IPSWICH

CITY

COUNCIL

AGENDA

of the

AGENDA

Finance and Governance

Committee

Tuesday, 20 May 2025

10 minutes after the conclusion of the Infrastructure,

Planning and Assets Committee or such later time as determined by the preceding

committee

Council Chambers, Level 8

1 Nicholas Street, Ipswich

|

MEMBERS OF THE Finance and

Governance Committee

|

|

Councillor Paul Tully (Chairperson)

Councillor Jacob Madsen (Deputy Chairperson)

|

Mayor Teresa Harding

Deputy Mayor Nicole Jonic

Councillor Marnie Doyle

Councillor Andrew Antoniolli

Councillor Jim Madden

|

|

Finance and Governance

Committee

Meeting Agenda

|

20 May

2025

|

Finance and Governance

Committee AGENDA

|

Item No.

|

Item Title

|

Page No.

|

|

|

Welcome to Country or Acknowledgment of Country

|

|

|

|

Declarations of Interest

|

|

|

|

Business Outstanding

Finance and Governance Committee 20 May 2025

Item 8 (Amendment of Lease Between Ipswich City Council

(Lessor) and Swifts Leagues Club Ltd (Lessee) and Entry into Associated

Documentation)

·

Question – Formal Business Plan

|

|

|

|

Confirmation of Minutes

|

|

|

1

|

Confirmation of Minutes of the Finance and Governance

Committee No. 2025(03) of 22 April 2025

|

9

|

|

|

Officers’ Reports

|

|

|

2

|

**Proposed Agreement for Lease - Dress Circle, Brookwater

|

20

|

|

3

|

**Lease Renewal over Freehold Land at 7-9 John Street,

Rosewood

|

25

|

|

4

|

Proposed Fees and Charges to apply from 1 July 2025

|

37

|

|

5

|

Monthly Financial Performance Report - April 2025

|

55

|

|

6

|

**Procurement - Infor Pathway Local Government Platform

|

66

|

|

7

|

Procurement - Online Community Engagement Platform

|

72

|

|

|

Notices of Motion

|

|

|

|

Matters Arising

|

|

|

|

Questions / General Business

|

|

** Item includes confidential papers

Finance

and Governance Committee NO. 2025(04)

20 May 2025

AGENDA

Welcome to

Country or Acknowledgement of Country

DECLARATIONS OF INTEREST IN MATTERS ON THE AGENDA

BUSINESS OUTSTANDING

Finance and Governance Committee 22 April 2025

QUESTION – Formal Business Plan

Mayor Teresa Harding stated that in the officer’s

report for Item 8 it talks about the tenure

of property policy ordinarily requiring a business plan to

be submitted in order to justify a

term of five (5) years in length and that Swifts have not

provided a formal business plan.

Mayor Harding queried why a formal business plan has not

been provided.

That the General Manager,

Corporate Services provide the Mayor and Councillors

with the reason why a formal

business plan has not been provided by Swifts.

RESPONSE

The following response to

this question was provided to all councillors:

At present the Tenure of

Property Policy does not specifically call out the format or

the specific content that a

business case should address where a lease term of 5 years or greater is

requested. It should also be noted that the current request relates to a variation

of an existing lease rather than the grant of a new lease.

Swifts have provided

explanations of their plans on occasion through the discussions, both prior to

the resolution on 8 December 2022 and during more recent discussions. Whilst

these have not taken the form of a traditional business case, they have

identified their planned future use for the premise and provided some concept designs

for the facility they are planning to construct.

Swifts have also flagged

concerns regarding the commercial risk present in a

competitive market and are

particularly apprehensive about any plans for future

development being made

publicly available.

Based on the above, we are

comfortable that the requirements of the Tenure of

Property Policy have been met.

Confirmation of

Minutes

1. Confirmation of Minutes of the Finance and

Governance Committee

No. 2025(03) of 22 April 2025

Recommendation

That the minutes of the Finance

and Governance Committee held on 22 April 2025 be confirmed.

Officers’

Reports

2. **Proposed Agreement for Lease - Dress Circle,

Brookwater

This is a report concerning a

proposed Agreement for Lease in conjunction with future local recreation parks

within the Dress Circle development at Brookwater.

Recommendation

A. That

pursuant to section 236(2) of the Local Government Regulation 2012 (Regulation),

Council resolve that the exception at section 236(1)(b)(ii) of the Regulation

applies to the disposal of interest in land at the Brookwater Dress Circle

development, more particularly described as two (2) equivalent local recreation

parks, to a community organisation, namely the Body Corporate for the

Brookwater Dress Circle Home Owners Club (BDCHOC) Community Titles Scheme.

B. That

Council enter into an agreement for lease and lease with the Body Corporate for

the BDCHOC Community Titles Scheme, Springfield Land Corporation (No.2) Pty

Limited and Springfield City Group Pty Limited.

C. That

the Chief Executive Officer be authorised to negotiate and finalise the terms

of the lease agreements for the future parks.

3. **Lease Renewal over Freehold Land at 7-9 John

Street, Rosewood

This is a report concerning the

proposed renewal over freehold land located at

7-9 John Street, Rosewood, described as part of Lot 9 on RP906761 (the Land),

between Ipswich City Council (Council) and Robert David Carrbuthers (RDC).

Recommendation

A. That

pursuant to section 236(2) of the Local Government Regulation 2012 (Regulation),

Council resolve that the exception at section 236(1)(c)(iii) of the Regulation

applies to the disposal of interest in land at 7-9 John Street, Rosewood more

particularly described as part of Lot 9 and Plan RP906761, for solicitor’s

office purposes, because it is for renewal of a lease to the existing lessee.

B. That

Council renew the lease (Council file reference number 6209 with Robert David

Carruthers (Lessee):

(i) at

a commencing annual rent of $18,500 excluding GST, payable to Council, and

(ii) for

an initial term of five (5) years, with no options for extension.

4. Proposed Fees and Charges to apply from 1 July

2025

This is a report concerning the

annual review of Ipswich City Council’s (Council) proposed commercial and

cost recovery fees and charges, and the recommended pricing to commence with

effect 1 July 2025.

Recommendation

That the proposed 2025-2026 Fees

and Charges, as detailed in Attachment 1 (excluding the following pages:

pages 19 to 32 Sections 1 to 7.4

pages 34 to 39 Sections 1 to 7.1

pages 40 to 41 Sections 8 to 8.8

page 41 Section 9

page 41 Sections 10 to 10.2

pages 41 to 43 Sections 11 to

11.1.2

Page

114 Sections 1 to

1.3

Pages 115 Section

3

Pages

116 to 117 Sections 3.2 to 3.2.4)

be adopted with an effective

date of 1 July 2025.

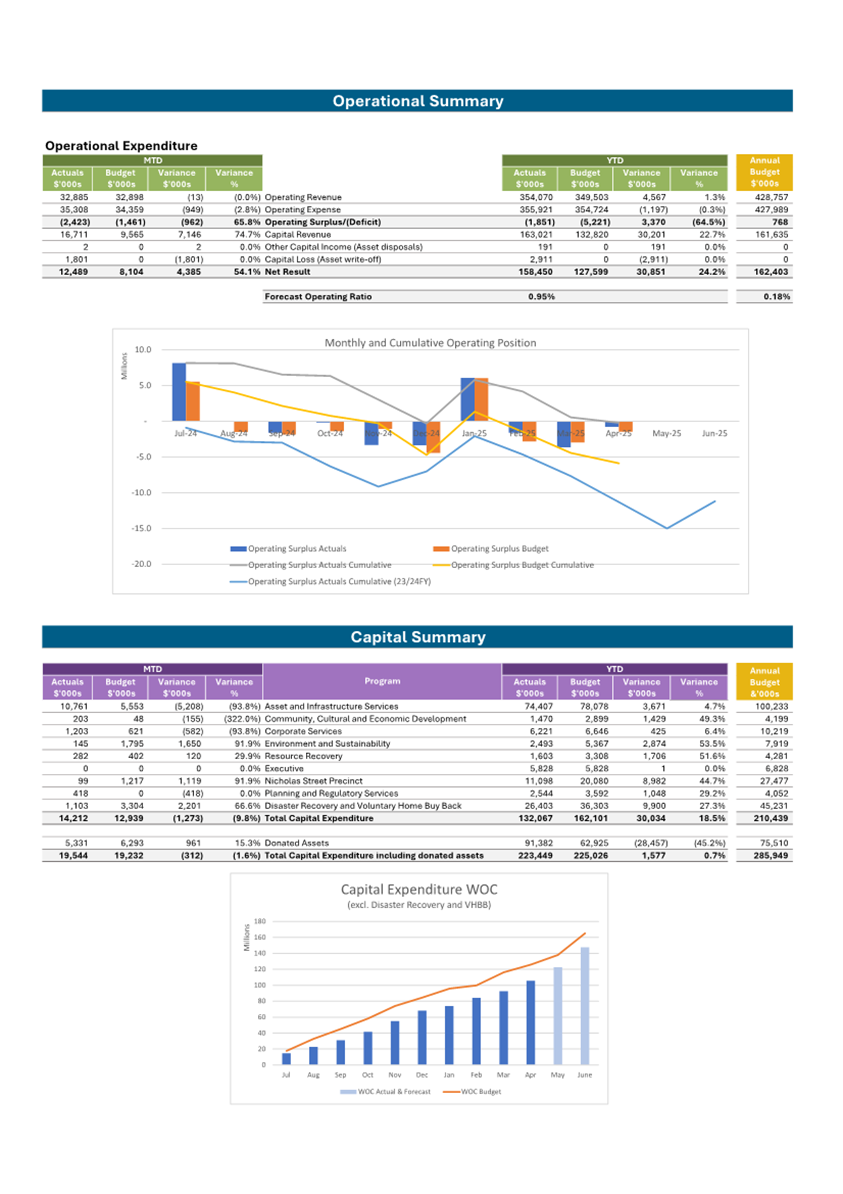

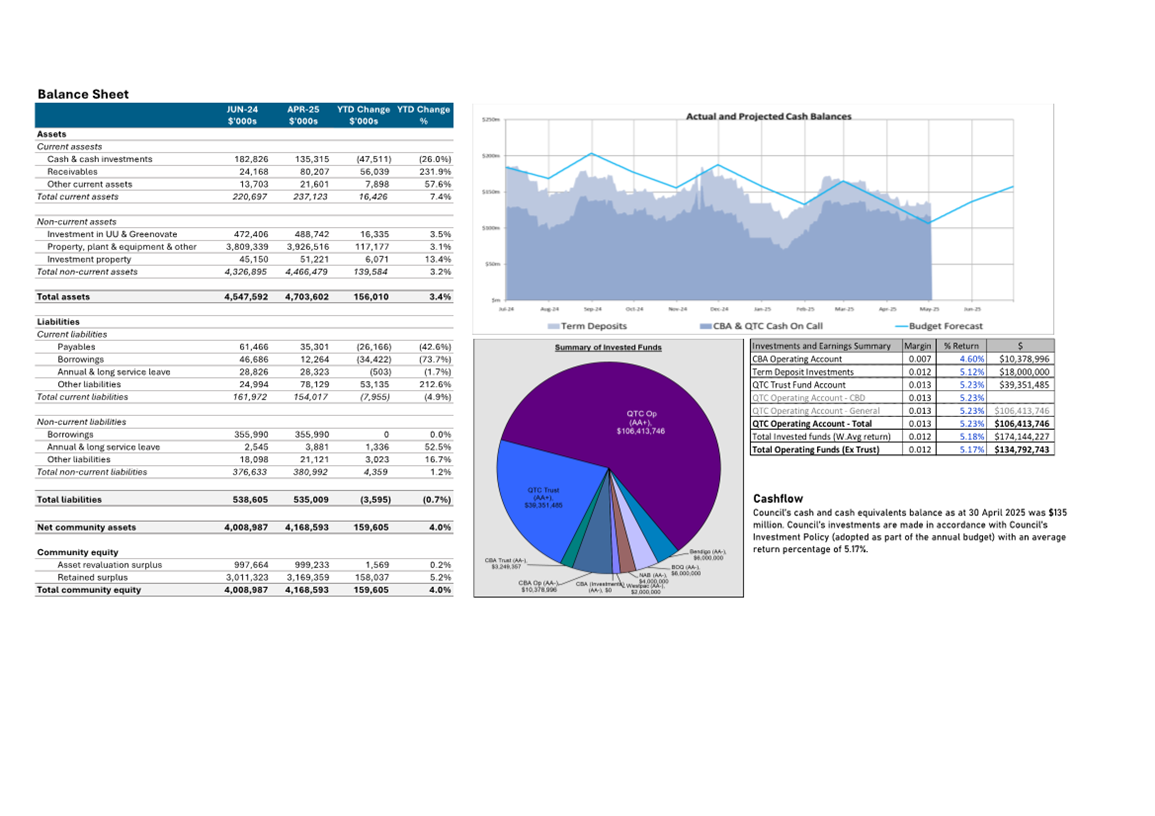

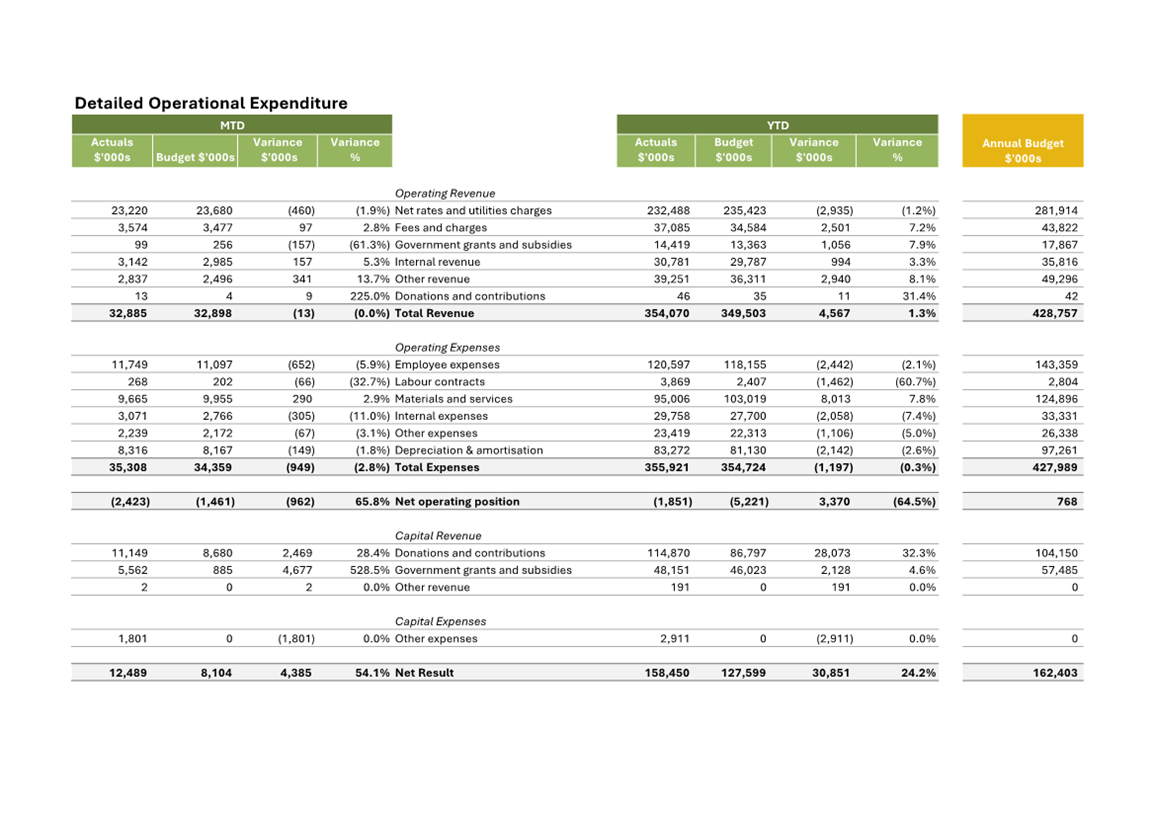

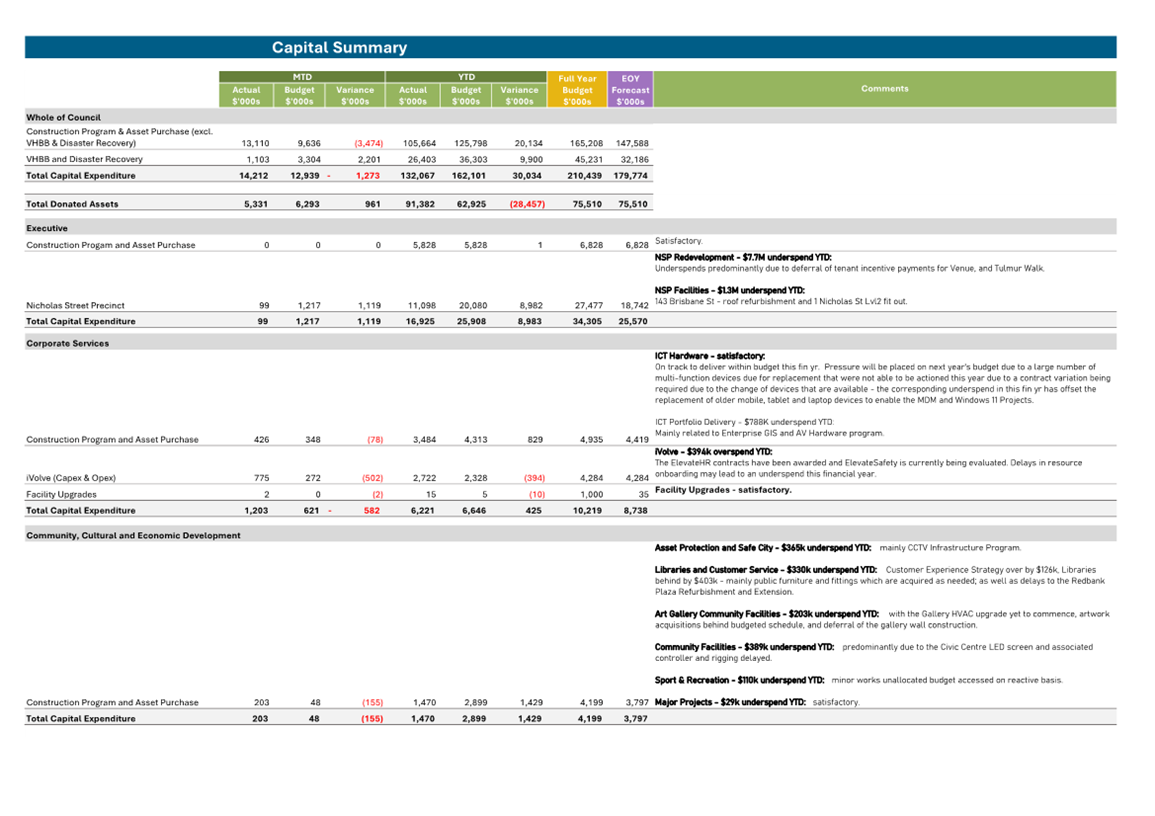

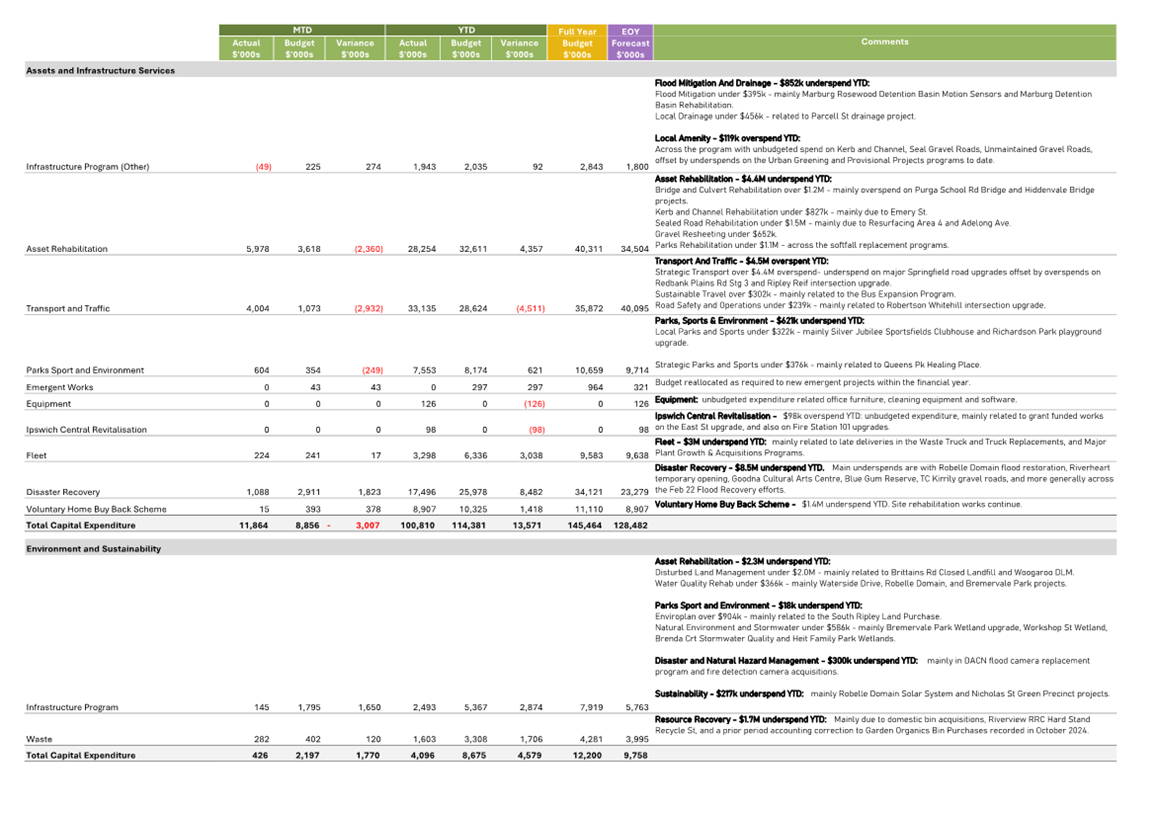

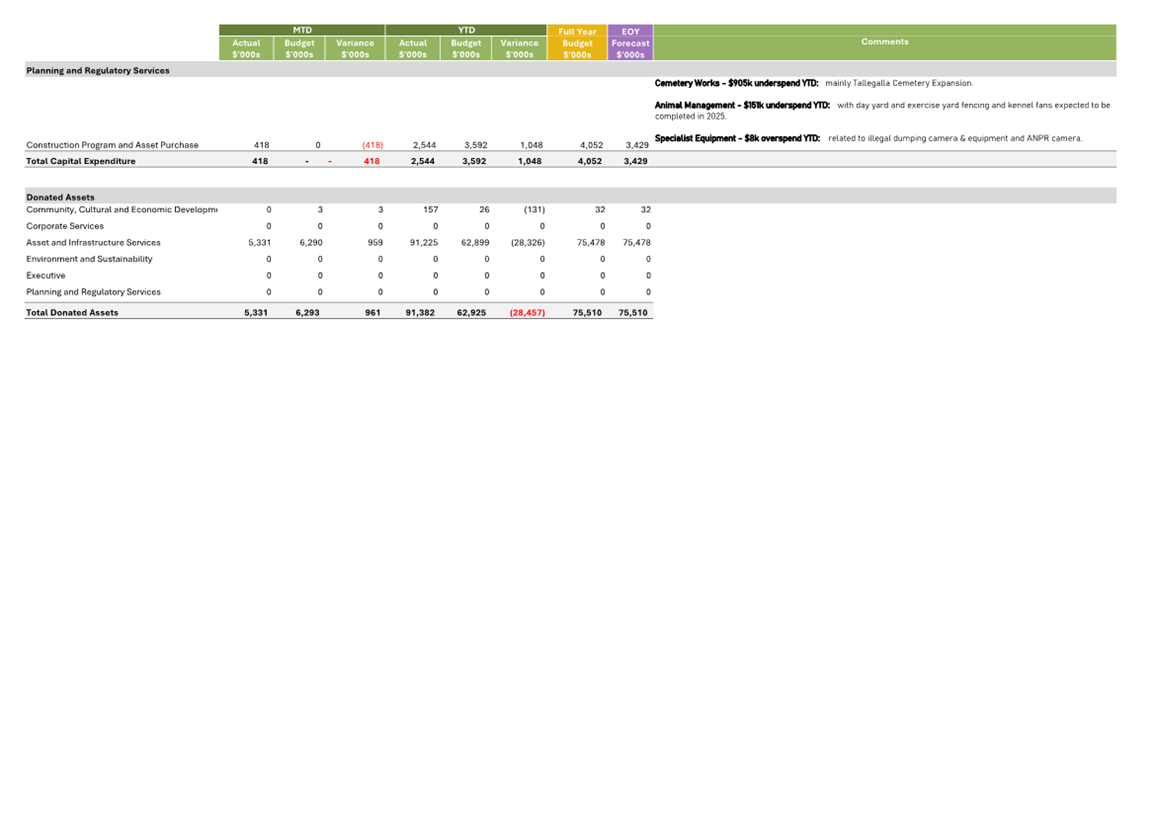

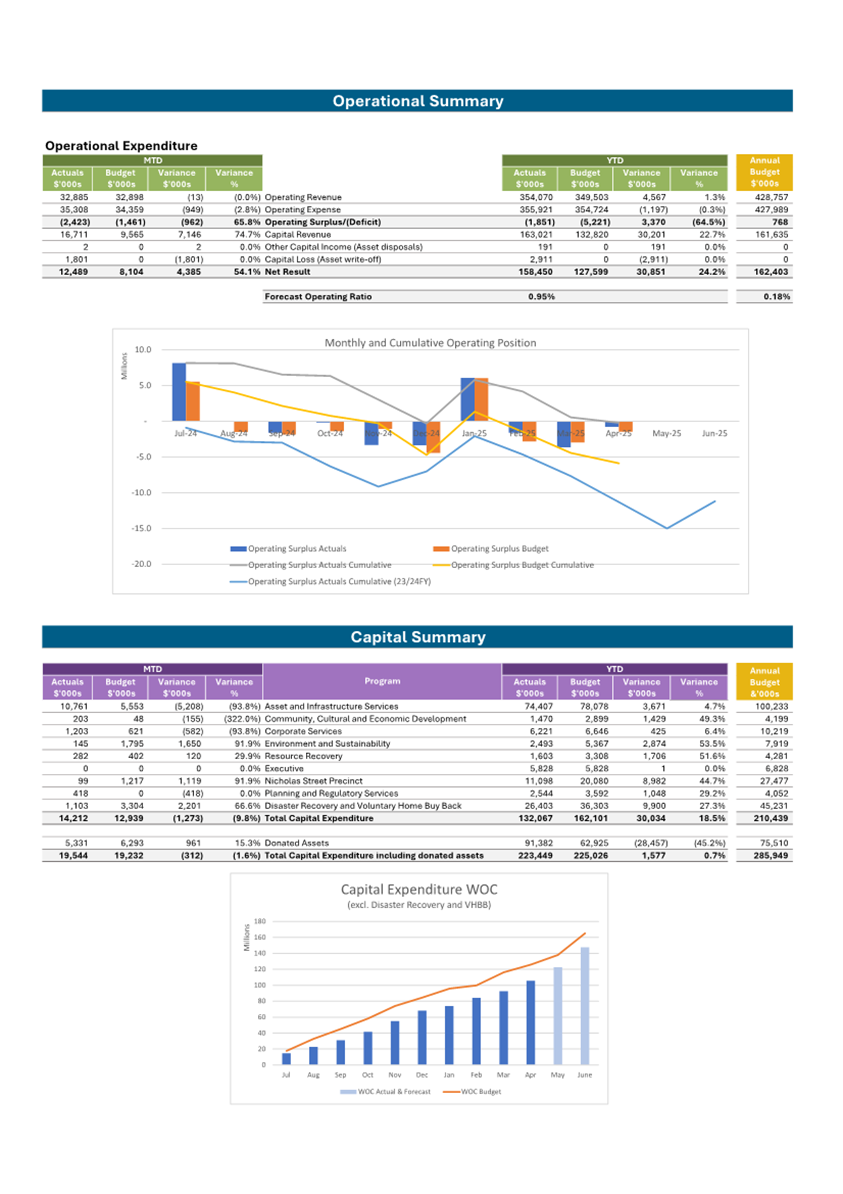

5. Monthly Financial Performance Report - April

2025

This is a report concerning

Ipswich City Council’s (Council) financial performance for the

period ending 30 April 2025, submitted in accordance with section 204 of the Local

Government Regulation 2012.

Recommendation

That the report on

Council’s financial performance for the period ending

30 April 2025, submitted in accordance with section 204 of the Local

Government Regulation 2012, be considered and noted by Council.

6. **Procurement - Infor Pathway Local Government

Platform

This is a report seeking

resolution by Council to enter into a contract with Infor Global Solutions

(ANZ) Pty Limited for the provision of Infor Pathway, a Local Government Cloud

Solution for a period of five (5) years at an estimated cost of $4,000,000 (ex

GST), without inviting quotes.

The exception under section

235(b) of the Local Government Regulation 2012 applies as the services

provided are of a specialised nature and it would be disadvantageous or

impractical to invite tenders.

Recommendation

A. That

pursuant to Section 235(b) of the Local Government Regulation 2012

(Regulation), Council resolve that the exception applies because of the

specialised nature of the services that are sought and it would be impractical

and disadvantageous to invite tenders for the provision of Infor Pathway.

B. That

Council enter into a contractual arrangement (Council file reference number 250226-000320) with Infor Global Solutions (ANZ) Pty

Limited (ABN 25 003 538 314), at an approximate purchase price of $4,000,000

excluding GST over the entire term, being a term of five (5) years, with no

options for extension.

C. That

pursuant to Section 257(1)(b) of the Local Government Act 2009, Council

resolve to delegate to the Chief Executive Officer the power to take “contractual

action” pursuant to section 238 of the Regulation, in order to

implement Council’s decision.

7. Procurement - Online Community Engagement

Platform

This is a report concerning the

continuation of a contract (#5079) with Social Pinpoint Pty Ltd (Social

Pinpoint), for the provision of the Online Community Engagement Platform in

accordance with section 235(b) of the Local Government Regulations, as it is

impractical and disadvantageous to invite quotes or tenders for a new platform

at this stage.

Recommendation

A. That

pursuant to Section 235(b) of the Local Government Regulation 2012

(Regulation), Council resolve that the exception applies because of the

specialised nature of the services that are sought and it would be impractical

and disadvantageous to invite quotes or tenders for the provision of the Community

Engagement Platform.

B. That

Council continue the contractual arrangement with Social Pinpoint Pty Ltd, with

an increase in purchase price of approximately $120,000 excluding GST over the

additional term, being options for extension at the

discretion of Council (as purchaser) of an additional three (3) X one (1) year

terms. The total spend for the platform from 2018 to 2028 will be approximately

$320,000 excluding GST.

C. That

Council use the next 12 months to explore community engagement platform options

that could integrate with Council’s new content management system.

NOTICES OF MOTION

MATTERS ARISING

QUESTIONS / GENERAL BUSINESS

|

Finance and Governance

Committee

Meeting Agenda

|

20 May

2025

|

Finance

and Governance Committee NO. 2025(03)

22 April 2025

Minutes

COUNCILLORS’

ATTENDANCE:

Councillor Paul Tully

(Chairperson); Councillors Jacob Madsen (Deputy Chairperson), Mayor Teresa

Harding, Deputy Mayor Nicole Jonic, Marnie Doyle, Andrew Antoniolli, Jim

Madden, Pye Augustine (Observer) and David Martin (Observer)

COUNCILLOR’S

APOLOGIES:

Nil

OFFICERS’ ATTENDANCE:

Chief Executive Officer (Sonia

Cooper), General Manager Corporate Services (Matt Smith), General Manager Asset

and Infrastructure Services (Seren McKenzie), General Manager Community,

Cultural and Economic Development (Ben Pole), General Manager Planning and

Regulatory Services (Brett Davey), Chief of Staff – Office of the Mayor

(Melissa Fitzgerald), Acting Chief Information Officer (Fiona Bristow), Acting

Chief Financial Officer (Christina Binoya), Manager, Media, Communications and

Engagement (Mark Strong), Acting Manager Legal and Governance (General Counsel)

(Allison Ferres-MacDonald), Senior Solicitor (Nicola Harris), Manager

Procurement (Tanya Houwen), Senior Media Officer (Darrell Giles), Construction

Manager (Pedro Baraza) and Theatre Technician (Thomas Haag)

Welcome to

Country or Acknowledgement of Country

Councillor Paul Tully (Chairperson) invited Mayor Teresa

Harding to deliver the Acknowledgement of Country

DECLARATIONS OF INTEREST IN MATTERS ON THE AGENDA

At Item 7 Councillor Andrew Antoniolli declared an interest

BUSINESS OUTSTANDING

Nil

Confirmation of

Minutes

|

1. Confirmation of Minutes of the Finance and

Governance Committee No. 2025(02) of 18 March 2025

|

|

Recommendation

Moved by Councillor Jim Madden:

Seconded by Councillor Andrew

Antoniolli:

That the minutes of the

Finance and Governance Committee held on 18 March 2025 be confirmed.

|

|

AFFIRMATIVE NEGATIVE

Councillors: Councillors:

Tully Nil

Madsen

Harding

Jonic

Doyle

Antoniolli

Madden

The motion was put and carried.

|

Officers’

Reports

|

2. Strategic Contracting Procedures

This is a report concerning the

adoption of ‘Strategic Contracting Procedures’ (SCP) from 1 July

2025 to Council contracts, as per the requirements of Chapter 6, Part 2 of

the Local Government Regulations 2012 (LGR).

|

|

Recommendation

Moved by Councillor Andrew

Antoniolli:

Seconded by Councillor Jim

Madden:

A. That

after:

(a) consideration

of the costs and benefits of complying with Chapter 6, Part 2 of the Local

Government Regulation 2012 (Regulation); and

(b) provision

of the public notice of this proposed resolution which occurred on Wednesday

5 March 2025; and

(c) pursuant

to section 218(1) of the Regulation,

Council decides to

apply Chapter 6, Part 2 ‘Strategic Contracting Procedures’ of the

Regulation to its contracts from 1 July 2025.

B. That

prior to the date on which the Strategic Contracting Procedures are to apply,

being 1 July 2025, a further report be presented to Council regarding the

adoption of a Contract Manual and Contracting Plan, as are required by

Chapter 6, Part 2 of the Regulation.

|

|

AFFIRMATIVE NEGATIVE

Councillors: Councillors:

Tully Nil

Madsen

Harding

Jonic

Doyle

Antoniolli

Madden

The motion was put and carried.

|

|

3. Procurement - Civic Centre Ticketing

Software

This is a report concerning the

recommendation to approve the continuation of Contract 15-16-247 for the

provision of a Ticketing Software solution with Vivaticket Pty Ltd

(Vivaticket) until 6 June 2026, with one (1) x twelve (12) month optional

extension, at an estimated cost of $110,000 (ex GST), without inviting

quotes.

Section 235(b) of the Local

Government Regulation 2012 allows a local government to enter into a

large sized contractual arrangement, if the local government resolves that

the services provided are of a specialised nature and it would be

disadvantageous or impractical to invite quotes or tenders.

|

|

Recommendation

Moved by Councillor Andrew

Antoniolli:

Seconded by Deputy Mayor

Nicole Jonic:

A. That

pursuant to Section 235(b) of the Local Government Regulation 2012

(Regulation), Council resolve that the exception applies because of the

specialised nature of the services that are sought and it would be

impractical and disadvantageous to invite quotes or tenders for the provision

of the Vivaticket Ticketing Software.

B. That

Council continue the contractual arrangement (Council file reference number 15-16-247) with Vivaticket

Pty Ltd, at an approximate purchase price of $110,000

excluding GST for the extended term, being a one (1) year period, with one

(1) additional option to extend of one (1) year at

the discretion of Council (as purchaser).

C. That

pursuant to Section 257(1)(b) of the Local Government Act 2009,

Council resolve to delegate to the Chief Executive Officer the power to take

“contractual action” pursuant to section 238 of the

Regulation, in order to implement Council’s decision.

|

|

AFFIRMATIVE NEGATIVE

Councillors: Councillors:

Tully Nil

Madsen

Harding

Jonic

Doyle

Antoniolli

Madden

The motion was put and carried.

|

|

4. Procurement - Amazon Web Cloud Computing

Services

This is a report concerning the

procurement and recommendation to negotiate and enter into a contractual

arrangement under the Commonwealth Government Digital

Transformation Agency’s (DTA) whole-of-government arrangement made

with Amazon Web Services Australia Pty Ltd (WofGA 3.0), for the provision of

the Amazon Web Cloud Computing Services requirements for Council.

|

|

“The attachment/s to this report are confidential in

accordance with section 254J(3)(g) of the Local Government Regulation 2012.”

|

|

Recommendation

Moved by Councillor Marnie Doyle:

Seconded by Councillor Andrew

Antoniolli:

A. That

pursuant to Section 235(f) of the Local Government Regulation 2012

(Regulation), Council utilise government agency contractual

arrangement AWS 3.0 Agreement by the Commonwealth of

Australia as represented by the Digital Transformation Agency for the

provision of Amazon Web Service Offerings (Council file

reference number 250207-000239), with the supplier listed as

Tenderer A (Supplier) in Confidential Attachment 1.

B. That

under the government agency contractual arrangement, Council’s

approximate spend will be $9,500,000 excluding GST over the entire term, the

end date of the initial term being 3 years after the commencement,

with current options for extension at the discretion of the

Commonwealth of Australia as represented by the Digital Transformation Agency

of an additional one (1) x three (3) year term.

C. That

pursuant to Section 257(1)(b) of the Local Government Act 2009,

Council resolve to delegate to the Chief Executive Officer the power to take

“contractual action” pursuant to section 238 of the

Regulation, in order to implement Council’s decision.

|

|

AFFIRMATIVE NEGATIVE

Councillors: Councillors:

Tully Nil

Madsen

Harding

Jonic

Doyle

Antoniolli

Madden

The motion was put and carried.

|

|

5. Procurement - Tender VP445749 - Purga School

Road Bridge Replacement Works

This is a report concerning the

approval for the award of tender VP445749 Bridge

Replacement Works Purga School Road, Purga.

|

|

“The attachment/s to this report are confidential in

accordance with section 254J(3)(g) of the Local Government Regulation 2012.”

|

|

Recommendation

A. That

Council note that Tender VP445749 was conducted pursuant to Section 228 of

the Local Government Regulation 2012.

B. That

pursuant to Section 257(1)(b) of the Local Government Act 2009,

Council resolve to delegate to the Chief Executive Officer the power to take

“contractual action” pursuant to section 238 of the

Regulation, in order to award Tender VP445749 to one of the shortlisted

Suppliers as detailed in Confidential Attachment 1, under the contract terms

outlined in that same attachment.

|

|

Councillor Paul Tully proposed that this matter be

referred to the next Council Ordinary meeting for further consideration.

|

|

Recommendation

Moved by Councillor Paul Tully:

Seconded by Mayor Teresa

Harding:

*** That

Item 5 be referred to the next Council Ordinary meeting for further

consideration.

|

|

AFFIRMATIVE NEGATIVE

Councillors: Councillors:

Tully Nil

Madsen

Harding

Jonic

Doyle

Antoniolli

Madden

The motion was put and carried.

|

6. Procurement - 5577 Adelong Avenue, Thagoona

- Pavement Rehabilitation

This is a report concerning the

recommendation to award Tender 5577 Adelong Avenue, Thagoona – Pavement

Rehabilitation with the nominated supplier, as per confidential Attachment 1,

to undertake the pavement rehabilitation works on Adelong Avenue, Thagoona.

After an open market request

for tender process, the evaluation panel has recommended one supplier for the

undertaking of the pavement rehabilitation works as set out in Recommendation

B below. The recommendation has been determined by the evaluation panel

to offer Council the best value for money.

If Council is satisfied with

the nominated supplier, the name of the supplier will be included in the

Council’s resolution at Recommendation B.

|

|

“The attachment/s to this report are confidential in

accordance with section 254J(3)(g) of the Local Government Regulation

2012.”

|

|

Recommendation

Moved by Mayor Teresa Harding:

Seconded by Councillor Jim

Madden:

A. That

pursuant to Section 228 of the Local Government Regulation 2012 (Regulation),

Council award Tender No. 5577 Adelong Avenue, Thagoona –

Pavement Rehabilitation.

B. That

Council enter into a contractual arrangement with the Supplier identified in

confidential Attachment 1, for the lump sum amount of two million, eight

hundred and eighteen thousand, three hundred and ninety-five dollars and

forty-four cents ($2,818,395.44) excluding GST and the contingency amount as

listed in confidential Attachment 1.

C. That

pursuant to Section 257(1)(b) of the Local Government Act 2009,

Council resolve to delegate to the Chief Executive Officer the power to take

“contractual action” pursuant to section 238 of the

Regulation, in order to implement Council’s decision.

D. That

owing to the confidential nature of the recommendations, that once adopted by

Council, the recommendations be made public.

|

|

AFFIRMATIVE NEGATIVE

Councillors: Councillors:

Tully Nil

Madsen

Harding

Jonic

Doyle

Antoniolli

Madden

The motion was put and carried.

|

In accordance with section 150EQ of the Local Government

Act 2009, Councillor Andrew Antoniolli informed the meeting that he has a

declarable conflict of interest in Item 7 titled Procurement – Contract

Extension 13482 Grounds Maintenance and Associated Services.

The nature of the interest is that the owner of one of the

companies (SAVCO) is a neighbour who lives in his street.

Councillor Andrew Antoniolli invited the other councillors

to determine if he can continue to participate in the decision process.

It was moved by Councillor Paul Tully and seconded by

Councillor Jim Madden that Councillor Andrew Antoniolli may participate in the meeting

in relation to the matter, including by voting on the matter because there is

no personal or financial benefit to the councillor and therefore a reasonable

person would trust that the final decision is made in the public interest.

The eligible councillors present at

the meeting decided that Councillor Andrew Antoniolli may participate in the

meeting in relation to the matter, including by voting on the matter.

AFFIRMATIVE NEGATIVE

Councillors: Councillors:

Tully Nil

Madsen

Harding

Jonic

Doyle

Madden

Councillor Andrew Antoniolli did not take part in the vote

on this matter.

The motion was put and carried.

|

7. Procurement - Contract Extension 13482

Grounds Maintenance and Associated Services

This is a report concerning the

extension of Contracts 13482-1, 13482-2, 13482-4 and 13482-5 Grounds

Maintenance and Associated Services. The available contract extension was

previously resolved in October 2024 to shorten to a six (6) month extension

rather than the full available twelve (12) month term.

The contracts relating to this

extension include:

13482-1

SKYLINE LANDSCAPE SERVICES (QLD) PTY LTD

13482-2

AUSTSPRAY ENVIRONMENTAL WEED CONTROL PTY LTD

13482-4

SAVCO VEGETATION SERVICES PTY LTD

13482-5

RIVERCITY GARDEN & LAWN PTY LTD

Approval is sought to vary the

contracts of all four (4) 13482 Grounds Maintenance and Associated Services

suppliers for the final six (6) months to allow additional time to finalise

the specification requirements and then commence the contract renewal process

including re-tendering, evaluation, and contract award.

|

|

Recommendation

Moved by Deputy Mayor Nicole

Jonic:

Seconded by Councillor Jacob

Madsen:

A. That

the contractual arrangement Council contract (13482-1) with SKYLINE

LANDSCAPE SERVICES (QLD) PTY LTD; (13482-2) with AUSTSPRAY ENVIRONMENTAL WEED

CONTROL PTY LTD; (13482-4) with SAVCO VEGETATION SERVICES PTY LTD and

(13482-5) with RIVERCITY GARDEN & LAWN PTY LTD (Suppliers) for Grounds

maintenance and Associated Services be varied as follows:

(i) Add

a final extension of all contracts for six (6) months (period from

25 July 2025 to 24 January 2026),

B. That

Council enter into deed of variation with the Suppliers to appropriately

amend the existing contractual arrangement.

C. That

pursuant to Section 257(1)(b) of the Local Government Act 2009,

Council resolve to delegate to the Chief Executive Officer the power to take

“contractual action” pursuant to section 238 of the

Regulation, in order to implement Council’s decision.

|

|

AFFIRMATIVE NEGATIVE

Councillors: Councillors:

Tully Nil

Madsen

Harding

Jonic

Doyle

Antoniolli

Madden

The motion was put and carried.

|

|

8. Amendment of Lease between Ipswich City

Council (Lessor) and Swifts Leagues Club Ltd (Lessee) and entry into associated

documentation

This is a report concerning an

amendment to the lease that is proposed to be entered into between Ipswich

City Council (‘Council’) as Lessor and Swifts Leagues Club

Limited (‘Swifts’) as Lessee for part of 95a Brisbane

Road, Booval, together with associated documentation for the amendment.

|

|

“The attachment/s to this report are confidential in

accordance with section 254J(3)(g) of the Local Government Regulation 2012.”

|

|

Recommendation

Moved by Councillor Marnie Doyle:

Seconded by Councillor Andrew

Antoniolli:

A. That

pursuant to section 236(2) of the Local Government Regulation 2012 (Regulation),

Council resolve that the exception at section 236(1)(c)(iii) of the

Regulation applies to the disposal of interest in part of the land at 95a

Brisbane Road, Booval more particularly described as part of Lot 169

on Registered Plan 24111, for the purpose of a Sports and Recreation Club,

because it is for renewal of a lease to the existing lessee.

B. That

Council vary the lease (Council file reference number L-6232) with Swifts

Leagues Club Limited (Lessee) by entering into the Form 13 Amendment

contained in Attachment 1 to this report, with options for extension of an

additional three (3) x ten (10) year terms.

C. That

Council enter into the associated documentation contained in Confidential

Attachment 2 to this report.

D. That

pursuant to Section 257(1)(b) of the Local Government Act 2009,

Council resolve to delegate to the Chief Executive Officer the power to take

“contractual action” pursuant to section 238 of the Regulation,

in order to implement Council’s decision.

|

|

AFFIRMATIVE NEGATIVE

Councillors: Councillors:

Tully Nil

Madsen

Harding

Jonic

Doyle

Antoniolli

Madden

The motion was put and carried.

|

|

Question on Notice

ITEM 8 - Amendment of Lease between Ipswich City Council (Lessor)

and Swifts Leagues Club Ltd (Lessee) and entry into associated documentation

|

|

Mayor Teresa Harding stated that in the officer’s

report for Item 8 it talks about the tenure of property policy ordinarily

requiring a business plan to be submitted in order to justify a term of five

(5) years in length and that Swifts have not provided a formal business plan.

Mayor Harding queried why a formal business plan has not been provided.

That the General Manager,

Corporate Services provide the Mayor and Councillors with the reason why a

formal business plan has not been provided by Swifts.

|

|

9. Monthly Financial Performance Report - March

2025

This is a report concerning

Ipswich City Council’s (Council) financial performance for the

period ending 31 March 2025, submitted in accordance with section 204 of the Local

Government Regulation 2012.

|

|

Recommendation

Moved by Deputy Mayor Nicole Jonic:

Seconded by Councillor Jacob

Madsen:

That the report on

Council’s financial performance for the period ending

31 March 2025, submitted in accordance with section 204 of the Local

Government Regulation 2012, be considered and noted by Council.

|

|

AFFIRMATIVE NEGATIVE

Councillors: Councillors:

Tully Nil

Madsen

Harding

Jonic

Doyle

Antoniolli

Madden

The motion was put and carried.

|

NOTICES OF MOTION

Nil

MATTERS ARISING

Nil

QUESTIONS / GENERAL BUSINESS

Nil

PROCEDURAL MOTIONS AND

FORMAL MATTERS

The

meeting commenced at 11.00 am.

The

meeting closed at 11.28 am.

*** Refer Council Ordinary

Meeting of 30 April 2025 for amendment

|

Finance

and Governance Committee

Meeting

Agenda

|

20 May

2025

|

Doc ID No: A11524645

ITEM: 2

SUBJECT: Proposed Agreement for Lease - Dress Circle,

Brookwater

AUTHOR: Development Assessment East Manager

DATE: 30 April 2025

Executive

Summary

This is a report concerning a

proposed Agreement for Lease in conjunction with future local recreation parks

within the Dress Circle development at Brookwater.

Recommendation/s

A. That

pursuant to section 236(2) of the Local Government Regulation 2012 (Regulation),

Council resolve that the exception at section 236(1)(b)(ii) of the Regulation

applies to the disposal of interest in land at the Brookwater Dress

Circle development, more particularly described as two (2) equivalent local

recreation parks, to a community organisation, namely the Body Corporate

for the Brookwater Dress Circle Home Owners Club (BDCHOC) Community Titles

Scheme.

B. That

Council enter into an agreement for lease and lease with the Body Corporate for

the BDCHOC Community Titles Scheme, Springfield Land Corporation (No.2) Pty

Limited and Springfield City Group Pty Limited.

C. That

the Chief Executive Officer be authorised to negotiate and finalise the terms

of the lease agreements for the future parks.

RELATED PARTIES

· Brookwater Dress

Circle Home Owners Club (BDCHOC) Community Titles Scheme

· Springfield City

Group Pty Limited

· Springfield Land

Corporation (No.2) Pty Limited

ifuture Theme

A Trusted and Leading Organisation

Vibrant and Growing

Purpose of Report/Background

The Brookwater residential estate has been developing

various stages of the development since approximately 2001. The titling

arrangements associated with the residential development incorporates a layered

community management scheme with the common property areas that are managed by

a principal body corporate (otherwise known as the ‘Brookwater Home

Owners Club’ (BHOC)) and a range of subsidiary body corporate schemes

(such as the BDCHOC).

Since the commencement of the development, the BHOC or the

subsidiary body corporate schemes have entered into a range of agreements with

Council to maintain street verge areas and parts of local recreation parks

which would typically be a Council responsibility. In turn, these areas

have been embellished to a higher standard (e.g. more street trees or

additional landscaping) for the community enjoyment. The BHOC also

maintains their own private entry features and common property landscaped

areas.

Council has previously agreed to leasing arrangements

associated with a number of parks (e.g. Scenic Park, Peter Napier Park, Pieter

Greef Park) and there are separate dealings that are currently underway in

relation to leasing arrangements associated with Oakmont Park. These

leases do not prevent the general public from accessing and utilising the park

facilities. These last agreements were entered into some time ago, in

some cases more than 10 years ago.

The Brookwater ‘Dress Circle’ residential

development is currently under construction in the southern portion of the

overall Brookwater residential estate. The approved Brookwater South

Precinct Plan identifies that two (2) ‘equivalent’ local recreation

parks will be constructed as part of the development to service the local community.

The developer of the Brookwater Dress Circle residential

estate, Springfield City Group, is now seeking to enter into an Agreement for

Lease for the two (2) ‘equivalent’ local recreation parks.

The developer is proposing to embellish the facilities within the local

recreation parks to a standard greater than Council’s standard park

standards and following construction and acceptance by Council on-maintenance,

the BHOC would maintain the relevant park. Council would subsequently

provide an annual financial amount to the BHOC however it would be limited to

the value of maintaining a Council standard park embellishment. Any

additional costs associated with the maintenance of the park would be at the

cost of the BHOC.

An Agreement for Lease has been

drafted to reflect the arrangements and responsibilities of Springfield City

Group, Springfield Land Corporation No. Pty Ltd, the body corporate and

Council.

Legal IMPLICATIONS

This report and its recommendations are consistent with the

following legislative provisions:

Local Government Regulation 2012

The Local Government Regulation 2012 Section

236(1)(b)(ii) provides an exception for the disposal of valuable non-current

assets other than by tender or auction if the organisation that is entering

into the lease is a community organisation. A community organisation is defined

in the Local Government Regulation 2012 as:

(a) An entity that carries on activities for a public

purpose; or

(b) Another entity whose primary object is not directed at

making a profit.

In this instance, the body corporate would be undertaking

maintenance activities that typically Council would need to undertake for a

standard recreation park and the primary object of the body corporate is to

manage the maintenance standard for those areas with the residential estate for

which they are responsible. This is also supported by the provisions of

the Body Corporate and Community Management Act 1997 which prohibits

body corporates from conducting business. This prohibition aligns with

the requirement that a community organisation must operate on a not-for-profit

basis. Therefore, it is considered that the body corporate qualifies as a

community organisation.

policy implications

The outcomes of the recommendation do not impact upon any

Council approved policies.

RISK MANAGEMENT IMPLICATIONS

If Council were to choose not to

resolve that the exception under Section 236(1)(b)(ii) of the Local

Government Regulation 2012 applies and therefore does not agree with the

proposed Agreement for Lease, the developer would be required to redesign the

local recreation park to meet Council’s minimum park standards.

Council would subsequently need to allocate resources for the ongoing

maintenance of the parks. The Agreement for Lease establishes minimum

maintenance standards that the body corporate need to maintain the parks to and

as such it is considered low risk in terms of Council’s reputation to

proceed in accordance with the recommendations of this report.

Financial/RESOURCE IMPLICATIONS

In light of the above, there are

no significant additional financial implications for Council in entering into

agreement for lease (and subsequent lease agreements) with the body corporate

that will maintain Council owned assets. Council would alternatively need to

allocate budget and / or resources for the maintenance of a standard

park.

It should be noted that any costs

as a result of embellishments above Council’s standards will be borne by

the body corporate. At the end of the lease term (21 years from the

execution), and in the absence of any further ongoing arrangements, the body

corporate is responsible for the removal of any

‘over-embellishments’ with Council’s minimum park

embellishments at its own cost.

COMMUNITY and OTHER CONSULTATION

There has been no community consultation in relation to this

report by Council.

Council’s Legal Services

Section and various officers from both the Asset and Infrastructure Services

Department and Planning and Regulatory Services Department have been consulted

in relation to the preparation of the Agreement for Lease document.

Conclusion

The Local Government Regulation

2012 Section 236(1)(b)(ii) provides an exception for Council to dispose of

a valuable non-current asset other than by tender or auction if the asset is

disposed of to a community organisation. The Body Corporate for the BDCHOC

Community Titles Scheme 52959 qualify as a community organisation. This

report seeks the Council to resolve that the exception applies and authorise

the Chief Executive Officer to negotiate and finalise the terms of the

agreement for lease and the future leases for the local recreation parks within

the Brookwater Dress Circle development.

HUMAN RIGHTS IMPLICATIONS

|

HUMAN RIGHTS IMPACTS

|

|

OTHER DECISION

|

|

|

|

|

(a) What

is the Act/Decision being made?

|

Recommendations A-C states that Council will enter into an

Agreement for Lease and subsequent leases over two (2) equivalent local

recreation parks with the Body Corporate for the BDCHOC Community Titles

Scheme to maintain parks that are embellished to a higher standard.

|

|

(b) What

human rights are affected?

|

No human rights are affected by this decision.

|

|

(c) How

are the human rights limited?

|

Not applicable

|

|

(d) Is

there a good reason for limiting the relevant rights? Is the limitation fair

and reasonable?

|

Not applicable

|

|

(e) Conclusion

|

The decision is consistent with human rights.

|

Attachments and Confidential Background Papers

|

|

CONFIDENTIAL

|

|

1.

|

Draft Agreement for Lease - Dress Circle, Brookwater

(under separate cover)

|

Tim Foote

Development

Assessment East Manager

I concur with the recommendations contained in this

report.

Brett Davey

General Manager

(Planning and Regulatory Services)

“Together,

we proudly enhance the quality of life for our community”

|

Finance

and Governance Committee

Meeting

Agenda

|

20 May

2025

|

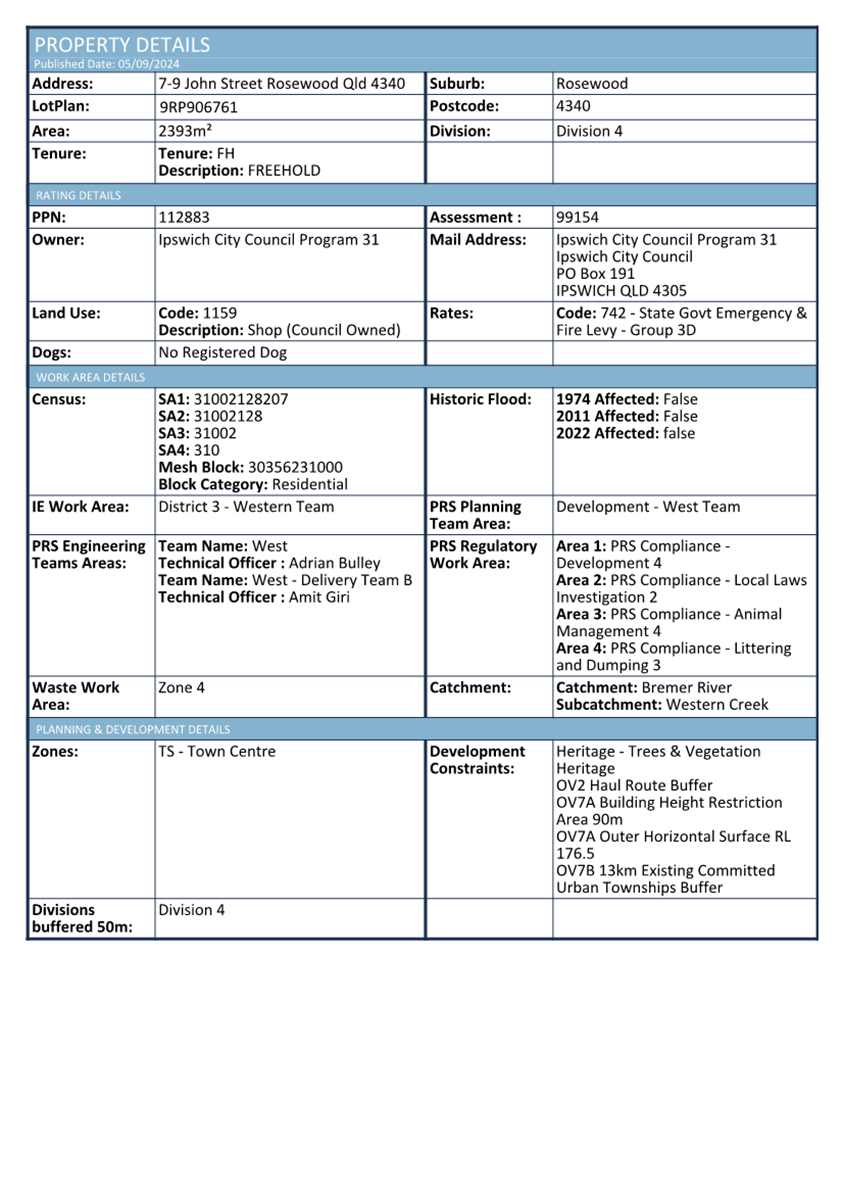

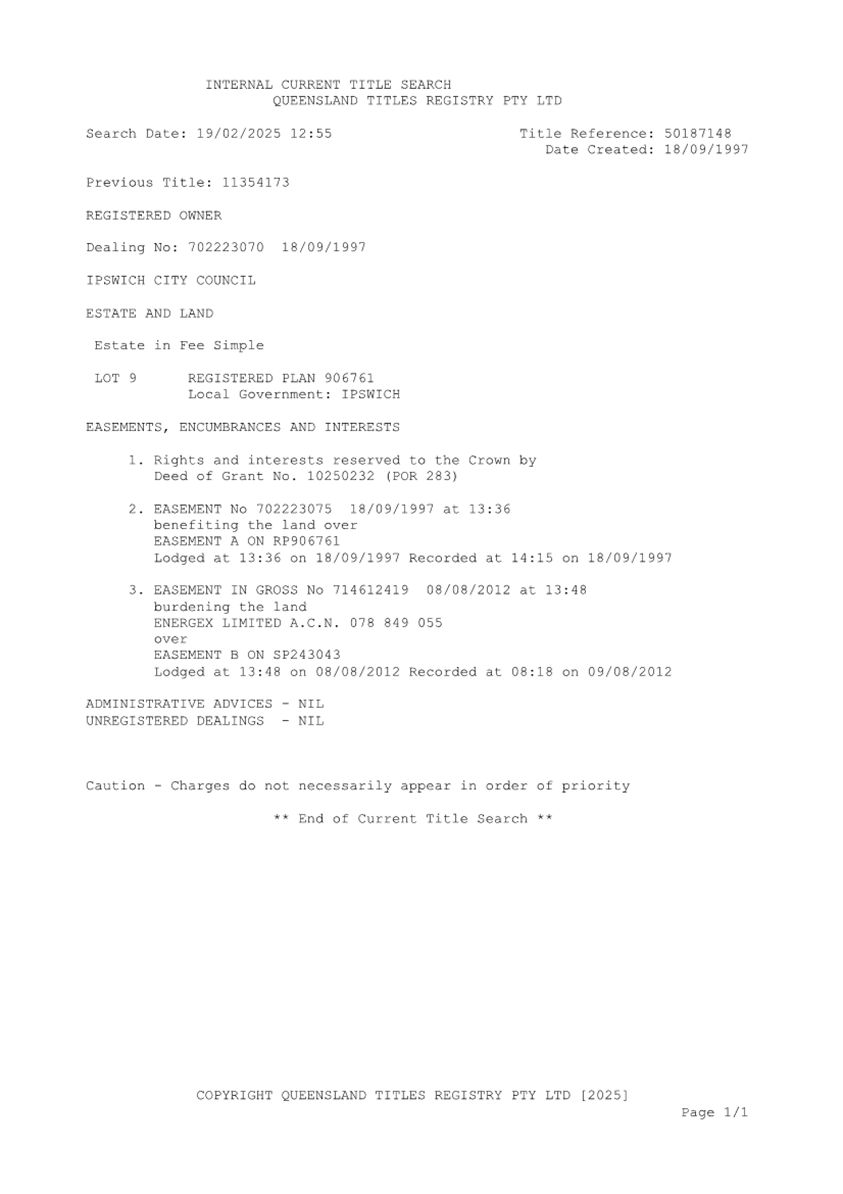

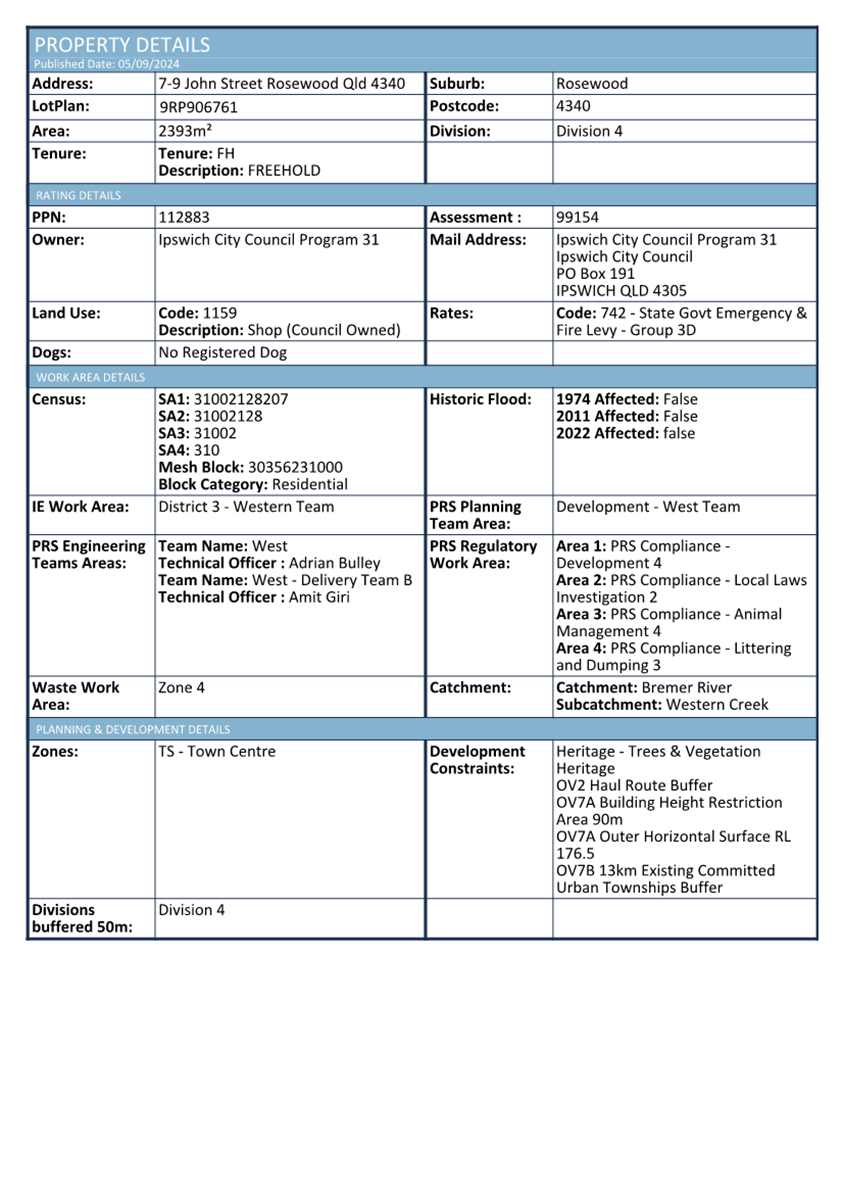

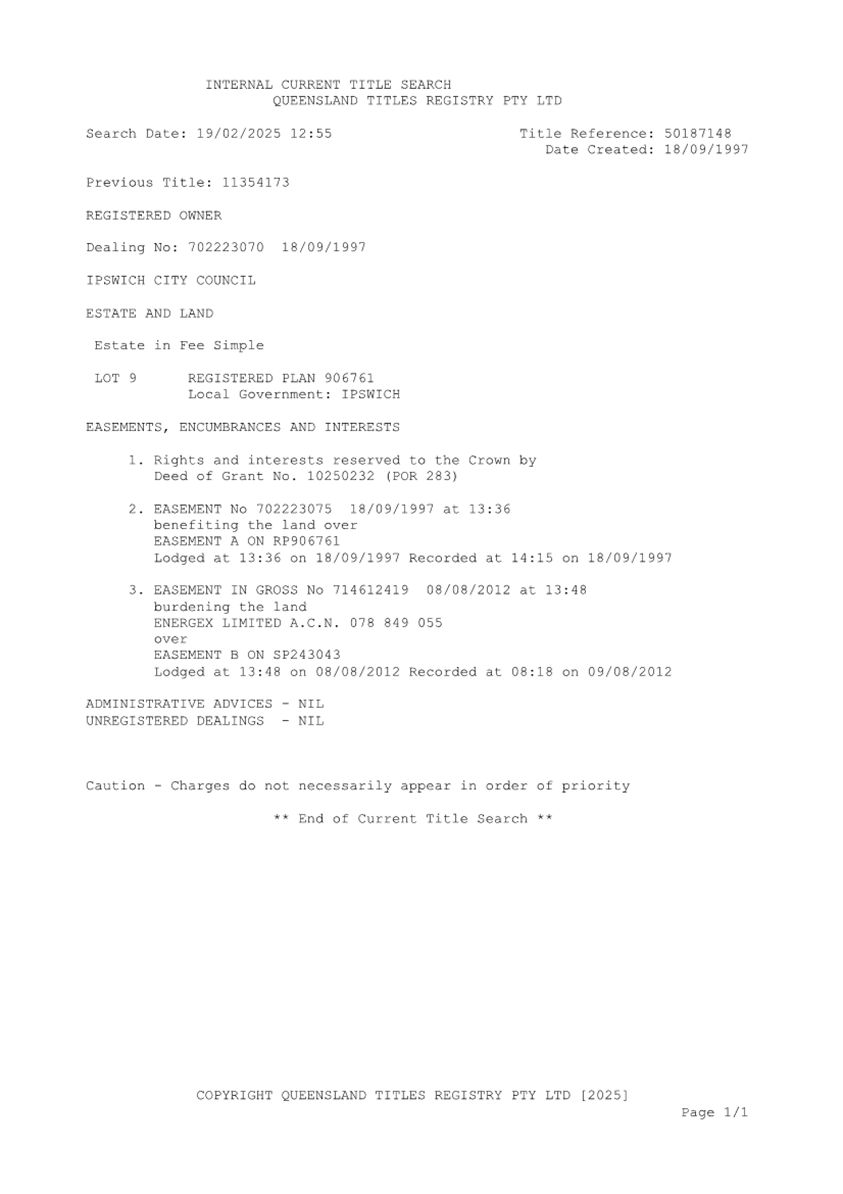

Doc ID No: A11466822

ITEM: 3

SUBJECT: Lease Renewal over Freehold Land at 7-9 John

Street, Rosewood

AUTHOR: Senior Property Officer (Tenure)

DATE: 9 April 2025

Executive Summary

This is a report concerning the

proposed renewal over freehold land located at 7-9 John Street, Rosewood,

described as part of Lot 9 on RP906761 (the Land), between Ipswich City Council

(Council) and Robert David Carruthers (RDC).

RECOMMENDATION

A. That

pursuant to section 236(2) of the Local Government Regulation 2012 (Regulation),

Council resolve that the exception at section 236(1)(c)(iii) of the Regulation

applies to the disposal of interest in land at 7-9 John Street, Rosewood

more particularly described as part of Lot 9 and Plan RP906761,

for solicitor’s office purposes, because it is for renewal of a

lease to the existing lessee.

B. That

Council renew the lease (Council file reference number 6209 with Robert

David Carruthers (Lessee):

(i) at

a commencing annual rent of $18,500 excluding GST, payable to Council,

and

(ii) for

an initial term of five (5) years, with no options for extension.

RELATED PARTIES

· Robert David

Carruthers

· There was no

declaration of conflicts of interest

ifuture Theme

A Trusted and Leading Organisation

Purpose of Report/Background

RDC is the proprietor of

Carruthers Solicitors, a law firm that provides a comprehensive range of legal

services tailored to both personal and business needs. Carruthers

Solicitors has been operating in this location since 2005.

Under Section 236(1)(c)(iii) of

the Local Government Regulation 2012, an exception exists to the requirement

for leasehold interest in land to be disposed of through tender or auction.

This exception applies specifically to leases for renewal to the existing

tenant. The Council may only approve the disposal of the interest in land if

the consideration is equal to or exceeds the market value of the leasehold

interest in the land.

To determine an appropriate rental

value, Council engaged an independent registered valuer to provide a written

market rental assessment. Following negotiations with RDC, an agreement subject

to Council resolution was reached on a commencing annual rent of $18,500

(excluding GST) for the land. Property Services has assessed that the agreed

rental amount, along with the proposed indexation rate, is consistent with

current market conditions.

The proposed lease terms are as

follows;

|

Lease Terms

|

Existing

|

Proposed

|

|

Period:

|

3

Years

|

5

Years

|

|

Commencement Date:

|

01/11/2017

|

01/07/2025

|

|

Expiry

Date:

|

31/10/2019

|

30/06/2030

|

|

Options:

|

3 Years

|

Nil

|

|

Commencing

Rent:

|

$16,085

(excluding GST)

|

$18,500

(excluding GST)

|

|

Existing Rent:

|

$17,415 (excluding GST)

|

-

|

|

Annual

Increase:

|

CPI

|

3%

|

|

Permitted Use:

|

Solicitor’s Office

|

Solicitor’s Office

|

Legal IMPLICATIONS

This report and its recommendations are consistent with the

following legislative provisions:

Land Act 1994

Local Government Act 2009

Local Government Regulation 2012

policy implications

The lease terms proposed align with the Council’s

approved Tenure over Council Property policy (the ‘Policy’).

RISK MANAGEMENT IMPLICATIONS

Risks of Renewing the Lease for

Five Years

1. Property Maintenance

Costs – The building is quite old and components of the building are

nearing the end of its life. Ongoing maintenance and replacement post 5 years

will start to become costly to Council.

2. Longer

Term – Council have not considered renewing for longer than 5 years

to allow further investigation and consideration of the future use of this

building.

Risks of Alternative

Recommendations

1. Shorter Lease Term

– Offering a shorter lease term may provide flexibility but could result

in frequent renegotiations and uncertainty for both parties.

2. Expression

of Interest – Seeking a new tenant could introduce risks related to

vacancy periods, tenant reliability, and the costs associated with marketing

and lease setup.

Risks of Not Approving the

Recommendation

1. Loss of Rental Income

– If the lease is not renewed and no immediate alternative tenant is

secured, the Council may face revenue loss due to property vacancy.

2. Community and

Business Impact – The firm is a well-established presence in the

area, and its removal could affect local business networks and legal service accessibility.

Financial/RESOURCE IMPLICATIONS

RDC is responsible for minor

maintenance, replacement of flooring, and internal painting. The Council is

responsible for general repairs and maintenance, addressing wear and tear, as

well as end of life replacement.

COMMUNITY and OTHER CONSULTATION

There has been no community consultation in relation to this

report by Council.

Following internal consultation, RDC have provided in

principle agreement with the proposal outlined in this report. While RDC

initially requested an option to renew for 1 x 4 years, discussions clarified

that Council intends to investigate and further discuss the future use of this

building.

The following internal branches

have been consulted and provided the below responses:

(a) Property

Services completed property due diligence.

a. Various

searches and assessments were completed to ensure comprehensive understanding

of the land and its constraints.

b. The land contains

two (2) easements for right of way and electricity supply purposes.

(b) Community

and Cultural Services agree with the proposal in this report.

a. The

prospective tenant, as a commercial operator, should adhere to a standard

tenancy schedule with an attached maintenance program.

b. The

agreement and schedules should align with typical commercial leasing standards.

c. As

this is a commercial arrangement, CCED holds no community interests in the

leasing outcome and has no objections to renewing the lease, unless Council is

required to seek additional interest or community feedback.

(c) Asset

Management agree with the proposal in this report.

a. The

maintenance schedule was reviewed accordingly, and a copy forwarded to Works

and Field Services.

b. Significant

rehabilitation works will be required in the next 5 years.

(d) Security

Services

a. No

response received.

(e) Infrastructure

Strategy

a. No

comments to extension of lease.

(f) Works

and Field Services

a. Timber

floor framing and low ground clearance pose a persistent high risk for termite infestation,

despite regular treatments.

b. No

crawl space access under the building prevents visual inspections.

c. Raised

surrounding car park results in water pooling beneath the building during heavy

rain, accelerating deterioration of timber stumps and floor framing.

d. Building

lacks disability access and may be nearing the end of its usable lifespan.

e. Consideration

should be given to the future of the building at this location or potential

rehabilitation to mitigate these risks.

(g) Cultural

Heritage and City Design

a. No

issues from a heritage perspective.

Conclusion

It is recommended that Council

applies the exception under the Local Government Regulation 2012 to

proceed with a lease agreement renewal to RCD with for a part of

7-9 John Street, Rosewood.

HUMAN RIGHTS IMPLICATIONS

|

HUMAN RIGHTS IMPACTS

|

|

OTHER DECISION

|

|

|

|

|

(a) What

is the Act/Decision being made?

|

Recommendation A outlines Council will apply an exemption

to dispose of a leasehold interest for the purposes of a solicitor’s office.

Recommendation B outlines the terms that Council is

applying to the disposal of leasehold interest.

|

|

(b) What

human rights are affected?

|

Recognition and equality before the law (section 15)

Protection from torture and cruel, inhuman or degrading

treatment (section 17)

Freedom of movement (section 19)

Freedom of expression (section 21)

Peaceful assembly and freedom of association (section 22)

Privacy and reputation (section 25)

|

|

(c) How

are the human rights limited?

|

The proposed decision to enter the lease will potentially

interfere to restrict with the rights identified above because the lessee

will have the power to eject persons in particular circumstances

|

|

(d) Is

there a good reason for limiting the relevant rights? Is the limitation fair

and reasonable?

|

Yes. Ejecting a person in particular circumstances is a

reasonable approach to ensure health and safety. Less restrictive means

would be warnings, etc, but it is anticipated that these would be utilised

prior to any ejection

|

|

(e) Conclusion

|

The decision is consistent with human rights.

|

Attachments and Confidential Background Papers

|

1.

|

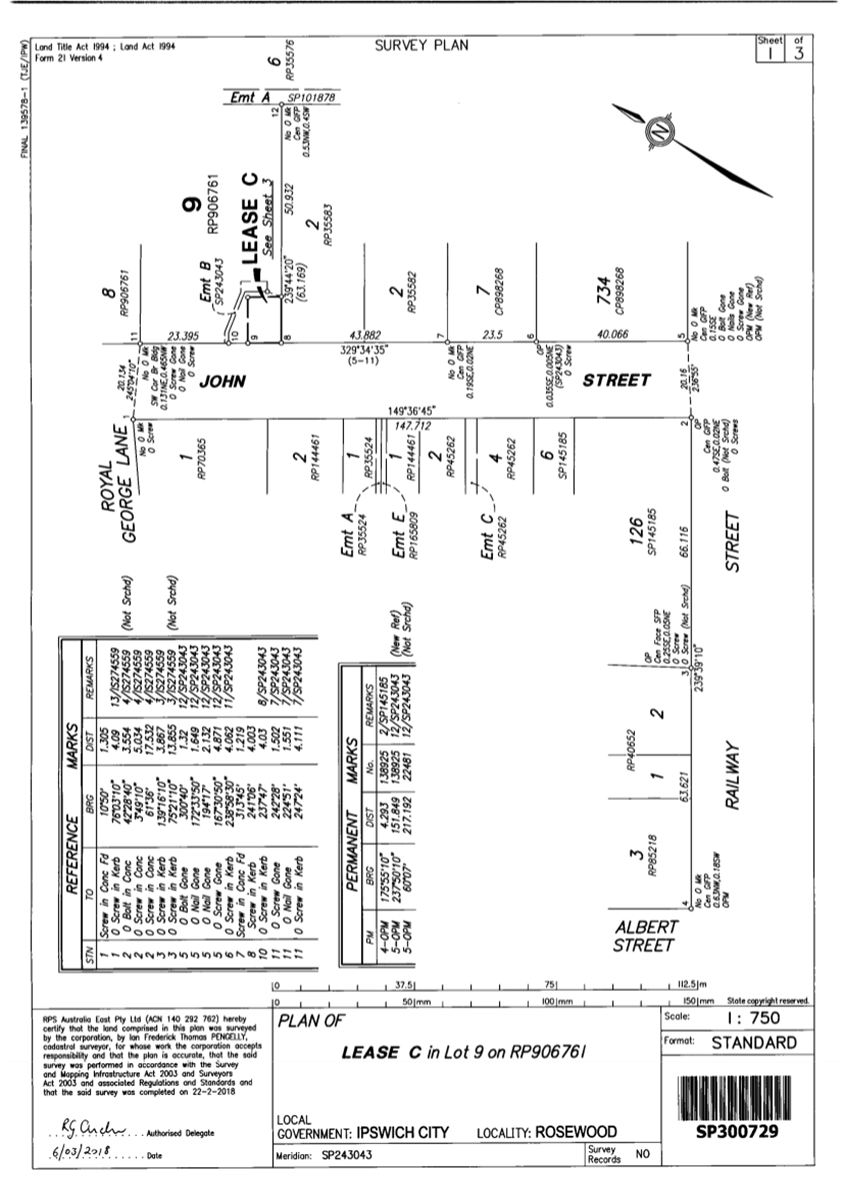

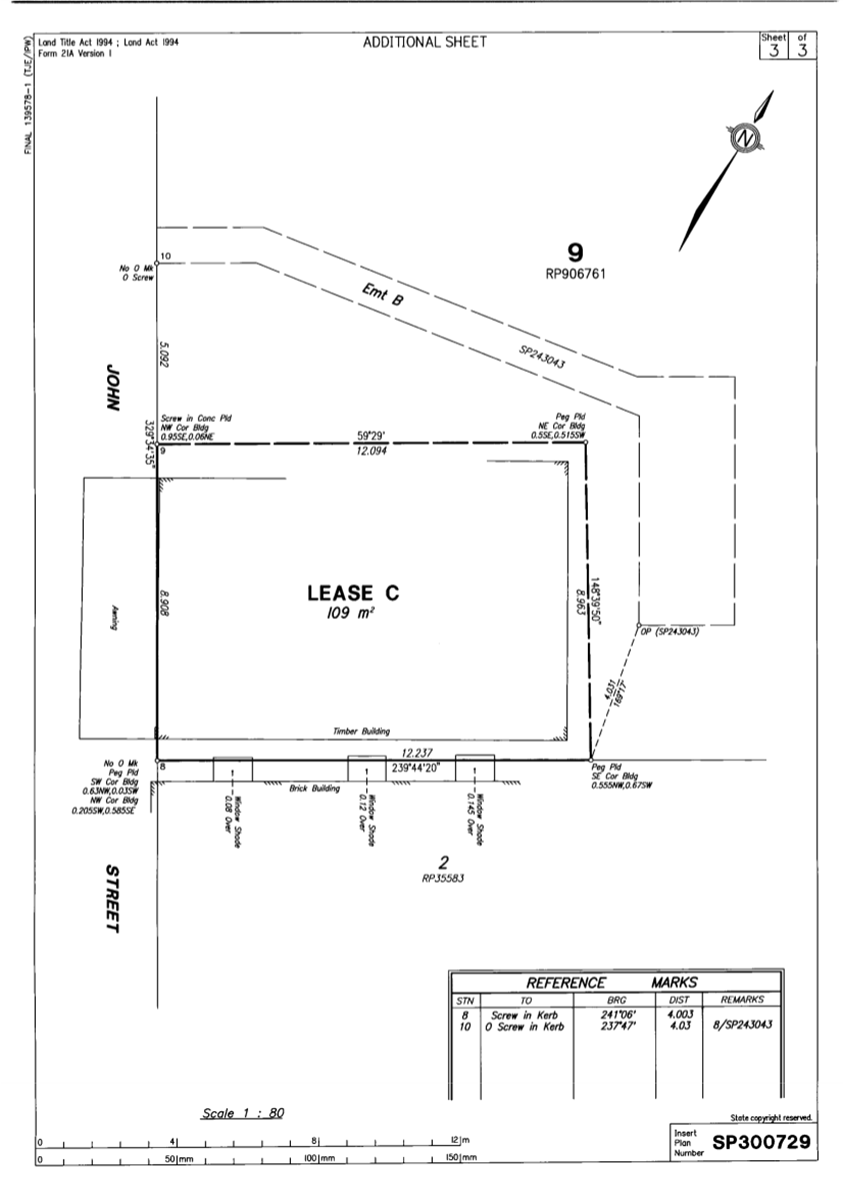

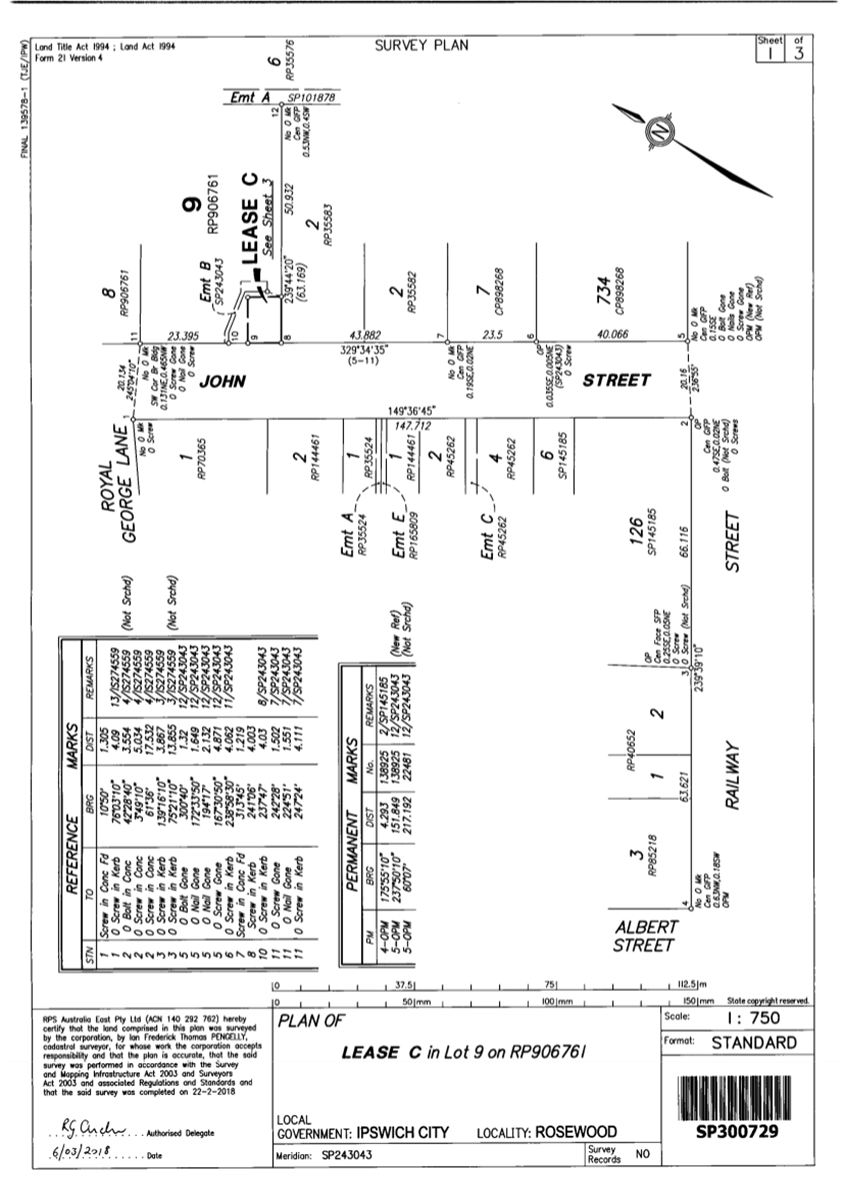

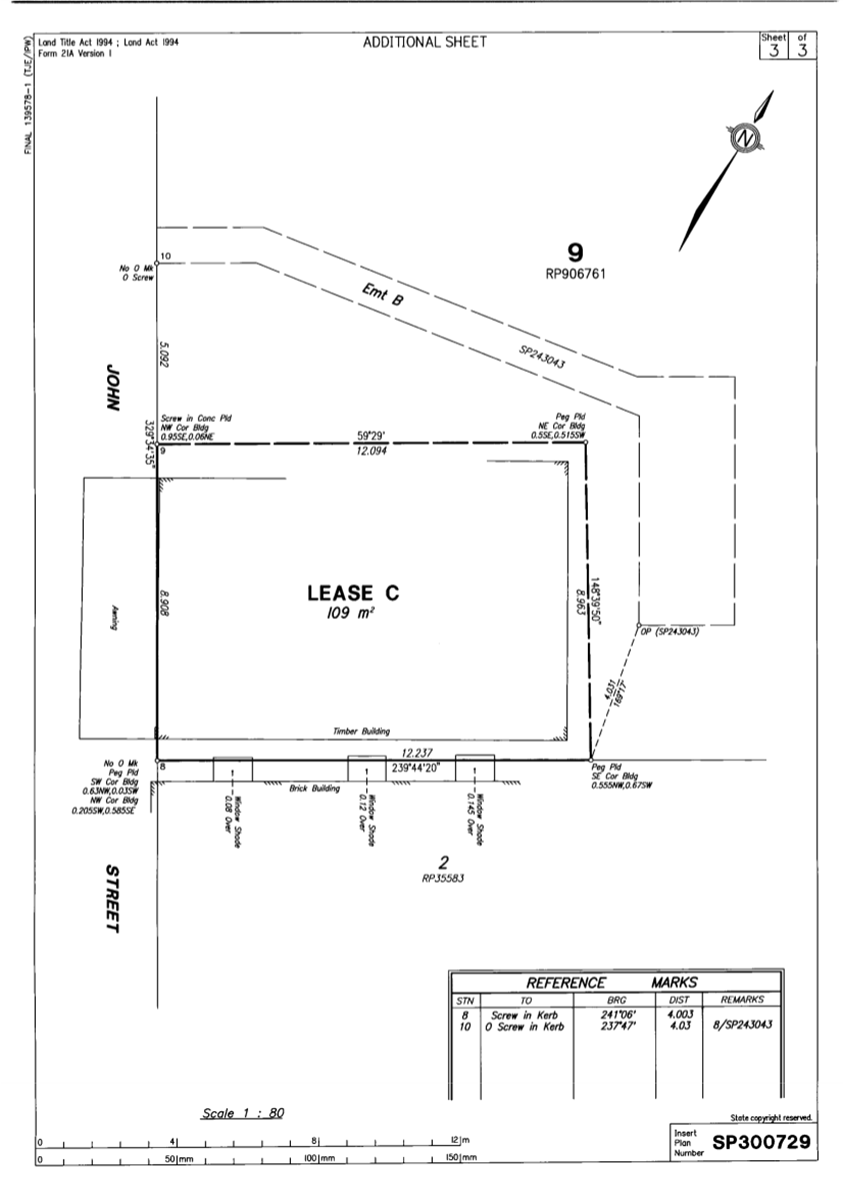

Lease Plan ⇩

|

|

2.

|

Property Plan ⇩

|

|

3.

|

Title Search ⇩

|

|

|

|

|

|

CONFIDENTIAL

|

|

4.

|

Valuation Report

|

Kerry Perrett

Senior Property

Officer (Tenure)

I concur with the recommendations contained in this

report.

Alicia Rieck

Property Services

Manager

I concur with the recommendations contained in this

report.

Allison Ferres-MacDonald

Acting Manager,

Legal and Governance (General Counsel)

I concur with the recommendations contained in this

report.

Matt Smith

General Manager

(Corporate Services)

“Together,

we proudly enhance the quality of life for our community”

|

Finance

and Governance Committee

Meeting

Agenda

|

20 May

2025

|

Item 3 / Attachment 1.

|

Finance and Governance

Committee

Meeting

Agenda

|

20 May

2025

|

Item 3 / Attachment 2.

|

Finance and Governance

Committee

Meeting

Agenda

|

20 May

2025

|

Item 3 / Attachment 3.

|

Finance

and Governance Committee

Meeting

Agenda

|

20 May

2025

|

Doc ID No: A11457068

ITEM: 4

SUBJECT: Proposed Fees and Charges to apply from 1 July

2025

AUTHOR: Treasury Accounting Manager

DATE: 29 April 2025

Executive Summary

This is a report concerning the

annual review of Ipswich City Council’s (Council) proposed commercial and

cost recovery fees and charges, and the recommended pricing to commence with

effect 1 July 2025.

Recommendation/s

That the proposed 2025-2026

Fees and Charges, as detailed in Attachment 1 (excluding the following pages:

pages 19 to 32 Sections 1 to 7.4

pages 34 to 39 Sections 1 to 7.1

pages 40 to 41 Sections 8 to 8.8

page 41 Section 9

page 41 Sections 10 to 10.2

pages 41 to 43 Sections 11 to

11.1.2

Page 114 Sections 1 to

1.3

Pages 115 Section

3

Pages

116 to 117 Sections 3.2 to 3.2.4)

be adopted with an effective

date of 1 July 2025.

RELATED PARTIES

This report deals with the

adoption of the pricing of fees and charges and does not specifically reference

any third party. There have been no conflicts of interest declared as at

the date of this report. Councillors should consider where fees and charges may

impact on their other interests or activities.

ifuture Theme

A Trusted and Leading Organisation

Purpose of Report/Background

Section

98 of the Local Government Act 2009 (LGA) requires Council

to maintain a publicly available register of cost recovery fees.

Council’s current register lists over nine hundred and thirty service

offerings, encompassing cost recovery fees, commercial fees and services

Council provides at no cost.

The proposed register is intended

to capture all fees and charges, it does not capture or include general rates

and charges, penalties, levies and commercial leases.

An annual review is undertaken

prior to the start of each financial year as part of the budget process. While

the annual review is coordinated by the Finance Branch, Departments remain

responsible for developing recommendations to Council with regard to the

proposed fees and charges.

A number of annual fees for

licences and permits (for example, food business licences) require invoices to

be issued by Council a minimum of 60 days ahead of the start of a financial

year. To ensure that these renewals could be issued to customers in a timely

manner in April, the relevant fee sections were approved by Council on 27 March

2025. The pre-approved fees are included within the attached register for

completeness and do not require a further resolution to adopt.

Approval of the remaining fees is

sought from Council in advance of 1 July, so as to give residents advance

notice of the cost of the optional services available, and to allow sufficient

time for invoices for remaining licence, permit and registration renewals to be

issued ahead of the start of the new financial year.

In reviewing fees and charges, the

Departments consider increases in the underlying costs of service delivery,

consistency of the fees with Council policy and objectives, financial impact

analysis and benchmarking of charges. Departments are also requested to take

consideration of market conditions and stakeholder consultation where

appropriate.

Section 97 of the LGA allows

Council to set cost-recovery fees for a range of regulatory functions, specifically:

a) licences,

permits, registration or approvals;

b) change

of ownership of land;

c) giving

of information kept under a Local Government Act;

d) seizing

property or animals under a Local Government Act; and

e) performance

of certain responsibilities under the Building Act or the Plumbing and Drainage

Act.

The LGA requires that a

cost-recovery fee be no more than the cost to the local government of taking

the action for which the fee is charged. Where the fee is a cost recovery fee,

it is identified within the register by the reference to the relevant paragraph

of LGA s 97(2), and the head of power under which the service is offered.

Approximately two-thirds of fees listed in the register are cost recovery fees.

In addition to cost recovery fees,

there are a small number of fees which are set by, or based on, a pricing

approach set by regulation. Such fees will typically relate to Planning and

Development matters, or regulated services such as Right to Information

charges.

The register also captures the

fees and charges for Council’s commercially offered range of goods and

services, such as venue hire, equipment hire and sporting facility use.

The proposed Fees and Charges

register for 2025-2026 is provided at Attachment 1.

An outline of any notable fees and

proposed changes within the register, by subject, is contained below.

A comparison of the existing Fees

and Charges in place through 2024-2025 and the proposed Fees and Charges for

2025-2026, including details of new and discontinued fees, are listed in

Attachment 2.

Overall, the service offerings for

the 2025-2026 financial year are not proposed to be significantly changed from

that of the current year.

The price of the majority of

regulatory fees for permits, registrations, licencing and related services are

proposed to increase in line with the forecast Council Cost Index (CCI), plus

rounding.

The CCI is a specific indexation

which reflects forecasted growth in the cost of Council service delivery,

calculated on the basis of anticipated growth in wages, construction costs and

the Consumer Price Index (CPI).

For 2025-2026, CCI was forecast at

4.0%. The applicable CCI is calculated using a medium term (two year) smoothed

CPI forecast rather than a spot rate in order to moderate the impact of short

term inflation spikes.

After rounding, the non-weighted

average increase to cost recovery fees subject to CCI escalation for 2025-2026

(excluding outliers) is 4.6%.

Commercial fees, most of which

relate to venue hire, have been reviewed in line with current market conditions

and subject to increases where considered appropriate. There are a number of

new commercial and community use booking options available for parks, sporting

facilities and community facilities.

The fees

and charges captured within the register represent standard or ‘business

as usual’ pricing for services. In the event that a significant event

prompts consideration of short-term variations to specific fees, such as

flooding or other disaster events, Council may resolve to apply discounts,

waivers or refunds to these fees.

Following

their adoption, the Fees and Charges may be amended at any time by a resolution

of Council.

Summary

of notable fee charges and proposed amendments for 2025-26.

References

to page number in this section relate to that of Attachment 2 only, not the

page number of the full agenda papers.

Corporate

Services and Information

• Corporate

Documentation and Reports

No substantive changes are

proposed in relation to Council’s corporate documents (Attachment 2, page

16). All documents are available free of charge in electronic form so as to

facilitate public access to information.

Where a customer requests a

hardcopy of a Local Law or Council meeting minutes, photocopy charges (at cost)

will apply.

• Card

Surcharges

A merchant service fee surcharge

was introduced in 2024 – 2025 to high value Mastercard and Visa credit

and debit card transactions at 0.68% for credit transactions over $50,000.

The Reserve Bank of Australia

(RBA) guidance on merchant surcharges is that a merchant’s surcharge may

not be greater that the average cost of acceptance for that card type.

A review of the annual Cost of

Acceptance (COA) for credit card transactions has revealed the COA for credit

cards has reduced to 0.67%. The surcharge for this transaction type is proposed

to be reduced to 0.67% in line with statutory requirements for transactions

over $50,000 (including GST), which are manually processed by phone or at a

service counter.

A separate new fee is proposed for

a merchant service fee for Mastercard and Visa debit card transactions of 0.38%

for transactions over $50,000 (including GST) (Attachment 2, pages 18 and 19)

• Rates

and Property Records

Rates enquiries, copies of current

or unpaid rates notices, and access to rates information online via the

eNotices portal remain at no charge to the registered property owner.

Provision of duplicate rates

notices, and where rates have been paid or the customer is not the registered

owner of the property, have been increased by CCI from $8.70 to $9.05 per

notice. (Attachment 2, page 20).

The change of ownership fee is

proposed to increase from $70 to $73, in line with costs (Attachment 2, page

21).

• Right

to Information

The Right to Information fees are

set under regulation by the Queensland Department of Justice and

Attorney-General on an annual basis. The charges to apply for the forthcoming

financial year are yet to be confirmed by the State. As a result, the draft

report reflects the current financial year charges, with an acknowledgement

that these charges will be updated upon confirmation by the State of the

pricing to be applied from 1 July 2025 (Attachment 2, page 22).

• Property

Services

Telecommunication companies can

apply to lease Council owned or managed land to install a new

telecommunications facility. Council receives a number of requests for consent,

as the owner or trustee or manager of land, for access for the purpose of

development or maintenance works. A nominal value of $200 was set as an

introductory fee in 2023-2024 and increased to $250 last year. The fee is

proposed to remain at $250 for 2025-2026 due to the 25% increase last year.

This excludes statutory document registration costs which will be on-charged at

cost. (Attachment 2, page 23).

Community Development and

Services

The user contribution for Home

Assist services is proposed to remain at the current rate of $64 per hour

(Attachment 2, page 45). This fee is only applied where a client has

requirements in excess of the funding already provided from within the scheme,

and as such is rarely charged.

A fee increases of $7.00 from

$173.00 to 180.00 is proposed in relation to the Ipswich Tourism Operators

Network (ITON) located outside Ipswich City boundaries, the Ipswich Visitor

Information Centre (Attachment 2, page 46).

Health and Regulatory Services

A number of fees under the Health

and Regulatory Services section were subject to approval on 27 March 2025, in

order to allow the issuance of licence renewals in April. This

encompasses the following sections, which will not be addressed in this report:

1 Health

and Regulatory Services Fee Policies (Attachment 2, page 47)

2 Application,

Amendment and Inspection fees related to Health and Regulatory Services

(Attachment 2, page 48)

3 Public

Health (Attachment 2, pages 48 to 49)

4 Public

Swimming Pools (Attachment 2, Page 51)

5 Caravan

Parks, Camping Grounds and Tourist Parks (Attachment 2, Pages 52 to 53)

6

Food Businesses (Attachment 2, pages 53 to 55)

7

Heavy Vehicle Permit (Attachment 2, page 55)

8

Cemeteries (Attachment 2, pages 55 to 56)

The remaining permits, inspections

and related services associated with entertainment events and traffic control

(Section 4, Attachment 2, pages 49 to 51) are all subject to fee increases in

line with CCI.

Ipswich Waste

A range of fees for Ipswich Waste

Services are subject to recommended price rises as a result of overall service

delivery cost increases, including the waste levy.

• Recycling

and Refuse Centres

Tyre disposal fees are proposed to

be increased by between $0.10 and $0.80 per tyre (Attachment 2, page 58). For

example, disposal of a standard passenger tyre (excluding rim) will increase

from $10.90 to $11.30 per tyre.

Waste disposal fees for Ipswich

Residents at the Riverview Refuse and Recycling Centre and Rosewood Recycling

and Refuse Centre are proposed to be increased from 1 July 2025 as per table 2,

below.

For Ipswich residents, the first

500kg of waste is to increase from $18.00 to $21.00, with excess waste charged

at $0.30 per kg thereafter at Riverview, and $40.00 per cubic metre or part

thereof at Rosewood (Table 2 below, and Attachment 2, pages 59-61).

A new Pensioner General Waste fee

is proposed for the Riverview and Rosewood Refuse and Recycling Centres which

is 20% less than the General Waste fee (Subject to Rounding). The Pensioner

General Waste fee is $17.00 for Riverview and Rosewood Refuse and Recycling

Centres (Table 2 below, and Attachment 2, pages 59-61).

Services remain below cost

recovery, and are in line with benchmarks of other providers, who are facing

similar waste processing cost increases.

Table

2: Summary of general waste gate fees

|

Current Fee

|

Proposed Fee

|

Increase ($)

|

|

2024-2025

|

2025-2026

|

|

Domestic

Waste (General)

|

|

Riverview: first 500kg

|

$ 18.00

|

$ 21.00

|

$

3.00

|

|

Riverview Pensioner: first 500kg

|

N/A

|

$ 17.00

|

|

|

Riverview: Excess (per kg over 500kg)

|

$

0.25

|

$

0.30

|

$

0.05

|

|

Riverview: Excess Pensioner (per kg over 500kg)

|

N/A

|

$

0.30

|

|

|

Rosewood: first 2 cubic metres

|

$ 18.00

|

$ 21.00

|

$

3.00

|

|

Rosewood Pensioner: first 2 cubic meters

|

N/A

|

$ 17.00

|

|

|

Rosewood: Excess (per cubic metre)

|

$ 38.00

|

$ 40.00

|

$

2.00

|

|

Rosewood Pensioner: Excess (per cubic metre)

|

N/A

|

$ 40.00

|

|

|

|

|

|

|

|

Non-Ipswich Residents /

Commercial / Industrial Waste

|

|

Riverview: first 300kg

|

$ 76.00

|

$ 79.00

|

$

3.00

|

|

Riverview: Excess (per kg over 300kg)

|

$

0.25

|

$

0.30

|

$

0.05

|

|

Rosewood: first 2 cubic metres

|

$ 76.00

|

$ 79.00

|

$

3.00

|

|

Rosewood: Excess (per cubic metre)

|

$ 38.00

|

$ 40.00

|

$

2.00

|

Green waste

Disposal of a standard volume (up

to first 500kg) of green waste is proposed to remain at the discounted price of

$14.00 for Ipswich residents, with excess waste charges to remain at $0.22 per

kg at Riverview, and $37.00 per cubic meter at Rosewood.

A new Pensioner Green Waste fee is

proposed for the Riverview and Rosewood Refuse and Recycling Centres which is

20% less than the full Green Waste fee (Subject to Rounding). The Pensioner

Green Waste fee is $11.00 for Riverview and Rosewood Refuse and Recycling

Centres

Uncontaminated green waste

disposal fees at the Riverview and Rosewood Recycling and Refuse Centres are

outlined in table 3 below. (Attachment 2, pages 59-61)

Table

3: Summary of proposed green waste gate fees

|

Proposed Fees

2025-2026

|

|

Riverview

|

Rosewood

|

|

Green Waste – Domestic

(Ipswich Residents)

|

|

Green Waste: Cars, vans and utilities, including

trailers: First 500kg

|

$ 14.00

|

$ 14.00

|

|

Pensioner Green Waste: Cars, vans and utilities,

including trailers: First 500kg

|

$ 11.00

|

$ 11.00

|

|

Green Waste: Cars, vans and utilities, including

trailers: Excess over 500kg per kg

|

$ 0.22

|

$

37.00

|

|

Pensioner Green Waste: Cars, vans and utilities,

including trailers: Excess over 500kg per kg

|

$

0.22

|

$

37.00

|

|

|

|

|

|

|

Non-Ipswich Residents /

Commercial / Industrial Waste

|

|

Green Waste: First 500kg or part thereof

|

$ 74.00

|

$ 74.00

|

|

Green Waste: Excess over 500kg (per kg)

|

$

0.22

|

$

37.00

|

|

|

|

|

|

• Domestic

Bin and On-demand Services

The fee for an extra domestic

wheelie bin service is proposed to increase by only $0.80 to $25.60 per service

(Attachment 2, page 62).

The annual garden organics (green

bin) waste bin service for tenants is proposed to be discontinued and will be

priced within the proposed three bin kerbside service bundle.

Where fees are applicable for

on-demand kerbside large waste collection, these have been increased in line

with contract service costs and standard waste disposal charges. (Attachment 2,

page 63). The free initial collection service remains at no charge.

Library

Services

Library services are proposed to

remain largely unchanged for the 2025-2026 financial year. (Attachment 2, pages

64-68). Fees are consistent for comparable facilities across Ipswich library

branches. Most venues are available free of charge to library members for

non-commercial purposes.

Parks, Sporting Grounds and

Facilities

• Park

Use

For commercial park hire, proposed

cost increases are in line with CCI to keep pace with maintenance and materials

costs. For example, the hourly rate per location for commercial hire

(1-100 people) is proposed to increase from $82 to $86 per hour (Attachment 2,

page 70).

Non-commercial use of parks

remains free of charge for the community so as to encourage utilisation.

• Sporting

Grounds and Facilities

Use of sporting grounds, sport and

recreation clubhouses, and community and cultural centre hire, and associated

bonds are proposed to increase by CCI (Attachment 2, pages 72 to 81).

Fees are proposed to be reinstated

for the George Alder Tennis Centre due to the lease being handed back to

Council. Proposed pricing is a 4% increase on 2022-2023 levels. (Attachment 2,

page 77).

• Venue

Use at the Council Administration Building - 1 Nicholas Street

The Commercial and Non-Commercial

fee categories have been condensed into a single category for venue hire at 1

Nicholas Street. These fees have been reviewed in line with comparable

benchmarks, with nominal increases (generally around 4%) proposed for meeting and

function rooms (Attachment 2, pages 81 to 83).

• Civic

Centre and other Venues and Services

Service offerings for events and

venue hire at Ipswich Civic Centre have been increased with audio and visual

packages available. The Rosewood Showground Cultural Centre has also been moved

under the Ipswich Civic Centre Venue Hire category to align with administrative

responsibilities. A standard CCI price increases of 4% has been applied to

existing fees. (Attachment 2, pages 83 to 91). Support services, which are

generally labour based (e.g.: floor setup, cleaning services) are similarly

increasing at between 0-11%, in line with industry benchmarks.

A new fee structure is proposed

for the Goodna Community Centre with pricing in line with existing community

centres. (Attachment 2, pages 79 to 80).

• Ipswich

Art Gallery

No changes are proposed to the

existing charges listed in relation to the Ipswich Art Gallery Ticketed events,

workshops and merchandise will continue to be offered on a retail basis. A new category

and fee structure has been proposed for the Ipswich Art Workshop space.

(Attachment 2, page 91)

• Camping

fees

Camping fees for Harding’s

Paddock and Rosewood Showgrounds are proposed to increase by $1 per site, per

night for both powered and non-powered site options. (Attachment 2, page 92).

With high demand for bookings and rising maintenance and management costs, a

further nominal increase is considered appropriate. The proposed fees, outlined

below, remain at the lower end of comparable camp site fees elsewhere and are

consistent with remaining RV friendly site pricing.

Table 4: Camping Site Fees (per site, per night)

|

Current

|

Proposed

|

Increase ($)

|

Increase (%)

|

|

2024-2025

|

2025-2026

|

|

Harding’s Paddock

|

|

Camping fee – unpowered

|

$ 16.00

|

$ 17.00

|

$ 1.00

|

6.3%

|

|

|

|

|

|

|

Rosewood Showgrounds

|

|

Camping fee – powered

|

$ 19.00

|

$ 20.00

|

$ 1.00

|

5.3%

|

|

Camping fee – unpowered

|

$ 16.00

|

$ 17.00

|

$ 1.00

|

6.3%

|

Planning and Development

The

Planning and Development fee structure have been updated to reflect the pending

adoption of the new planning scheme (agenda item on the Infrastructure,

Planning and Assets Committee of 20 May 2025).

Planning and Development Fees

constitute approximately 50% of fees and charges revenue.

Fees

associated with the new Planning Scheme are proposed to be escalated by 5.0%

plus rounding from 1 July. This indexation is reflective of underlying cost

increases, combined with additional resourcing being directed to inspecting

works. Benchmarking exercises have been undertaken and have identified the

proposed fees as comparable to market rates. (Attachment 2, pages 93 to

179).

The following is a summary of key

changes related to the new planning scheme:

· A new Schedule of

Uses – Material Change of Use table is required under section 4.1

Material Change of Use of Premises.

· Development types

1, 2 and 3 remain, however there is no longer a separation between Impact

Assessable - Inconsistent Use and Consistent Use, but rather Impact Assessable

only.

· Notifiable PDA

Permissible Development has also been added to Types 2 and 3 Impact Assessable

development to cover development within the Ripley Valley Priority Development

Area.

· Due to terminology

changes between the old and new Planning Schemes several fees have been removed

and replacement fees added; the amounts charged are reflective of the similar

fee previously charged and indexed by 5% plus rounding.

· Section 6 –

Developer Contributions - Footpath, Kerb and Channel, and Vegetation Retention

Contributions previously applicable within an Implementation Guideline will no

longer exist with the new Planning Scheme and as such these sections and their

associated fees have been removed.

· New section 6.2