IPSWICH

CITY

COUNCIL

AGENDA

of the

Council Special Meeting

Held in the Council Chambers

2nd floor – Council Administration

Building

45 Roderick Street

IPSWICH QLD 4305

On Thursday,

24 June 2021

At 9.00

am

The purpose of

the meeting is to consider:

1. Adoption

of the 2021-2022 Budget and associated matters

2. Ipswich

City Council Annual Plan (incl. operational plan)

3. Overall

Plan for the Rural Fire Resources Levy Special Charge

4. Rates

Timetable for 2021-2022

5. Rate

Concessions - Charitable, Non Profit/Sporting Organisation

|

Council

Special

Meeting Agenda

|

24 June

2021

|

BUSINESS

1. OPENING OF MEETING:

2. WELCOME

TO COUNTRY OR ACKNOWLEDGEMENT OF COUNTRY:

3. OPENING

PRAYER:

4. APOLOGIES

AND LEAVE OF ABSENCE:

5. DECLARATIONS

OF INTEREST IN MATTERS ON THE AGENDA:

6. OFFICERS'

REPORTS:

6.1 Adoption

of the 2021-2022 Budget and associated matters......................... 5

6.2 Ipswich

City Council Annual Plan (incl. operational plan)............................ 33

6.3 Overall

Plan for the Rural Fire Resources Levy Special Charge.................... 43

6.4 Rates

Timetable for 2021-2022.................................................................... 55

6.5 Rate

Concessions - Charitable, Non Profit/Sporting Organisation.............. 65

--ooOOoo--

|

Council

Special

Meeting Agenda

|

24 June

2021

|

Doc ID No: A7350939

ITEM: 6.1

SUBJECT: Adoption of the 2021-2022 Budget and

associated matters

AUTHOR: Acting Chief Financial Officer

DATE: 18 June 2021

Executive Summary

This is a report concerning the

adoption of the 2021-2022 Budget and associated matters.

Recommendation/s

A. That

Ipswich City Council receive and note the contents of the report by the Acting

Chief Financial Officer dated 18 June 2021 concerning the 2021‑2022

Budget and associated matters.

B. That

Ipswich City Council receive and note the Statement of Estimated Financial

Position for the previous financial year 2020‑2021, outlined in

Attachment 1 to the report by the Acting Chief Financial Officer dated

18 June 2021.

C. That

in accordance with section 81 of the Local Government Regulation 2012,

Ipswich City Council decide the different rating categories of rateable land in

the local government area as follows:

(a) the

rating categories of rateable land in the local government area are in column 1

of the table below which is stated in Part 2 of the 2021‑2022 Budget

in Attachment 2 to the report by the Acting Chief Financial Officer dated

18 June 2021;

(b) the

description of each of the rating categories of rateable land in the local

government area are in column 2 of the table below which is stated in

Part 2 of the 2021‑2022 Budget in Attachment 2 to the report by

the Acting Chief Financial Officer dated 18 June 2021;

(c) the

rating category to which each parcel of rateable land in the local government

area belongs, is the rating category which is included in the Council’s

rating files at the date of issue of a relevant quarterly rating assessment

notice.

|

Column 1

Rating category of rateable land

|

Column 2

Description of rating category

|

|

1

|

Land not in Brookwater used

for a residential purpose which is owner occupied.

|

Land which meets all of the

following criteria:

(a) has any

of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) is

owner occupied;

(d) is not

located in Brookwater.

|

|

4

|

Land not used for a

residential purpose or for profit purpose.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is not

used for a residential purpose or for profit purpose.

|

|

8

|

Land in Brookwater used for

a residential purpose which is owner occupied or which is vacant land that is

potential owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

either:

(i) primarily

residential and owner occupied; or

(ii) vacant land that

is potential owner occupied;

(c) is

located in Brookwater.

|

|

9

|

Land not in Brookwater used

for a residential purpose which is not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) is not

owner occupied;

(d) is not

located in Brookwater.

|

|

10

|

Land not in Brookwater

which is vacant land less than 20,000m2 that is potential owner

occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

vacant land;

(c) is

less than 20,000m2;

(d) is

potential owner occupied;

(e) is not

located in Brookwater.

|

|

11

|

Land not in Brookwater used

for a residential purpose which is owner occupied that is in a community

titles scheme not in a high rise structure.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) is

owner occupied;

(d) is

included in a community titles scheme;

(e) is not

in a high rise structure;

(f) is

not located in Brookwater.

|

|

15

|

Land in Brookwater used for

a residential purpose which is not owner occupied or which is vacant land

that is not potential owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

either:

(i) primarily

residential and is not owner occupied; or

(ii) vacant land that

is not potential owner occupied;

(c) is

located in Brookwater.

|

|

16

|

Land not in Brookwater used

for a residential purpose which is not owner occupied that is in a community

titles scheme not in a high rise structure.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) is not

owner occupied;

(d) is

included in a community titles scheme;

(e) is not

in a high rise structure;

(f) is

not located in Brookwater.

|

|

17

|

Land not in Brookwater used

for a residential purpose which is owner occupied that is in a community

titles scheme in a high rise structure.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) is

owner occupied;

(d) is

included in a community titles scheme;

(e) is in

a high rise structure;

(f) is

not located in Brookwater.

|

|

18

|

Land not in Brookwater used

for a residential purpose which is not owner occupied that is in a community

titles scheme in a high rise structure.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) is not

owner occupied;

(d) is

included in a community titles scheme;

(e) is in

a high rise structure;

(f) is

not located in Brookwater.

|

|

19

|

Land not in Brookwater

which is vacant land less than 20,000m2 that is not potential

owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

vacant land;

(c) is

less than 20,000m2;

(d) is not

potential owner occupied;

(e) is not

located in Brookwater.

|

|

22a

|

Land used for a multi

residential purpose, with two dwellings or a dwelling with an auxiliary unit,

which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes:

(i)---- two dwellings; or

(ii)--- a dwelling with an auxiliary unit;

(d) none

of the dwellings or the auxiliary unit are owner occupied.

|

|

22b

|

Land used for a multi

residential purpose with three to five dwellings which are not owner

occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is primarily

residential;

(c) includes

three to five dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

|

22c

|

Land used for a multi

residential purpose with six to nine dwellings which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes

six to nine dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

|

22d

|

Land used for a multi

residential purpose with 10 to 14 dwellings which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes

10 to 14 dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

|

22e

|

Land used for a multi

residential purpose with 15 to 19 dwellings which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes

15 to 19 dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

|

22f

|

Land used for a multi

residential purpose with 20 to 29 dwellings which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes

20 to 29 dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

|

22g

|

Land used for a multi

residential purpose with 30 to 39 dwellings which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is primarily

residential;

(c) includes

30 to 39 dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

|

22h

|

Land used for a multi

residential purpose with 40 or more dwellings which are not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily residential;

(c) includes

40 or more dwellings;

(d) one or

more of the dwellings is not owner occupied.

|

|

23

|

Land not in Brookwater

which is vacant land that is 20,000m2 or greater and is potential

owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

vacant land;

(c) is

20,000m2 or greater;

(d) is potential

owner occupied;

(e) is not

located in Brookwater.

|

|

24

|

Land not in Brookwater

which is vacant land that is 20,000m2 or greater and is not

potential owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

vacant land;

(c) is

20,000m2 or greater;

(d) is not

potential owner occupied;

(e) is not

located in Brookwater.

|

|

25

|

Land which is vacant land

requiring rehabilitation as the subject of a previous extractive industry

involving coal mining.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

vacant land;

(c) has

the Secondary Land Use Code of 78 Previous extractive industries land use

requiring site rehabilitation;

(d) requires

rehabilitation as the subject of a previous extractive industry involving

coal mining.

|

|

41

|

Land used for a farming and

grazing purpose which is owner occupied or potential owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for farming and grazing;

(c) is

either:

(i) owner

occupied; or

(ii) potential owner

occupied.

|

|

42

|

Land used for a farming and

grazing purpose which is not owner occupied.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for farming and grazing;

(c) is not

owner occupied.

|

|

43a

|

Land used for a commercial

purpose with a rateable value of less than $200,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a commercial use;

(c) has a

rateable value of less than $200,000.

|

|

43b

|

Land used for a commercial

purpose with a rateable value of $200,000 to less than $500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a commercial use;

(c) has a

rateable value of $200,000 to less than $500,000.

|

|

43c

|

Land used for a commercial

purpose with a rateable value of $500,000 to less than $1,000,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a commercial use;

(c) has a

rateable value of $500,000 to less than $1,000,000.

|

|

43d

|

Land used for a commercial

purpose with a rateable value of $1,000,000 to less than $2,500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a commercial use;

(c) has a

rateable value of $1,000,000 to less than $2,500,000.

|

|

44a

|

Land used for a commercial

purpose with a rateable value of $2,500,000 to less than $5,000,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a commercial use;

(c) has a

rateable value of $2,500,000 to less than $5,000,000.

|

|

44b

|

Land used for a commercial

purpose with a rateable value of $5,000,000 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a commercial use;

(c) has a

rateable value of $5,000,000 or greater.

|

|

45

|

Land used for a noxious

industry that is not in rating categories 46, 47b and 50.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a noxious industry;

(c) is not

in rating categories 46, 47b and 50.

|

|

46

|

Land used for a noxious

industry involving waste recycling or waste processing.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) has

the Secondary Land Use Code of 37 Noxious Industry - Waste

Recycling/Processing;

(c) is

primarily for a noxious industry involving waste recycling or waste

processing.

|

|

47a

|

Land used for an extractive

industry involving coal mining or the rehabilitation of land the subject of a

previous or current extractive industry involving coal mining.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) has

the Secondary Land Use Codes of 00 Coal mining and ancillary and/or

associated activities including mine rehabilitation;

(c) is

primarily for an extractive industry involving coal mining or the

rehabilitation of land the subject of a previous or current extractive

industry involving coal mining.

|

|

47b

|

Land used for a noxious

industry involving a landfill.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) has

any of the following Secondary Land Use Codes:

(i) 17 Noxious

Industry Land Fill - Putrescible Material;

(ii) 27 Noxious

Industry Land Fill - Non Putrescible Material;

(c) is

primarily for a noxious industry involving a landfill.

|

|

48

|

Land used for an extractive

industry that is not in rating category 47a.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for an extractive industry not involving any of the following:

(i) coal mining;

(ii) rehabilitation of

land the subject of a previous or current extractive industry involving coal

mining;

(c) is not

in rating category 47a.

|

|

49a

|

Land used for a light

industry with a rateable value of less than $500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a light industry;

(c) has a

rateable value of less than $500,000.

|

|

49b

|

Land used for a light

industry with a rateable value of $500,000 to less than $1,000,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a light industry;

(c) has a

rateable value of $500,000 to less than $1,000,000.

|

|

49c

|

Land used for a light

industry with a rateable value of $1,000,000 to less than $2,500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a light industry;

(c) has a

rateable value of $1,000,000 to less than $2,500,000.

|

|

49d

|

Land used for a light

industry with a rateable value of $2,500,000 to less than $5,000,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a light industry;

(c) has a

rateable value of $2,500,000 to less than $5,000,000.

|

|

49e

|

Land used for a light

industry with a rateable value of $5,000,000 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a light industry;

(c) has a

rateable value of $5,000,000 or greater.

|

|

50

|

Land used for a heavy

industry.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) if the

land has a Primary Council Land Use Code of 37 Noxious/Offensive Industry,

the land also has a Secondary Land Use Code of 99 Power Station;

(c) is

primarily for a heavy industry.

|

|

55a

|

Land used for a retail

purpose with a total GLA of less than 5,000m2 and a rateable value

of less than $200,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of less than 5,000m2;

(c) has a

rateable value of less than $200,000.

|

|

55b

|

Land used for a retail

purpose with a total GLA of less than 5,000m2 and a rateable value

of $200,000 to less than $500,000.

|

Land which meets all of the

following criteria:

(a) has any

of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of less than 5,000m2;

(c) has a

rateable value of $200,000 to less than $500,000.

|

|

55c

|

Land used for a retail

purpose with a total GLA less of than 5,000m2 and a rateable value

of $500,000 to less than $1,000,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of less than 5,000m2;

(c) has a

rateable value of $500,000 to less than $1,000,000.

|

|

55d

|

Land used for a retail

purpose with a total GLA of less than 5,000m2 and a rateable value

of $1,000,000 to less than $2,500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of less than 5,000m2;

(c) has a

rateable value of $1,000,000 to less than $2,500,000.

|

|

55e

|

Land used for a retail

purpose with a total GLA of 5,000m2 to less than 7,500m2 and

a rateable value of less than $2,500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 5,000m2 to less

than 7,500m2;

(c) has a

rateable value of less than $2,500,000.

|

|

55f

|

Land used for a retail

purpose with a total GLA of 7,500m2 to less than 10,000m2 and

a rateable value of less than $2,500,000.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 7,500m2 to less

than 10,000m2;

(c) has a

rateable value of less than $2,500,000.

|

|

55g

|

Land used for a retail

purpose with a total GLA of less than 10,000m2 and a rateable

value of $2,500,000 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of less than 10,000m2;

(c) has a

rateable value of $2,500,000 or greater.

|

|

55h1

|

Land used for a retail

purpose with a total GLA of 10,000m2 to less than 12,500m2

and a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 10,000m2 to

less than 12,500m2;

(c) has a

land area of less than 200,000m2.

|

|

55h2

|

Land used for a retail

purpose with a total GLA of 12,500m2 to less than 15,000m2

and a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 12,500m2 to

less than 15,000m2;

(c) has a

land area of less than 200,000m2.

|

|

55h3

|

Land used for a retail

purpose with a total GLA of 15,000m2 to less than 17,500m2

and a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 15,000m2 to

less than 17,500m2;

(c) has a

land area of less than 200,000m2.

|

|

55h4

|

Land used for a retail

purpose with a total GLA of 17,500m2 to less than 20,000m2

and a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 17,500m2 to

less than 20,000m2;

(c) has a

land area of less than 200,000m2.

|

|

55i1

|

Land used for a retail

purpose with a total GLA of 20,000m2 to less than 25,000m2

and a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 20,000m2 to

less than 25,000m2;

(c) has a

land area of less than 200,000m2.

|

|

55i2

|

Land used for a retail

purpose with a total GLA of 25,000m2 to less than 30,000m2

and a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 25,000m2 to

less than 30,000m2;

(c) has a

land area of less than 200,000m2.

|

|

55j

|

Land used for a retail purpose

with a total GLA of 30,000m2 to less than 45,000m2 and

a land area of less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 30,000m2 to

less than 45,000m2;

(c) has a

land area of less than 200,000m2.

|

|

55k

|

Land used for a retail

purpose with a total GLA of 45,000m2 or greater and a land area of

less than 200,000m2.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 45,000m2 or

greater;

(c) has a

land area of less than 200,000m2.

|

|

55l

|

Land used for a retail

purpose with a total GLA of 10,000m2 to less than 20,000m2

and a land area of 200,000m2 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 10,000m2 to

less than 20,000m2;

(c) has a

land area of 200,000m2 or greater.

|

|

55m

|

Land used for a retail

purpose with a total GLA of 20,000m2 to less than 30,000m2

and a land area of 200,000m2 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 20,000m2 to

less than 30,000m2;

(c) has a

land area of 200,000m2 or greater.

|

|

55n

|

Land used for a retail

purpose with a total GLA of 30,000m2 to less than 45,000m2

and a land area of 200,000m2 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 30,000m2 to

less than 45,000m2;

(c) has a

land area of 200,000m2 or greater.

|

|

55o

|

Land used for a retail

purpose with a total GLA of 45,000m2 or greater and a land area of

200,000m2 or greater.

|

Land which meets all of the

following criteria:

(a) has

any of the Primary Council Land Use Codes for this rating category;

(b) is

primarily for a retail purpose with a total GLA of 45,000m2 or greater;

(c) has a

land area of 200,000m2 or greater.

|

D. That

in accordance with section 257 of the Local Government Act 2009,

Ipswich City Council delegate to the Chief Executive Officer the power to

identify the rating category to which each parcel of rateable land belongs

under section 81(4) and (5), section 82 and any other applicable

provision of Chapter 4 of the Local Government Regulation 2012.

E. That

in accordance with section 94 of the Local Government Act 2009 and

section 80 of the Local Government Regulation 2012, Ipswich City

Council decide to levy differential general rates on rateable land in the local

government area, on the basis stated in Part 2 of the 2021‑2022

Budget in Attachment 2 to the report by the Acting Chief Financial Officer

dated 18 June 2021.

F. That

in accordance with section 74 and section 76 of the Local

Government Regulation 2012, Ipswich City Council decide that the rateable

value of land for the financial year will be the three (3)-year averaged value

of the land, on the basis stated in Part 2 of the 2021‑2022 Budget

in Attachment 2 to the report by the Acting Chief Financial Officer dated

18 June 2021.

G. That

in accordance with section 80 of the Local Government Regulation 2012,

Ipswich City Council decide that the differential general rates for each rating

category of rateable land in the local government area is that in column 2

of the table below which is stated in Part 2 of the 2021‑2022 Budget

in Attachment 2 to the report by the Acting Chief Financial Officer dated

18 June 2021.

|

Column

1

Rating category

|

Column

2

Differential

general rates

|

Column

3

Minimum

amount of general rates

|

Column

4

Limitation on increase of levied

2020-2021 differential general rates (%)

|

|

1

|

0.7340 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,014

|

15

|

|

4

|

0.7340 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$621

|

15

|

|

8

|

0.7340 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$2,462

|

15

|

|

9

|

0.9785 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,375

|

15

|

|

10

|

0.7340 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,014

|

15

|

|

11

|

0.7340 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,014

|

15

|

|

15

|

0.9785 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$3,126

|

15

|

|

16

|

0.9785 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,375

|

15

|

|

17

|

0.7340 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,014

|

15

|

|

18

|

0.9785 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,375

|

15

|

|

19

|

1.0039 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$1,375

|

15

|

|

22a

|

0.9785 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$2,750

|

15

|

|

22b

|

0.9785 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$4,123

|

15

|

|

22c

|

0.9785 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$8,248

|

15

|

|

22d

|

0.9785 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$13,746

|

15

|

|

22e

|

0.9785 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$20,619

|

15

|

|

22f

|

0.9785 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$27,492

|

15

|

|

22g

|

0.9785 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$41,237

|

15

|

|

22h

|

0.9785 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$54,983

|

15

|

|

23

|

0.7340 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$1,014

|

15

|

|

24

|

1.2333 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$1,375

|

15

|

|

25

|

6.5185 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$1,375

|

15

|

|

41

|

0.6603 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$1,316

|

15

|

|

42

|

0.8403 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$1,316

|

15

|

|

43a

|

1.9006 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$1,303

|

15

|

|

43b

|

1.9956 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

15

|

|

43c

|

2.0907 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

15

|

|

43d

|

2.1857 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

15

|

|

44a

|

2.3758 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

15

|

|

44b

|

2.5183 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

15

|

|

45

|

2.4709 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$1,721

|

15

|

|

46

|

5.1373 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$24,317

|

15

|

|

47a

|

20.2575 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$14,351

|

15

|

|

47b

|

32.4230 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$464,486

|

5

|

|

48

|

3.2310 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$2,209

|

15

|

|

49a

|

2.0907 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$1,460

|

15

|

|

49b

|

2.1857 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

15

|

|

49c

|

2.2807 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

15

|

|

49d

|

2.4708 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

15

|

|

49e

|

2.6133 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

15

|

|

50

|

3.1360 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

15

|

|

55a

|

1.9006 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$1,303

|

15

|

|

55b

|

1.9956 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

15

|

|

55c

|

2.0907 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

15

|

|

55d

|

2.1857 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

15

|

|

55e

|

2.6133 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

7.5

|

|

55f

|

3.0410 cents in the dollar on the rateable value of all rateable land in this

rating category

|

Not applicable

|

7.5

|

|

55g

|

3.5161 cents in the dollar on the rateable value of all

rateable land in this rating category

|

Not applicable

|

7.5

|

|

55h1

|

4.8438 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$332,332

|

15

|

|

55h2

|

4.8438 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$410,883

|

15

|

|

55h3

|

4.8438 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$489,434

|

15

|

|

55h4

|

4.8438 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$567,984

|

15

|

|

55i1

|

4.8438 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$672,731

|

15

|

|

55i2

|

4.8438 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$777,127

|

15

|

|

55j

|

4.8438 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$925,378

|

15

|

|

55k

|

4.8438 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$1,480,646

|

15

|

|

55l

|

4.8438 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$942,746

|

15

|

|

55m

|

4.8438 cents in the dollar on the rateable value of all

rateable land in this rating category

|

$1,413,965

|

15

|

|

55n

|

4.8438 cents in the dollar on the rateable value of all rateable

land in this rating category

|

$2,122,238

|

15

|

|

55o

|

4.8438 cents in the dollar on the rateable value of all rateable land in this

rating category

|

$2,744,498

|

15

|

H. That

in accordance with section 77 of the Local Government Regulation 2012,

Ipswich City Council decide that the minimum amount of general rates for

certain rating categories of rateable land in the local government area is to

be fixed to that amount in column 3 of the table in Resolution G, on

the basis stated in Part 2 of the 2021‑2022 Budget in

Attachment 2 to the report by Acting Chief Financial Officer dated

18 June 2021.

I. That

in accordance with section 116 of the Local Government Regulation 2012,

Ipswich City Council decide to limit the increase in the differential general

rates for certain rating categories of rateable land in the local government

area to not more than the differential general rates for the last financial

year increased by the percentage stated in column 4 of the table in

Resolution G, on the basis stated in Part 2 of the 2021‑2022

Budget in Attachment 2 to the report by the Acting Chief Financial Officer

dated 18 June 2021.

J. That

in accordance with section 94 of the Local Government Act 2009 and

section 99 of the Local Government Regulation 2012, Ipswich City

Council decide to levy utility charges for waste management services on

rateable land in the local government area that are in column 2 of the

table below, on the basis stated in Part 3 of the 2021‑2022 Budget

in Attachment 2 to the report by the Acting Chief Financial Officer dated

18 June 2021.

|

Column 1

Type of waste management

service

|

Column 2

Waste management utility

charge per waste management service (per annum)

|

|

Household waste service

|

$377.00

|

|

Adjusted household waste

service

|

$188.40

|

|

Food organics garden

organics waste service

|

$80.00

|

|

Non-household waste service

|

$377.00

|

|

Non-household waste levy

|

$69.60

|

K. That

in accordance with section 94 of the Local Government Act 2009,

section 94 of the Local Government Regulation 2012 and

section 128A of the Fire and Emergency Services Act 1990, Ipswich

City Council decide to levy a special charge of $39 per annum for the Rural

Fire Brigades Services for the services, facilities or activities identified in

the Rural Fire Resources Levy Special Charge Overall Plan, on rateable land in

the local government area that specially benefits from the Rural Fire Brigades

Services, on the basis stated in Part 4 of the 2021‑2022 Budget in

Attachment 2 to the report by the Acting Chief Financial Officer dated

18 June 2021.

L. That

in accordance with section 94 of the Local Government Act 2009,

section 103 of the Local Government Regulation 2012 and

section 128A of the Fire and Emergency Services Act 1990, Ipswich

City Council decide to levy a separate charge of $3 per annum for the Rural

Fire Brigades Services on rateable land in the local government area, on the

basis stated in Part 5 of the 2021‑2022 Budget in Attachment 2

to the report by the Acting Chief Financial Officer dated

18 June 2021.

M. That

in accordance with section 94 of the Local Government Act 2009 and

section 103 of the Local Government Regulation 2012, Ipswich City

Council decide to levy a separate charge of $51 per annum for the Ipswich

Enviroplan on rateable land in the local government area, on the basis stated

in Part 6 of the 2021‑2022 Budget in Attachment 2 to the report

by the Acting Chief Financial Officer dated 18 June 2021.

N. That

in accordance with section 107 of the Local Government Regulation 2012

and section 114 of the Fire and Emergency Services Act 1990,

Ipswich City Council decide that rates and charges (including the Emergency

Management Levy) will be levied quarterly on the basis stated in Part 7 of

the 2021‑2022 Budget in Attachment 2 to the report by the Acting

Chief Financial Officer dated 18 June 2021.

O. That

Ipswich City Council decide on the basis stated in Part 7 of the 2021‑2022

Budget in Attachment 2 to the report by the Acting Chief Financial Officer

dated 18 June 2021, the following:

(a) the

period within which rates and charges (including the Emergency Management Levy

under section 115 of the Fire and Emergency Services Act 1990) must

be paid in accordance with section 118 of the Local Government

Regulation 2012;

(b) to

allow ratepayers to pay rates and charges (including the Emergency Management

Levy) by instalments in accordance with section 129 of the Local

Government Regulation 2012;

(c) to

allow a discount for payment of rates and charges before the end of a period

that ends on or before the due date for payment in accordance with

section 130 of the Local Government Regulation 2012.

P. That

in accordance with section 133 of the Local Government Regulation 2012,

Ipswich City Council decide that interest is payable on overdue rates and

charges, at an annual rate of 8.03%, on the basis stated in Part 8 of the

2021‑2022 Budget in Attachment 2 to the report by the Acting Chief

Financial Officer dated 18 June 2021.

Q. That

in accordance with Chapter 4, Part 10 of the Local Government

Regulation 2012, Ipswich City Council decide to grant a concession for

rates and charges to an eligible pensioner who owns and occupies rateable land,

on the basis stated in Part 9 of the 2021‑2022 Budget in

Attachment 2 to the report by the Acting Chief Financial Officer dated

18 June 2021.

R. That

in accordance with section 192 of the Local Government Regulation 2012,

Ipswich City Council adopt the Debt Policy for 2021-2022 which is stated in

Part 11 of the 2021‑2022 Budget in Attachment 2 to the report

by the Acting Chief Financial Officer dated 18 June 2021.

S. That

in accordance with section 191 of the Local Government Regulation 2012,

Ipswich City Council adopt the Investment Policy for 2021‑2022 which is

stated in Part 12 of the 2021‑2022 Budget in Attachment 2 to

the report by the Acting Chief Financial Officer dated 18 June 2021.

T. That

Ipswich City Council adopt the Financial Management Policy for 2021‑2022

which is stated in Part 13 of the 2021‑2022 Budget in

Attachment 2 to the report by the Acting Chief Financial Officer dated

18 June 2021.

U. That

in accordance with section 104 of the Local Government Act 2009 and

section 170 of the Local Government Regulation 2012, Ipswich City Council

consider and adopt the 2021‑2022 Budget, which is Attachment 2 to

the report by the Acting Chief Financial Officer dated 18 June 2021,

that includes the following:

(a) the

Budget and Long-Term Financial Forecast which is stated in Part 1,

including the Forecast Financial Statements: Statement of Income and

Expenditure, Statement of Financial Position, Statement of Cash Flows and

Statement of Changes in Equity;

(b) the

Revenue Statement which is stated in Part 10;

(c) the

Revenue Policy which is stated in Part 15;

(d) the

relevant measures of financial sustainability which is stated in Part 1;

(e) the

total value of the change, expressed as a percentage, in the rates and utility

charges levied for the financial year compared with the rates and utility

charges levied in the previous budget which is stated in Part 1.

V. That

it be recorded that in each case where a preceding Resolution refers to the

whole or a part of a document which is in Attachment 1 or

Attachment 2 to the report by the Acting Chief Financial Officer dated

18 June 2021, the whole or part of the document is incorporated by

reference into and forms part of the terms and content of the Resolution

RELATED PARTIES

There are no related parties in

relation to this report.

Advance Ipswich Theme

Listening, leading and financial

management

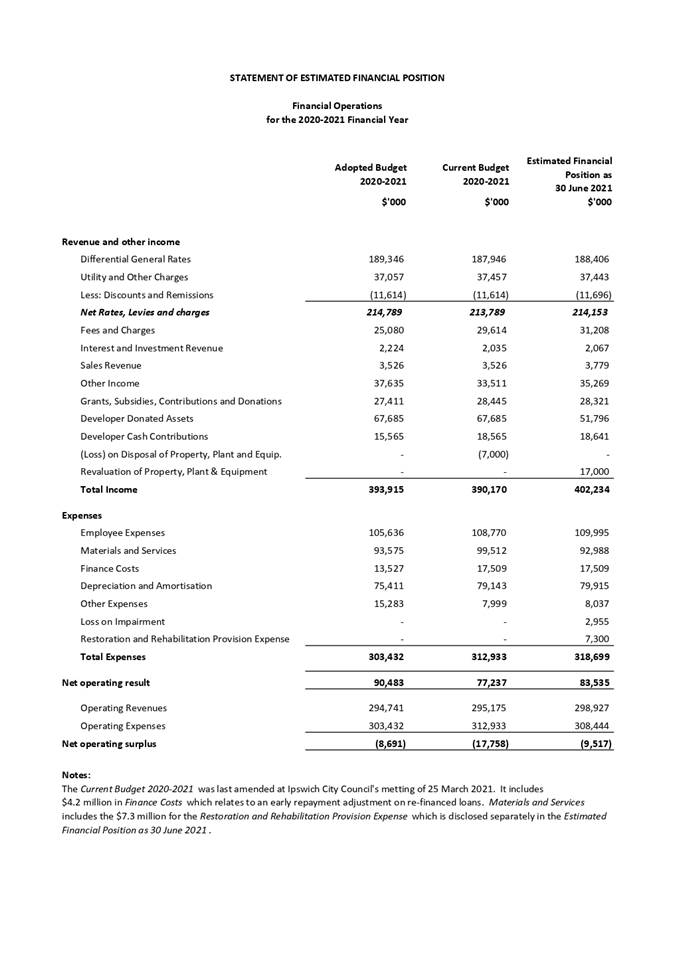

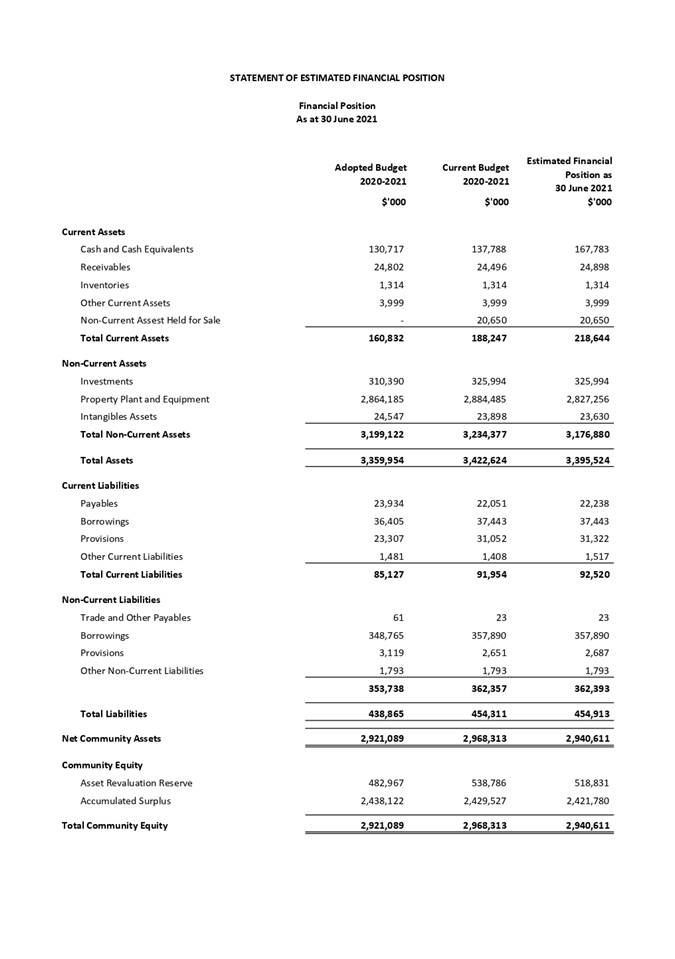

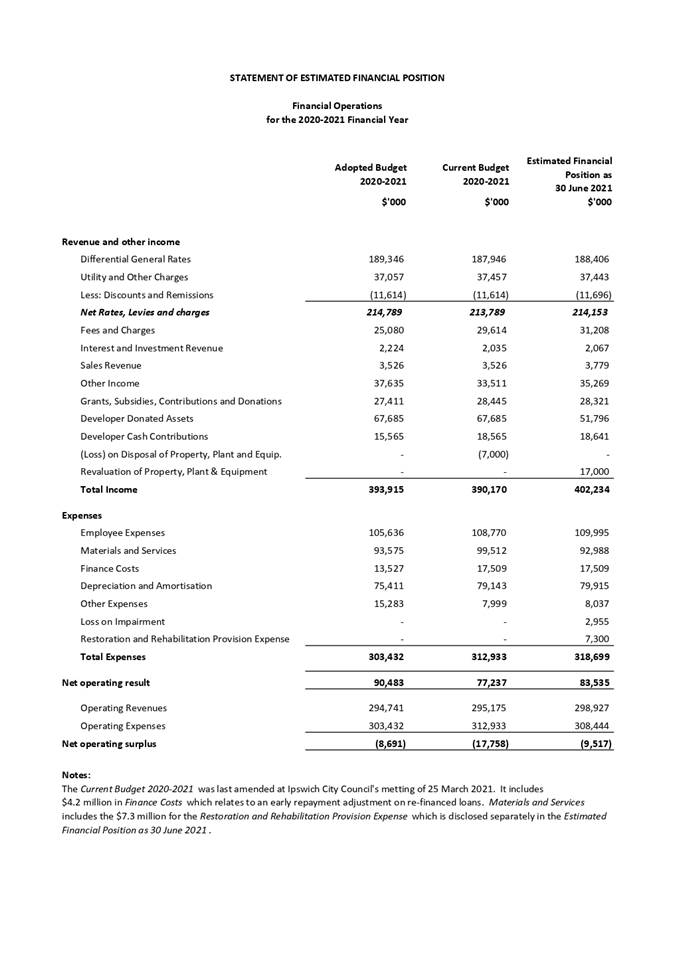

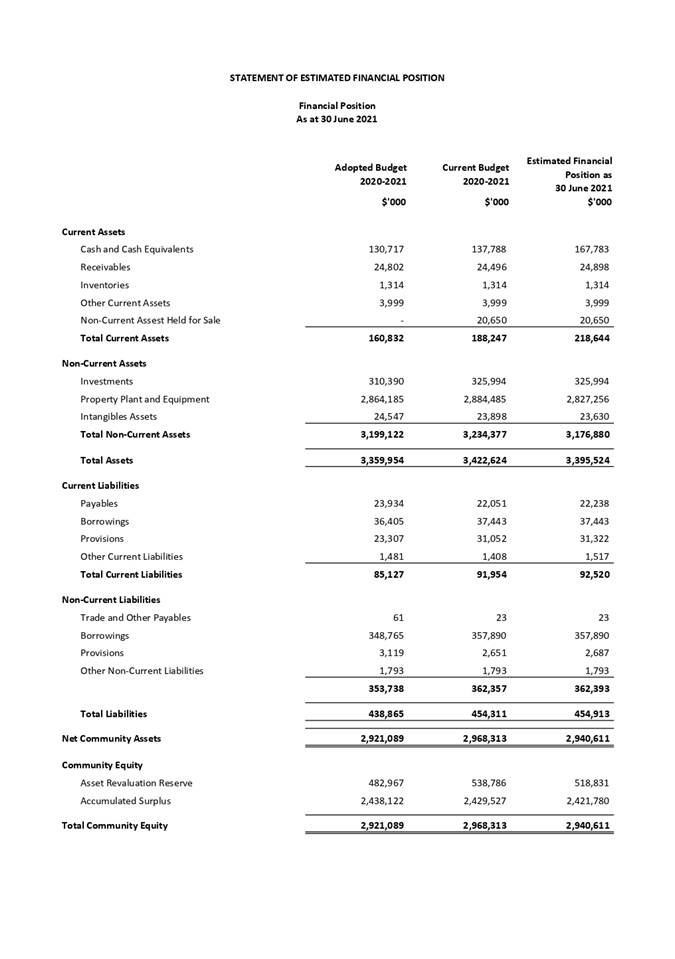

Purpose of Report/Background

Financial Information for the

Budget Meeting

Section 205 of the Local

Government Regulation 2012 requires the Chief Executive Officer to present

the local government’s annual budget meeting with a statement of

estimated financial position for the previous financial year.

The statement of estimated

financial position is a document stating the financial operations, and

financial position, of the local government for the previous financial year (Attachment 1).

2021-2022 Budget

The 2021-2022 Budget (Attachment 2)

contains the Budget, Long-Term Financial Forecast, General Rates, Utility

Charges, Special Charges, Separate Charges and other associated documents and

polices for the 2021-2022 financial year including the following:

• The

2021-2022 Budget;

• Long-Term

Financial Forecast

• Differential

General Rates;

• Waste

Management Utility Charges;

• Rural

Fire Resources Levy Special Charge;

• Rural

Fire Resources Levy Separate Charge;

• Enviroplan

Separate Charge;

• Time

and Manner of Payment of Rates and Charges;

• Interest

on Overdue Rates and Charges;

• Concession

for Rates or Charges to Pensioners;

• Revenue

Statement;

• Debt

Policy;

• Investment

Policy;

• Financial

Management Policy;

• Procurement

Policy;

• Revenue

Policy.

Legal/Policy Basis

This report and its

recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

Land Valuation Act 2010

Retail Shop Leases Regulation 2016

Waste Reduction and Recycling (Waste Levy) Amendment Act

2019

Fire and Emergency Services Act 1990

Revenue Policy

Revenue Statement

Financial Management Policy

Debt Policy

Investment Policy

Procurement Policy

Pensioner remission of Rates Policy

RISK MANAGEMENT IMPLICATIONS

There no specific risk management

issues to consider in adopting the 2021‑2022 Budget and Long Term

Financial Forecast.

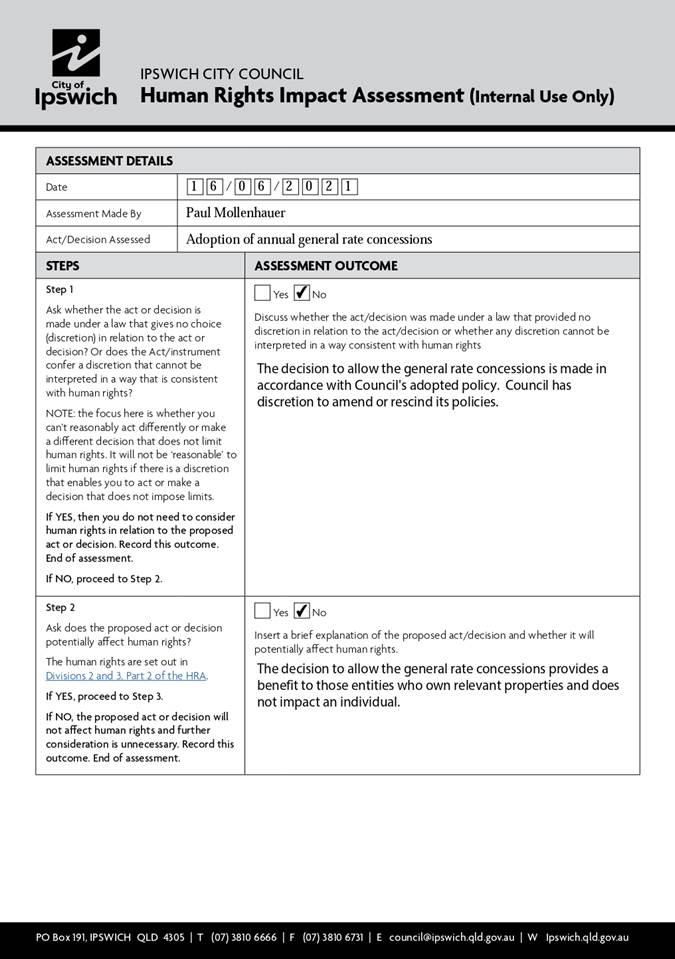

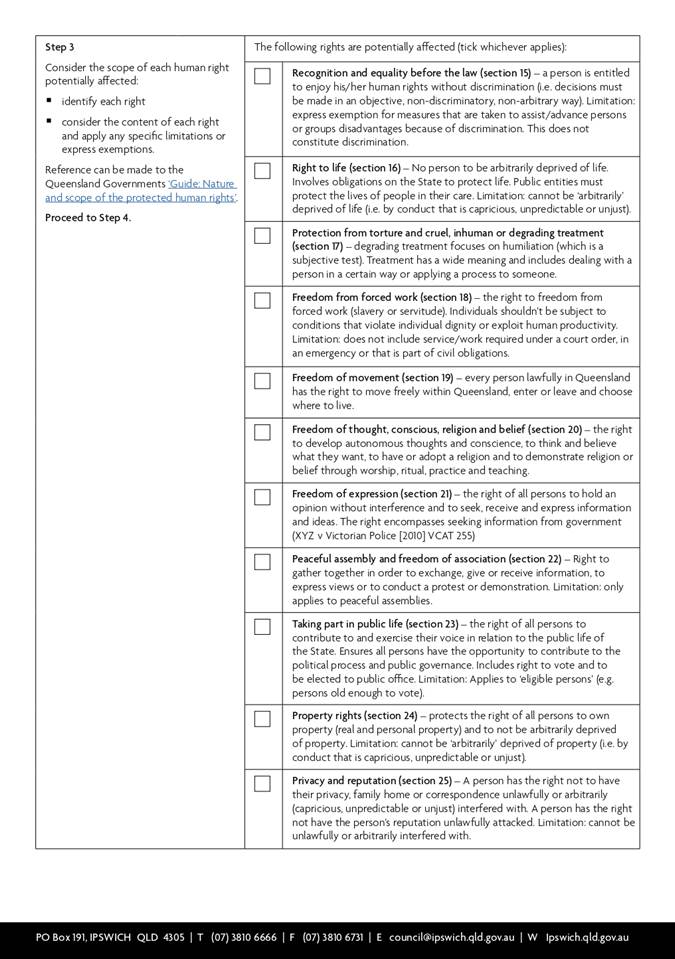

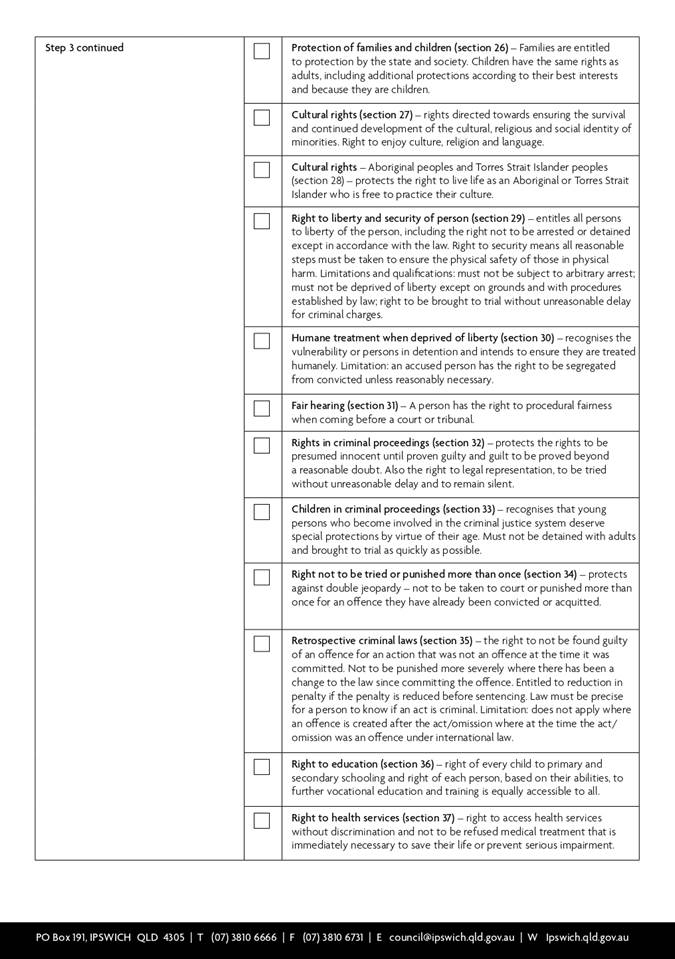

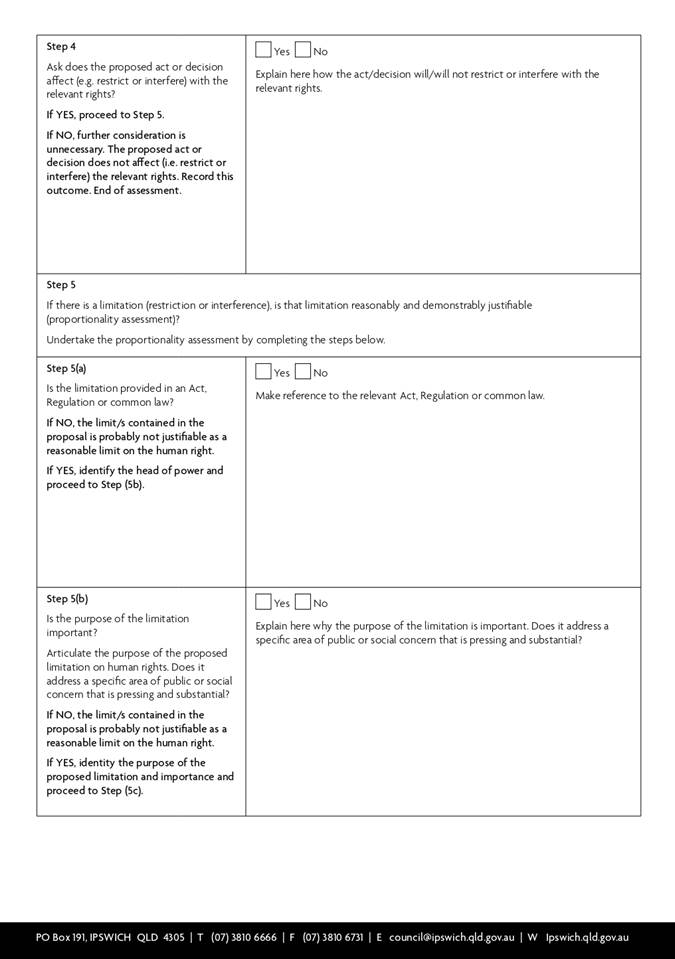

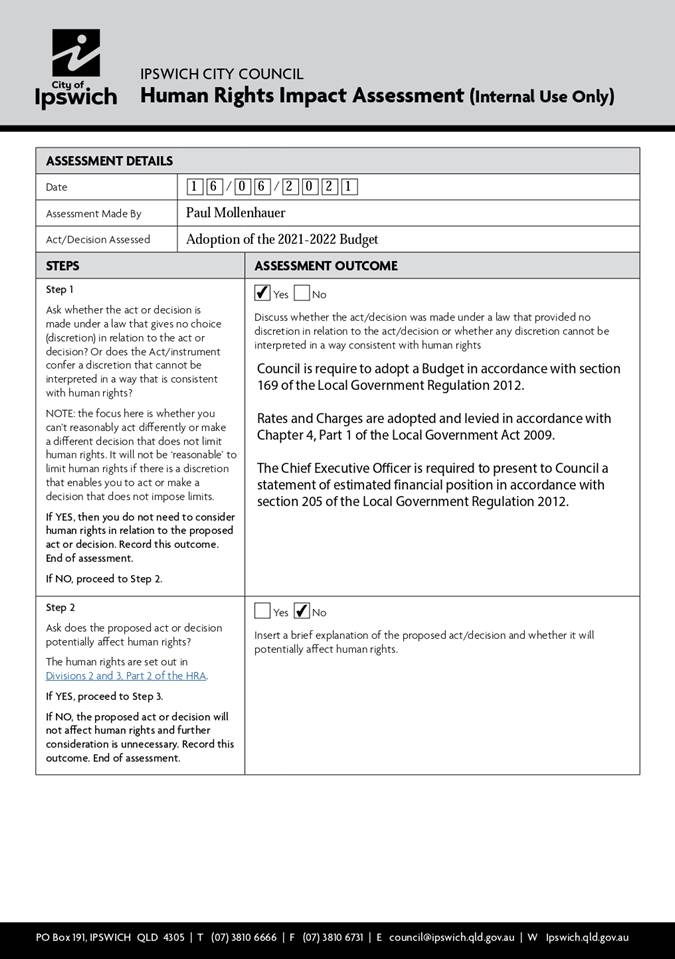

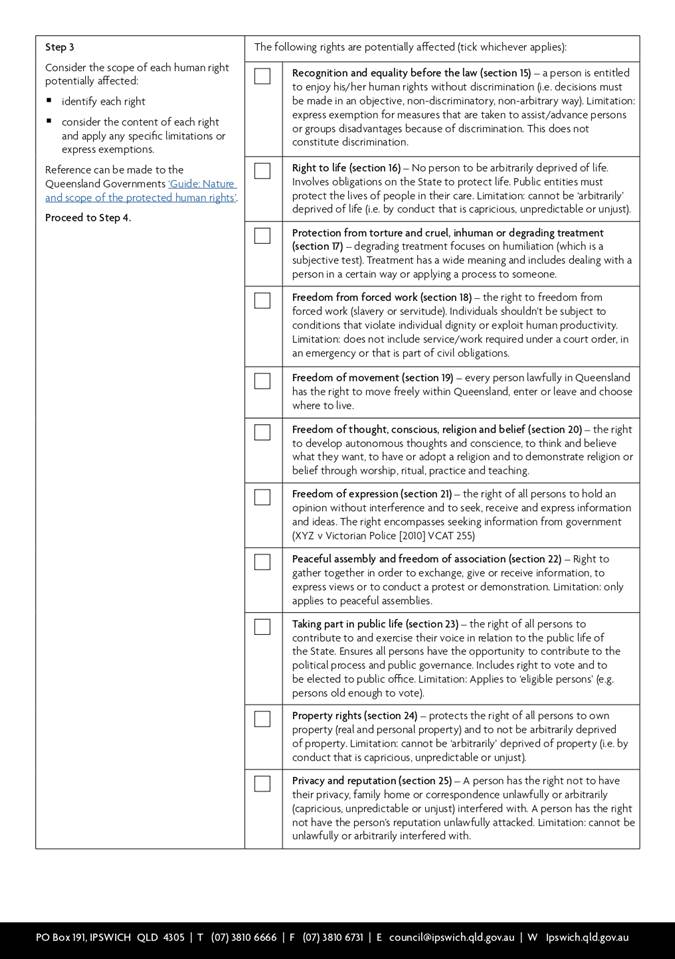

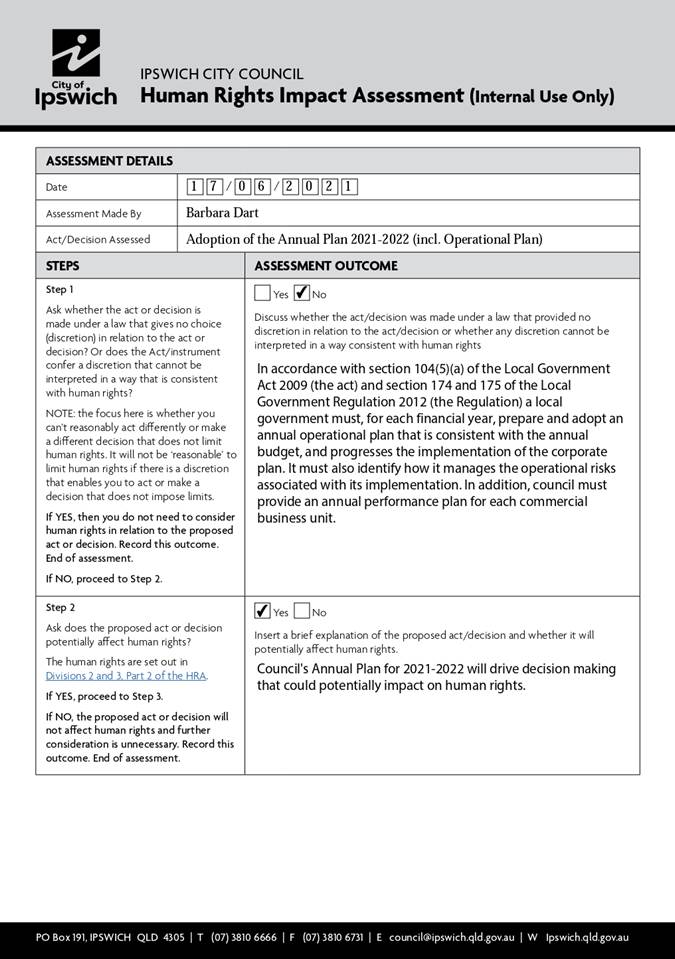

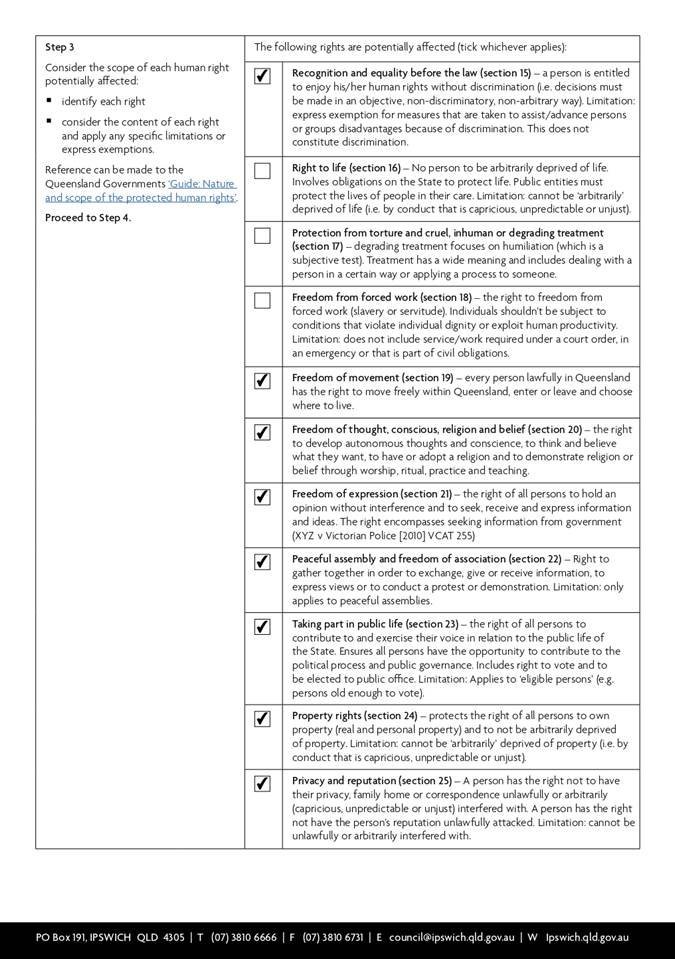

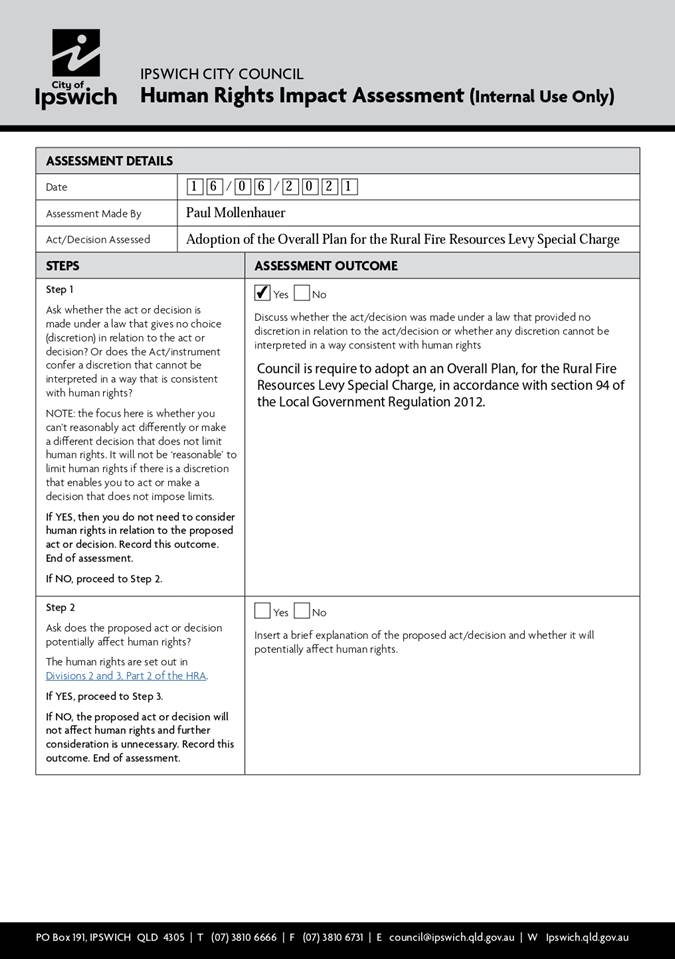

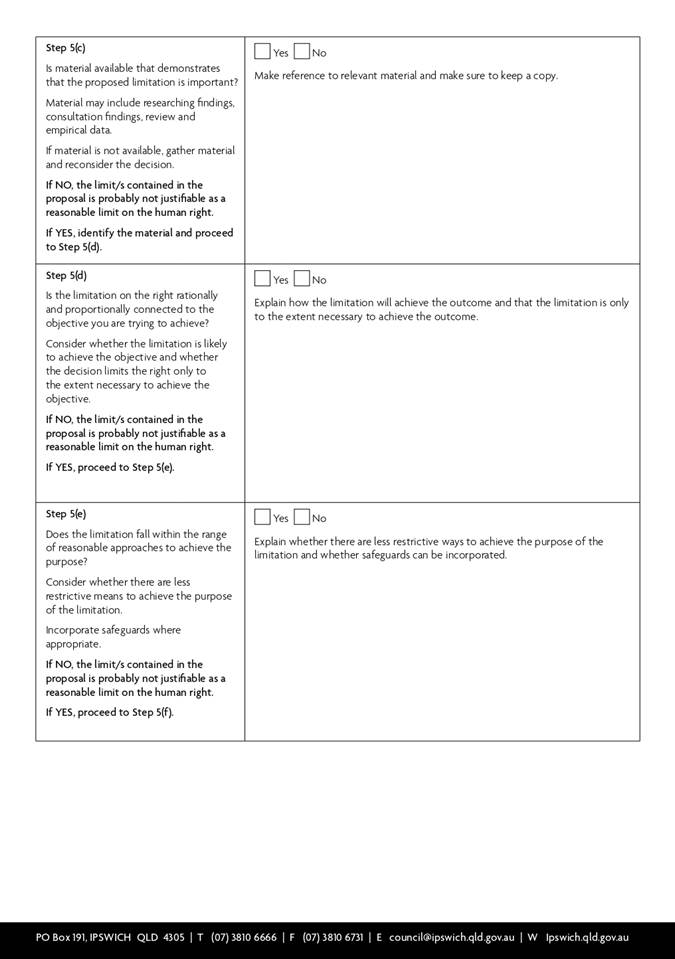

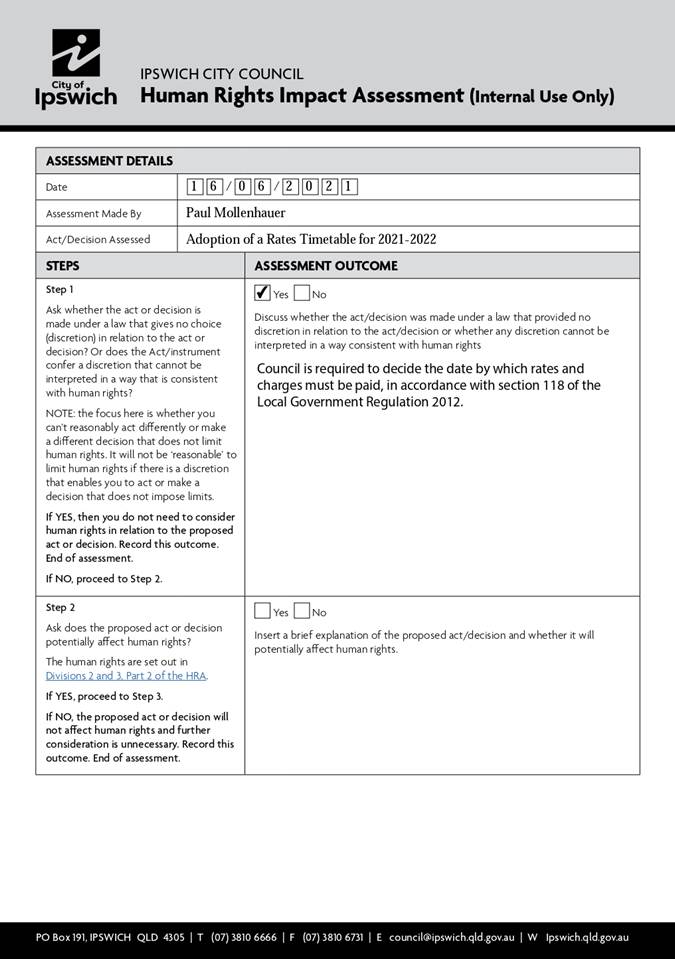

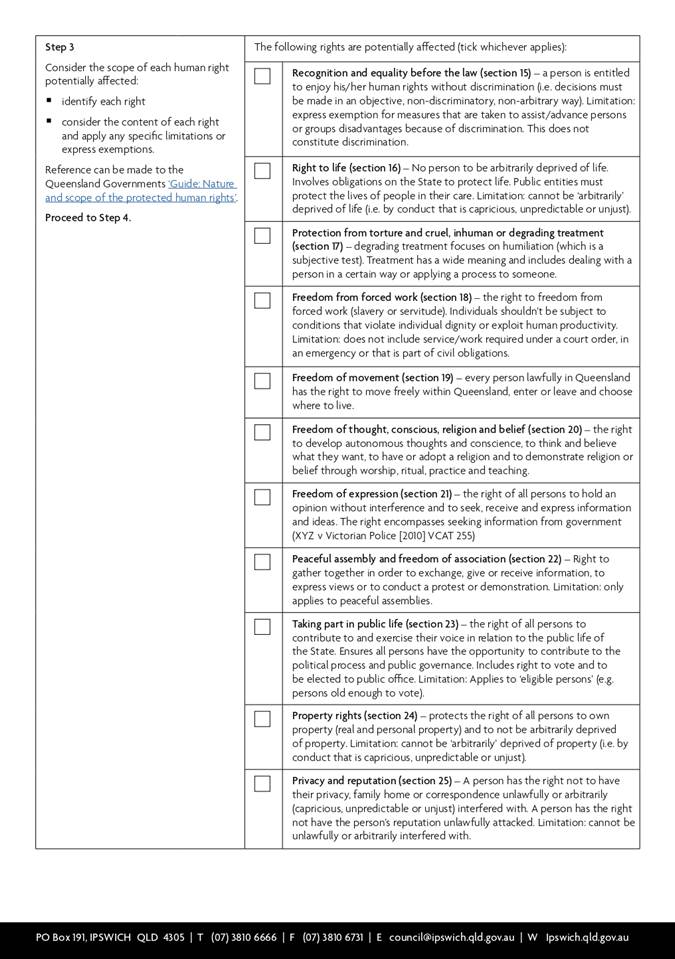

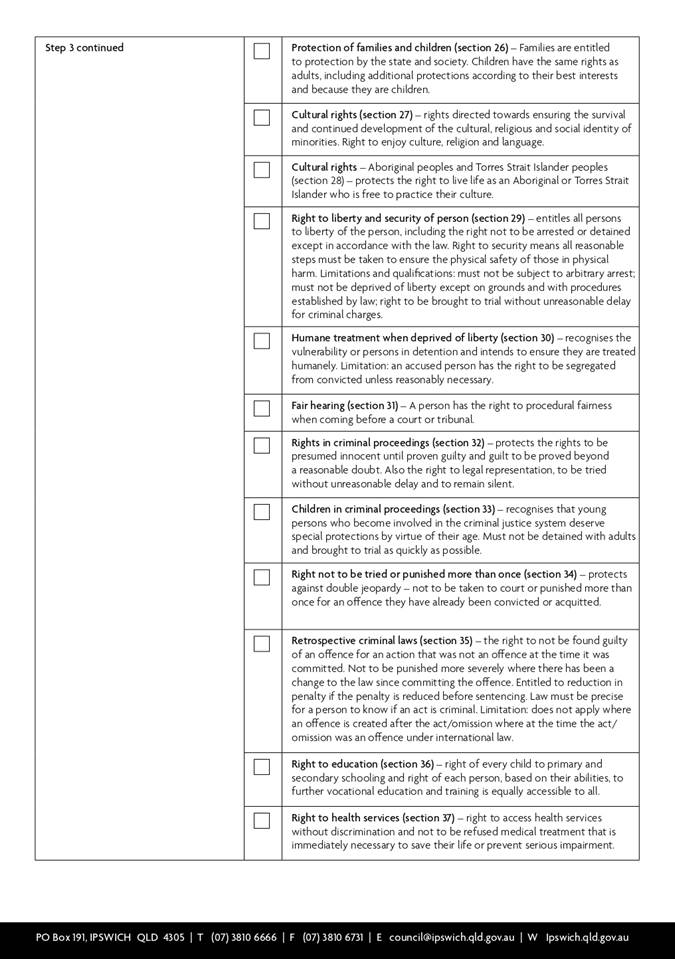

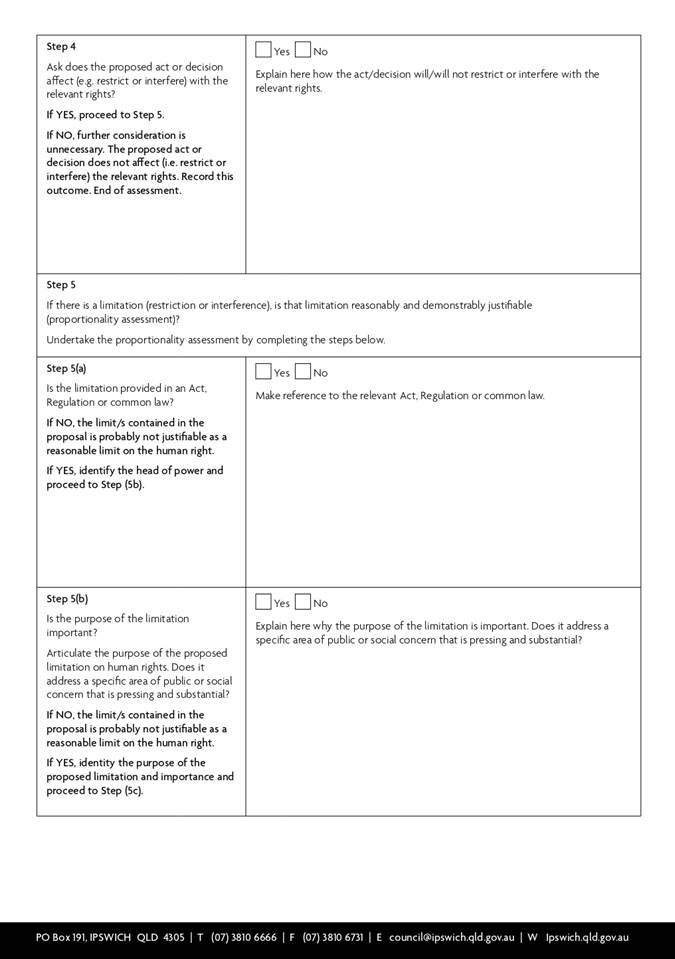

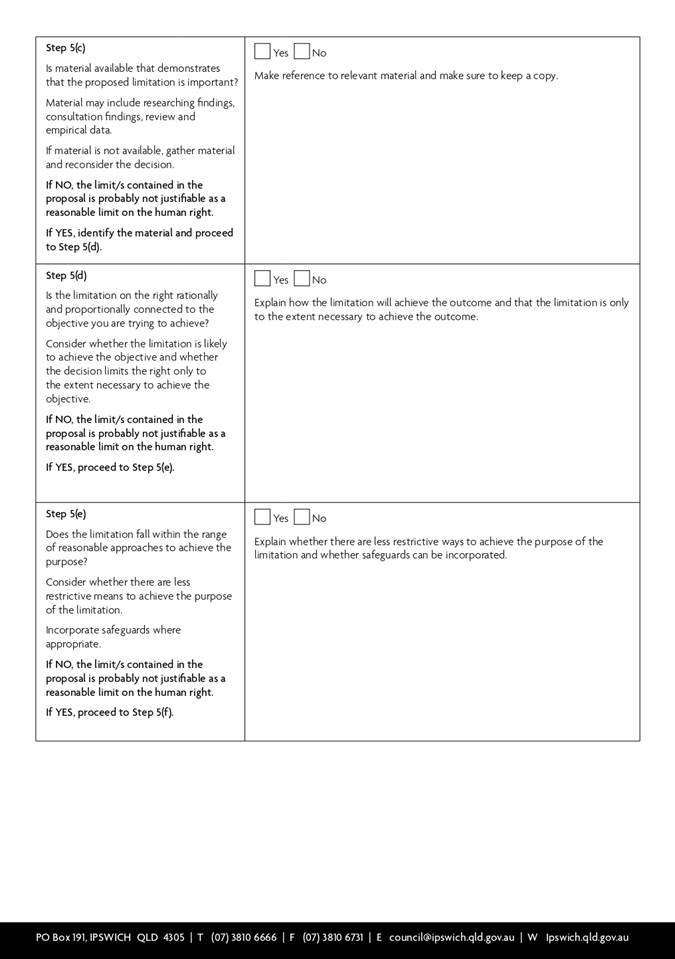

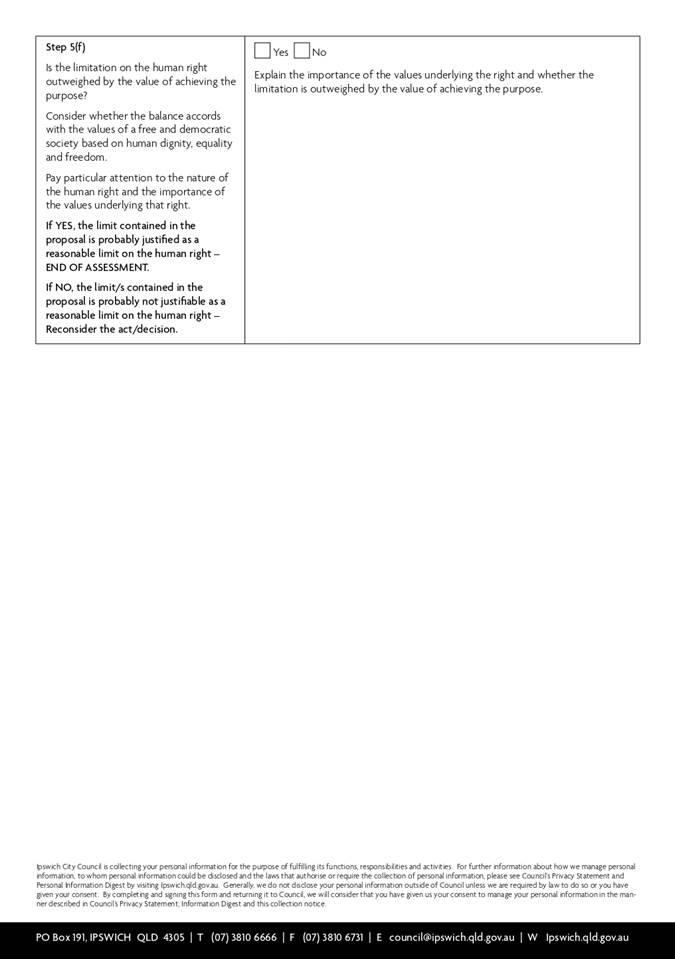

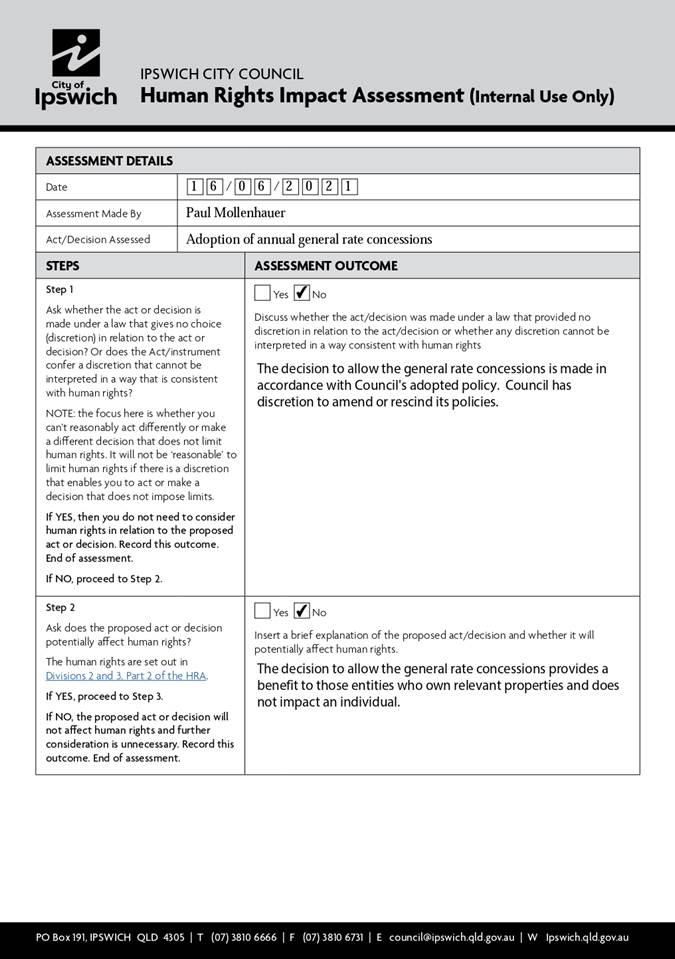

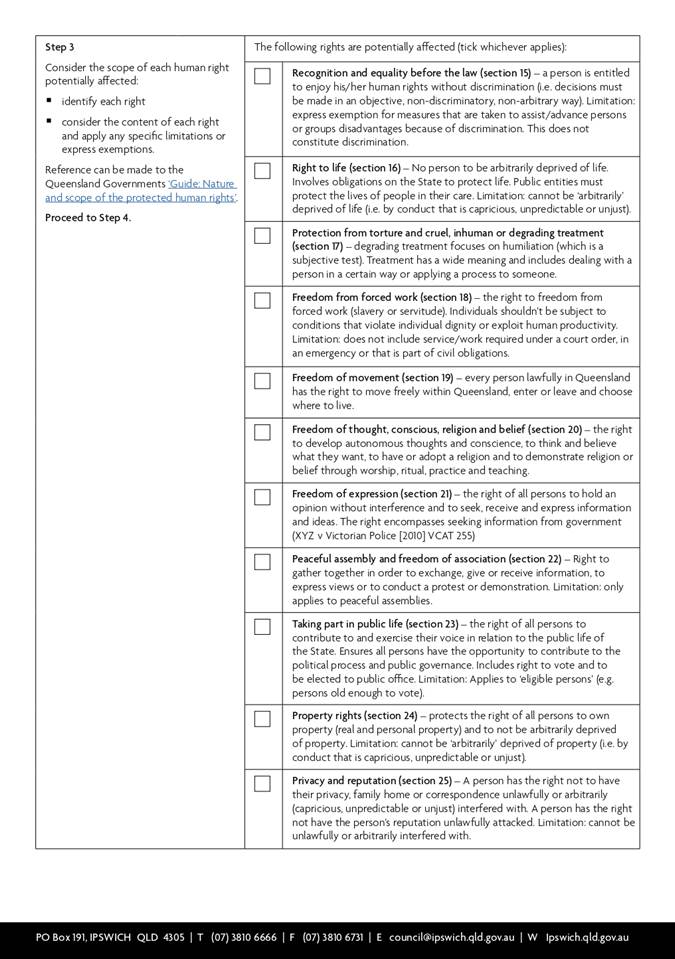

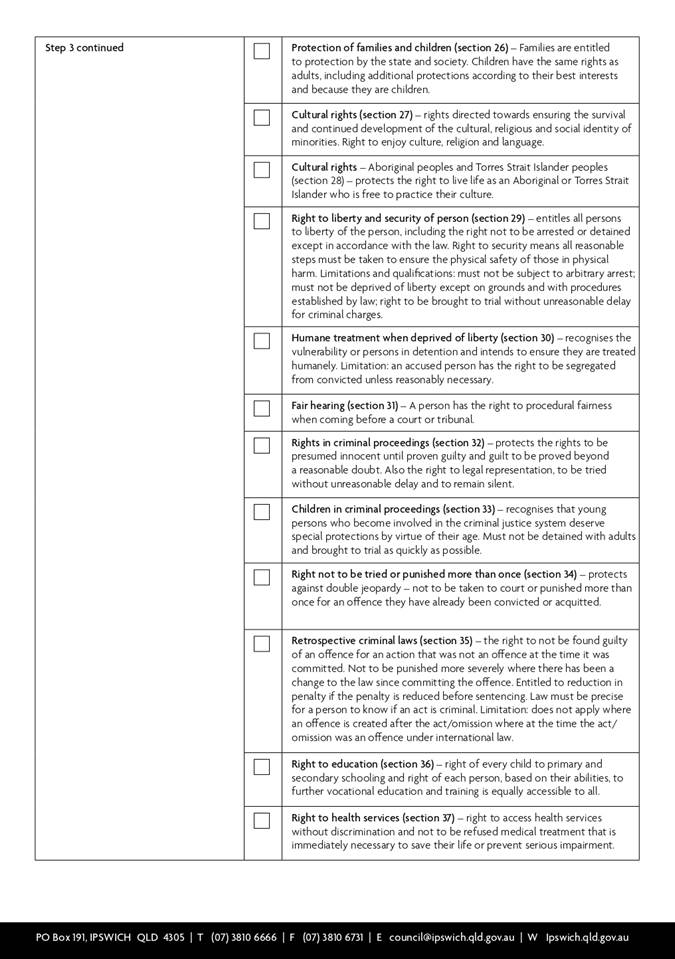

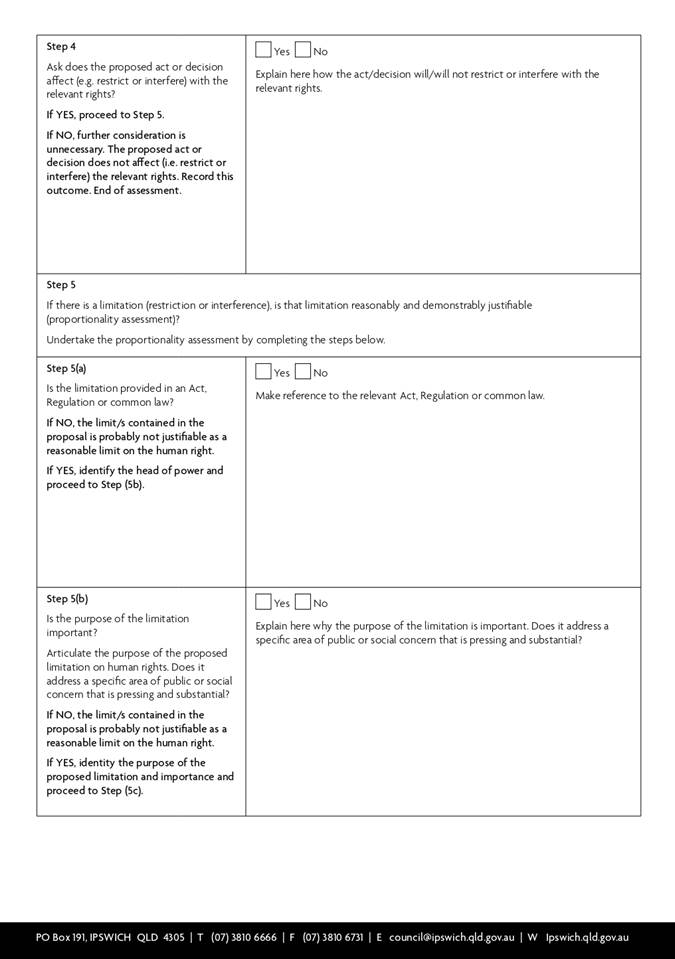

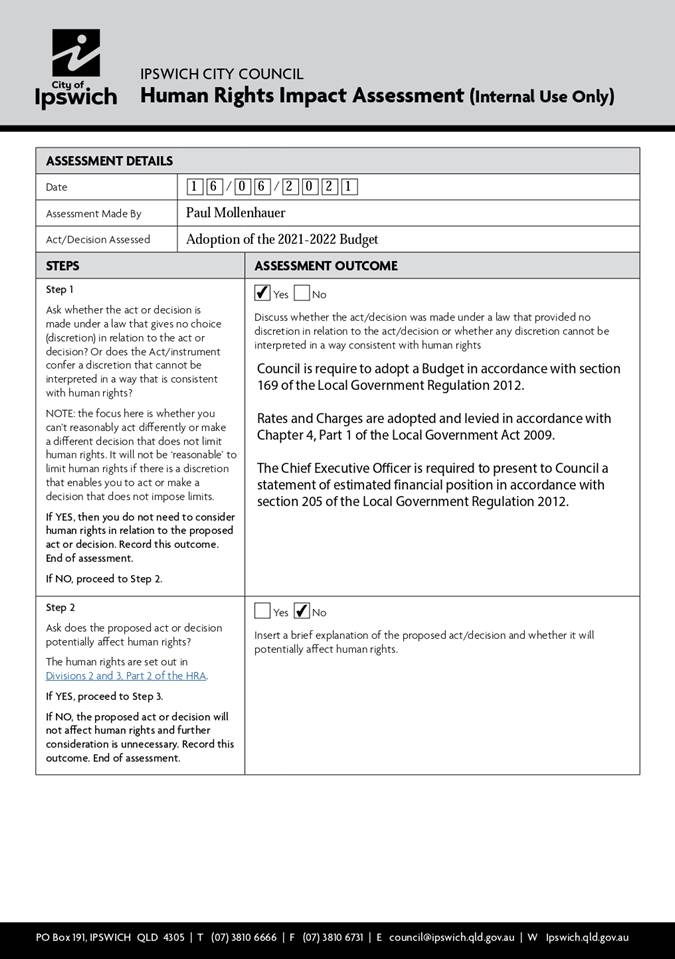

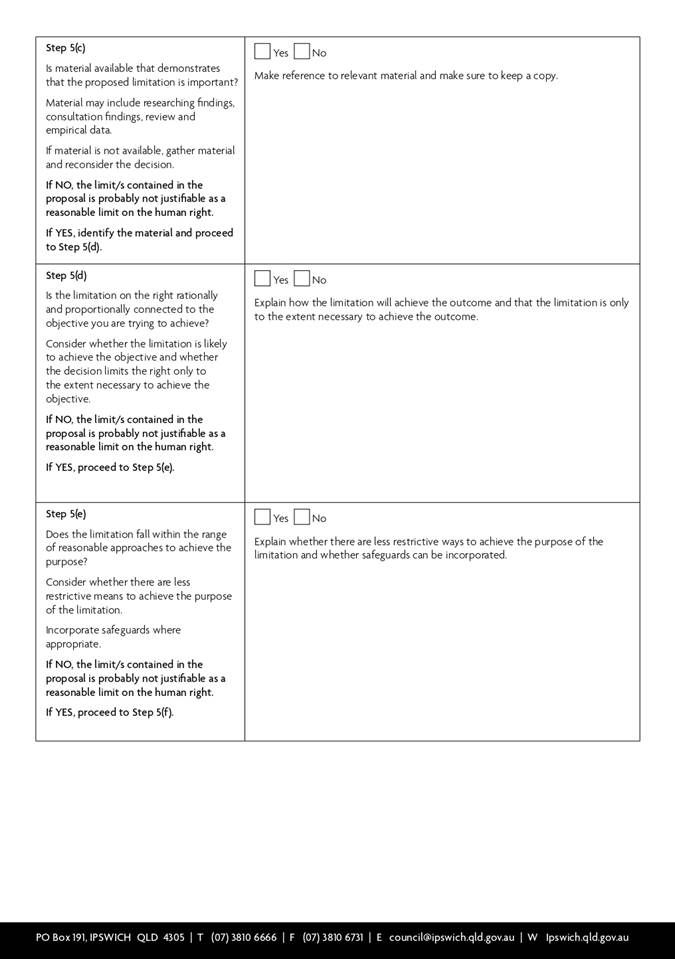

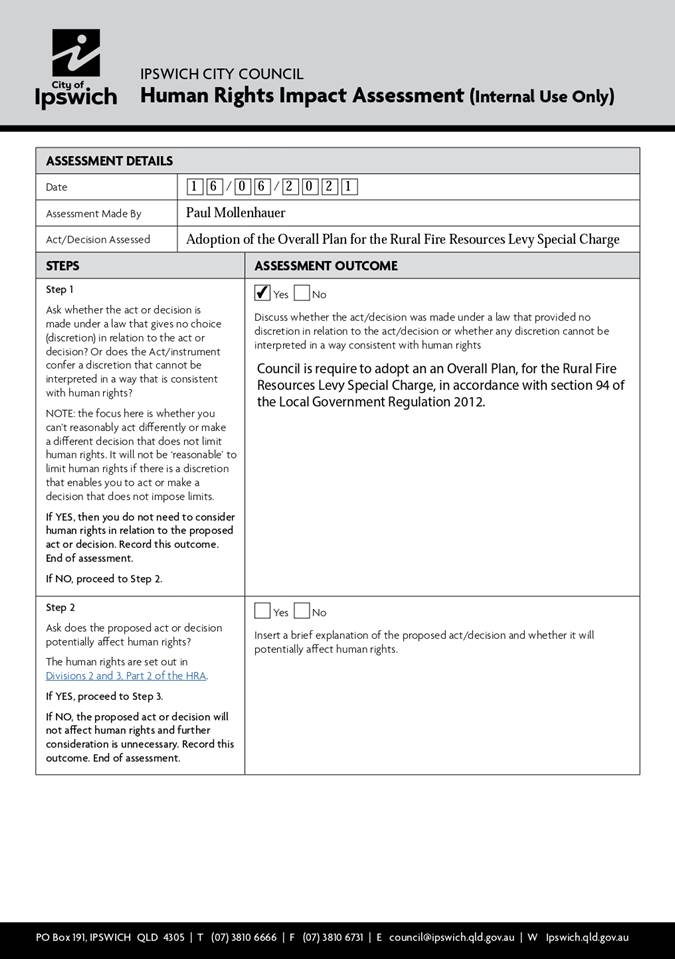

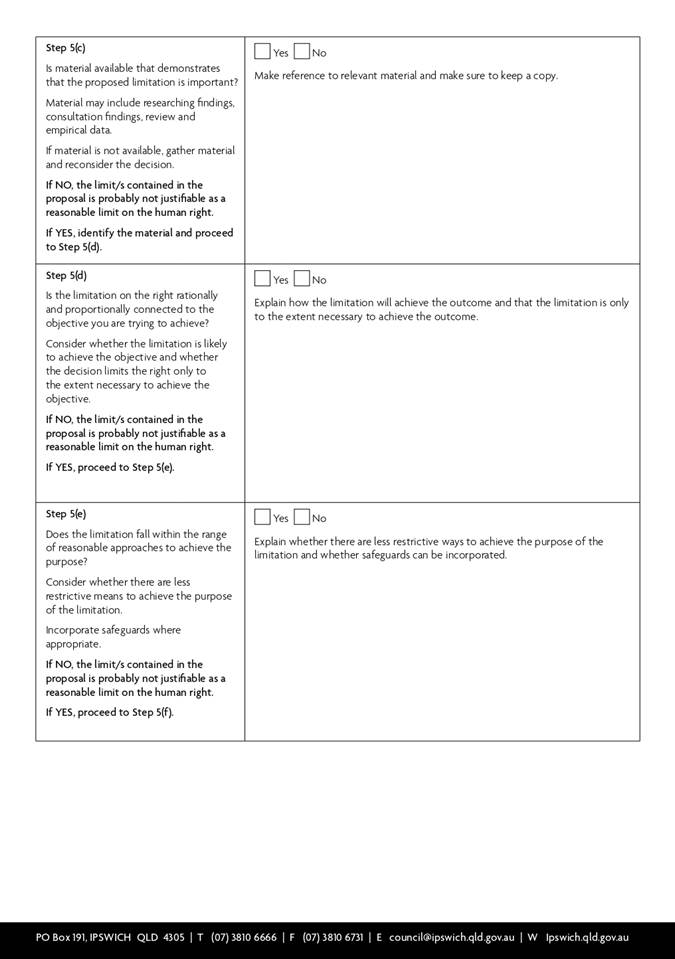

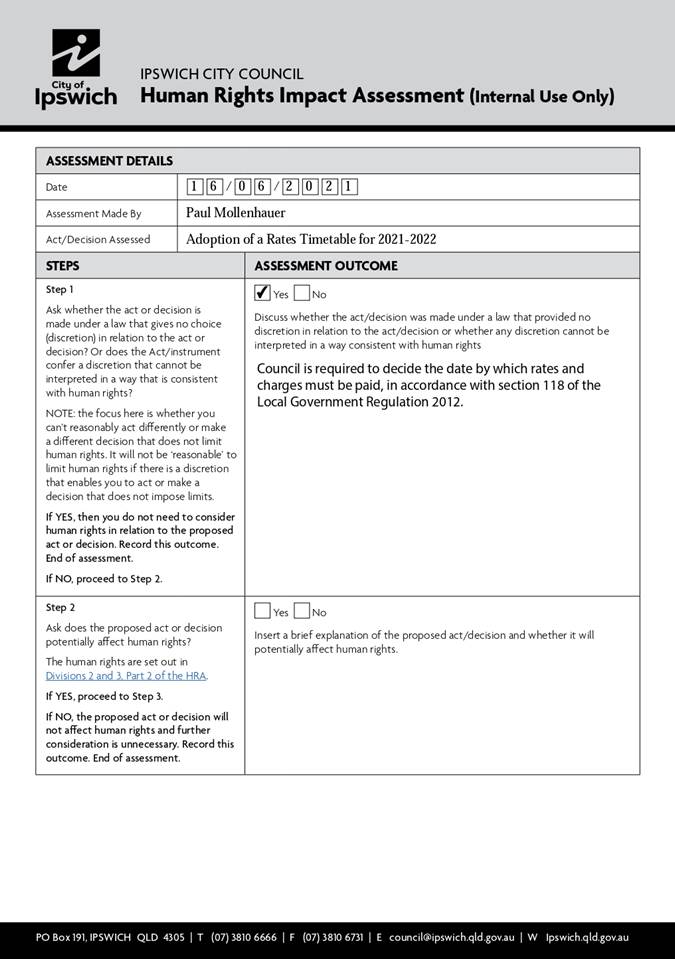

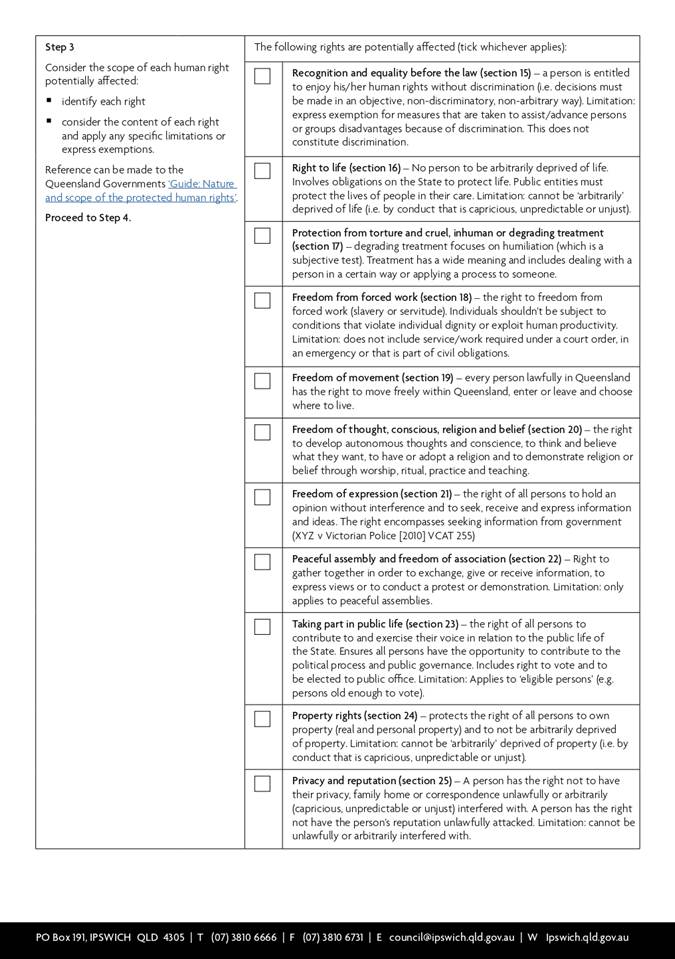

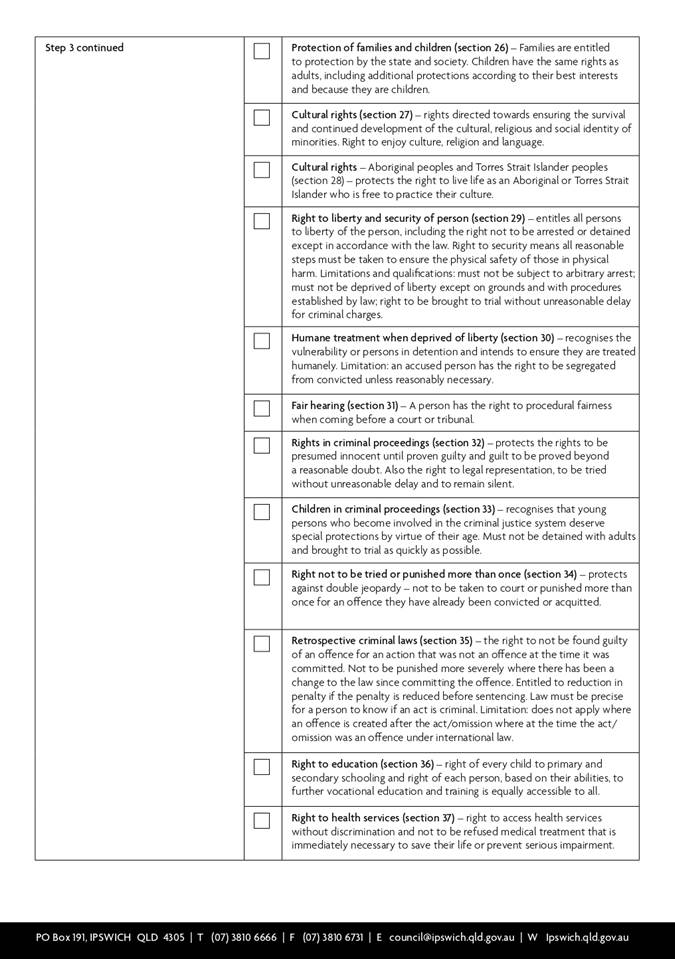

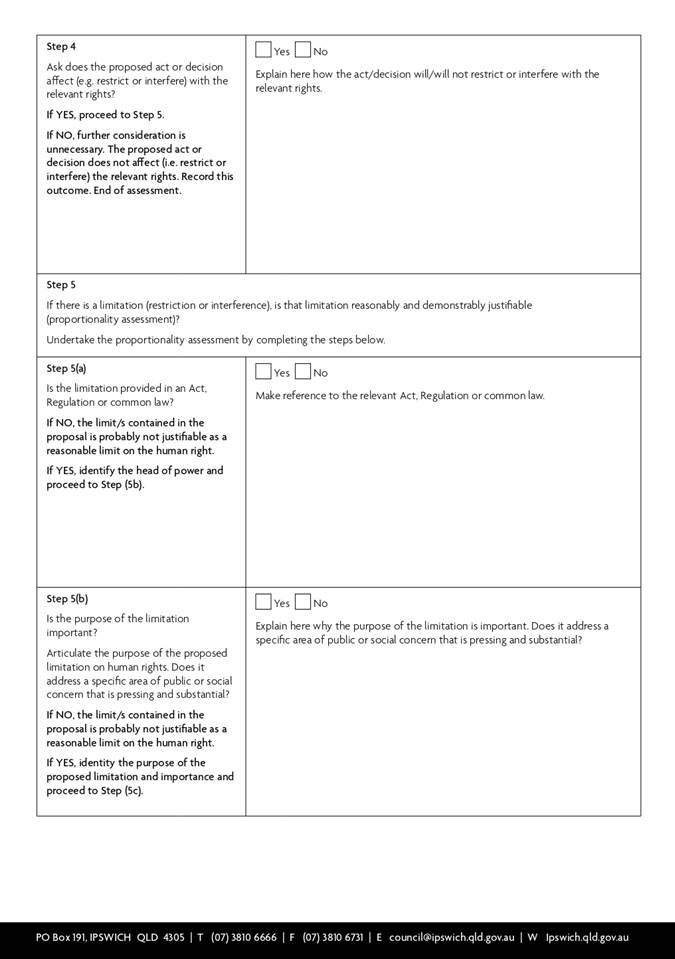

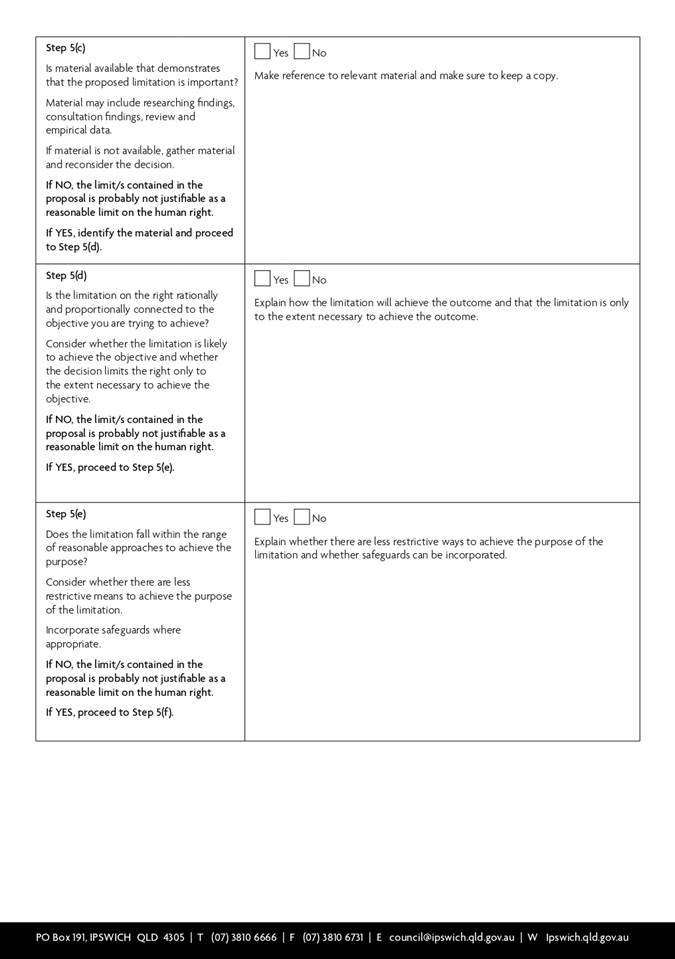

HUMAN RIGHTS IMPLICATIONS

Section 58(1) of the Human

Rights Act 2019 makes it unlawful for council to act or make a decision in

a way that is not compatible with human rights; or in making a decision, to

fail to give proper consideration to a human right relevant to the decision.

Recommendations A to V relate to

the adoption of Council’s 2021-2022 Budget and associated matters. The

decision to adopt 2021-2022 Budget and associated matters has been subject to a

human rights analysis to ensure:

(a) the adoption of the 2021-2022 Budget and associated matters is compatible

with human rights; and

(b) to give proper consideration to human rights relevant to that decision.

The human rights analysis is

detailed in Attachment 3. The outcome of the human rights analysis is

that the adoption of the 2021-2022 Budget and associated matters is compatible

with human rights.

Financial/RESOURCE IMPLICATIONS

The 2021-2022 Budget, rating

resolutions and related policies provide the financial resources for the

organisation for the coming financial year. The Long Term Financial

Forecast are the outcomes of the financial strategies intended to provide a

sustainable future for the City of Ipswich.

COMMUNITY and OTHER CONSULTATION

The 2021‑2022 Budget has

been developed with extensive involvement from the Mayor and Councillors,

representing the interests the Ipswich Community, the Executive Leadership

Team, Branch and Section Managers as well as other operational officers from

across the organisation.

Conclusion

The 2021‑2022 Budget

including the Long Term Financial Forecast is presented for consideration.

Attachments and Confidential Background Papers

|

1.

|

Statement of Estimated Financial Position ⇩

|

|

2.

|

2021-2022 Budget (under separate cover)

|

|

3.

|

Human Rights Impact Assessment ⇩

|

Paul Mollenhauer

Acting Chief

Financial Officer

I concur with the recommendations contained in this

report.

Jeffrey Keech

Acting General

Manager Corporate Services

I concur with the recommendations contained in this

report.

Sonia Cooper

Acting Chief

Executive Officer

“Together,

we proudly enhance the quality of life for our community”

|

Council

Meeting

Agenda

|

24 June

2021

|

Item 6.1 / Attachment 1.

|

Council

Meeting

Agenda

|

24 June

2021

|

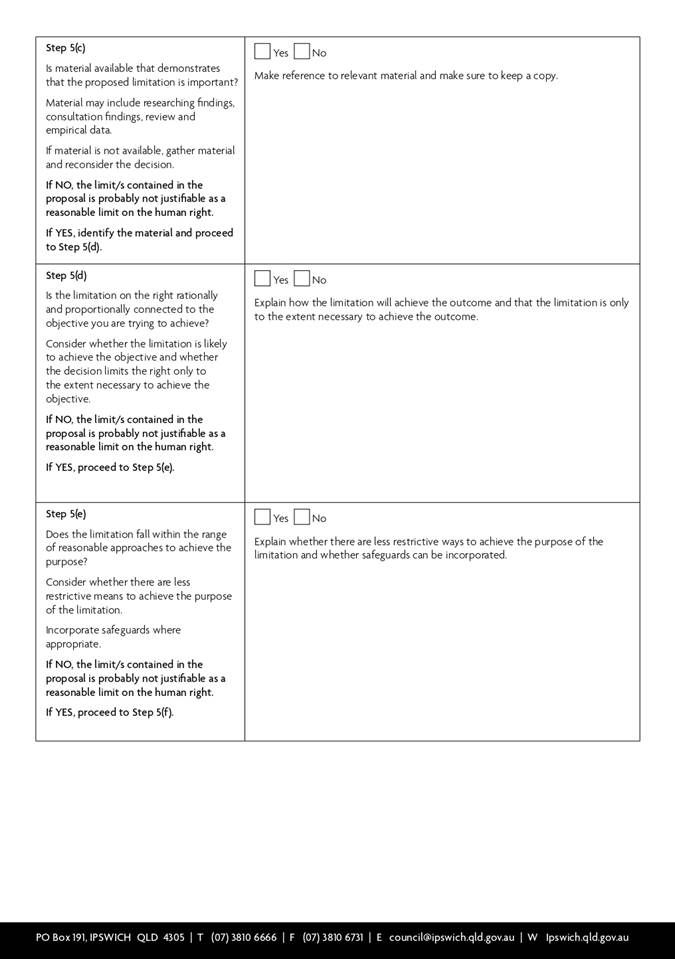

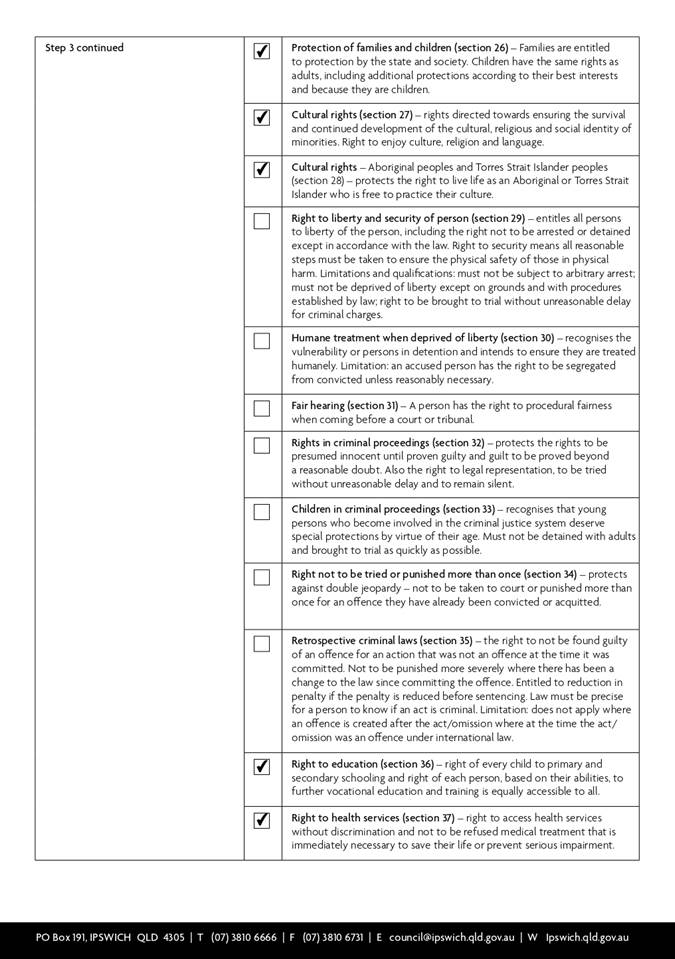

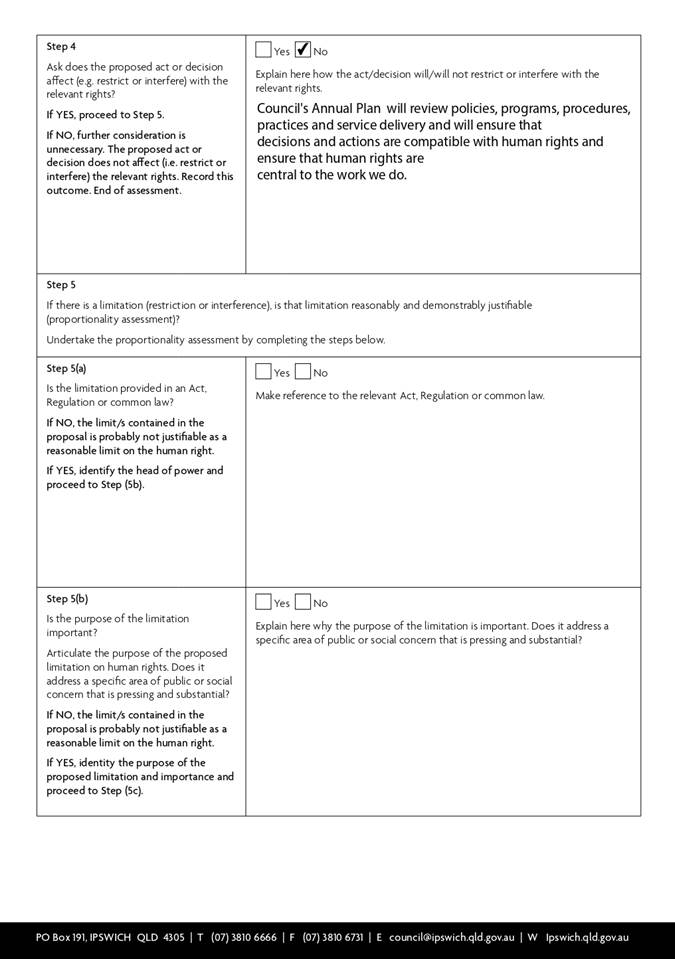

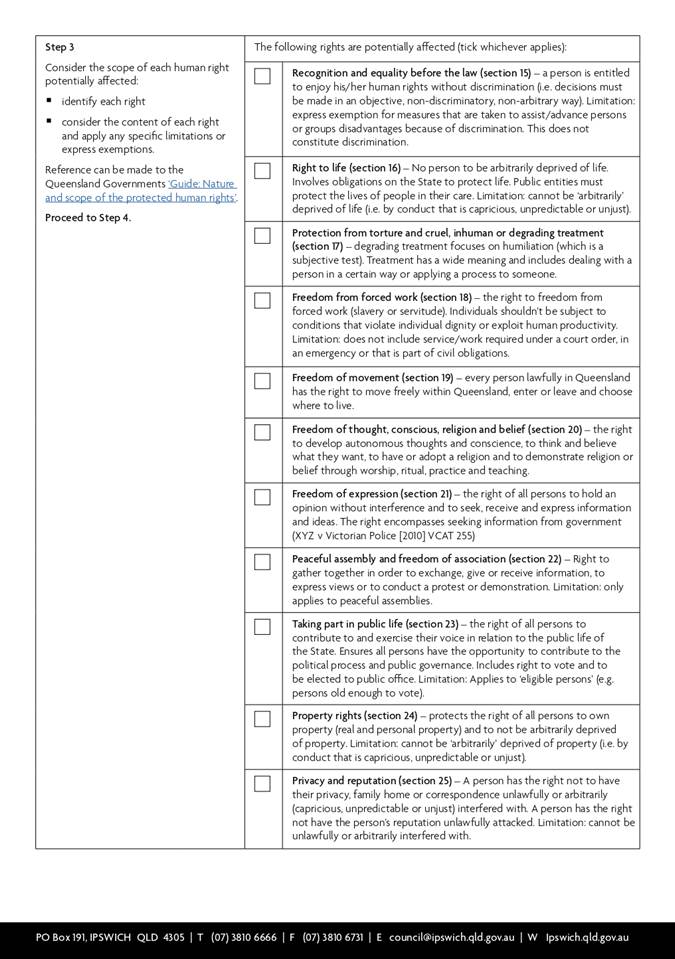

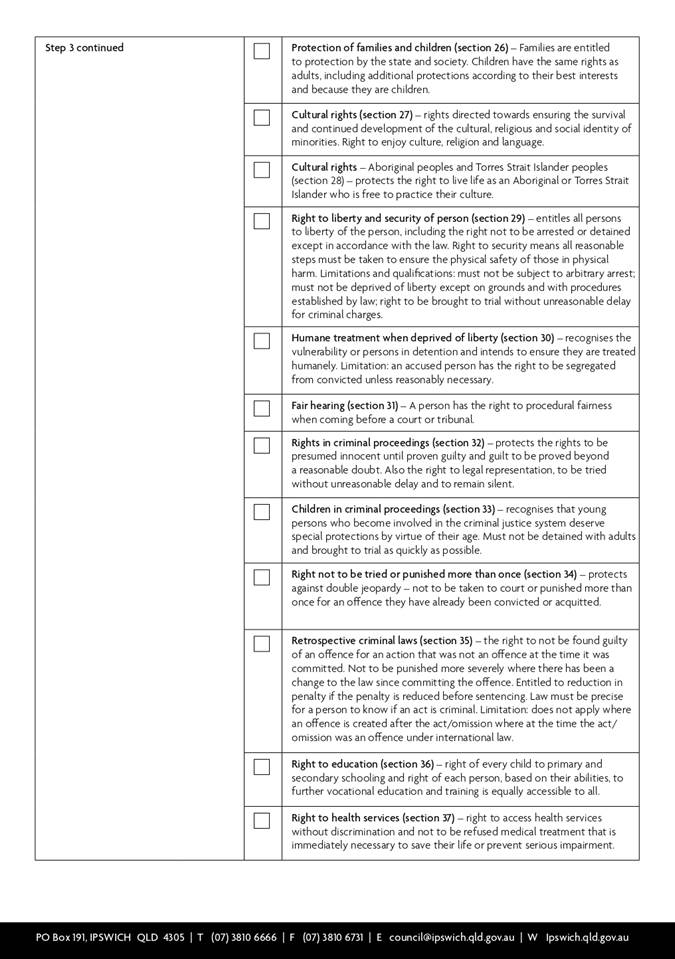

Item 6.1 / Attachment 3.

|

Council

Special

Meeting Agenda

|

24 June

2021

|

Doc ID No: A7362512

ITEM: 6.2

SUBJECT: Ipswich City Council Annual Plan (incl.

operational plan)

AUTHOR: Corporate Planning and Performance Officer

DATE: 17 June 2021

Executive Summary

This is a report concerning the

adoption of the proposed Ipswich City Council Annual Plan for 2021-2022. This

Annual Plan is a first for Ipswich City Council and forms part of our approach

to increase good governance, transparency, and integrity. The Annual Plan

for the 2021-2022 financial year comprises complementary sub documents: an

operational plan; a capital works program; core business services; Ipswich

Waste Services Performance Plan and the annual budget. The report and

recommendations also meet our legislative obligations to adopt an annual

operational plan and an annual performance plan for any commercial

business unit prescribed by State Government legislation, noting that the

adoption of the annual budget by council is done by a separate report.

Recommendation/s

A. That

in accordance with section 104(5)(a) of the Local Government Act 2009

and sections 174 and 175 of the Local Government Regulation 2012,

Ipswich City Council adopt the Annual Plan 2021‑2022, which includes the

Annual Operational Plan 2021-2022 on pages 20 to 28 (the annual operational

plan) and the Ipswich Waste Services Performance Plan 2021-2022 on pages 87

to 93 (the annual performance plan for a commercial business unit),

but excluding the City Annual Budget 2021-2022 on pages 94 to 159, as detailed

in Attachment 2 to the report by the Corporate Planning and Performance Officer

dated 17 June 2021.

B. Recommendation

A is compatible with human rights and relevant human rights have been given

proper consideration in accordance with section 58(1) of the Human Rights Act

2019 (Qld).

RELATED PARTIES

There are no related party matters associated with this

report.

Advance Ipswich Theme

Listening, leading and financial

management

Purpose of Report/Background

In accordance with section 104(5)(a) of the Local

Government Act 2009 (the act) and section 174 and 175 of the Local

Government Regulation 2012 (the Regulation) a local government must, for

each financial year, prepare and adopt an annual operational plan

that is consistent with the annual budget, and progresses the implementation of

the corporate plan. It must also identify how it manages the operational risks

associated with its implementation. In addition, council must provide an annual performance

plan for each commercial business unit. Ipswich Waste Services is

council’s only commercial business unit.

The Annual Plan 2021-2022 (Attachment

2) represents the first of five years for the delivery of council’s corporate

plan – iFuture 2021-2026. Adopted in April 2021 and taking affect from 1

July 2021, iFuture is our leading strategic plan and details 4 themes to which

the annual plan is aligned.

The four

themes of iFuture and the annual plan are:

· Vibrant

and Growing

· Safe,

Inclusive and Creative

· Natural

and Sustainable

· A

Trusted and Leading Organisation

The Annual Plan 2021-2022 is

comprised of five parts presented as a single document.

1. Annual

Operational Plan – delivers iFuture outcomes through projects and

programs.

2. Capital

Works Program – delivering and maintaining the city’s

infrastructure and assets.

3. Core

Business Services – provides an insight that council has never

provided before in an annual plan on what services the city delivers to the

community and how they align to the city vision and strategic direction.

4. Ipswich

Waste Services Performance Plan – provides information about the

performance plan for our commercialised business unit.

5. Annual

Budget – delivers a balanced budget with a sustainable long-term

financial outlook.

The operational plan component

of the Annual Plan 2021-2022 describes councils’ deliverables for the

financial year and are those projects that will help council achieve the

outcomes listed in iFuture as well as any catalyst projects that may be

actioned during the year. This is all supported by the core business services undertaken

across 33 service category types. This work ensures the City of Ipswich has

well maintained parks and community facilities; that officers assist with

requests that come in about animals, parking, development and land use; that

waste is collected; and we are working with businesses, community groups and

sporting organisations. The annual plan also incorporates the annual performance

plan for Ipswich Waste Services.

Progress monitoring of the

annual plan is undertaken throughout the year and is reported to community

through the presentation of the Quarterly Performance Reports to council.

While contained as a component

of the Annual Plan document, the annual budget has been considered by council

in a separate report.

Legal/Policy Basis

This report and its

recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

RISK MANAGEMENT IMPLICATIONS

The Local Government Act 2009

and Local Government Regulation 2012 requires an annual operational plan

and an annual performance plan for each commercial business unit to be prepared

and adopted each year. The highest risks are political/reputational and

legal/governance should council fail to meet this legislative requirement.

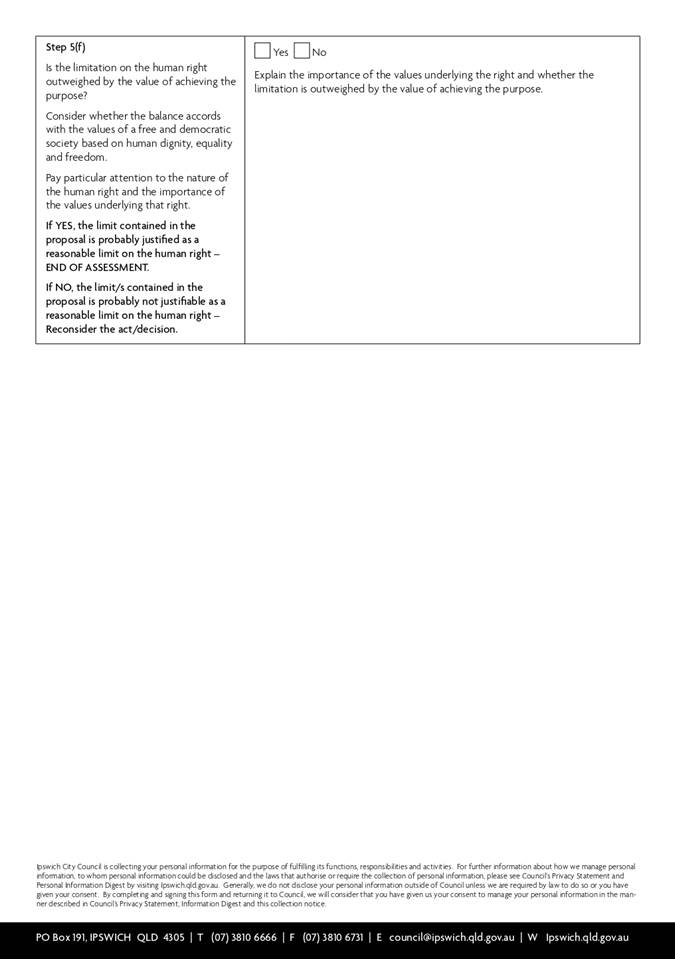

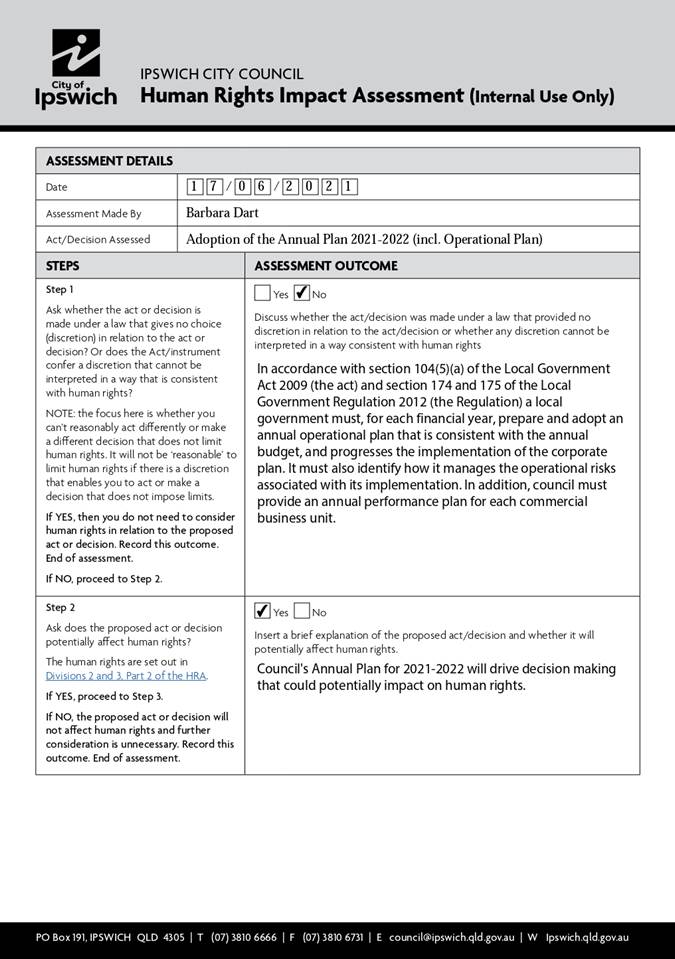

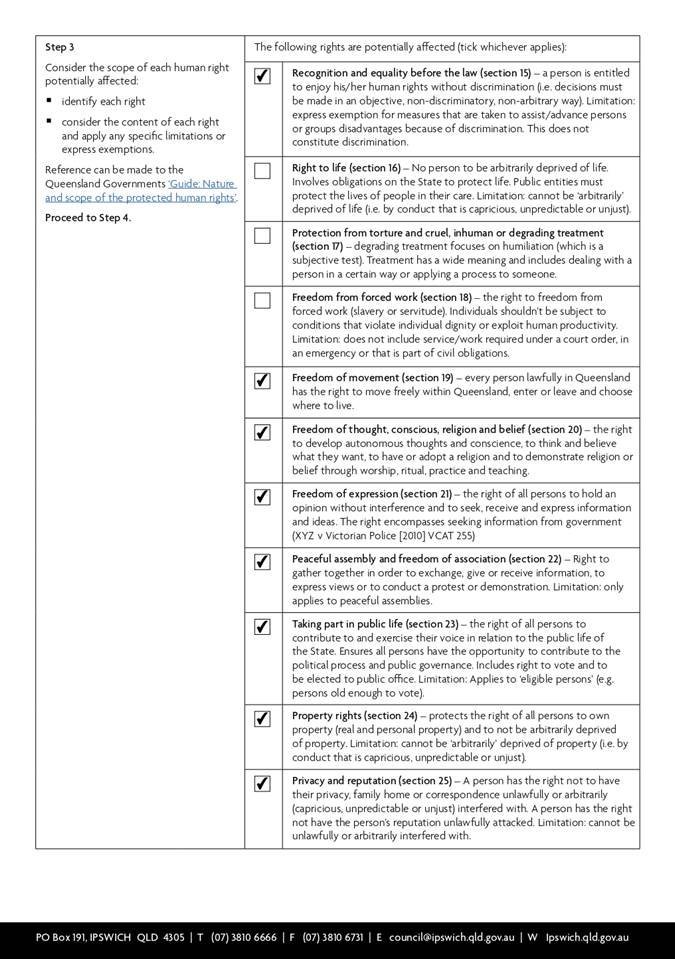

HUMAN RIGHTS IMPLICATIONS

Section 58(1) of the Human Rights

Act 2019 makes it unlawful for council to act or make a decision:

(a) in

a way that is not compatible with human rights; or

(b) in

making a decision, to fail to give proper consideration to a human right

relevant to the decision.

Recommendation A is that council adopt the Annual Plan

2021-2022, and Recommendation B is that council note the Annual Plan 2021-2022

satisfy the requirements of the Local Government Act 2009, and the Local

Government Regulation 2012 regarding the development of an annual

operational Plan. The decision under Recommendation A and the act the subject

of Recommendation B have been subject to a human rights analysis:

a) to

ensure they are compatible with human rights; and

b) to

give proper consideration to human rights relevant to them.

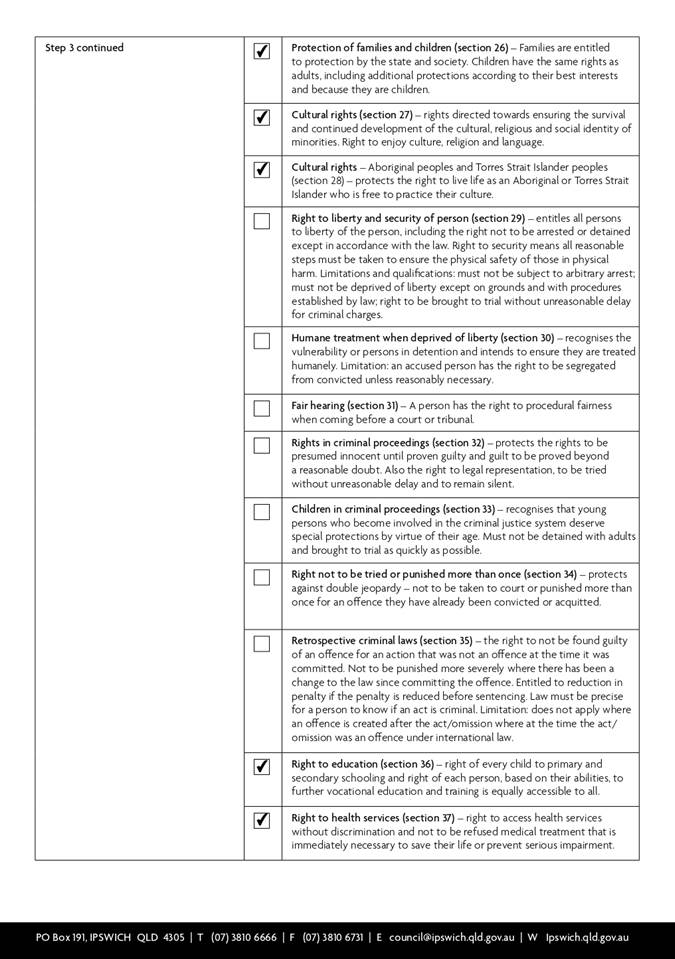

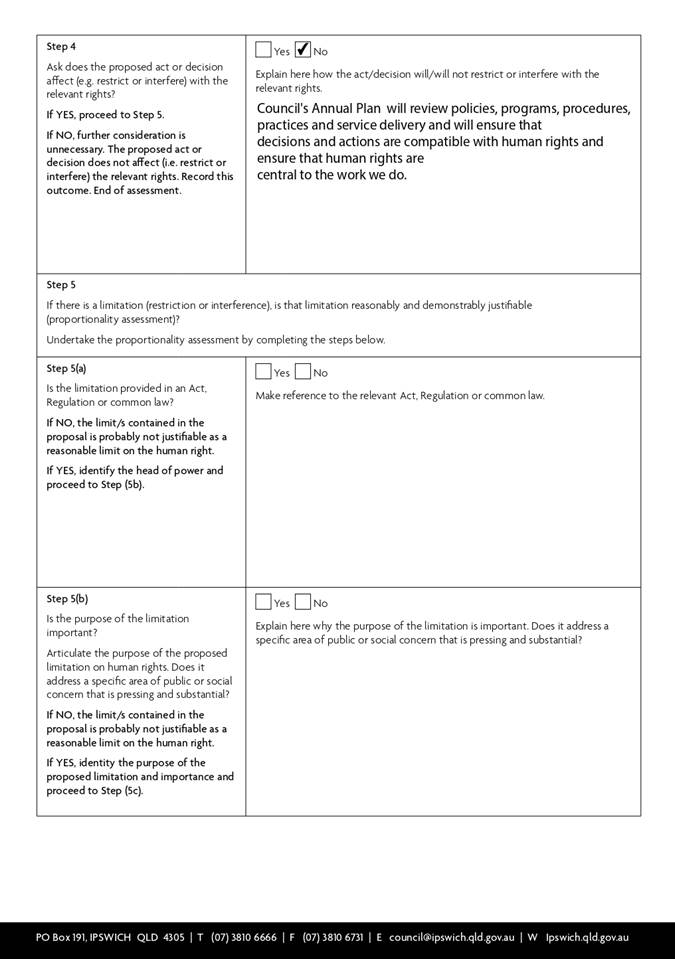

The human rights analysis is detailed in Attachment 1.

The outcome of the human rights analysis is that the decision is compatible

with human rights.

Financial/RESOURCE IMPLICATIONS

The Annual Plan has been developed

in concert with the development of the annual budget. All activity recorded in

the plan has been appropriately funded where required.

COMMUNITY and OTHER CONSULTATION

The Annual Plan 2020-2021 was

prepared in parallel to the development of the annual budget that involved

Councillors and staff. The Annual Plan presents the activities to be undertaken

in the 2021-2022 financial year to meet the deliverables in the corporate plan

– iFuture 2021-2026 that was developed with a robust community engagement

process. Details on the engagement process for iFuture can be found at: https://www.shapeyouripswich.com.au/corporate-plan-2021-2026.

Conclusion

The Annual Plan 2021-2022

increases council’s approach to good governance, transparency and

integrity and represents the activities council proposes to undertake in the

financial year. The Annual Plan 2021-2022 meets the legislative

obligations and requirements for an annual operational plan and an annual

performance plan for a commercial business unit in the Local Government

Act 2009 and the Local Government Regulation 2012.

Attachments and Confidential Background Papers

|

1.

|

Human Rights Assessment Annual Plan 2021-2022 ⇩

|

|

2.

|

Ipswich City Council Annual Plan 2021-2022 (under

separate cover)

|

Stephanie Hoffmann

Corporate Planning

and Performance Officer

I concur with the recommendations contained in this

report.

Barbara Dart

Acting General

Manager Coordination and Performance

“Together,

we proudly enhance the quality of life for our community”

|

Council

Meeting

Agenda

|

24 June

2021

|

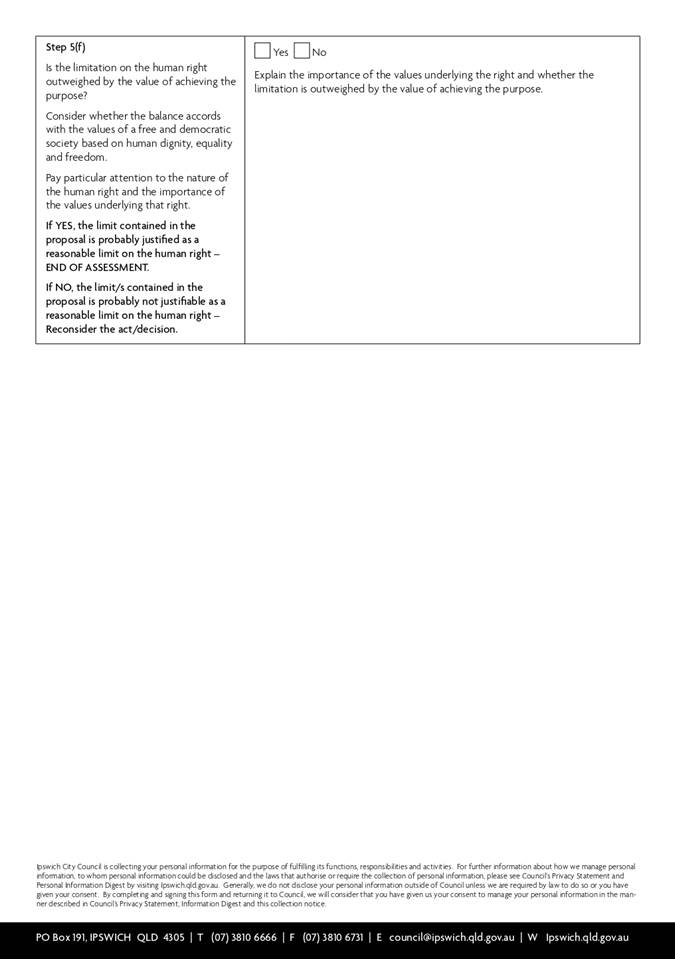

Item 6.2 / Attachment 1.

|

Council

Special

Meeting Agenda

|

24 June

2021

|

Doc ID No: A7201638

ITEM: 6.3

SUBJECT: Overall Plan for the Rural Fire Resources Levy

Special Charge

AUTHOR: Acting Chief Financial Officer

DATE: 16 June 2021

Executive Summary

This is a report concerning the adoption

of an Overall Plan for the Rural Fire Resources Levy Special Charge. The

Overall Plan is made in accordance with section 94 of the Local

Government Regulation 2012 for the special benefited area adopted by

Council in the 2021‑2022 Budget.

Recommendation/s

A. That

in accordance with section 94 of the Local Government Regulation 2012,

the Overall Plan for the Rural Fire Resources Levy Special Charge, as detailed in

the report by the Acting Chief Financial Officer dated 16 June 2021, be

adopted.

B. Recommendation

A is compatible with human rights and relevant human rights have been given

proper consideration in accordance with section 58(1) of the Human Rights

Act 2019 (Qld).

RELATED PARTIES

Rural Fire Service

(Ipswich area) Rural Fire Brigades

Local Area Finance Committee

Queensland Fire and Emergency Services (QFES)

Advance Ipswich Theme Linkage

Listening, leading and financial

management

Purpose of Report/Background

Section 94 of the Local

Government Regulation 2012 requires Council to make an Overall Plan for the

implementation of a special charge. The Overall Plan must be adopted by

resolution of Council either before or at the same time Council resolves to

levy the special rate or charge. However, the Budget resolution making a

special rate or charge must make mention of the overall plan.

An overall plan must include the following:

(i) describe

the service, facility or activity;

(ii) identify

the rateable land to which the special rates or charges apply;

(iii) state

the estimated cost of carrying out the overall plan; and

(iv) state

the estimated time for carrying out the overall plan.

RURAL FIRE RESOURCES LEVY SPECIAL CHARGE

OVERALL PLAN

Service, Facility or Activity

The specially benefited area will receive the benefit of activities and

improvements funded by the Rural Fire Brigades in the Ipswich City Council

local government area, including:

(i) the purchase of

equipment not usually supplied by the Queensland Government;

(ii) maintenance of

equipment;

(iii) additional training;

(iv) funding of administration

and day-to-day operating expenses;

(v) promotion of the

Rural Fire Services in the community and the attractive opportunity to

participate as a volunteer;

(vi) grading of fire tracks to

ensure adequate access for firefighting equipment; and

(vii) capital improvements to rural

fire brigade depots.

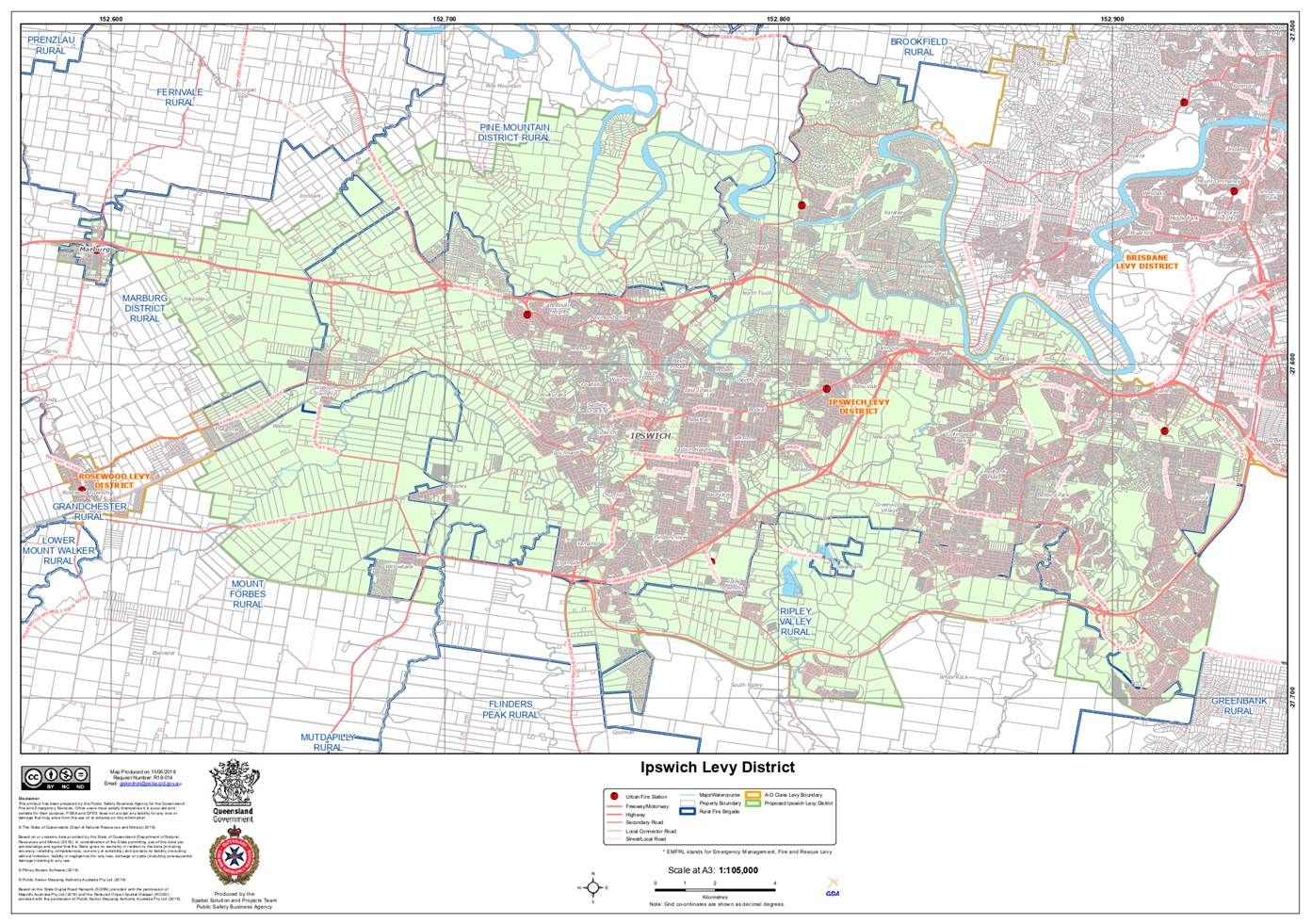

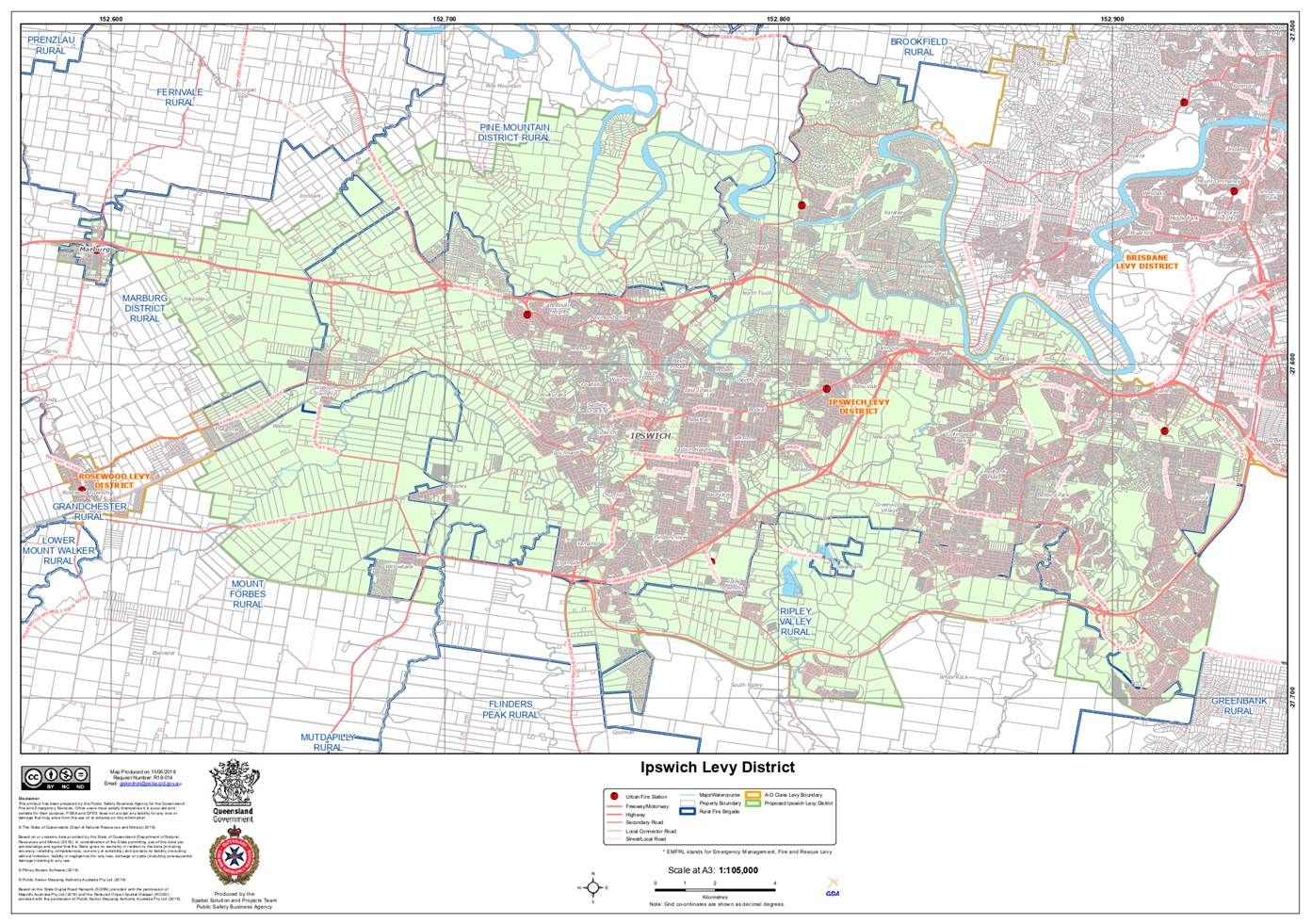

Identification of the rateable land to

which the Special Rates or Charges apply

In accordance with section 94 of the Local Government Regulation

2012, Council is of the opinion that each parcel of rateable land within

the Ipswich Local Government area that is not within the boundaries of the Rosewood

Levy District and Ipswich Levy District (the Urban Fire Boundaries), as

defined by the QFES and detailed in Attachment 1, will receive a

special benefit from the services, facilities and activities funded by the Rural

Fire Resources Levy Special Charge.

Estimated cost of carrying out the Overall

Plan

The total cost of carrying out the Overall Plan is estimated to be

$340,000. This includes both operating and capital expenditure

components.

Estimated time for carrying out the Overall Plan

The estimated time for carrying out this Overall Plan is one year.

Financial/RESOURCE IMPLICATIONS

Table 1 details the

number properties that have been subject to the Rural Fire Resources Levy

Special Charge in recent years.

Table 1

|

Year

|

Properties

|

|

2020

|

1,924

|

|

2021

|

1,930

|

|

2022 (Estimated)

|

1,940

|

The Rural Fire Resources Levy Special Charge for 2020-2021 was adopted by

Council at $39 per annum. For the 2020-2021 financial year, Council also adopt a Rural Fire Resources Levy Separate Charge at $3 per

annum. This separate charge was levied on all rateable land within the

local government area and while it has provided funding, additional to the special

charge, it is not subject to this Overall Plan.

Table 2 details the

collections and disbursements related to the special charge for 2020‑2021.

It also includes the estimated revenue for 2021‑2022 from the special charge

if adopted at $39 per annum for each parcel of rateable land as well as the

estimated disbursements.

Table 2

|

2020-2021

|

|

|

Unspent Special Charges carried forward from previous Overall Plan

|

$0

|

|

add Special Charges levied from the 2020-2021 Overall Plan

|

$75,192

|

|

less disbursements under the 2020-2021 Overall Plan

|

$330,000

|

|

Deficit funded from other separate levies

|

$254,808

|

|

2021-2022

|

|

|

Unspent Special Charges carried forward from previous Overall Plan

|

$0

|

|

Special Charges estimated from the 2021-2022 Overall Plan

|

$75,660

|

|

less disbursements estimated under the 2021-2022 Overall Plan

|

$340,000

|

|

Estimated deficit from the Special Charges

|

$264,340

|

The estimated deficit for 2021-2022 is proposed to be funded by Council through

the continuation of the Rural Fire Resources Levy

Separate Charge at $3 per annum levied on all rateable land within the

local government area.

RISK MANAGEMENT IMPLICATIONS

The rateable land located within

the benefited area continues to benefit from

the services, facilities and activities provided by the Ipswich area Rural Fire Brigades. The continuation of

the special charge in the 2021-2022 financial year is considered appropriate.

The growth in rateable land within the benefited area needs to be

monitored on a regular basis and Council

liaise with QFES regarding future revisions to the boundaries of the Rosewood

Levy District and Ipswich Levy District.

The continuation of any separate charge, levied on all rateable land

within the local government area, will be subject an annual review by Council.

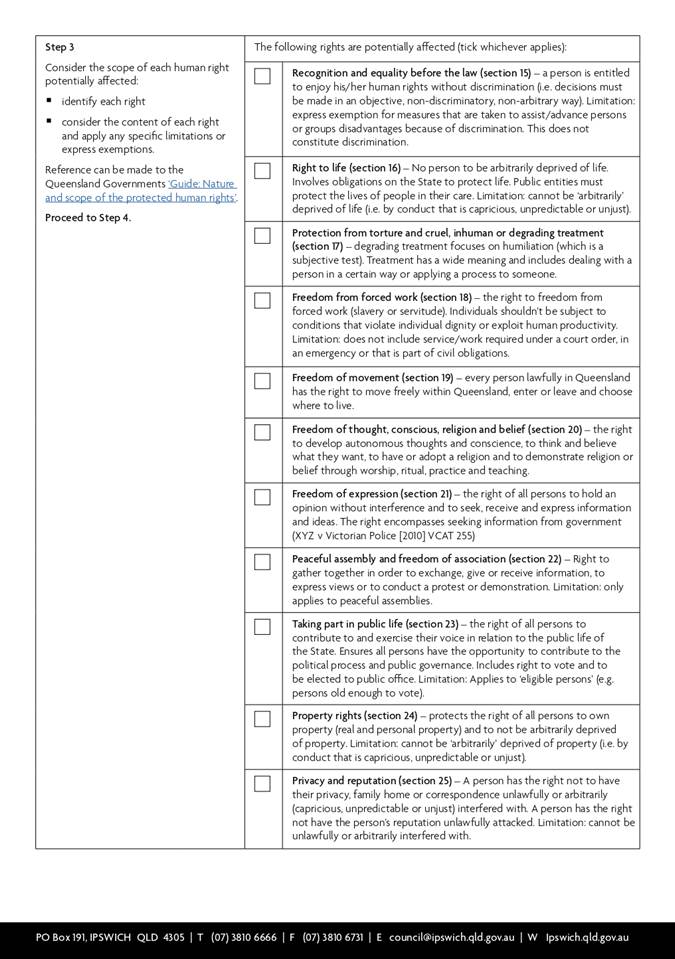

HUMAN RIGHTS IMPLICATIONS

Section 58(1) of the Human

Rights Act 2019 makes it unlawful for council to act or make a decision in

a way that is not compatible with human rights; or in making a decision, to

fail to give proper consideration to a human right relevant to the decision.

Recommendation A states that Council

adopt the Overall Plan. The decision to adopt the Overall Plan has been subject

to a human rights analysis to ensure:

(a) the decision to adopt the Overall Plan is compatible with human rights; and

(b) to give proper consideration to human rights relevant to that decision.

The human rights analysis is

detailed in Attachment 2. The outcome of the human rights analysis is

that the decision to adopt the Overall Plan is compatible with human rights.

Legal/Policy Basis

This report and its

recommendations are consistent with the following legislative provisions:

Local Government Act 2009

Local Government Regulation 2012

Fire and Emergency Services Act 1990

COMMUNITY and OTHER CONSULTATION

The financial needs of the Ipswich

area Rural Fire Brigades have been

presented to Council for consideration. The continuation of the special

charge, consistent with previous years.

Consultation with the property

owners within the benefited area, the Ipswich area Rural Fire Brigades as well as all other land owners in the local

government area, remains an opportunity in the coming year for Council to

better understand community expectations in regards to the services, facilities

and activities provided by the Ipswich area Rural Fire Brigades and funded, in part, by this special charge.

Conclusion

The rateable land within the

benefited area, being rateable land outside the Urban Fire Boundaries, continue to specially benefit from the services,

facilities and activities funded by the Rural Fire Resources Levy Special

Charge and continuation of the special charge is appropriate.

Attachments and Confidential Background Papers

|

1

|

QFES District Boundaries ⇩

|

|

2

|

Human Rights Impact Assessment ⇩

|

Paul Mollenhauer

Acting Chief

Financial Officer

I concur with the recommendations contained in this

report.

Jeffrey Keech

Acting General

Manager Corporate Services

“Together,

we proudly enhance the quality of life for our community”

|

Council

Meeting

Agenda

|

24 June

2021

|

Item 6.3 / Attachment 1

|

Council

Meeting

Agenda

|

24 June

2021

|

Item 6.3 / Attachment 2

|

Council

Special

Meeting Agenda

|

24 June

2021

|

Doc ID No: A7201374

ITEM: 6.4

SUBJECT: Rates Timetable for 2021-2022

AUTHOR: Acting Chief Financial Officer

DATE: 18 June 2021

Executive Summary

This is a report concerning the

issuance date as well as the discount and due date for payment for the

quarterly rates for the 2021-2022 year.

Recommendation/s

A. That

in accordance with section 118 of the Local Government Regulation 2012,

Ipswich City Council decide the dates by which rates and

charges for 2021-2022 must be paid, as detailed in Table 1 to the report by