IPSWICH

CITY

COUNCIL

AGENDA

of the

Economic Development Committee

Held in the Council Chambers

2nd floor – Council Administration Building

45 Roderick Street

IPSWICH QLD 4305

On Tuesday, 3 December 2019

At 8:30 am

IPSWICH

CITY

COUNCIL

AGENDA

of the

Economic Development Committee

Held in the Council Chambers

2nd floor – Council Administration Building

45 Roderick Street

IPSWICH QLD 4305

On Tuesday, 3 December 2019

At 8:30 am

|

MEMBERS OF THE Economic Development Committee |

|

|

Interim Administrator Greg Chemello (Chairperson) |

|

|

Economic Development Committee Meeting Agenda |

3 December 2019 |

Economic Development Committee AGENDA

8:30 am on Tuesday, 3 December 2019

Council Chambers

|

Item No. |

Item Title |

Page No. |

|

1 |

Council Brand Relationship Spectrum |

8 |

|

2 |

Tender Consideration Plan Approval - Retail Project Audit Consultants |

17 |

|

3 |

**Tender Consideration Plan - Principal Contractor for Commonwealth Hotel Reconstruction Work |

33 |

|

4 |

**Ipswich Central Program Report No. 17 to 16 October 2019 and Report No. 18 to 15 November 2019 |

46 |

|

5 |

**Tender Consideration Plan Approval - Retail Construction - Nicholas Street - Ipswich Central |

77 |

** Item includes confidential papers

Economic Development Committee NO. 12

3 December 2019

AGENDA

1. Council Brand Relationship Spectrum

This is a report concerning the relationship of council brands.

In July 2019, council adopted an update to its City of Ipswich logo, making it a cleaner and more contemporary design.

That report also highlighted a greater inconsistency in the array of council sub-brands which over time have developed customised or distinctly different identities from the council master brand.

The decision of council was that the Interim Administrator of Ipswich City Council resolve:

A. That

the update to the council logo application be adopted and implemented as part

of the Ipswich City Council Style Guide and subordinate manuals and style

guides.

B. That a subsequent report be submitted to a future meeting of Economic Development Committee in relation to the application of council’s logo across current sub-brands addressing the comments from the committee outlined below.

The committee noted that in relation to the council sub-brand design and architecture outlined on page 3 of the report, that it was not what had been identified in discussions on this matter in the 19 February Economic Development Committee meeting. It was requested that a further report be presented outlining the principles and options to align or eliminate council’s sub-brands.

This report recommends a clear direction for the relationship of council brands following a review of local government examples and advertising industry practices.

Recommendation

That the Interim Administrator of Ipswich City Council resolve:

A. That a Branded House framework for all council owned facilities and primarily council operations and services, be adopted.

B. That the application of the logo and Brand House be specified as part of a council style guide to be approved by the Chief Executive Officer.

2. Tender Consideration Plan Approval - Retail Project Audit Consultants

This is a report concerning a proposed Tender Consideration Plan for the engagement of design audit consultants for the retail works within the Nicholas Street - Ipswich Central project (the Retail Project).

Recommendation

That the Interim Administrator of Ipswich City Council resolve:

A. That a Tender Consideration Plan be prepared in accordance with section 230(1)(a) of the Local Government Regulation 2012 (Qld) to engage design audit consultants for the Nicholas Street – Ipswich Central project.

B. That the Tender Consideration Plan as outlined in the report by the General Manager – Coordination and Performance dated 22 November 2019, in accordance with section 230(1)(b) of the Local Government Regulation 2012 for the engagement of design audit consultants for the Nicholas Street – Ipswich Central Retail Project be adopted by Council.

C. That the Chief Executive Officer be authorised to negotiate and finalise the terms of the retail project variations to be executed on behalf of Council and to do any other acts necessary to implement Council’s decision in accordance with section 13(3) of the Local Government Act 2009.

3. **Tender Consideration Plan - Principal Contractor for Commonwealth Hotel Reconstruction Work

This is a report concerning the procurement process for the Principal Contractor for the reconstruction of the Commonwealth Hotel. This report recommends that competitive tenders be invited from a list of suitably qualified Contractors drawn from the Expression of Interest (EOI) process completed in 2017 for this same purpose. Due to the time elapsed since this initial EOI process, the list be supplemented if required with other suitably qualified Contractors currently available for the work.

The section 230 of the Local Government Regulation 2012 allows a local government to enter into medium and large contractual agreements, without first inviting written quotes or tenders, through the preparation and adoption of a Tender Consideration Plan (TCP). The TCP provides the information required to comply with the regulation and to justify the use of the plan as an effective and appropriate alternative to seeking quotes or to calling for open tenders. The scope of services to which the TCP relates is:

· Principal Contractor for the Commonwealth Hotel Reconstruction Work.

Recommendation

That the Interim Administrator of Ipswich City Council resolve:

A. That a Tender Consideration Plan be prepared in accordance with section 230 (1) (a) of the Local Government Regulation 2012 (Qld) for the Principal Contractor for Commonwealth Hotel Reconstruction Work, as outlined in the report by the General Manager – Coordination and Performance dated 25 November 2019.

B. That in accordance with section 230(1)(b) of the Local Government Regulation 2012, the Tender Consideration Plan for the Principal Contractor for Commonwealth Hotel Reconstruction Work, be adopted

C. That the Chief Executive Officer be authorised to negotiate and finalise the terms of the contracts to be executed by Council and to do any other acts necessary to implement Council’s decision in accordance with section 13(3) of the Local Government Act 2009.

4. **Ipswich Central Program Report No. 17 to 16 October 2019 and Report No. 18 to 15 November 2019

This is a report concerning a monthly update for the Ipswich Central Program of Works.

Recommendation

That the report on the Ipswich

Central Program Report No. 17 effective to

16 October 2019 and Report No. 18 effective 15 November 2019 be received and

the contents noted.

5. **Tender Consideration Plan Approval - Retail Construction - Nicholas Street - Ipswich Central

This is a report concerning a proposed Tender Consideration Plan for the provision of construction work associated with the retail areas within Nicholas Street - Ipswich Central project (i.e. the Retail Project).

Recommendation

That the Interim Administrator of

Ipswich City Council resolve:

B. That the Chief Executive Officer be authorised to negotiate and finalise the terms of the Retail Project variation to be executed on behalf of Council and to do any other acts necessary to implement Council’s decision in accordance with section 13(3) of the Local Government Act 2009.

** Item includes confidential papers

and any other items as considered necessary.

|

Economic Development Committee Meeting Agenda |

3 December 2019 |

ITEM: 1

SUBJECT: Council Brand Relationship Spectrum

AUTHOR: Marketing and Promotion Manager

DATE: 6 November 2019

This is a report concerning the relationship of council brands.

In July 2019, council adopted an update to its City of Ipswich logo, making it a cleaner and more contemporary design.

That report also highlighted a greater inconsistency in the array of council sub-brands which over time have developed customised or distinctly different identities from the council master brand.

The decision of council was that the Interim Administrator of Ipswich City Council resolve:

A. That

the update to the council logo application be adopted and implemented as part

of the Ipswich City Council Style Guide and subordinate manuals and style

guides.

B. That a subsequent report be submitted to a future meeting of Economic Development Committee in relation to the application of council’s logo across current sub-brands addressing the comments from the committee outlined below.

The committee noted that in relation to the council sub-brand design and architecture outlined on page 3 of the report, that it was not what had been identified in discussions on this matter in the 19 February Economic Development Committee meeting. It was requested that a further report be presented outlining the principles and options to align or eliminate council’s sub-brands.

This report recommends a clear direction for the relationship of council brands following a review of local government examples and advertising industry practices.

That the Interim Administrator of Ipswich City Council resolve:

A. That a Branded House framework for all council owned facilities and primarily council operations and services, be adopted.

B. That the application of the logo and Brand House be specified as part of a council style guide to be approved by the Chief Executive Officer.

An update to council brands does not have any reliance, impact or involvement of external parties. The change will require the replacement of current signage, branding or logo use on some third party assets, but this will be done over the medium to long term on a priority basis and worked into current operating budgets.

An update to council brands does have an impact, reliance and involvement of internal parties particularly those with established branded assets, facilities and programs. An update would require all sub-brands to be modified or wholly changed. However, this will be done as an evolution with minimal cost or disruption. Primary assets will be identified and replacement of signage will be factored into the facility’s forward capital expenditure.

Stakeholders with internal sub-brands have been consulted on the update prior to this report going before council.

There are no conflicts of interest identified from this report.

Listening, leading and financial management

Council’s brand architecture has been developed in an ad-hoc, non-strategic manner, meaning that council has found itself with a number of disparate sub-brands that have been developed over time. There are no clear naming standards, rules or rationale for the creation of sub-brands, or a framework around their use or hierarchy in relation to the council master brand. Together this reduces the impact of the marketing messages, leads to negative positioning of the city and leads to inefficiencies.

Positive positioning requires intent. For the City of Ipswich, that means aligning and harnessing the power and reach of its brands and presenting a united brand front. Building a strong brand architecture is imperative to convey a common and consistent identity and reflect a unified approach.

Brand architecture should be designed with external audiences in mind, not designed to reflect legal entities or an internal organisational structure. When an existing brand can be used, a new brand should not be created. This approach to brand architecture works when you want to enrich the master or main brand with new associations. In the case of council, our alignment with our current sub-brands could yield quick wins for the master brand when associated with the engagement and reach of popular sub-brands. This will assist to drive positive association with the council brand.

Most importantly for council, brand recognition and brand equity builds trust. Brand recognition relies on consistency, brand naming clarity and building awareness quickly and efficiently. A unified brand consolidates brand capital to improve value and resilience.

The combined effect of this should also encourage a positive response in the community and more recognition of the large range of services that Ipswich City Council provides.

Graphic 1: Current Council Brand Relationship

There is no obvious relationship between the current council brands.

Graphic 2: Current Council Co-Brand Application

Since early 2019 council has used a co-branding approach to improve the relationship between council brands.

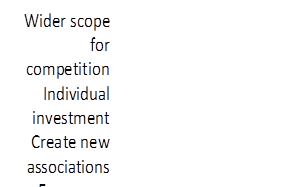

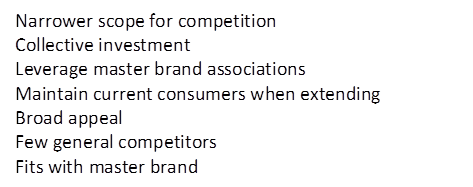

The advertising industry looks at brand relationships on a spectrum from the fully integrated Branded House to the practically independent House of Brands.

In this context, companies follow a set of guidelines which help understand how brands may fit together in a coherent offering and optimise its marketing efficiency and performance.

· What is the preferred brand relationship – Branded House, Sub-Brands, Endorsed Brands or House of Brands

· How many levels of branding should exist

· What types of brands exist at each level

· How brands at different levels relate to each other – if at all

· Which brand identities are dominant and which are recessive

· Decision making rules for creating new brands

Graphic 3: Brand Relationship Spectrum

![]() Using the brand

relationship spectrum, council would be classified as having a House of Brands.

A House of Brands allows for each brand to speak to a more specific purpose and

more targeted audience. The Art Gallery for example can rightly demonstrate

that their purpose and audience is distinctly different to Fire Station 101.

Council however has to consider if the higher purpose is to promote its

facilities and services to the entire community or to promote a specific

facility or service to a sub-group of consumers. A house of Brands also enables

a decoupling of risk when one of the brands fails or is harmed.

Using the brand

relationship spectrum, council would be classified as having a House of Brands.

A House of Brands allows for each brand to speak to a more specific purpose and

more targeted audience. The Art Gallery for example can rightly demonstrate

that their purpose and audience is distinctly different to Fire Station 101.

Council however has to consider if the higher purpose is to promote its

facilities and services to the entire community or to promote a specific

facility or service to a sub-group of consumers. A house of Brands also enables

a decoupling of risk when one of the brands fails or is harmed.

The co-brand application being applied by council currently enables a level of an Endorsed Brand relationship but it is a retrofitted outcome and therefore fails to correlate to any of the guidelines brands use to construct a coherent offering. The Endorsed Brand structure increases flexibility but limits the synergy effects. It therefore depends on the nature of the categories and target groups council wants to reach to decide if Endorsed Brands are the best structure. A rule of thumb is that the more disconnected the category / audience is from the parent, the more appropriate an Endorsed Brands approach.

In the July 2019 report provided a Branded House direction executed as below.

This approach makes for a more consistent brand experience that minimises confusion.

With a Branded House there are economies of scale and synergy effects, thus making it easier to build brand equity for each individual brand and for the portfolio as a whole. However, there is a risk of negative spill-over and it becomes both expensive and hard to do future brand changes.

The key question on this approach though is if the brand application works across all markets, categories, target groups. Most contemporary municipal branding is based in a Branded House application with key exceptions.

Newcastle for example has this year aligned all its council facilities and services in a Branded House. Prior to the rebrand, research showed that a third to half of Newcastle residents weren’t aware that the Civic Theatre, Museum and Art Gallery were council facilities.

![]()

![]()

The obvious exception Newcastle has made is for its destination brand. The reason for this relates to the brand promise, category and target group audience.

The purpose of the Newcastle council Brand House is to provide a narrative and consistency for council facilities and services to the community who engage with them.

The purpose of the destination brand however is to create awareness and provide a narrative to audiences outside of the region.

It is recommended that Ipswich City Council takes a similar approach to its brand application, that council establishes a Brand House for facilities and services which it provides the community it serves. Further examples of how that may be executed are provided here.

|

|

|

|

|

|

|

|

It is further recommended that programs which are clearly dealing with a brand promise, category and target group audience which is not a council facility or service for the local community have the opportunity to develop as stand-alone brands. The qualification of that recommendation however is that any such brand should complement the City of Ipswich Brand House.

The only clear example of such a brand which council will need to consider is the Discover Ipswich destination brand. This brand primarily promotes the products and services of private operators to audiences outside the Ipswich local government area. Its primary purpose is to create awareness, provide a narrative to audiences outside of the region and attract visitation to the city.

It is recommended that the Discover Ipswich destination brand be retained as a stand-alone brand but be adjusted to better complement the City of Ipswich Brand House.

Council may consider a similar exception to Ipswich Waste Services which is a commercial business unit of council delivering waste management services to domestic and commercial customers. However, as Ipswich Waste Services provides the city’s residential waste collection and manages the city’s recycling and refuse centres, there is a definite connection to council’s expected service provision. Therefore, it is more likely that the Ipswich Waste Services brand should operate within the council Brand House.

It is also worth considering the position of the Ipswich Art Gallery as stated in the Consultation section of this report.

This report and its recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Following the principles of this report, council will set in motion a body of work to consult and agree on a style guide which covers all sub-brands and applications.

The risk of proceeding with a City of Ipswich Brand House is that current sub-brands which have built a position and audience over many years will be discarded. This may change people’s opinions of those facilities and services for the negative through the more obvious association with council.

This risk would be mitigated by a focus on continuity of service being provided. Customers will experience no difference in their interaction with council facilities and services which were previously branded individually.

There is a potential risk of less effective marketing and communication if the facilities and services are standardised within a council Brand House. This may negatively impact the facilities and services ability to position themselves in their category and appeal to their target audience.

This risk would be mitigated by the application of the standardised brand within the broader context of each facility and service’s communications. Branding is not simply a logo, but an integrated style seen throughout the organisation’s communications. This standardisation does not necessarily prevent creativity and individuality in design, content, imagery or tone.

There is a potential risk of significant costs being incurred in the application of a City of Ipswich Brand House considering the vast amount of signage, collateral and merchandise council’s facilities and services require.

This risk would be mitigated by taking an as needs replacement approach over the medium to long term with costs being worked into operating budgets. Primary assets will be identified and replacement of signage will be factored into the facilities forward capital expenditure.

Not following the principles of this report presents a continued risk of failing to develop awareness and value in the community for the facilities and services council provides. Aligning council sub-brands is a proven and effective way to build positive brand equity and trust.

The implementation of the principles of this report has minimal direct resource and financial implication, as its application will be primarily on an as needed replacement when material has reached end of life or is scheduled for update.

Some key facilities signage will be actioned as a priority using some capital expenditure budget.

The Marketing and Promotions Branch will prioritise an updated Council Style Guide and continue to work with internal stakeholders on the brand architecture and sub-brand style guides. This work will result in resource efficiencies over the medium and longer term as a more coordinated and better defined and managed portfolio of style guides will reduce error, duplication and design time.

Owners of the key council sub-brands have been consulted as part of the development of this report, their positions are summarised below.

Ipswich Art Gallery – believes the Art Gallery should maintain a stand-alone brand as its audience is seeking a cultural experience, not a council interaction. Data indicates that 50% of visitation to the Art Gallery comes from outside the Ipswich region. The leading Australian regional galleries and museums tend to have stand-alone brands and in order to continue to attract high quality touring exhibitions it is important that the Ipswich Art Gallery is perceived to be part of this group.

Ipswich Libraries – believes the Libraries should maintain a stand-alone brand in a co-brand application as it has built a good amount of value in its brand. However, understands the benefit of a Brand House approach and could make it work.

Ipswich Civic Centre – believes the Civic Centre could operate within a Brand House without detriment.

Studio 188 – believes Studio 188 could operate within a proposed Brand House without detriment.

Fire Station 101 – believes Fire Station 101 could operate within a proposed Brand House without detriment.

Sport Ipswich – believes Sport Ipswich could operate within a proposed Brand House without detriment.

Ipswich Waste Services – TBC

In July 2019, council adopted an update to its City of Ipswich logo and sought further consideration of principles and options to align or eliminate council’s sub-brands.

This report uses a standard advertising industry framework to look at brand relationships on a spectrum from the fully integrated Branded House to the practically independent House of Brands with indication of the advantages and disadvantages at each point of the spectrum.

In the development of this report research has been undertaken to assess contemporary practice in municipal branding and a leading example of that has been included.

This report recommends council adopt a Branded House approach for those facilities and services which it provides the community it serves.

Carly Gregory

Marketing and Promotion Manager

I concur with the recommendations contained in this report.

Ben Pole

General Manager - Community, Cultural and Economic Development

“Together, we proudly enhance the quality of life for our community”

|

Economic Development Committee Meeting Agenda |

3 December 2019 |

ITEM: 2

SUBJECT: Tender Consideration Plan Approval - Retail Project Audit Consultants

AUTHOR: Project Manager

DATE: 22 November 2019

Executive Summary

This is a report concerning a proposed Tender Consideration Plan for the engagement of design audit consultants for the retail works within the Nicholas Street - Ipswich Central project (the Retail Project).

RECOMMENDATION

That the Interim Administrator of Ipswich City Council resolve:

A. That a Tender Consideration Plan be prepared in accordance with section 230(1)(a) of the Local Government Regulation 2012 (Qld) to engage design audit consultants for the Nicholas Street – Ipswich Central project.

B. That the Tender Consideration Plan as outlined in the report by the General Manager – Coordination and Performance dated 22 November 2019, in accordance with section 230(1)(b) of the Local Government Regulation 2012 for the engagement of design audit consultants for the Nicholas Street – Ipswich Central Retail Project be adopted by Council.

C. That the Chief Executive Officer be authorised to negotiate and finalise the terms of the retail project variations to be executed on behalf of Council and to do any other acts necessary to implement Council’s decision in accordance with section 13(3) of the Local Government Act 2009.

RELATED PARTIES

· Bornhorst and Ward

· WSP

· Rider Levett Bucknall

· Cambray

· Hutchinson Builders

Advance Ipswich Theme

Strengthening our local economy and building prosperity.

Purpose of Report/Background

The purpose of this report and tender consideration plan is to procure consultants to audit the work currently being conducted by Hutchinson Builders on the design of the retail assets contained in the Ipswich Central redevelopment.

The Retail project is part of a broader program of works taking place to revitalise the Ipswich CBD around Nicholas Street adjacent to the current construction as summarised below:

· The Eats building is partially located within the Civic Project construction site. For example, the elevator to the Eats building and several internal walls are being replaced as part of the Civic Project;

· The Metro B building is immediately adjacent the Civic Project and external paving that serves Metro B is part of the Civic Project scope of work. Work to the exterior of the Metro B will require access from the Civic Project construction site;

· The Metro A building is adjacent to Metro B. It doesn’t directly interface with the Civic Project and progressing construction works to this building is subject to a future council decision;

· Parts of the Civic Project, Eats Building and Metro A are either adjacent to or directly over the operating rail corridor servicing the electrified rail network; and

· The Venue building is located on Nicholas Street approximately 50m from the current site.

Hutchinson Builders are currently working on designs for the retail assets contained in the Ipswich Central redevelopment area.

The scope of work to which the tender consideration plan relates is summarised as the engagement of audit consultants to peer review Hutchinson Builders design as it progresses to construction documentation for the retail project. The procurement of the consultants identified in this report under the tender consideration plan is required to audit the work conducted by Hutchinson Builders to ensure that it is appropriate and to assess the costs associated with these works to ensure that value for money is achieved for Ipswich ratepayers.

These consultants are currently engaged by Council to conduct audit services for the civic and administration works in the Ipswich Central redevelopment and the TCP seeks to engage them to conduct the additional audit services required for the retail development.

The report recommends that the attached Tender Consideration Plan (TCP) be adopted.

The Local Government Regulation 2012 Section 230 allows a local government to enter into medium and large contractual agreements, without first inviting written quotes or tenders, through the preparation and adoption of a TCP. The TCP provides the information required to comply with the regulation and to justify the use of the plan as an effective and appropriate alternative to seeking quotes or to calling for open tenders.

The TCP details the advantages of extending engagements of existing consultants to undertake the audit role for the Retail Project including:

· Retain the intellectual knowledge these consultants have on the Retail Project due to long-standing involvement;

· Remove risks associated with historical project knowledge being lost, and retain resources and expertise currently on site and familiar with the precinct;

· Utilise the consultants who created the original Retail Project design to review and provide comment on any changes proposed by the head contractor’s D&C subcontractors;

· Remove likely delays and additional costs associated with an incoming consultant getting up to speed with the project;

· Maintaining benefits of existing contractual agreements through warranties and licenses to intellectual property (IP); and

· Continuation of Professional Indemnity coverage of existing consultants.

Legal/Policy Basis

This report and its recommendations are consistent with the following legislative provisions:

Section 230 (1) (a) and (b) of the Local Government Regulation 2012

RISK MANAGEMENT IMPLICATIONS

Fee proposals received from the audit consultants will be assessed by the project’s independent cost consultant against market rates for roles from similar projects to ensure they are appropriate. Doing so will ensure that value for money is achieved for the services provided.

Extending existing contractual engagements with nominated consultants will be in accordance Council’s standard terms.

Failure to engage the audit services of these consultants could result in financial and reputational damage to Council.

Financial/RESOURCE IMPLICATIONS

The services being provided by these consultants to audit the design work of Hutchinson Builders will not result in significant costs to Council.

These costs will be covered under the existing approved Ipswich Central

redevelopment budget.

COMMUNITY and OTHER CONSULTATION

No consultation has been conducted in relation to this report.

Conclusion

It is recommended that Council adopt the TCP for the following reasons:

· Retain the intellectual knowledge these consultants have on the Retail Project due to long-standing involvement;

· Remove risks associated with historical project knowledge being lost, and retain resources and expertise currently on site and familiar with the precinct;

· Utilise the consultants who created the original Retail Project design to review and provide comment on any changes proposed by the head contractor’s D&C subcontractors;

· Remove likely delays and additional costs associated with an incoming consultant getting up to speed with the project;

· Maintain benefits of existing contractual agreements through warranties and licenses to IP;

· Continuation of Professional Indemnity coverage of existing consultants;

· Avoid delays associated with a new procurement process;

· Minimise tender management costs for Council; and

· Minimise tendering costs to industry.

Attachments and Confidential Background Papers

|

1. |

Tender Consideration Plan - Retail Audit Consultants ⇩ |

Greg Thomas

Project Manager

I concur with the recommendations contained in this report.

Sean Madigan

General Manager - Coordination and Performance

I concur with the recommendations contained in this report.

David Farmer

Chief Executive Officer

“Together, we proudly enhance the quality of life for our community”

|

Economic Development Committee Meeting Agenda |

3 December 2019 |

ITEM: 3

SUBJECT: Tender Consideration Plan - Principal Contractor for Commonwealth Hotel Reconstruction Work

AUTHOR: Project Manager

DATE: 22 November 2019

Executive Summary

This is a report concerning the procurement process for the Principal Contractor for the reconstruction of the Commonwealth Hotel. This report recommends that competitive tenders be invited from a list of suitably qualified Contractors drawn from the Expression of Interest (EOI) process completed in 2017 for this same purpose. Due to the time elapsed since this initial EOI process, the list be supplemented if required with other suitably qualified Contractors currently available for the work.

The section 230 of the Local Government Regulation 2012 allows a local government to enter into medium and large contractual agreements, without first inviting written quotes or tenders, through the preparation and adoption of a Tender Consideration Plan (TCP). The TCP provides the information required to comply with the regulation and to justify the use of the plan as an effective and appropriate alternative to seeking quotes or to calling for open tenders. The scope of services to which the TCP relates is:

· Principal Contractor for the Commonwealth Hotel Reconstruction Work.

Recommendation/s

That the Interim Administrator of Ipswich City Council resolve:

A. That a Tender Consideration Plan be prepared in accordance with section 230 (1) (a) of the Local Government Regulation 2012 (Qld) for the Principal Contractor for Commonwealth Hotel Reconstruction Work, as outlined in the report by the General Manager – Coordination and Performance dated 25 November 2019.

B. That in accordance with section 230(1)(b) of the Local Government Regulation 2012, the Tender Consideration Plan for the Principal Contractor for Commonwealth Hotel Reconstruction Work, be adopted

C. That the Chief Executive Officer be authorised to negotiate and finalise the terms of the contracts to be executed by Council and to do any other acts necessary to implement Council’s decision in accordance with section 13(3) of the Local Government Act 2009.

RELATED PARTIES

Refer to confidential Attachment 4 ‘Draft List of Contractors for Prequalification’.

Advance Ipswich Theme

Strengthening our local economy and building prosperity.

Purpose of Report/Background

· ICP has previously invited EOI’s for ‘Demolition, Deconstruction, Construction and Traditional Heritage Reconstruction Works’ for the Commonwealth Hotel. These were submitted on 24 November 2017.

· Pursuant to a separate procurement process James Trowse (QLD) Pty Ltd was awarded a Contract for Design and Construction of Jacking, Underpinning and Foundation Works and this scope of work is now complete.

· The work of reconstructing the Commonwealth Hotel is expected to be issued for tender in Q1 of 2020. The purpose of this report is to confirm (due to the elapsed time) that the tender be issued to a short-list of contractors that responded to the 2017 EOI process. Furthermore, if required, this list be supplemented with suitably qualified contractors currently operating in the market drawn from consultant recommendations.

Legal/Policy Basis

This report and its recommendations are consistent with the following legislative provisions:

Section 230 (1) (a) and (b) of the Local Government Regulation 2012.

RISK MANAGEMENT IMPLICATIONS

New engagements will be formed on the basis of Council’s standard terms in consultation with Council’s legal advisors.

Financial/RESOURCE IMPLICATIONS

Any additional resources required as a result of the engagement of these supplier or contractors on the Ipswich Central CBD Transformation Project will be funded within current project budget allocations.

COMMUNITY and OTHER CONSULTATION

There has been no community consultation conducted in relation to this report.

Conclusion

It is recommended that the contract for rebuilding the Commonwealth Hotel be procured by competitive tender to a select short-list of Contractors to be prequalified from the original EOI process completed for this purpose in 2017 and supplemented if required from suitably qualified contractors currently available in the market. The benefits include:

· Utilising the work completed during the original EOI process.

· Avoiding potential delays associated with a repeated EOI or open tender process.

· Avoiding wasted effort by the industry or Council by limiting the competitive tender list to four suitably qualified Contractors capable of completing this specialised heritage restoration.

Conducting a competitive tender process in lieu of awarding the work as a variation to the incumbent contractor James Trowse or the adjacent contractor Hutchinson Builders.

Attachments and Confidential Background Papers

|

1. |

Tender Consideration Plan Commonwealth Hotel

Reconstruction Work ⇩ |

|

|

|

|

|

CONFIDENTIAL |

|

2. |

|

|

3. |

|

|

4. |

Greg Thomas

Project Manager

I concur with the recommendations contained in this report.

Sean Madigan

General Manager - Coordination and Performance

“Together, we proudly enhance the quality of life for our community”

|

Economic Development Committee Meeting Agenda |

3 December 2019 |

ITEM: 4

SUBJECT: Ipswich Central Program Report No. 17 to 16 October 2019 and Report No. 18 to 15 November 2019

AUTHOR: Business Support Officer

DATE: 19 November 2019

This is a report concerning a monthly update for the Ipswich Central Program of Works.

That the report on the Ipswich Central Program Report No. 17 effective to 16 October 2019 and Report No. 18 effective 15 November 2019 be received and the contents noted.

Program Management Partner, Ranbury Management Group – for the Ipswich CBD Transformation Project.

Strengthening our local economy and building prosperity

This report includes Monthly Program Report No. 17 for Ipswich Central effective to 16 October 2019 and Report No. 18 for Ipswich Central effective to 15 November 2019. It is to inform the Committee of the progress of the redevelopment works, including status of design, procurement, programme, potential risks with related mitigation strategies, etc.

Not applicable

Not applicable

This report and its recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Not applicable

This report is provided as a monthly update on the Ipswich Central Program of Works.

|

1. |

Summary Report No 17 ⇩ |

|

2. |

Summary Report No 18 ⇩ |

|

|

|

|

|

CONFIDENTIAL |

|

3. |

|

|

4. |

Nicole Denman

Business Support Officer

I concur with the recommendations contained in this report.

Sean Madigan

General Manager - Coordination and Performance

“Together, we proudly enhance the quality of life for our community”

ITEM: 5

SUBJECT: Tender Consideration Plan Approval - Retail Construction - Nicholas Street - Ipswich Central

AUTHOR: Business Support Officer

DATE: 22 November 2019

Executive Summary

This is a report concerning a proposed Tender Consideration Plan for the provision of construction work associated with the retail areas within Nicholas Street - Ipswich Central project (i.e. the Retail Project).

RECOMMENDATION

That the Interim Administrator

of Ipswich City Council resolve:

A. That the Tender Consideration Plan for the procurement of the Nicholas Street Ipswich Central Retail Project construction work to be awarded as a variation to the civic project D&C contract, as outlined in the report by the General Manager, Coordination and Performance dated 12 November 2019, be adopted by Council in accordance with section 230(1)(b) of the Local Government Regulation 2012.

B. That the Chief Executive Officer be authorised to negotiate and finalise the terms of the Retail Project variation to be executed on behalf of Council and to do any other acts necessary to implement Council’s decision in accordance with section 13(3) of the Local Government Act 2009.

RELATED PARTIES

Ranbury, Hutchinson Builders and various other suppliers and sub consultants listed in Attachment 1 - Tender Consideration Plan.

The Interim Administrator has previously stated that he has, or could reasonably be taken to have, a perceived conflict of interest in relation to Ranbury Management Group. The nature of the perceived conflict of interest is that Ranbury Management Group is the primary consultant for the CBD Redevelopment and from 2008 to 2012 the interim administrator was an employee and was a director and part owner of Ranbury but has had no association with the company since then other than through his current role.

Advance Ipswich Theme

Strengthening our local economy and building prosperity

Purpose of Report/Background

The report recommends that the Tender Consideration Plan (TCP), requested to be prepared by Council on 28 October 2019, now be adopted. Pursuant to completion of a competitive bid process for selected trade subcontractors and detailed negotiation by the Chief Executive Officer the Retail Project work be awarded as a variation to the Civic Project D&C Contract.

The Local Government Regulation 2012 Section 230 allows a local government to enter into medium and large contractual agreements, without first inviting written quotes or tenders, through the preparation and adoption of a TCP. The TCP provides the information required to comply with the regulation and to justify the use of the plan as an effective and appropriate alternative to seeking quotes or to calling for open tenders.

The scope of work for which the TCP relates (i.e. Retail Project) are summarised below as demolition and landlord works for:

· Eats Building

· Venue Building

· Metro B

· Metro A (selected work only) The work will exclude tenant fit out.

The Retail Project is part of a broader program of works taking place to revitalise the Ipswich CBD around Nicholas Street, the largest part of which is the Civic Project. A competitive tender process was undertaken to appoint the D&C Contractor for the Civic Project.

Prior to award of the contract for the Civic Project, during commercial negotiations, clauses were included in the Civic Project Contract to enable the Retail Project to be added to the scope of the Civic Project via a contract variation if the Principal (Council) requested it. The Retail Project is approximately 25% of the value of the Civic Project depending on the elements that are chosen to proceed.

During negotiations, fixed rates for profit and overheads were pre-agreed and included in the Construction Contract pursuant to review by the Council’s quantity surveyor Rider Levitt Bucknall (RLB). The relevant Retail Project terms were drafted by ICC’s lawyers Clayton Utz and included in the Contract.

The Retail Project is located adjacent to the Civic Project as summarised below:

· The Eats building is partially located within the Civic Project construction site. For example, the elevator to the Eats building and several internal walls are being replaced as part of the Civic Project;

· The Metro B building is immediately adjacent the Civic Project and external paving that serves Metro B is part of the Civic Project scope of work. Work to the exterior of the Metro B will require access from the Civic Project construction site;

· Parts of the Civic Project, Eats Building and Metro A are either adjacent to or directly over the operating rail corridor servicing the electrified rail network;

· The Metro A building is adjacent Metro B. It doesn’t directly interface with the Civic Project with and subject to a future council decision;

· The Venue building is located on Nicholas Street approximately 50m from the current site.

INDEPENDENT THIRD-PARTY REVIEWS

Quantity Surveyor

Independent quantity surveyor RLB reviewed Hutchinson Builder’s rates for preliminaries included in Retail Variation contract clause against market rates from similar projects. Their benchmarking exercise included in confidential Attachment 3 concluded that the proportion nominated for preliminaries is fair and reasonable for the scope included and falls within the cost plan allowance for these works.

RLB also reviewed the exclusions from the Retail Variation preliminaries (e.g. survey/set-out, traffic control, fencing gantries etc.) and confirmed these also fall within the current cost plan parameters.

The provision for margin/profit in the Retail Variation is the same allowance used within the main Civic Project contract.

Probity Adviser

Independent probity consultant, Argyle Corporate Advisers, performed a review to confirm that the proposed process for engaging Hutchinson Builders to undertake the Retail Project works as a variation to the existing Civic Project contract is consistent with:

· Council’s procurement principles;

· The intent of ‘Clause 36.7 Proposed Retail Variations’ in the existing D&C contract in place between Council and Hutchinson Builders for the Civic Project works; and,

· Adheres to the sound contracting principles as set out in Section 104(3) of the Local Government Act 2009.

The probity adviser concluded that the proposed retail variation to Hutchinson Builder’s D&C contract is not inconsistent with the contents of Council’s procurement policy 2018 – 2019, and that by implementing the measures outlined in the Tender Consideration Plan, Council will achieve the intent of Clause 36.7 and adhere to sound contracting principles, including value for money, as set out in Section 104 (3) of the Local Government Act 2009.

Argyle’s probity statement is included in Attachment 2, with a more detailed probity report included in confidential Attachment 4.

This report and its recommendations are consistent with the following legislative provisions:

Local Government Regulation 2012

RISK MANAGEMENT IMPLICATIONS

The existing Contract for the Civic Project has been extensively reviewed by Council and external legal resources. The existing Civic Project contract includes clauses drafted by Council’s legal advisers to enable the option for incorporating the work of the Retail Project via a variation to the Civic Project contract.

Inclusion of these works into one Contract reduces the risk of managing multiple Contractors working on adjoining buildings.

Financial/RESOURCE IMPLICATIONS

The Tender Consideration Plan details the advantages of proceeding with the work as a variation including:

· Maintaining the intellectual knowledge suppliers have on the Project due to long-standing involvement;

· A single point of responsibility for the design and management of construction works in a confined area of the CBD;

· Reduced tender period and overall delivery timeframe;

· Reduced management costs to Council;

· Reduced tendering burden on the industry - reduces risk of market failure in the tender process due to the current Contractor’s site location;

· Competitive pricing will still be undertaken for approximately 77% of subcontract work in a transparent process fully auditable by the Council’s independent quantity surveyor;

· The main item being single-sourced is the Principal Contractor role which is benchmarked against the results for the competitive tender process for the recently awarded Civic Project;

· Reduced interface risk associated with multiple contractors since one contractor will be responsible for coordination of construction works on the site;

· Reduced risk profile due to the elimination of interface risk between different contractors and the responsibility for coordination of works by a single contractor;

· Single point of accountability remains with a Tier 1 contractor for any disruptions to the rail corridor and rail network operations;

· Reduced risk of access issues for material supply and mitigation of potential delay claims; and

· Reduced overall cost for the works.

The indicative costs as assessed by the Project Team and the quantity surveyor for the development of the Venue, Eats and Metro B are $37.57 million. Further work is required to quantify the limited upgrade to the façade of Metro A. The detailed financial analysis for the development of these assets was contained in the KPMG report provided to Council on 28 October 2019. Council’s Finance Branch are aware of these costs and are incorporating these into Council’s budget.

COMMUNITY and OTHER CONSULTATION

The likely impact on community and the public is expected to be reduced by streamlining construction activities to a single Principal Contractor for coordination of works within the precinct.

Council’s Finance Branch have been consulted in relation to costs of the development of these assets.

Council’s Legal Branch have been consulted in relation to the contents of this report and have reviewed the recommendations.

Conclusion

It is recommended that Council adopt the TCP for the following reasons:

· Maintaining the intellectual knowledge suppliers have on the Project due to long-standing involvement;

· Preserve a single Principal Contractor on the existing site and the expanded site area to facilitate safety for workers and the public;

· Preserve a single Principal Contractor in the precinct to streamline activities that may be disruptive to the tenants and public within the precinct;

· Avoid delays associated with a full procurement process;

· Minimise tender management costs for Council;

· Minimise tendering costs to industry;

· Make use of the Civic Project Contract clauses and rates that were negotiated prior to contract award;

· Gain a program benefit by starting on works while the site is still in possession of the current Principal Contractor;

· Reduced risk profile due to the elimination of interface risk between different contractors and the responsibility for safety and coordination of works by a single contractor;

· Single point of accountability remains with a Tier 1 Contractor for any disruptions to the rail corridor and rail network operations;

· Reduce construction risk by conducting selective demolition and site investigation using resources and expertise currently on site and familiar with the precinct; and

· Ensure consistency with finishes and fixtures across the precinct between the Civic Project and Retail Project.

Attachments and Confidential Background Papers

|

1. |

Tender Consideration Plan ⇩ |

|

2. |

Probity Statement ⇩ |

|

|

|

|

|

CONFIDENTIAL |

|

3. |

|

|

4. |

|

|

5. |

Nicole Denman

Business Support Officer

I concur with the recommendations contained in this report.

Sean Madigan

General Manager - Coordination and Performance

I concur with the recommendations contained in this report.

David Farmer

Chief Executive Officer

“Together, we proudly enhance the quality of life for our community”