IPSWICH

CITY

COUNCIL

AGENDA

of the

Audit and Risk Management Committee

Held in the Cunningham Room, Ipswich Civic Centre

Corner Nicholas and Limestone Street

IPSWICH QLD 4305

On Wednesday, 20 May 2020

At 1.00 pm to 3.30 pm

IPSWICH

CITY

COUNCIL

AGENDA

of the

Audit and Risk Management Committee

Held in the Cunningham Room, Ipswich Civic Centre

Corner Nicholas and Limestone Street

IPSWICH QLD 4305

On Wednesday, 20 May 2020

At 1.00 pm to 3.30 pm

|

MEMBERS OF THE Audit and Risk Management Committee |

|

|

External Member - Rob Jones (Chairperson) |

External Member - Martin Power External Member – Annette Quale Deputy Mayor Councillor Marnie Doyle Councillor Nicole Jonic

|

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

Audit and Risk Management Committee AGENDA

1.00 pm to 3.30 pm on Wednesday, 20 May 2020

Cunningham Room, Ipswich Civic Centre

|

Item No. |

Item Title |

Page No. |

|

1 |

Report - Audit and Risk Management Committee No. 2020(01) of 12 February 2020 |

10 |

|

2 |

Report - Risk ELT Meeting No. 2020(01) of 10 February 2020 |

19 |

|

3 |

Report - Risk ELT Meeting No. 2020(02) of 3 April 2020 |

27 |

|

4 |

**Outstanding actions |

37 |

|

5 |

**Queensland Audit Office Briefing Paper and 2020 Interim Report |

39 |

|

6 |

**Summary of Recent Internal Audit Reports Issued |

41 |

|

7 |

**Internal Audit Branch Activities Report for the period 4 February 2020 to 11 May 2020 |

44 |

|

8 |

**Progress of the 2019-2020 Annual Internal Audit Plan |

51 |

|

9 |

**Annual Internal Audit Plan for 2020-2021 including the Strategic Three Year Plan for 2020-2023 |

54 |

|

10 |

**Overdue Recommendations as at 11 May 2020 |

59 |

|

11 |

**Insurance and Risk Update |

63 |

|

12 |

Governance and Compliance Report |

79 |

|

13 |

ICT Strategy Update Report |

90 |

|

14 |

**Nicholas Street/CBD Redevelopment Update |

94 |

|

15 |

**ICT Platform Project - Update |

98 |

|

16 |

Corporate Program Management Office |

102 |

|

17 |

People & Culture Update |

124 |

|

18 |

Impact of New Accounting Standards - FY 2020 |

140 |

|

19 |

2019-2020 Asset Valuation - Update |

154 |

|

20 |

Next Meeting |

- |

|

21 |

General Business |

- |

|

22 |

Private Session of Member (if required) |

- |

** Item includes confidential papers

Audit and Risk Management Committee NO. 2

20 May 2020

AGENDA

1. Report - Audit and Risk Management Committee No. 2020(01) of 12 February 2020

This is the report of the Audit and Risk Management Committee No. 2020(01) of 12 February 2020.

Recommendation

That the report be received and the contents noted.

2. Report - Risk ELT Meeting No. 2020(01) of 10 February 2020

This is the report of the Risk ELT Meeting No. 2020(01) of 10 February 2020.

Recommendation

That the report be received and the contents noted.

3. Report - Risk ELT Meeting No. 2020(02) of 3 April 2020

This is the report of the Risk ELT Meeting No. 2020(02) of 3 April 2020.

Recommendation

That the report be received and the contents noted.

4. **Outstanding actions

This is a report concerning the

outstanding actions associated with the following committees:

Audit and Risk Management Committee

Risk ELT Committee

Risk – Infrastructure and Environment Committee

Risk – Corporate Services Committee

Risk – Co-ordination and Performance Committee

Risk – Planning and Regulatory Services Committee

Risk – Community, Cultural and Economic Development Committee

Recommendation

That the report be received and the contents noted.

5. **Queensland Audit Office Briefing Paper and 2020 Interim Report

This is a report concerning a briefing paper presented by the Queensland Audit Office together with the 2020 Draft Interim Report for Ipswich City Council.

Recommendation

That the report be received and the contents noted.

6. **Summary of Recent Internal Audit Reports Issued

This is a report concerning recently completed internal audits and the subsequent reports released since the previous report dated 4 February 2020.

Recommendation

That the report be received and the contents noted.

7. **Internal Audit Branch Activities Report for the period 4 February 2020 to 11 May 2020

This is a report concerning the activities of Internal Audit undertaken since 4 February 2020 and the current status of these activities.

Recommendation

That the report be received, the contents noted and the recommendations in Attachments 3, 4 and 5, be considered finalised and archived.

8. **Progress of the 2019-2020 Annual Internal Audit Plan

This is a report concerning the status of the 2019-2020 Annual Internal Audit Plan as presented in the attachment to this report.

Recommendation

That the report be received and the contents noted.

9. **Annual Internal Audit Plan for 2020-2021 including the Strategic Three Year Plan for 2020-2023

This is a report concerning the proposed Annual Audit Plan for 2020-2021 that includes the Strategic Three Year Internal Audit Plan for 2020-2023.

Recommendation

That the draft Internal Audit Annual Plan for 2020-2021 that includes the draft Strategic Three Year Internal Audit Plan for 2020-2023 (Attachment 2) as prepared by the Chief Audit Executive be considered and approved by the Audit and Risk Management Committee.

10. **Overdue Recommendations as at 11 May 2020

This is a report concerning the status of each Department's progress in actioning the internal and external audit recommendations due or overdue for implementation.

Recommendation

That the report be received and considered.

11. **Insurance and Risk Update

This is a report concerning Council’s Insurance Statistics for the period 1 January 2020 to 31 March 2020 and the implementation of Transformational Project Risk Management Framework (TP#7).

Recommendation

12. Governance and Compliance Report

This is a report concerning the performance of the Corporate Governance Section (the Section) in relation to Council’s legislative compliance in the management of Complaints, Right to Information and Information Privacy functions for the period 1 January 2020 to 31 March 2020 (the Quarter).

Recommendation

That the report be received and the contents noted.

13. ICT Strategy Update Report

This is a report concerning an update relating to the progress of implementation of the ICT Strategy 2019-2024. The strategy was published on 2 August 2019 and was developed in collaboration with a diverse range of internal stakeholders and includes stakeholder perspectives, key trends and influences, guiding principles and a strategy map.

Recommendation

That the report be received and the contents noted.

14. **Nicholas Street/CBD Redevelopment Update

This is a report concerning the progress of the Nicholas Street – Ipswich Central Project (the Project).

Recommendation

That the report be received and the contents noted.

15. **ICT Platform Project - Update

This is a report concerning the ICT Platform Project.

Recommendation

That the report be received and the contents noted.

16. Corporate Program Management Office

This is a report concerning the process, systems and controls currently in place to manage the delivery of the Business Transformation Program and other key strategic projects.

Recommendation

That the report be received and the contents noted.

17. People & Culture Update

This is a report to the Audit and Risk Management Committee on progress in the implementation of the People and Culture Strategic Plan 2019-2021.

Recommendation

That the progress in the implementation of the People and Culture Strategic Plan 2019-2021 be noted by the Audit and Risk Management Committee.

18. Impact of New Accounting Standards - FY 2020

This is a report concerning a request from the Queensland Audit Office (QAO) requiring Ipswich City Council (ICC) to provide a position paper regarding the impact of recently issued or amended accounting standards for Council and its controlled entities (Ipswich City Properties Pty Ltd (in Members Voluntary Liquidation), Ipswich City Enterprises Pty Ltd, Ipswich City Enterprises Investments Pty Ltd, Ipswich Arts Foundation, Ipswich Arts Foundation Trust and Cherish the Environment Foundation Ltd). In accordance with the key milestones agreed in the External Audit Plan, Council is required to provide the position paper to QAO by 31 May 2020.

Recommendation

That the report of the Principal Financial Accountant regarding the impact of the recently released or amended Accounting Standards for Ipswich City Council dated 27 April 2020 be received and the contents noted.

19. 2019-2020 Asset Valuation - Update

This is a report concerning the progress of the 2019-2020 asset valuation for land, buildings and infrastructure assets.

Recommendation

A. That the report of the Principal Financial Accountant regarding the progress of the 2019-2020 asset valuation for land, buildings and infrastructure assets be received and the contents noted.

B. That through the Audit and Risk Management Committee Chair, the final valuation report for 2019-2020 (to be finalised by mid-June 2020) be circulated to Committee Members for discussion and endorsement and if required a special Audit and Risk Management Committee meeting be convened to approve and endorse the report prior to 30 June 2020.

20. NEXT MEETING

The next meeting is scheduled for Wednesday, 19 August 2020.

21. GENERAL BUSINESS

22. PRIVATE SESSION OF MEMBER (IF REQUIRED)

** Item includes confidential papers

and any other items as considered necessary.

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

ITEM: 1

SUBJECT: Report - Audit and Risk Management Committee No. 2020(01) of 12 February 2020

AUTHOR: Committee Manager

DATE: 7 May 2020

This is the report of the Audit and Risk Management Committee No. 2020(01) of 12 February 2020.

That the report be received and the contents noted.

|

1. |

Audit and Risk Management Committee Report No. 2020(01) of

12 February 2020 ⇩ |

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

ITEM: 2

SUBJECT: Report - Risk ELT Meeting No. 2020(01) of 10 February 2020

AUTHOR: Committee Manager

DATE: 11 May 2020

This is the report of the Risk ELT Meeting No. 2020(01) of 10 February 2020.

That the report be received and the contents noted.

|

1. |

Report of Risk ELT Meeting of 10 February 2020 ⇩ |

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

ITEM: 3

SUBJECT: Report - Risk ELT Meeting No. 2020(02) of 3 April 2020

AUTHOR: Committee Manager

DATE: 7 May 2020

This is the report of the Risk ELT Meeting No. 2020(02) of 3 April 2020.

That the report be received and the contents noted.

|

1. |

Risk ELT Meeting Report No. 2020(02) of 3 April 2020 ⇩ |

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

ITEM: 4

SUBJECT: Outstanding actions

AUTHOR: Committee Manager

DATE: 12 May 2020

This is a report concerning the

outstanding actions associated with the following committees:

Audit and Risk Management Committee

Risk ELT Committee

Risk – Infrastructure and Environment Committee

Risk – Corporate Services Committee

Risk – Co-ordination and Performance Committee

Risk – Planning and Regulatory Services Committee

Risk – Community, Cultural and Economic Development Committee

That the report be received and the contents noted.

Not applicable

Listening, leading and financial management

This report provides an update as to current outstanding actions associated with the various risk committees operating within council.

This report and its recommendations are consistent with the following legislative provisions:

Not Applicable

Actions exist so that there is a record of matters that council has resolved. The actions exist as a way to ensure these tasks are undertaken.

Not applicable.

Not applicable.

The outstanding actions listing has been compiled as a record of actions still outstanding.

|

|

CONFIDENTIAL |

|

1. |

Vicki Lukritz

Committee Manager

I concur with the recommendations contained in this report.

Sonia Cooper

General Manager Corporate Services

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

ITEM: 5

SUBJECT: Queensland Audit Office Briefing Paper and 2020 Interim Report

AUTHOR: Committee Manager

DATE: 11 May 2020

This is a report concerning a briefing paper presented by the Queensland Audit Office together with the 2020 Draft Interim Report for Ipswich City Council.

That the report be received and the contents noted.

Ipswich City Council

Queensland Audit Office

Listening, leading and financial management

The Queensland Audit Office have presented these two papers for the information of the Audit and Risk Management Committee.

This report and its recommendations are consistent with the following legislative provisions:

Not applicable

Not applicable

There are no financial or resource implications.

No consultation has been undertaken in relation to this report.

The Queensland Audit Office have presented a briefing paper and their 2020 draft Interim Report for the information of the Audit and Risk Management Committee.

|

|

CONFIDENTIAL |

|

1. |

|

|

2. |

Vicki Lukritz

Committee Manager

I concur with the recommendations contained in this report.

Sonia Cooper

General Manager Corporate Services

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

ITEM: 6

SUBJECT: Summary of Recent Internal Audit Reports Issued

AUTHOR: Chief Audit Executive

DATE: 11 May 2020

This is a report concerning recently completed internal audits and the subsequent reports released since the previous report dated 4 February 2020.

That the report be received and the contents noted.

Not applicable

The intention is for the Internal Audit activity to support all five themes:

Strengthening our local economy and building prosperity

Managing growth and delivering key infrastructure

Caring for the community

Caring for the environment

Listening, leading and financial management

Individual internal audits and corrupt conduct investigations will to a varying degree support these themes, but the main objective for Internal Audit is to support the organisation in achieving its objectives.

Since 11 May 2020, Internal Audit has issued/finalised 6 Internal Audit reports/Consulting Tasks and the extracts of the reports containing the audit recommendations, management response and agreed action by date, are attached to enable any further discussion that may be required by the Audit and Risk Management Committee.

|

Control Environment Opinion Summary over Areas in Scope of Audits |

5 |

4 |

3 |

2 |

1 |

|

Arrangements/Agreements/Leases (I&E non-construction) (A1920-01) |

|

ü |

|

|

|

|

Grants, Sponsorships and Donations Program (A1920-08) |

|

|

ü |

|

|

|

IMC Information Transfer (A1920-09) |

|

|

|

|

ü |

|

Payroll Transactions (A1920-13) |

|

|

ü |

|

|

|

Receipting, Cash Handling and Floats (A1920-16) |

|

ü |

|

|

|

|

Workplace Safety and Wellbeing (A1920-23) |

|

|

|

ü |

|

|

Rating Definitions |

|

|

5 |

Indicates unacceptable control environment or critical operating or control problems or extreme exposure. |

|

4 |

Indicates unsatisfactory control environment or significant operational, procedural or control deficiencies or high exposure. |

|

3 |

Indicates limited control environment or some operational, procedural or control deficiencies, issues or moderate exposure |

|

2 |

Indicates acceptable control environment or minor operational, procedural or control deficiencies, issues or exposure. |

|

1 |

Indicates well controlled environment or no or limited unfavourable audit findings, observations or exposure. |

Resources are provided to internal audit through the annual audit plan and budgeting processes. No additional resources were required because of this report.

Each of the individual reports provides for a control environment opinion as well as individual risk ratings per individual findings and recommendations. The importance is for management to implement the individual recommendations well to either address or diminish the exposure for Council, or explain why it is acceptable to not implement the suggested improvements. As per the corrupt conduct investigation, the findings and risks vary in each situation and are discussed in the confidential reports. Having said that the key risks are still a reality if the information is not well presented, well understood or does not generate an appropriate response.

This report and its recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

Internal Audit mostly consults internally to the organisation and its management in conducting the internal audits and finalising the reports.

Over this period it was still difficult to conduct audits and finalise reports mainly due to other priorities receiving preference. Having said that, through management and auditor cooperation things had improved.

|

|

CONFIDENTIAL |

|

1. |

|

|

2. |

|

|

3. |

|

|

4. |

|

|

5. |

|

|

6. |

|

|

7. |

Freddy Beck

Chief Audit Executive

I concur with the recommendations contained in this report.

Freddy Beck

Chief Audit Executive

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

ITEM: 7

SUBJECT: Internal Audit Branch Activities Report for the period 4 February 2020 to 11 May 2020

AUTHOR: Chief Audit Executive

DATE: 11 May 2020

This is a report concerning the activities of Internal Audit undertaken since 4 February 2020 and the current status of these activities.

That the report be received, the contents noted and the recommendations in Attachments 3, 4 and 5, be considered finalised and archived.

Not applicable

The intention is for the Internal Audit activity to support all five themes:

Strengthening our local economy and building prosperity

Managing growth and delivering key infrastructure

Caring for the community

Caring for the environment

Listening, leading and financial management

Individual internal audits and corrupt conduct investigations will, to a varying degree, support these themes, but the main objective for Internal Audit is to support the organisation in achieving its objectives.

The purpose of this report is to keep the Audit and Risk Management Committee informed and to report on performance of the Internal Audit Branch:

• Report the status of the audits currently under way

• Summary of the activities of the Internal Audit Branch

• Annual Performance Report and Assertion on Internal Auditing Standards

• Report the status of the audit recommendations from completed audits

The supply of the information to the Mayor, the Chief Executive Officer and Audit and Risk Management Committee, is a requirement of the Internal Audit Charter.

Internal Audit Report Register (Attachment 1)

This is a historic register recording the reference number of formal reports produced, audits commenced, report status and date completed for the last number of years.

Audits, Reviews, Projects and Activities (Attachment 2)

This is a report on audits, reviews, projects and activities that were conducted during the period or in progress as at 11 May 2020.

Audit Recommendations (Attachments 3, 4 and 5)

Extracted from the Audit Recommendations System, these reports list all Internal and External Audit recommendations as well as de-identified Investigation/Ad-hoc reports (with management comments and responses) that managers advise have been implemented since the report made to the last Audit and Risk Management Committee meeting. These reports are presented to the Audit and Risk Management Committee prior to the recommendations being finalised and/or archived.

Resources are provided to internal audit through the annual audit plan and budgeting processes. No additional resources were required because of this report. However situations will dictate if internal audits and investigations have to be outsourced and also management will have to consider their implications to implement the recommendations as per the individual reports.

Each of the individual reports provides for a control environment opinion as well as individual risk ratings per individual findings and recommendations. The importance is for management to implement the individual recommendations well to either address or diminish the exposure for Council, or explain why it is acceptable to not implement the suggested improvements. As per the corrupt conduct investigation, the findings and risks vary in each situation and are discussed in the confidential reports. Having said that the key risks are still if the information is not well presented, well understood or does not generate an appropriate response.

This report and its recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

Crime and Corruption Act 2001

Internal Audit mostly consults internally to the organisation and its management in conducting the internal audits and finalising the reports. For investigations the appropriate consultations take place as the situation allows and requires.

During the period under review the Internal Audit Branch undertook a number of activities, including as listed in Attachment 2.

During the course of Internal Audit activities, contributions to the improvement of operational procedures, practices and the control environment have been achieved.

|

1. |

Internal Audit Register ⇩ |

|

|

|

|

|

CONFIDENTIAL |

|

2. |

|

|

3. |

|

|

4. |

|

|

5. |

Freddy Beck

Chief Audit Executive

I concur with the recommendations contained in this report.

Freddy Beck

Chief Audit Executive

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

ITEM: 8

SUBJECT: Progress of the 2019-2020 Annual Internal Audit Plan

AUTHOR: Chief Audit Executive

DATE: 11 May 2020

This is a report concerning the status of the 2019-2020 Annual Internal Audit Plan as presented in the attachment to this report.

That the report be received and the contents noted.

Not applicable.

The intention is for the Internal Audit activity to support all five themes:

Strengthening our local economy and building prosperity

Managing growth and delivering key infrastructure

Caring for the community

Caring for the environment

Listening, leading and financial management

Individual internal audits and corrupt conduct investigations will to a varying degree support these themes, but the main objective for Internal Audit is to support the organisation in achieving its objectives.

The attachment is an indication of the progress and indicating the number of actual audit days compared to the budgeted audit days in the approved audit plan, relative to various Internal Audit Branch activities undertaken during the year.

Resources are provided to internal audit through the annual audit plan and budgeting processes. No additional resources were required because of this report. However situations will dictate if internal audits and investigations have to be outsourced and also management will have to consider their implications to implement the recommendations as per the individual reports.

Each of the individual reports provides for a control environment opinion as well as individual risk ratings per individual findings and recommendations. The importance is for management to implement the individual recommendations well to either address or diminish the exposure for Council, or explain why it is acceptable to not implement the suggested improvements. As per the corrupt conduct investigation, the findings and risks vary in each situation and are discussed in the confidential reports. Having said that the key risks are still if the information is not well presented, well understood or does not generate an appropriate response.

This report and its recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

Internal Audit mostly consults internally to the organisation and its management in conducting the internal audits and finalising the reports. For investigations the appropriate consultations take place as the situation allows and requires.

The Internal Audit Branch continued to have another demanding year due to the push to transform the organisation, requirements regarding corrupt conduct investigations and the current disruption to normal activities.

There were six carryover internal audits from the previous year completed in this financial year.

Five internal audits in this year’s plan have been postponed. These were mainly postponed into the next financial year due to the workload and being affected by the level of change in the organisation.

Asset Management in the organisation had not progressed far enough yet, Procurement was in the middle of centralisation, the Libraries were in the middle of completing two new Libraries including a change of branch manager and therefore the first two were moved to the next financial year and Libraries to 2021-2022. Financial Control; and Information and Related Technology on-boarding were also moved to next year due to work demands and readiness of the respective areas. Although the pandemic has had an effect on the organisation and availability it did not have a huge effect on the productivity of the internal audit activity due to good staff, technical support from Information, Communications and Technology and other support.

With the carry overs from the previous year added it is expected that the Internal Audit Branch will still complete about 18 of the 23 planned Internal Audit Reports/Projects/Consulting Tasks and 20 Investigations projects for the year. The total jobs completed will then be in the range of 38 to exceed the expected number of jobs of 32⅛.

|

|

CONFIDENTIAL |

|

1. |

Freddy Beck

Chief Audit Executive

I concur with the recommendations contained in this report.

Freddy Beck

Chief Audit Executive

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

ITEM: 9

SUBJECT: Annual Internal Audit Plan for 2020-2021 including the Strategic Three Year Plan for 2020-2023

AUTHOR: Chief Audit Executive

DATE: 11 May 2020

Executive Summary

This is a report concerning the proposed Annual Audit Plan for 2020-2021 that includes the Strategic Three Year Internal Audit Plan for 2020-2023.

Recommendation/s

That the draft Internal Audit Annual Plan for 2020-2021 that includes the draft Strategic Three Year Internal Audit Plan for 2020-2023 (Attachment 2) as prepared by the Chief Audit Executive be considered and approved by the Audit and Risk Management Committee.

RELATED PARTIES

Not applicable.

Advance Ipswich Theme Linkage

The intention is for the Internal Audit activity to support all five themes:

Strengthening our local economy and building prosperity

Managing growth and delivering key infrastructure

Caring for the community

Caring for the environment

Listening, leading and financial management

Individual internal audits and corrupt conduct investigations will to a varying degree support these themes, but the main objective for Internal Audit is to support the organisation in achieving its objectives.

Purpose of Report/Background

This report is submitted for review and to approve the proposed draft Internal Audit plan.

The Internal Audit Charter requires that:

“3. Scope, Roles and Responsibilities

3.1 The scope of internal auditing is to determine whether the organisation’s governance, risk management and control processes, as designed and represented by management, are adequate and operating effectively so that the organisation’s objectives can be achieved. It includes, but is not necessarily limited to, the following:

3.1.1 Internal audit planning must be sufficiently comprehensive to audit/review all key facets of Council’s operations, having regard to the functions and duties imposed on Council.

3.2 The scope of internal audit function extends to include all departments, programs, sub‐programs, functions, funded schemes and entities over which Council has direct management, sponsorship or financial control.

6. Authority

6.3 The Chief Audit Executive and staff of the Internal Audit Branch are authorised to review all areas of Council and to have full, free, and unrestricted access to all Council's activities, records (both manual and electronic), property, and personnel. Council activities include entities over which Council has direct management, sponsorship or financial control.

6.5 It is the policy of Council that all internal audit activities remain free of influence by any organisational elements. This will include such matters as scope of internal audit programs, the frequency and timing of examinations and the content of internal audit reports.

7. INTERNAL AUDIT APPROACH

7.2 Risk Profile, Three Year Strategic and Annual Internal Audit Plans:

7.2.1 The Internal Audit Branch, in consultation with management, will consider Council’s Risk Management Framework as well as the Strategic and Departmental risks so that greater audit attention can be directed to areas of higher risk.

7.2.2 Using these key risks as a basis while considering mitigation processes and controls, the general direction of Council's internal audit activities over the medium term is to be documented in the Three Year Strategic Internal Audit Plan. This plan shall be reviewed by the CEO and approved by the Audit and Risk Management Committee. The Plan will also be reviewed annually to take account of any change in circumstances.

7.2.3 The Annual Audit Plan projects may include financial, compliance, performance, due diligence, information systems, program evaluation, operational audits and other approaches as deemed appropriate, given the resources and also the priorities established through the risk assessment process and other more recent considerations.

7.3 Responsibilities and Auditing Standards1:

7.3.2 Specific standards which are to be followed include:

• Internal Audit staff must maintain an independent outlook and must ensure their independence to plan, investigate and report with honesty and objectivity.

1 Standards includes as follows: The Institute of Internal Auditors’ Core Principles for the Professional Practice, Definition of Internal Auditing, Code of Ethics and the International Standards for Professional Practice (Standards). This also includes the Information Systems Audit and Control Association’s Statements on Information Systems Auditing Standards.

Internal Audit attended the corporate and departmental risk workshops in reviewing the risk assessment for internal audit planning purposes. As a consequence of these discussions, the more significant risks and an indication of the key controls that are relied upon in determining auditable areas within the organisation have been identified and is summarised in the Strategic Three Year Audit Plan.

This proposed Internal Audit Program was presented at the Executive Leadership Team meeting of 5 May 2020 and is now tabled at the meeting of the Audit and Risk Management Committee for consideration and approval.

Financial/RESOURCE IMPLICATIONS

Resources are provided to internal audit through the annual audit plan and budgeting processes. No additional resources are considered at this moment in time. However situations will dictate if internal audits and investigations have to be outsourced and also management will have to consider their implications to implement the recommendations as per the individual reports.

RISK MANAGEMENT IMPLICATIONS

Each of the individual reports provides for a control environment opinion as well as individual risk ratings per individual findings and recommendations. The importance is for management to implement the individual recommendations well to either address or diminish the exposure for Council, or explain why it is acceptable to not implement the suggested improvements. As per the corrupt conduct investigation, the findings and risks vary in each situation and are discussed in the confidential reports. Having said that the key risks are still a reality if the information is not well presented, well understood or does not generate an appropriate response.

Legal/Policy Basis

This report and its recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

Crime and Corruption Act 2001

Internal Audit is constituted as per the Local Government Act 2009 and Local Government Regulation 2012 and the following are the requirements in relation to the internal audit plan:

|

Part 11 |

Auditing |

|

|

Division 1 |

Internal audit function |

|

|

Subdivision 1 |

Internal auditing and reporting |

|

|

207 |

Internal audit |

|

|

Requirement |

Section in Plan |

|

|

(1) For each financial year, a local government must— |

||

|

(a) prepare an internal audit plan; |

The whole annual and strategic audit plan |

|

|

(2) A local government’s internal audit plan is a document that includes statements about— |

||

|

(a) the way in which the operational risks have been evaluated; and |

3, 5 and 6 |

|

|

(b) the most significant operational risks identified from the evaluation; and |

7, 11, 12 and 13 |

|

|

(c) the control measures that the local government has adopted, or is to adopt, to manage the most significant operational risks. |

7, 8, 9, 10 and 13 |

|

COMMUNITY and OTHER CONSULTATION

Internal Audit mostly consults internally to the organisation and its management in conducting the internal audits and finalising the reports. For investigations the appropriate consultations take place as the situation allows and requires.

Conclusion

The process of audit planning by the Chief Audit Executive has been completed and has been reviewed by Council’s Executive Leadership Team.

Attachments and Confidential Background Papers

|

|

CONFIDENTIAL |

|

1. |

|

|

2. |

Annual 2020-2021 and Strategic 2020-2023 Internal Audit Plan |

Freddy Beck

Chief Audit Executive

I concur with the recommendations contained in this report.

Freddy Beck

Chief Audit Executive

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

ITEM: 10

SUBJECT: Overdue Recommendations as at 11 May 2020

AUTHOR: Chief Audit Executive

DATE: 11 May 2020

This is a report concerning the status of each Department's progress in actioning the internal and external audit recommendations due or overdue for implementation.

That the report be received and considered.

Not applicable

The intention is for the Internal Audit activity to support all five themes:

Strengthening our local economy and building prosperity

Managing growth and delivering key infrastructure

Caring for the community

Caring for the environment

Listening, leading and financial management

Individual internal audits will, to a varying degree, support these themes, but the main objective for Internal Audit is to support the organisation in achieving its objectives.

Every month each Department Head is requested to update the status of both the internal and external audit recommendations due for implementation within their area of responsibility.

Traffic lights have been introduced based on the request of the Audit and Risk Management Committee. The following is an indication of what each indicator could mean:

|

|

Green |

Light |

Orange |

Light |

Red |

|

|

Under control Reasonable number Low overall risk |

|

Need to monitor Number increasing Moderate overall risk |

|

Need to be addressed Number problematic High overall risk |

The following Departments’ progress towards the implementation of Internal Audit recommendations, for which they are responsible, is summarised below:

|

Corporate Services |

|

||||

|

Date of Report |

Total overdue |

Catastrophic |

High |

Moderate |

|

|

11 May 2020 |

1 |

0 |

0 |

1 |

|

|

In relation to: Credit Cards Framework‐ Allocation and Use (A1819-05) |

|||||

|

Planning and Regulatory Services |

|

||||

|

Date of Report |

Total overdue |

Catastrophic |

High |

Moderate |

|

|

11 May 2020 |

4 |

0 |

0 |

2 |

|

|

In relation to: Immunisation Program (A1718-11), Residential Swimming Pools (A1718-16), Penalty Infringement Process (A1819-13), Animal Management Branch – Pound Operations (A1819-15) |

|||||

All other departments had no recommendations overdue for more than 3 months.

Resources are provided to internal audit through the annual audit plan and budgeting processes. No additional resources are required because of this report. However management will have to consider their implications to implement the recommendations as per the individual reports.

Each of the individual reports provides for a control environment opinion as well as individual risk ratings per individual findings and recommendations. The importance is for management to implement the individual recommendations well to either address or diminish the exposure for Council, or explain why it is acceptable to not implement the suggested improvements.

This report and its recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

Internal Audit mostly consults internally to the organisation and its management in conducting the internal audits and finalising the reports.

Total Internal Audit recommendations overdue for more than 3 months and level of risk:

Minimal and Low not indicated.

|

Date of Report |

Total overdue |

Catastrophic |

High |

Moderate |

|

|

11 May 2020 |

5 |

0 |

0 |

3 |

|

|

4 February 2020 |

15 |

0 |

1 |

8 |

Total Internal Audit recommendations open and level of risk:

|

Date of Report |

Total open |

Catastrophic |

High |

Moderate |

|

|

11 May 2020 |

60 |

0 |

6 |

40 |

|

|

4 February 2020 |

32 |

0 |

1 |

21 |

Total External Audit recommendations overdue and level of risk:

Ratings as used by QAO.

|

Date of Report |

Total overdue |

High |

Moderate |

Low |

|

|

11 May 2020 |

1 |

1 |

0 |

0 |

|

|

4 February 2020 |

6 |

1 |

2 |

3 |

Total External Audit recommendations open and level of risk:

|

Date of Report |

Total open |

High |

Moderate |

Low |

|

|

11 May 2020 |

7 |

3 |

2 |

2 |

|

|

4 February 2020 |

7 |

2 |

2 |

3 |

Total Investigation/Ad Hoc Report recommendations overdue and level of risk:

Minimal and Low not indicated.

|

Date of Report |

Total overdue |

Catastrophic |

High |

Moderate |

|

|

11 May 2020 |

3 |

0 |

0 |

2 |

|

|

4 February 2020 |

2 |

0 |

0 |

1 |

Total Investigation/Ad Hoc Report recommendations open and level of risk:

|

Date of Report |

Total open |

Catastrophic |

High |

Moderate |

|

|

11 May 2020 |

3 |

0 |

0 |

2 |

|

|

4 February 2020 |

6 |

0 |

0 |

4 |

|

Overall Status |

|

|

The total number of overdue recommendations have gone down, but the overall number of open recommendations have gone up significantly. This is a positive result for the moment, but managers will need to monitor the open recommendations. |

Freddy Beck

Chief Audit Executive

I concur with the recommendations contained in this report.

Freddy Beck

Chief Audit Executive

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

ITEM: 11

SUBJECT: Insurance and Risk Update

AUTHOR: Principal Risk and Compliance Specialist

DATE: 27 April 2020

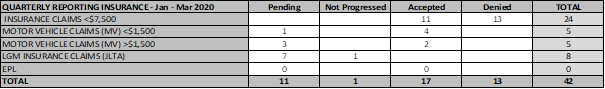

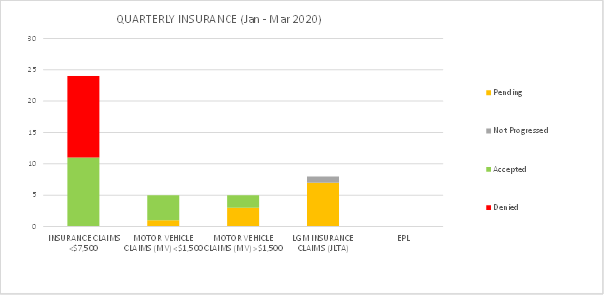

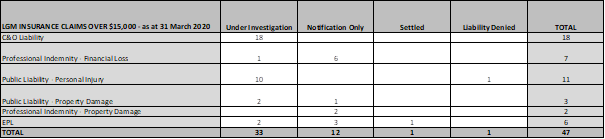

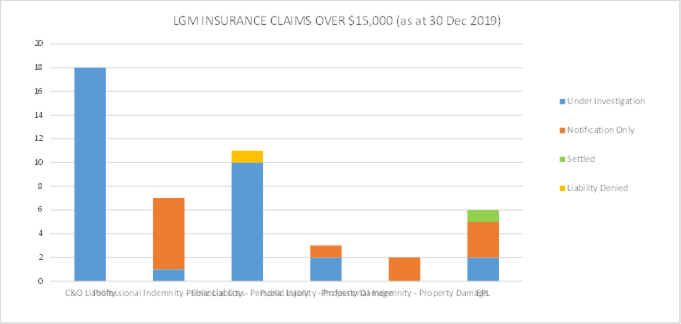

This is a report concerning Council’s Insurance Statistics for the period 1 January 2020 to 31 March 2020 and the implementation of Transformational Project Risk Management Framework (TP#7).

All members of ELT, Business Transformation Program Steering Committee members, Council’s third level Managers. Principal Risk and Compliance Specialist, Senior Insurance Officer and the Corporate Governance Manager. There are no perceived conflict of interest issues regarding this report.

Listening, leading and financial management.

To inform the Committee of:

1. Corporate Insurance Statistics for the Quarter

2. Status of Transformation Project Risk Management TP#7

1. Corporate Insurance Statistics for the period 1 January 2020 to 31 March 2020

The following tables and graphs provide a high-level summary of insurance claims for the period (refer Attachment No. 1 and No. 2 for detail):

2. Status of Transformational Project No. 7 Risk Management Framework (TP#7)

The purpose of the TP#7 project was to develop a better practice and consistent whole of Council approach to Enterprise Risk Management (ERM) in order to proactively identify, manage and respond to issues that represent risks to achieving Council’s strategic objectives. The TP#7 Project was finalised as at 31 March 2020.

The project consisted of five (5) sub-projects:

1. Enterprise Risk Management program (ERM Program)

2. Fraud and Corruption Control Program (FCCP)

3. Good Decision Making and Ethics Principles

4. Business Continuity Planning (BCP)

5. Project Risk Management Model

SUB-PROJECT UPDATES AS AT 31 MARCH 2020;

1. Enterprise Risk Management Program (ERM Program)

· First ELT Risk Committee held on 10 February 2020 and the second ELT Risk Committee was held on 3 April 2020.

· The first Departmental Risk Advisory Committee for each of the five Departments was held in the third week of March 2020 with the Committee being chaired by the General Manager. All the five Committees endorsed the Advisory Committee Terms of Reference.

· Charlie Dill, GM Infrastructure and Environment will be presenting at today’s committee on how he is managing his departmental risks.

Corporate Risk Register

A review was undertaken to review the risk descriptions, the causes, the impacts, likelihood and consequence ratings and the development of the action plans for the eight risks which are the primary area of focus for review at the February 2020 and April 2020 ELT Risk Committee. At Attachment No. 3 is: ICC Corporate Risk Register.

Departmental Risk Registers

A review was undertaken of the five Departmental risk registers to review the risk descriptions, the causes, the impacts, likelihood and consequence ratings and the development of the action plans for the risks which are the primary area of focus for each Department for review at the March 2020 Departmental Risk Advisory Committee and April 2020 ELT Risk Committee.

Risk Profile

Due to the COVID-19 Pandemic the CEO at the ELT Risk Committee held on 3 April 2020 suggested that the corporate risks are retained and further discussed once the threat of COVID-19 has lessened.

Risk Appetite

At the ELT Risk Committee held on 3 April 2020 ELT endorsed the proposed PWC “Draft” Risk Appetite Statement (RAS) for use in executive decision-making.

The Principal Risk and Compliance Specialist outlined that it is proposed to do a more in-depth analysis for the nine (9) risk areas during 2020 and that for the next ELT Risk meeting there will be discussion around how Council can look at compiling a risk appetite for Council covering these nine (9) risk areas.

Reporting

Work is still progressing with the reporting timeframes and reporting templates.

Implementation of the Risk Management Framework and Training

The risk management training is in the process of being developed by the Learning and Development Section within the People and Culture Branch based on the Framework, Procedure and Administrative Directive and will be rolled out commencing in the third quarter of 2020.

2. Fraud and Corruption Control

The ELT Risk Committee held on 3 April 2020 noted that the Fraud and Corruption Training for ELT/Branch and Section Managers and key staff was carried out by PWC in four sessions on 19 and 20 February 2020 involving 100 staff. General Managers were also able to nominate key staff from their Department and Finance were able to secure funding for PWC’s engagement.

Further Fraud and Corruption Training for all Ipswich City Council Staff will be rolled out commencing in the third quarter of 2020.

Fraud and Corruption Control Risk Register

The ELT Risk Committee held on 10 February 2020 endorsed the ICC Fraud and Corruption Control Risk Register.

Reporting

Work is still progressing with the reporting timeframes and reporting templates.

3. Good Decision-Making and Ethics Principles

Due to resource issues all other key deliverables/planned outcomes are work in progress. The project schedule for this sub-project will be reviewed and new deliverable dates approved by the ELT Risk Committee.

4. Business Continuity Planning

The ELT at its meeting on 23 March 2020 endorsed that due to the current circumstances in relation to the COVID-19 Pandemic, that the planned development of a business continuity test exercise, which was to be carried out in the first half of 2020 be postponed.

At the ELT Risk Committee held on 3 April 2020 the CEO requested that a date be pencilled in towards the end of the year and this is to be used as an exercise that reflects on current COVID-19 actions.

At the ELT Risk Committee held on 3 April 2020 the committee endorsed the CEO’s request that the Principal Risk and Compliance Specialist prepare a separate risk register for COVID-19 as a priority, a simple document outlining 3 or 4 risks, including financial risks to the organisation, risk to staff and risk to the economy for a COVID-19 briefing with the incoming councillors.

5. Project Risk Management Model

Completed and now operationalised and BAU.

In managing risk and insurance for the organisation Council officers perform their duties in keeping with the Local Government Principles of:

· Transparent and effective processes, and decision-making in the public interest;

· Good governance of, and by, local government; and

· Ethical and legal behaviour of Councillors and local government employees

The following table outlines the relevant legislation and the administrative functions and services provided by the Section:

|

Relevant Legislation |

Corporate Services Section Functions and Services Provided |

|

Local Government Act 2009 Local Government Regulation 2012 AS/NZS ISO 31000:2018 Risk Management – Principles and Guidelines

|

Manage and coordinate:

· the implementation of Council’s Risk Management Framework · public liability claims from external customers · public liability claims for Councillors and staff · negotiate (within Delegated Authority), on behalf of Council any insurance resolutions · the insurance of Council assets including but not limited to Council buildings, machinery and equipment, park infrastructure, swimming pools, sports centres, club houses, fleet vehicles, etc. · the renewal of Council insurance policies (excluding Workers Compensation) · the provision of expert insurance and risk advice to both external and internal stakeholders · recover costs from damaged made by third parties to Council assets |

It was essential that TP#7 Risk Management be successfully implemented and that risk management is embedded in the organisation. The management of corporate risks lies with the CEO and all General Managers, with departmental risk management the responsibility of the respective General Manager. The Corporate Governance Section and the Principal Risk and Compliance Specialist can provide the necessary framework, policy, procedures, advice etc., but successful risk management will only be achieved if senior management takes responsibility for managing the risk and fraud registers, implements appropriate controls and leads the organisation in developing a strong risk management culture and increasing the organisation’s risk management capabilities.

TP#7 has a financial year (FY) budget of $87,000. FY actuals and commitments to date (costs incurred with engagement of PWC) total $176,437. The project budget is monitored by the Project Lead and by the TPCT.

This report did not require community engagement.

With the implementation of an Enterprise Risk Management Framework and an increase in the capability of the organisation to manage risk efficiently and effectively, Council has positioned itself to be an exemplar Council in the management of Risk and Insurance.

|

1. |

ICC Corporate Risk Register ⇩ |

|

2. |

ICC Critical Systems and Facilities Table ⇩ |

|

|

|

|

|

CONFIDENTIAL |

|

3. |

|

|

4. |

Graham McGinniskin

Principal Risk and Compliance Specialist

I concur with the recommendations contained in this report.

Angela Harms

Governance Manager

I concur with the recommendations contained in this report.

Sonia Cooper

General Manager Corporate Services

“Together, we proudly enhance the quality of life for our community”

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

ITEM: 12

SUBJECT: Governance and Compliance Report

AUTHOR: Integrity and Complaints Manager

DATE: 12 May 2020

Executive Summary

This is a report concerning the performance of the Corporate Governance Section (the Section) in relation to Council’s legislative compliance in the management of Complaints, Right to Information and Information Privacy functions for the period 1 January 2020 to 31 March 2020 (the Quarter).

Recommendation/s

That the report be received and the contents noted.

RELATED PARTIES

There are no related parties.

Advance Ipswich Theme

Listening, leading and financial management

Purpose of Report/Background

To inform the Committee on how the Section has performed and managed the below functions for the Quarter:

· Management of Right to Information and Information Privacy Applications

· Delivery of Transformation Project TP#06 Complaints Management Framework

To also inform the Committee on a follow-up report by the Information Commissioner on the 2017-18 Audit Report on Ipswich City Council’s management of Right to Information and Information Privacy.

1. Management of Complaints

The number of complaints being received by the Complaints Management Unit (CMU) continues to increase each quarter. This is recognised as evidence of Council’s customers trusting the established complaint channel, CMU, to have their concerns addressed.

It is anticipated that complaint numbers will increase with the return of the Elected Representatives as customers/constituents raise matters with them for referral to the CMU for management.

Reporting in the complaints space will evolve with the introduction of the use of the Insights Function of Council’s CRM database used for complaints management, Objective. Among other measures, Council will move towards including handling times in reports as a measure for the efficacy of processes utilised in the complaints management space.

|

|

JAN – MAR 2020 |

OCT – DEC 2019 |

||||

|

COMPLAINT TYPE |

CLOSED |

IN PROGRESS |

GRAND TOTAL |

CLOSED |

IN PROGRESS |

GRAND TOTAL |

|

Administrative Action Complaints |

0 |

2 |

2 |

4 |

0 |

4 |

|

Privacy Complaints |

0 |

0 |

0 |

0 |

0 |

0 |

|

Publication Scheme Complaints |

0 |

0 |

0 |

0 |

0 |

0 |

|

General Administration Action Complaints |

176 |

18 |

194 |

94 |

12 |

106 |

|

Ombudsman Direct Referrals Received |

0 |

0 |

0 |

0 |

0 |

0 |

|

General - Staff Complaint |

12 |

1 |

13 |

16 |

3 |

19 |

|

Ombudsman Review |

1 |

1 |

2 |

2 |

0 |

2 |

|

Internal Reviews on AACs |

0 |

0 |

0 |

0 |

0 |

0 |

|

OIC Reviews |

0 |

0 |

0 |

0 |

0 |

0 |

|

TOTAL NUMBER OF COMPLAINTS RECEIVED |

189 |

22 |

211 |

116 |

15 |

131 |

Statistics above show a significant increase in General Administrative Action Complaints (Stage One review of complaint) received within the quarter compared to the previous quarter. The report indicates that CMU received 194 complaints where 176 of these complaints were successfully closed in that quarter and 18 are still in progress awaiting for information provided by the business nominated persons. These complaints range from operational work issues, road maintenance, rates complaints, parking complaints and animal management to name a few major complaints categories. It is anticipated that there will be another notable increase in the next reporting period.

A slight decrease in General Staff Complaints from 19 to 13 was received. The report shows that within the 13 complaints, 12 were successfully closed, 1 is still in progress. These complaints are mainly waste truck drivers’ behaviour while servicing bins, rates related matters, compliance officers who are looking after enforcement notices, animal management officers and parking infringement officers. The CMU provide customer feedback to relevant departments and give them the opportunity to review expected behaviours of all staff as Council strives to achieve a strong customer service focus in all service delivery areas.

CMU received one request for information on a legacy complaint matter managed by Council to assist with an internal reviews on the Ombudsman’s Delegate’s decision on that matter. This request for information was intensive with a high volume of advice/information being requested to assist their investigation. The other request for information was to determine if a matter had been appropriately managed under Council’s Complaints Management Framework before accepting the matter for a review. That matter remained open in that quarter waiting on advice from the Ombudsman’s Office on how to proceed.

There was a decrease of Administrative Action Complaints from 4 to 2 complaints received in this quarter which indicates continued success in the internal review process. Having the CMU respond to the customer is proving to be successful with Council having complaint management specialists managing complaint matters and providing customer responses with a strong customer centric focus.

There were no requests for Internal Reviews, Privacy Complaints or Publication Scheme Complaints received in this quarter. This will be monitored in future reporting periods.

Quality assurance monitoring of different processing stages will be continue to be undertaken to ensure the efficacy of the Complaints Framework remains and ensure robust processes continue to be used effectively in complaints management.

2. Management of Infringement Reviews

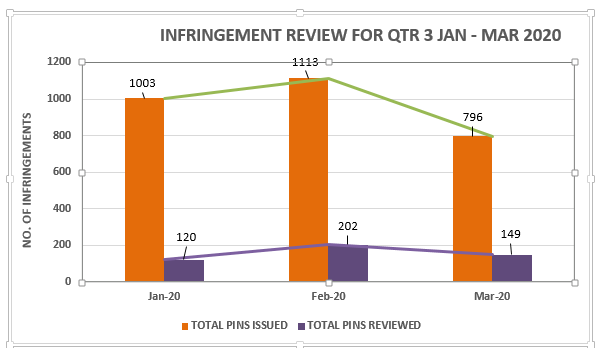

According to the data extracted from Council’s Crystal report, PRS issued the least number of infringements in March 2020 and issued the highest in February 2020. An increase in infringements issued in February was mainly due to the changes with the parking conditions at Springfield Station. This also resulted in an increase of requests that came in for review.

Within these issued pins, the report shows an increase of request for review from 143 to 470 requests. These reviews were mainly from customers who were issued an infringement at Springfield Station.

Based on advice received, a reduction of infringements in March was due to the COVID-19 Pandemic and restrictions imposed by the Commonwealth and State Governments in relation to travelling.

Further detail on the types of infringements is set out in the addendum below.

3. Management of Right to Information and Information Privacy Applications

All RTI Applications were processed in accordance with legislative requirements, Council Policy and Procedures. The below tables provide details of the management of all RTI Applications for the reporting period.

Two RTI applications received during the Quarter were dealt with administratively. Documents released were predominantly maintenance logs of Council’s infrastructure – parks.

Moving forward work will be undertaken with the Performance Management team to develop more robust reporting on applications and data will be utilised to inform Council on improvements to its Publication Scheme.

The efficacy of application handling is evidenced by no internal or external reviews being undertaken on applications received in this quarter.

The tables below indicate the volume of RTI/IP applications received.

|

RTI Management |

No. |

|

CARRIED OVER FROM PREVIOUS QUARTER |

3 |

|

NEW APPLICATIONS |

9 |

|

CLOSED |

6 |

|

OPEN AND CARRIED INTO NEXT QUARTER |

6 |

|

IP Management |

No. |

|

CARRIED OVER FROM PREVIOUS QUARTER |

1 |

|

NEW APPLICATIONS |

3 |

|

CLOSED |

3 |

|

OPEN AND CARRIED INTO NEXT QUARTER |

1 |

4. Status of the Transformation Projects which impact the Integrity and Governance Section’s management of complaints and RTI/IP applications

4.1 TP#6 Complaints Management Framework

The Project will be formally closed in May 2020 by the Business Transformation Program Steering Committee. Any remaining deliverables will be transitioned to either business as usual activities or further strategic projects.

All but two key deliverables are 100% delivered (Key Deliverables 1 and 2 are 90% implemented)

|

No. |

Key Deliverable |

Progress achieved this period |

Activities planned for next period |

|

1 |

Complaints Management Policy & procedure |

Continued to monitor current policies to ensure efficacy. |

Legal Services Team updating policies to reflect Human Rights Act that came into effect in January 2020. Complaints Management Framework has been amended to state that all decisions made with HRA components the HRA must be considered. Discoverable evidence must be available. Considerations will be had on what this looks like. Thoughts are an assessment criteria will be developed to ensure compliance by decision makers. A new procedure is likely to be required to dovetail in with the new HRA policy being adopted. Work on this continues with Legal Services Section as BAU. |

|

2 |

Unreasonable Complaint Conduct (UCC) Policy and Manual |

Once adopted tool box talks to be undertaken with operational teams so full understanding is had on responsibilities of all staff for managing UCC. This will be done quarterly to ensure staff remain current on how to use the policy |

This policy and procedure still requires review by Legal Services Team to ensure it is meeting HRA. Work is being done to ensure that this policy/procedure dovetails into HRA policy/procedure. This will be completed by the end of May and will go up to Committee once finalised. |

5. Follow-up by the Information Commissioner to their 2017-18 Audit Report on Ipswich City Council’s management of Right to Information and Information Privacy

The Office of the Information Commissioner (OIC) is currently finalising a follow-up report on Council’s implementation of recommendations made in their 2017-18 audit of Council’s management of Right to Information and Information Privacy. A draft report was received by Council on 28 April 2020 and a response was provided on 12 May 2020. The draft report prepared by the OIC included an assessment that six of the recommendations are fully implemented, one partially implemented, one in progress, one with limited progress and three assessed as no action having been taken.

Council’s response set out additional action that has been taken both within the audit period, since the audit period and future planned work. The response also suggested alternate assessments that could have been made by the OIC based on the available evidence.

After considering Council’s response, the Information Commissioner has decided to re-open the follow-up audit to consider the additional evidence presented.

A further update will be provided to the ARMC through the Chair once the revised draft report is received.

Financial/RESOURCE IMPLICATIONS

There are no financial/resource implications.

RISK MANAGEMENT IMPLICATIONS

The greatest risk to the organisation is the lack of awareness by staff of their responsibilities under Council’s Complaint Management Framework, the Public Record Act, and RTI and IP Acts. All outside staff have attended Public Records Act, RTI Act and IP Act Training delivered by the TP#6 Project Lead. Internal staff have undertaken Office of the Information Commissioner RTI and IP Training and Queensland State Archives Records Challenge Training online via E-Hub. Training in Records, RTI and IP Act obligations and responsibilities is now a component of induction training and will be incorporated into annual refresher training for all staff.

Council has an obligation under the RTI and IP Acts to work towards open proactive disclosure, administrative access and information sharing (the “push model”). Considerations are being had on the Section engaging a consultant to develop a 12 month project plan using the recent organisational ‘scorecard’ developed by the Office of the Information Commission (OIC). The aim of the project plan will be to improve the organisation’s implementation of the “push model” and hopefully increase our scorecard results for the next OIC assessment. The project plan will be delivered by the Section as BAU.

Legal/Policy Basis

The following table outlines the relevant legislation and the administrative functions and services provided by the Branch:

|

Relevant Legislation |

Integrity and Complaints Team Administrative Functions and Services Provided |

|

Local Government Act 2009 and Local Government Regulation 2012 State Penalties Enforcement Act 1999 State Penalties Enforcement Regulation 2014 Withdrawal of Infringement Notice Policy (Council resolution, 27 February 2018) ALARMS risk rating (Council resolution, 26 April 2007)

|

Management complaint types:

· Administrative Action Complaints and Internal Reviews · Privacy Complaints · Publication Scheme Complaints · Ombudsman Review of Complaint Management · Ombudsman Direct Referral of Complaints · Office of Information Commission (OIC) Complaint Reviews · Operational i.e. General Department complaints referred to relevant Council Depart./Branch for resolution · Infringement Reviews |

|

Right to Information Act 2006 |

Management of Right to Information Applications for:

· access to information that is not administratively available · internal review of a reviewable decision |

|

Information Privacy Act 2006 |

Management of Information Privacy Applications:

· for personal information · to amend personal information or · to investigate complaints of privacy breaches · internal review of a reviewable decision |

COMMUNITY and OTHER CONSULTATION

This report did not require community engagement.

Conclusion

The Governance Section has performed its responsibilities and obligations in relation to maintaining Council’s compliance with the Local Government Act, Local Government Regulation, Right to Information Act and Information Privacy Act for the previous Quarter.

Dianne Nikora

Integrity and Complaints Manager

I concur with the recommendations contained in this report.

Sonia Cooper

General Manager Corporate Services

“Together, we proudly enhance the quality of life for our community”

ADDENDUM

Detail on Infringements

The below table represents the breakdown of the types of infringements being issued during Jan – Mar 2020 quarter:

|

TYPES OF PINS ISSUED |

JAN – 20 |

FEB – 20 |

MAR – 20 |

|

ANIMAL INFRINGEMENTS |

62 |

71 |

22 |

|

ANPR INFRINGEMENTS |

500 |

550 |

257 |

|

LOCAL LAWS INFRINGEMENTS |

9 |

14 |

31 |

|

OTHER PARKING INFRINGEMENTS |

432 |

478 |

486 |

|

TOTAL |

1003 |

1113 |

796 |

|

PINS REVIEWED |

JANUARY 2020 |

FEBRUARY 2020 |

MARCH 2020 |

|

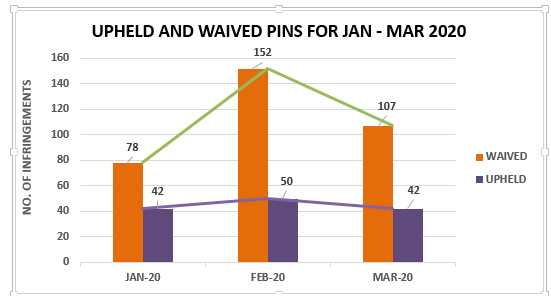

WAIVED |

78 |

152 |

107 |

|

UPHELD |

42 |

50 |

42 |

|

TOTAL PINS REVIEWED |

120 |

202 |

149 |

According to the table and graph above, February recorded the most infringements that were waived and also upheld, with 152 and 50 infringements respectively.

January had the lowest of number of infringements waived.

Also, January and March scored the lowest number of infringements that were upheld with 42 infringements in both months.

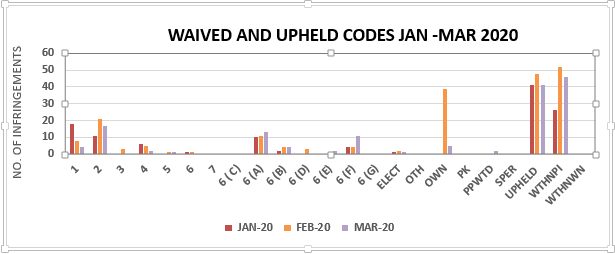

The below graph depicts the statistics of the different exemption codes that were applied to all approved waived and upheld infringements:

Table of exemption codes for reference:

|

CODES |

JAN-20 |

FEB-20 |

MAR-20 |

|

1 |

18 |

8 |

4 |

|

2 |

11 |

21 |

17 |

|

3 |

0 |

3 |

0 |

|

4 |

6 |

5 |

2 |

|

5 |

0 |

1 |

1 |

|

6 |

1 |

1 |

0 |

|

6 (A) |

10 |

11 |

13 |

|

6 (B) |

2 |

4 |

4 |

|

6 ( C) |

0 |

0 |

0 |

|

6 (D) |

0 |

3 |

0 |

|

6 (E) |

0 |

0 |

2 |

|

6 (F) |

4 |

4 |

11 |

|

6 (G) |

0 |

0 |

0 |

|

7 |

0 |

0 |

0 |

|

ELECT |

1 |

2 |

1 |

|

UPHELD |

41 |

48 |

41 |

|

OTH |

0 |

0 |

0 |

|

OWN |

0 |

39 |

5 |

|

PPWTD |

0 |

0 |

2 |

|

PK |

0 |

0 |

0 |

|

SPER |

0 |

0 |

0 |

|

WTHNPI |

26 |

52 |

46 |

|

WTHNWN |

0 |

0 |

0 |

|

TOTAL |

120 |

202 |

149 |

Table of definitions for exemption codes for reference:

|

EXEMPTION CODES |

DEFINITION |

|

1 |

Incorrect/Incomplete/Unclear Information – A notice has been issued containing incorrect or incomplete information (eg. Incorrect vehicle registration number, incorrect name of offender or incorrect offence code) and this has caused the PIN to be invalid or the information recorded on the PIN is so unclear that it cannot be read. |

|

2 |

Medical Certification – A medical certificate or other acceptable supporting documentation including statements from witnesses can be produced confirming that the medical condition or a medical situation at the time of the offence caused or substantially contributed to the offence occurring and that in view of such circumstances, the PIN should be withdrawn. |

|

3 |

Motor Vehicle Breakdown (regulated Parking Offence) - Evidence can be produced to prove a vehicle had a mechanical problem at the time of the parking offence and that the circumstances caused the driver to park illegally. |

4 |

People with a Disability (Regulated Parking Offences) – A valid disabled persons parking permit can be produced in instances where the vehicle would not have been issued with a PIN had the permit been affixed to the vehicle. |

|

5 |

Charity Workers (Regulated Parking Offences) – The person to whom the PIN was issued was at the time of the alleged offence undertaking a bona-fide temporary duty on behalf of a charitable organisation and the offence did not involve traffic/pedestrian obstruction or safety related offences (withdrawal of a PIN under this criterion will only be applied to a first offence) |

|

6 |

Extraordinary Circumstances - In a case where an application is not addressed by the abovementioned circumstances, the decision maker may determine that the circumstances are sufficient to warrant the withdrawal of the PIN. |

|

6 (A) |

Extraordinary Circumstances – Instances where a decision to uphold the PIN would be contrary to Council’s Corporate Plan, Vision, Mission and Values. |

|

6 (B) |

Extraordinary Circumstances – Instances where the likelihood of successful prosecution is low. |

|

6 (D) |

Extraordinary Circumstances – The person to whom the infringement notice was issued was involved in an emergency situation at the time of the alleged offence. (Proof of the emergency would be required, eg. Doctor’s certificate, statutory declaration, oaths acted witness statements) |

6 (F) |

Extraordinary Circumstances – Ambiguous, illegible, malfunctioning or damaged signage or devices which would lead to confusion about the requirements. (For ‘malfunction of parking meters, evidence is to include a witness statement or statutory declaration that correct monies were deposited into regulated parking devices) |

|

7 |

Interstate Vehicle or Overseas Driver |

|

ELECT |

Offender has Elected to have the PIN decided in Magistrates Court |

|

PPWTD |

Prosecution Panel Withdrawn |

|

NO EXEMPTION |

PIN has been UPHELD |

|

OTH |

Other Circumstances |

|

OWN |

Owner cannot be located |

|

SPER |

Referred to SPER |

|

WTHNPI |

Withdrawn by Review Team – For new PIN to be considered by Compliance Branch |

|

WTHNWN |

Withdrawn by Management Team |

The following table represents the percentage rate of how many PINS were reviewed over the total number of PINS issued:

|

ITEMS |

JAN-20 |

FEB-20 |

MAR-20 |

|

TOTAL PINS REVIEWED |

120 |

1113 |

796 |

|

TOTAL PINS ISSUED |

1003 |

202 |

149 |

|

PERCENTAGE RATE |

11.96% |

18.15% |

18.72% |

Furthermore, CMU also receive CES requests jobs where work is undertaken that hasn’t resulted in a review being conducted. Below is the breakdown of the total number of these jobs that was received via our CES portal for the quarter Jan – Mar 2020:

|

RESOLUTION CODES |

Count of Resolution Summary |

|

Customer inquiry |

157 |

|

Upheld |

141 |

|

Withdrawn new PIN issued |

138 |

|

Medical certification |

48 |

|

Contrary to Council’s vision and values |

32 |

|

Closed as Duplicate |

27 |

|

Incorrect/incomplete/unclear information |

26 |

|

Ambiguous, illegible, damaged signage |

19 |

|

Likelihood of prosecution low |

13 |

|

Referred to SPER |

11 |

|

People with a disability (reg parking) |

10 |

|

Motor vehicle breakdown (reg parking) |

3 |

|

Unavoidably delayed through Council bus. |

3 |

|

Involved in an emergency situation |

3 |

|

Charity workers (reg parking) |

2 |

|

Extraordinary circumstances |

2 |

|

Customer Satisfied |

1 |

|

SPER - Waived |

1 |

|

Court election |

1 |

|

GRAND TOTAL |

638 |

|

Audit and Risk Management Committee Meeting Agenda |

20 May 2020 |

ITEM: 13

SUBJECT: ICT Strategy Update Report

AUTHOR: Chief Information Officer

DATE: 12 May 2020

This is a report concerning an update relating to the progress of implementation of the ICT Strategy 2019-2024. The strategy was published on 2 August 2019 and was developed in collaboration with a diverse range of internal stakeholders and includes stakeholder perspectives, key trends and influences, guiding principles and a strategy map.

That the report be received and the contents noted.

Nil

Managing growth and delivering key infrastructure

There are four core strategic areas of focus that have been developed to support the ICT Strategy 2019-2024. This report provides an update against each of these focus areas:

1. ICT Governance