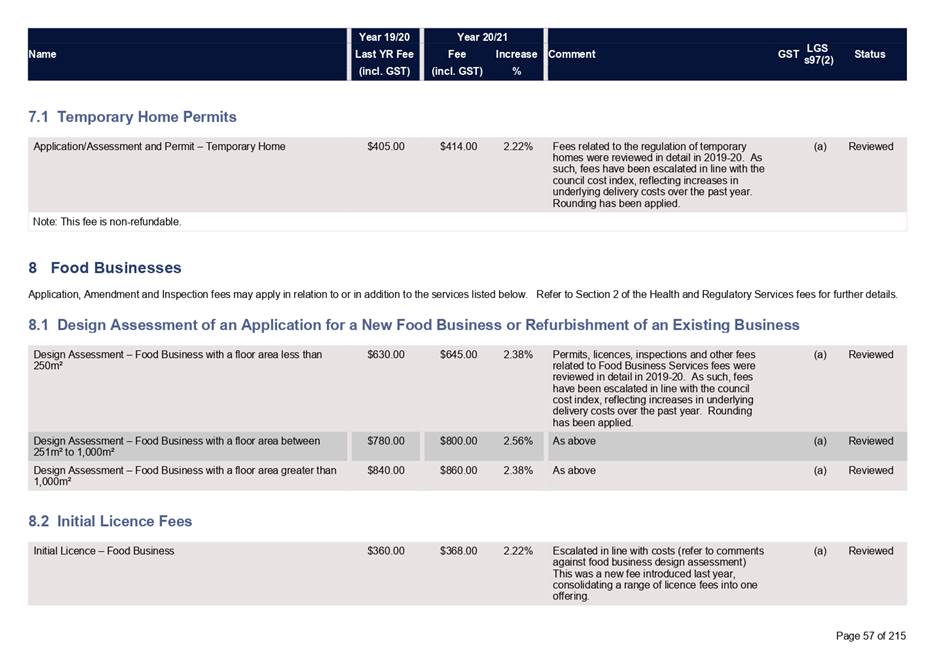

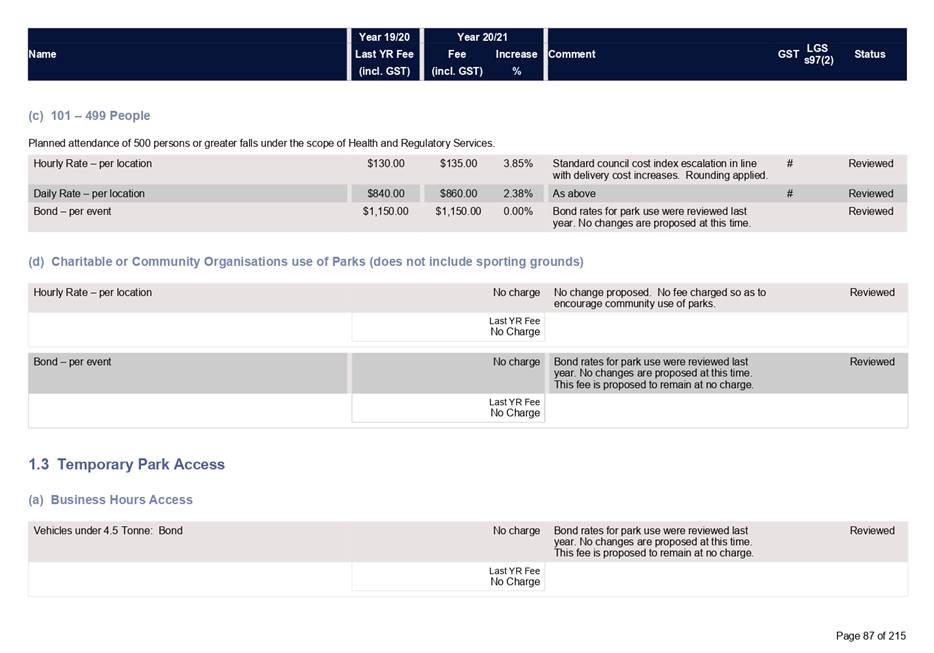

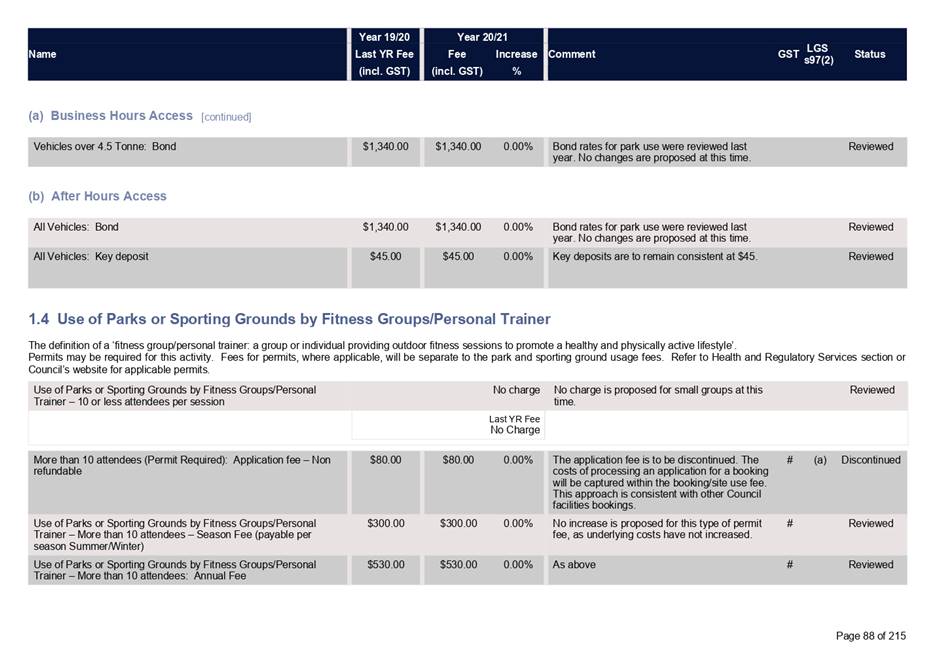

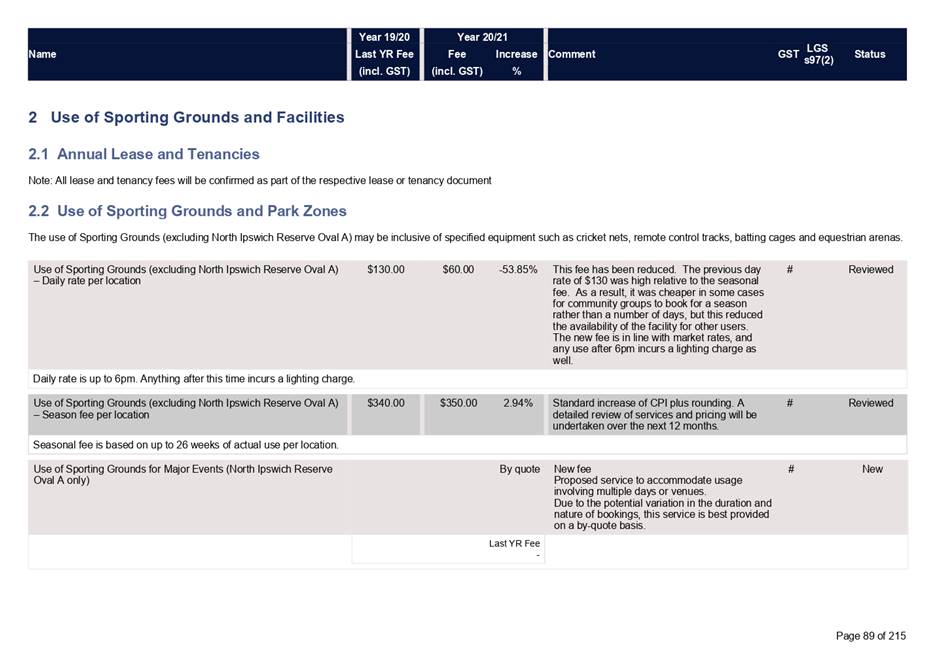

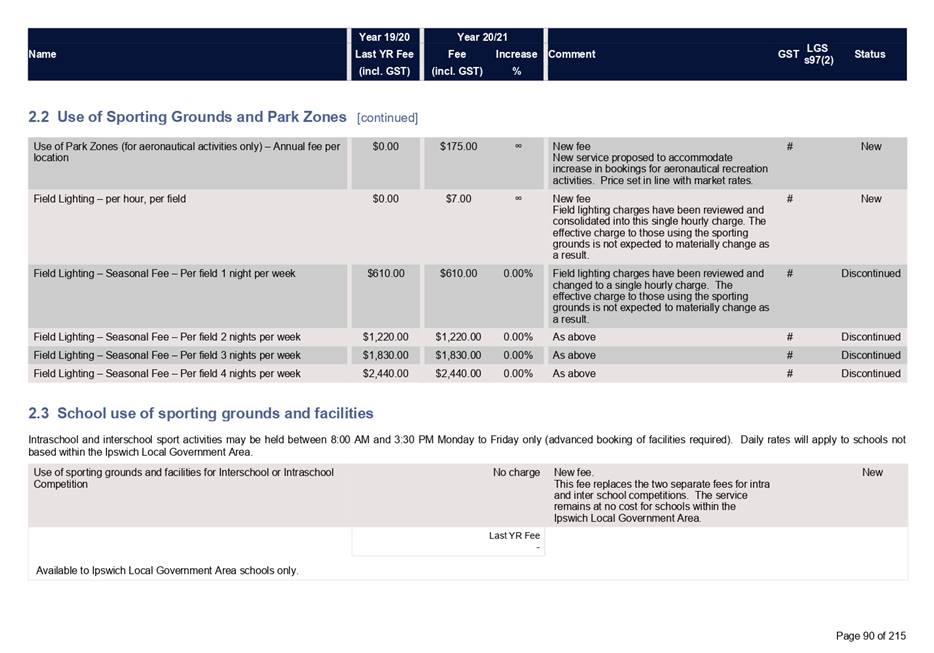

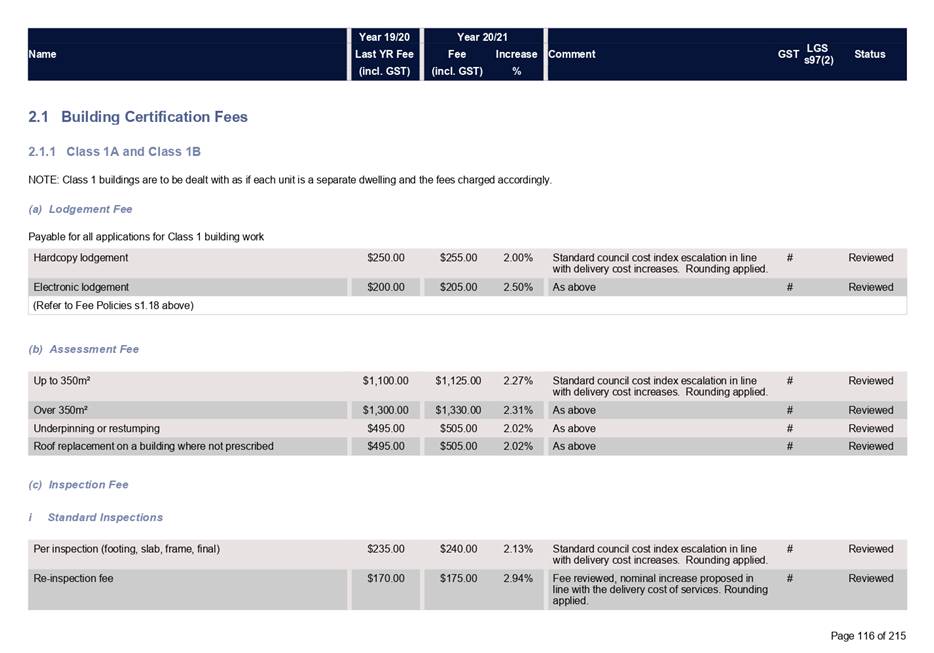

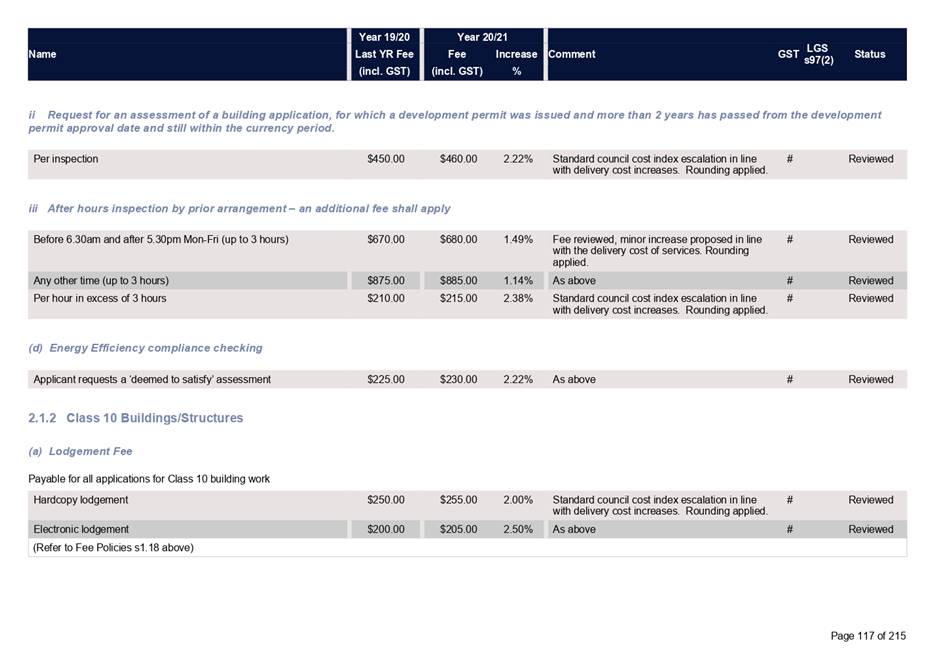

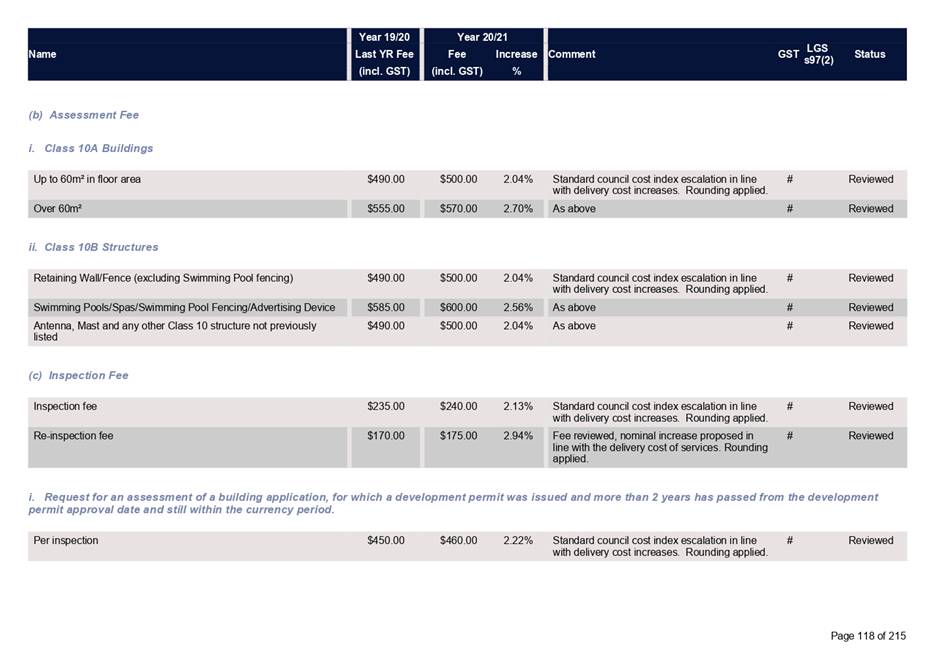

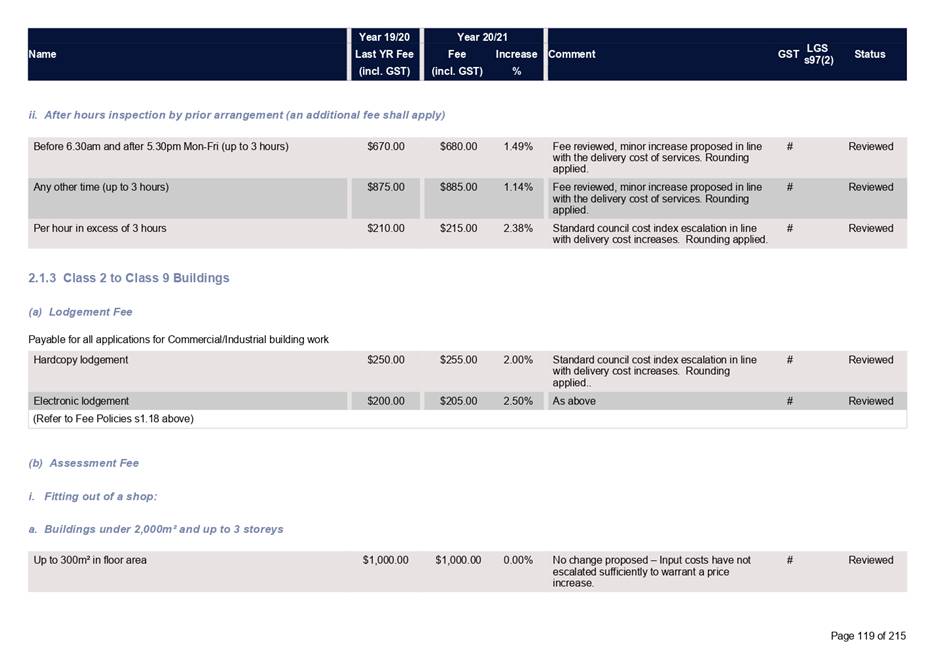

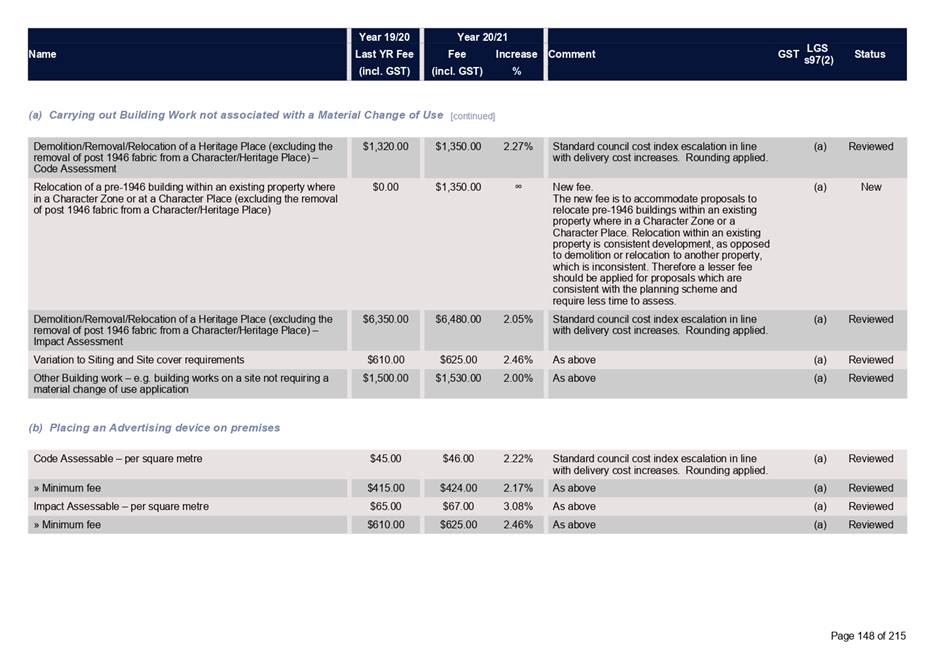

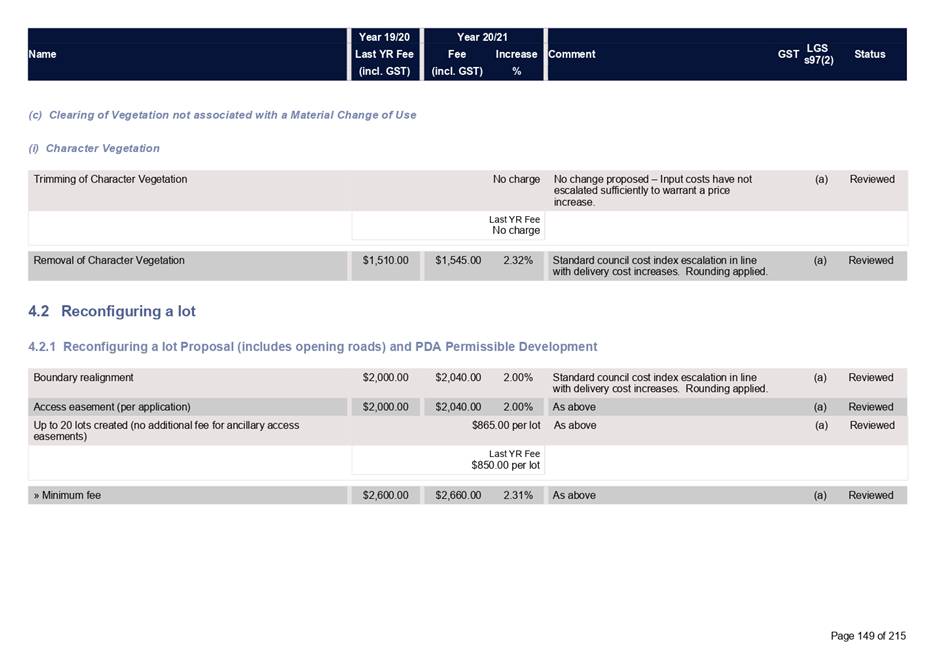

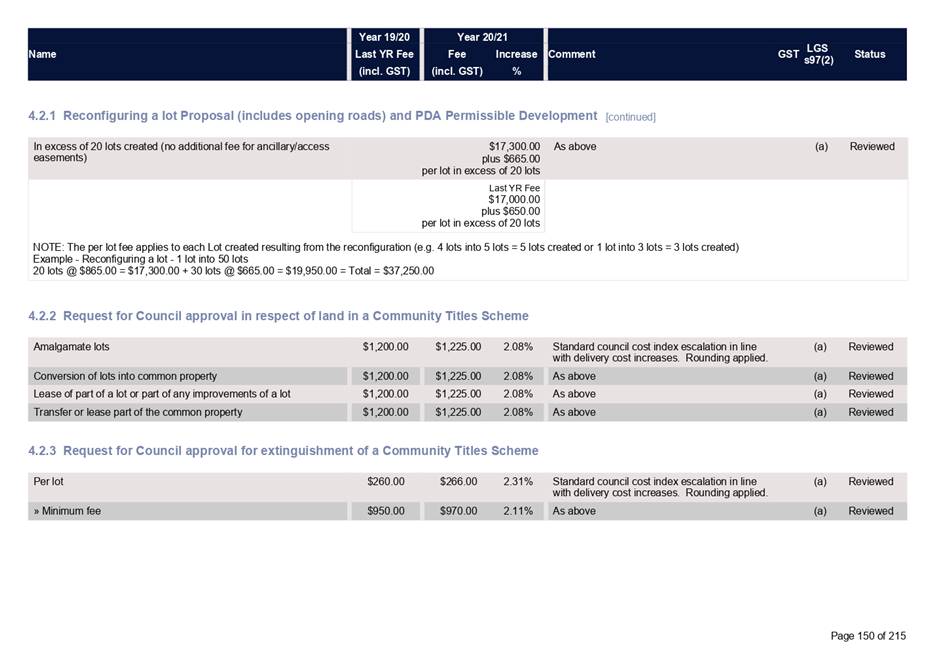

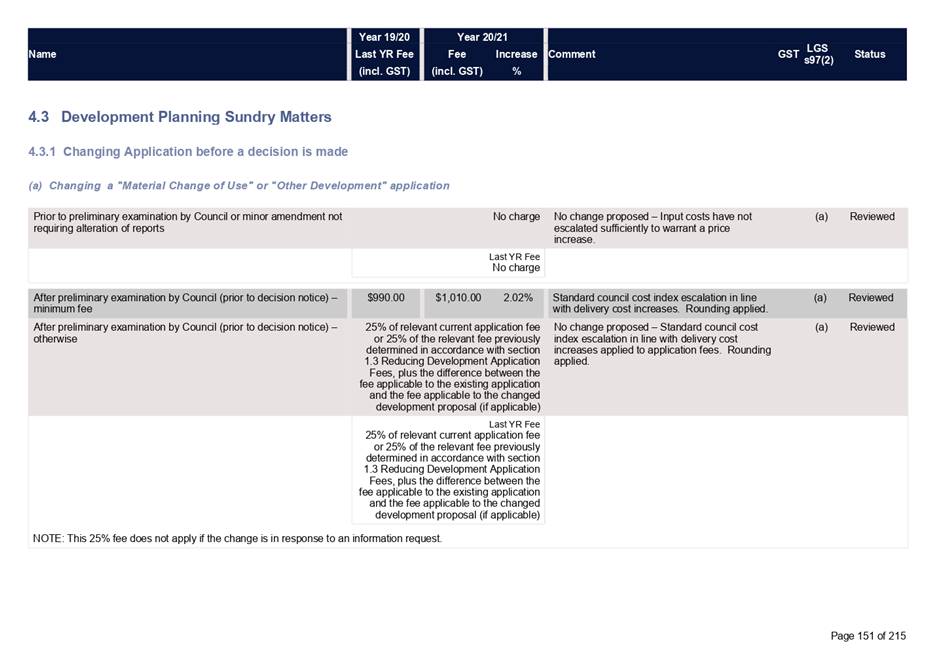

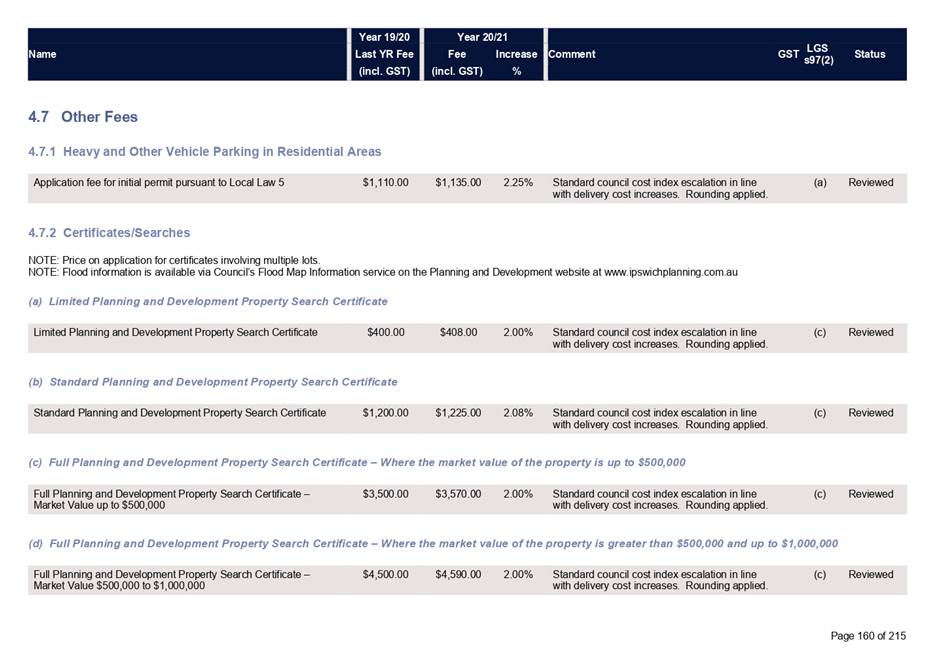

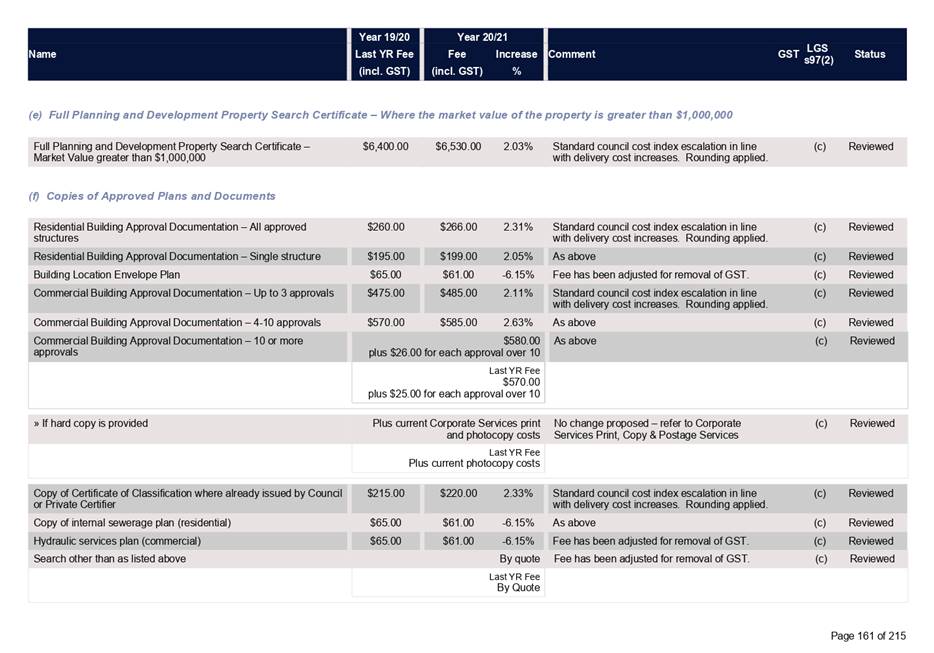

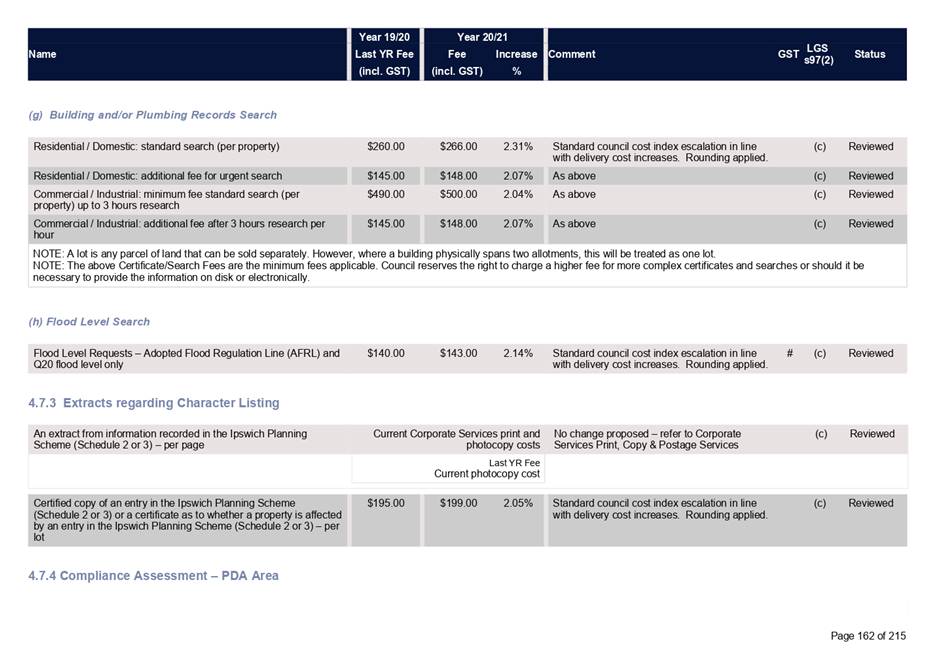

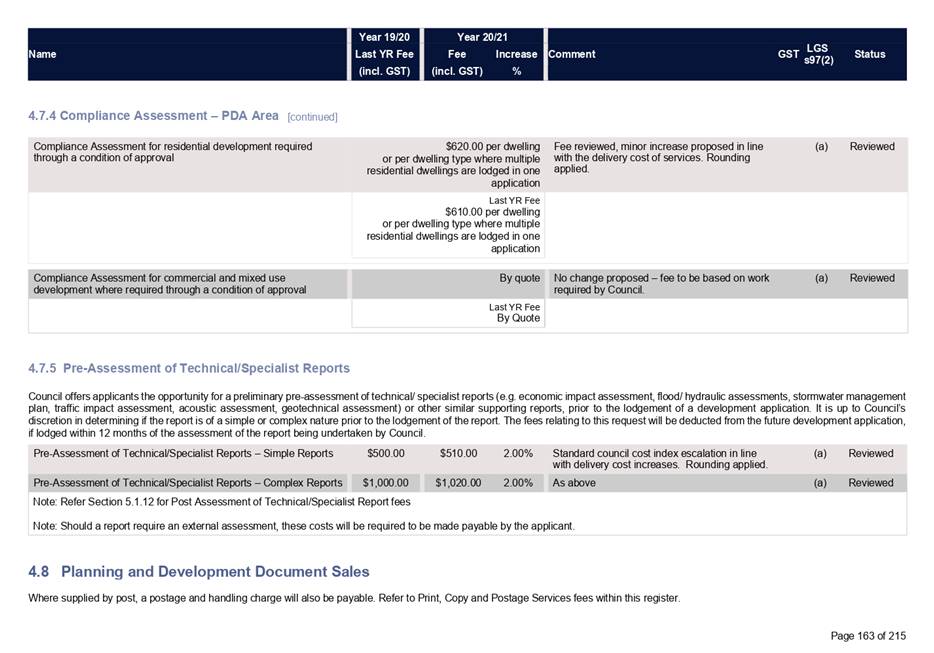

ITEM: 5.3

SUBJECT: Proposed 2020-2021 Fees and Charges

AUTHOR: Treasury Accounting Manager

DATE: 8 June 2020

Executive Summary

This is a report concerning the

annual review of Ipswich City Council’s (Council) proposed

commercial and cost recovery fees and charges and the recommended pricing to

commence with effect 1 July 2020. This report also outlines a

proposed extension of temporary fee relief measures for environmental health

services, parks, sporting grounds and community facilities hire for the first

quarter of the 2020-2021 financial year in response to COVID‑19.

Recommendation/s

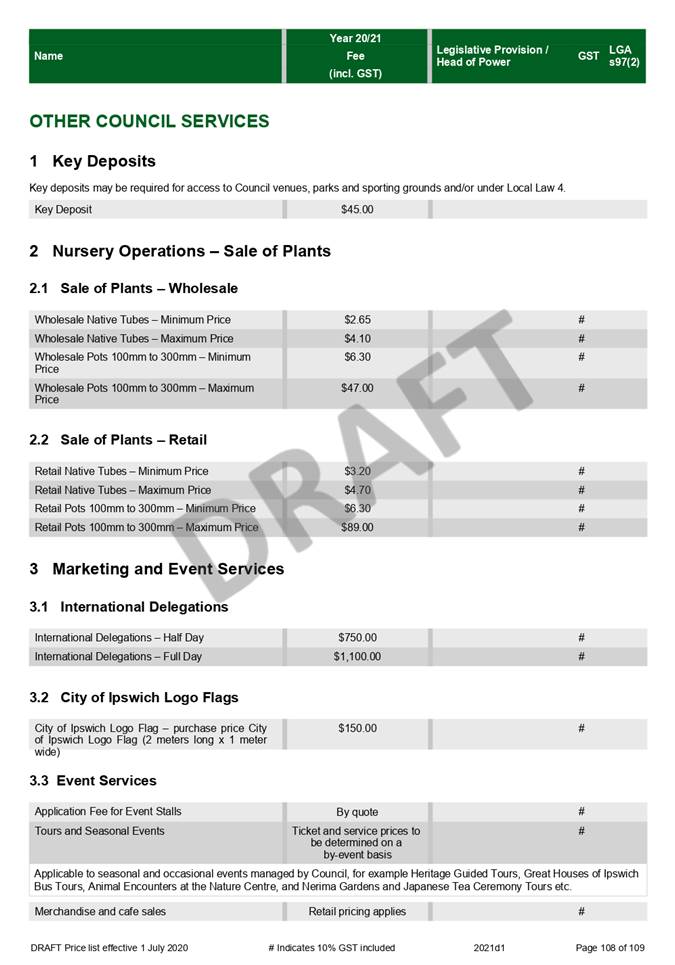

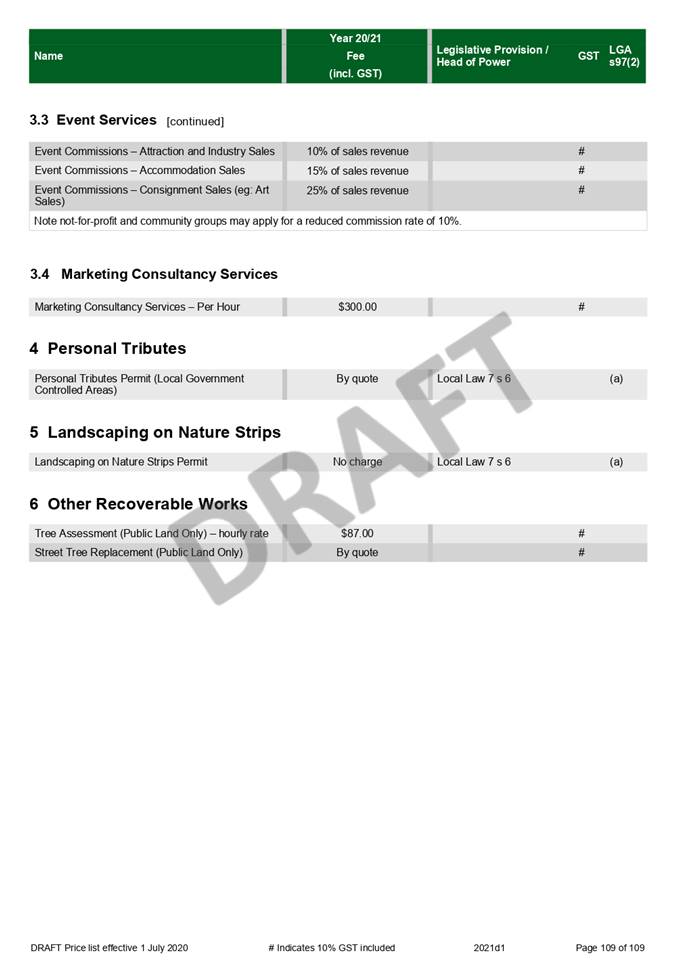

A. That the proposed 2020-2021 Fees and Charges, as detailed

in Attachment 1 to the report by the Treasury Accounting Manager dated

8 June 2020, excluding pages 16 to 18 and 19 to 23, be adopted with an

effective date of 1 July 2020.

B. That

the amendments to Fees and Charges for 2020-2021, as detailed in

Attachment 2 to the report by the Treasury Accounting Manager dated

8 June 2020, be received and noted.

C. That

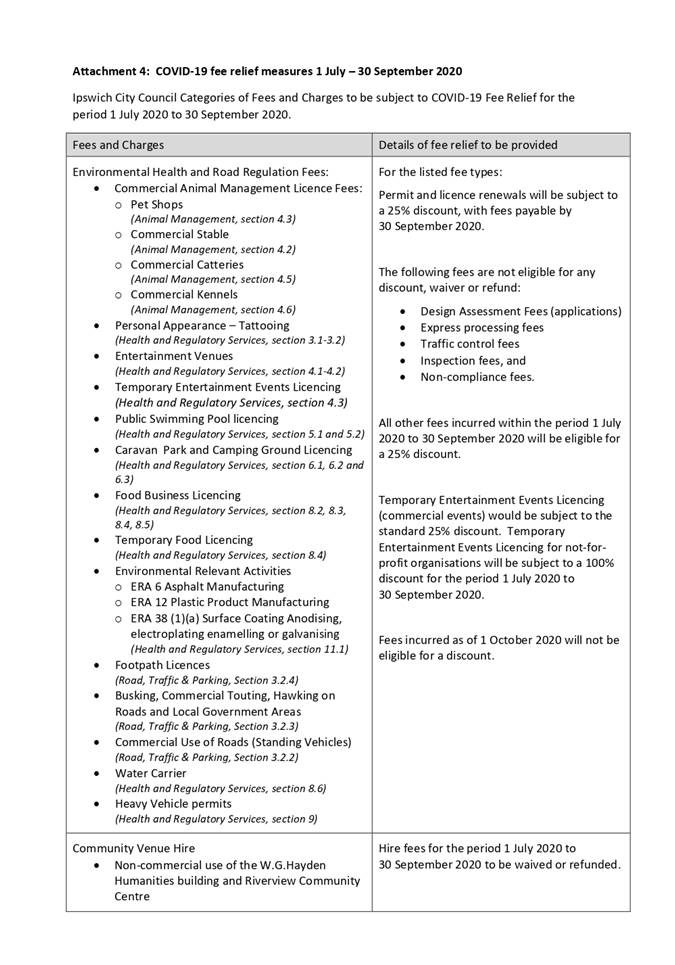

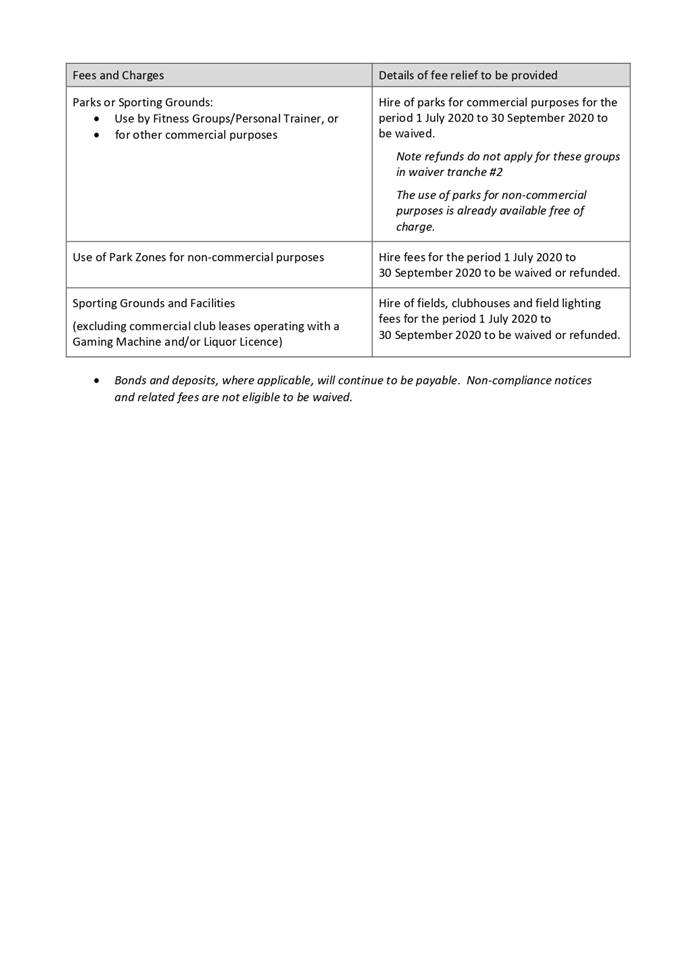

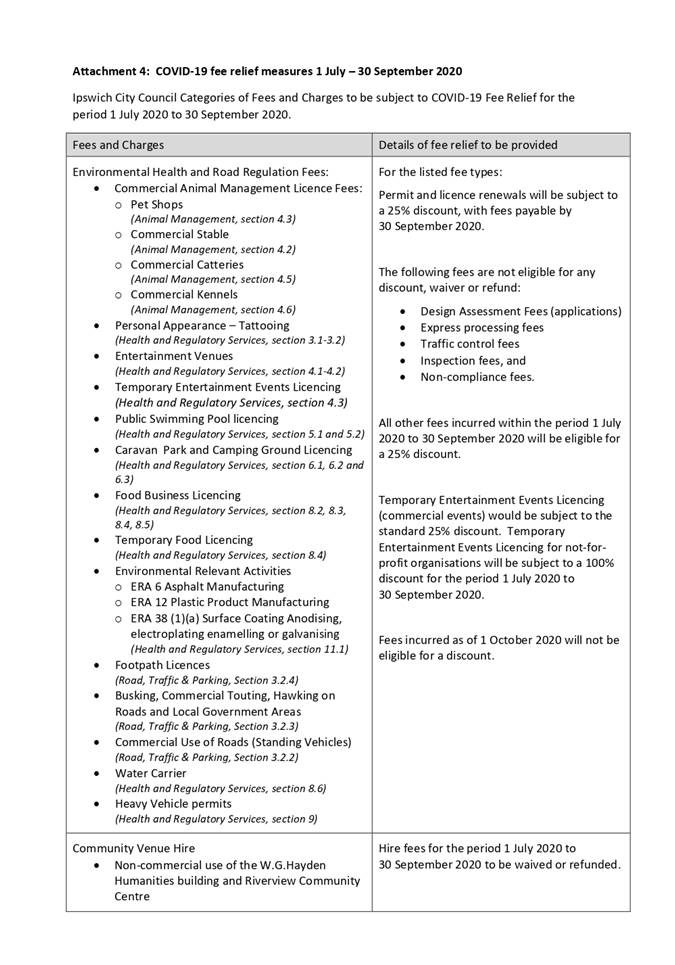

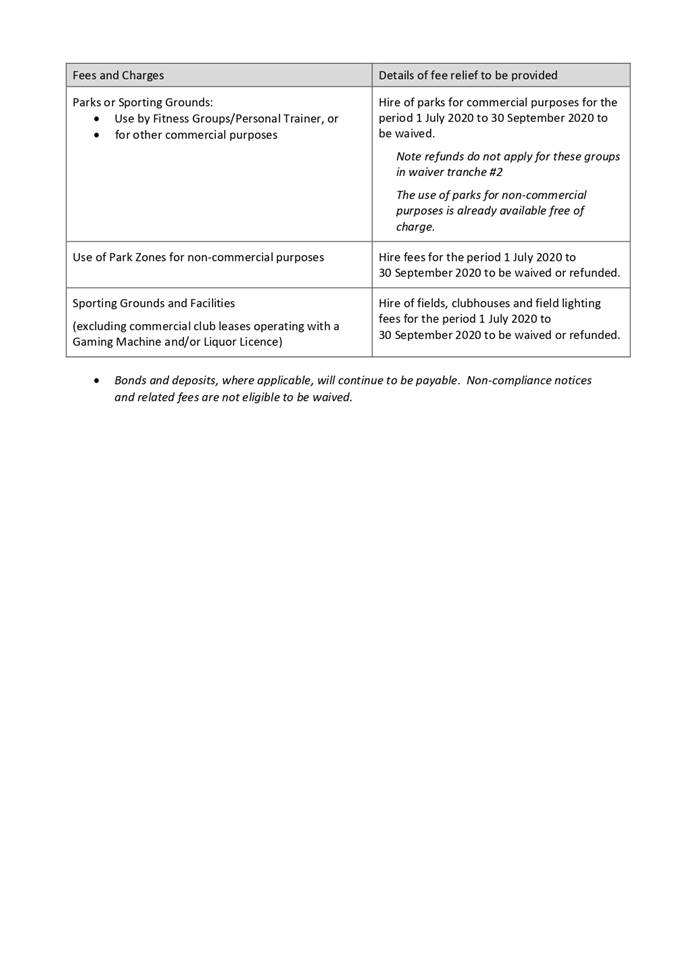

the extension of COVID-19 fee relief measures for environmental health

services, parks, sporting grounds and community facilities hire to

30 September 2020, as outlined in Attachment 4 to the report by the Treasury Accounting Manager dated

8 June 2020, be adopted.

RELATED PARTIES

This report deals with the

adoption of the pricing of fees and charges and does not specifically reference

any third party. Councillors should consider where fees and charges may

impact on their other interests or activities.

Advance Ipswich Theme

Listening, leading and financial

management

Strengthening our local economy and building prosperity

Purpose of Report/Background

Section

98 of the Local Government Act 2009 (LGA) requires Council to maintain a

publicly available register of cost recovery fees. Council’s

register lists approximately 1,024 current services, encompassing both cost

recovery and commercial fees.

An

annual review is undertaken prior to the start of each financial year as part

of the budget process. Whilst the annual review is coordinated by the

Finance Branch, Departments remain responsible for developing recommendations

to Council with regard to the proposed fees and charges.

In

reviewing fees and charges, the Departments consider increases in the

underlying costs of service delivery, consistency of the fees with Council

policy and objectives, financial impact analysis and benchmarking of

charges. Departments are also requested to undertake stakeholder

consultation where appropriate.

The

proposed register is intended to capture all fees and charges, with the

exception of property rates, penalties, levies, and services provided by

controlled entities.

Section

97 of the LGA allows Council to set cost-recovery fees for a range of

regulatory functions, specifically:

a) licences, permits, registration or

approvals;

b) change of ownership of land;

c) giving of information kept under a

Local Government Act;

d) seizing property or animals under a

Local Government Act; and

e) performance of certain

responsibilities under the Building Act or the Plumbing and Drainage Act.

The LGA

requires that a cost-recovery fee be no more than the cost to the local

government of taking the action for which the fee is charged. Where the

fee is a cost recovery fee, it is identified within the register by the

reference to the relevant paragraph of LGA s 97(2), and the head of power under

which the service is offered. Approximately two-thirds of fees listed in

the register are cost recovery fees.

In

addition to cost recovery fees, there are a small number of fees which are set

by, or based on a pricing approach set by regulation. Such fees will

typically relate to Planning and Development matters, or regulated services

such as Right to Information fees.

The

register also captures the fees and charges for Council’s commercially

offered range of goods and services, such as venue hire, equipment hire and

park use.

The

proposed Fees and Charges register for 2020-2021 is provided at Attachment

1. For completeness, this extract includes Animal Management

Permits and Dog Registration fees, which were subject to separate consideration

and approval by Council in May.

A

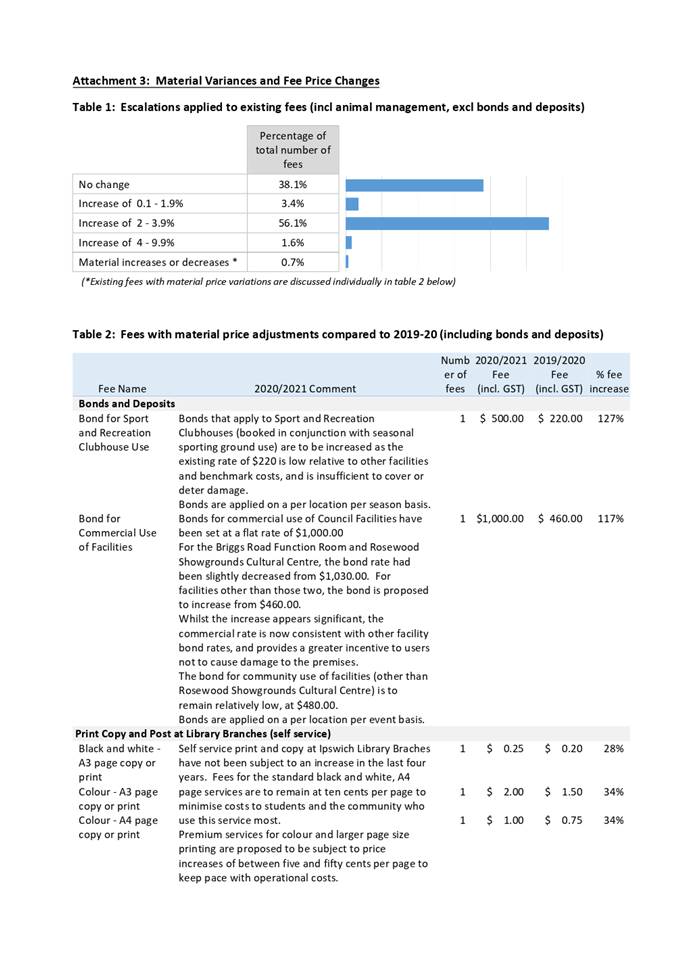

comparison of the existing Fees and Charges in place through 2019-2020 and the

proposed Fees and Charges for 2020-2021, including details of new or deleted

fees and charges, are listed in Attachment 2. There are very few material

changes proposed for fees and charges at this time. The price of the

majority of regulatory fees are proposed to increase in line with the forecast

Council Cost Index at 2%, plus rounding. Commercial fees, most of which

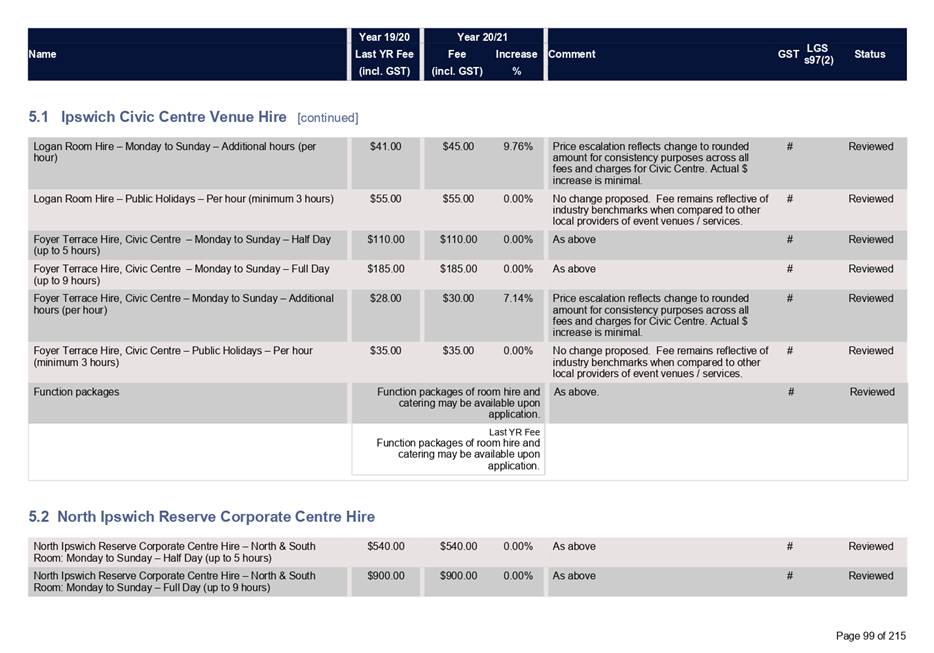

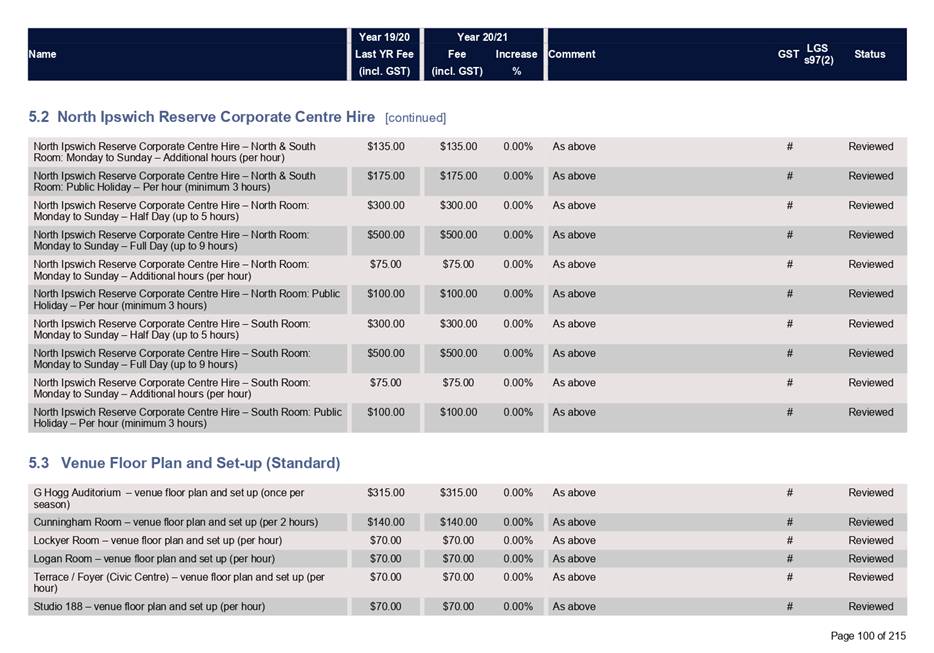

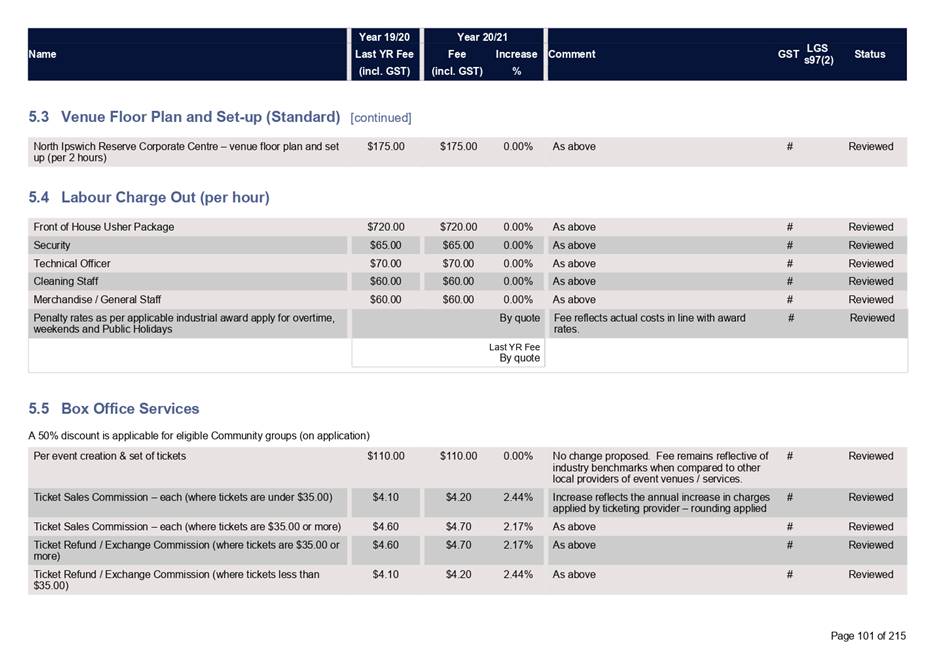

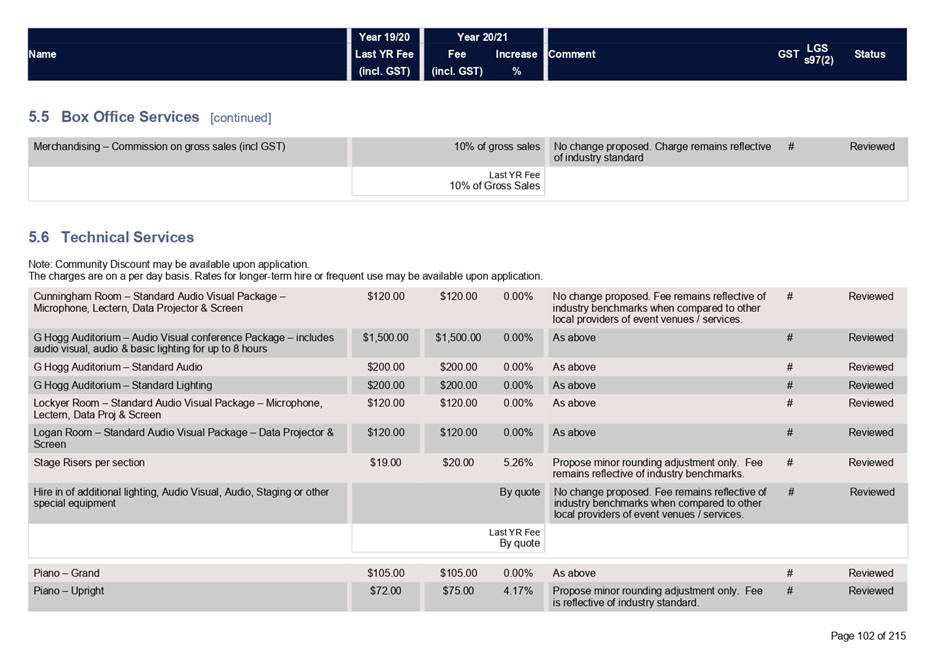

relate to venue hire, are proposed to remain at the 2019-2020 rates, reflecting

staticity in market benchmarks as at February 2020.

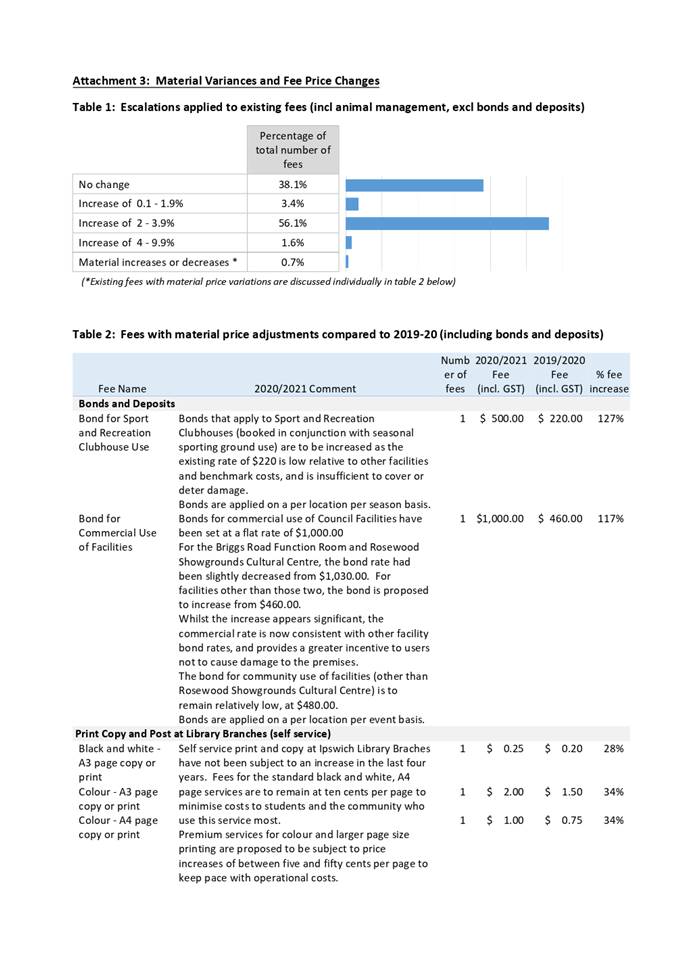

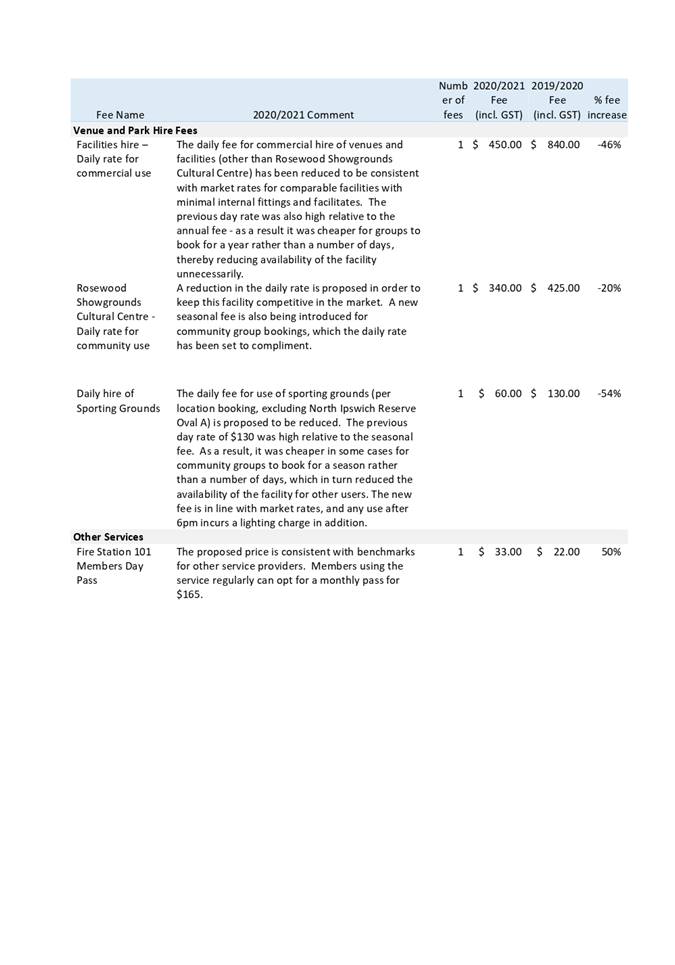

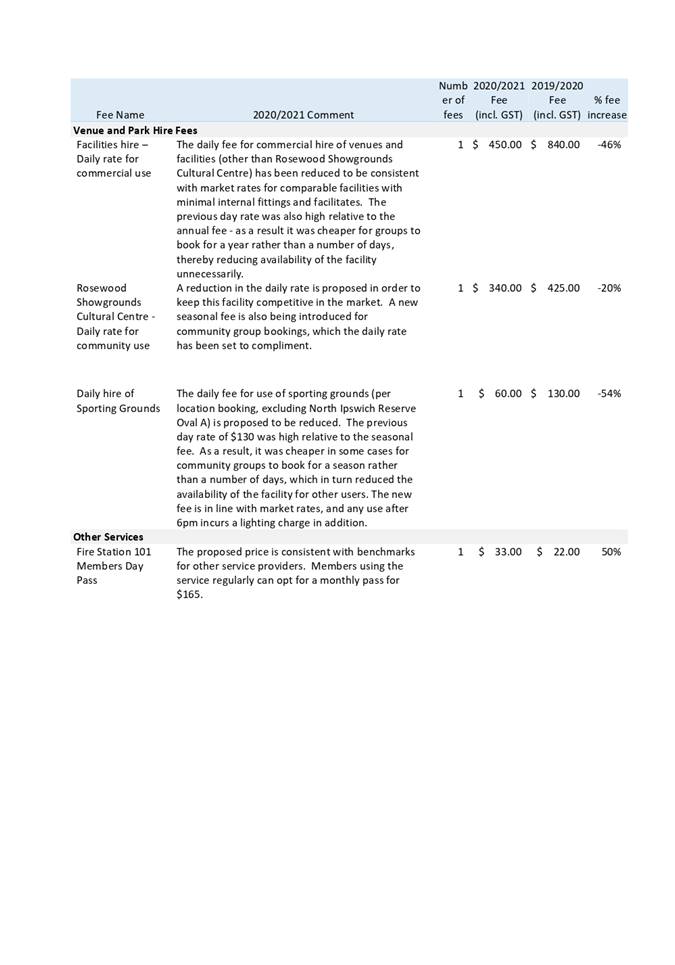

Attachment

3 provides a summary of the existing fees and charges which are proposed to be

subject to a material increase or decrease, not in line with the Council Cost

Index.

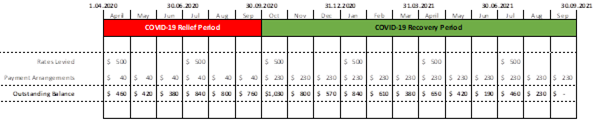

The

proposed fees and charges were developed prior to the economic impact of

COVID-19 materialising. As such, the proposed fees reflect a baseline or

‘business as usual’ position. In recognition of this, the

proposal includes an extension of temporary fee relief measures for

environmental health services, parks, sporting grounds and community facilities

hire for the first quarter of the 2020-2021 financial year (detailed in

Attachment 4).

Following

their adoption, the Fees and Charges may be subsequently amended at any time by

a resolution of Council.

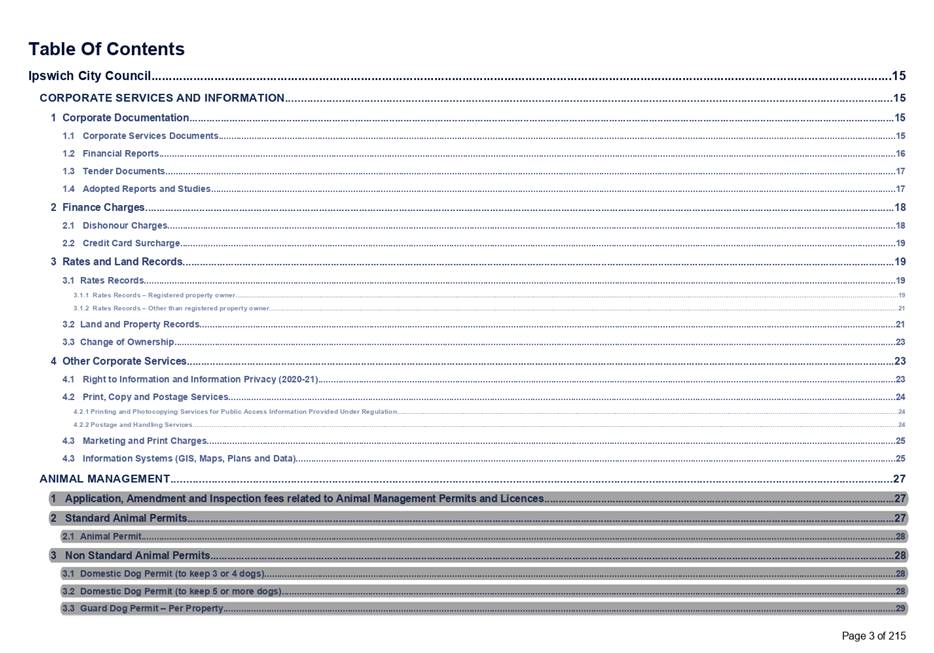

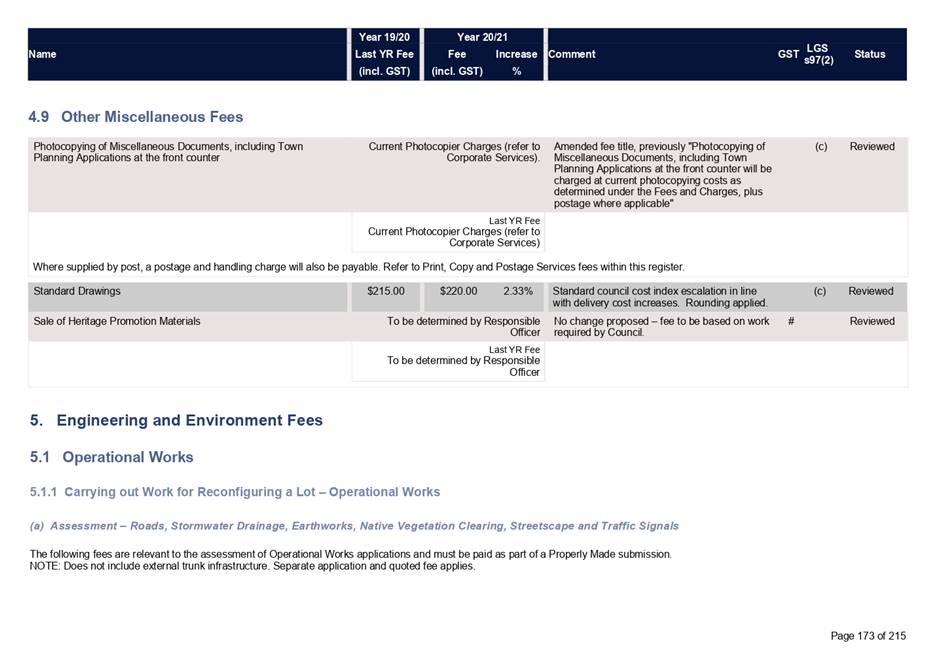

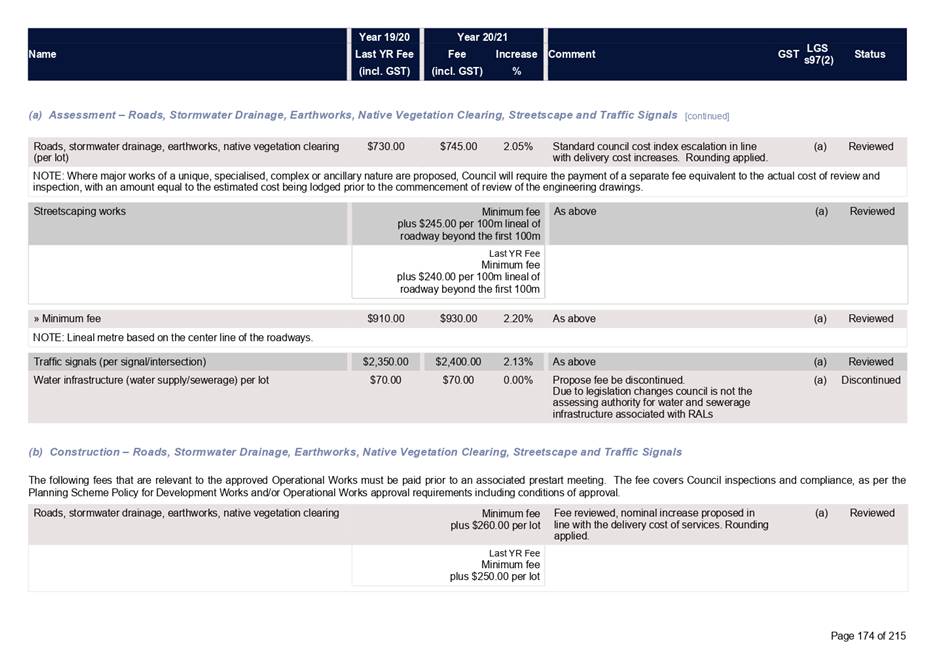

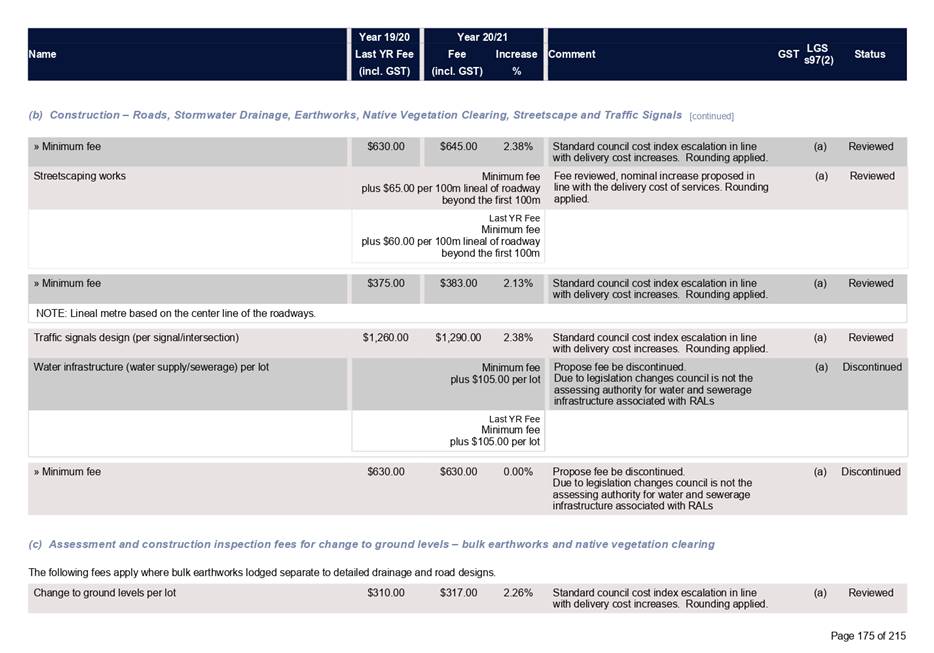

The key

fee categories within the register, by subject header, are as follows:

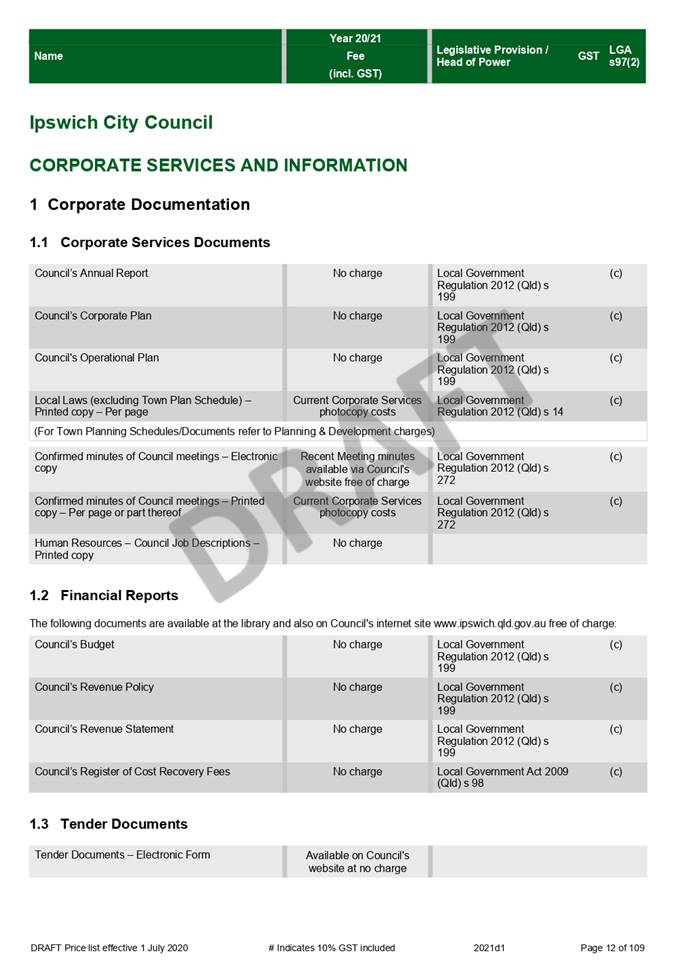

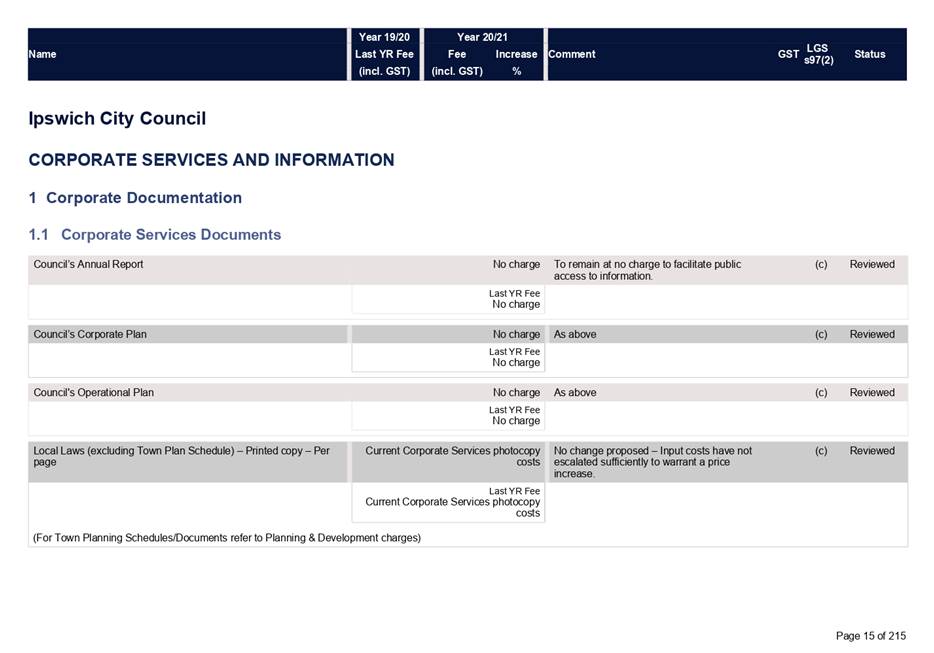

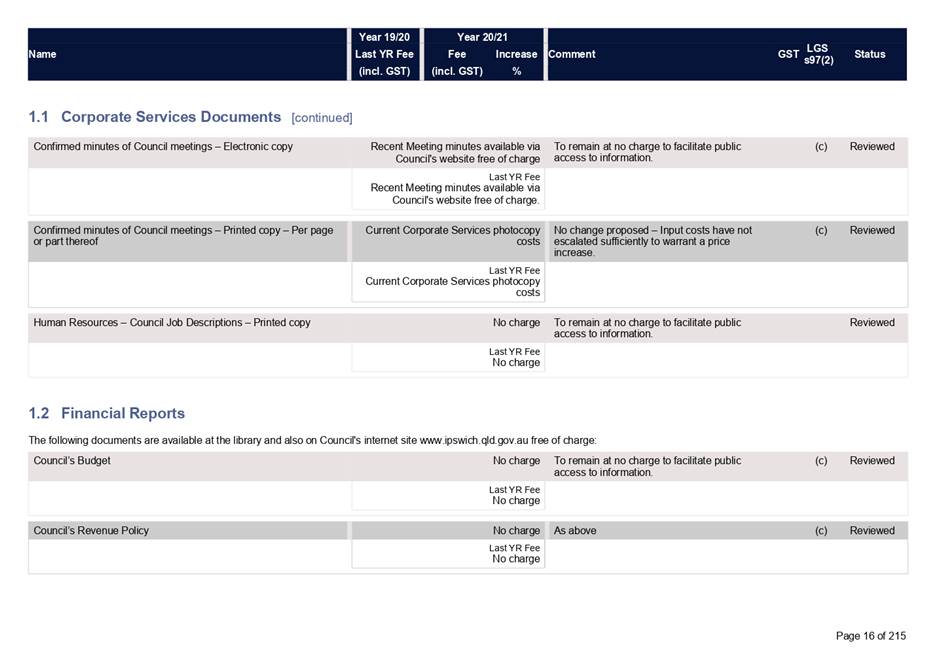

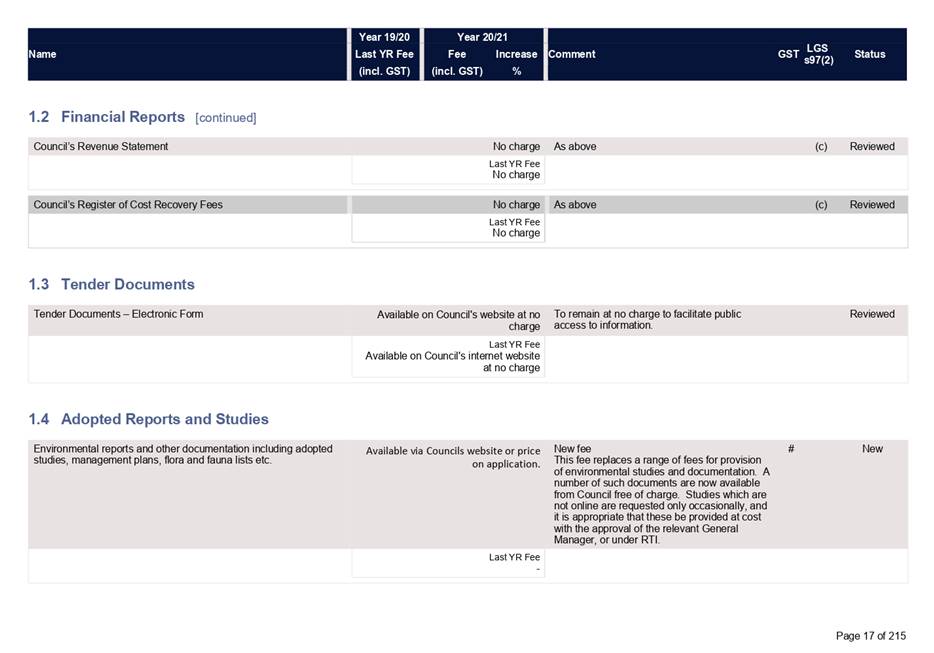

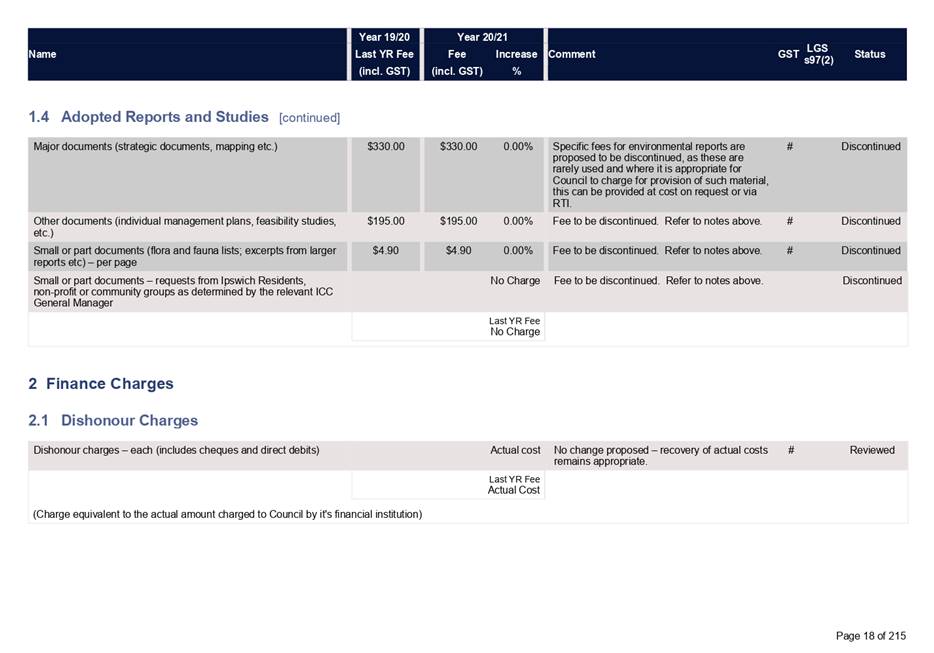

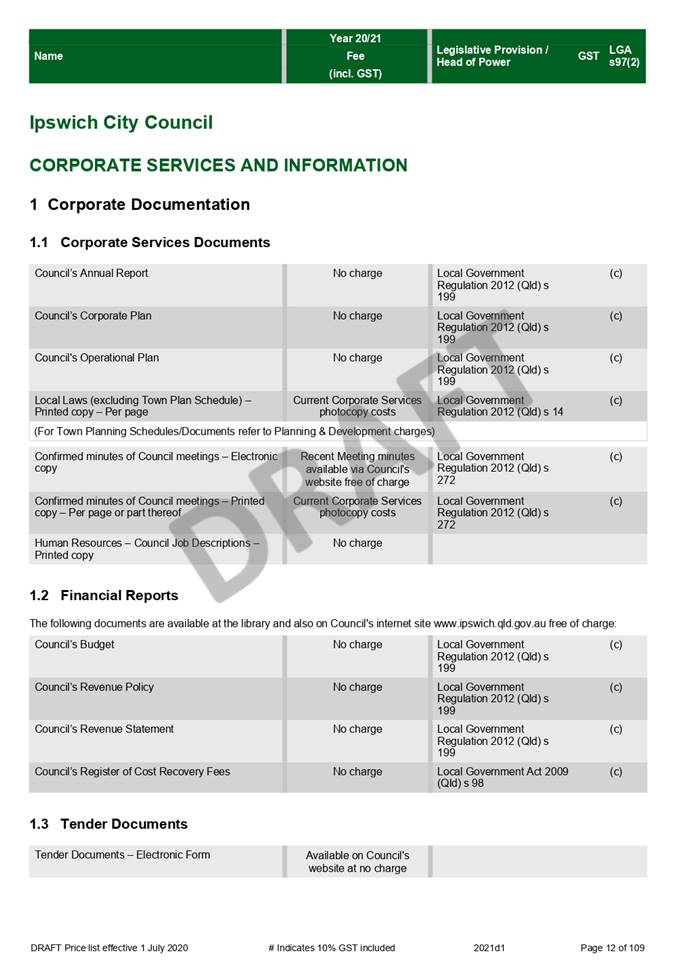

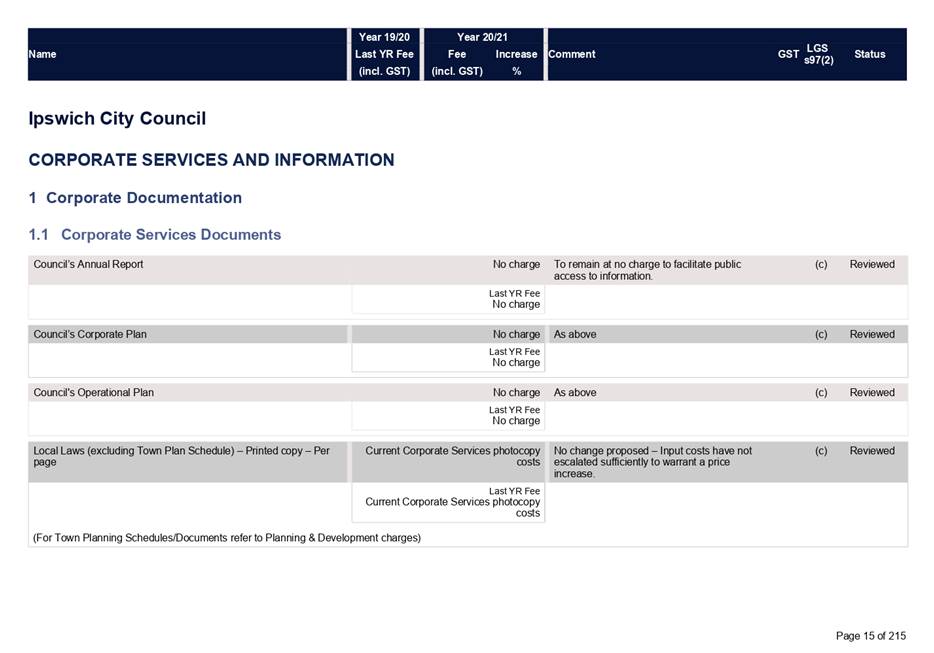

Corporate

Services and Information

• Corporate

Documentation and Reports

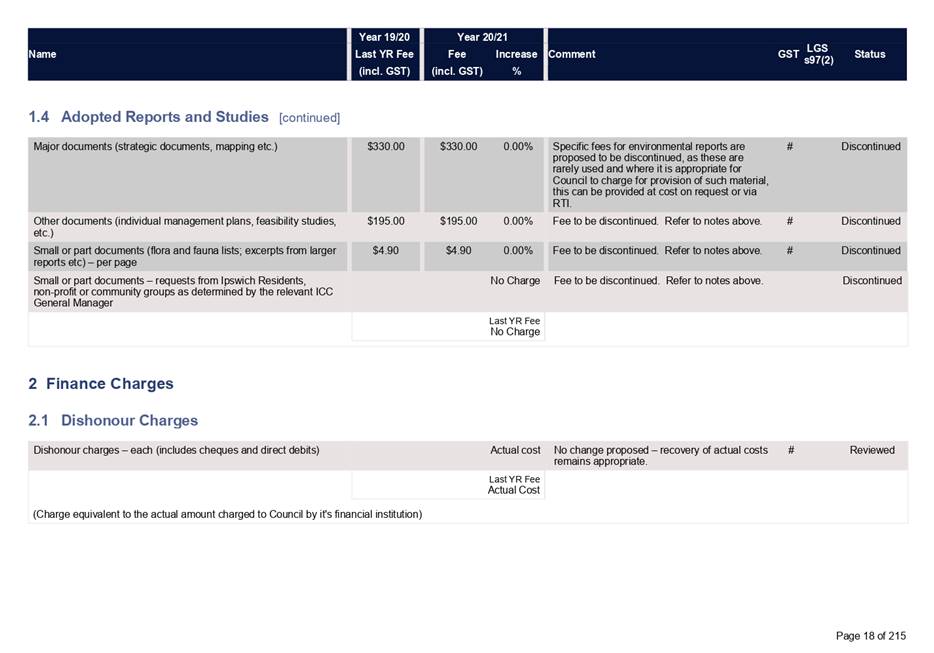

Included

in the register is a listing of key Council documents, such as the Annual

Report, Budget and Local Laws, which are available free of charge (Attachment

2, pages 15-17).

A series

of fees for environmental reports and data sets have been removed from the

register due to limited demand or Council making the reports available online

and therefore free of charge. Where it is appropriate for Council to

charge for provision of such material, this can be provided at cost on request

or via a right to information request (Attachment

2, page 17).

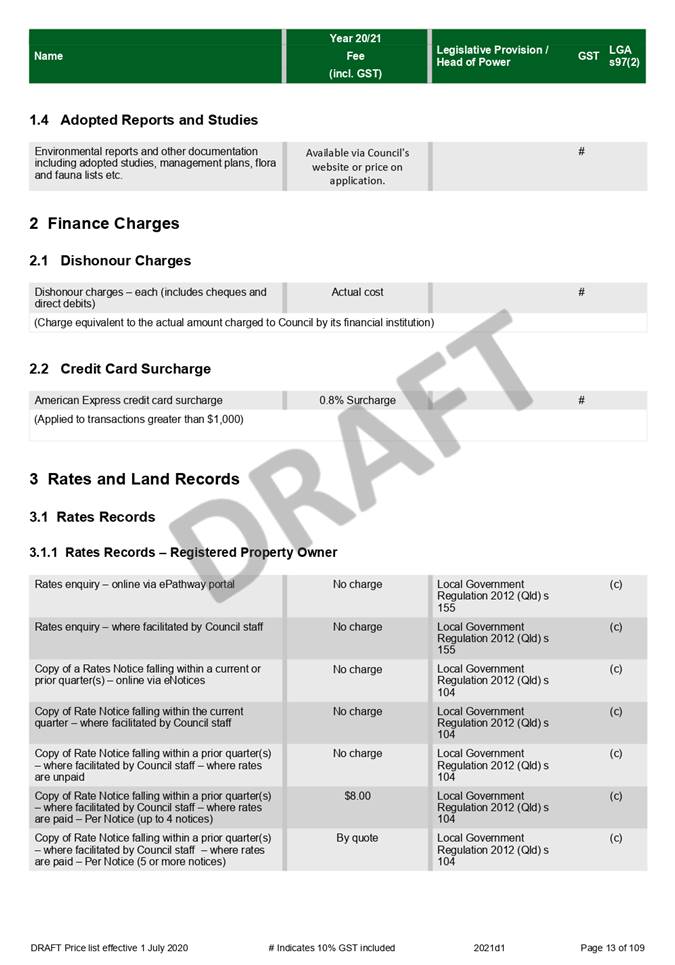

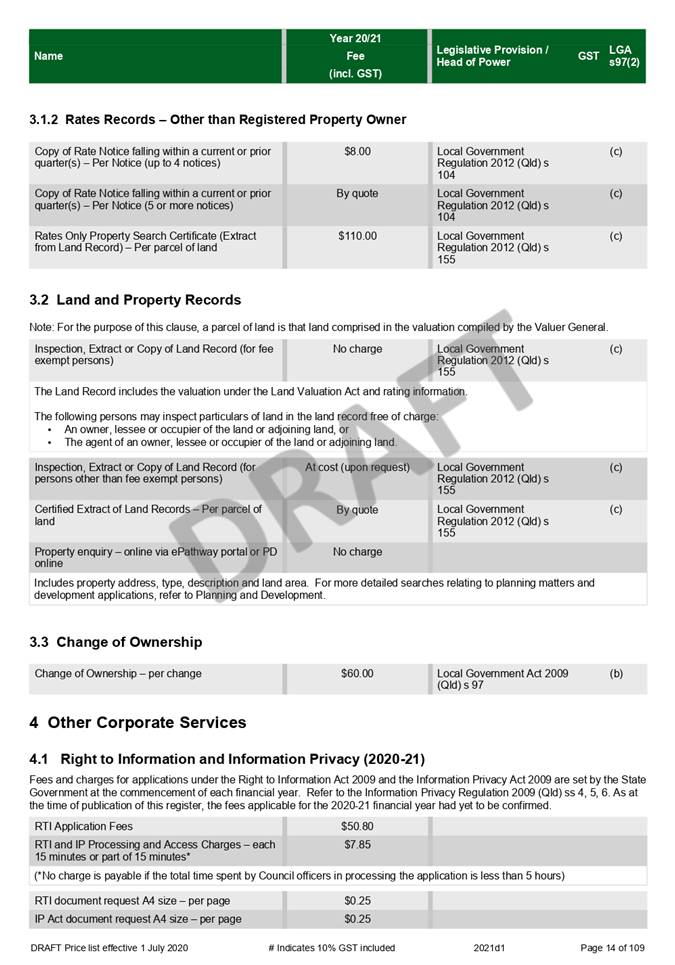

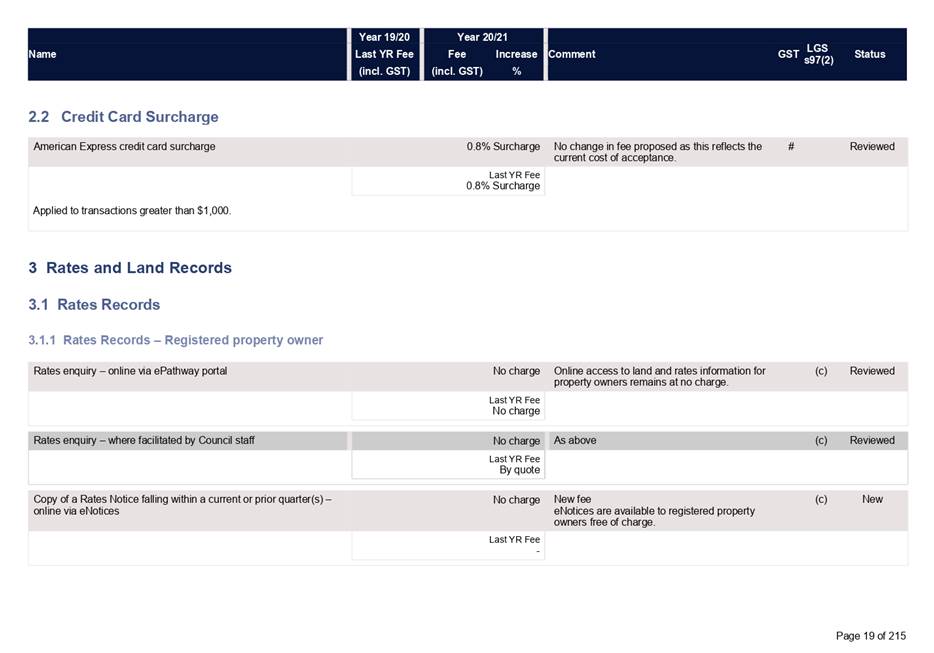

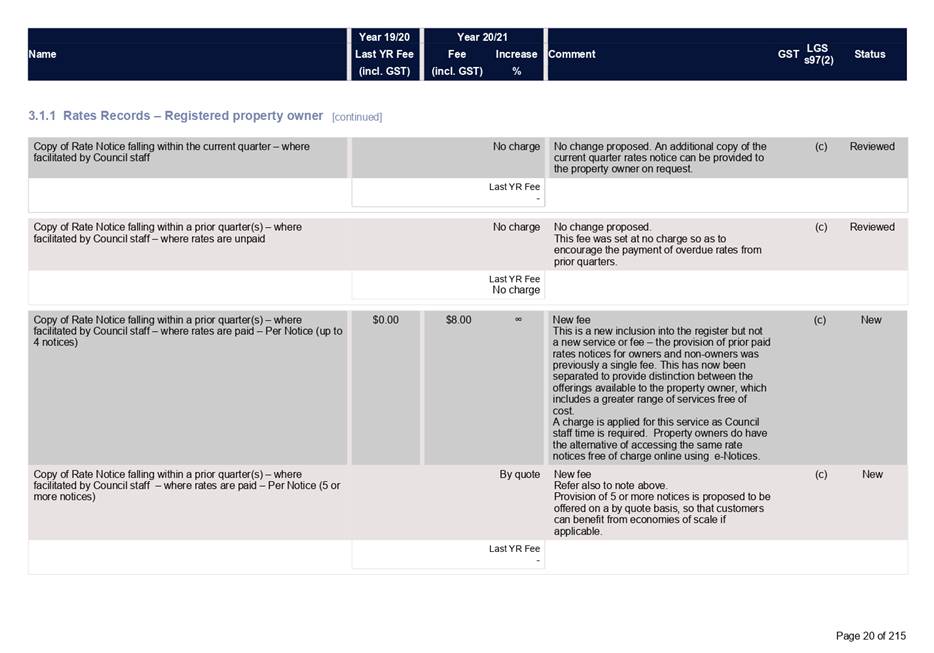

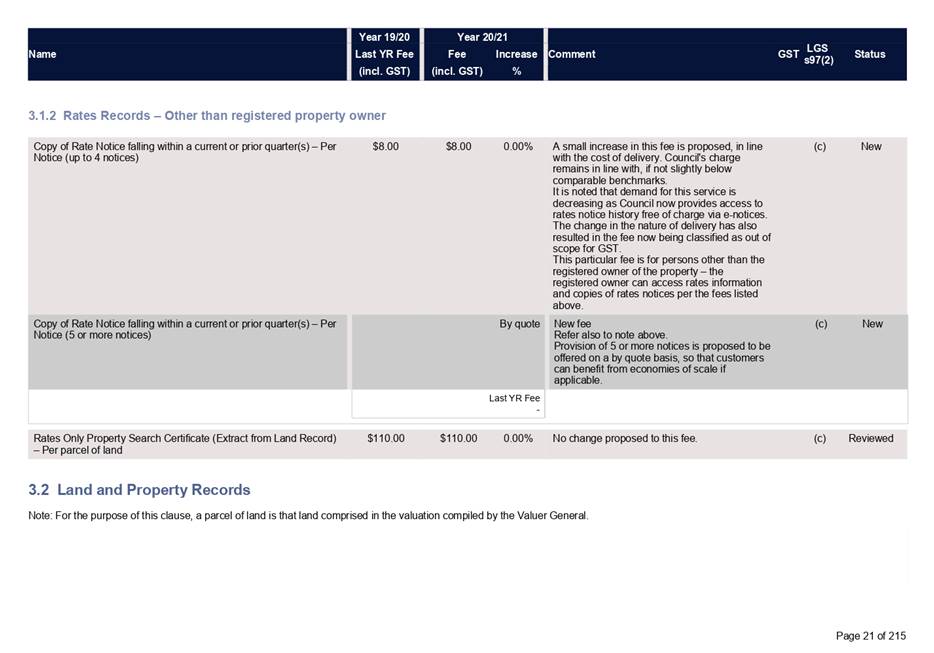

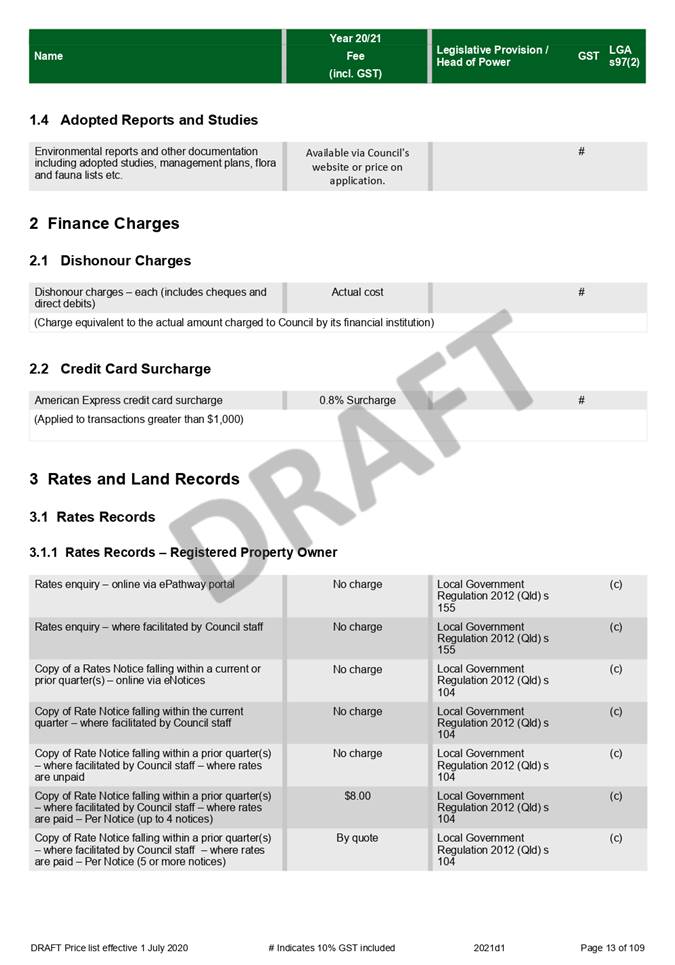

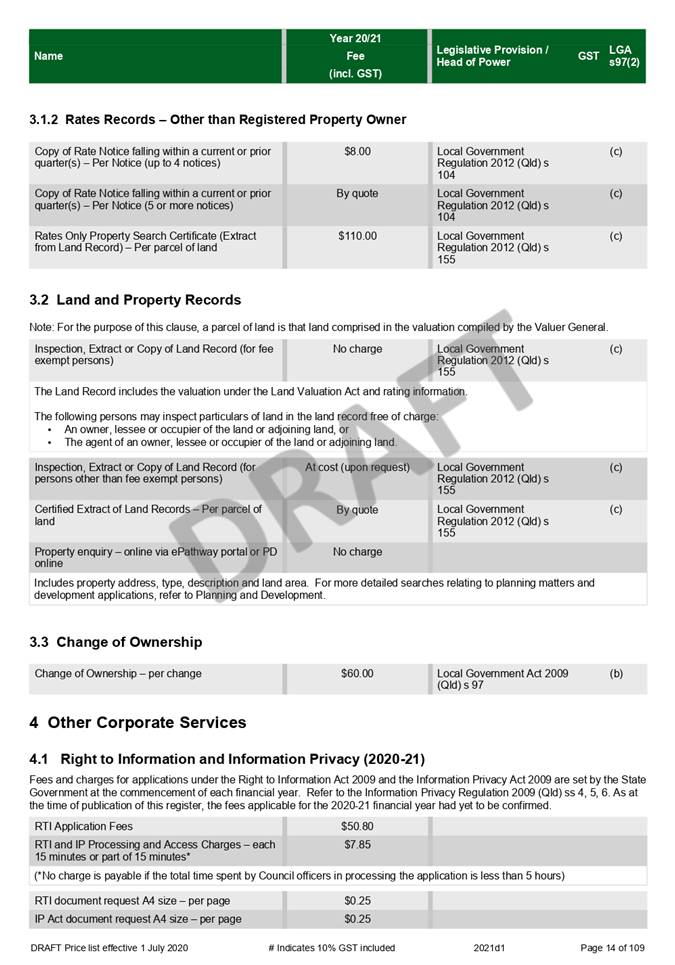

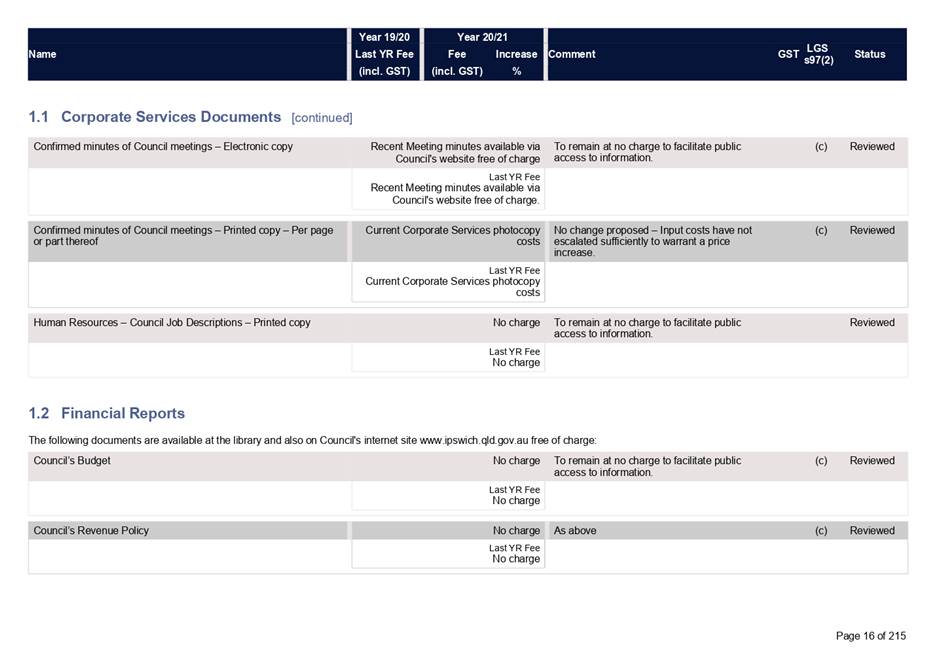

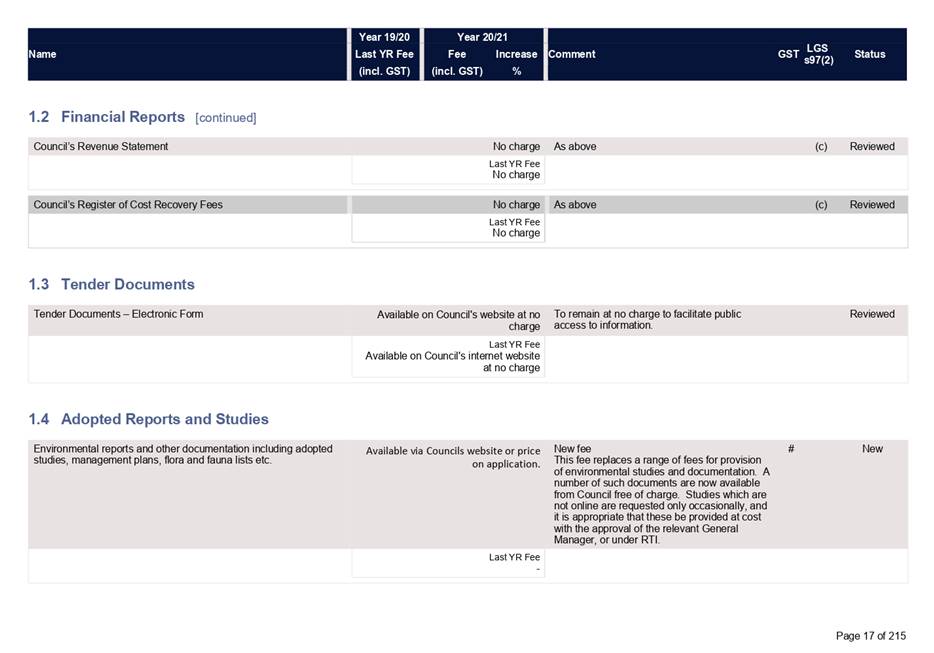

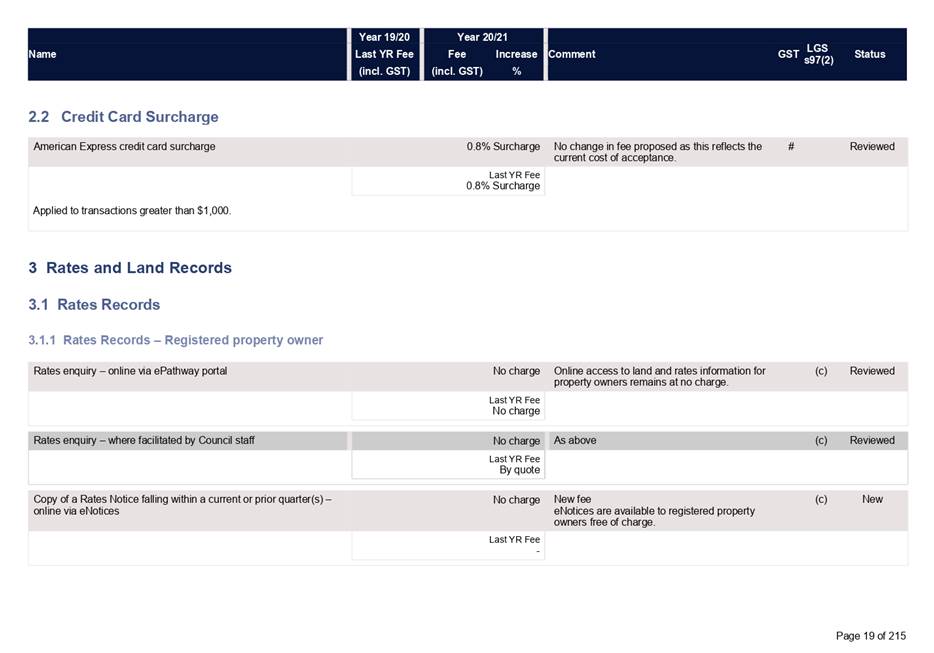

• Rates

and Property Records

Minor

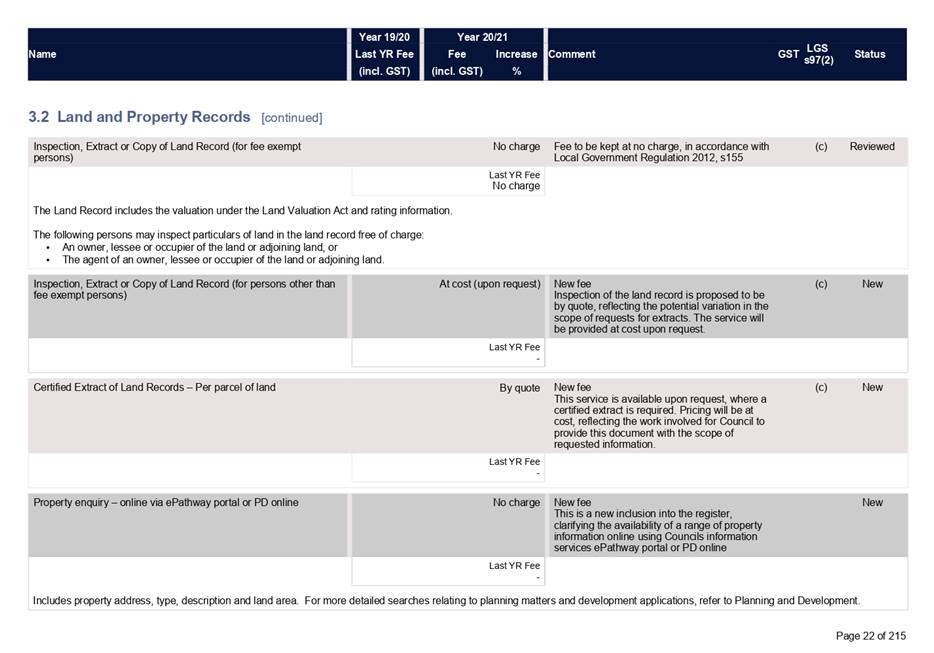

changes are proposed to the provision of Rates and Property records, reflecting

additional service options being made available by Council (Attachment 2, pages

19-22).

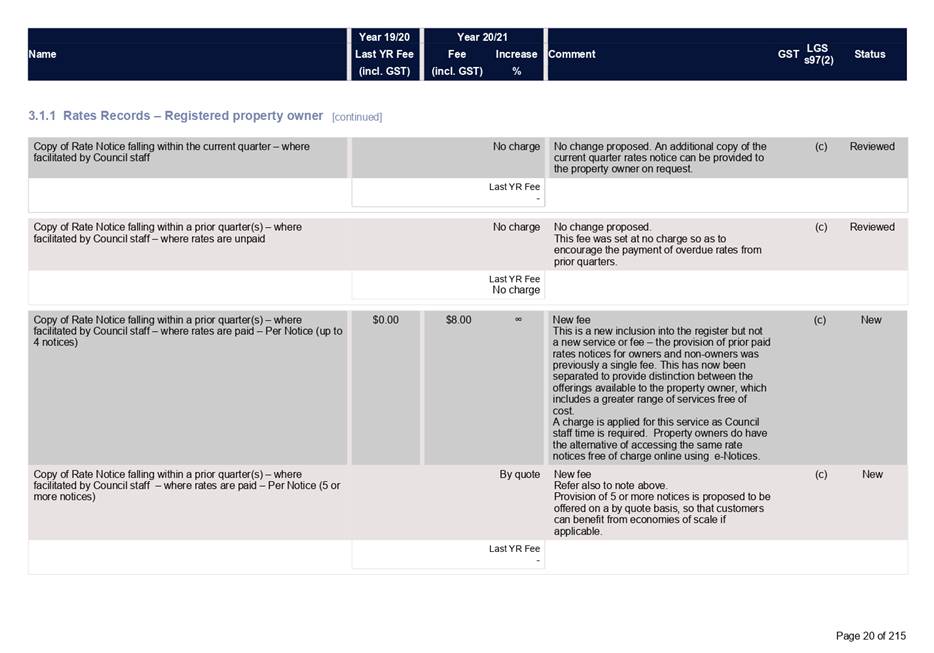

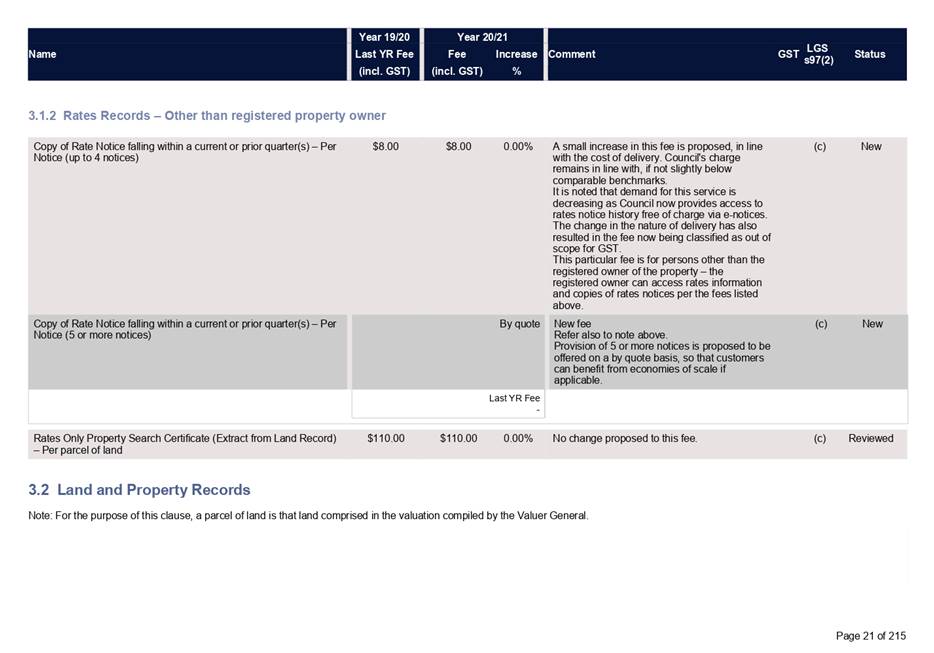

Where

property information and rates notices are available to property owners free of

charge using Councils online services, this option has been articulated in the

register. For example, copies of rates notices are now available at no

charge for the registered property owner via Council’s online eNotices

portal.

Where a

hardcopy of a prior (paid) notice is requested via customer service, this

remains at $8.00 to cover the cost of production.

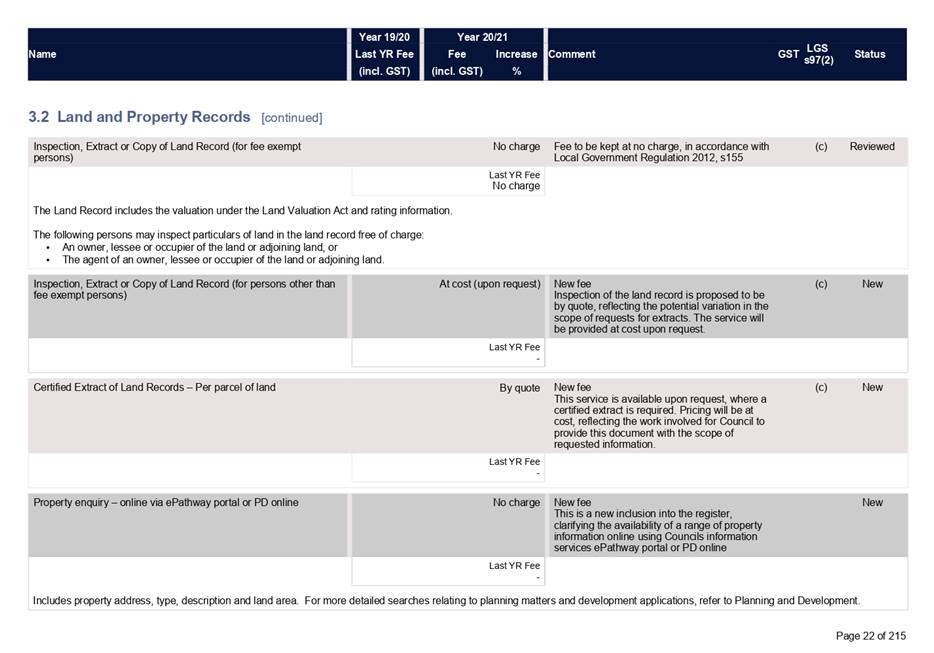

Customised

services, such as inspection and extract of the land record and multiple rates

notices are available upon request, and will be calculated at cost on the basis

of the scope of work involved.

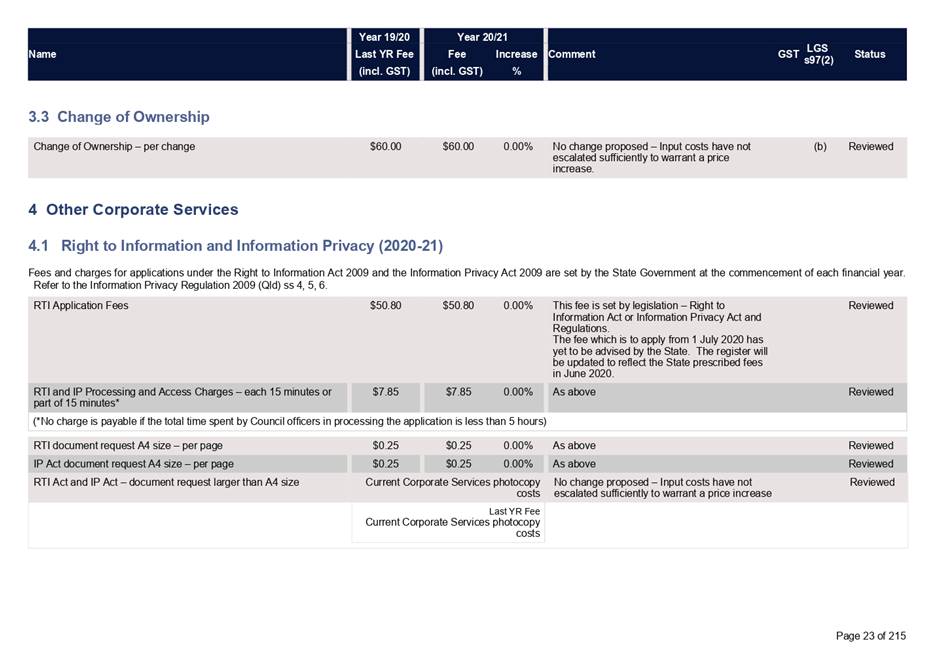

The

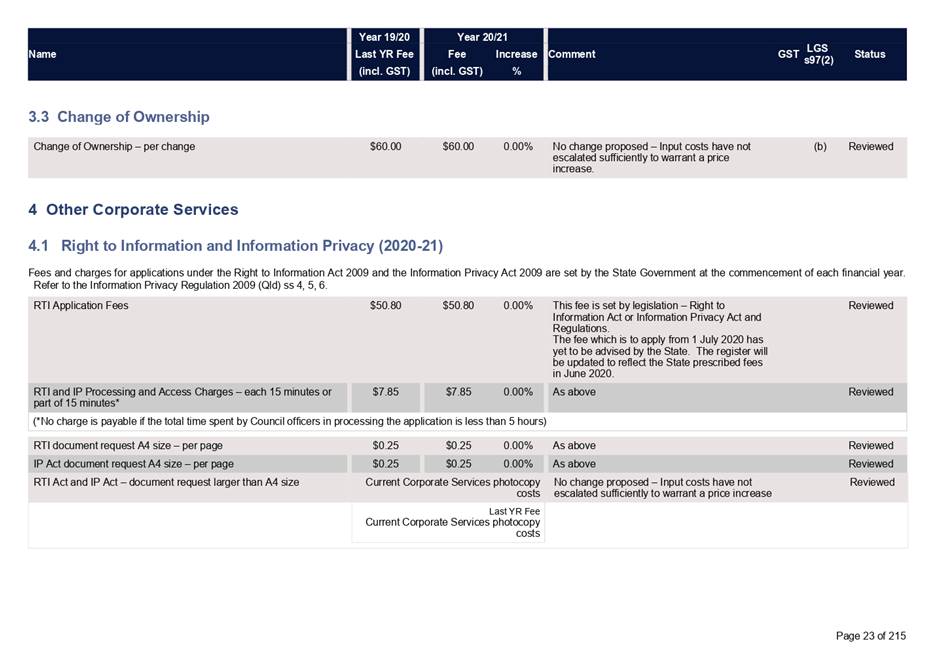

change of ownership fee is proposed to remain at $60.00 (Attachment 2, page

23).

• Right

to Information

The

Right to Information fees are set under regulation by the Queensland Department

of Justice and Attorney-General on an annual basis. The charges to apply

for the forthcoming financial year are yet to be confirmed by the State.

As a result, the draft report reflects the current financial year charges, with

an acknowledgement that these charges will be updated upon confirmation by the

State of the pricing to be applied from 1 July 2020 (Attachment 2, page 23).

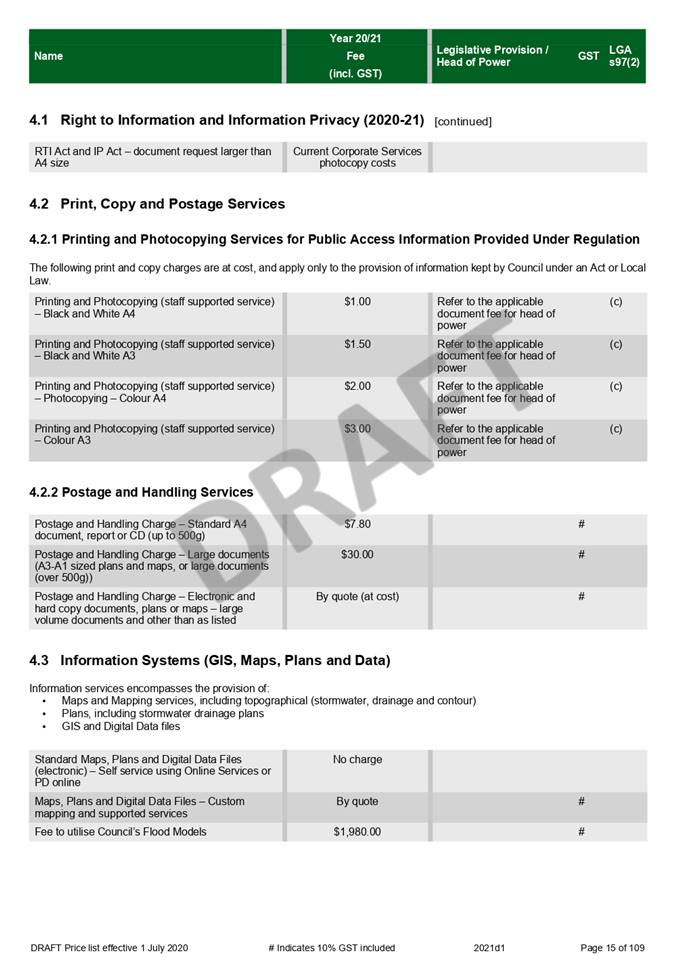

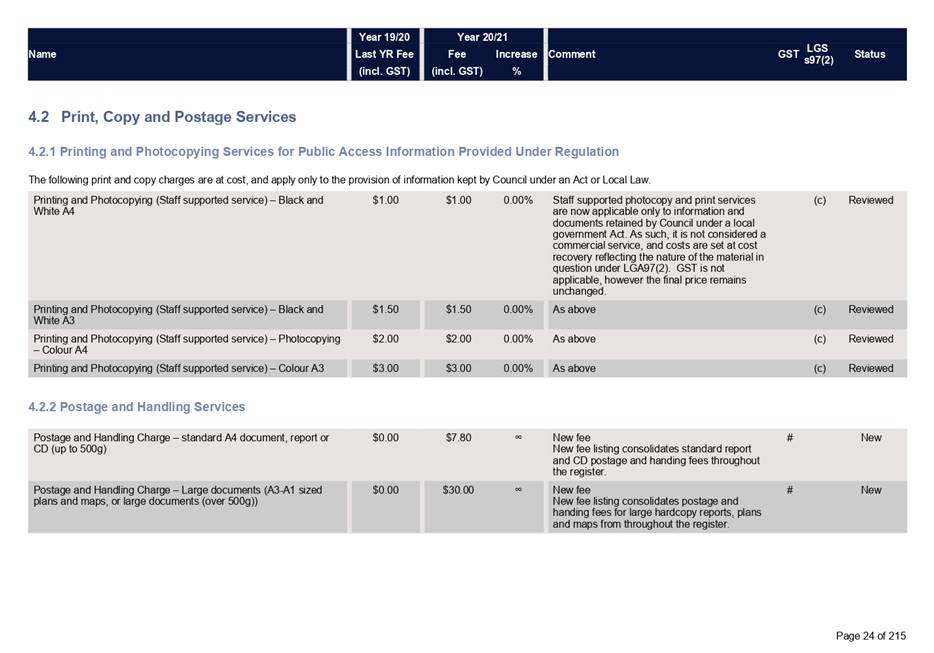

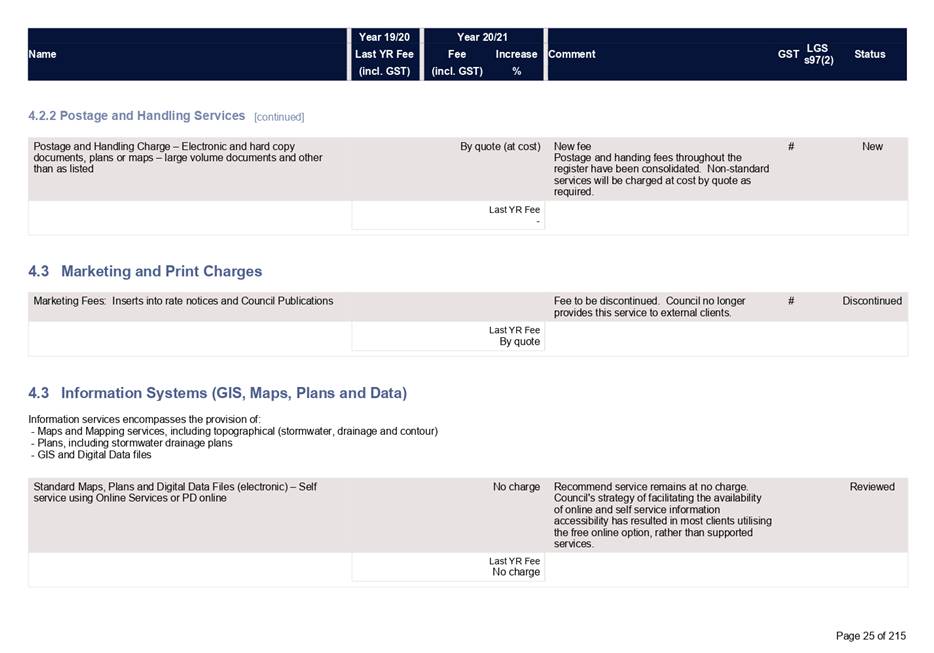

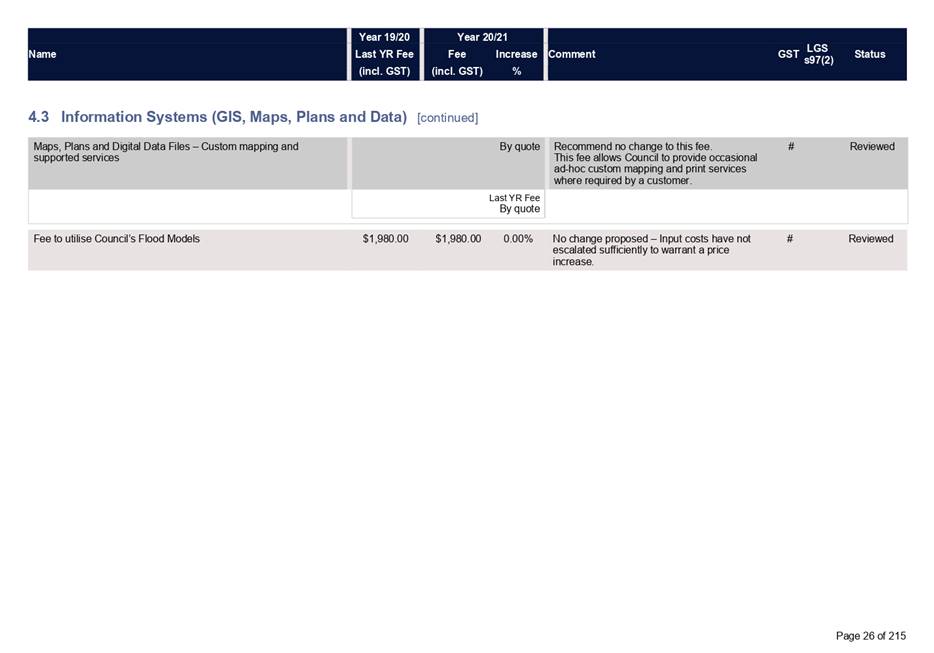

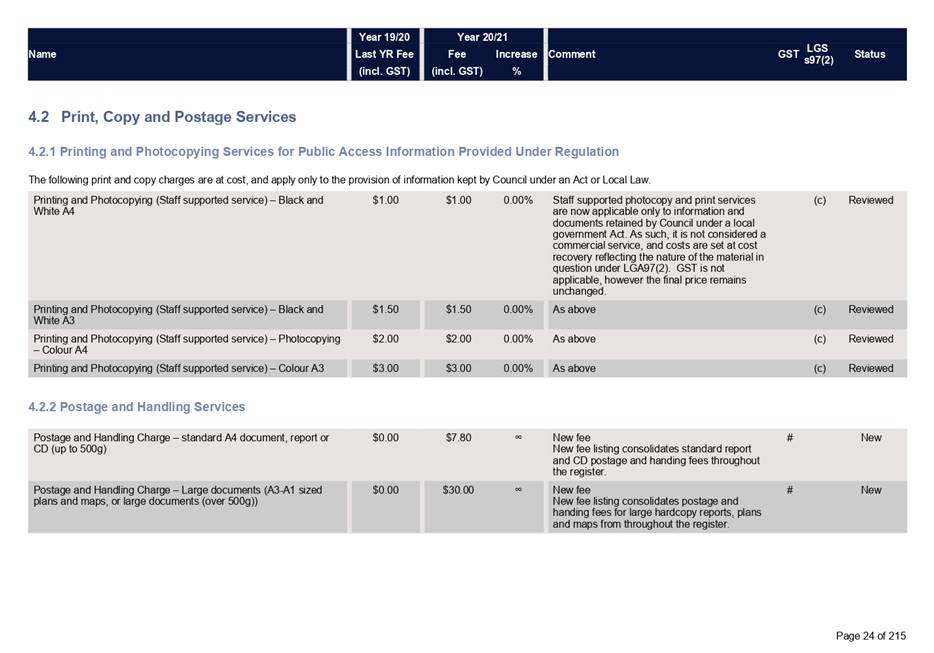

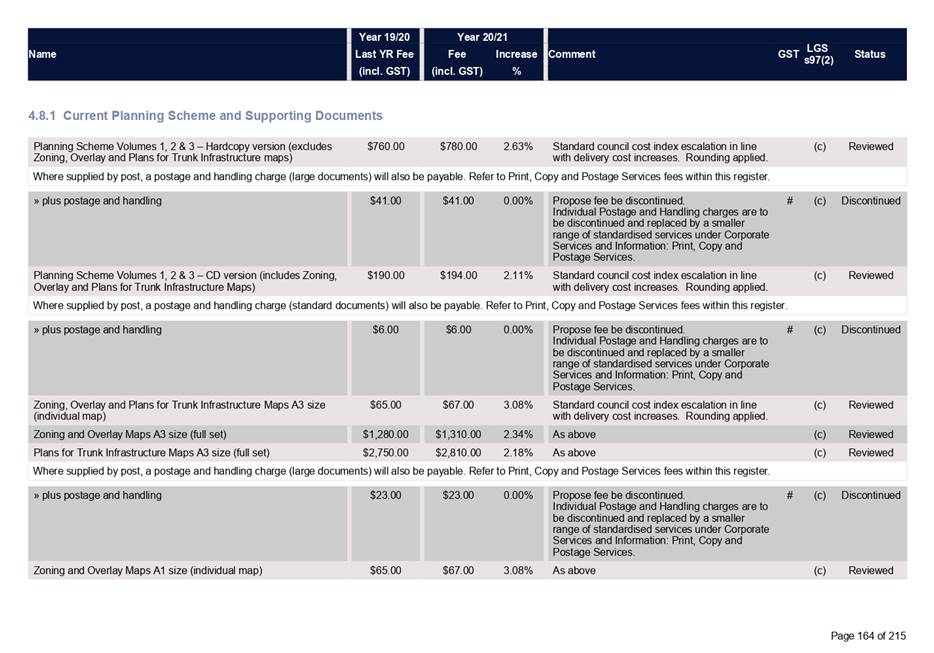

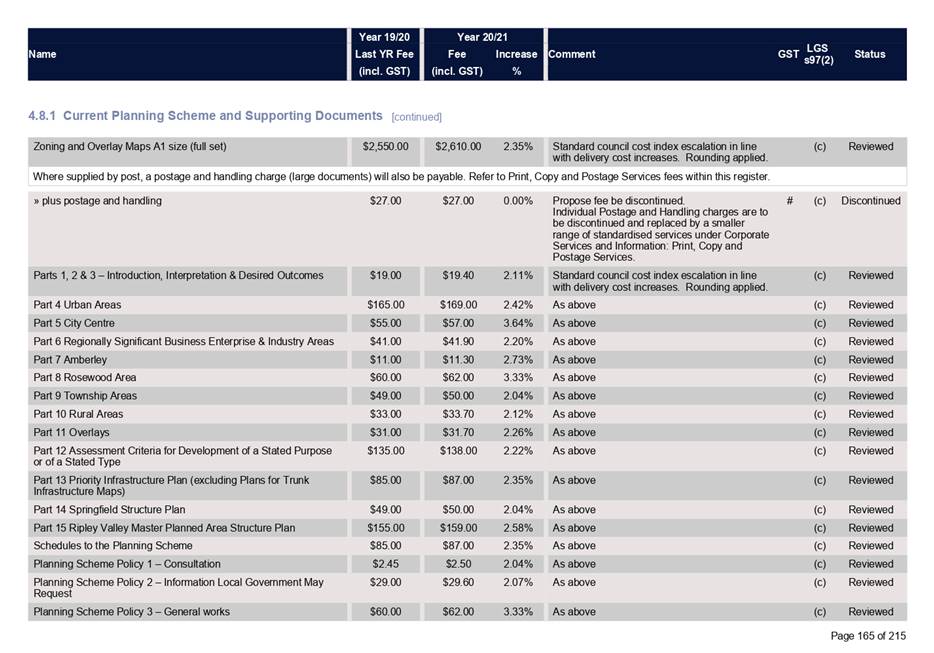

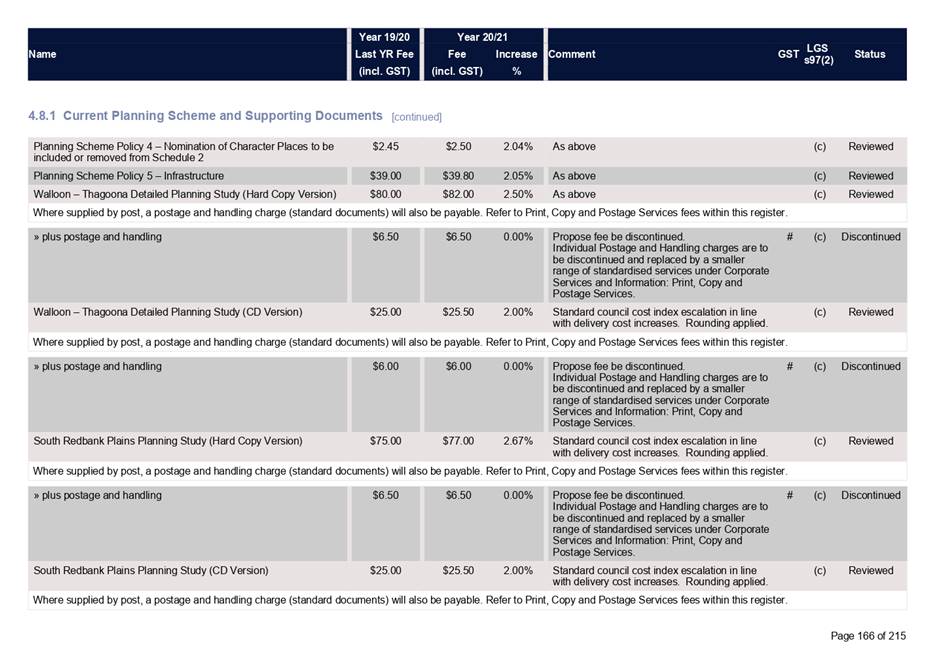

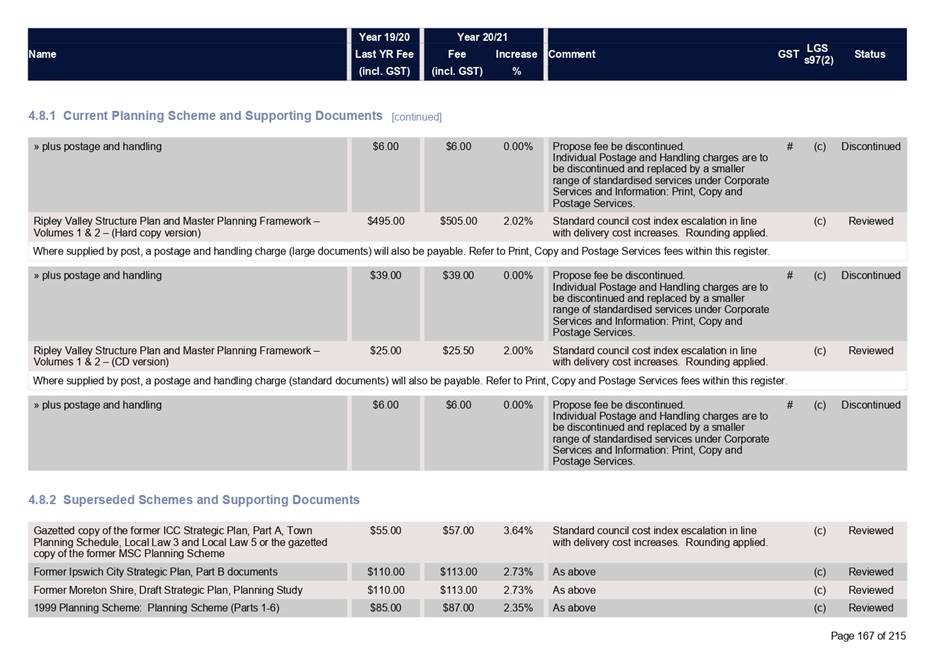

• Postage

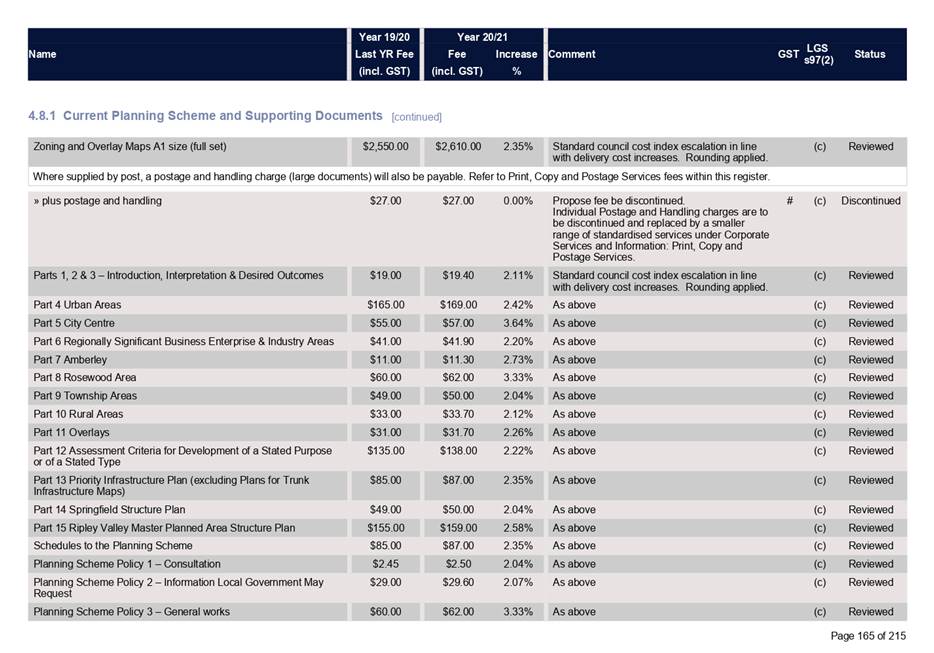

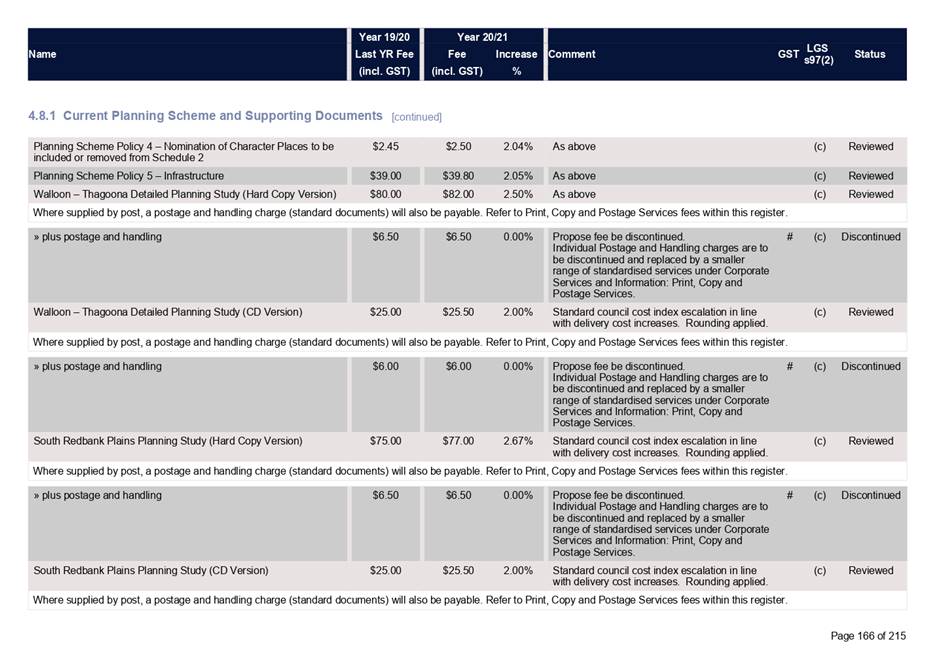

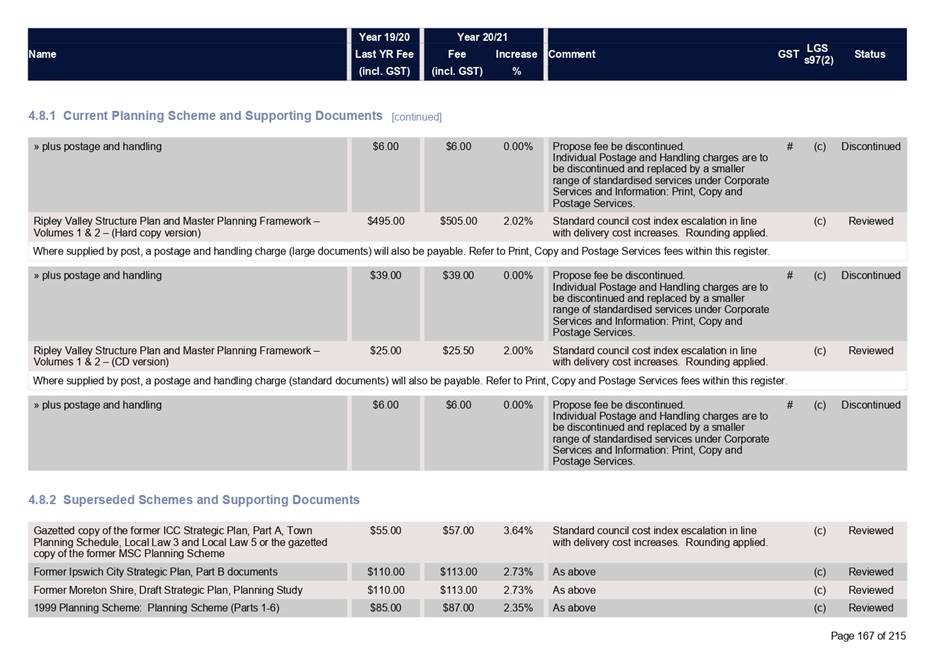

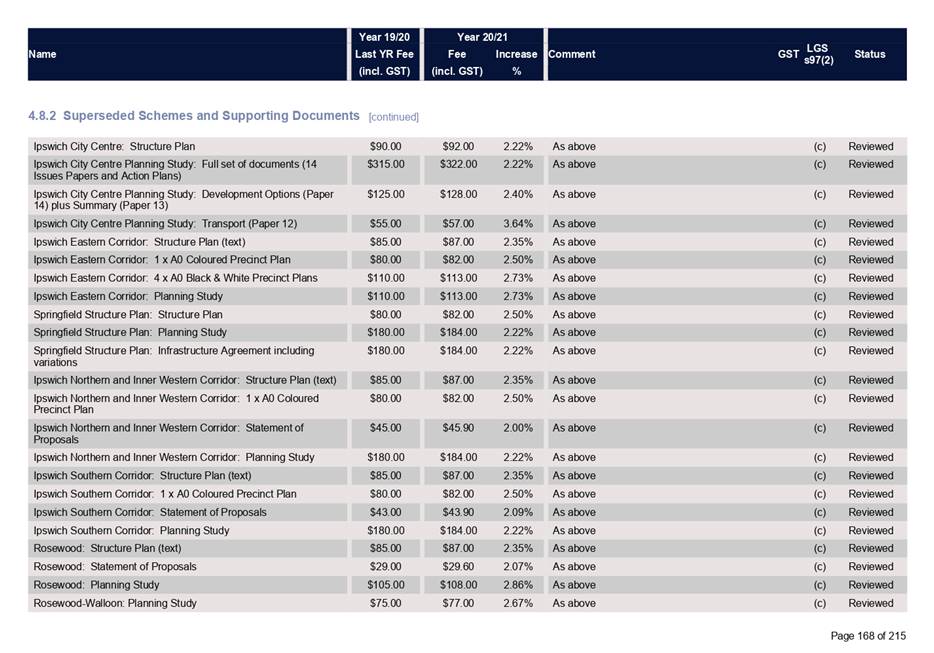

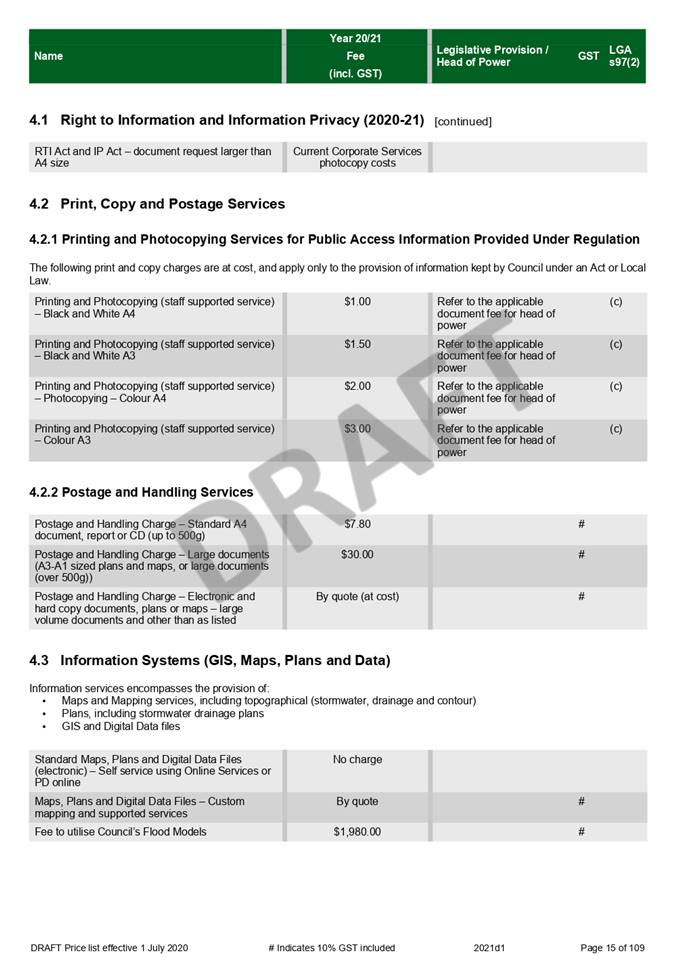

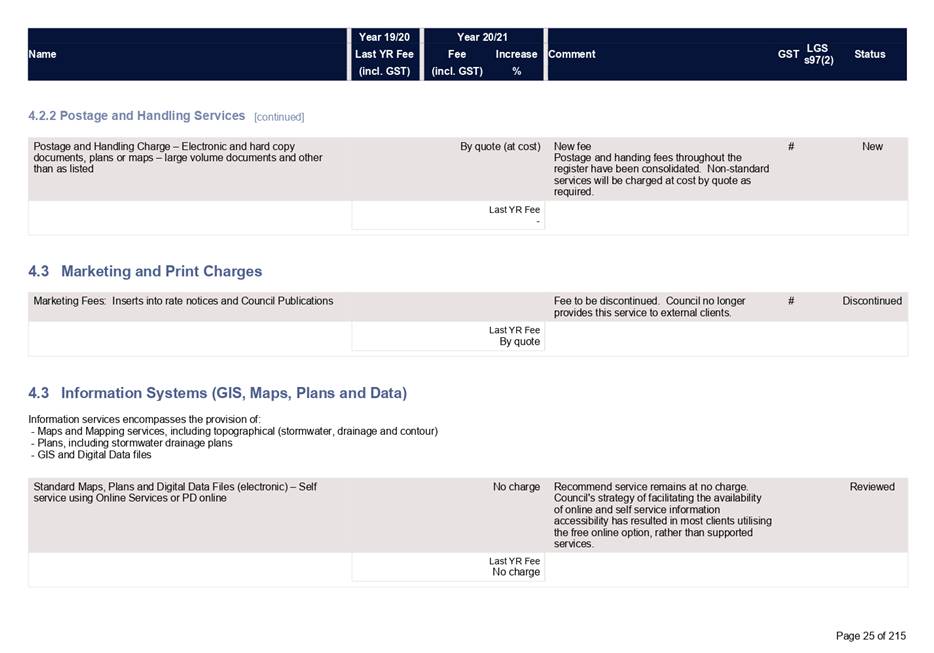

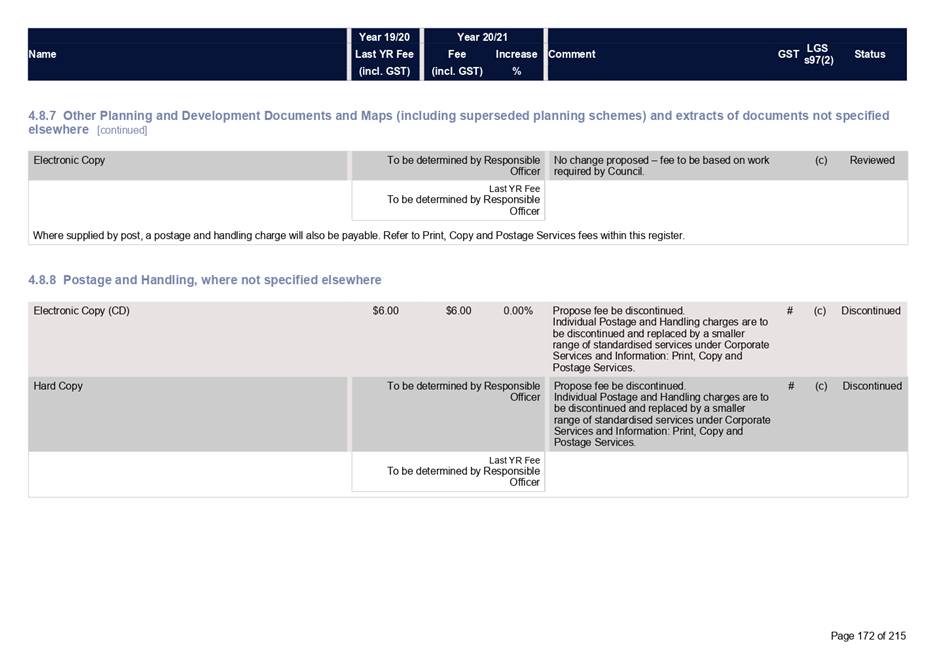

Postage

and handling charges are applicable to a range of services across

Council. Service options and fees have been reviewed and simplified

within the new register (Attachment 2, page 24). Where previously a

specific postage rate was listed for each applicable item (typically hardcopy

publications or maps), individual rates have now been removed and a smaller

number of options are captured under Corporate Services. Postage charges

for standard letters are absorbed into the service cost, as it would not be

cost effective to administer a separate charge for such a low cost

service. Flat rate charges apply for standard documents and CDs and large

documents. Postage rates for large volume and non‑standard items

can be calculated on request. While charges are based on recovery of

actual costs only, retention of postage charges is recommended to encourage the

use of electronic delivery wherever possible.

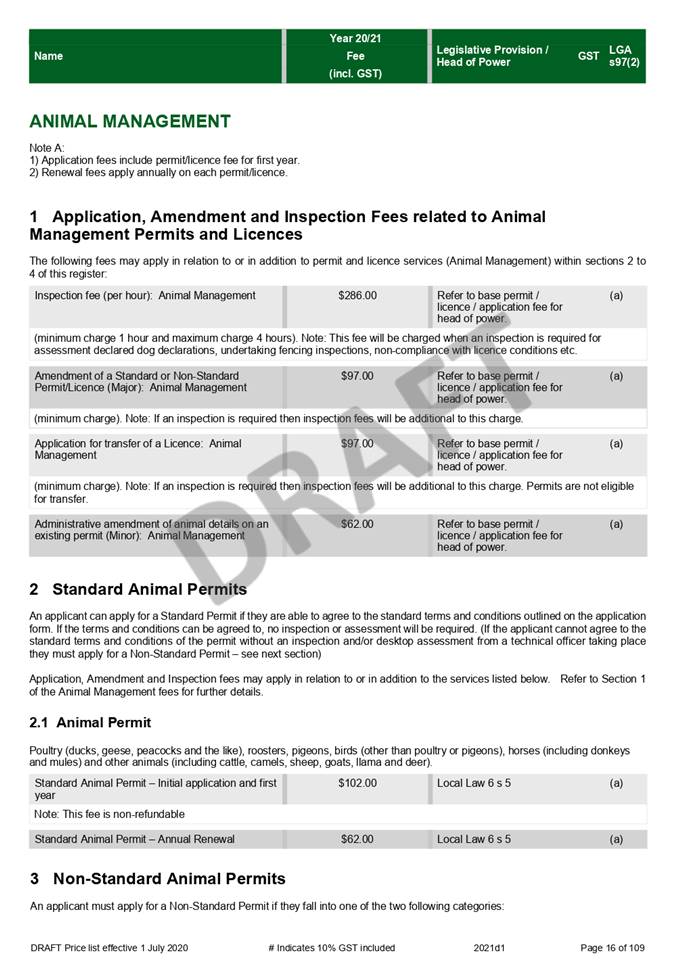

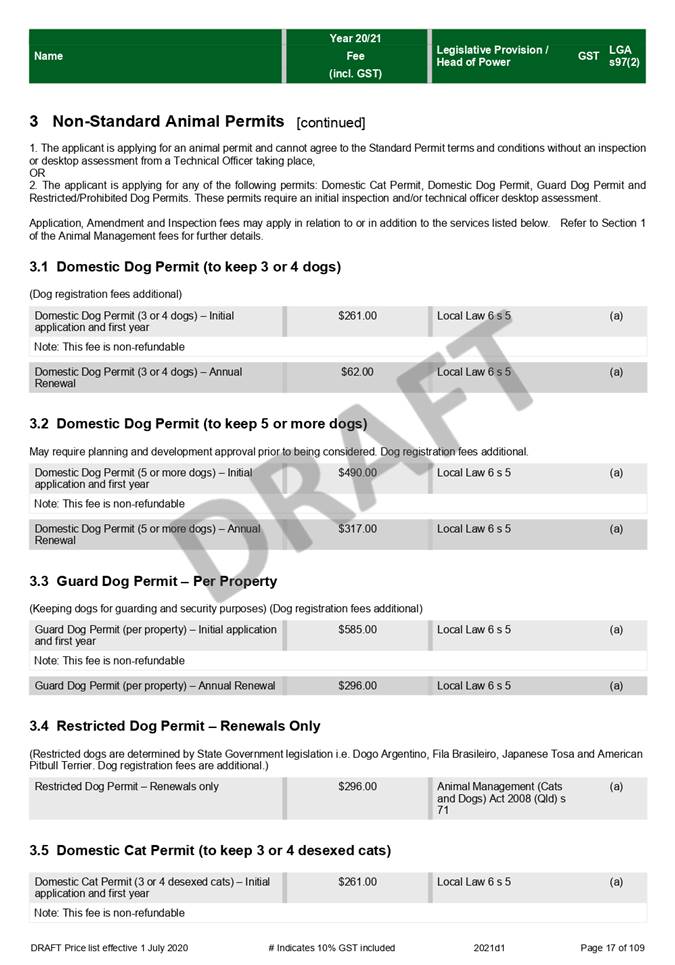

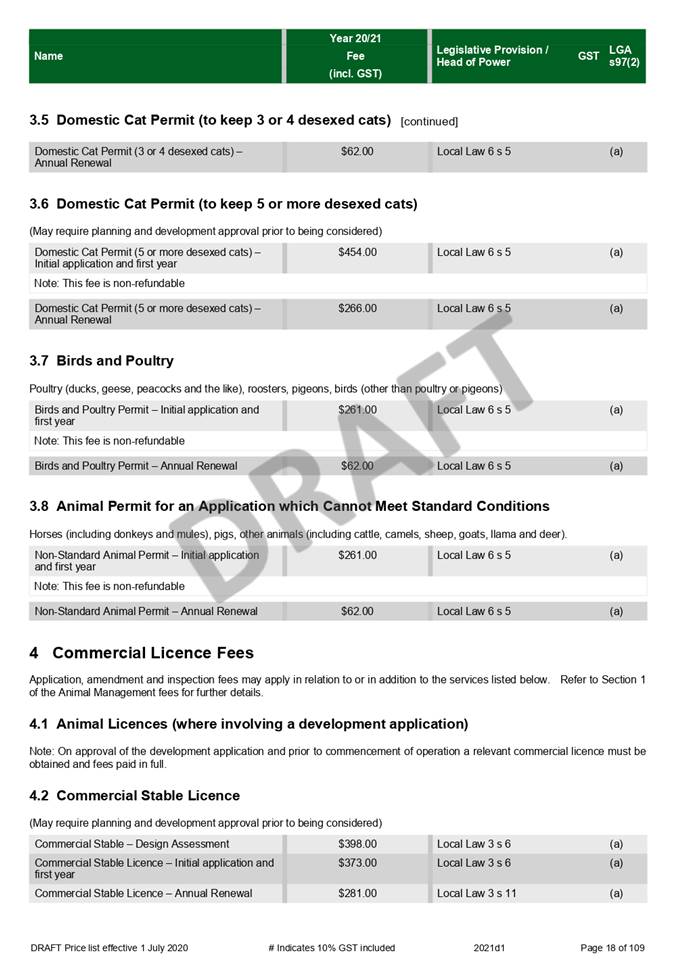

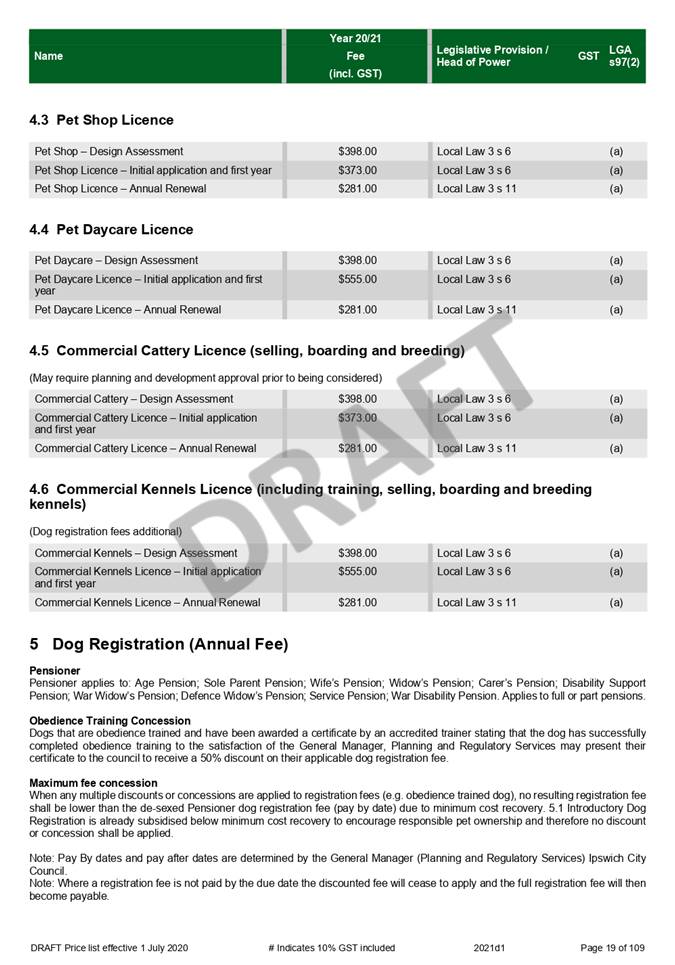

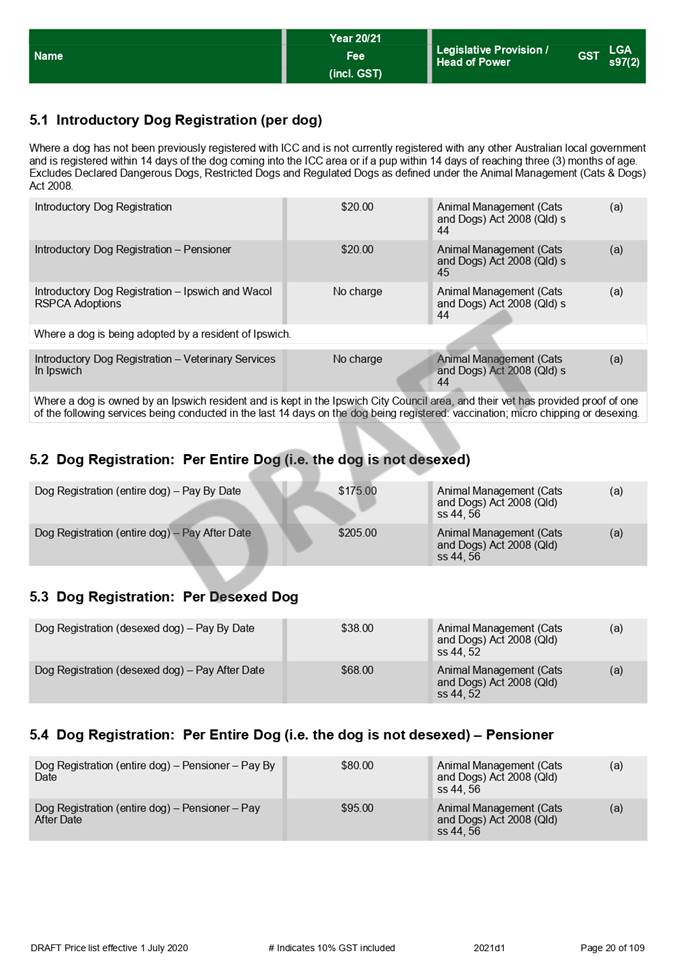

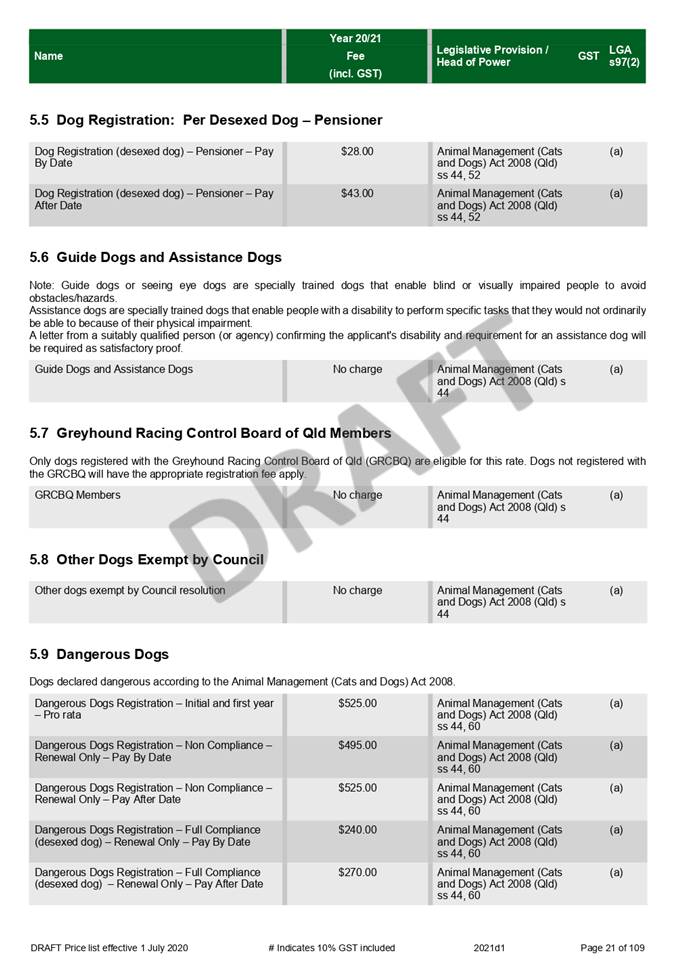

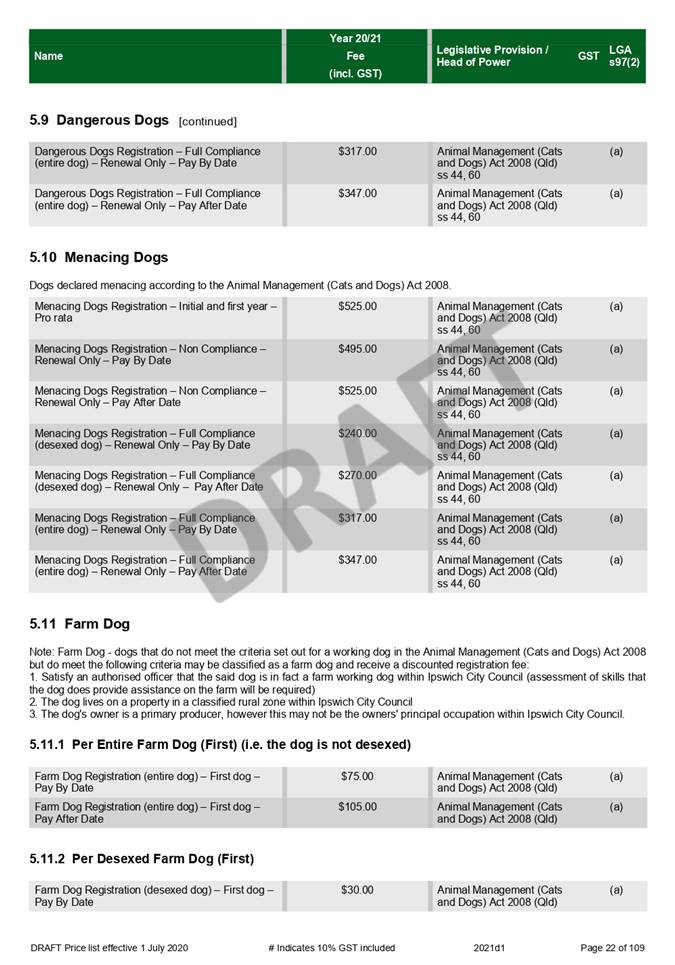

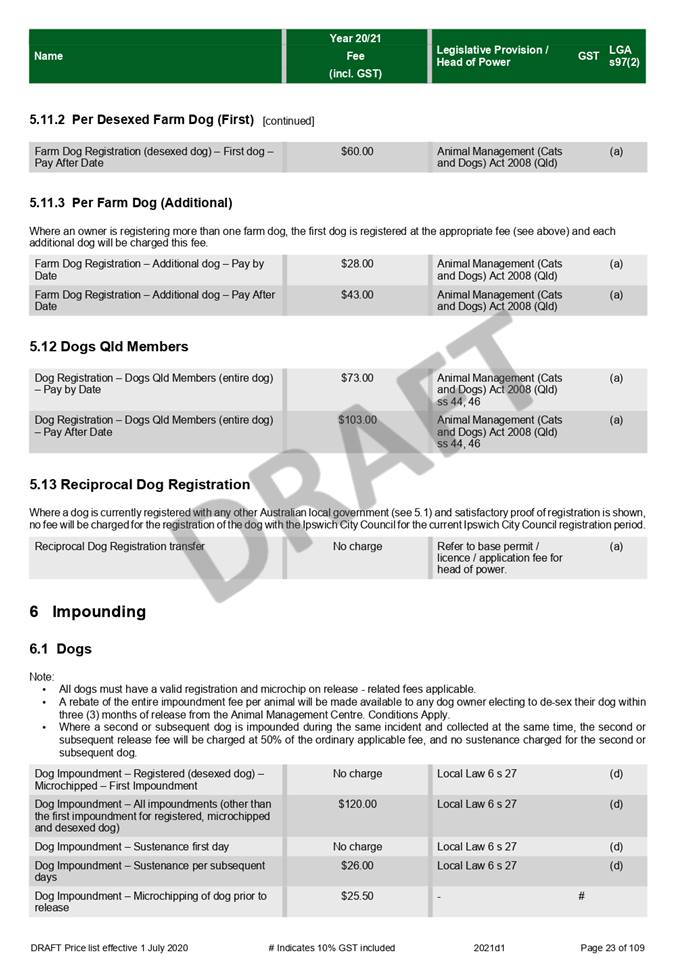

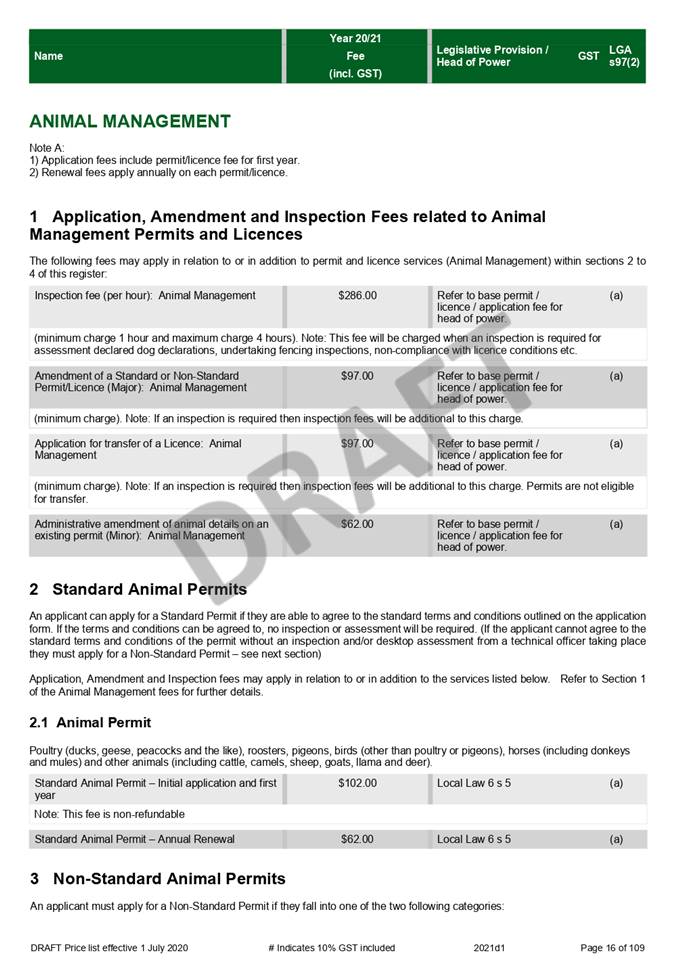

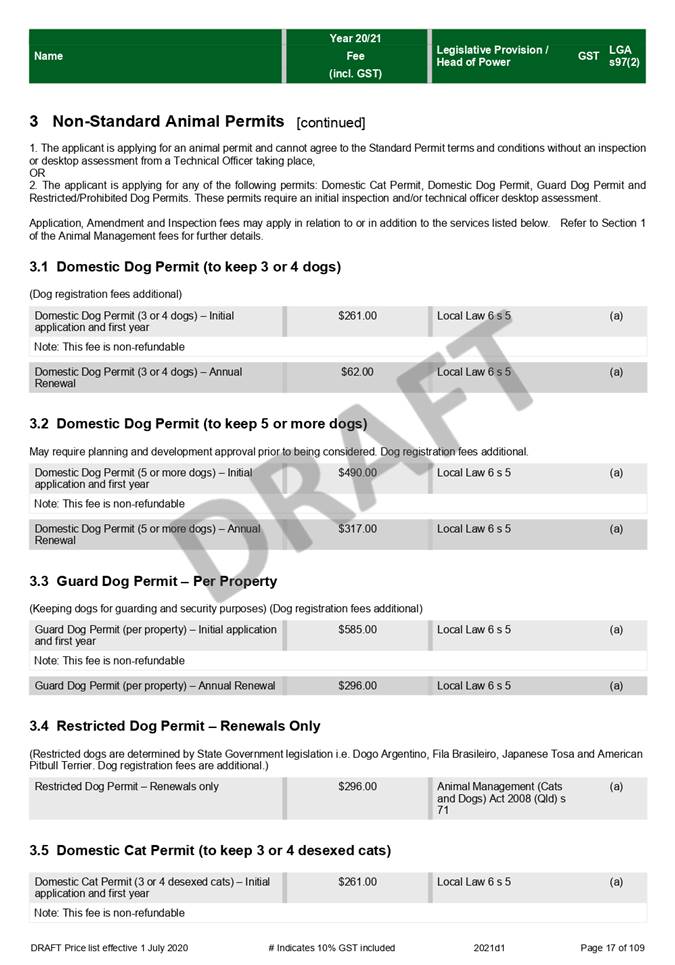

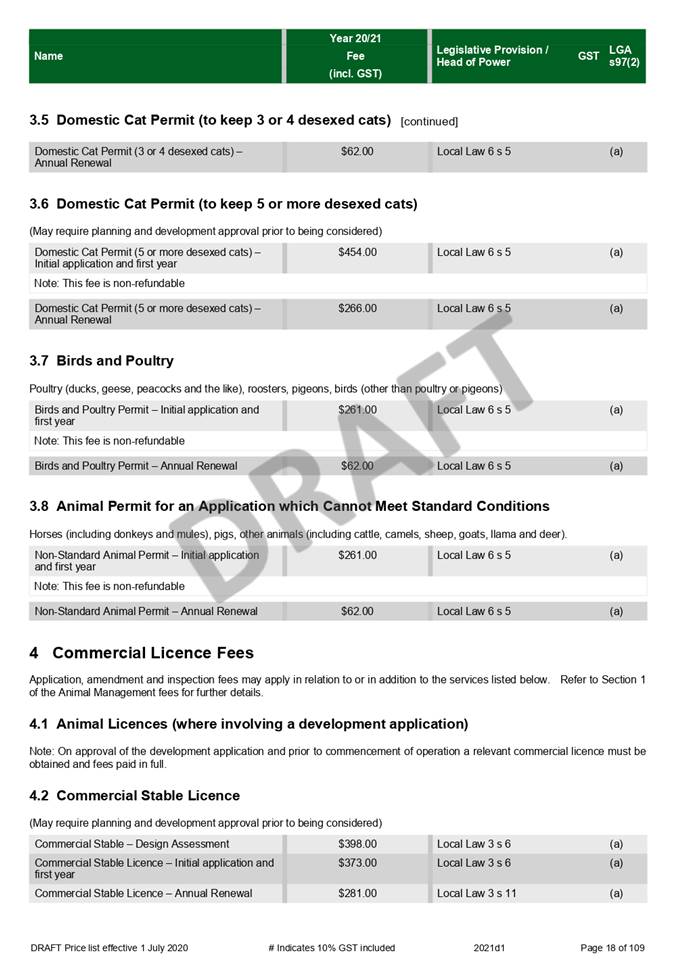

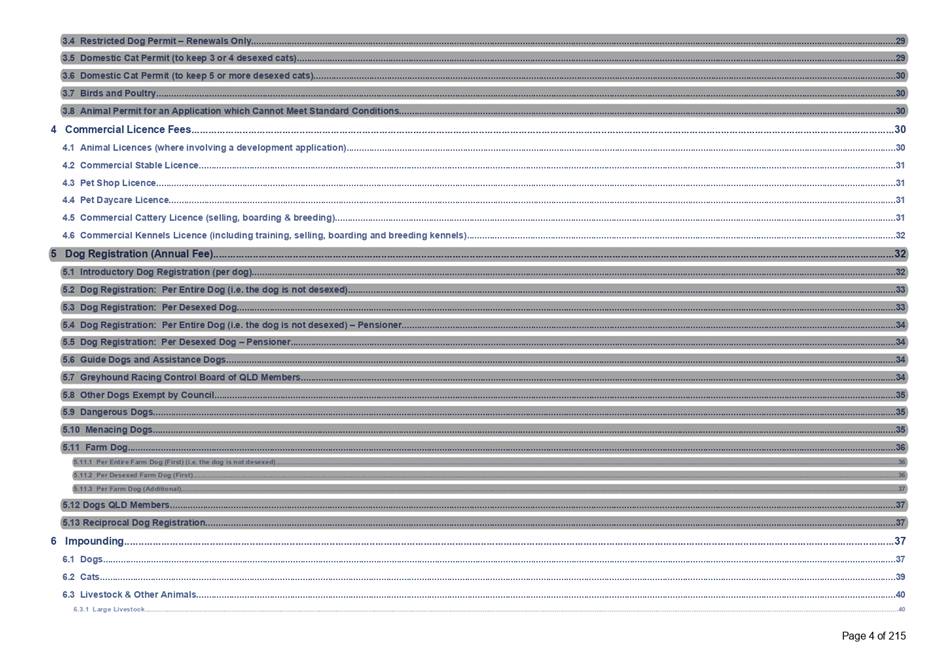

Animal

Management

Most

animal management regulatory services, including registrations, permits and

licences, are proposed to increase by 2% (plus rounding), in line with the

forecast increase in Council’s underlying costs of delivery.

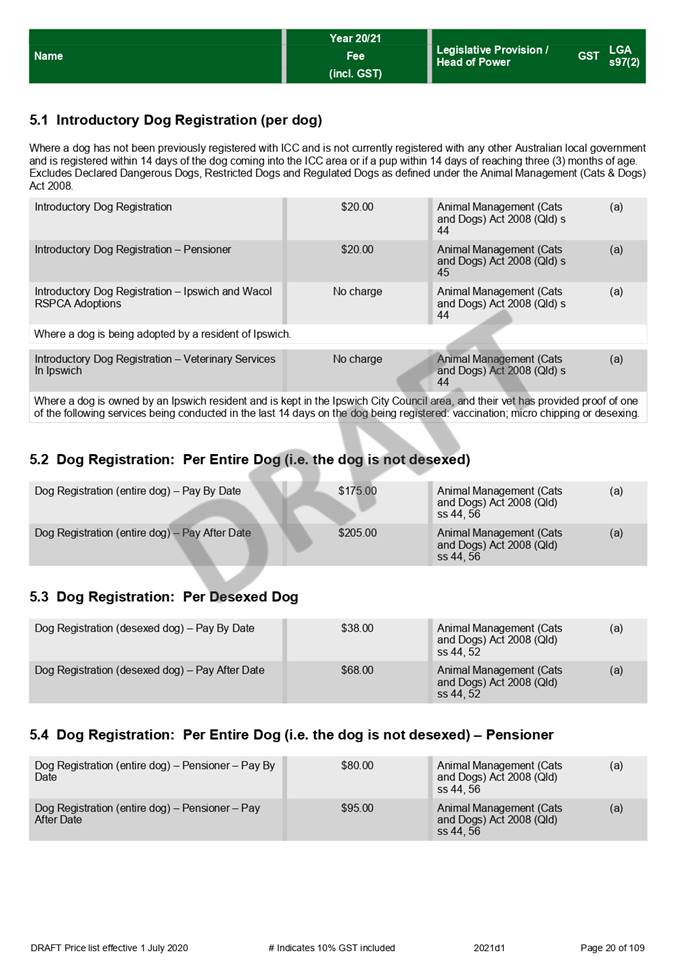

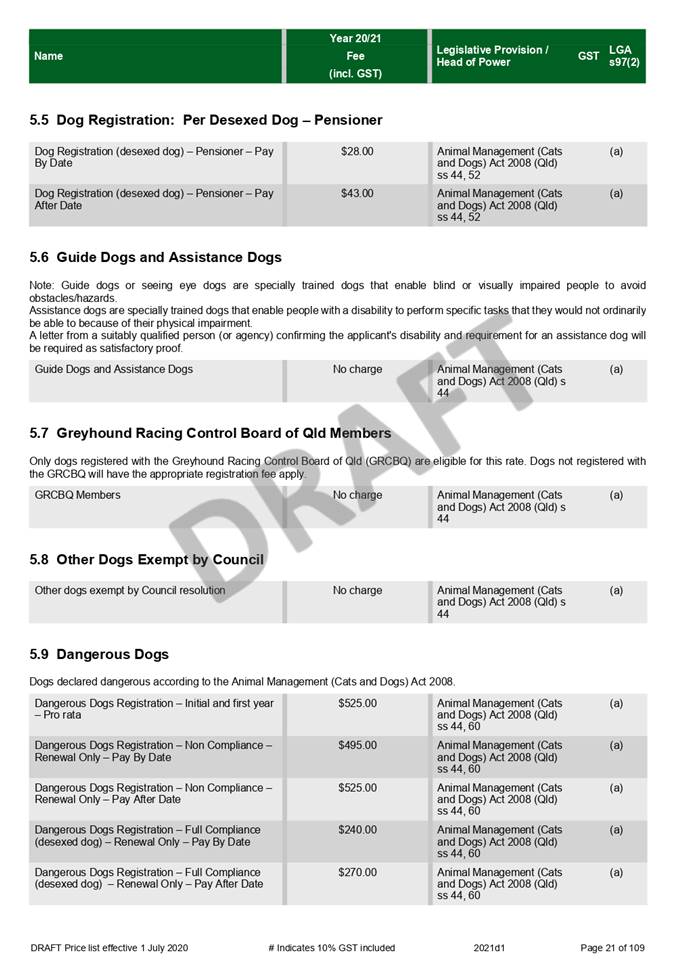

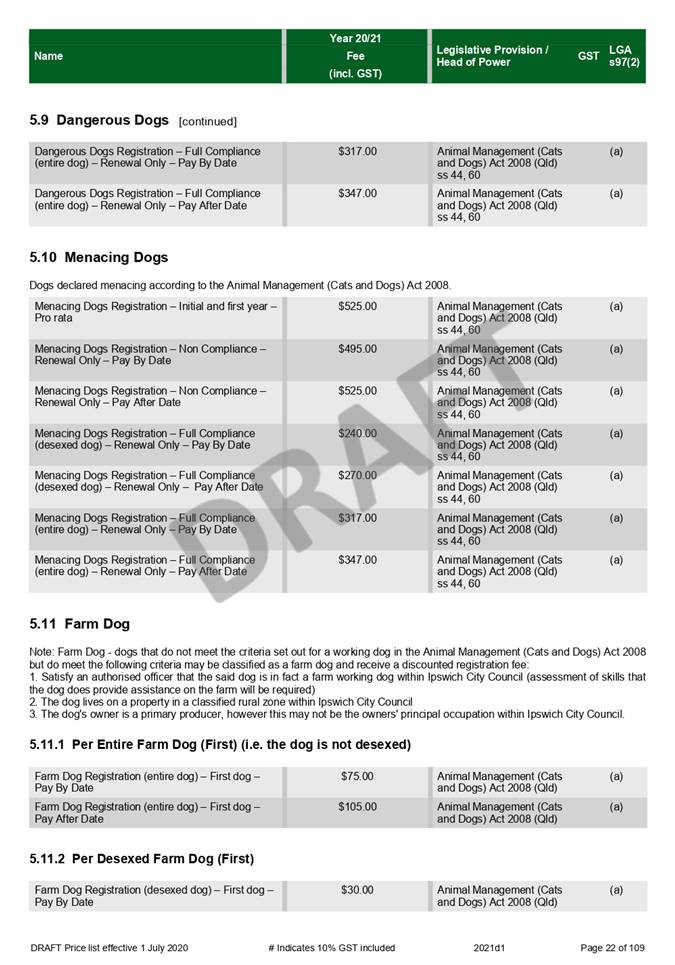

Domestic

animal management permits and licences and dog registration fees were subject

to consideration and approval by Council in May 2020 to enable annual renewal invoices

to be issued ahead of the start of the new financial year. As such, these

fees have been excluded from the comparative report (Attachment 2). The

approved fees are displayed in the proposed register of fees and charges

(Attachment 1, pages 15-17 and pages 18-22).

Commercial

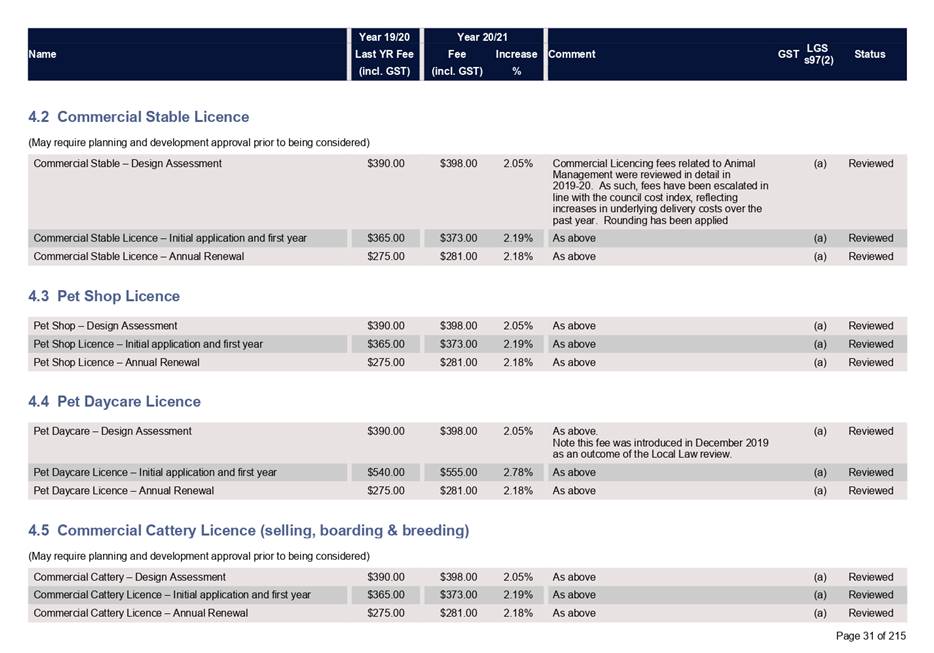

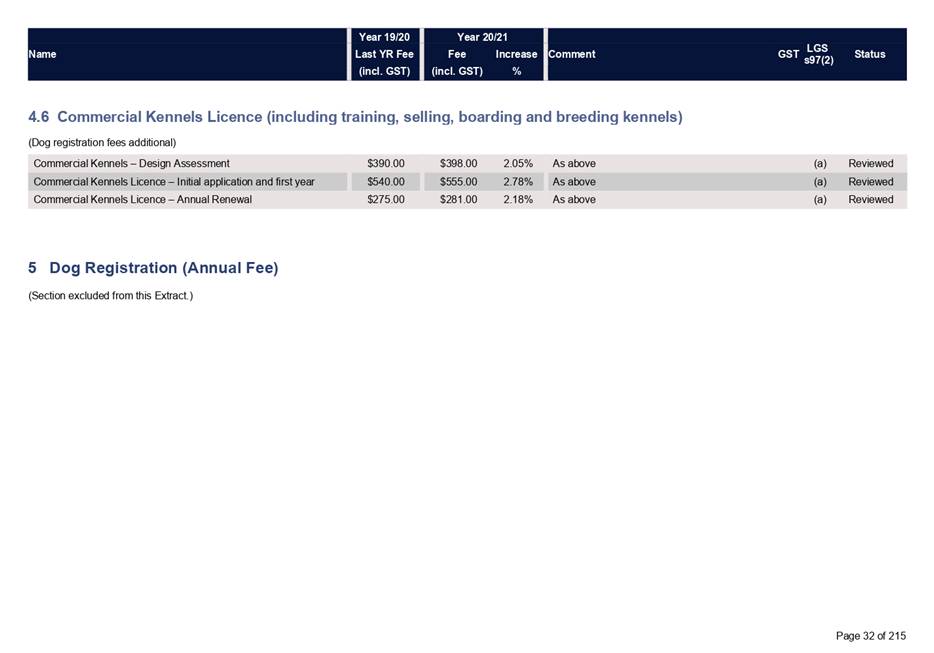

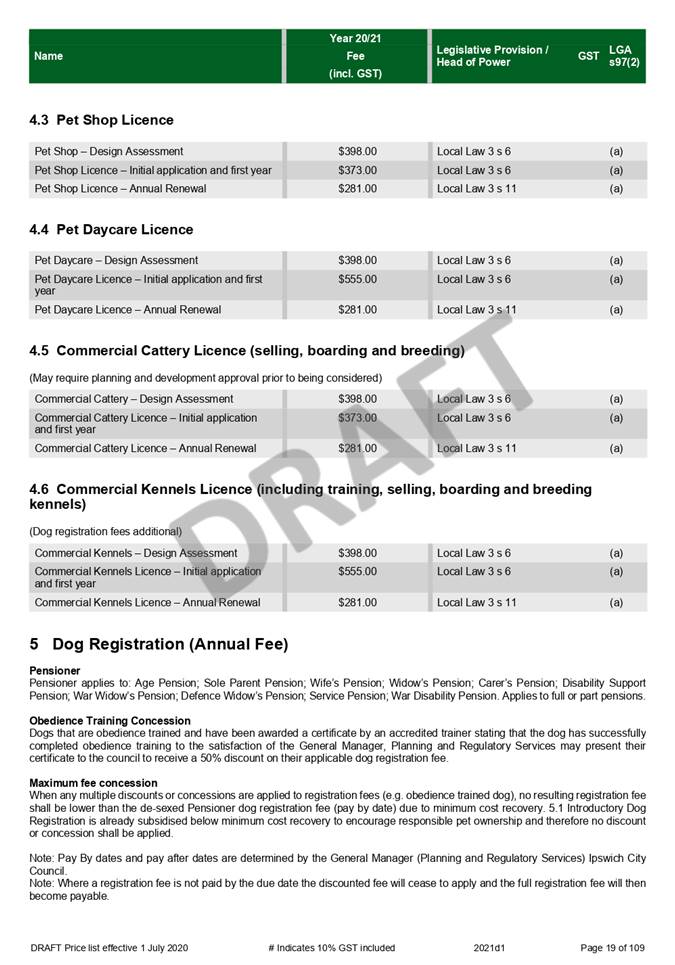

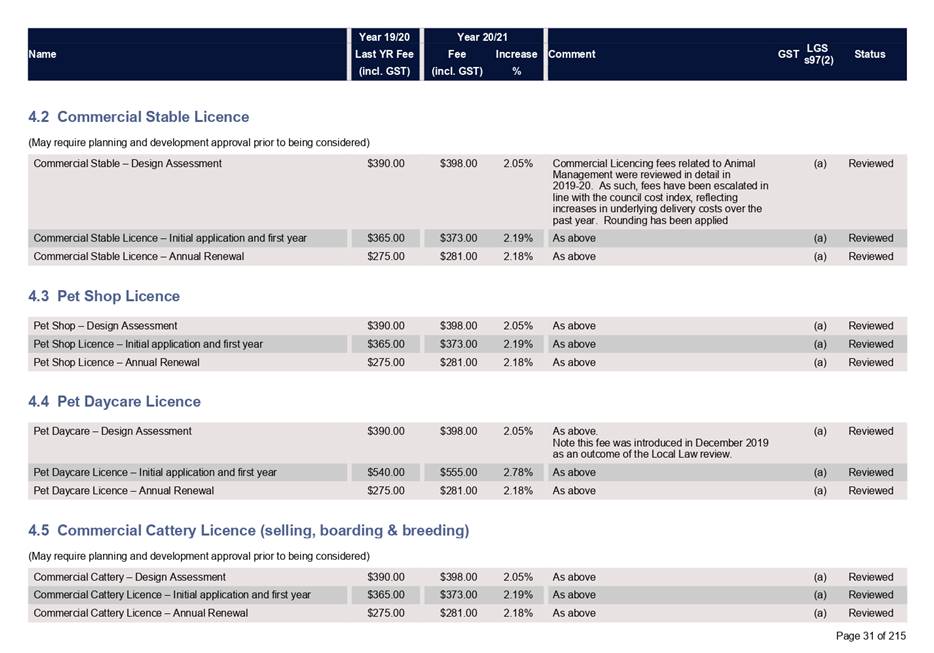

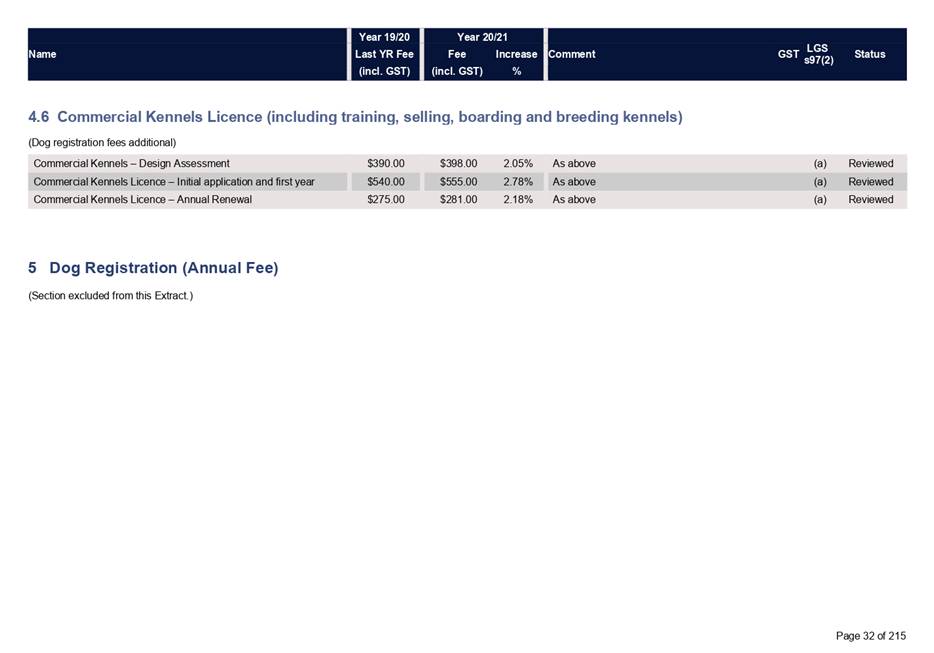

licence fees, for example Pet Shop and Pet Daycare licences, Commercial

Stables, Catteries and Kennel Licences are to be increased in line with the

Council Cost Index (Attachment 2, pages 30-32). These licence fees may be

eligible for reduction under the COVID-relief program (refer to page 11 of this

report).

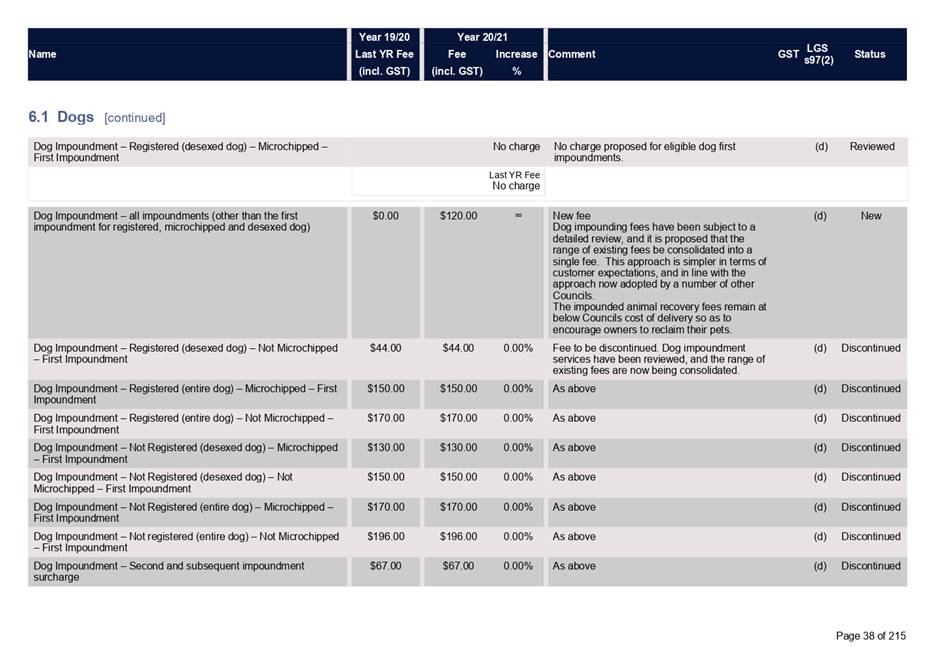

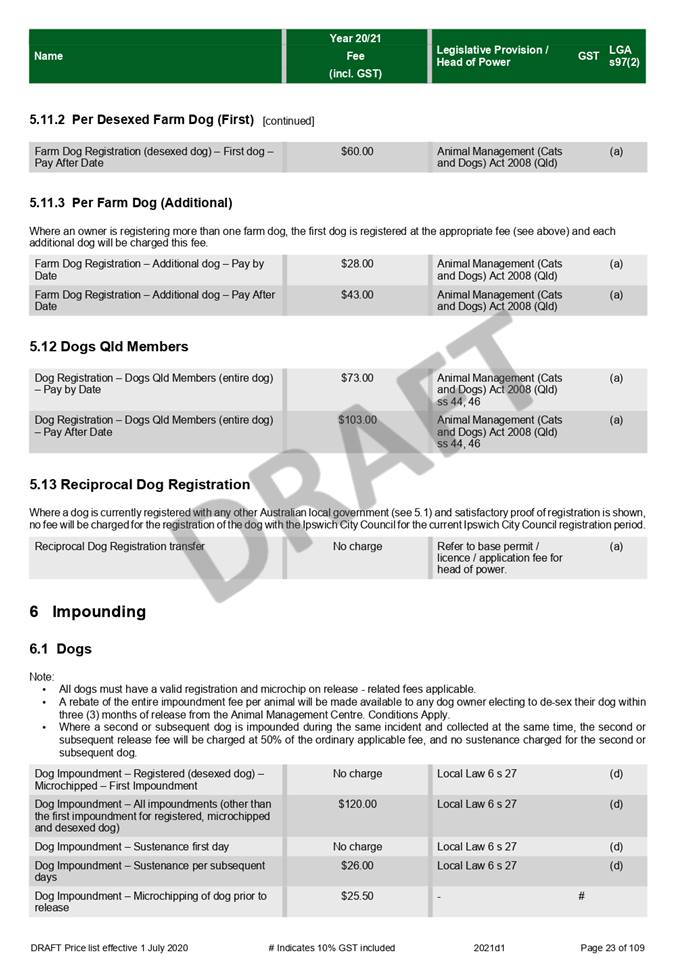

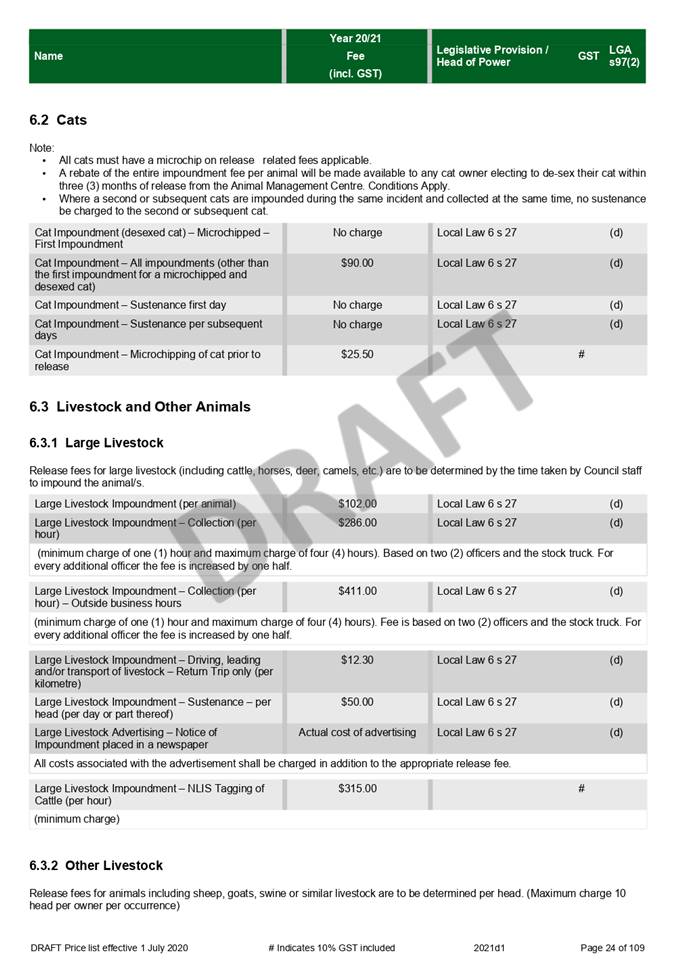

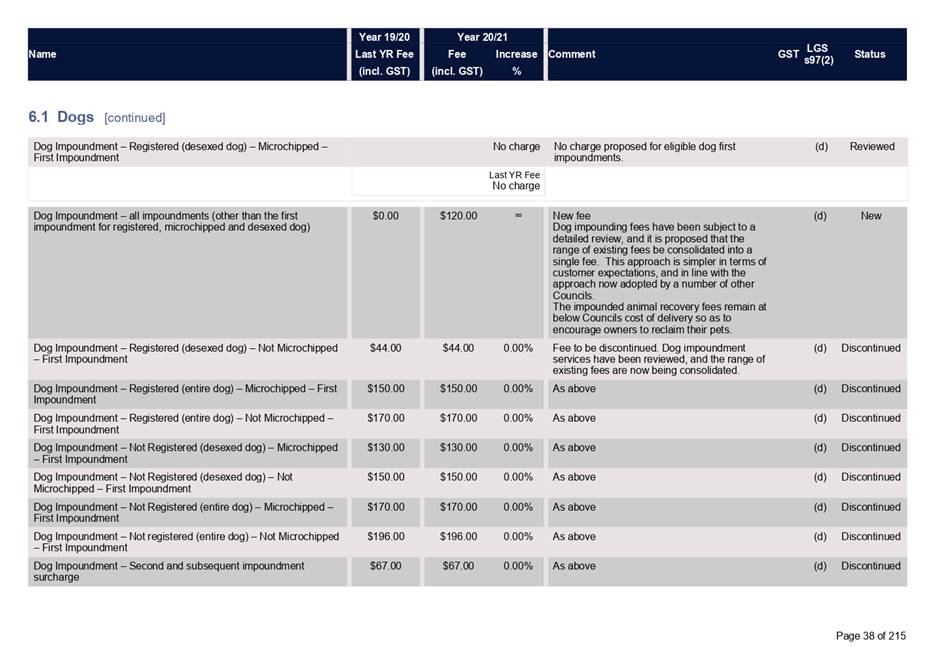

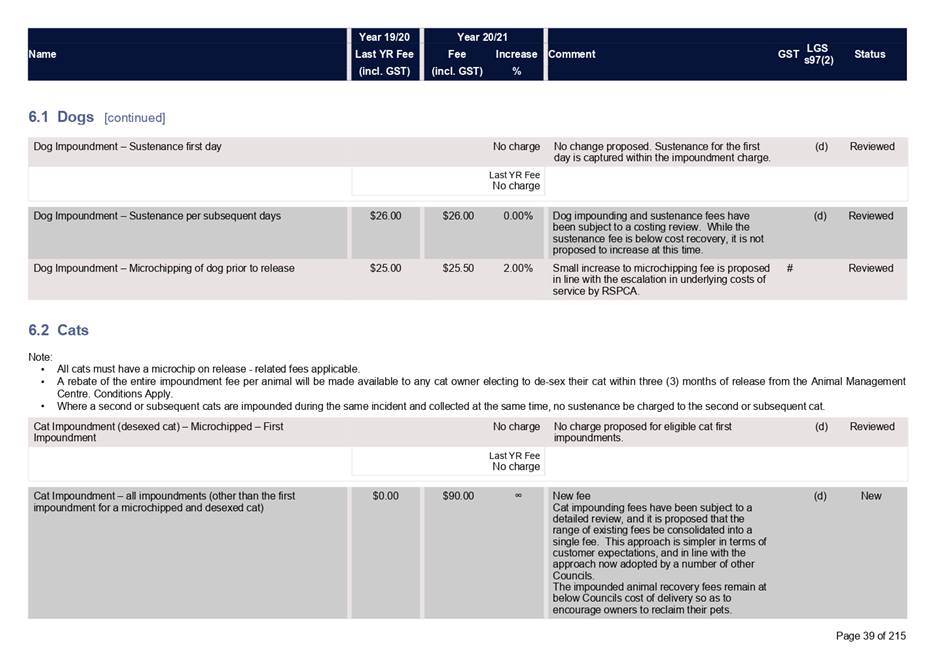

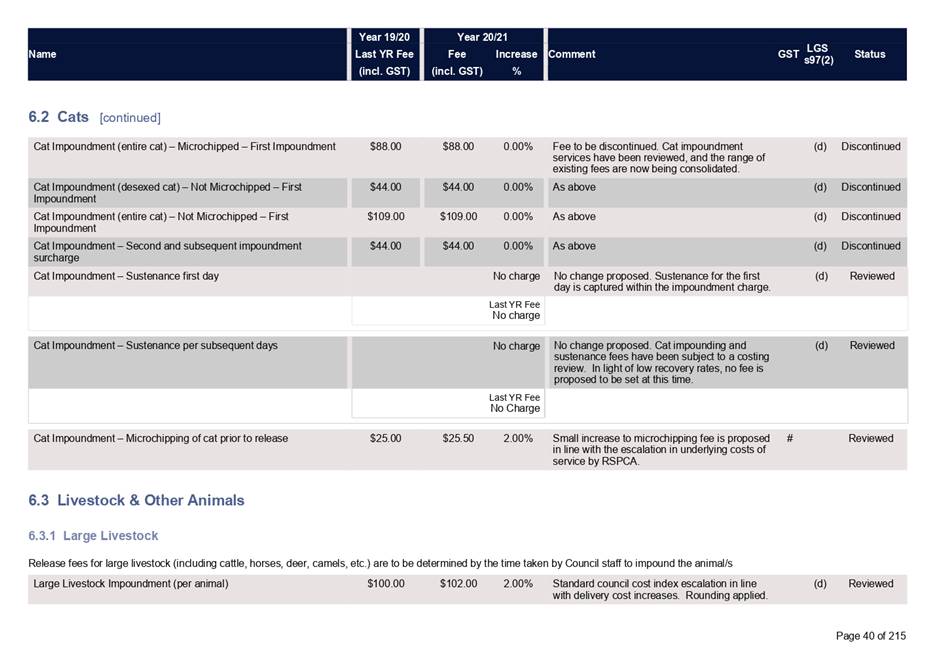

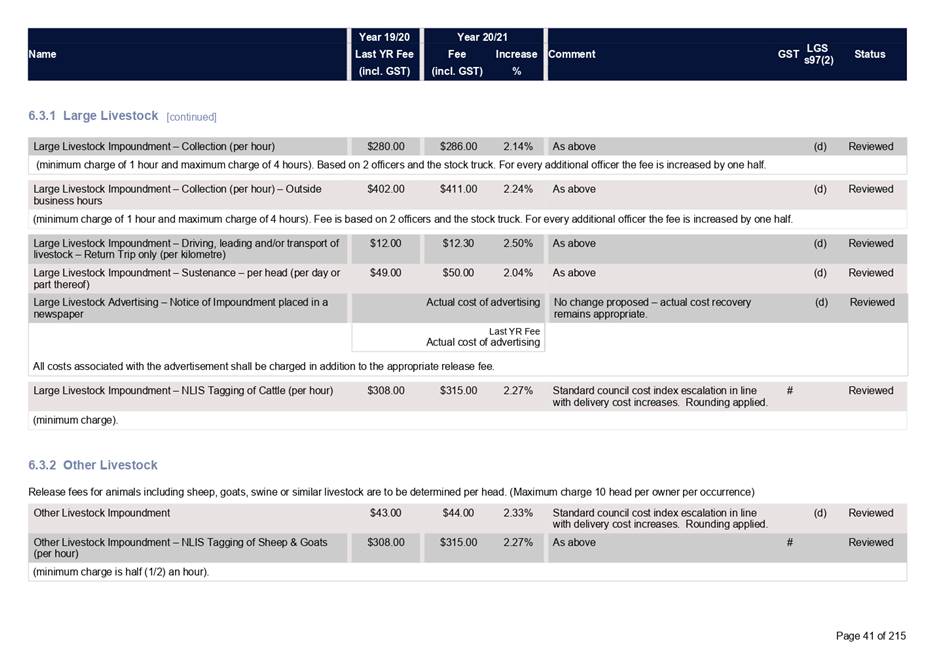

A new

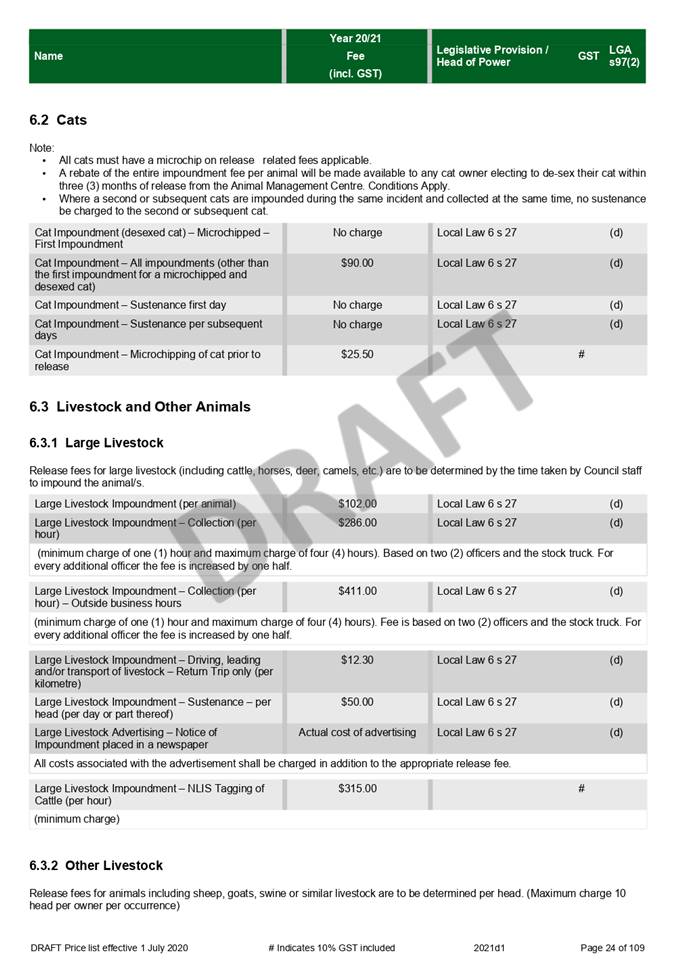

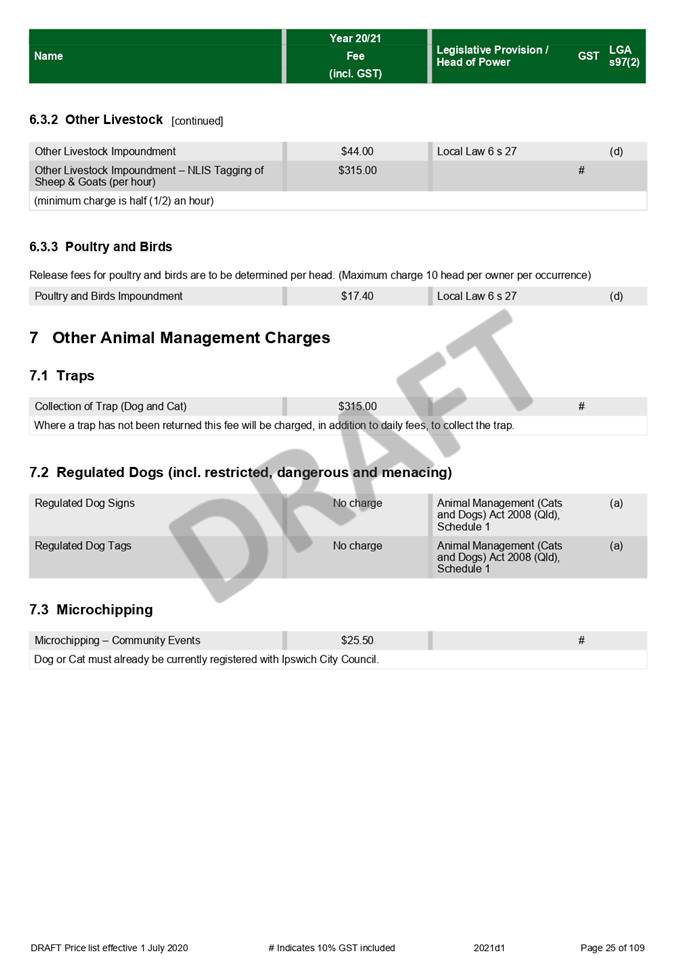

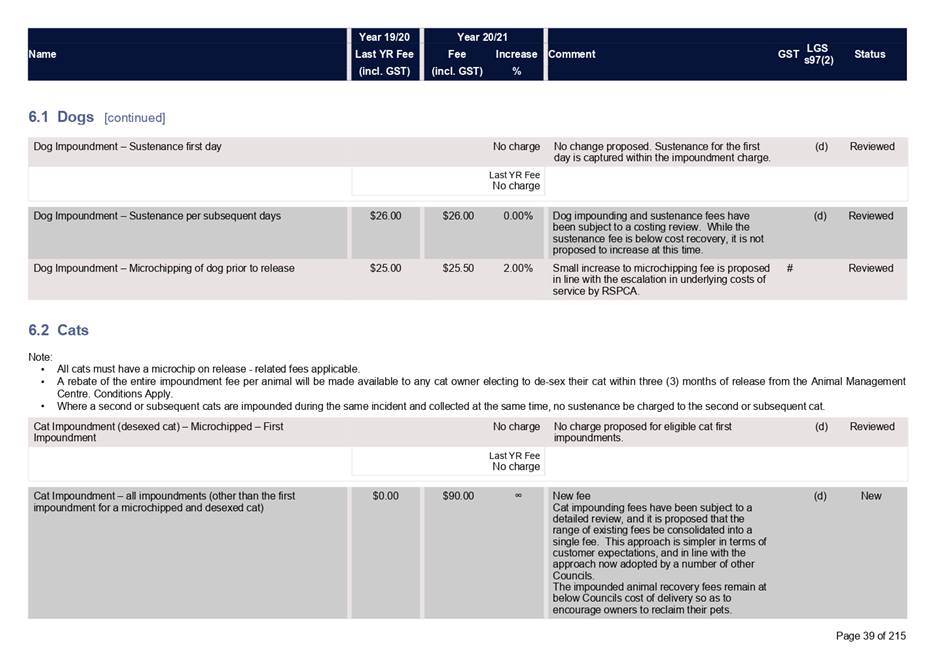

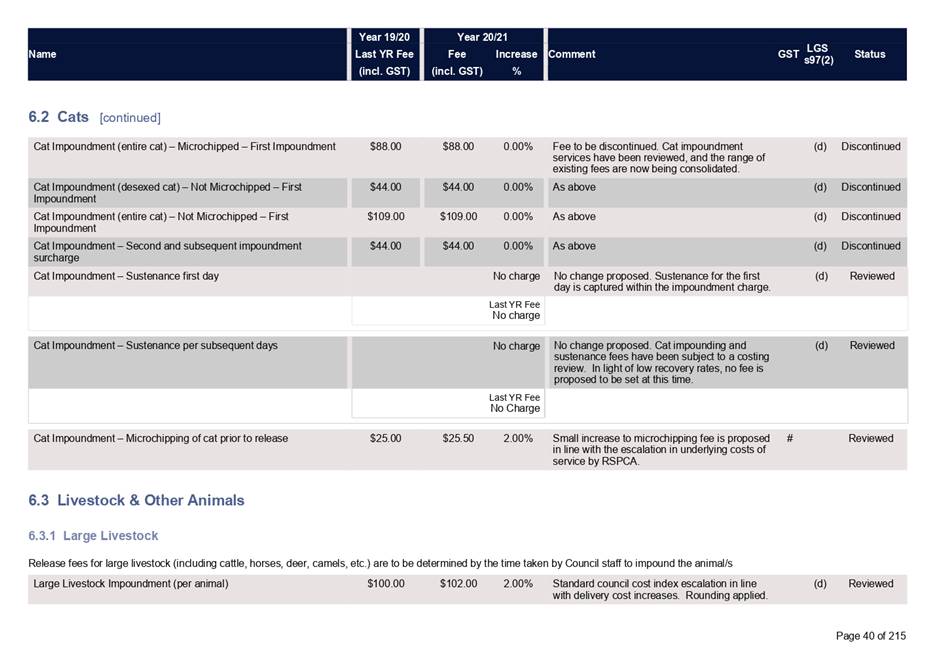

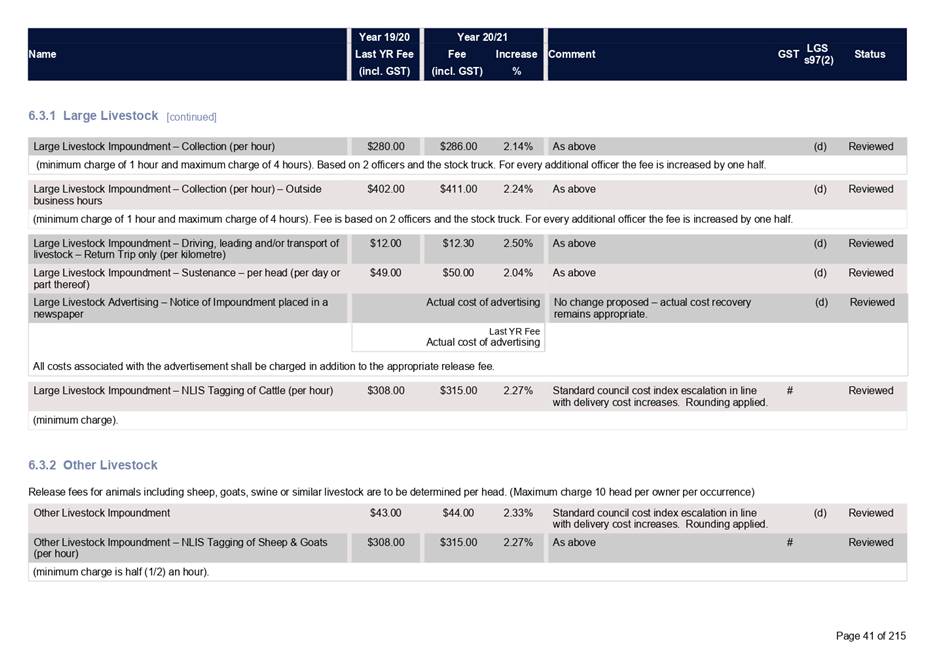

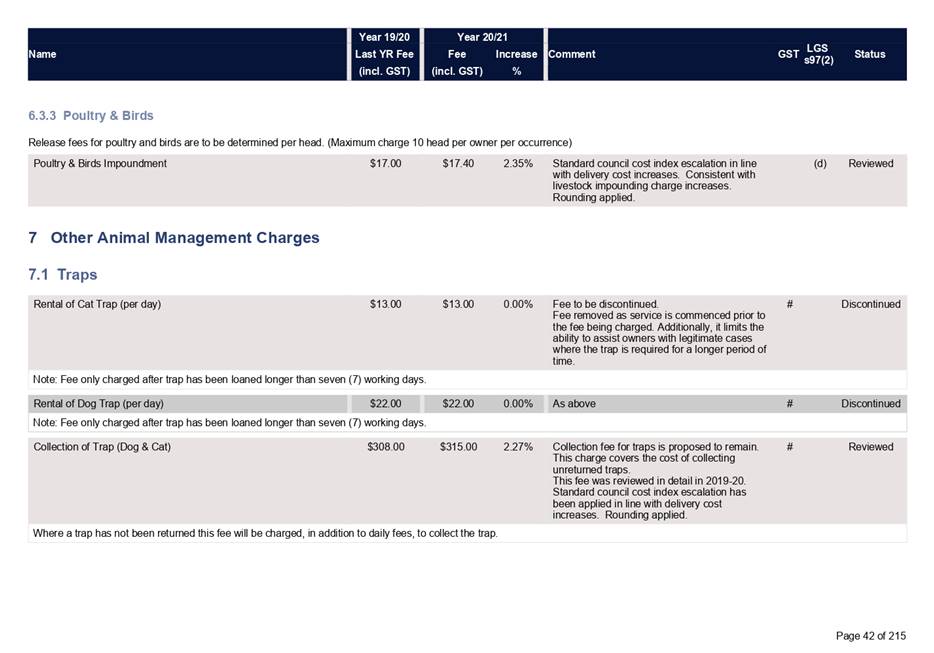

charging structure is proposed to simplify dog and cat impounding fees.

Charges are currently vary based on whether the impounded dog or cat has been

impounded before, is microchipped, desexed or registered (applicable to dogs

only). It is proposed that the range of existing fees be consolidated

into a simpler suite of fees (Attachment 2, pages 37-42). This approach is

simpler in terms of customer expectations, and in line with the approach now

adopted by a number of other Councils.

The

impounded animal recovery fees remain at below Council’s cost of delivery

so as to encourage owners to reclaim their pets. Standard dog impounding

is proposed to be $120.00, being the median of the existing suite of

charges. The standard cat impoundment fee is proposed to be $90.00.

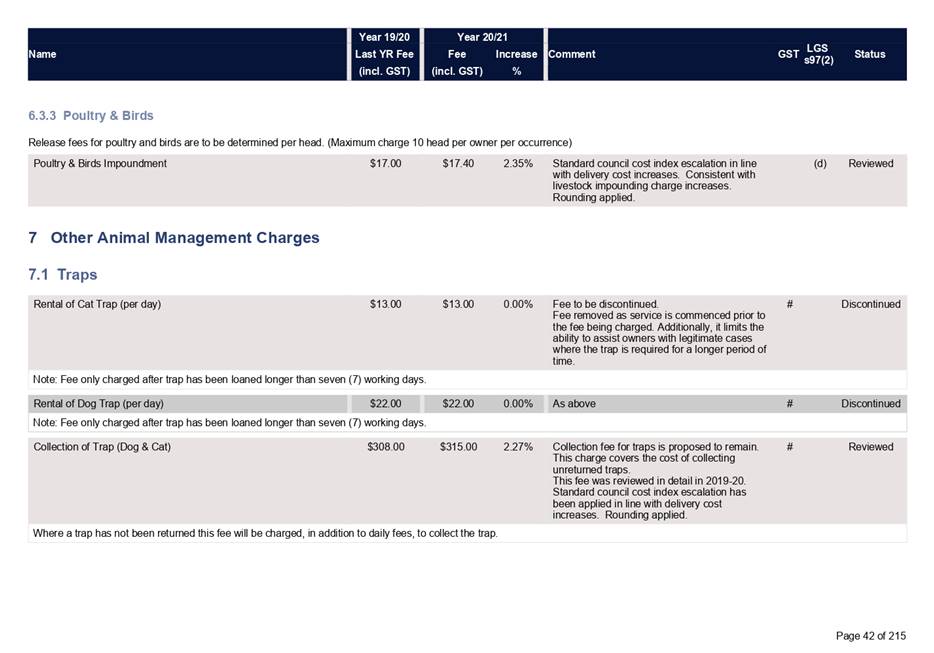

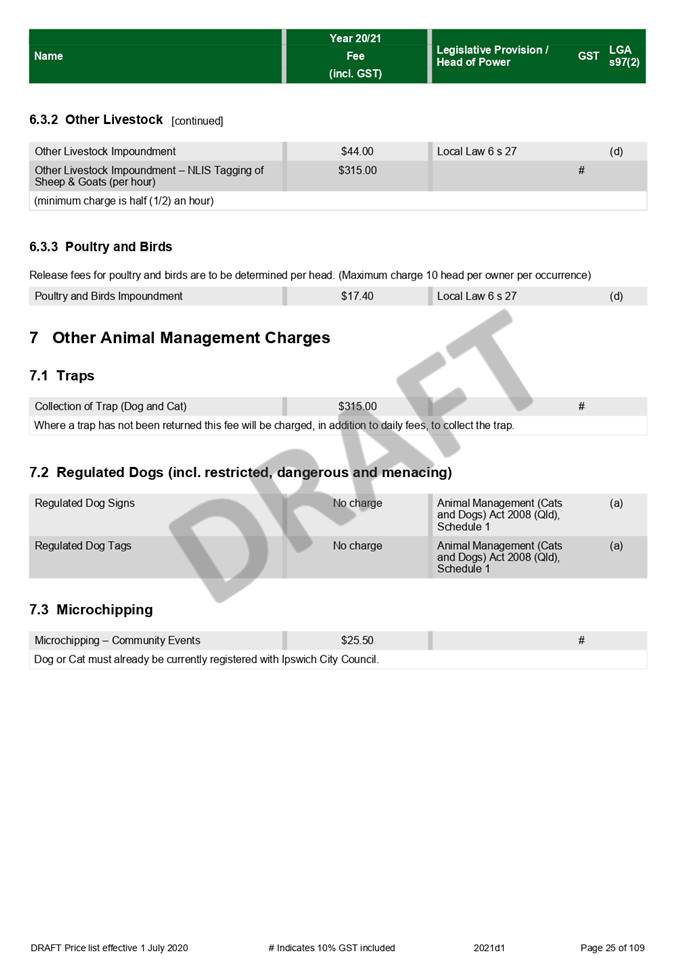

Daily

charges for the hire of dog and cat traps are also proposed to be discontinued

(Attachment 2, page 42). Short term rentals are not cost effective to

administer, and the daily fee may act as a disincentive for longer term rentals

where this is required. The fee for recovery of traps which have not been

returned in a timely manner is to remain.

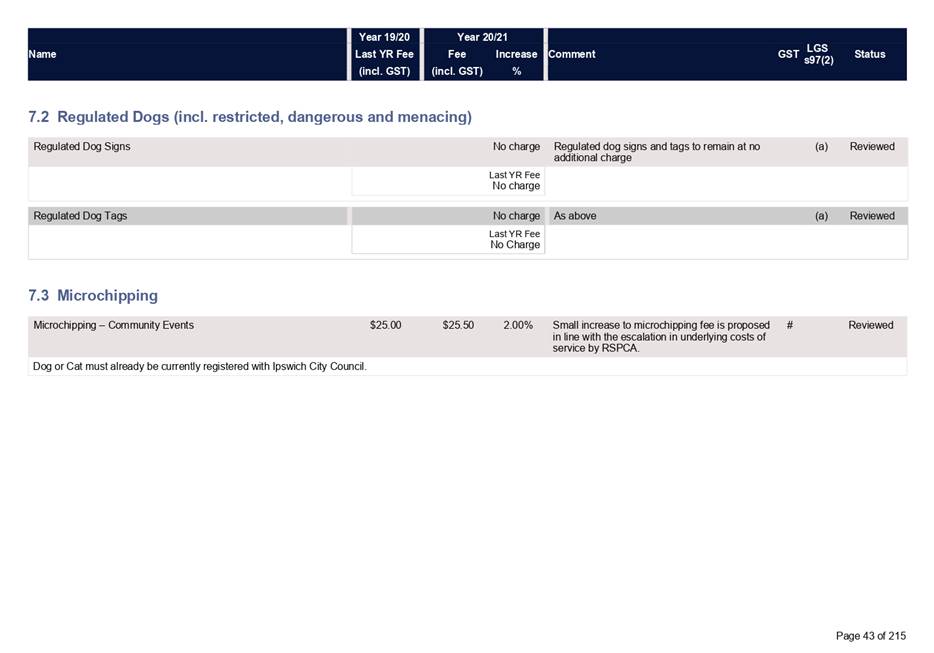

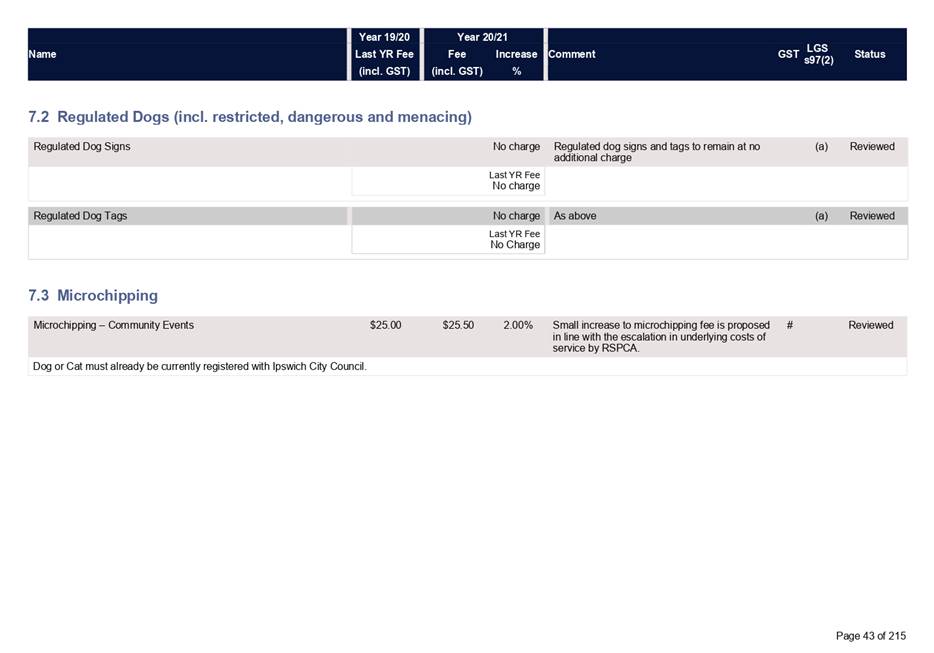

Microchipping

services, undertaken by the RSPCA for Council, are proposed to increase by

$0.50 to $25.50, in line with service costs (Attachment

2, page 43).

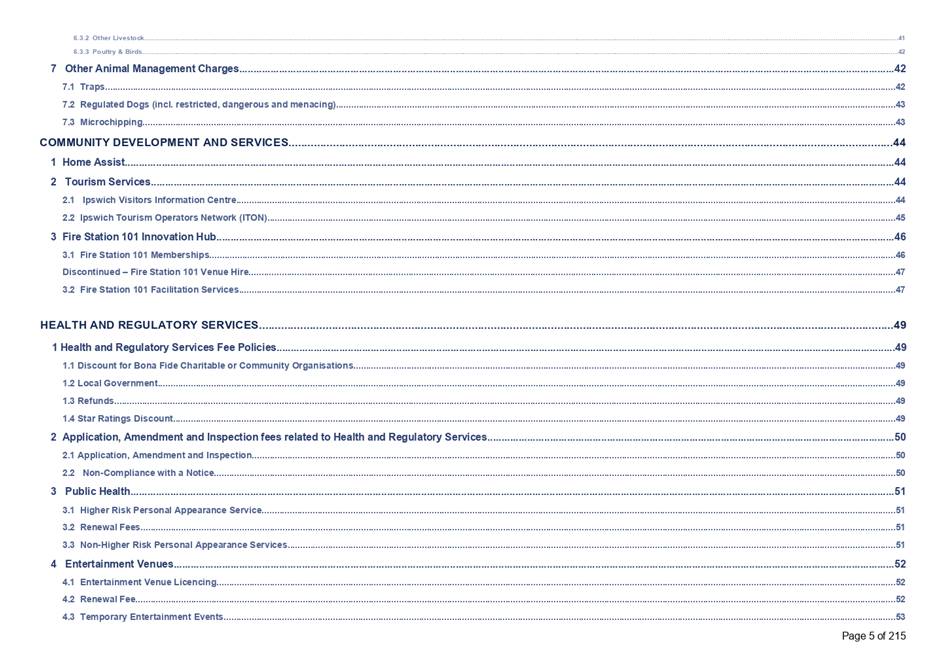

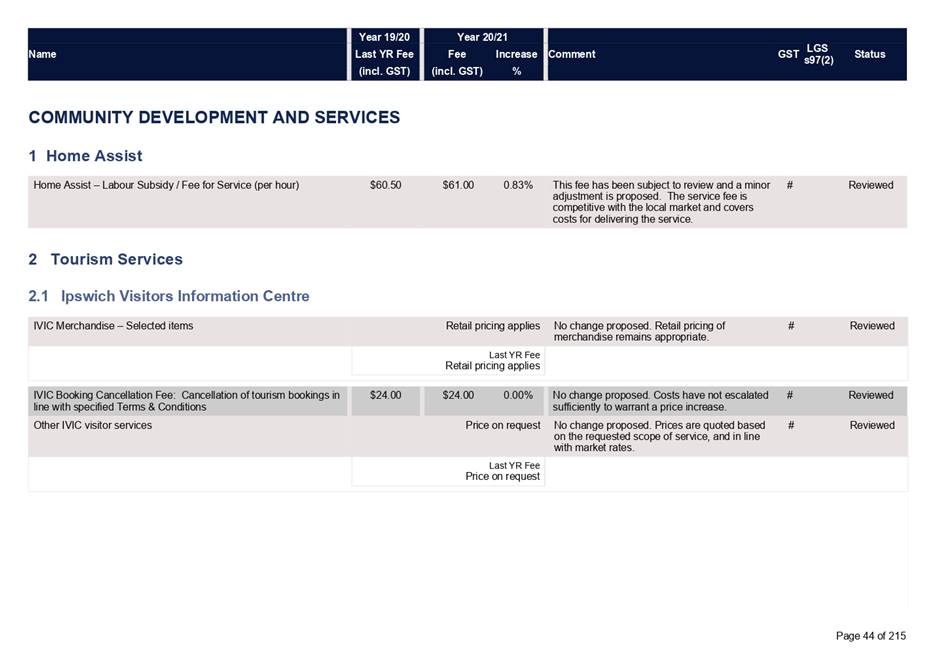

Community

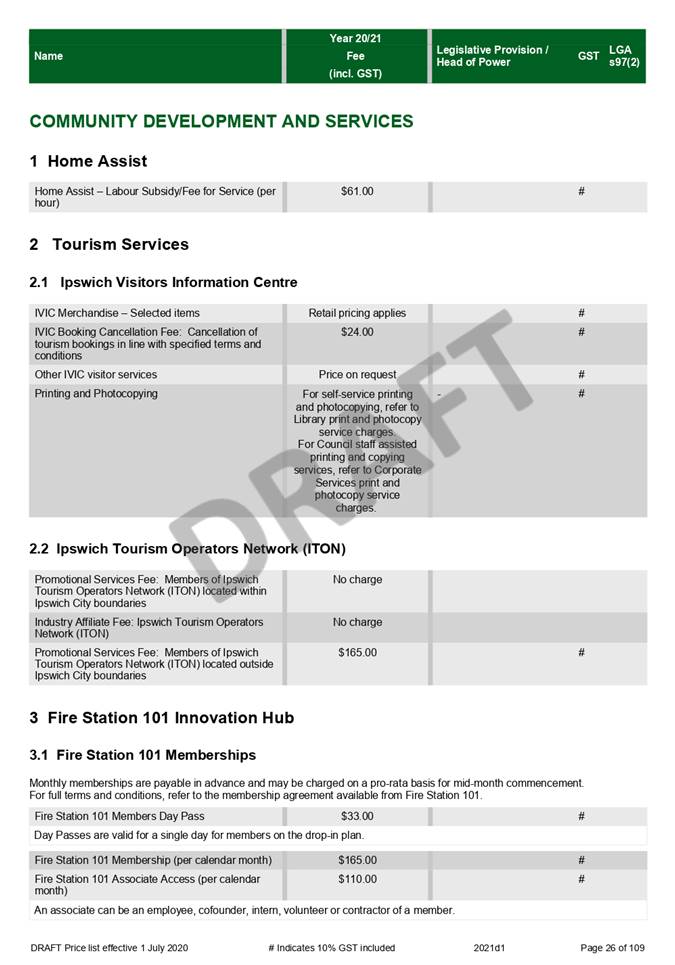

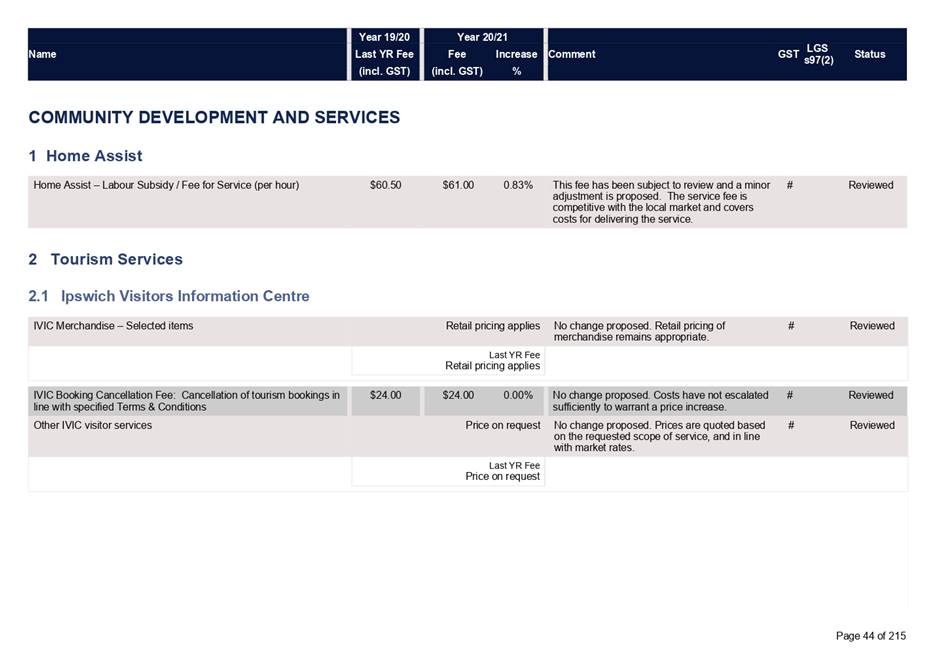

Development and Services

The user

contribution for Home Assist services is proposed to increase slightly from

$60.50 per hour to $61.00 per hour, in line with benchmarks and increases in

underlying costs (Attachment 2, page 44). This fee is only applied where

a client has requirements in excess of the funding already provided from within

the scheme.

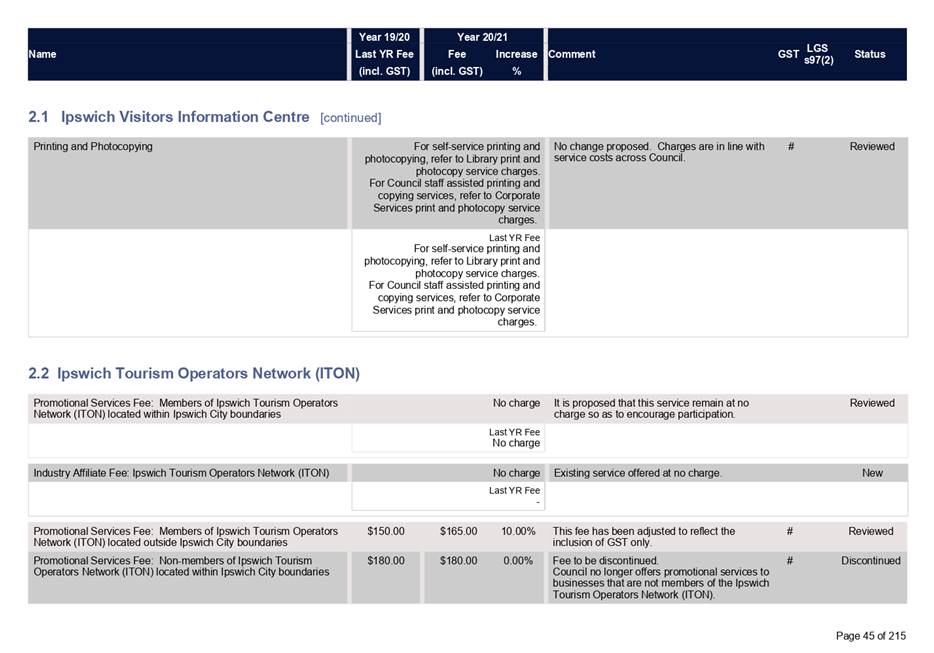

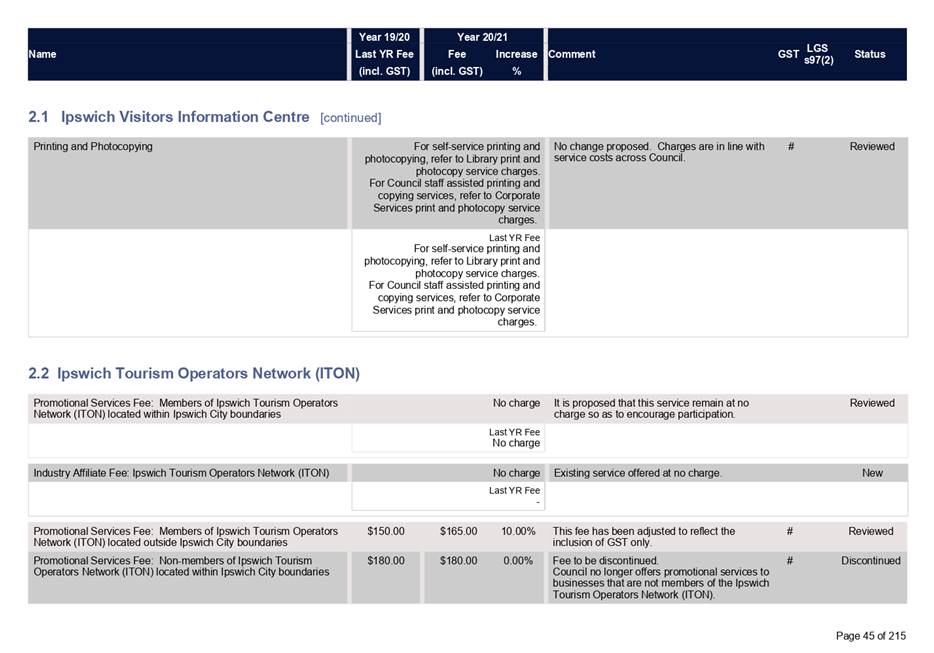

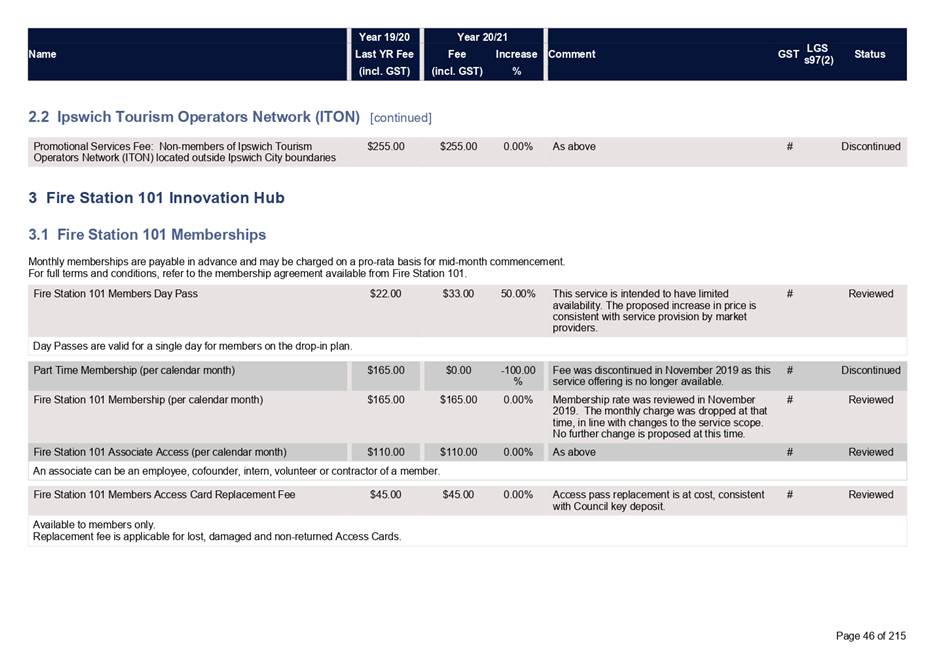

Promotional

services fees for businesses that are not members of the Ipswich Tourism

Operators Network (ITON) are to be discontinued, with Council support services

now offered only to members within the Ipswich region. An industry

affiliate fee membership option has also been included in the register at no

charge (Attachment 2, pages 45-46).

No

changes are proposed in relation to the Ipswich Visitor Information Centre.

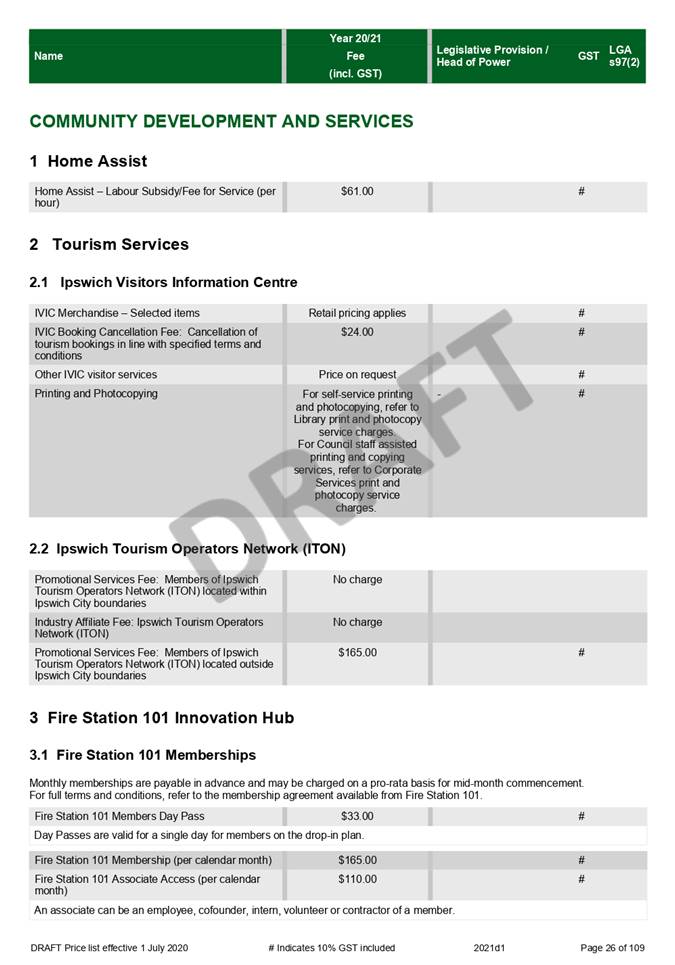

The

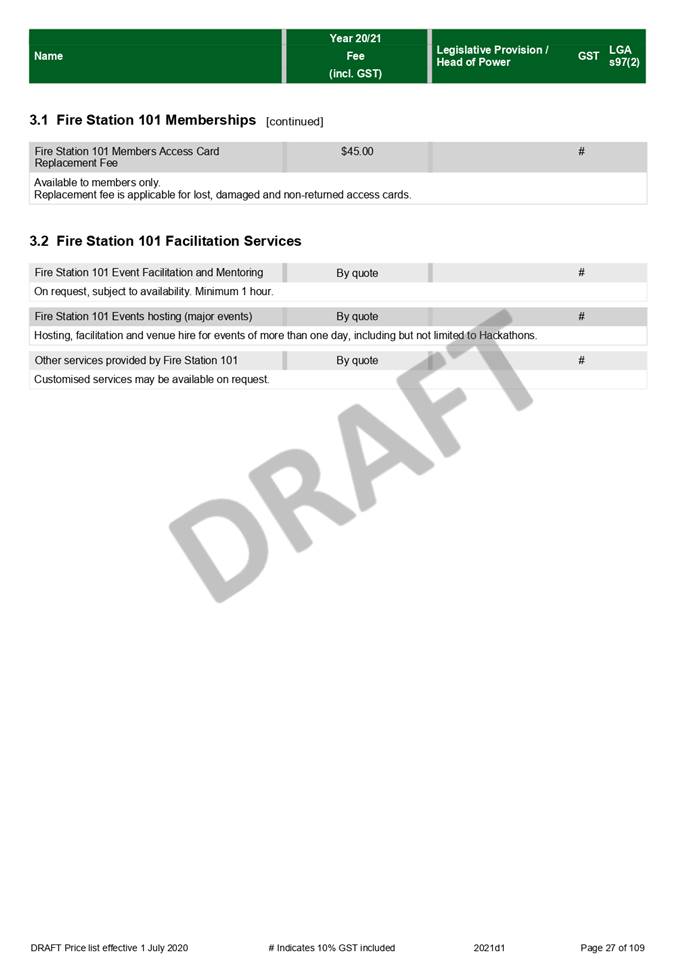

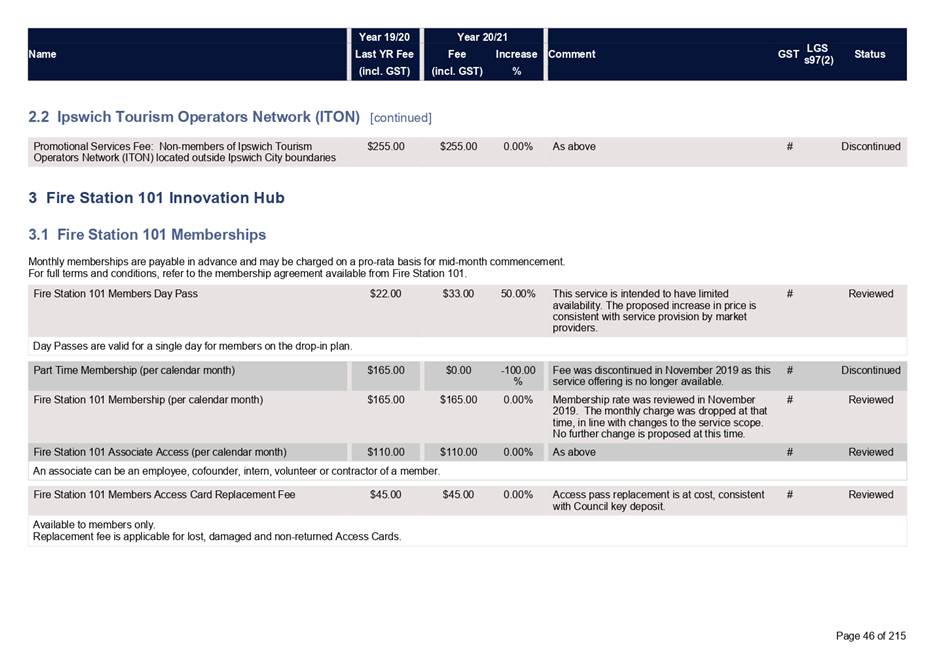

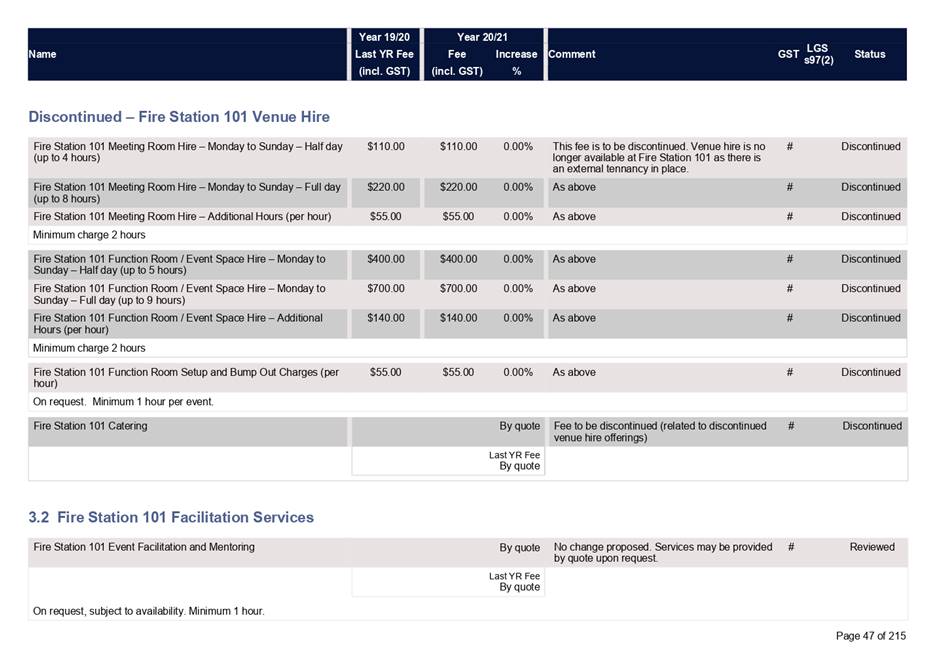

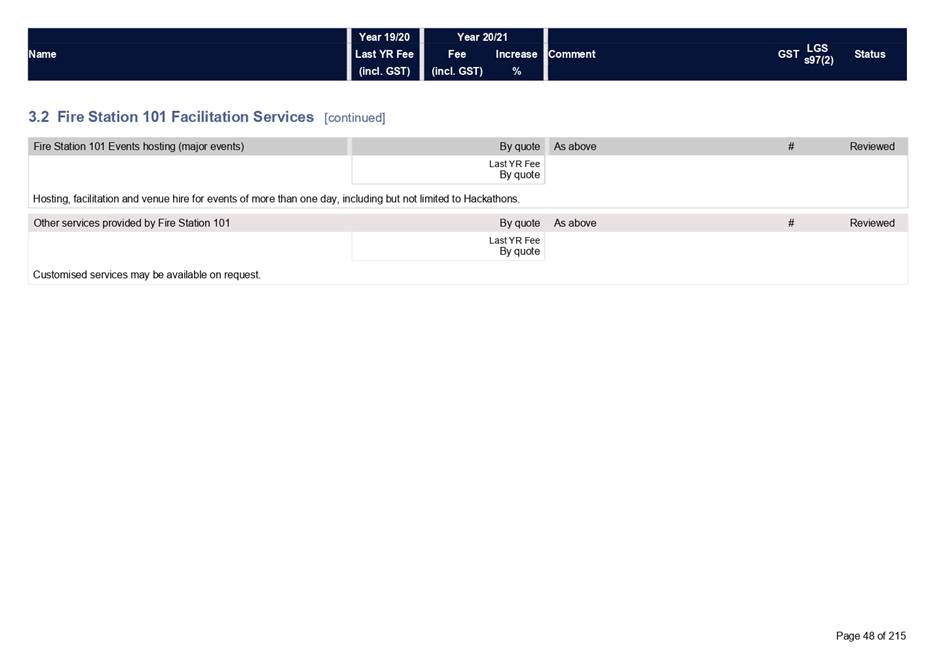

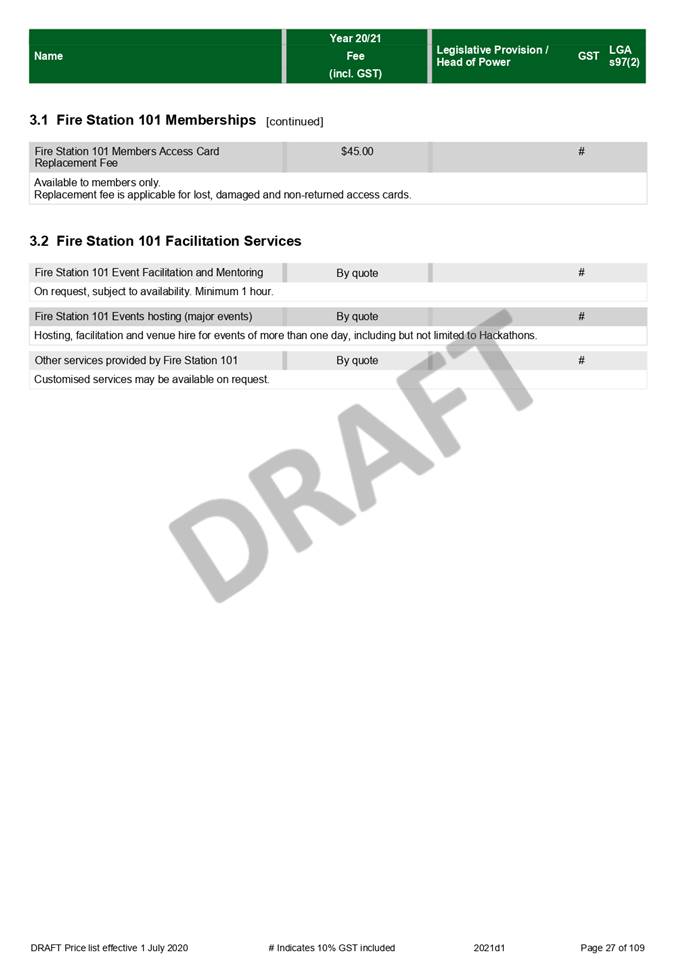

daily or drop-in pass for the Fire Station 101 Innovation Hub is proposed to

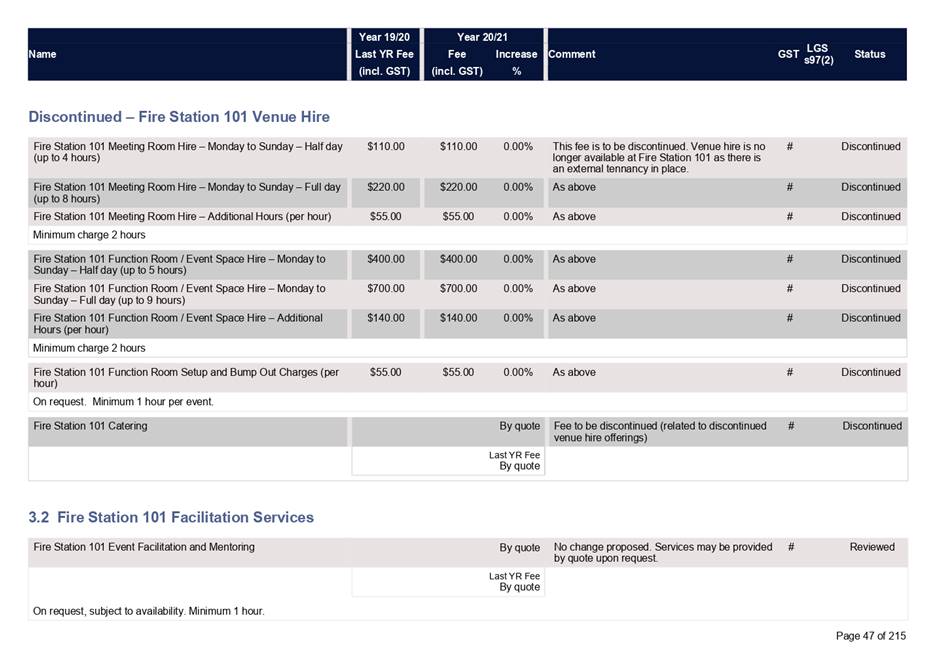

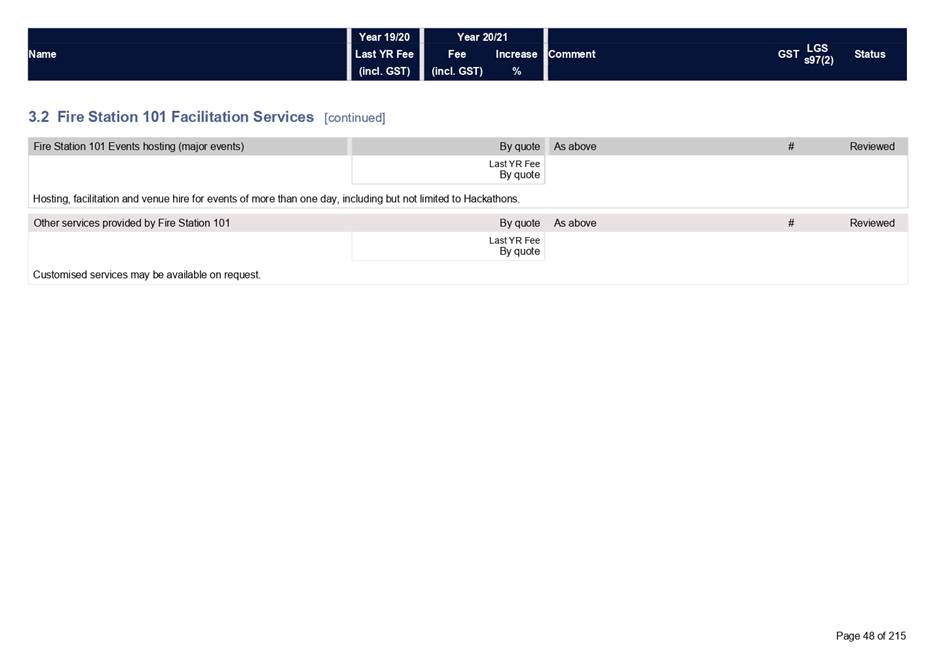

increase from $22.00 to $33.00 in order to encourage members to use the ongoing

membership option. (Attachment 2, page 46). Other membership

options remain unchanged. Public venue hire and catering services at Fire

Station 101 have been discontinued to accommodate a long term tenancy by the

State Government which provides services complimentary to the strategic

objectives of the facility (Attachment 2, page 47).

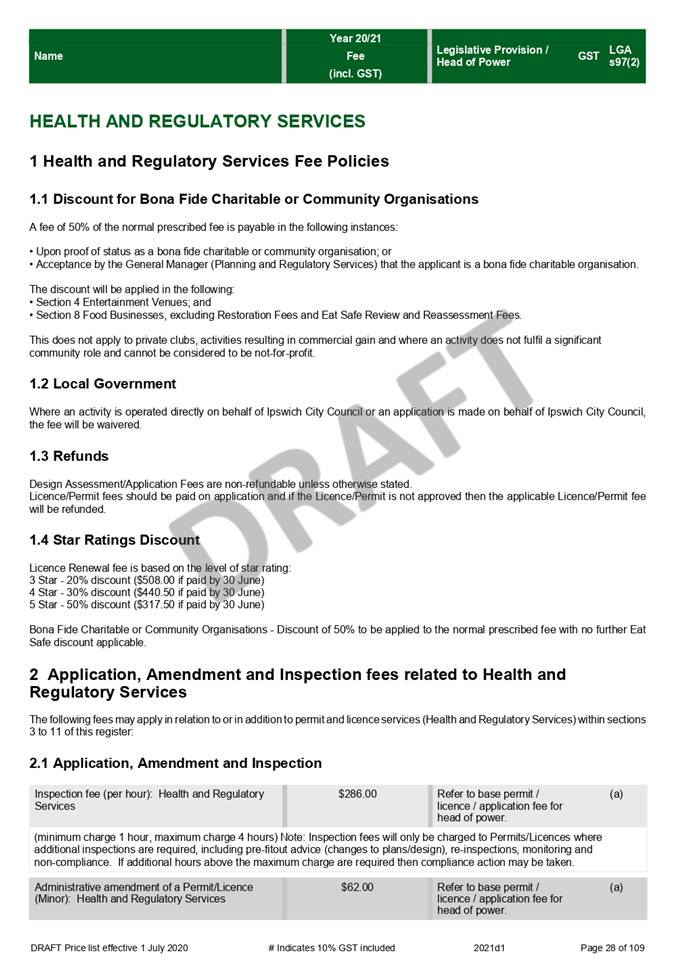

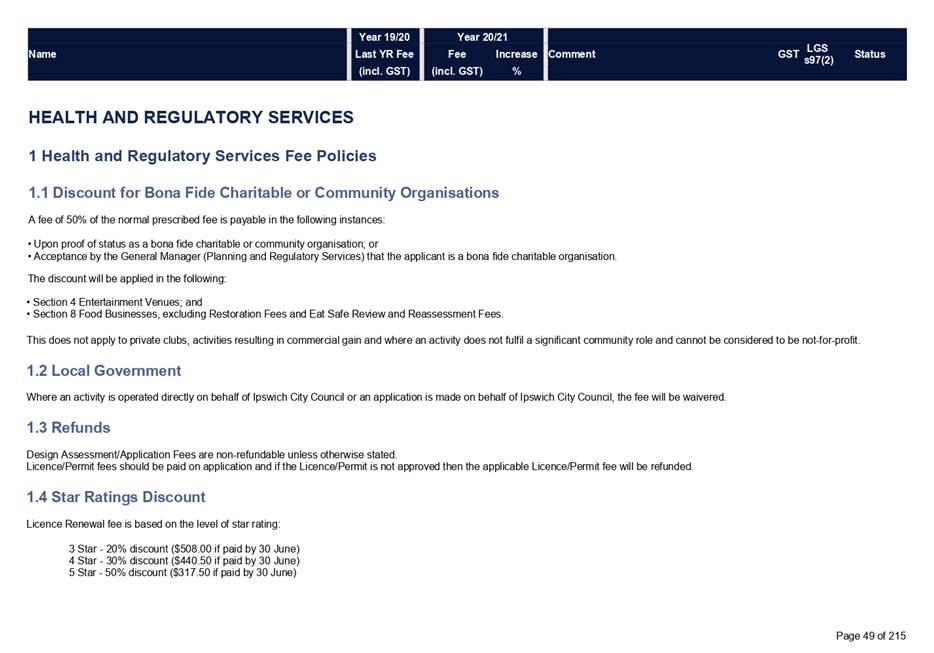

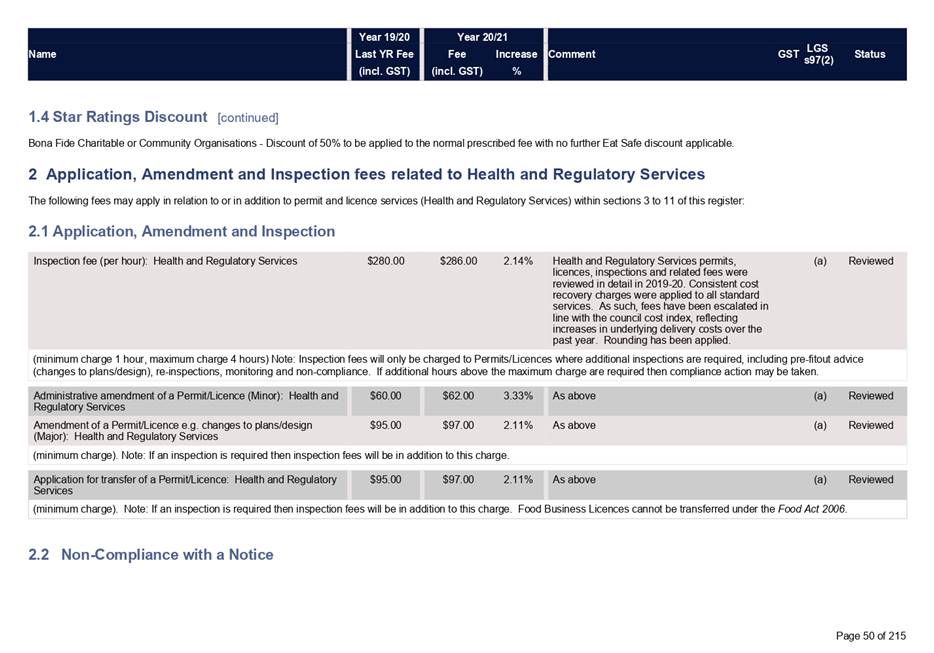

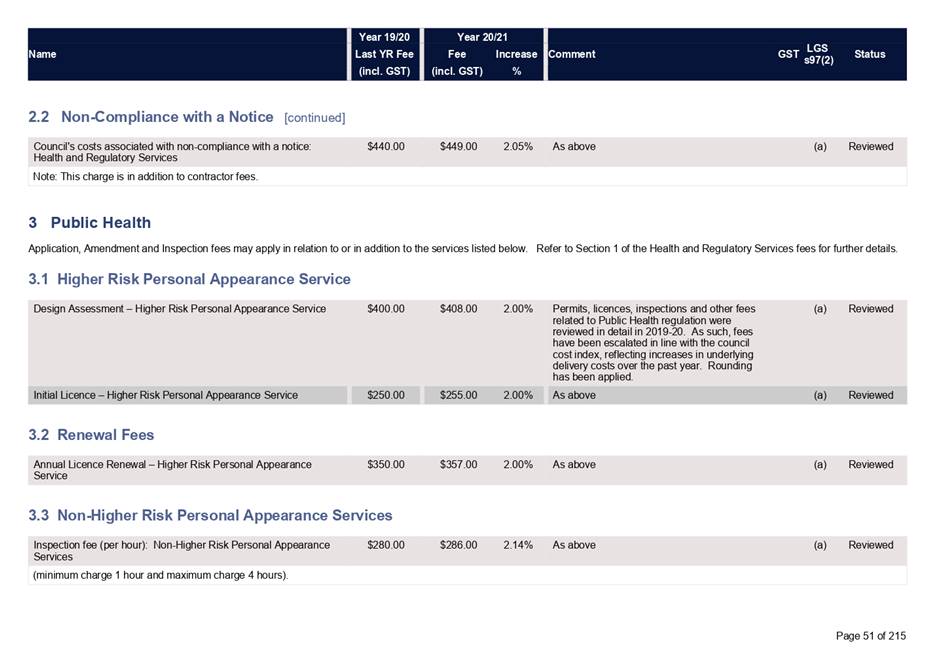

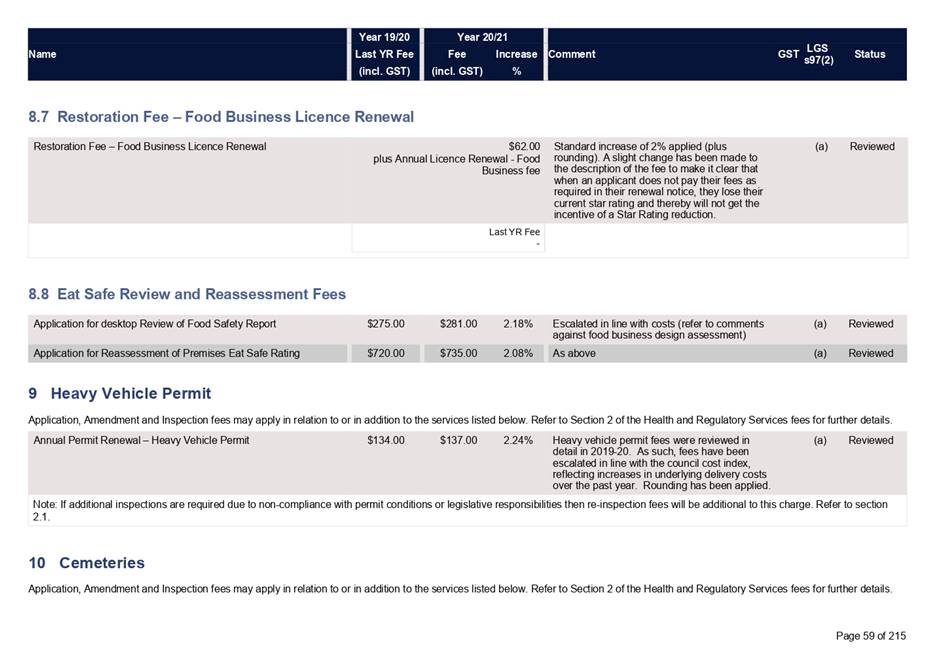

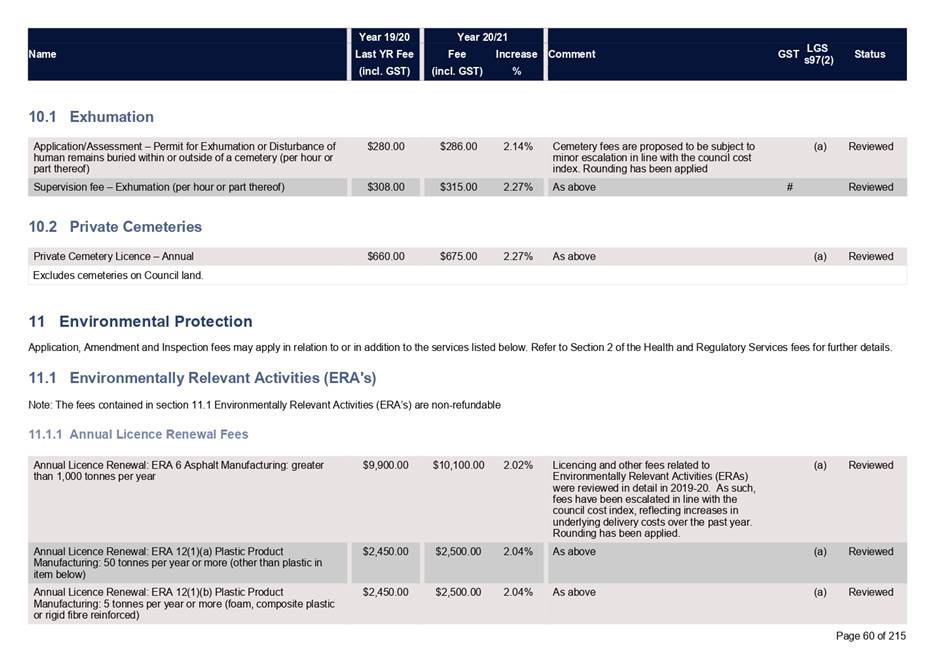

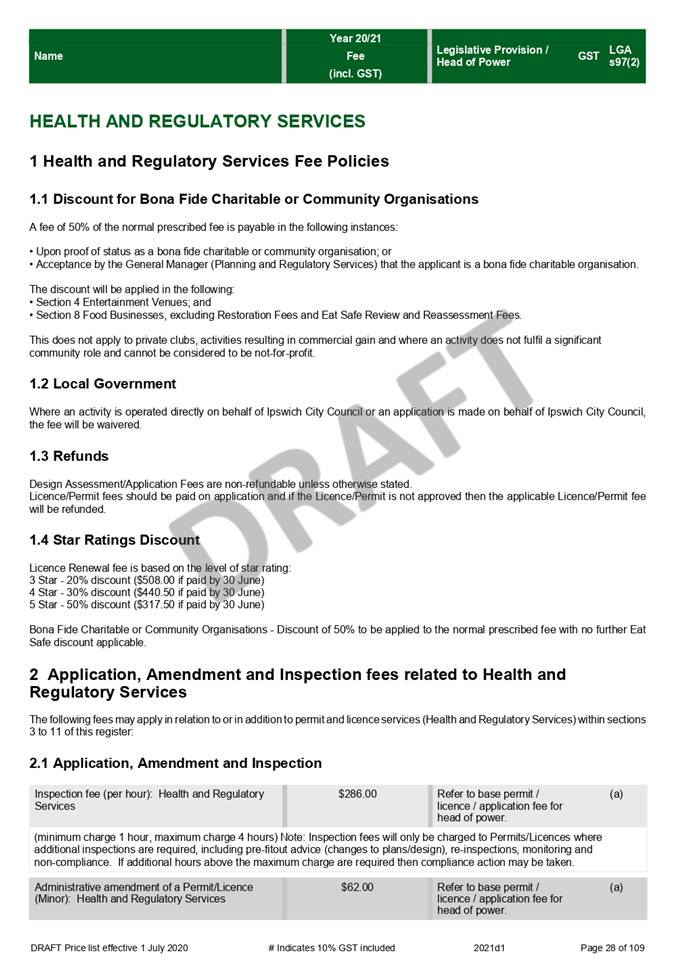

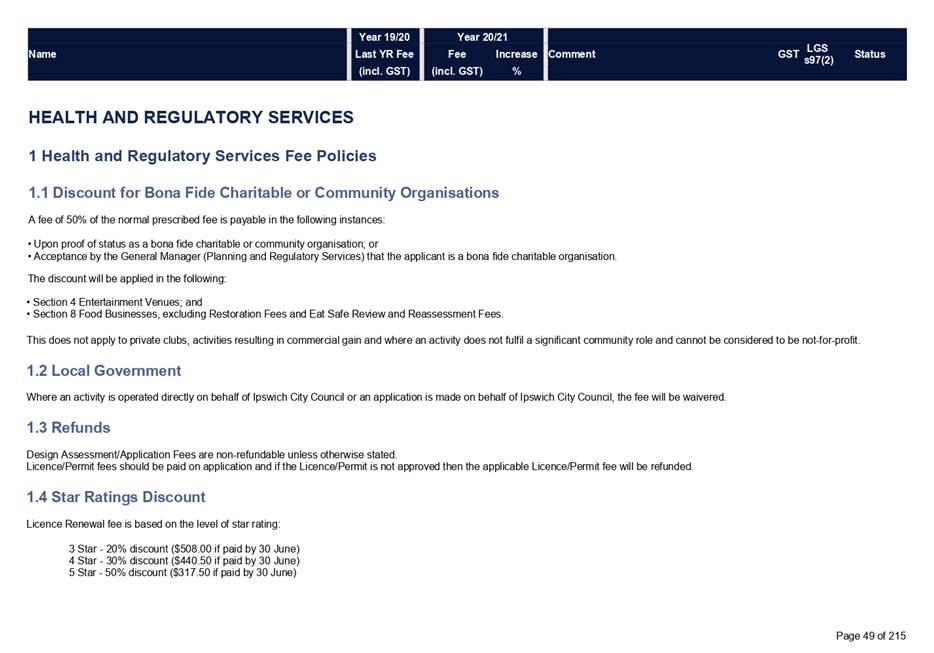

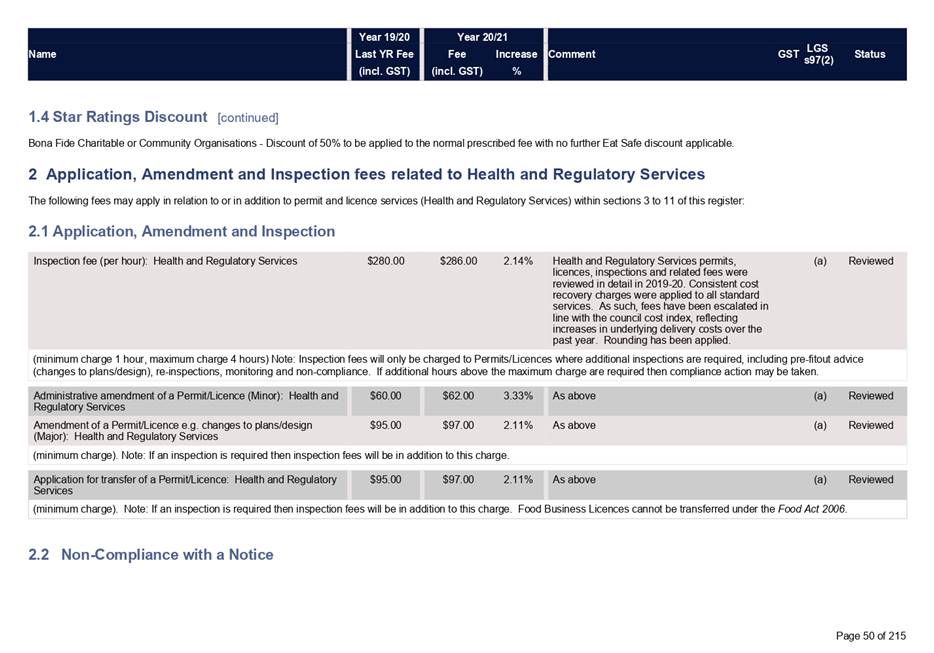

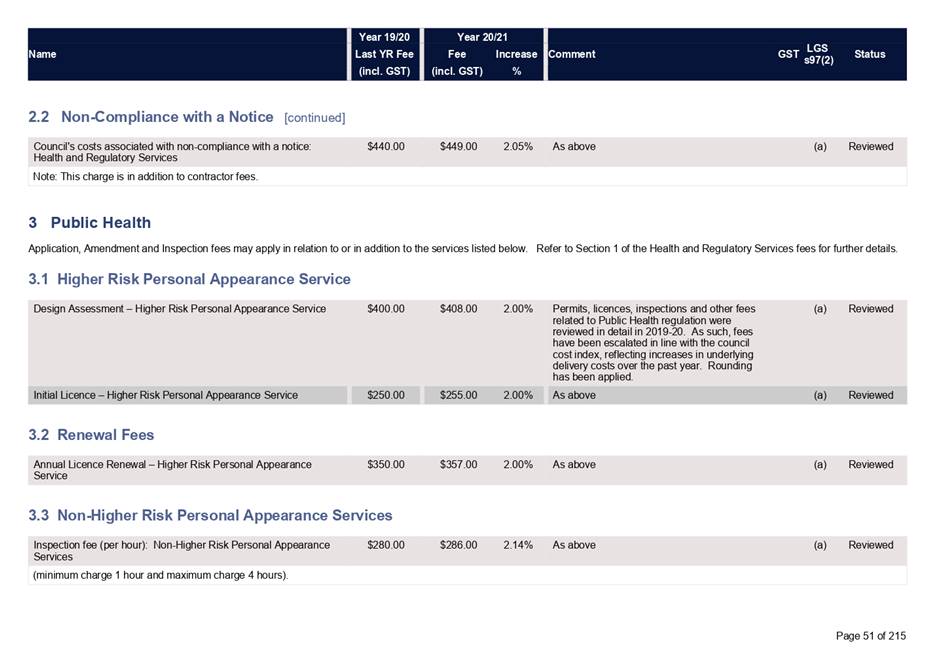

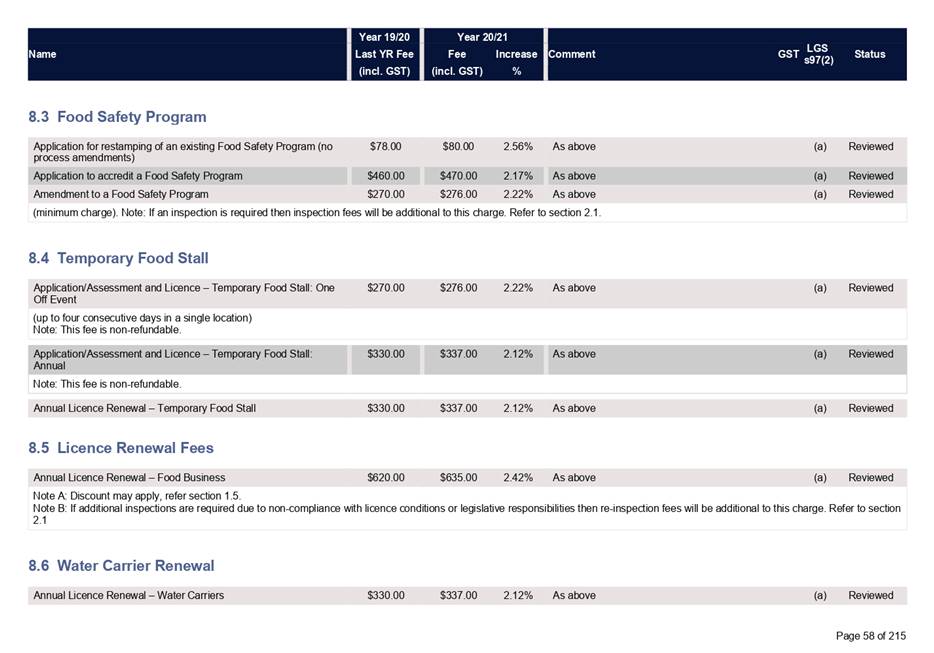

Health

and Regulatory Services

Most

fees under the Health and Regulatory Services section were subject to a

detailed review in 2019. As such, the existing services have been subject

to minimal change and prices generally escalated in line with Council

costs. As with commercial animal licences, a number of the Health and

Regulatory licence and service fees are proposed to be eligible for a reduction

under the COVID-19 relief program (refer to page 11 of this paper).

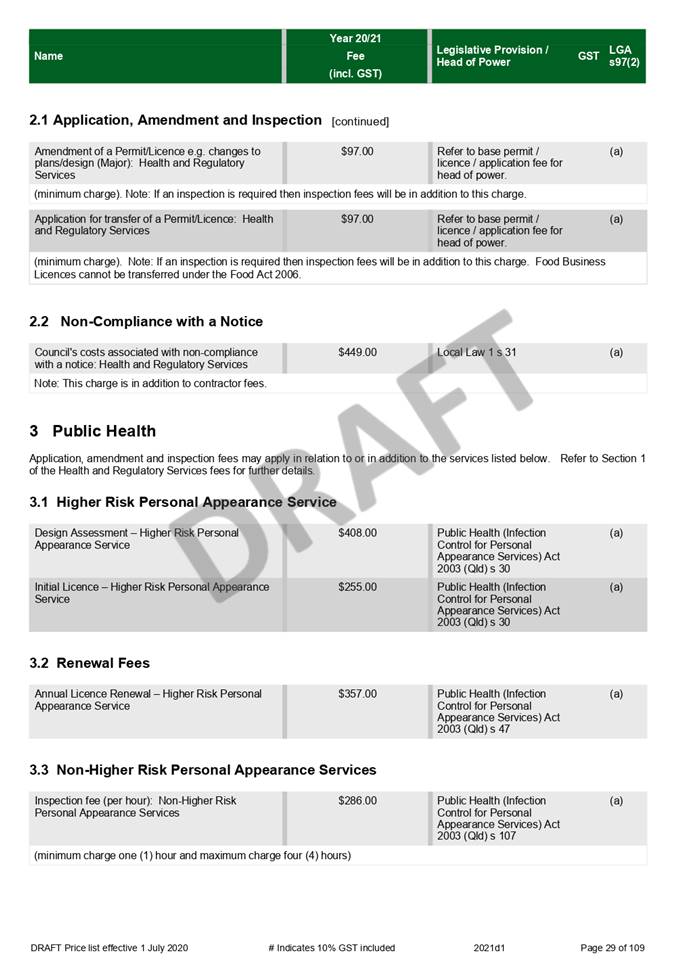

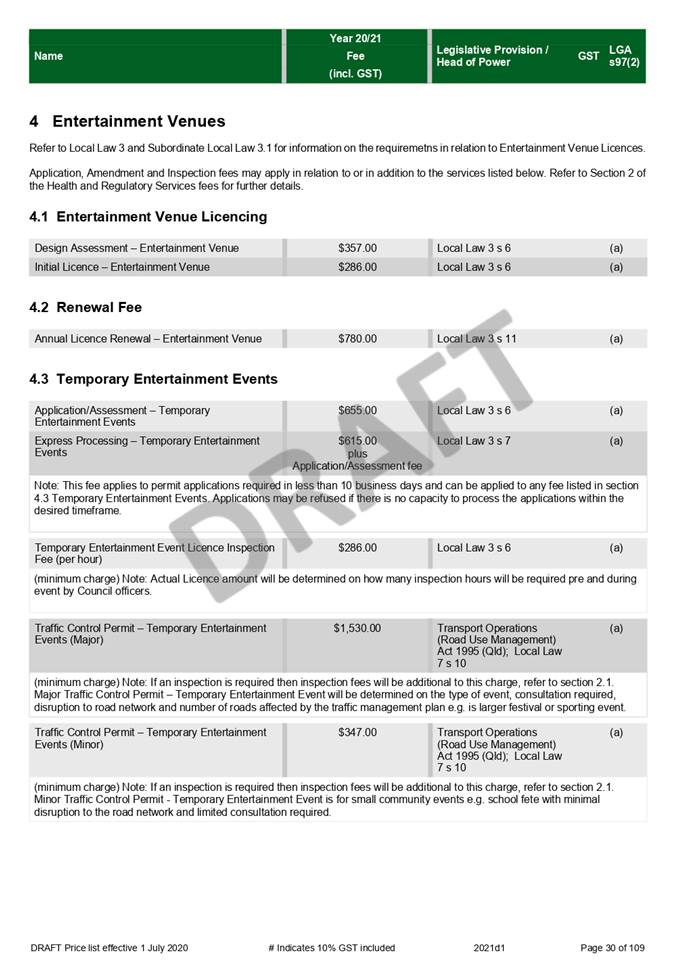

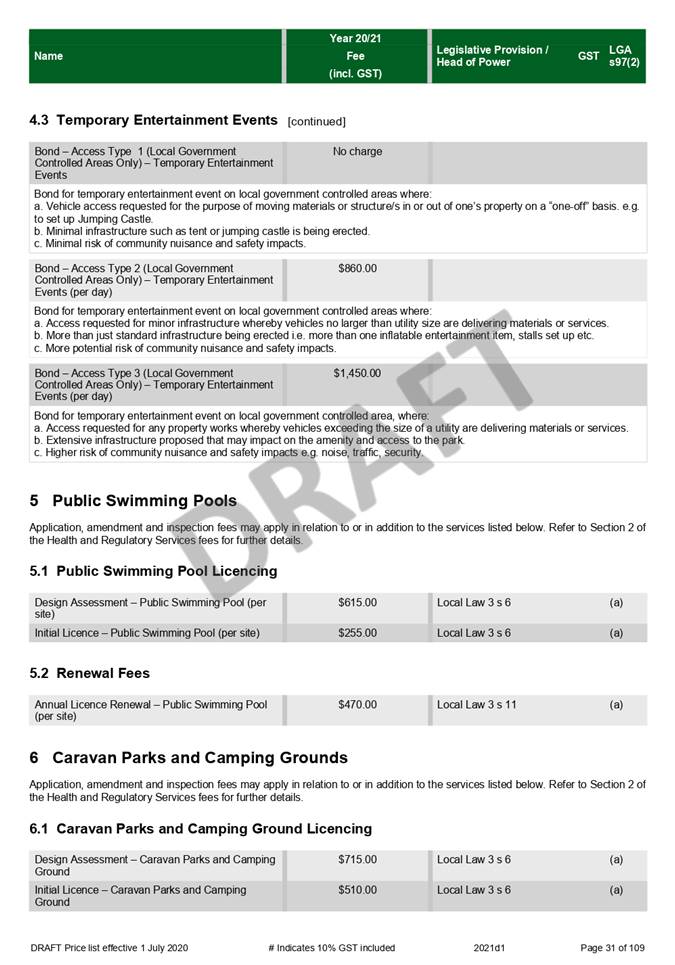

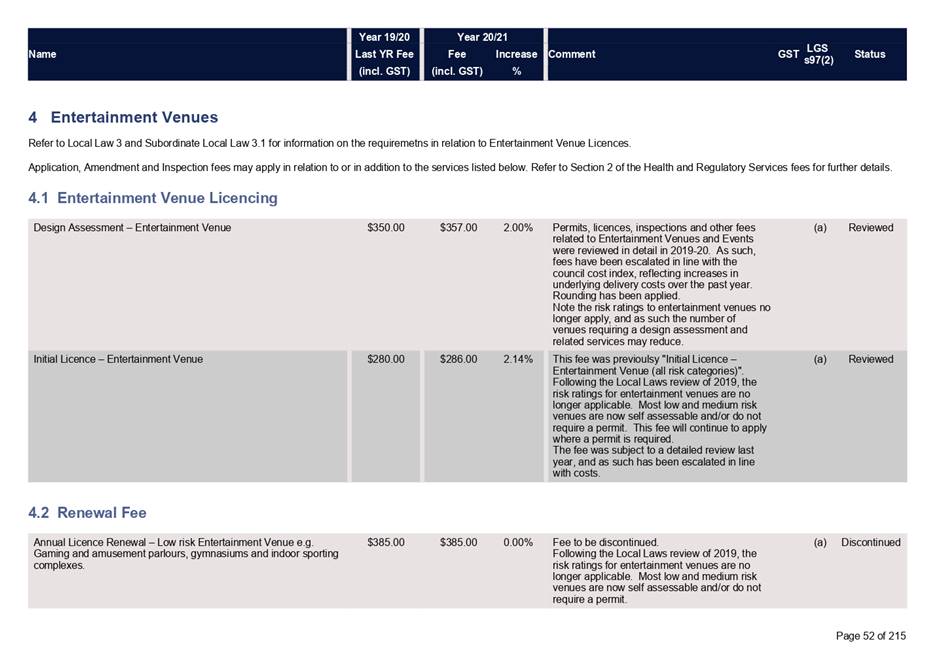

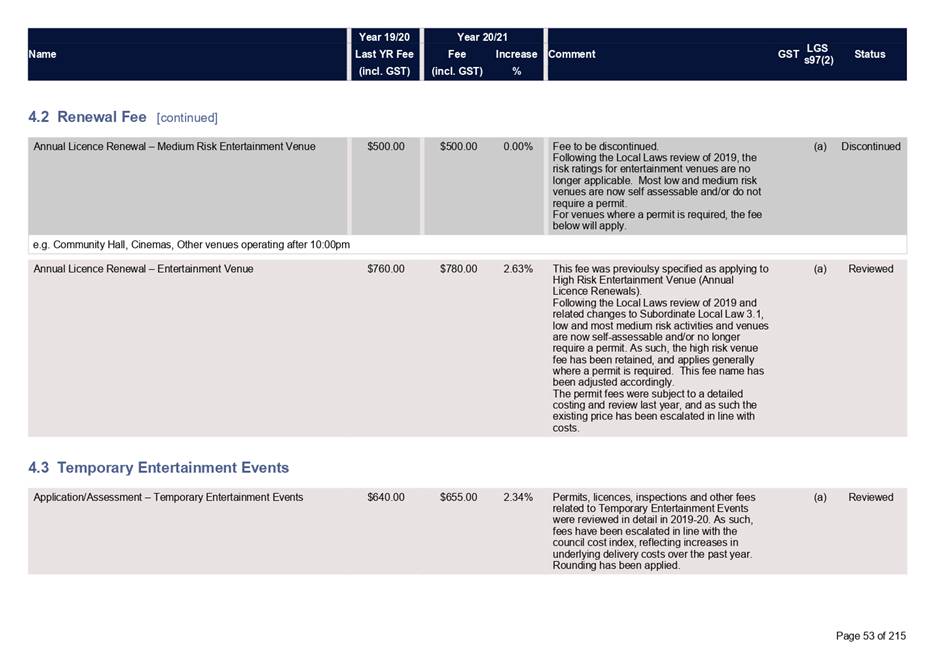

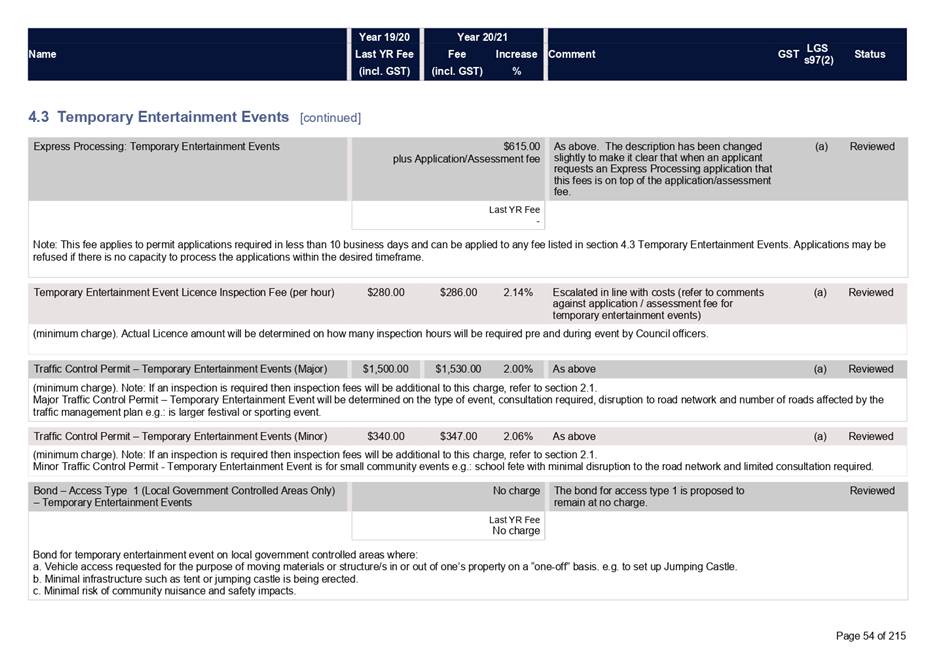

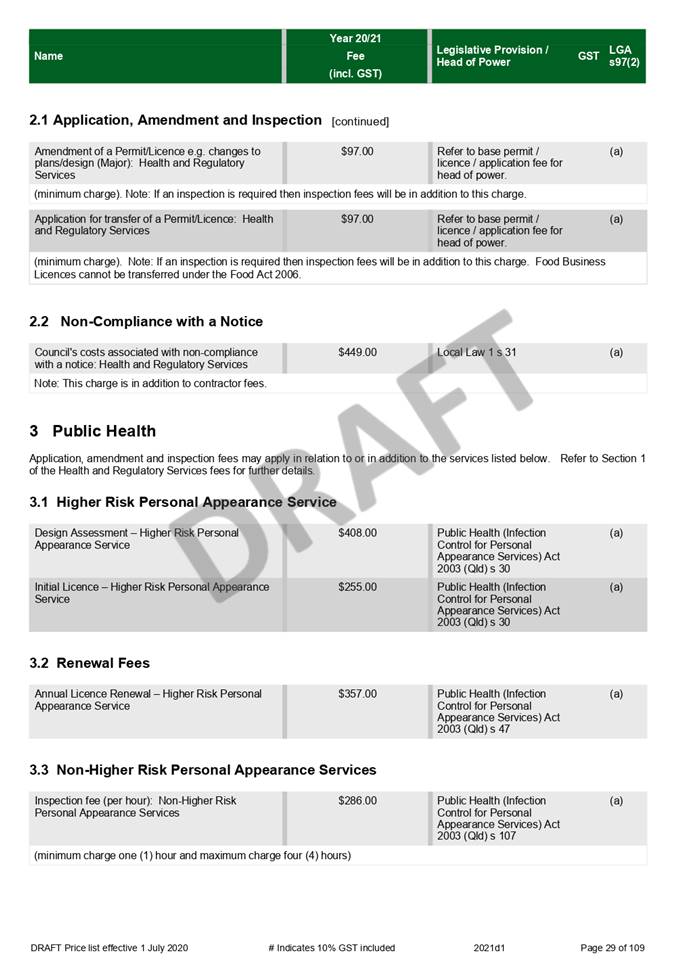

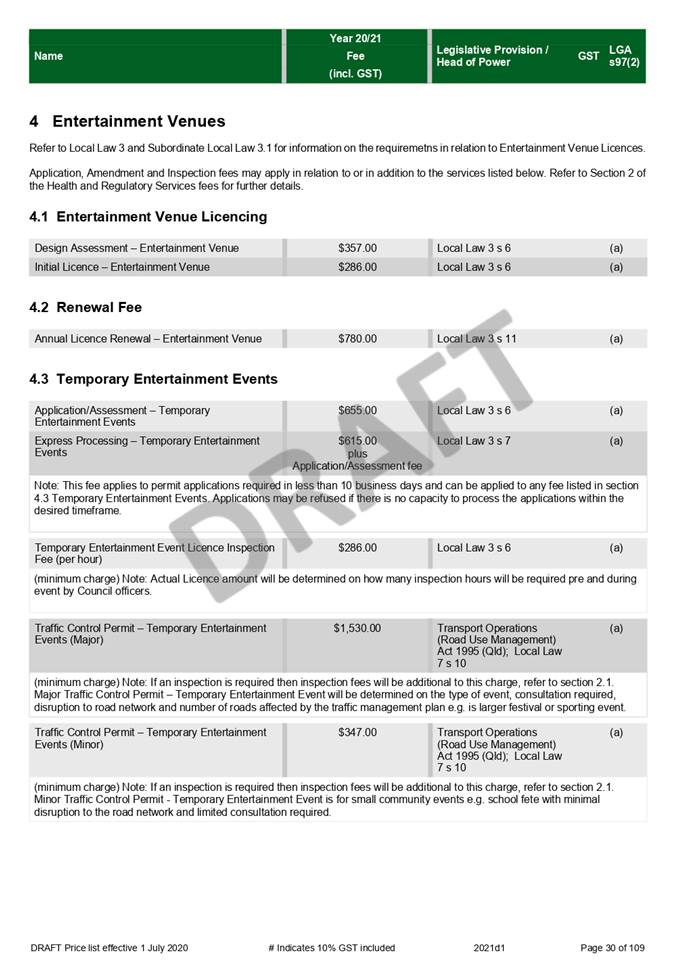

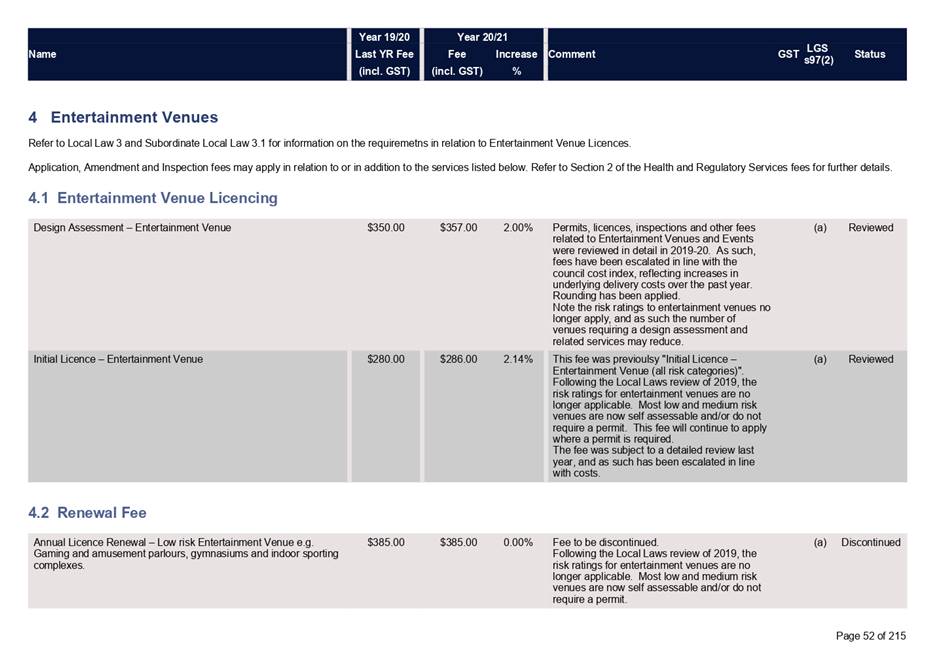

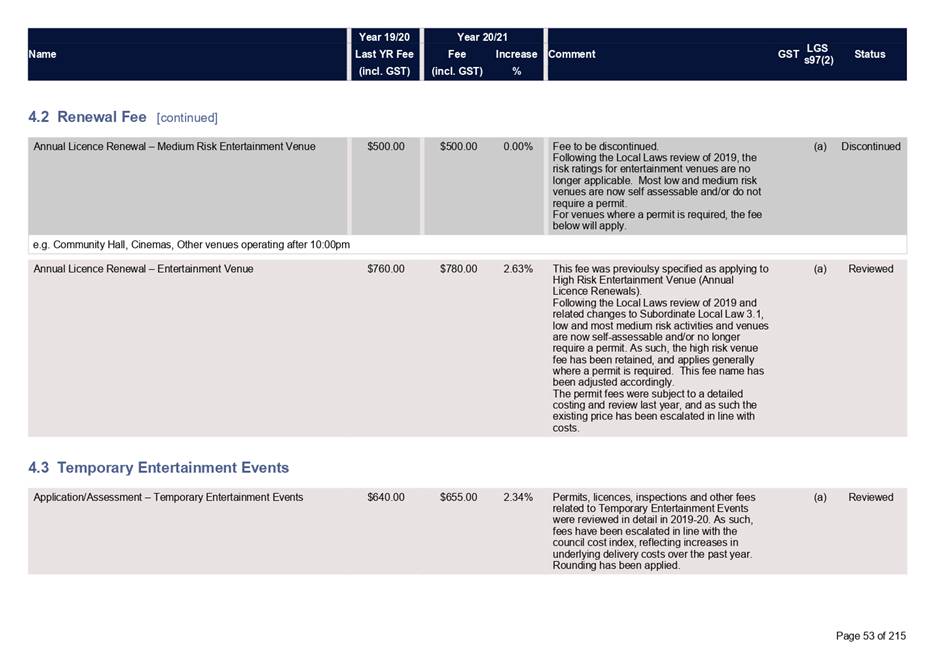

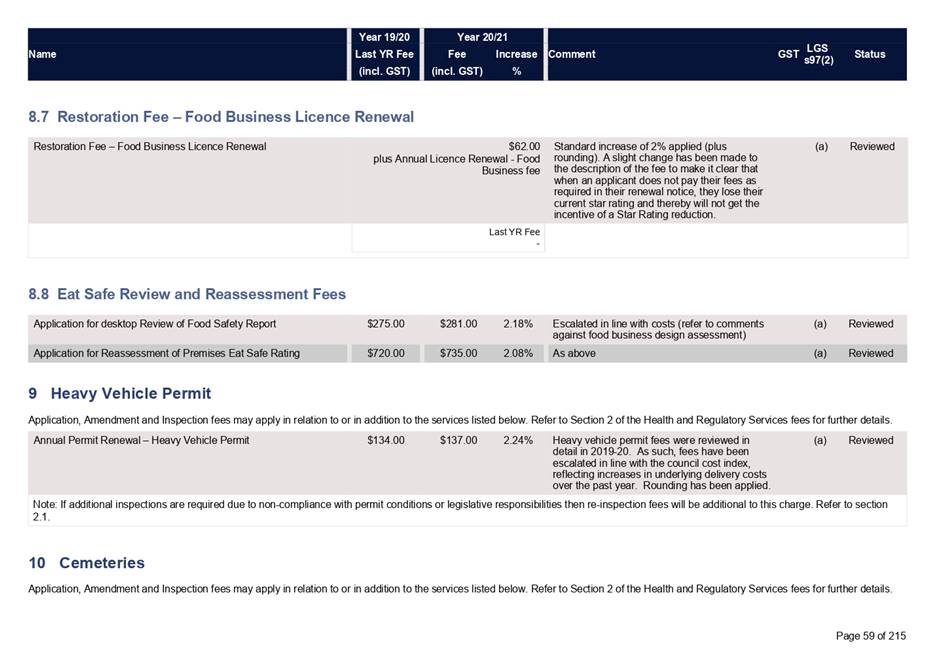

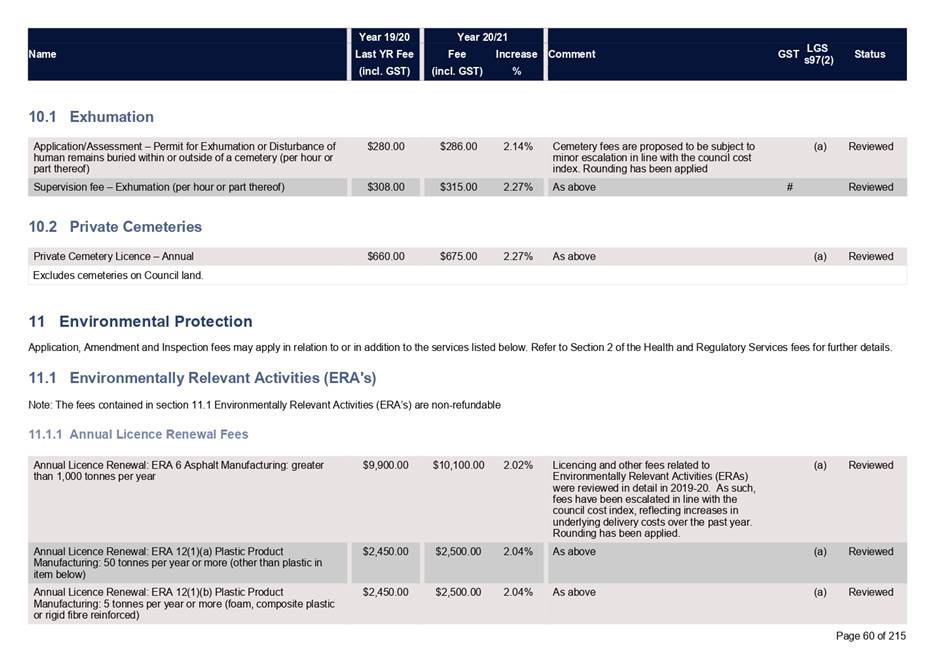

Additional

changes have been proposed with respect to entertainment venue licences and

Environmentally Relevant Activities (ERAs).

Annual

licence renewals for low and medium risk entertainment venue licences are to be

discontinued following the Local Law review of 2019 (Attachment 2, pages

52-53). Most low and medium risk venues are now self-assessable, and may

not require a permit. Where a permit is required, the fee (equivalent to

a high risk venue licence) is applicable.

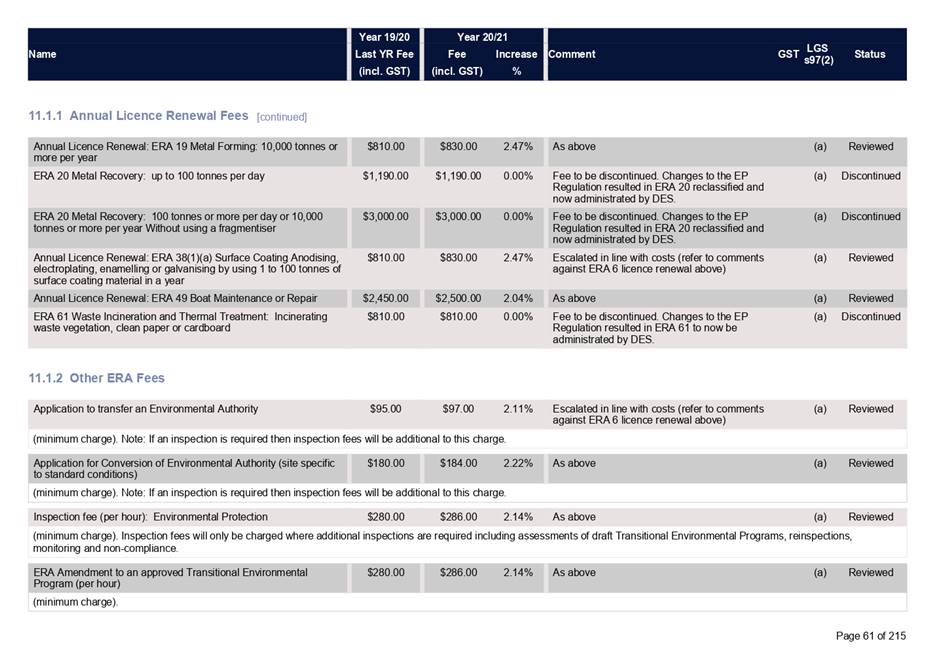

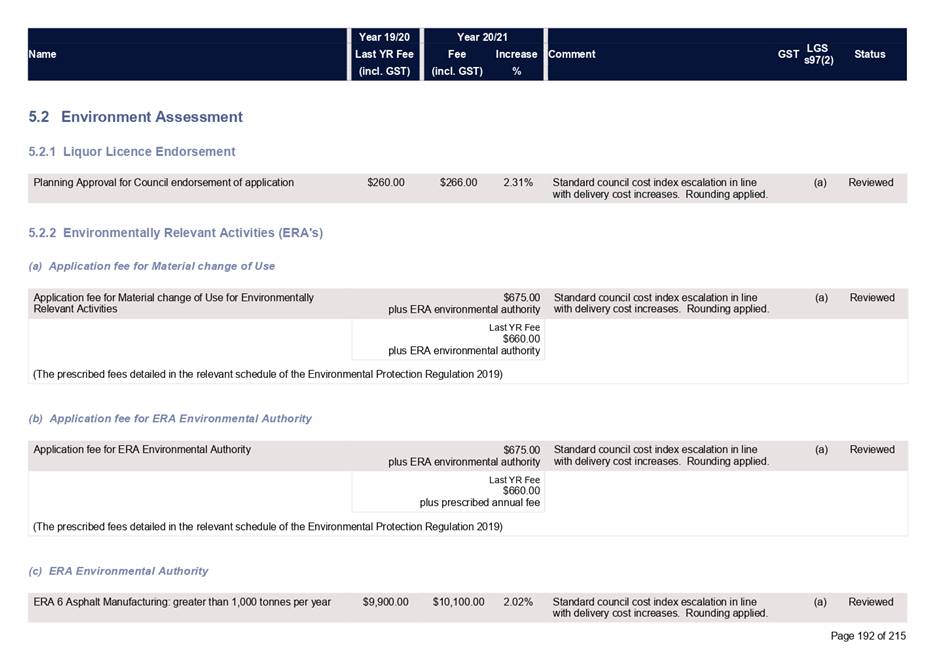

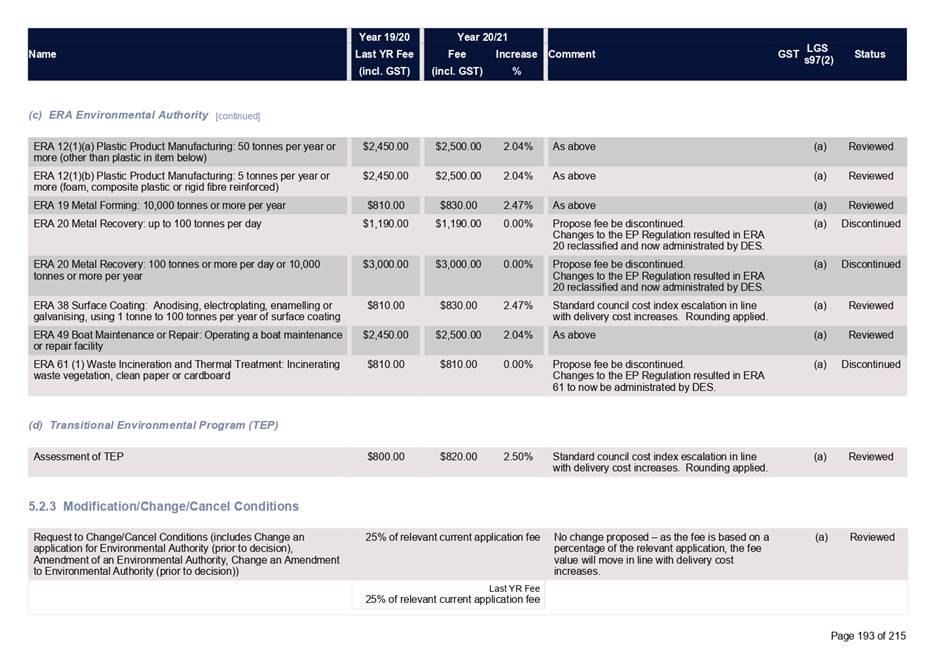

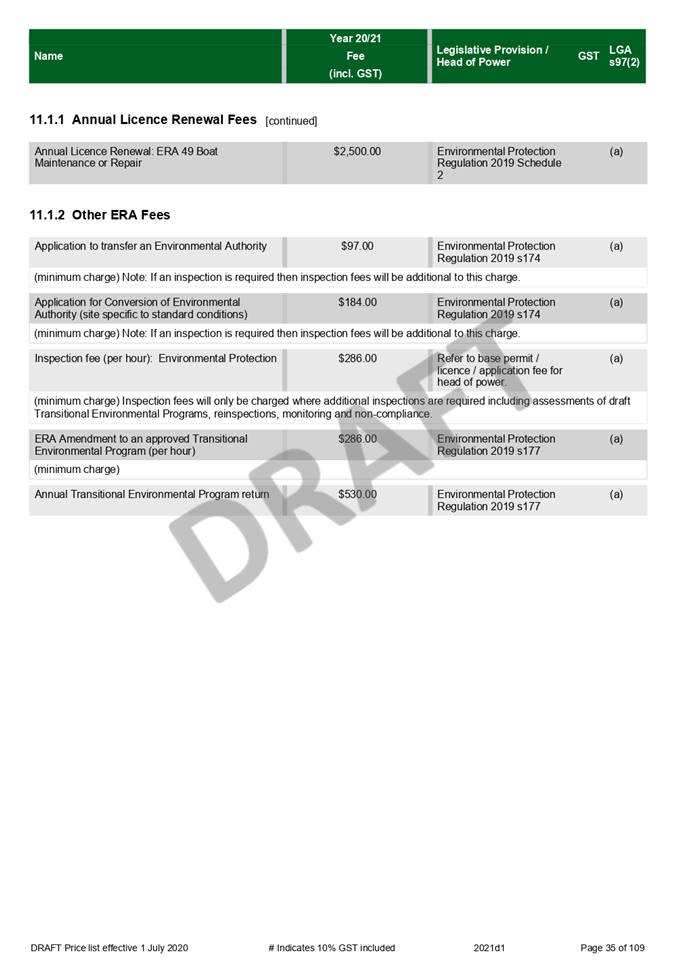

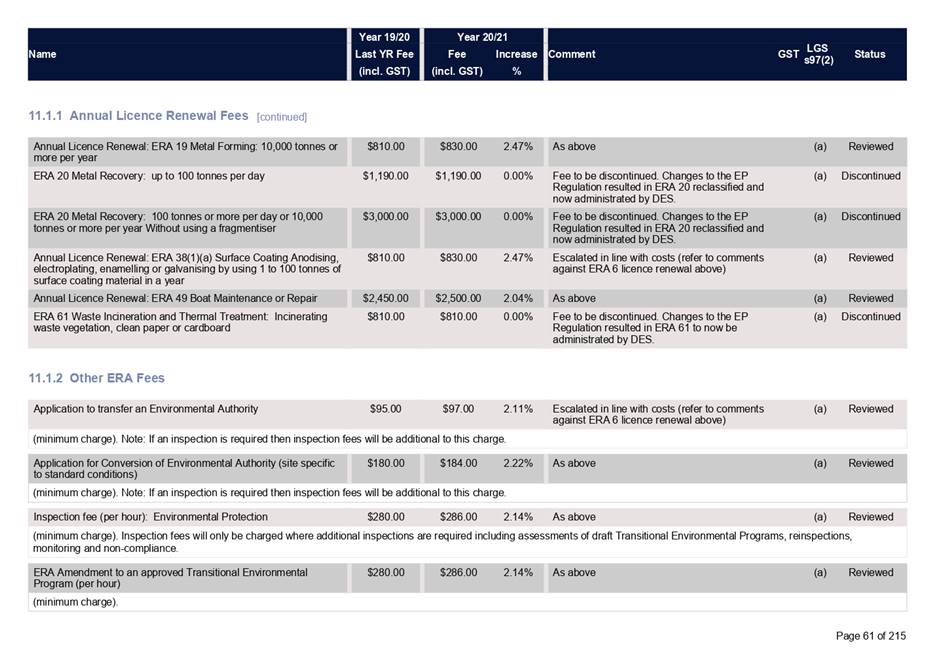

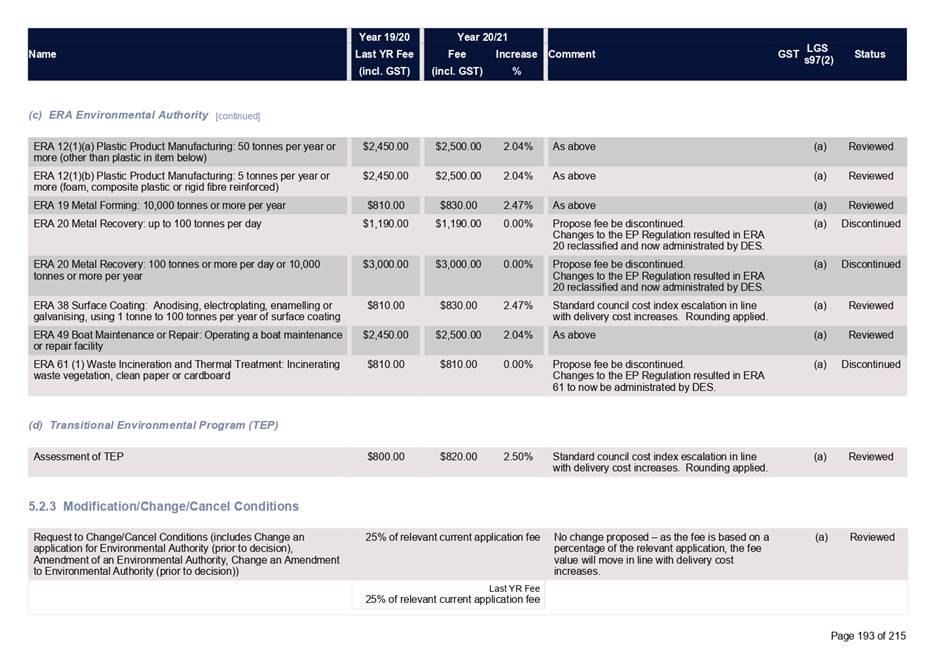

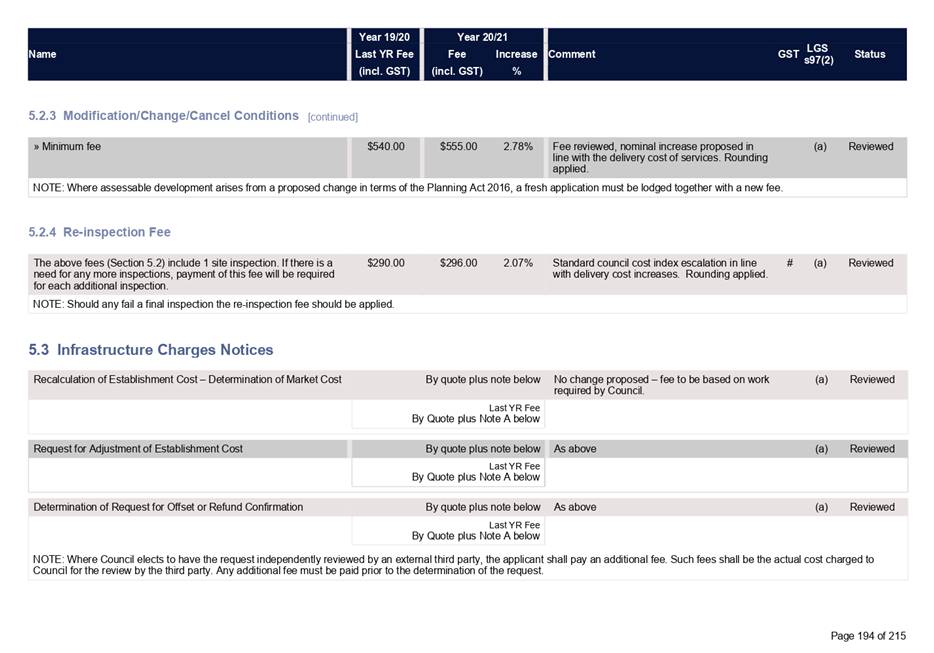

Several

permits for ERAs are to be discontinued, where recent changes to environmental

protection regulations have resulted in reclassification of the activity and

these now being administered by the State Government (Attachment 2, page 61)

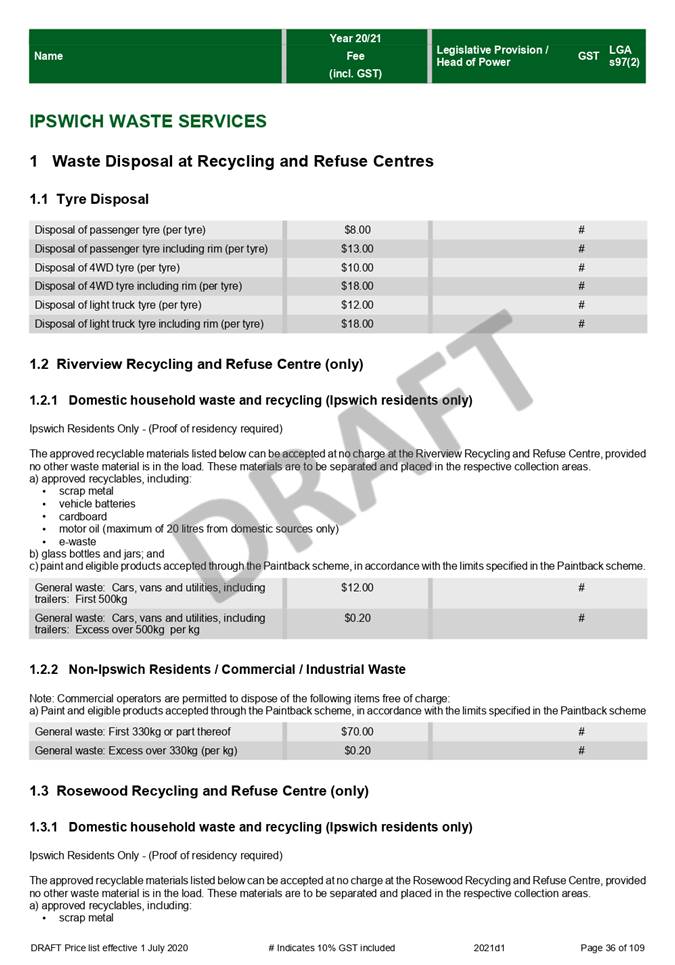

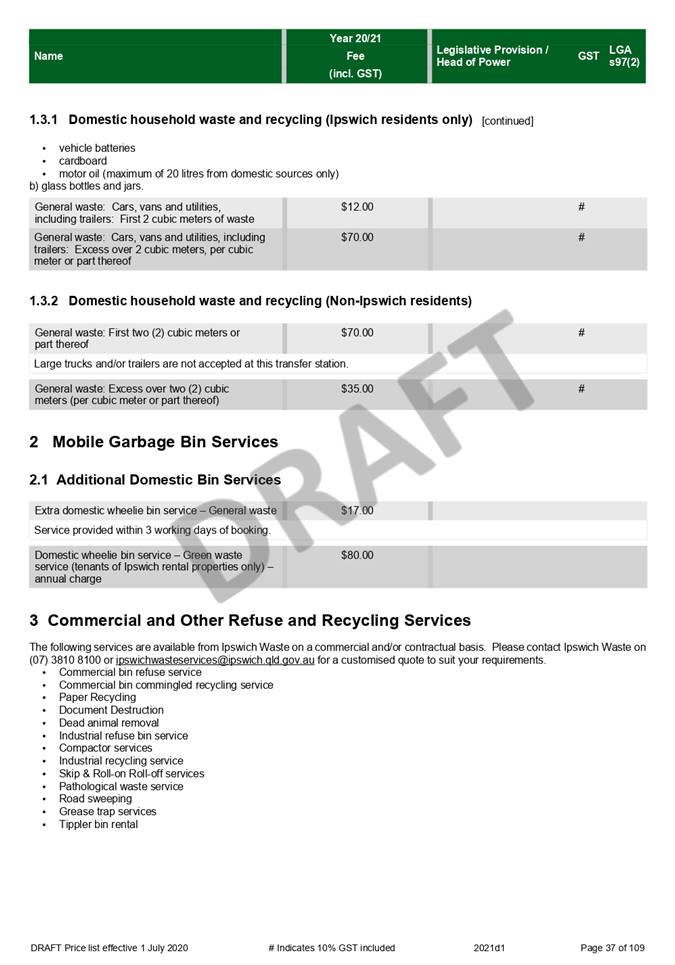

Ipswich

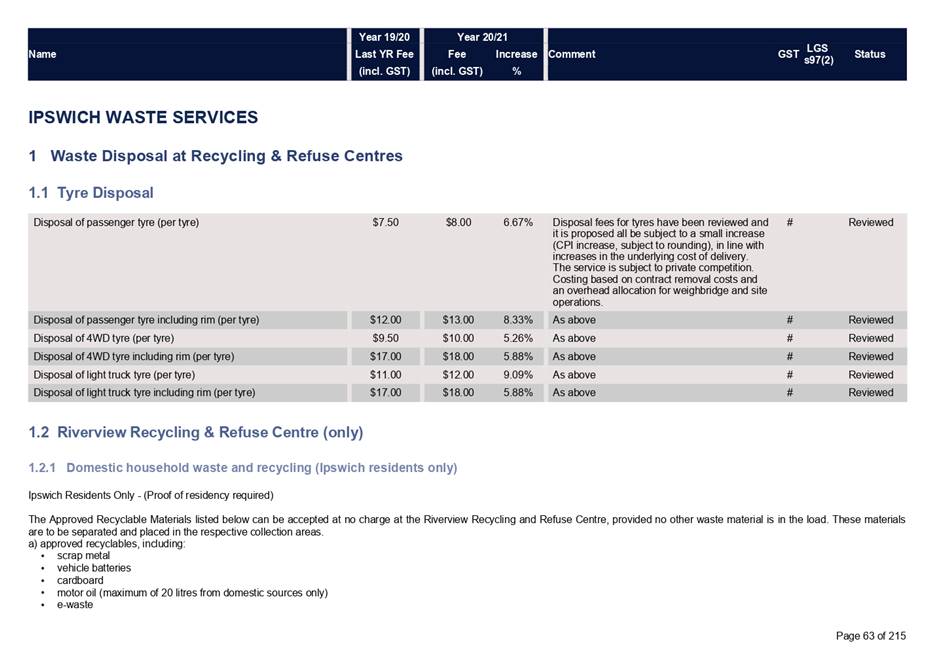

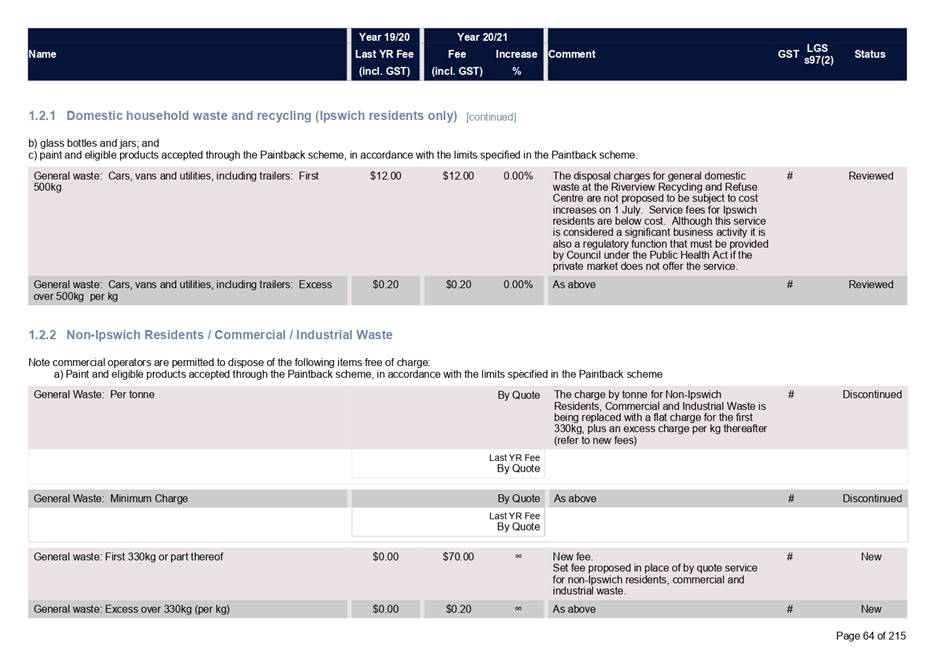

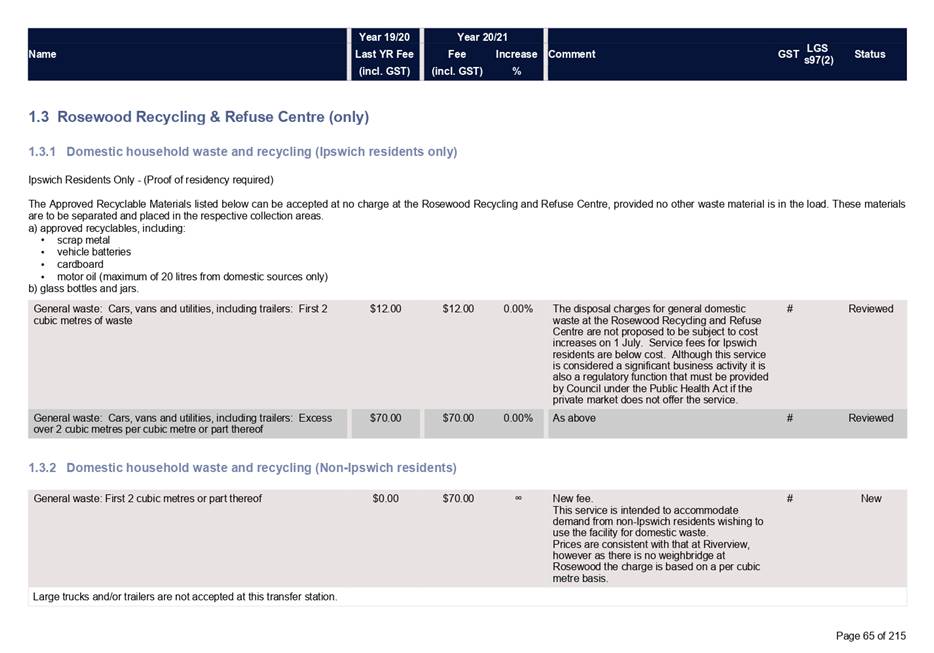

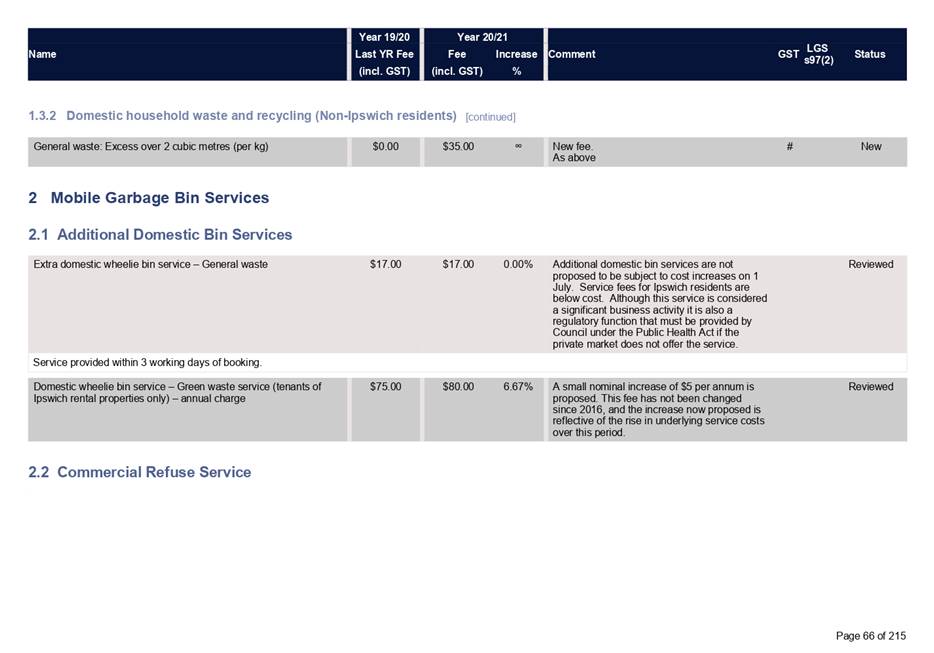

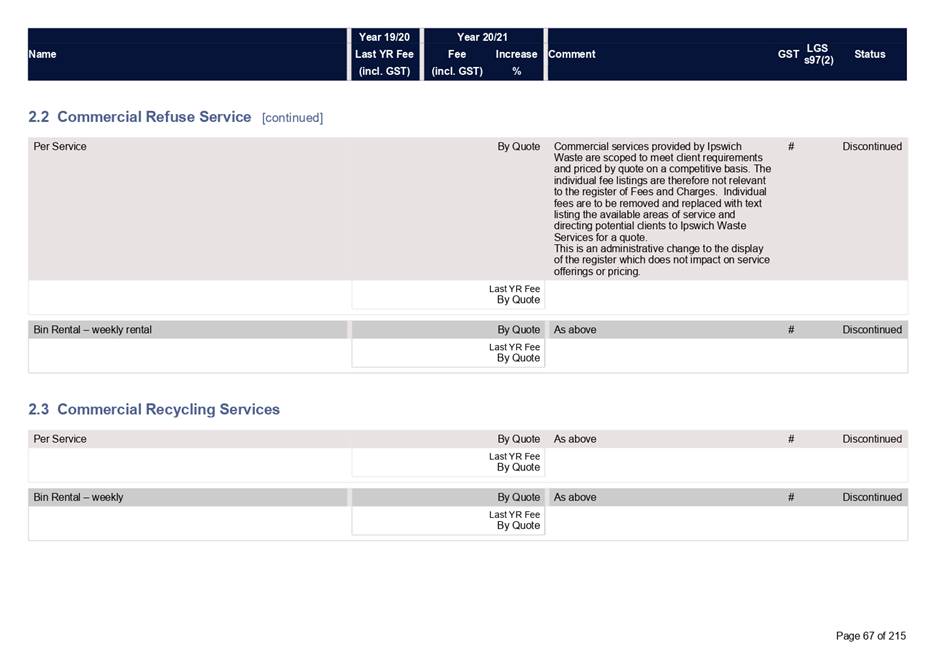

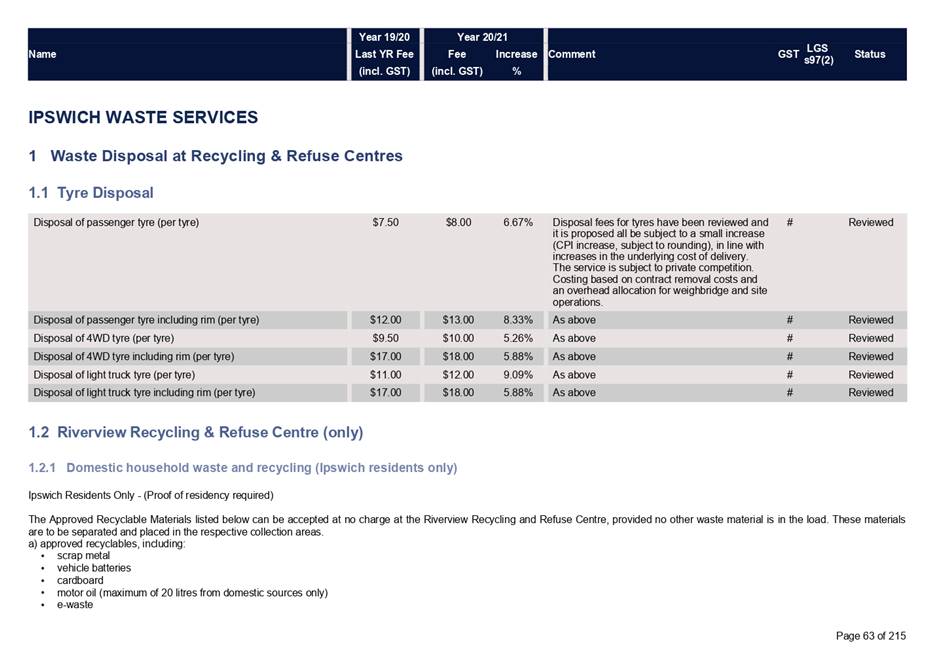

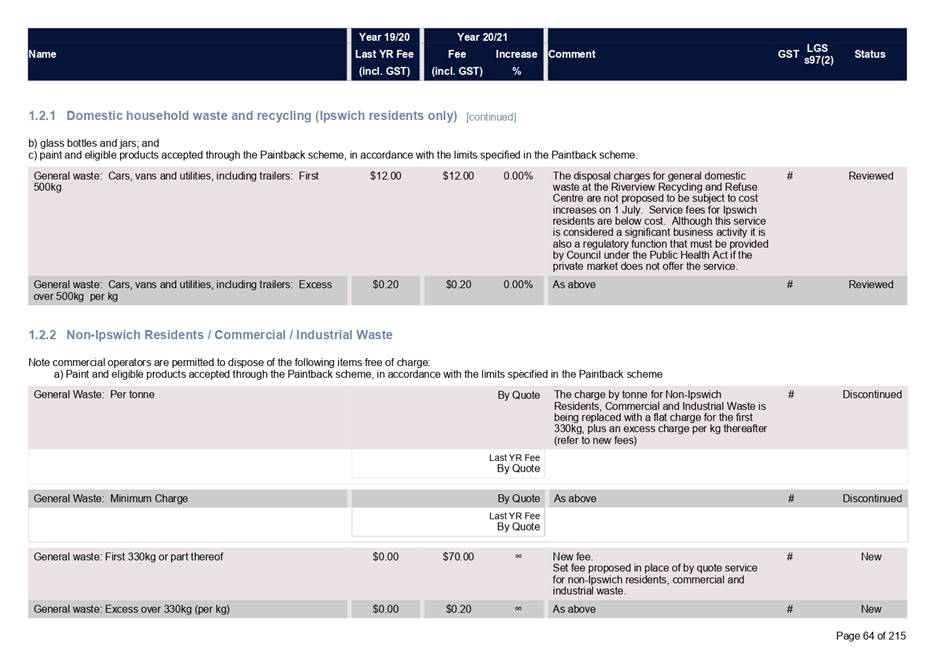

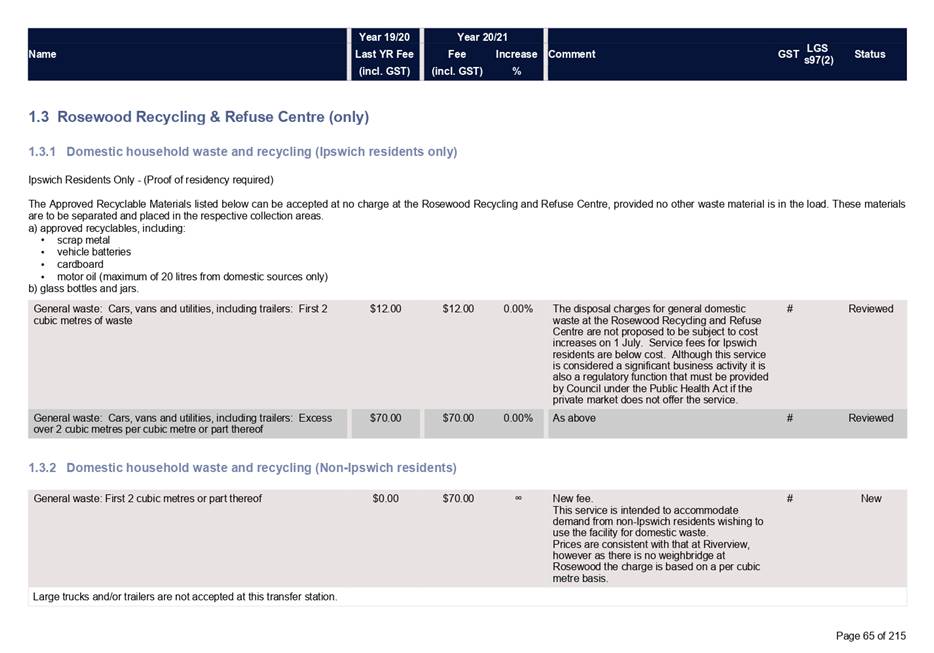

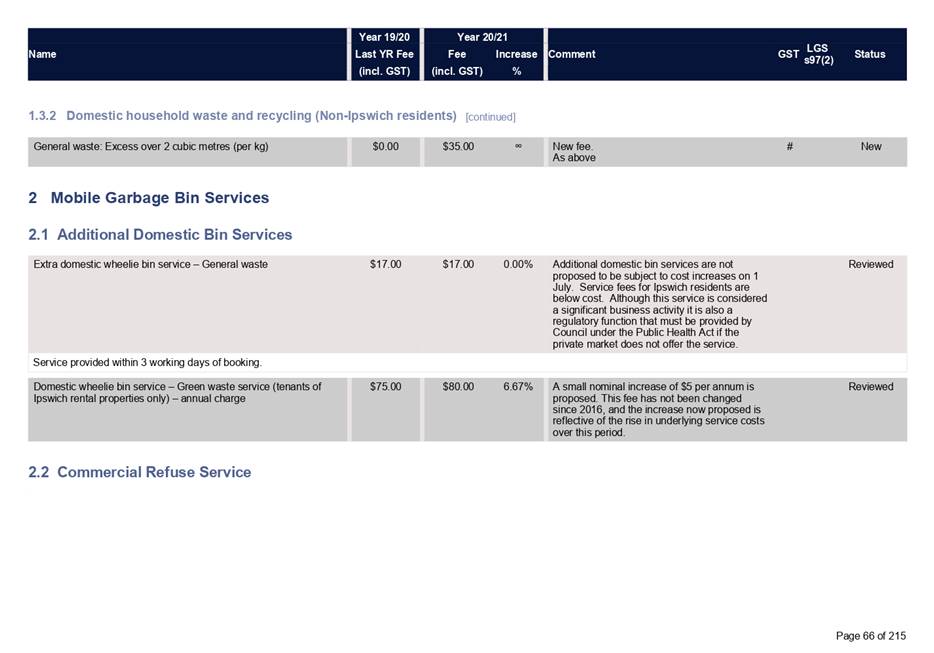

Waste

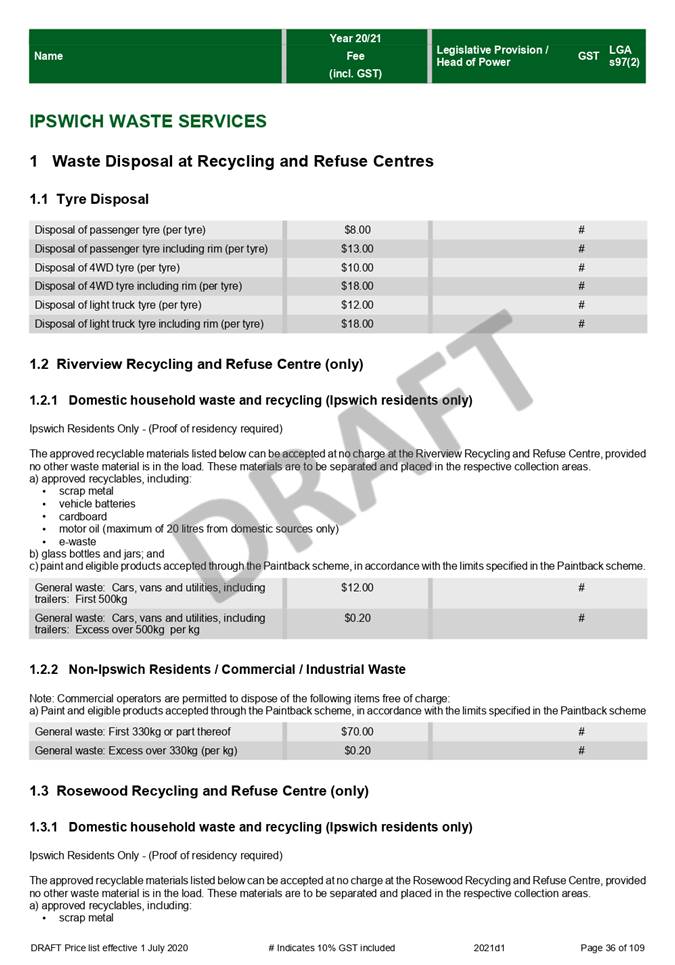

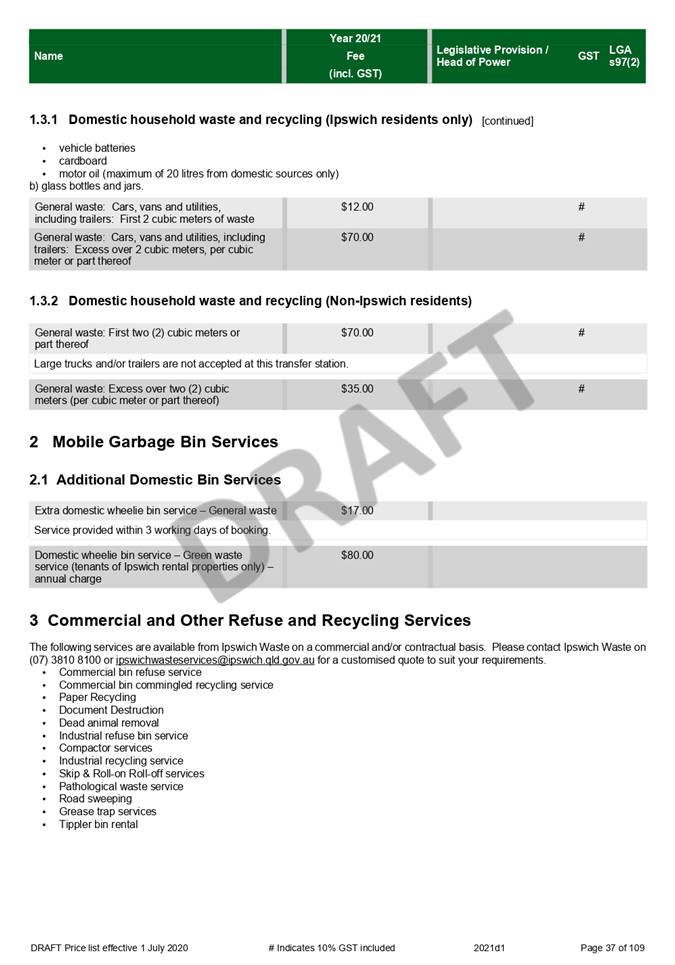

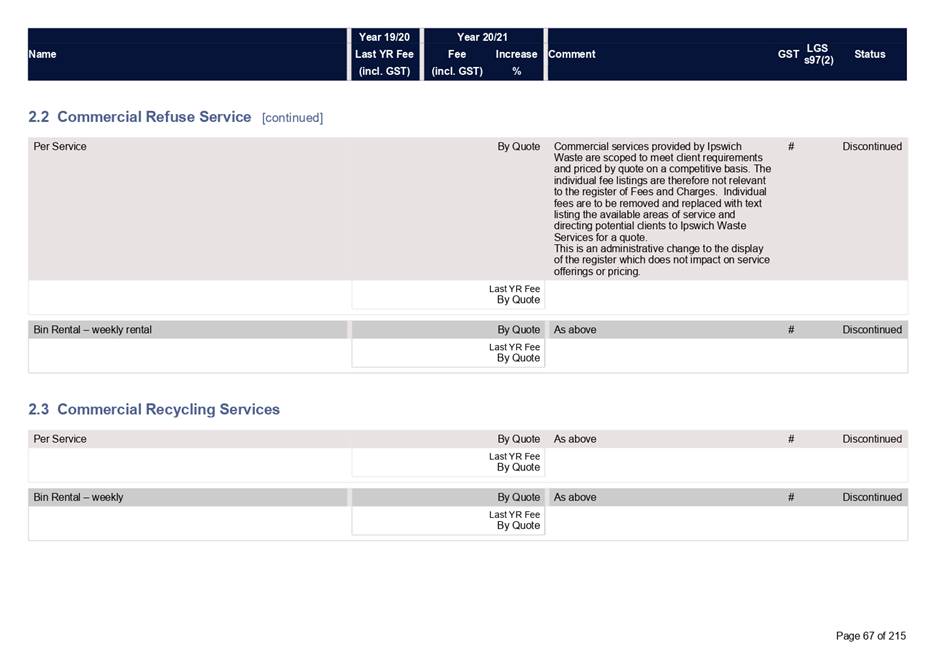

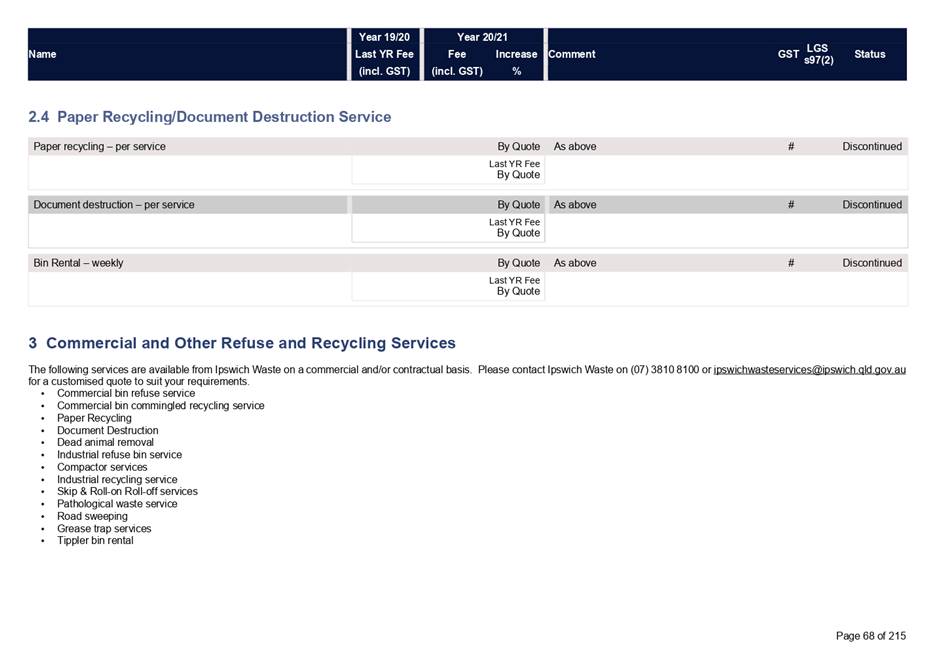

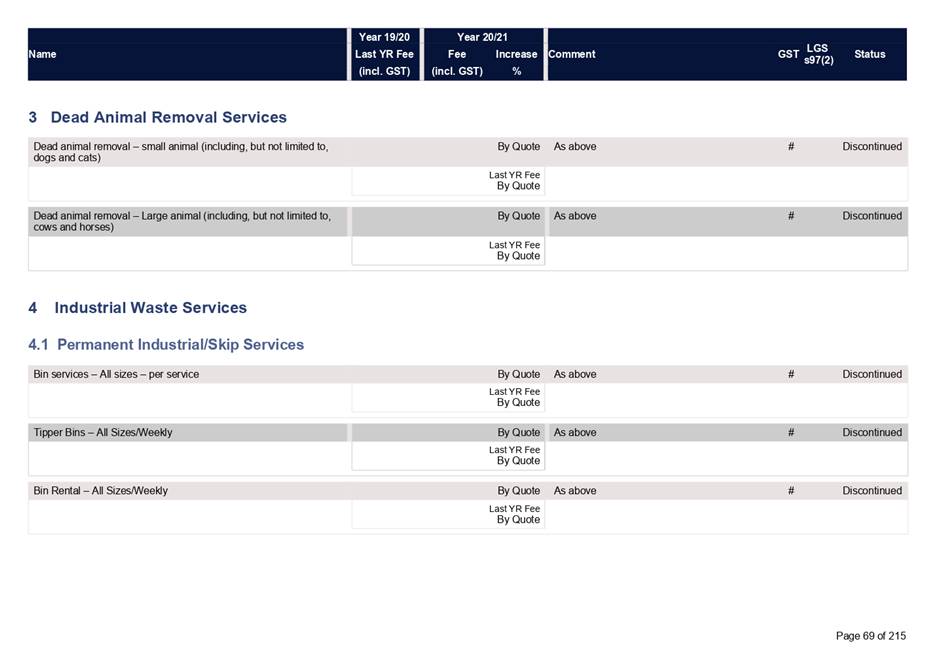

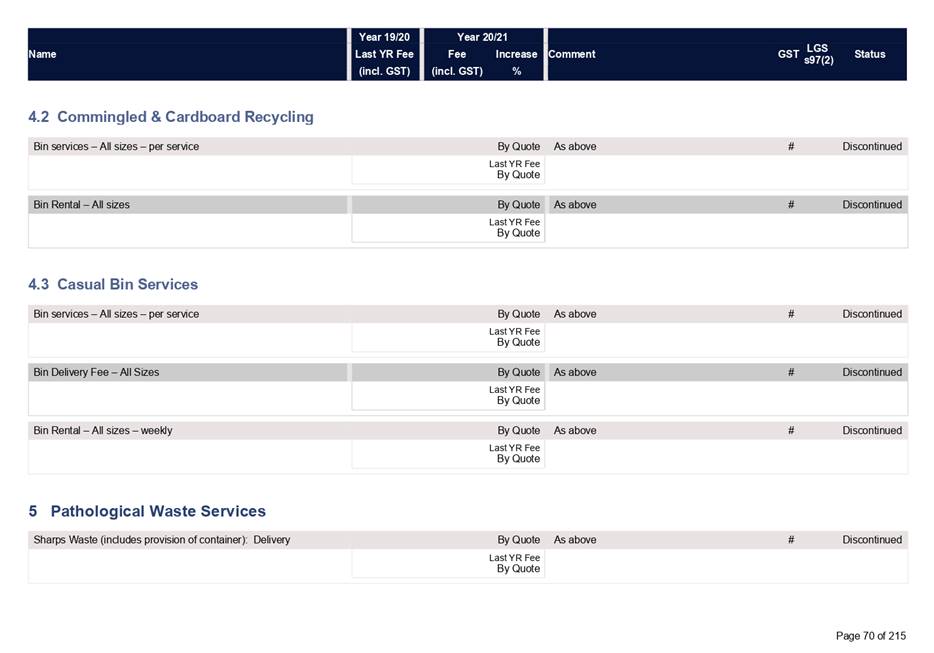

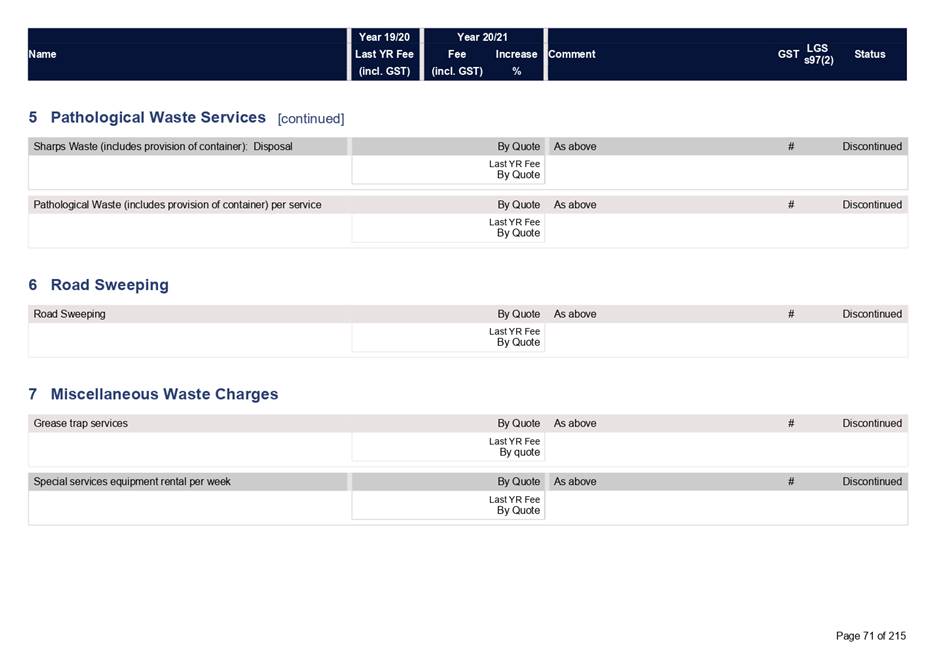

• Recycling

and Refuse Centres

Waste

disposal fees for Ipswich Residents at both the Riverview and Rosewood Refuse

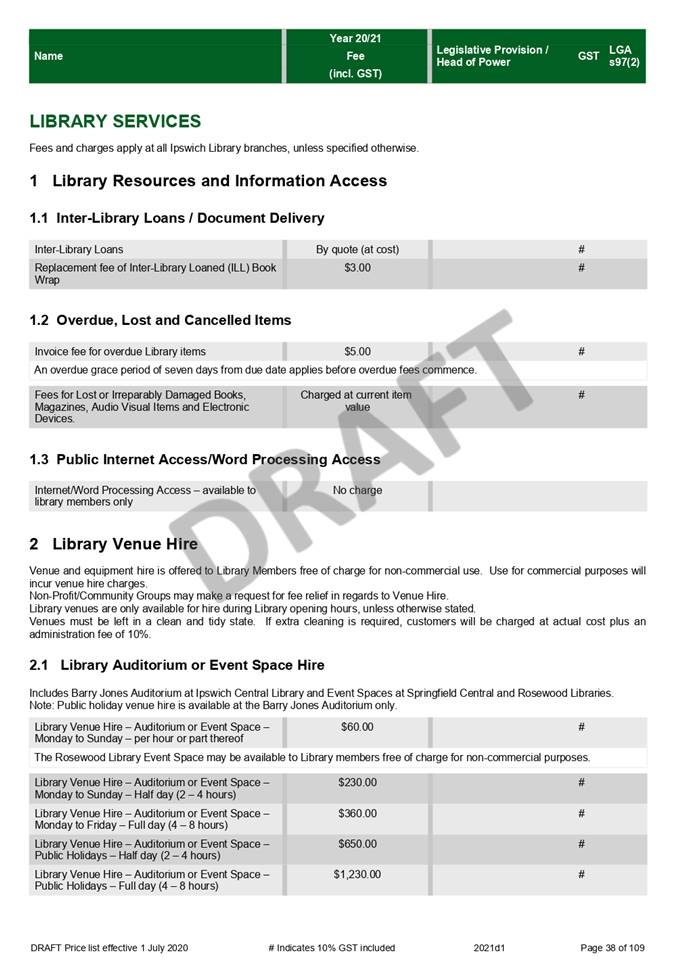

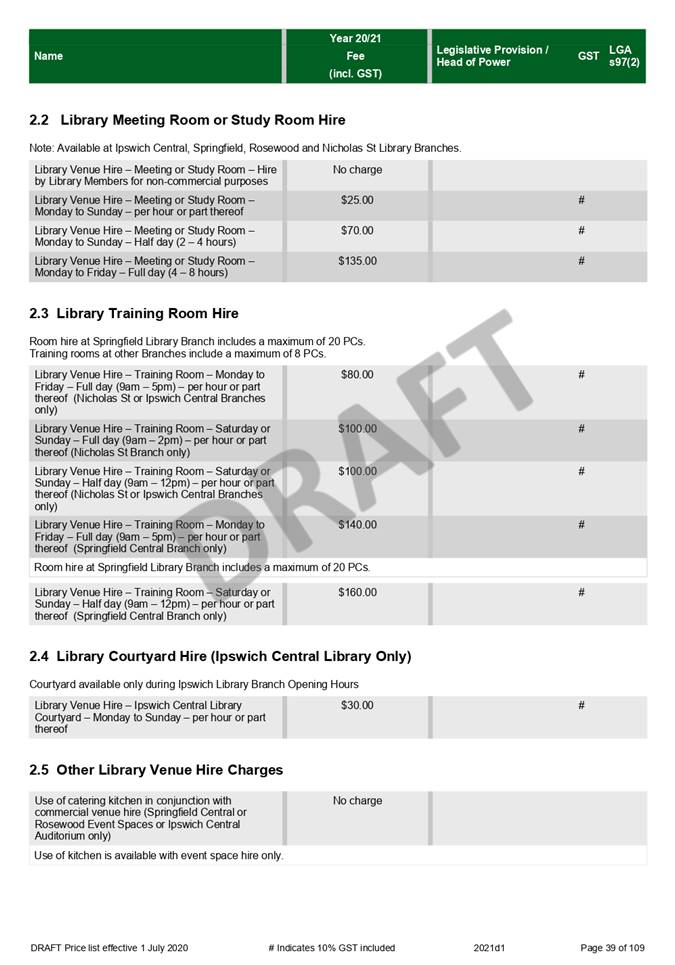

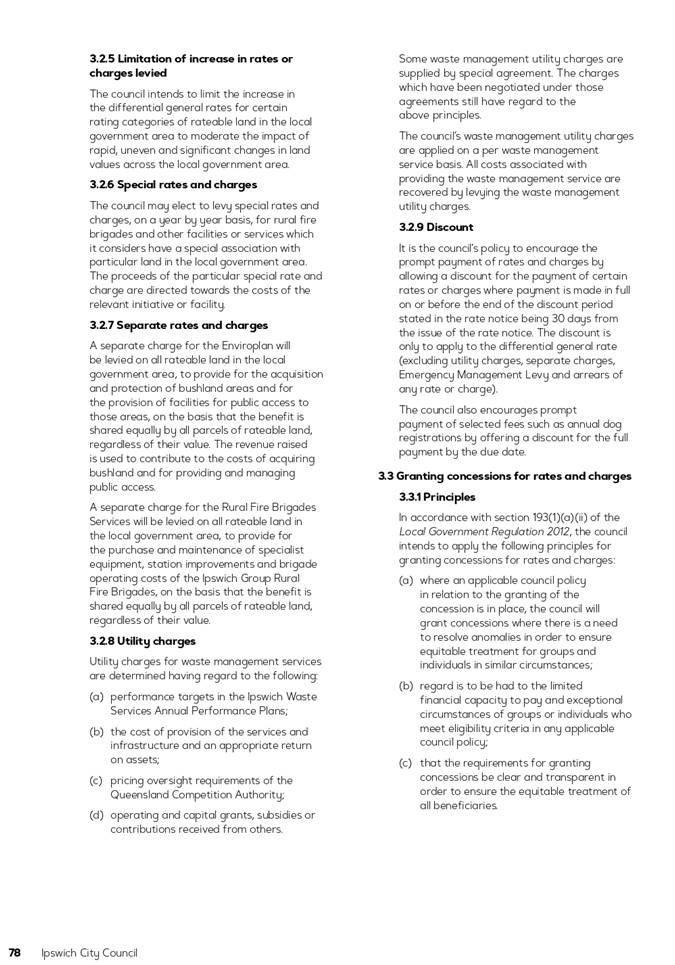

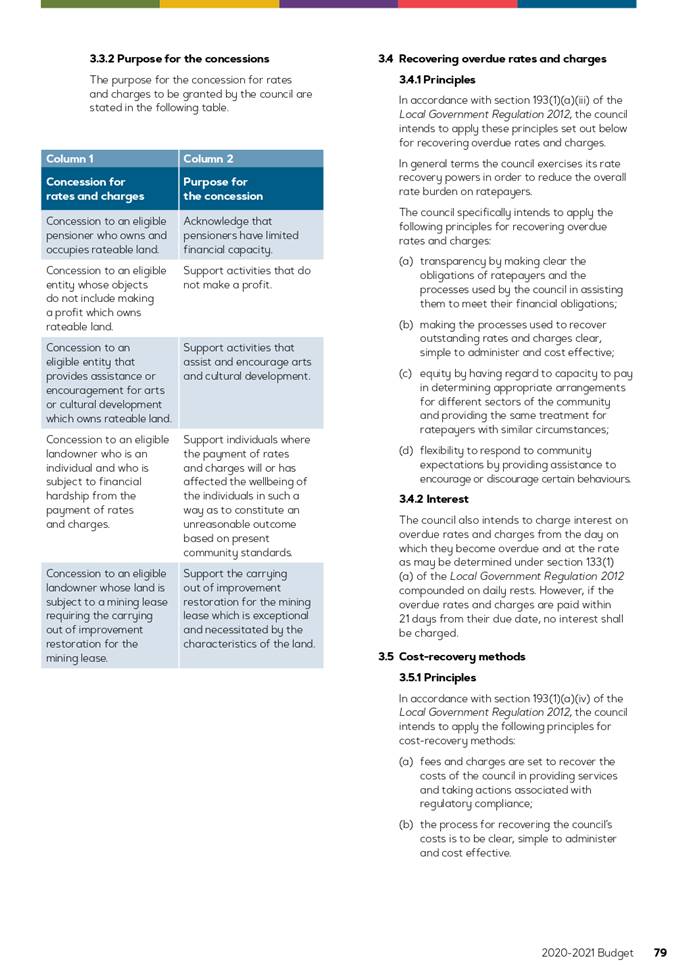

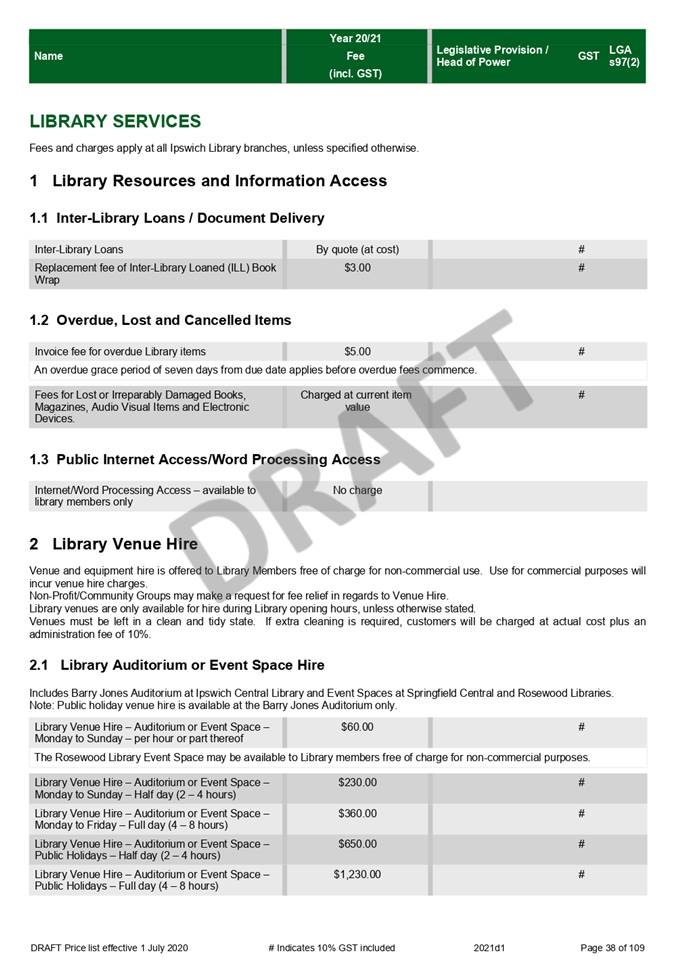

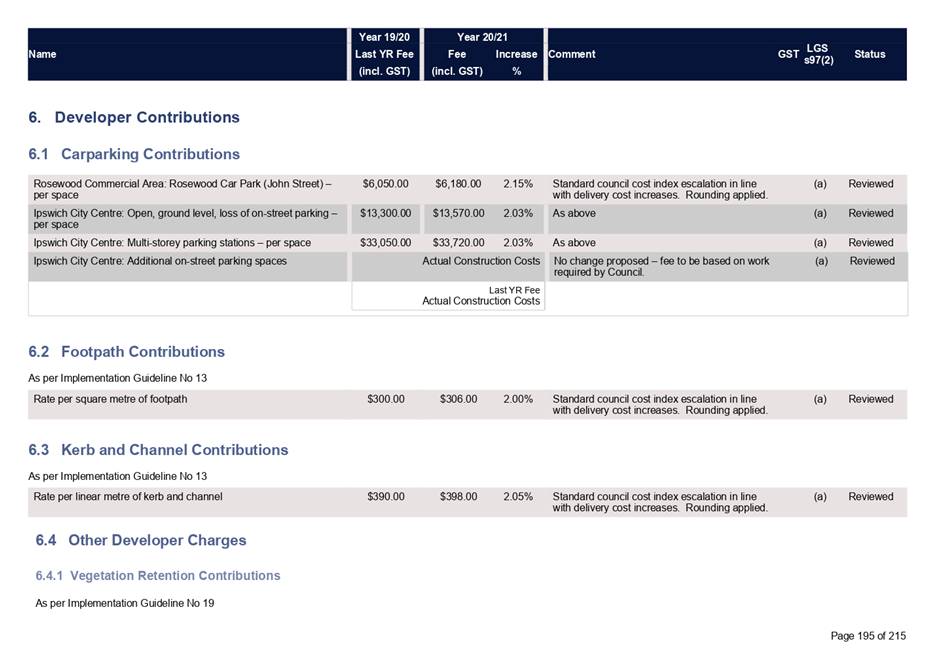

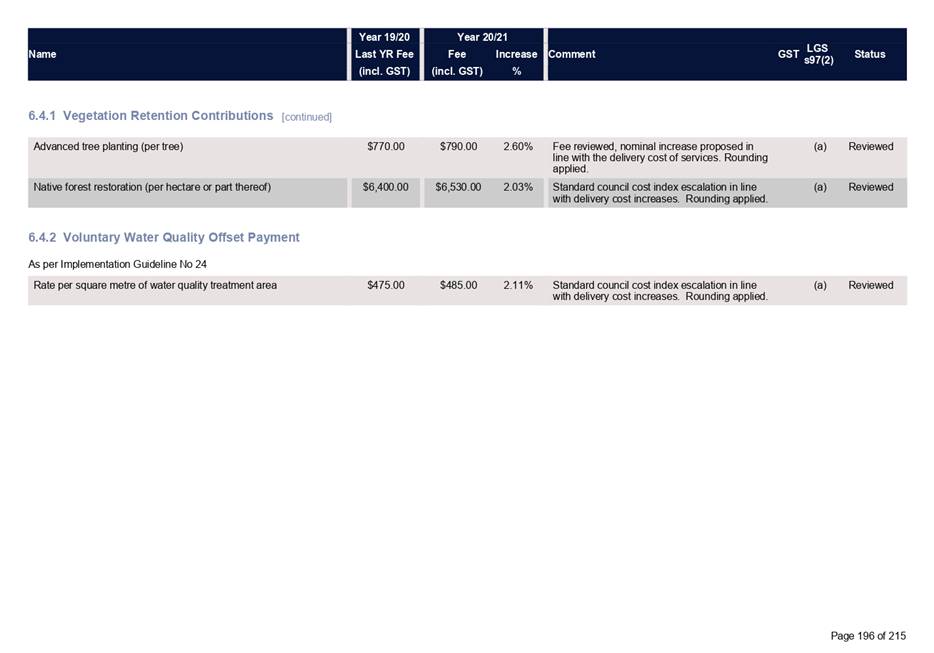

and Recycling Centres are to remain unchanged, with a minimum $12.00 fee for